Air Cargo Screening Systems Market Report

Published Date: 03 February 2026 | Report Code: air-cargo-screening-systems

Air Cargo Screening Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a thorough analysis of the Air Cargo Screening Systems market, including insights on market size, growth forecasts, segmentation, technological trends, and competitive landscape from 2023 to 2033.

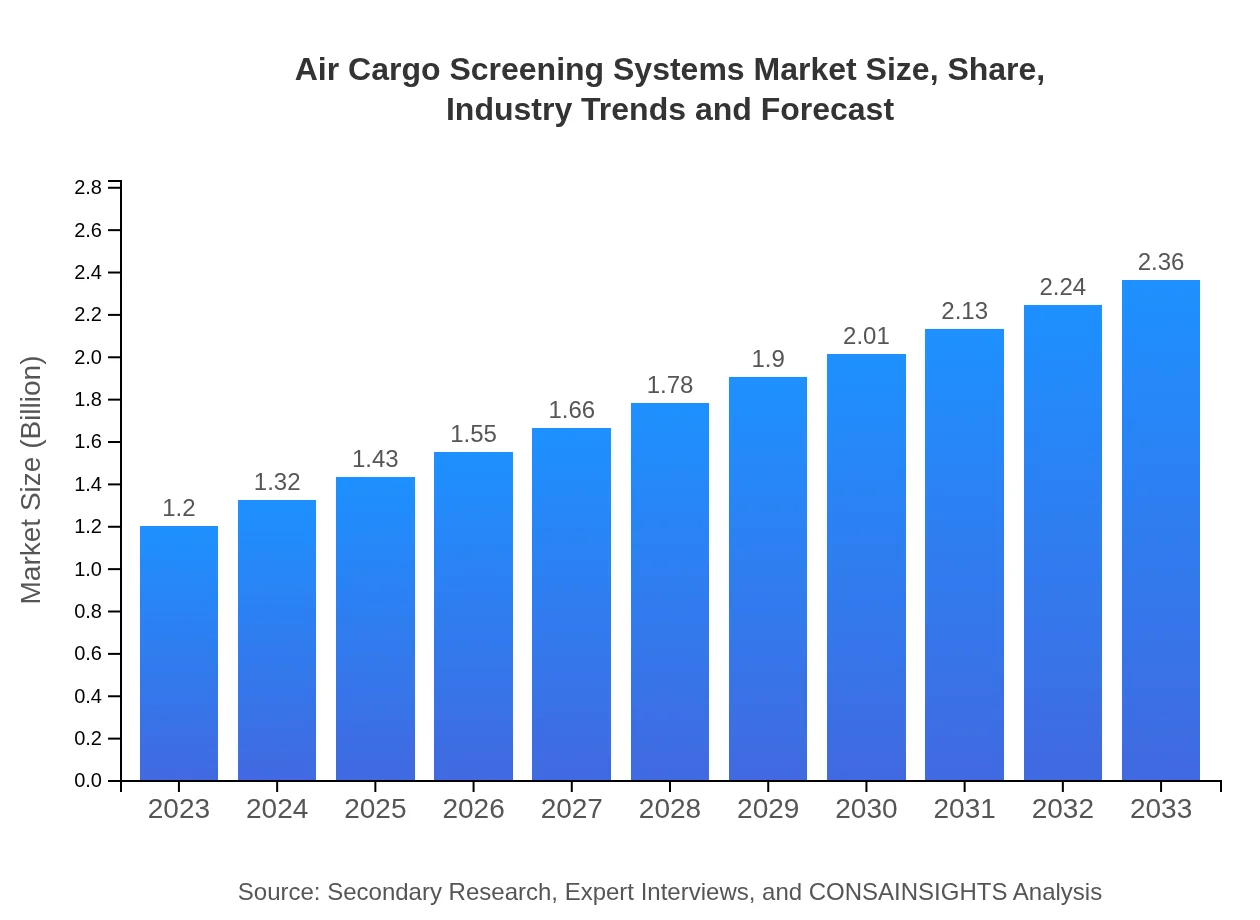

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Jeol Ltd., Smiths Detection, Rapiscan Systems, L3Harris Technologies, Köhl GmbH |

| Last Modified Date | 03 February 2026 |

Air Cargo Screening Systems Market Overview

Customize Air Cargo Screening Systems Market Report market research report

- ✔ Get in-depth analysis of Air Cargo Screening Systems market size, growth, and forecasts.

- ✔ Understand Air Cargo Screening Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Cargo Screening Systems

What is the Market Size & CAGR of Air Cargo Screening Systems market in 2023?

Air Cargo Screening Systems Industry Analysis

Air Cargo Screening Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Cargo Screening Systems Market Analysis Report by Region

Europe Air Cargo Screening Systems Market Report:

The European market is anticipated to evolve from a size of $0.34 billion in 2023 to $0.67 billion by 2033. Heightened regulatory pressures from the EU combined with an expanding air transport network necessitate robust cargo screening technologies. The region's focus on compliance will drive the demand for novel screening solutions.Asia Pacific Air Cargo Screening Systems Market Report:

The Asia Pacific region holds significant promise for the Air Cargo Screening Systems market, with a projected market size expanding from $0.24 billion in 2023 to $0.48 billion by 2033. Growth is supported by increasing trade activity and a boost in air freight capacity among emerging economies. Regulatory scrutiny over security practices is also elevating the importance of advanced screening systems in the region.North America Air Cargo Screening Systems Market Report:

North America is a mature market with a significant increase in air cargo transit, projected to grow from $0.41 billion in 2023 to $0.81 billion by 2033. Stringent security regulations and a focus on facilitating seamless cargo movement contribute significantly to the region’s growth. Advancements in technologies such as AI and machine learning enhance system performance, attracting investments from key stakeholders.South America Air Cargo Screening Systems Market Report:

In South America, the market is expected to grow from $0.10 billion in 2023 to $0.19 billion by 2033. Economic recovery post-pandemic and growing logistics infrastructure investments are key factors contributing to this expansion. As air cargo transportation increases, there will be a corresponding demand for enhanced security systems.Middle East & Africa Air Cargo Screening Systems Market Report:

With a projected market growth from $0.11 billion in 2023 to $0.21 billion by 2033, the Middle East and Africa region are becoming increasingly significant. This growth is influenced by the expansion of airport infrastructure and logistics capabilities, making it essential for regional players to invest in advanced air cargo screening technologies.Tell us your focus area and get a customized research report.

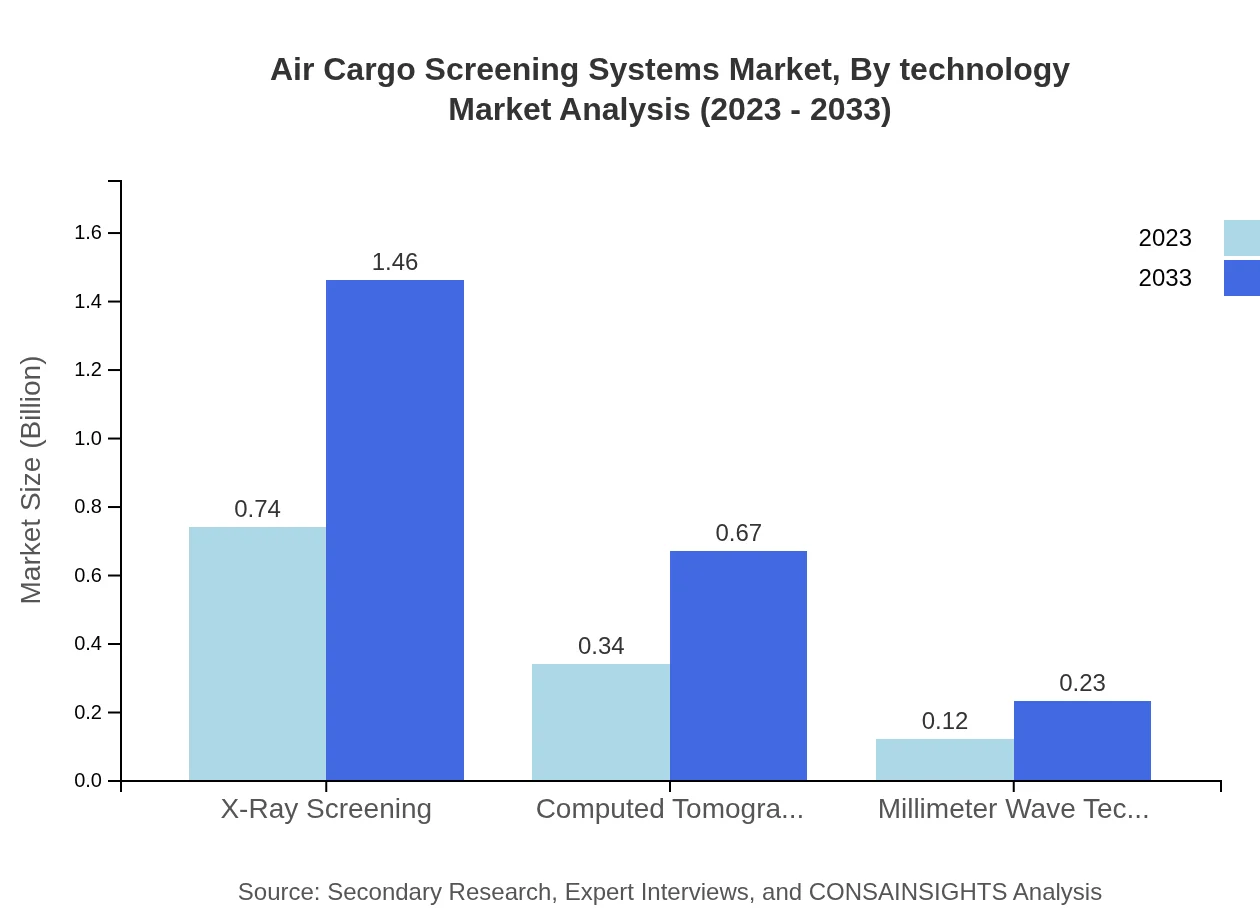

Air Cargo Screening Systems Market Analysis By Technology

The market can be analyzed based on technology types. Hardware leads at $0.74 billion in 2023 with expected growth to $1.46 billion by 2033, maintaining a market share of 61.92%. Software solutions also play a critical role, projected to grow from $0.34 billion to $0.67 billion and holding a 28.21% share. Services are expected to expand from $0.12 billion to $0.23 billion, representing 9.87%. Specific technologies like X-ray screening and CT dominate the hardware segment, reflecting ongoing enhancements in security effectiveness.

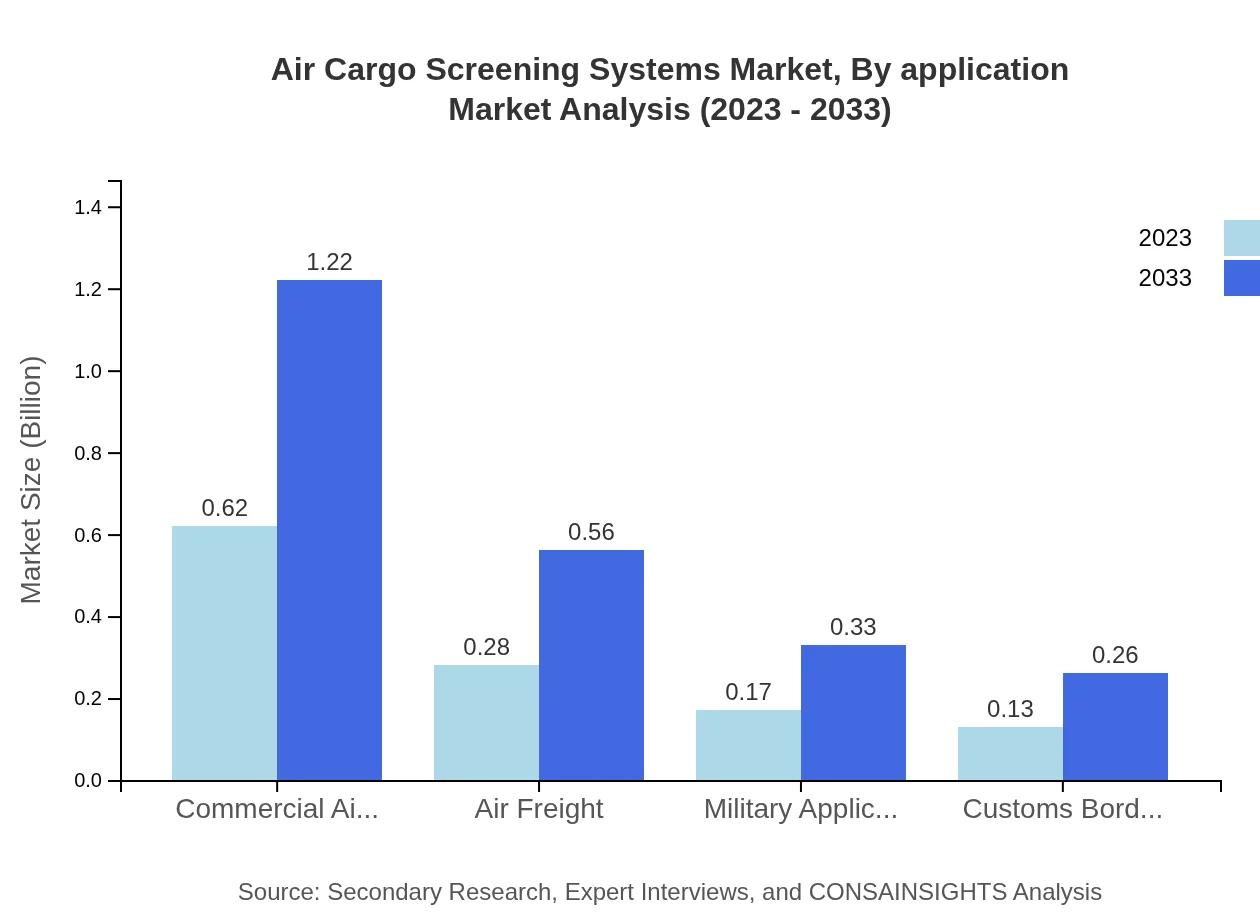

Air Cargo Screening Systems Market Analysis By Application

The major application categories include commercial airlines, air freight, military applications, and customs border protection. Commercial airlines make up a substantial portion of the market, projected to increase from $0.62 billion in 2023 to $1.22 billion by 2033, representing a share of 51.69%. The air freight segment, growing from $0.28 billion to $0.56 billion, constitutes 23.59%, driven by the rising demand for cargo transport solutions across borders.

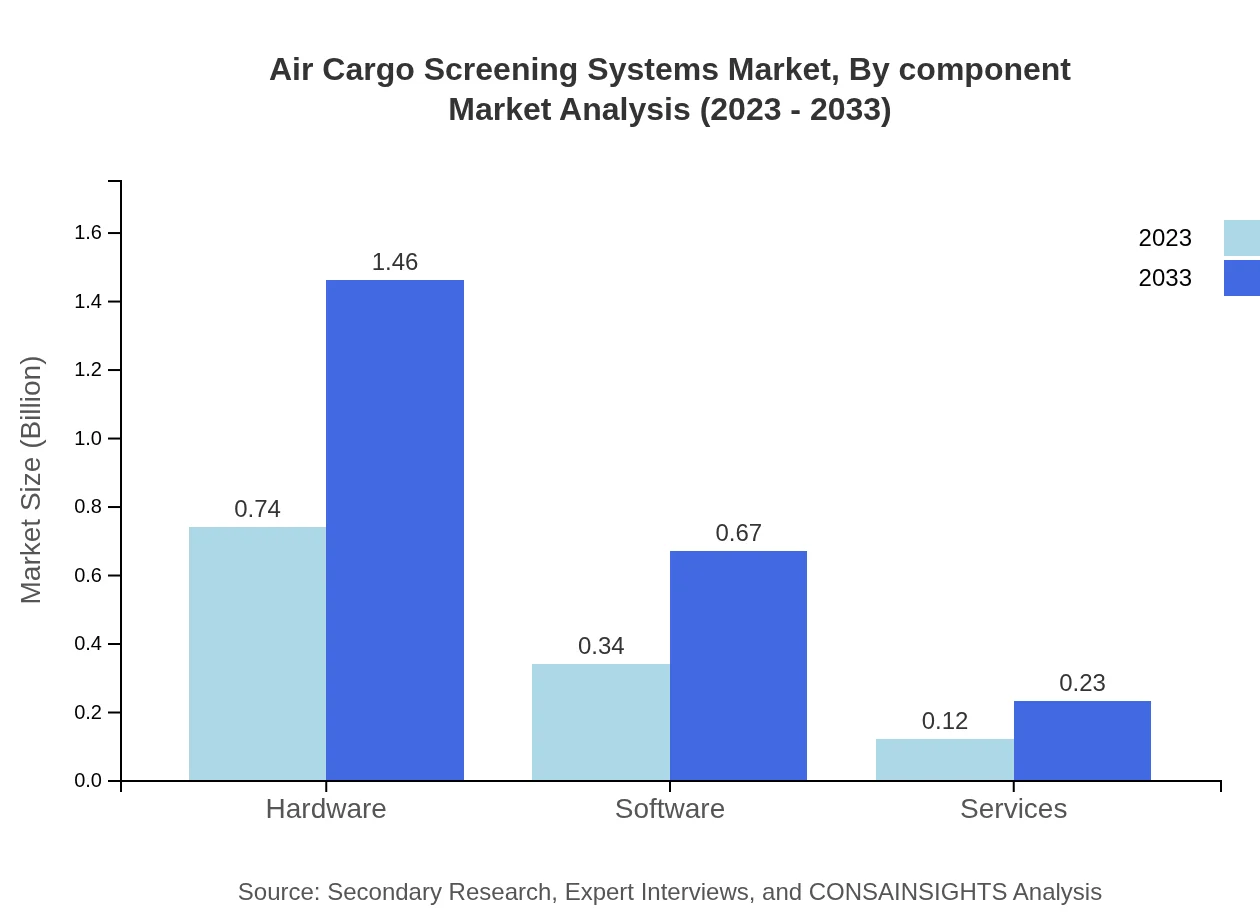

Air Cargo Screening Systems Market Analysis By Component

The components of the market break down into screening hardware, software solutions, and services. Hardware systems are at the forefront of market growth, driven by innovations in technology. Software solutions are essential for operational efficiency, while services contribute to system maintenance and compliance support, driving overall market transactions and customer relationships.

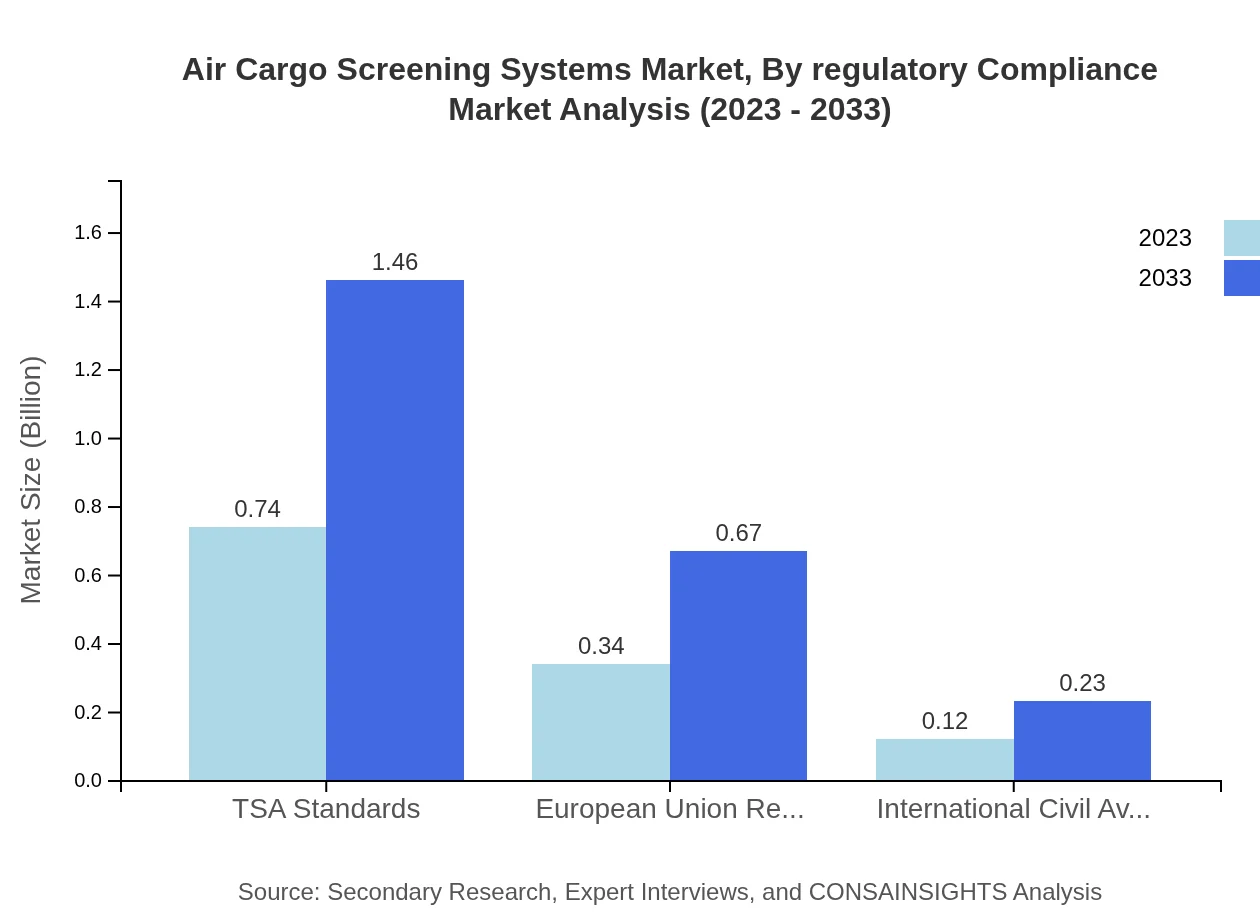

Air Cargo Screening Systems Market Analysis By Regulatory Compliance

Regulatory compliance remains a core determinant of market framework. Companies must adhere to TSA Standards, European Union Regulations, and ICAO guidelines to operate effectively. The TSA standards hold the largest market share at 61.92%, significantly influencing investment and operational strategies within the industry. As regulations tighten globally, compliance-related services and solutions are becoming crucial in the sector.

Air Cargo Screening Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Cargo Screening Systems Industry

Jeol Ltd.:

A leader in analytical instruments and screening systems, Jeol Ltd. is committed to developing innovative technologies for effective cargo security monitoring and threat detection.Smiths Detection:

A global leader in security screening technologies, Smiths Detection specializes in the design and manufacturing of state-of-the-art screening equipment essential for air cargo and passenger security.Rapiscan Systems:

Rapiscan Systems offers cutting-edge security screening solutions, ensuring compliance with global aviation security standards while delivering reliable cargo screening options.L3Harris Technologies:

L3Harris is known for providing integrated security solutions, including advanced imaging technologies to enhance air cargo screening capabilities across various sectors.Köhl GmbH:

Köhl specializes in providing comprehensive cargo screening solutions tailored to meet the growing demands of the air cargo industry, ensuring safety and compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of air Cargo Screening Systems?

The global air cargo screening systems market is projected to reach $1.2 billion by 2033, growing at a CAGR of 6.8%. This growth reflects the increasing need for secure and efficient cargo handling across global supply chains.

What are the key market players or companies in this air Cargo Screening Systems industry?

Key players in the air cargo screening systems market include Smiths Detection, L3Harris Technologies, Rapiscan Systems, and Leidos. These companies dominate due to their advanced technology and extensive customer networks within the aviation security sector.

What are the primary factors driving the growth in the air Cargo Screening Systems industry?

Growth in the air cargo screening systems industry is primarily driven by rising global trade, stricter security regulations, and technological advancements. These factors compel airports and freight operators to invest in modern screening solutions to enhance security.

Which region is the fastest Growing in the air Cargo Screening Systems?

The Asia Pacific region is currently the fastest-growing market for air cargo screening systems, projected to double from $0.24 billion in 2023 to $0.48 billion by 2033. Increased air freight volumes and regulations contribute to this significant growth.

Does Consainsights provide customized market report data for the air Cargo Screening Systems industry?

Yes, Consainsights offers customized market report data tailored to the air cargo screening systems industry. Clients can request specific analyses to meet their unique needs, including targeted regional and segment insights.

What deliverables can I expect from this air Cargo Screening Systems market research project?

Deliverables from the air cargo screening systems market research include in-depth market analysis, competitive landscape assessments, trend reports, and projections for market size and growth across regions and segments.

What are the market trends of air Cargo Screening Systems?

Current trends in the air cargo screening systems market include increased investments in automated screening technologies, enhancement of AI capabilities in security systems, and emphasis on compliance with international security standards to boost operational efficiency.