Automotive Brake Caliper Market Report

Published Date: 02 February 2026 | Report Code: automotive-brake-caliper

Automotive Brake Caliper Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Brake Caliper market, offering insights into market size, trends, regional performance, and forecasts from 2023 to 2033.

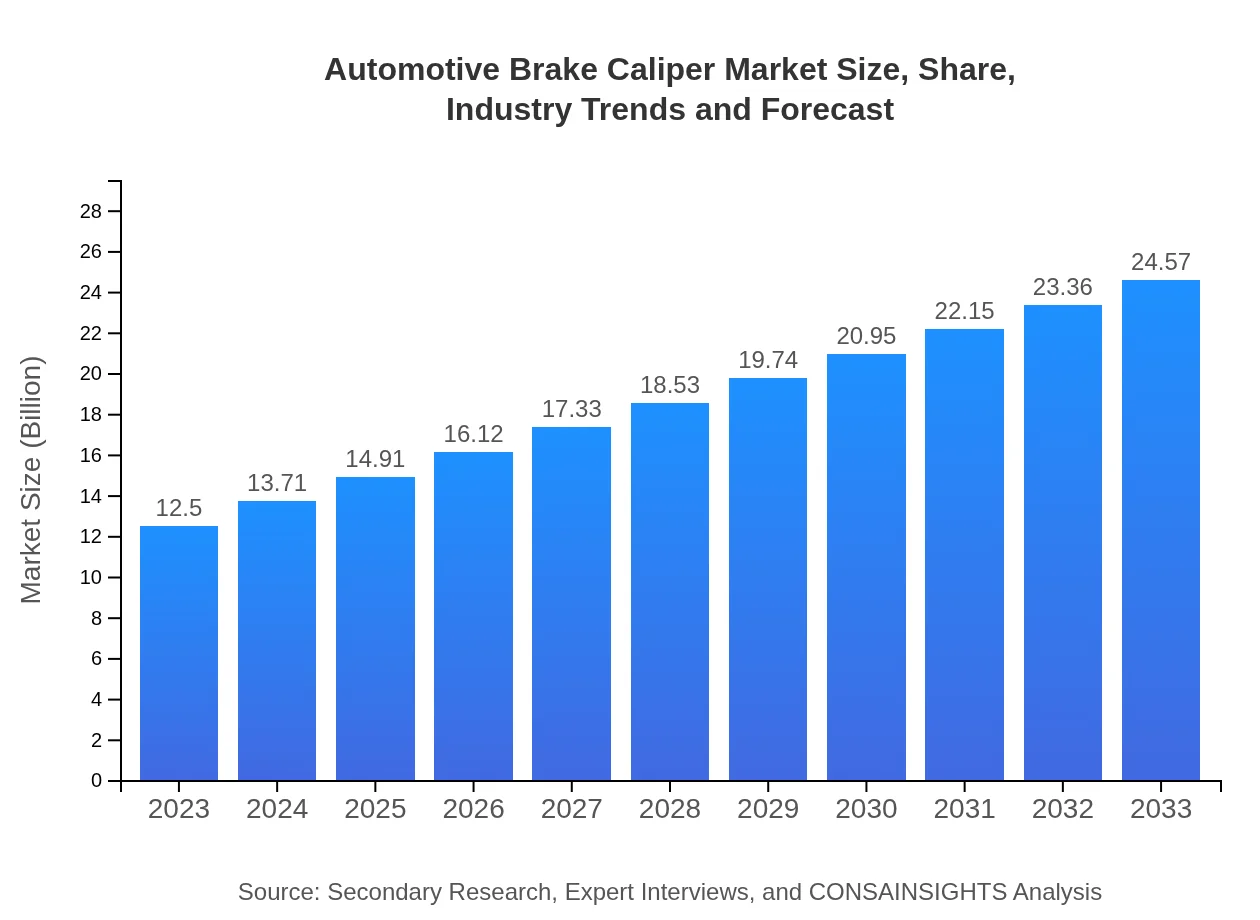

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Brembo S.p.A., Bosch Group, TRW Automotive, Zhejiang Yueling, Aisin Seiki Co., Ltd. |

| Last Modified Date | 02 February 2026 |

Automotive Brake Caliper Market Overview

Customize Automotive Brake Caliper Market Report market research report

- ✔ Get in-depth analysis of Automotive Brake Caliper market size, growth, and forecasts.

- ✔ Understand Automotive Brake Caliper's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Brake Caliper

What is the Market Size & CAGR of Automotive Brake Caliper market in 2033?

Automotive Brake Caliper Industry Analysis

Automotive Brake Caliper Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Brake Caliper Market Analysis Report by Region

Europe Automotive Brake Caliper Market Report:

In Europe, the automotive brake caliper market is projected to grow from $3.01 billion in 2023 to $5.91 billion in 2033. Market growth is stimulated by the stringent safety regulations and increasing demand for lighter, more efficient braking solutions in the face of rising emissions standards.Asia Pacific Automotive Brake Caliper Market Report:

The Asia Pacific region is poised for robust growth, with an expected market size of $5.37 billion by 2033, up from $2.73 billion in 2023. This growth is largely attributable to the rapid increase in automotive manufacturing, particularly in countries like China and India, due to growing consumer demand and favorable government policies.North America Automotive Brake Caliper Market Report:

North America is expected to remain a dominant player, with a market size anticipated to reach $9.02 billion by 2033, growing from $4.59 billion in 2023. The presence of major automotive manufacturers and a shift towards electric vehicles is propelling market growth in this region despite potential market saturation.South America Automotive Brake Caliper Market Report:

The South American market is projected to witness gradual growth, expanding from $0.78 billion in 2023 to $1.54 billion by 2033. The increasing demand for vehicles in emerging economies like Brazil and Argentina will drive this growth, complemented by a rising middle class and improving economic conditions.Middle East & Africa Automotive Brake Caliper Market Report:

The Middle East and Africa region is expected to grow from $1.38 billion in 2023 to $2.72 billion by 2033. Economic recovery and increasing vehicle production in countries such as South Africa and the UAE are key contributors to this growth.Tell us your focus area and get a customized research report.

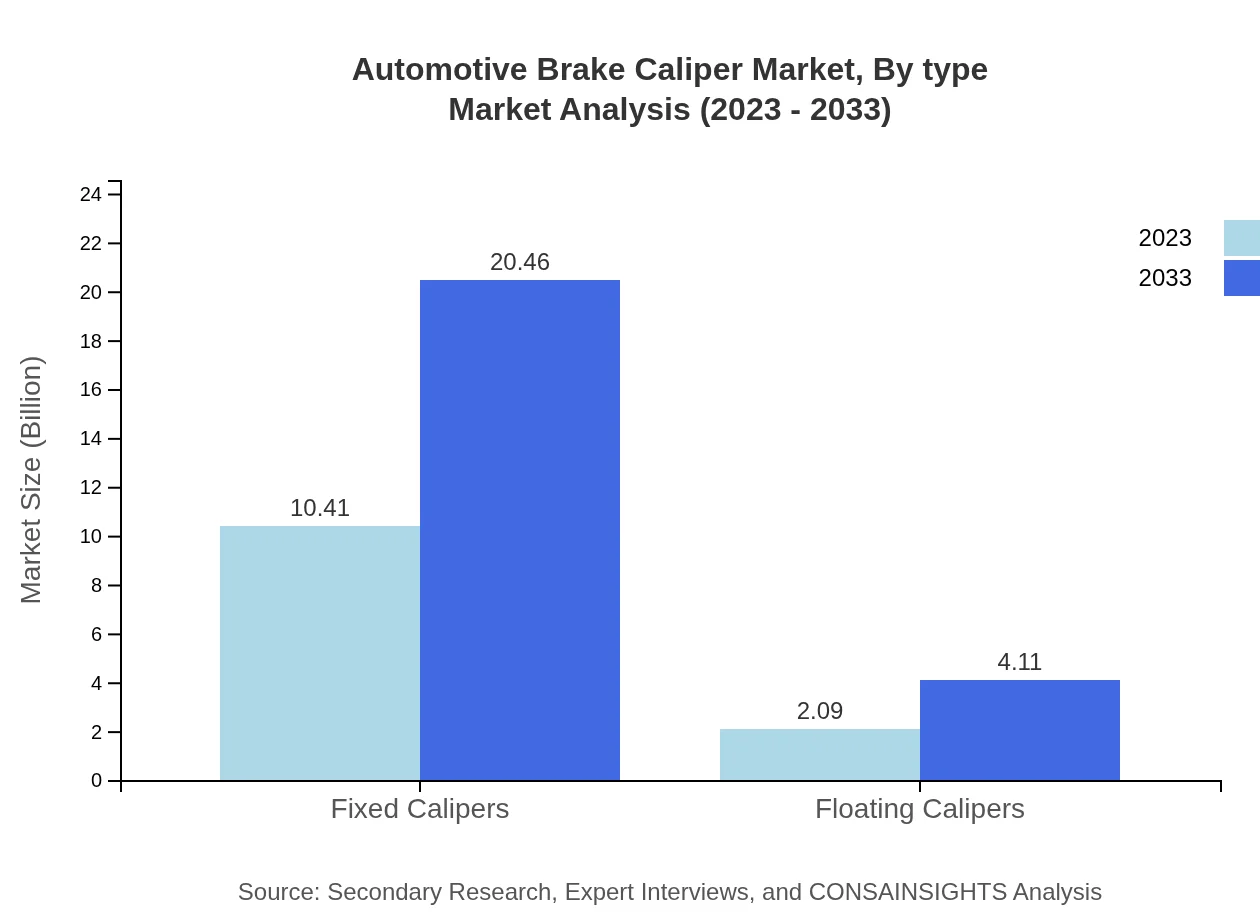

Automotive Brake Caliper Market Analysis By Type

In the analysis of the Automotive Brake Caliper Market by type, fixed calipers dominate the market with a size estimated at $10.41 billion in 2023, projected to grow to $20.46 billion by 2033. Floating calipers hold a smaller market share at $2.09 billion in 2023, with expected growth to $4.11 billion by 2033.

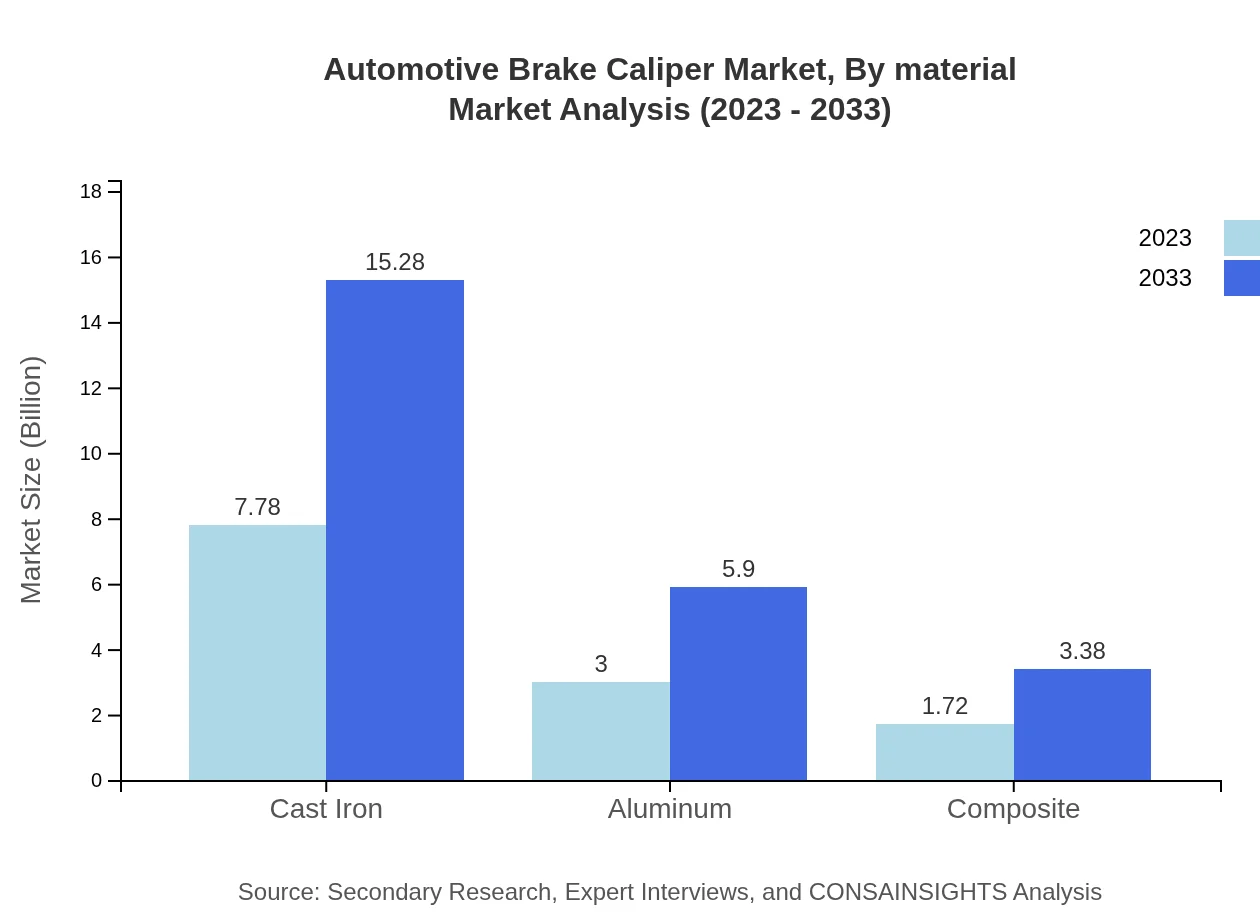

Automotive Brake Caliper Market Analysis By Material

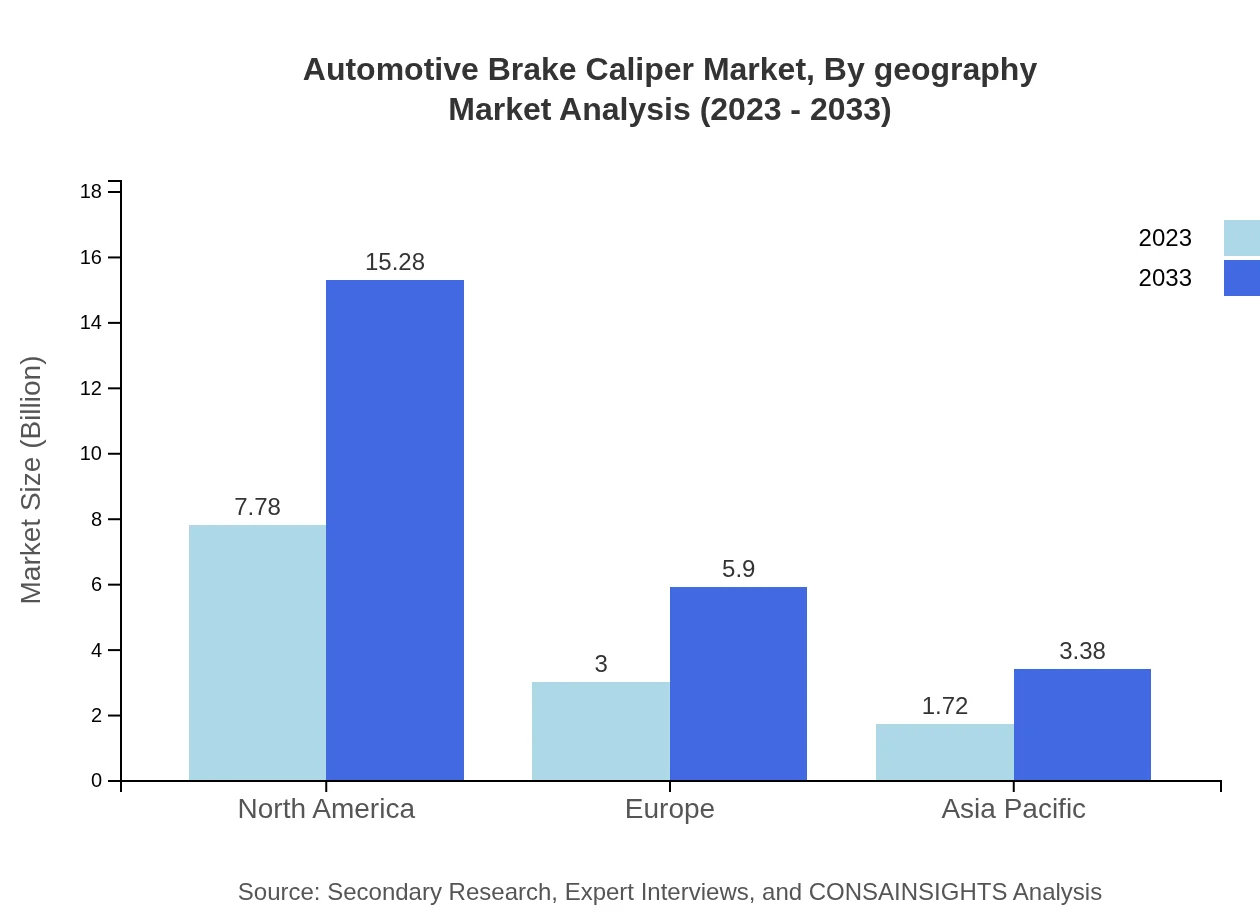

Materials used in brake calipers play a critical role in overall performance. Cast iron, being the predominant material, holds a 62.2% market share in 2023, expected to expand from $7.78 billion to $15.28 billion by 2033. Aluminum also shows significant growth potential, moving from $3.00 billion in 2023 to $5.90 billion by 2033. Composite materials are gaining traction due to their lightweight properties.

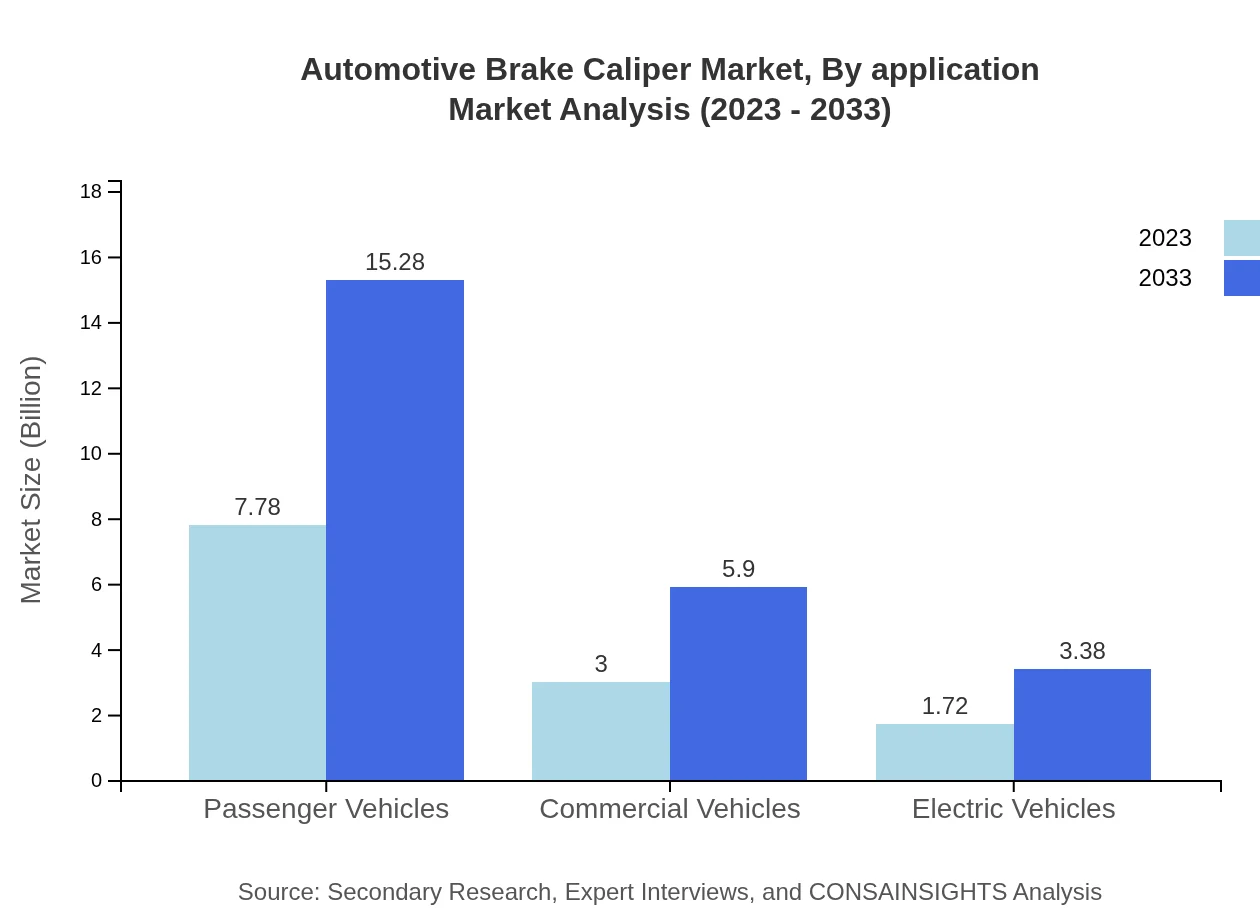

Automotive Brake Caliper Market Analysis By Application

Passenger vehicles account for the largest segment of the market, with a size of $7.78 billion in 2023, expected to increase to $15.28 billion by 2033. Commercial vehicles also represent a significant share at $3.00 billion in 2023 and are projected to reach $5.90 billion. Electric vehicles are a growing segment, expected to grow from $1.72 billion to $3.38 billion.

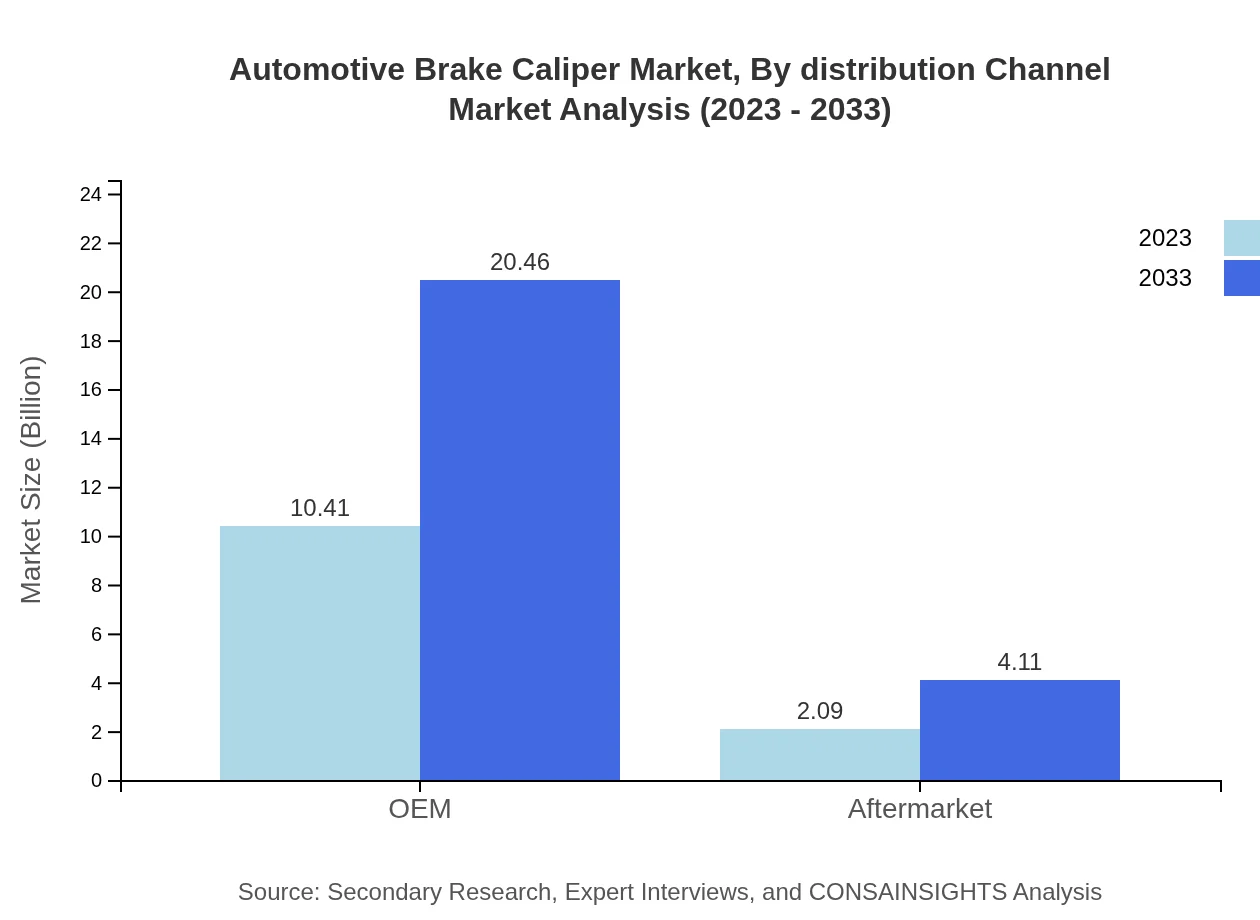

Automotive Brake Caliper Market Analysis By Distribution Channel

The market is divided into OEM and aftermarket channels. OEMs hold a significant share, with a projected growth from $10.41 billion in 2023 to $20.46 billion by 2033. The aftermarket segment, while smaller, is also poised for growth from $2.09 billion to $4.11 billion in the same period.

Automotive Brake Caliper Market Analysis By Geography

Global geographical analysis shows diversified growth patterns. North America leads market expansion followed by Europe and Asia Pacific. Each region shows unique growth drivers, including regulatory factors, regional safety demands, and technological advancements.

Automotive Brake Caliper Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Brake Caliper Industry

Brembo S.p.A.:

Brembo is a global leader in high-performance brake systems, known for its innovation and technical excellence in the automotive sector.Bosch Group:

Bosch Group specializes in automotive technology, including brake systems, and is recognized for its commitment to quality and sustainability.TRW Automotive:

A key supplier of brake systems, TRW Automotive focuses on advanced braking technologies and solutions tailored to modern vehicle needs.Zhejiang Yueling:

Zhejiang Yueling is renowned in the Asian market for its production of reliable and efficient brake components, ensuring safety and performance.Aisin Seiki Co., Ltd.:

Aisin Seiki is a Japanese firm that plays a significant role in the development of automotive brakes and is known for its innovative approaches.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive brake caliper?

The automotive brake caliper market is projected to reach a size of $12.5 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% during the forecast period from 2023 to 2033.

What are the key market players or companies in the automotive brake caliper industry?

The automotive brake caliper industry features several key players, including global manufacturers of automotive components, aftermarket suppliers, and specialized brake systems producers. Notable companies drive competition and innovation in this sector, enhancing the overall market landscape.

What are the primary factors driving the growth in the automotive brake caliper industry?

Growth in the automotive brake caliper sector is driven by rising vehicle production rates, advancements in brake technologies, and increasing demand for high-performance braking systems. Additionally, expanding electric vehicle markets boost the demand for efficient braking components.

Which region is the fastest Growing in the automotive brake caliper?

North America is the fastest-growing region in the automotive brake caliper market, expected to increase from $4.59 billion in 2023 to $9.02 billion by 2033. Europe and Asia Pacific are also notable growth regions due to rising automotive production.

Does ConsaInsights provide customized market report data for the automotive brake caliper industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the automotive brake caliper industry. This service allows clients to obtain targeted insights, analyze trends, and enhance strategic decision-making.

What deliverables can I expect from this automotive brake caliper market research project?

Expect comprehensive deliverables including detailed market analysis, regional and segment data, competitive landscape insights, forecasts, and actionable recommendations aimed at supporting strategic planning.

What are the market trends of automotive brake caliper?

Current market trends include an increase in demand for lightweight materials like aluminum, a shift towards electric vehicle technologies, and a growing focus on advanced braking systems. These trends reflect the sector's adaption to evolving automotive needs.