Composite Materials Market Report

Published Date: 02 February 2026 | Report Code: composite-materials

Composite Materials Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the Composite Materials market from 2023 to 2033, offering insights into market size, growth projections, and industry dynamics, as well as regional and segment analysis.

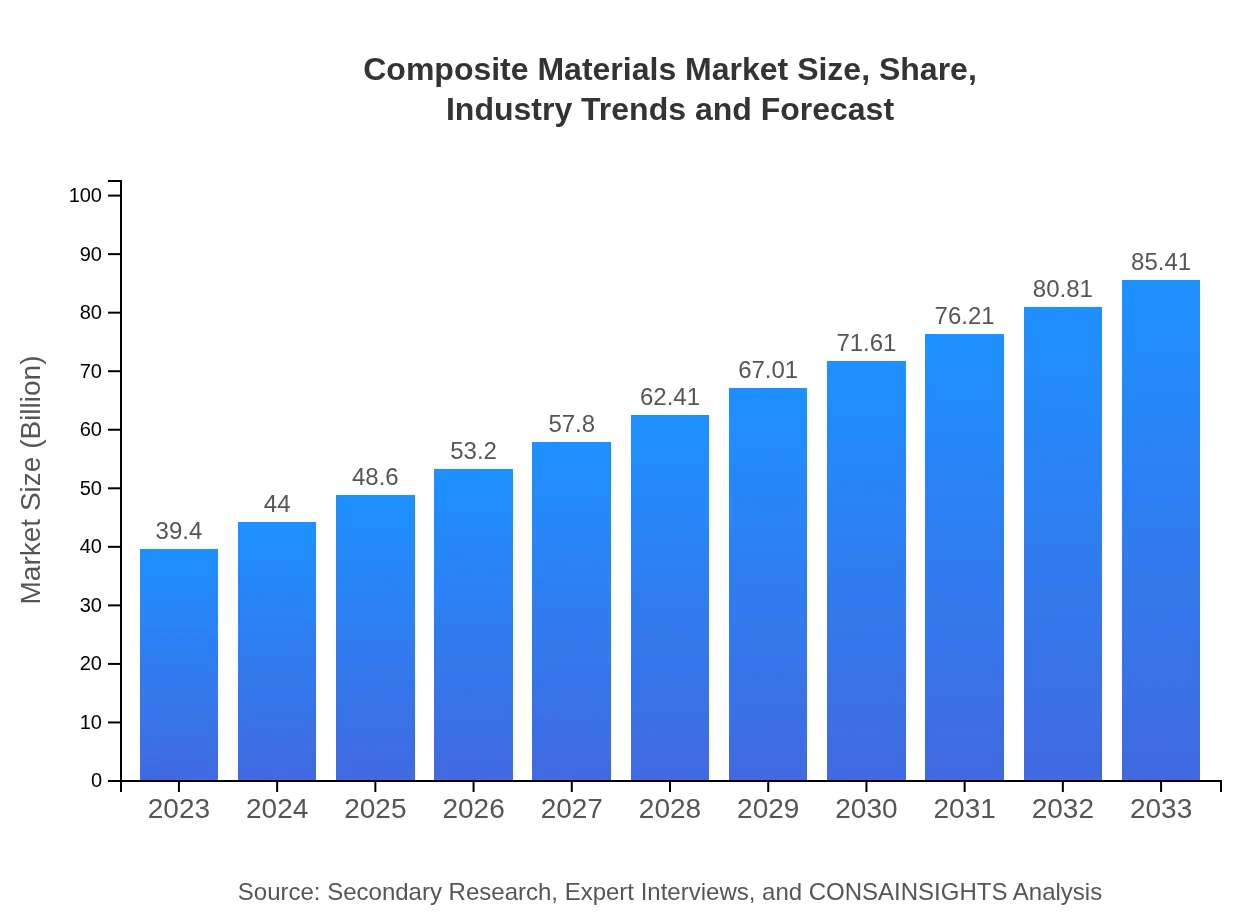

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $39.40 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $85.41 Billion |

| Top Companies | Toray Industries, Inc., Hexcel Corporation, SABIC, Mitsubishi Chemical Corporation |

| Last Modified Date | 02 February 2026 |

Composite Materials Market Overview

Customize Composite Materials Market Report market research report

- ✔ Get in-depth analysis of Composite Materials market size, growth, and forecasts.

- ✔ Understand Composite Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Composite Materials

What is the Market Size & CAGR of Composite Materials market in 2023?

Composite Materials Industry Analysis

Composite Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Composite Materials Market Analysis Report by Region

Europe Composite Materials Market Report:

Europe is witnessing a dynamic market environment, with projections suggesting growth from $12.82 billion in 2023 to $27.78 billion in 2033. The region's stringent regulations promoting lightweight materials in transportation are major drivers of this growth.Asia Pacific Composite Materials Market Report:

The Asia Pacific region is anticipated to grow significantly, with a market size of $16.17 billion projected by 2033, up from $7.46 billion in 2023. This growth is driven by the booming automotive and aerospace sectors, coupled with the region's increasing focus on infrastructure development.North America Composite Materials Market Report:

North America maintains a strong market presence, projected to reach $28.74 billion by 2033 from $13.26 billion in 2023. The region benefits from advanced technological capabilities and capacity for high-performance materials, particularly in aerospace and defense sectors.South America Composite Materials Market Report:

In South America, the Composite Materials market is expected to expand from $2.16 billion in 2023 to approximately $4.68 billion by 2033. The growth can be attributed to rising demand in the construction and automotive industries, supported by ongoing infrastructure projects.Middle East & Africa Composite Materials Market Report:

The Middle East and Africa market is set to advance from $3.71 billion in 2023 to around $8.04 billion by 2033. Factors contributing to this rise include increased investments in infrastructure and growing industries such as oil and gas, where composites are used for corrosive resistance.Tell us your focus area and get a customized research report.

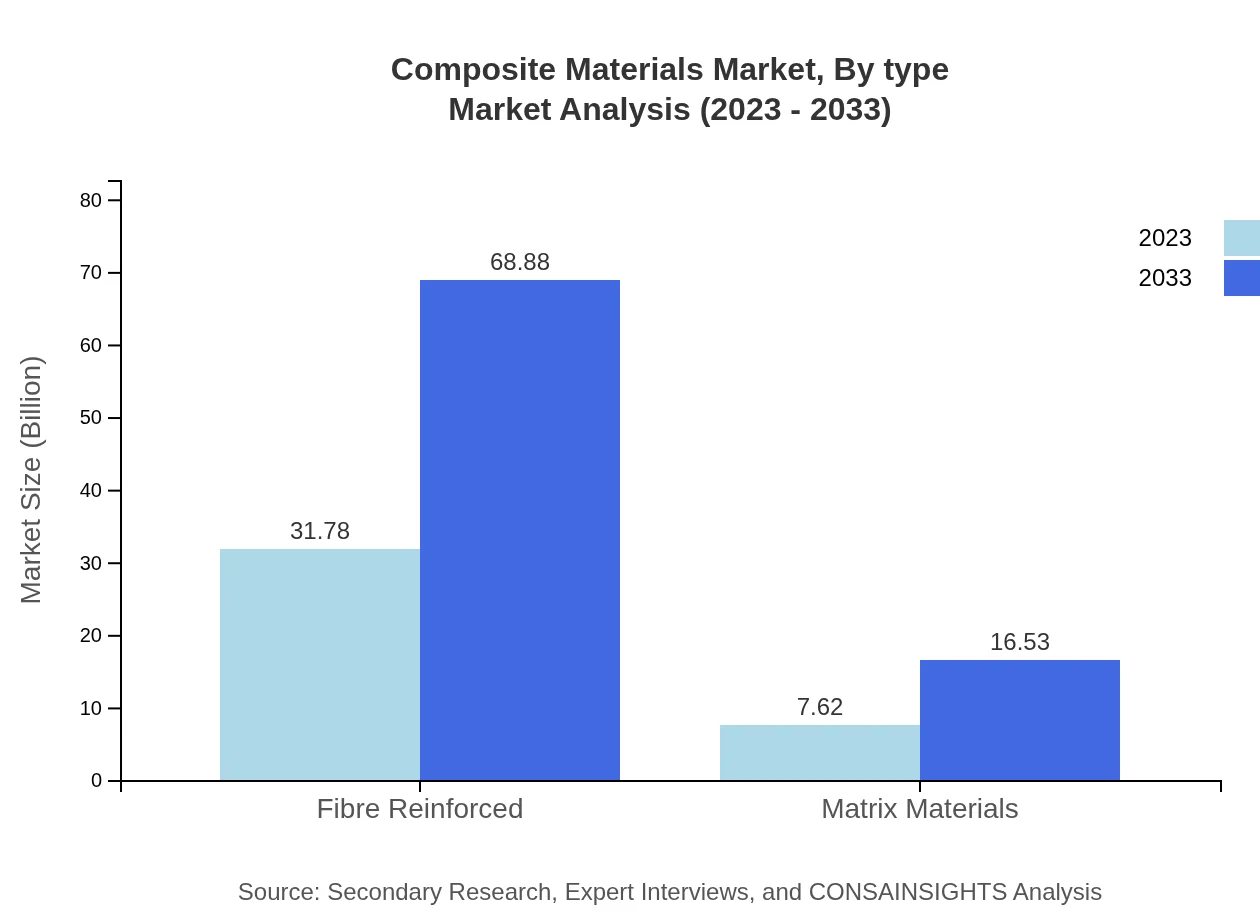

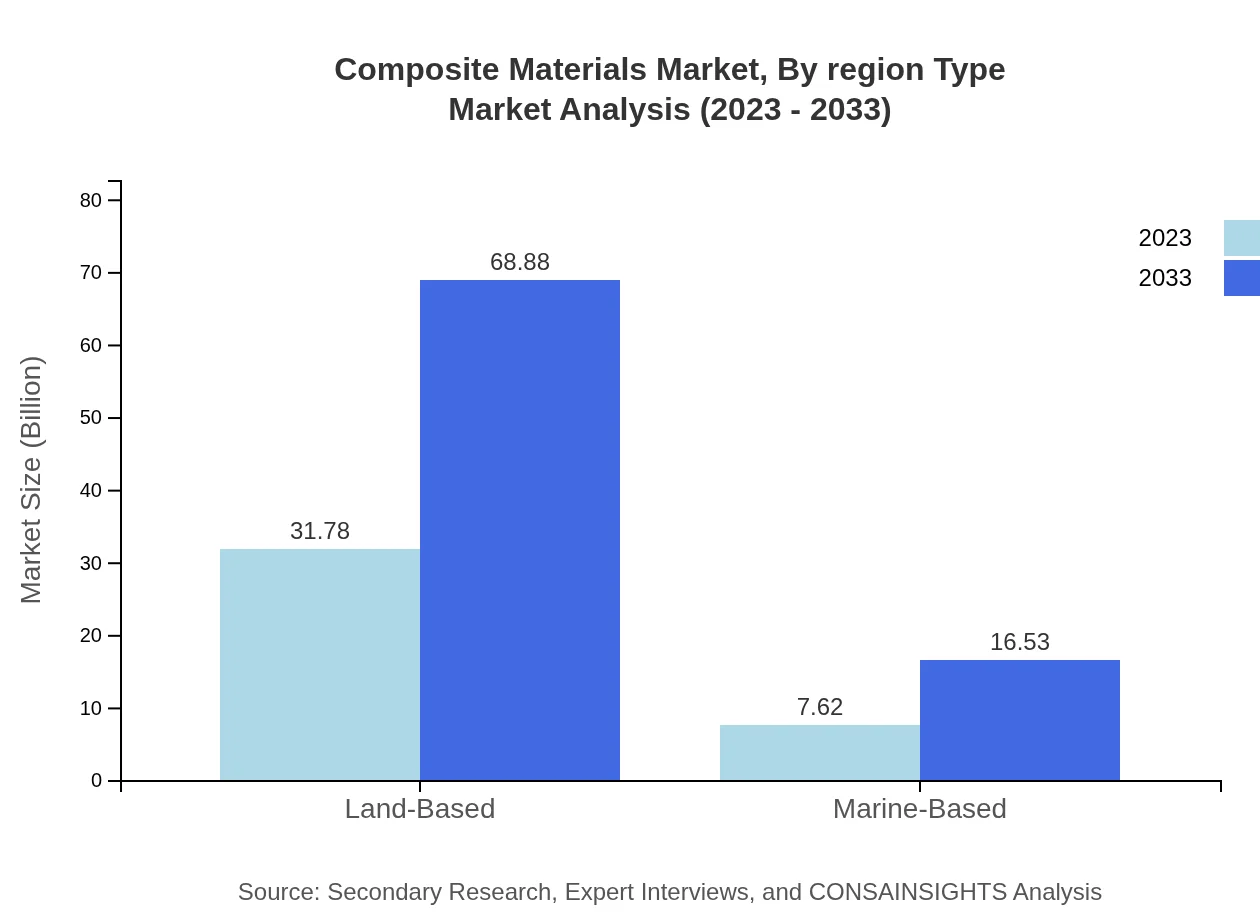

Composite Materials Market Analysis By Type

The Fiber Reinforced segment dominates the market, accounting for 80.65% of the share in 2023, with a projected market size of $68.88 billion by 2033. Matrix Materials represent a smaller but significant share at 19.35%, expected to reach $16.53 billion in the same timeframe.

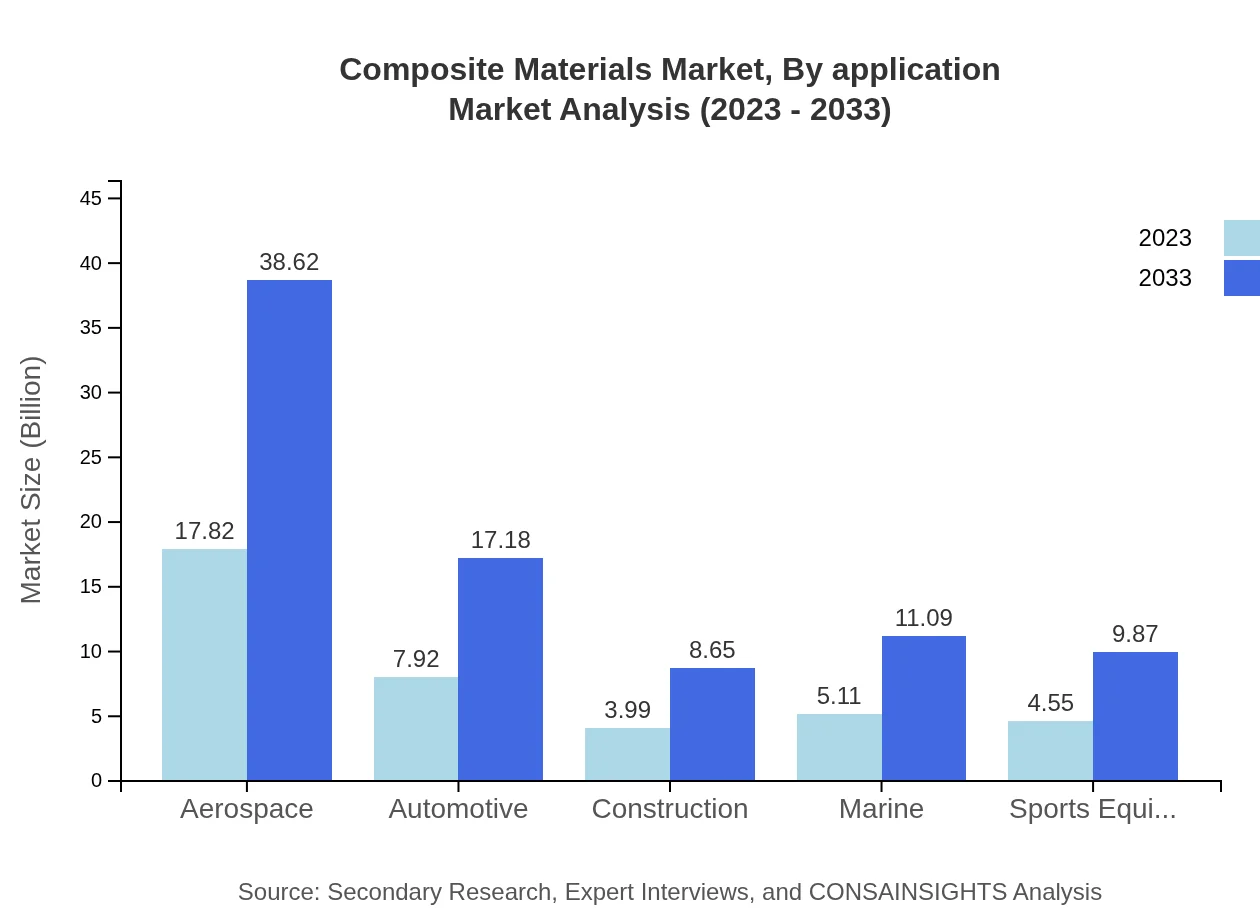

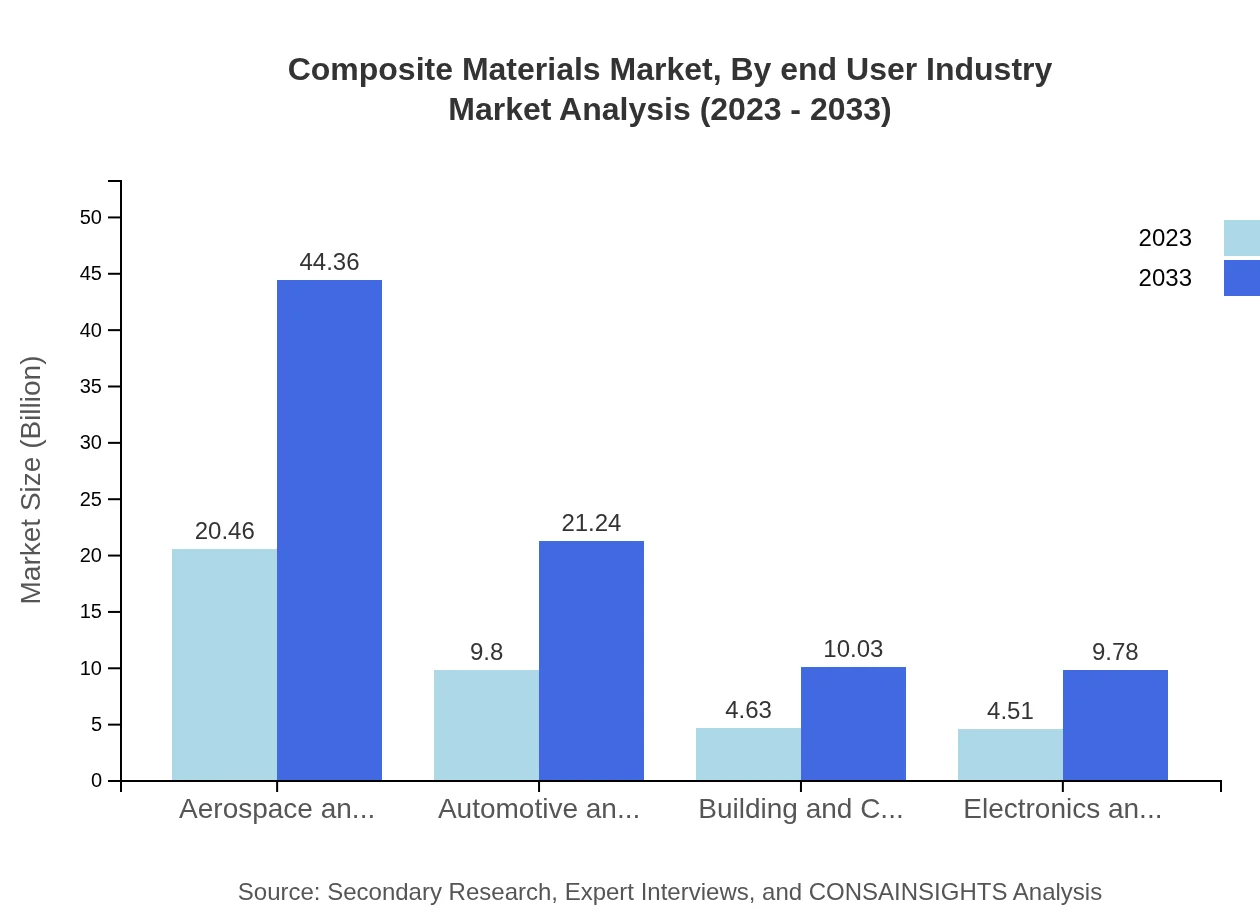

Composite Materials Market Analysis By Application

The Aerospace application leads with a considerable share of 45.22% in 2023, projected to grow to $38.62 billion by 2033. Automotive and transportation applications follow, with expectations of significant growth from $9.80 billion in 2023 to $21.24 billion by 2033.

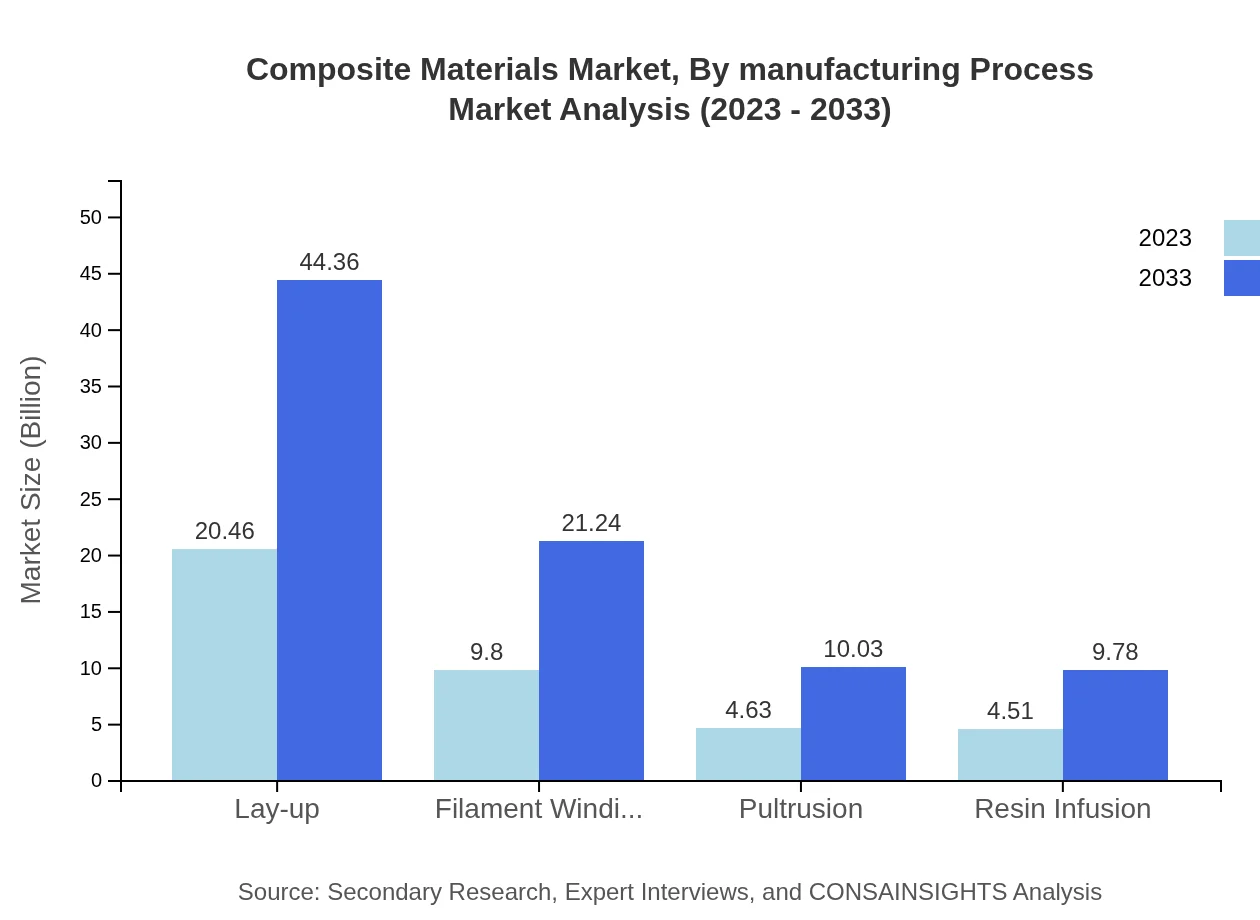

Composite Materials Market Analysis By Manufacturing Process

Key manufacturing processes such as Lay-up, Filament Winding, and Pultrusion indicate diverse methods yielding different sector applicability. Lay-up is predicted to hold a 51.94% market share, while Filament Winding's share is steadily increasing, indicating innovation in production.

Composite Materials Market Analysis By End User Industry

The Aerospace and Defense sector remains the largest consumer, representing 51.94% of the market in 2023, showcasing strong growth potential. Industries like construction, electronics, and telecommunications are also expected to expand, maintaining diversity in application.

Composite Materials Market Analysis By Region Type

Regional analysis reflects varying growth trajectories influenced by economic conditions, technological advancements, and regulatory frameworks, demonstrating that North America, Europe, and Asia Pacific lead the way while emerging markets in South America and Africa present new opportunities.

Composite Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Composite Materials Industry

Toray Industries, Inc.:

A leading developer of advanced composite materials, known for innovations in carbon fiber and resin systems extensively used in aerospace and automotive industries.Hexcel Corporation:

Specializes in carbon fiber composites and honeycomb structures utilized in aerospace, wind energy, and automotive sectors, driving sustainable solutions.SABIC:

Offers a wide range of composite materials focusing on high-performance applications in electronics, aerospace, and transportation, emphasizing sustainability.Mitsubishi Chemical Corporation:

Engages in developing composite materials for various applications, particularly known for their advancements in thermoplastics and aviation materials.We're grateful to work with incredible clients.

FAQs

What is the market size of composite materials?

The composite materials market is projected to reach USD 39.4 billion by 2033, growing at a CAGR of 7.8%. This growth indicates an increasing demand across various industries, reflecting the expanding applications of composite materials.

What are the key market players or companies in the composite materials industry?

Key players in the composite materials market include Toray Industries, Hexcel Corporation, and Owens Corning. These companies are pivotal in innovation and supply chain management, contributing significantly to market growth and technological advancements.

What are the primary factors driving the growth in the composite materials industry?

Growth drivers include increasing demand in aerospace and automotive sectors due to the lightweight nature of composites, technological advancements in manufacturing processes, and growing applications in the construction and energy sectors.

Which region is the fastest Growing in the composite materials market?

Asia Pacific is the fastest-growing region in the composite materials market, with a projected growth from USD 7.46 billion in 2023 to USD 16.17 billion by 2033, driven by rising industrialization and demand from the automotive sector.

Does ConsaInsights provide customized market report data for the composite materials industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the composite materials industry, allowing clients to gain insights specific to their market interests and strategic objectives.

What deliverables can I expect from this composite materials market research project?

Deliverables from the composite materials market research project typically include comprehensive market analysis, segmentation data, competitive landscape assessment, and actionable recommendations for business strategies.

What are the market trends of composite materials?

Key trends include increasing adoption of bio-based composites, advancements in nanotechnology, and a focus on sustainability. These trends reflect the industry's adaptation to regulatory pressures and consumer preferences for eco-friendly materials.