Automotive Carbon Fiber Market Report

Published Date: 02 February 2026 | Report Code: automotive-carbon-fiber

Automotive Carbon Fiber Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Carbon Fiber market from 2023 to 2033, covering market size, growth trends, segmentation, regional insights, and forecasts. It aims to equip stakeholders with valuable data for strategic decision-making.

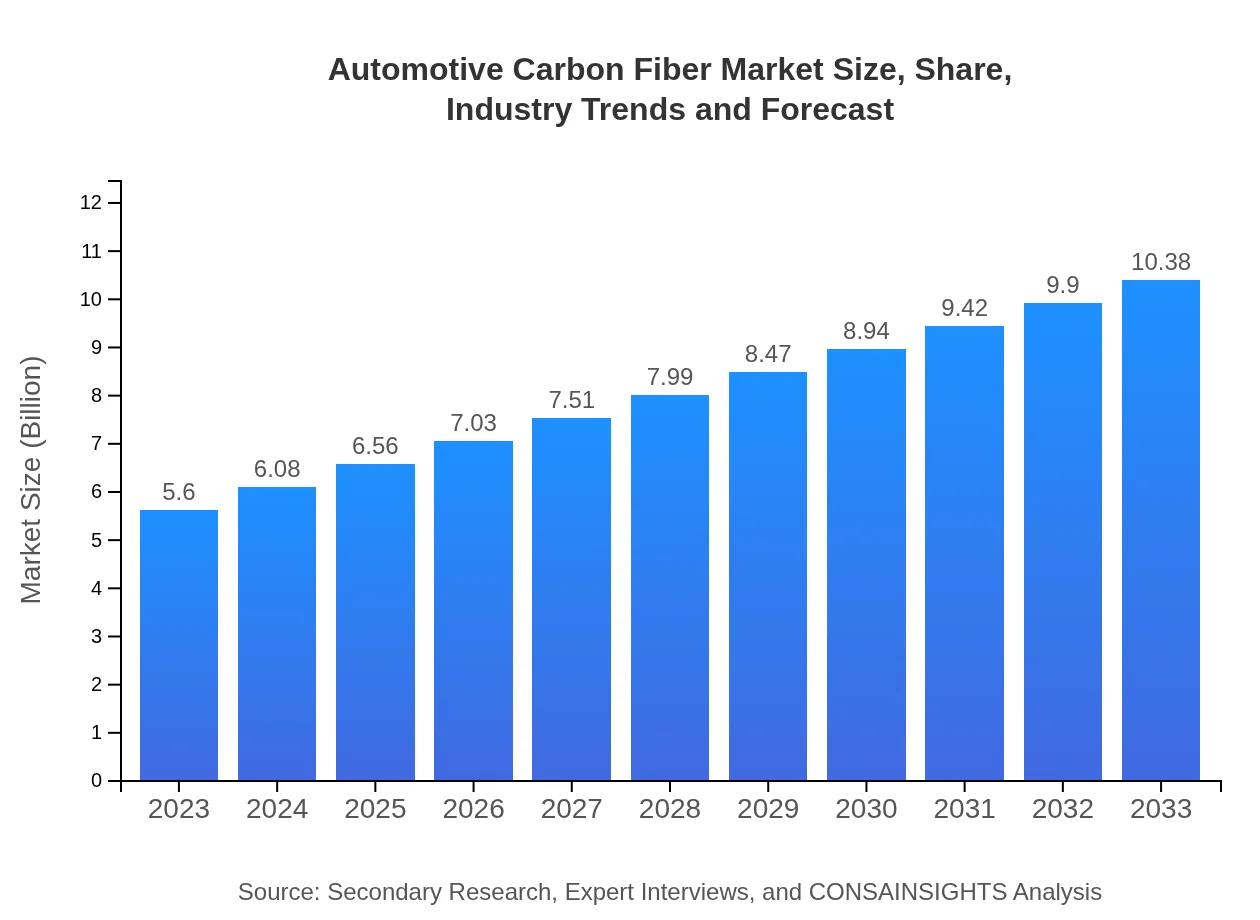

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Toray Industries, Inc., Hexcel Corporation, SGL Carbon SE, Cytec Solvay Group |

| Last Modified Date | 02 February 2026 |

Automotive Carbon Fiber Market Overview

Customize Automotive Carbon Fiber Market Report market research report

- ✔ Get in-depth analysis of Automotive Carbon Fiber market size, growth, and forecasts.

- ✔ Understand Automotive Carbon Fiber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Carbon Fiber

What is the Market Size & CAGR of Automotive Carbon Fiber market in 2033?

Automotive Carbon Fiber Industry Analysis

Automotive Carbon Fiber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Carbon Fiber Market Analysis Report by Region

Europe Automotive Carbon Fiber Market Report:

Europe remains a significant player, with the Automotive Carbon Fiber market anticipated to grow from $1.36 billion in 2023 to $2.52 billion by 2033. The European market benefits from stringent emission regulations and a robust automotive industry focused on sustainability and lightweight materials, particularly in Germany, France, and the UK.Asia Pacific Automotive Carbon Fiber Market Report:

The Asia Pacific region is poised for robust growth in the Automotive Carbon Fiber market, projected to reach approximately $2.19 billion by 2033, up from $1.18 billion in 2023. This growth is fueled by rapid industrialization, increasing automotive production, and a shift towards electric vehicles in countries such as China and Japan. The region's strength in manufacturing and technology adoption also plays a significant role.North America Automotive Carbon Fiber Market Report:

North America, with a market size projected to expand from $1.80 billion in 2023 to $3.33 billion in 2033, is at the forefront of automotive innovation. The region's focus on fuel-efficient vehicles and aggressive policies promoting electric vehicles creates opportunities for carbon fiber integration in manufacturing.South America Automotive Carbon Fiber Market Report:

In South America, the Automotive Carbon Fiber market is expected to grow from $0.51 billion in 2023 to $0.95 billion by 2033. This market growth is primarily driven by increasing investments in infrastructure and the strengthening of the automotive supply chain within the region, particularly in Brazil and Argentina.Middle East & Africa Automotive Carbon Fiber Market Report:

The Middle East and Africa market is projected to increase from $0.75 billion in 2023 to $1.39 billion in 2033. The growth in automotive production, particularly in South Africa and the UAE, and the introduction of new automotive manufacturing plants are key drivers of this upward trend.Tell us your focus area and get a customized research report.

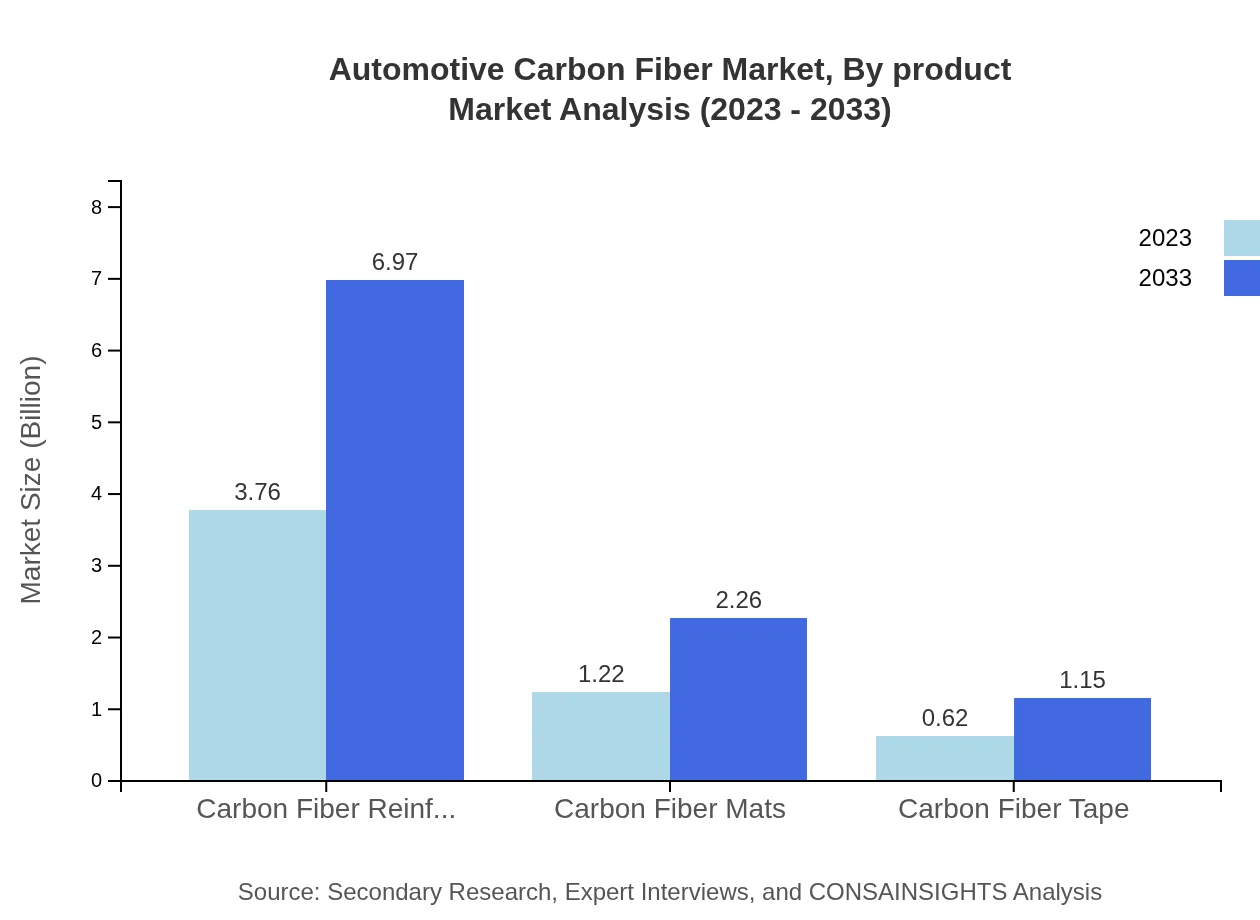

Automotive Carbon Fiber Market Analysis By Product

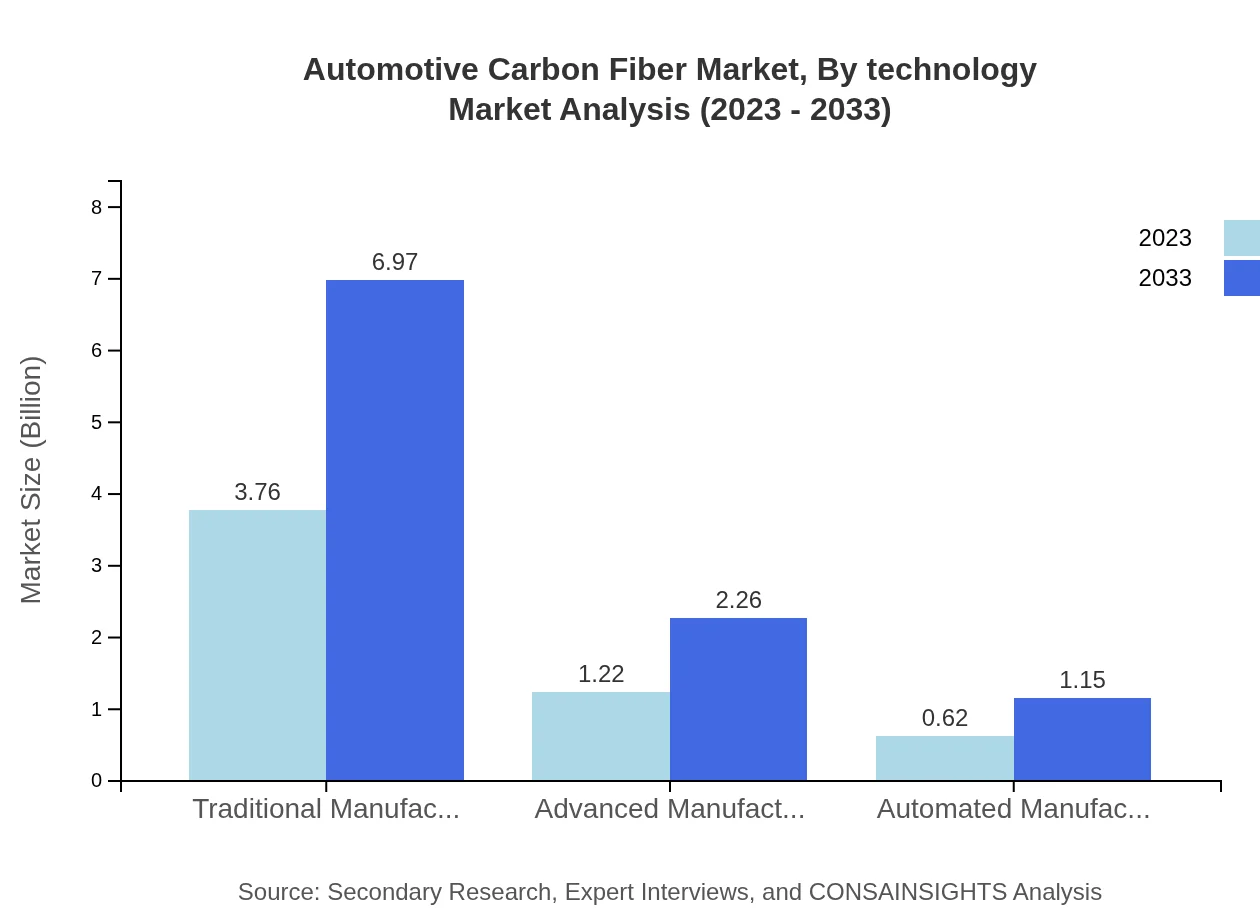

The key products in the Automotive Carbon Fiber market include Carbon Fiber Reinforced Composites, which dominate with a notable market share. In 2023, it stands at $3.76 billion, and it's projected to rise to $6.97 billion by 2033. Carbon Fiber Mats and Carbon Fiber Tape also play significant roles, with market sizes of $1.22 billion and $0.62 billion in 2023, respectively.

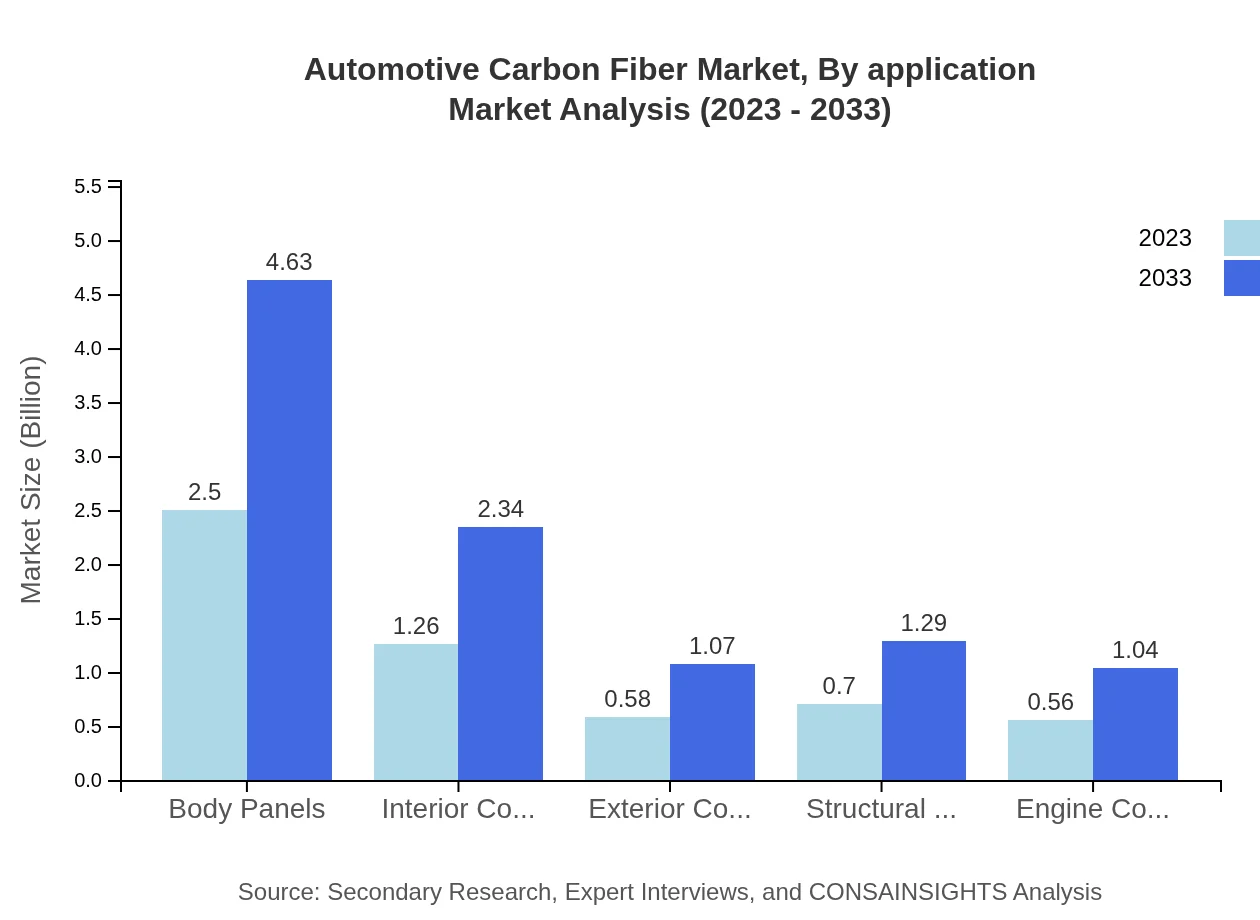

Automotive Carbon Fiber Market Analysis By Application

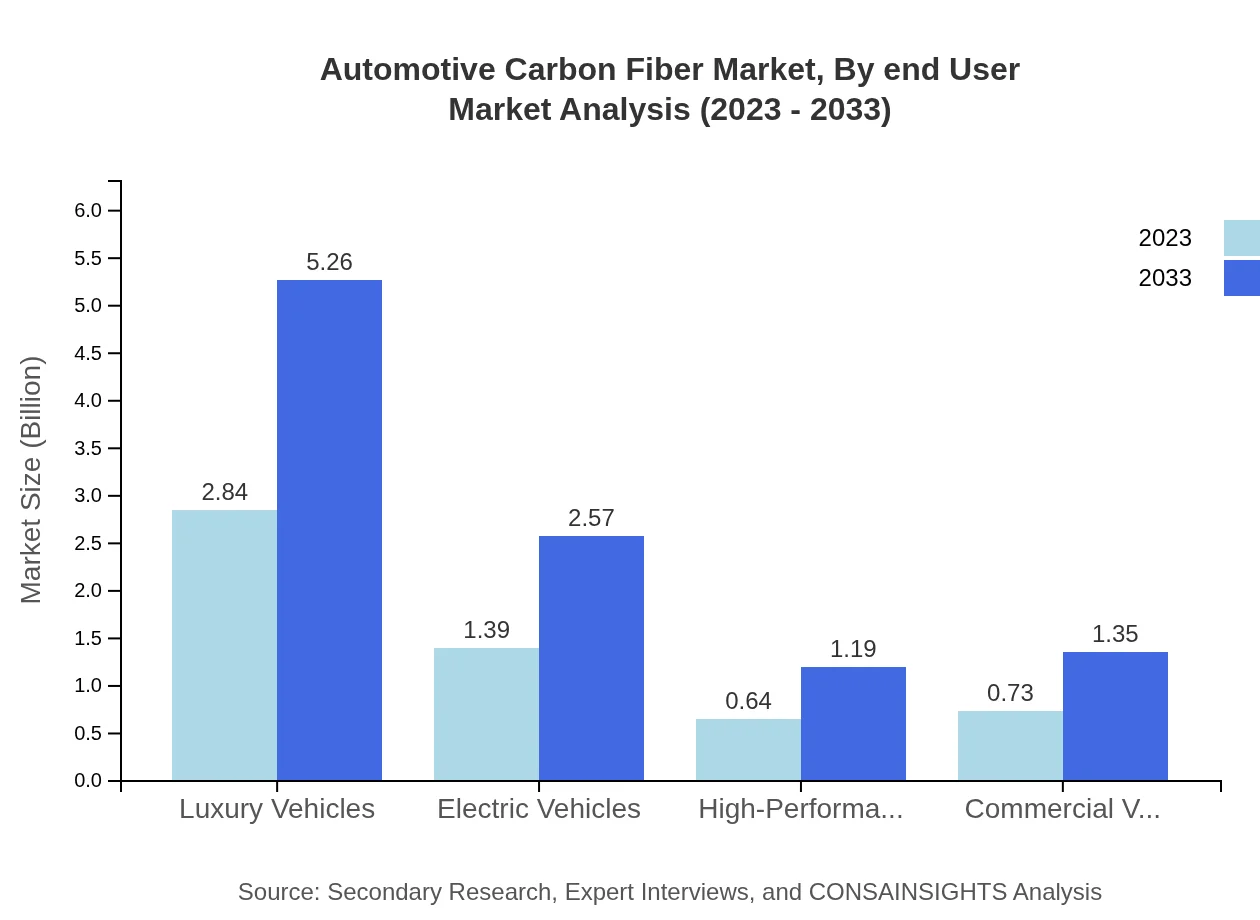

In terms of application, Luxury Vehicles lead the sector with a market size of $2.84 billion in 2023, set to grow to $5.26 billion by 2033. Electric Vehicles also occupy a substantial position with a projected increase from $1.39 billion to $2.57 billion in the same timeframe, reflecting the industry's transformation towards electrification.

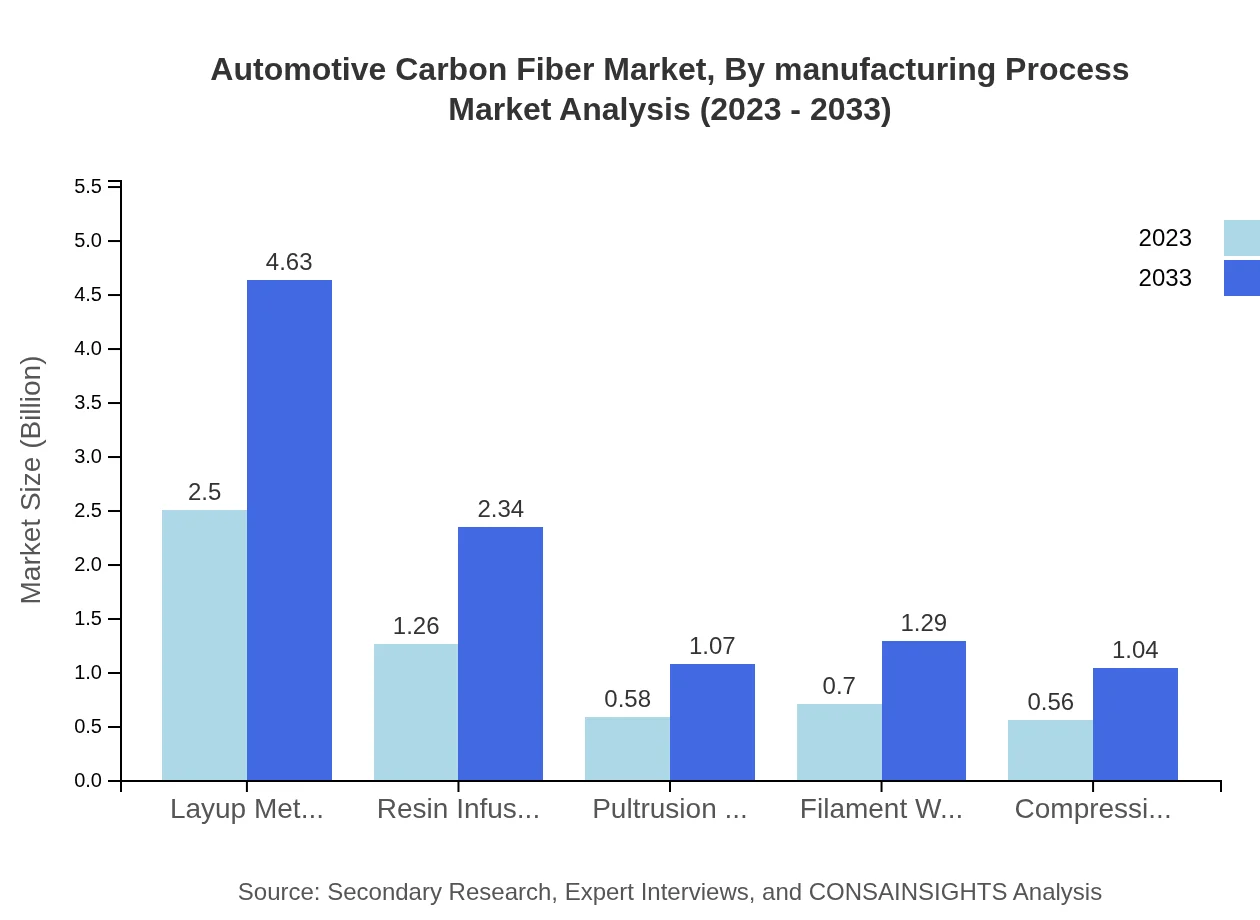

Automotive Carbon Fiber Market Analysis By Manufacturing Process

Market segments by manufacturing process include Traditional Manufacturing, Advanced Manufacturing, and Automated Manufacturing processes. Traditional Manufacturing commands a leading share with $3.76 billion in 2023 and is projected to expand to $6.97 billion. Automated Manufacturing is also showing growth, expected to increase from $0.62 billion to $1.15 billion by 2033.

Automotive Carbon Fiber Market Analysis By End User

According to end-user segments, leading automotive manufacturers are applying carbon fiber in body panels, engine components, and structural components. Body Panels hold a significant market share with $2.50 billion in 2023, anticipated to rise to $4.63 billion by 2033 reflecting the focus on aesthetics and performance.

Automotive Carbon Fiber Market Analysis By Technology

Segmented by technology, the market insights reflect the application of innovative methods such as the Resin Infusion Process and Filament Winding. The Resin Infusion Process market stands at $1.26 billion in 2023, growing to $2.34 billion by 2033, indicative of increasing technological adoption within the industry.

Automotive Carbon Fiber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Carbon Fiber Industry

Toray Industries, Inc.:

Toray is one of the leading manufacturers of carbon fiber and composite materials in the world. Their focus on innovation and sustainability has positioned them as a key player in automotive applications, offering high-performance products geared towards lightweight vehicles.Hexcel Corporation:

Hexcel specializes in advanced composites, providing carbon fiber solutions that are widely used in the aerospace and automotive industries. Their products contribute to lighter, more fuel-efficient vehicles, making them crucial to the market.SGL Carbon SE:

SGL Carbon is known for high-quality carbon fiber products and has strong partnerships within the automotive sector to innovate lightweight solutions that reduce emissions and enhance vehicle performance.Cytec Solvay Group:

Cytec is a pioneer in advanced materials and composites, including carbon fiber, and has significant experience in automotive applications, impacting the design and performance of modern vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Carbon Fiber?

The global automotive carbon fiber market is valued at $5.6 billion in 2023, with a projected growth to $9.8 billion by 2033, demonstrating a CAGR of 6.2% over the decade.

What are the key market players or companies in this automotive Carbon Fiber industry?

Key players in the automotive carbon fiber market include Toray Industries, SGL Carbon SE, Teijin Limited, Hexcel Corporation, and Mitsubishi Rayon. These companies lead in innovation, production, and supply chain management.

What are the primary factors driving the growth in the automotive Carbon Fiber industry?

Key drivers include the demand for lightweight materials to improve fuel efficiency, the rise of electric vehicles, and the need for high-performance materials in luxury and commercial vehicles.

Which region is the fastest Growing in the automotive Carbon Fiber market?

North America is the fastest-growing region for automotive carbon fiber, with the market expected to increase from $1.80 billion in 2023 to $3.33 billion by 2033, highlighting a significant demand surge.

Does ConsaInsights provide customized market report data for the automotive Carbon Fiber industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs in the automotive-carbon-fiber industry, providing accurate and actionable insights.

What deliverables can I expect from this automotive Carbon Fiber market research project?

Expect detailed reports, market size estimates, growth forecasts, competitive analysis, and insights into trends and regional performances tailored to the automotive carbon fiber sector.

What are the market trends of automotive Carbon Fiber?

Current trends include increasing adoption in electric and luxury vehicles, advancements in manufacturing processes, and a focus on sustainable production methods, driving innovation in the automotive carbon fiber market.