Automotive E Tailing Market Report

Published Date: 02 February 2026 | Report Code: automotive-e-tailing

Automotive E Tailing Market Size, Share, Industry Trends and Forecast to 2033

This report delivers a comprehensive analysis of the Automotive E Tailing market, exploring its growth from 2023 to 2033. Offering insights into market size, segmentation, regional performance, and trends, this document serves as a valuable resource for stakeholders seeking to understand this rapidly evolving sector.

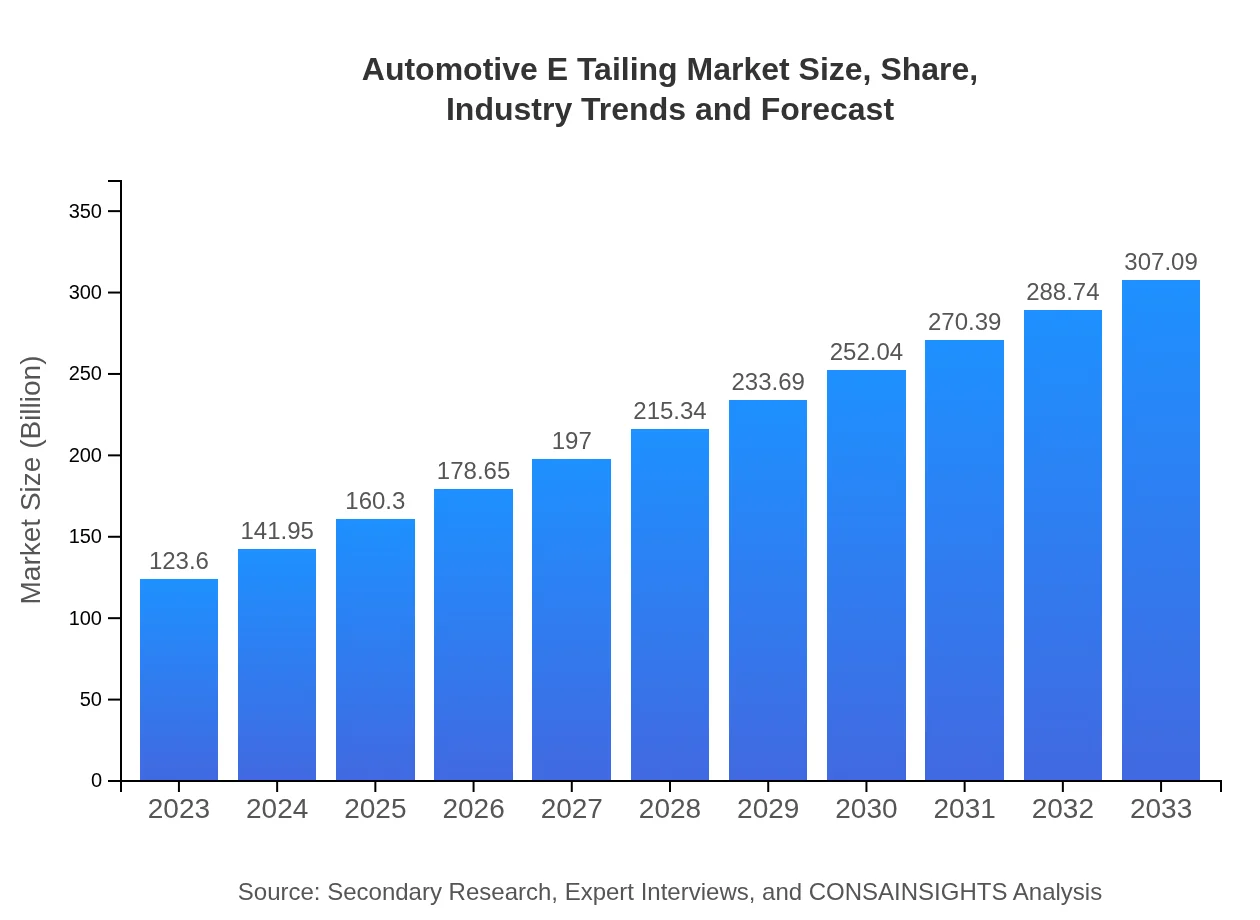

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $123.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $307.09 Billion |

| Top Companies | Carvana, Vroom, AutoTrader, Cars.com |

| Last Modified Date | 02 February 2026 |

Automotive E Tailing Market Overview

Customize Automotive E Tailing Market Report market research report

- ✔ Get in-depth analysis of Automotive E Tailing market size, growth, and forecasts.

- ✔ Understand Automotive E Tailing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive E Tailing

What is the Market Size & CAGR of Automotive E Tailing market in 2023?

Automotive E Tailing Industry Analysis

Automotive E Tailing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive E Tailing Market Analysis Report by Region

Europe Automotive E Tailing Market Report:

Europe's Automotive E Tailing market was valued at $30.97 billion in 2023 and is projected to reach $76.96 billion by 2033. The region benefits from a strong regulatory framework supporting online trade and a keen consumer interest in sustainability, pushing retailers towards selling more eco-friendly vehicles and products.Asia Pacific Automotive E Tailing Market Report:

In the Asia Pacific region, the Automotive E Tailing market was valued at approximately $24.67 billion in 2023 and is anticipated to grow to $61.29 billion by 2033. The region's rapid digitalization, urbanization, and increasing disposable income cater to a growing demand for online purchasing in the automotive sector, making it one of the fastest growing markets for e-tailing.North America Automotive E Tailing Market Report:

North America is currently a leading region in the Automotive E Tailing market, with a market size of $45.52 billion in 2023, expected to reach $113.10 billion by 2033. The U.S. dominates this landscape due to a high prevalence of internet users and widespread adoption of smartphone technology, alongside established automotive eCommerce players.South America Automotive E Tailing Market Report:

The South American market for Automotive E Tailing is projected to grow from $9.70 billion in 2023 to $24.11 billion by 2033, driven by improvements in internet access and increasing consumer comfort with online shopping. Despite challenges in logistics and infrastructure, the market is positioning itself for significant growth in the coming years.Middle East & Africa Automotive E Tailing Market Report:

The Middle East and Africa market is growing steadily, with a size of $12.73 billion in 2023 projected to reach $31.63 billion by 2033. Greater internet penetration and a youthful population are essential drivers, as businesses adapt their models to cater to emerging online purchasing trends.Tell us your focus area and get a customized research report.

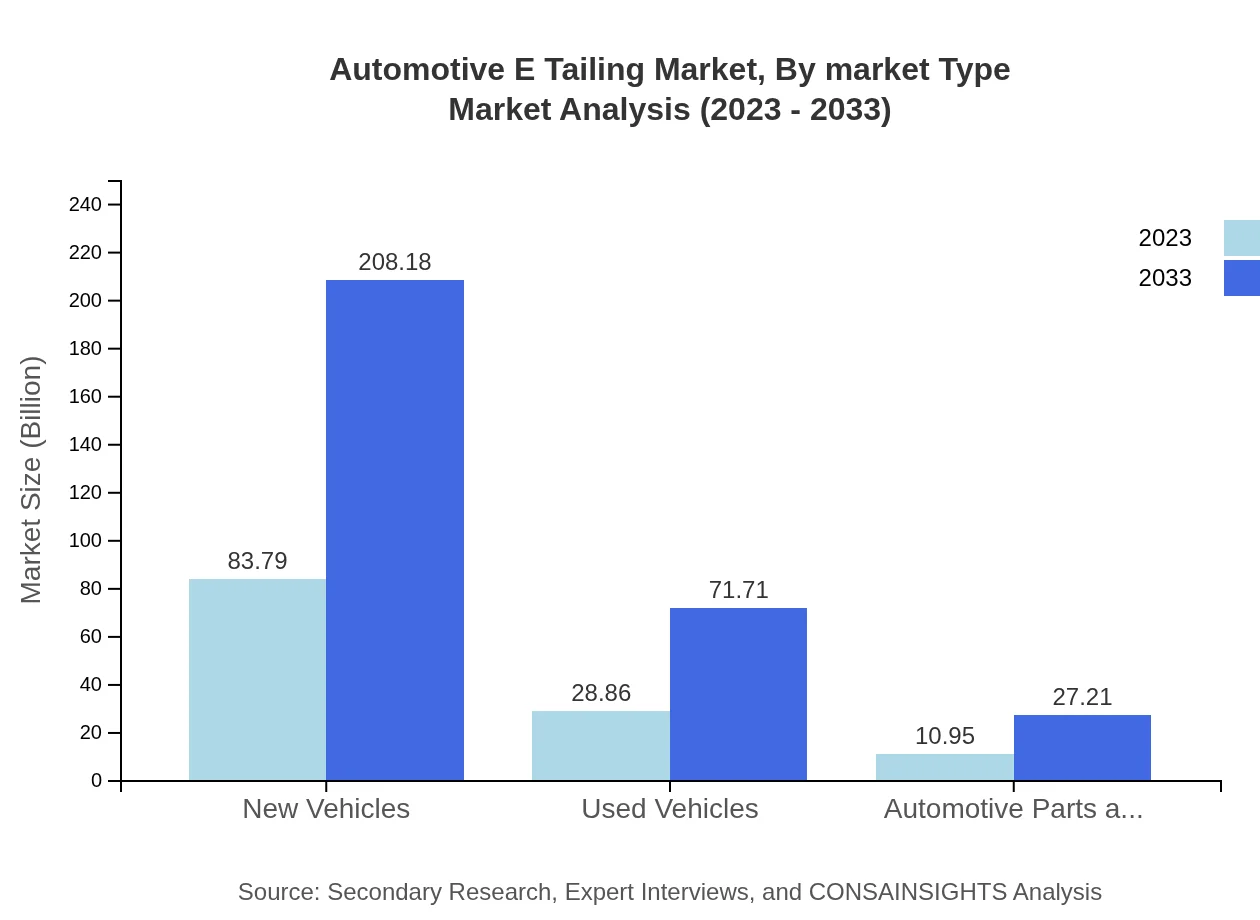

Automotive E Tailing Market Analysis By Market Type

The Automotive E-Tailing Market by type comprises new vehicles, used vehicles, and automotive parts and accessories. New vehicles accounted for a substantial market share in 2023, with a size of $83.79 billion, increasing to $208.18 billion by 2033. The used vehicles segment is also gaining traction, showcasing an increase from $28.86 billion to $71.71 billion over the same period. Automotive parts and accessories are projected to rise from $10.95 billion to $27.21 billion, highlighting the importance of aftermarket sales alongside vehicle sales.

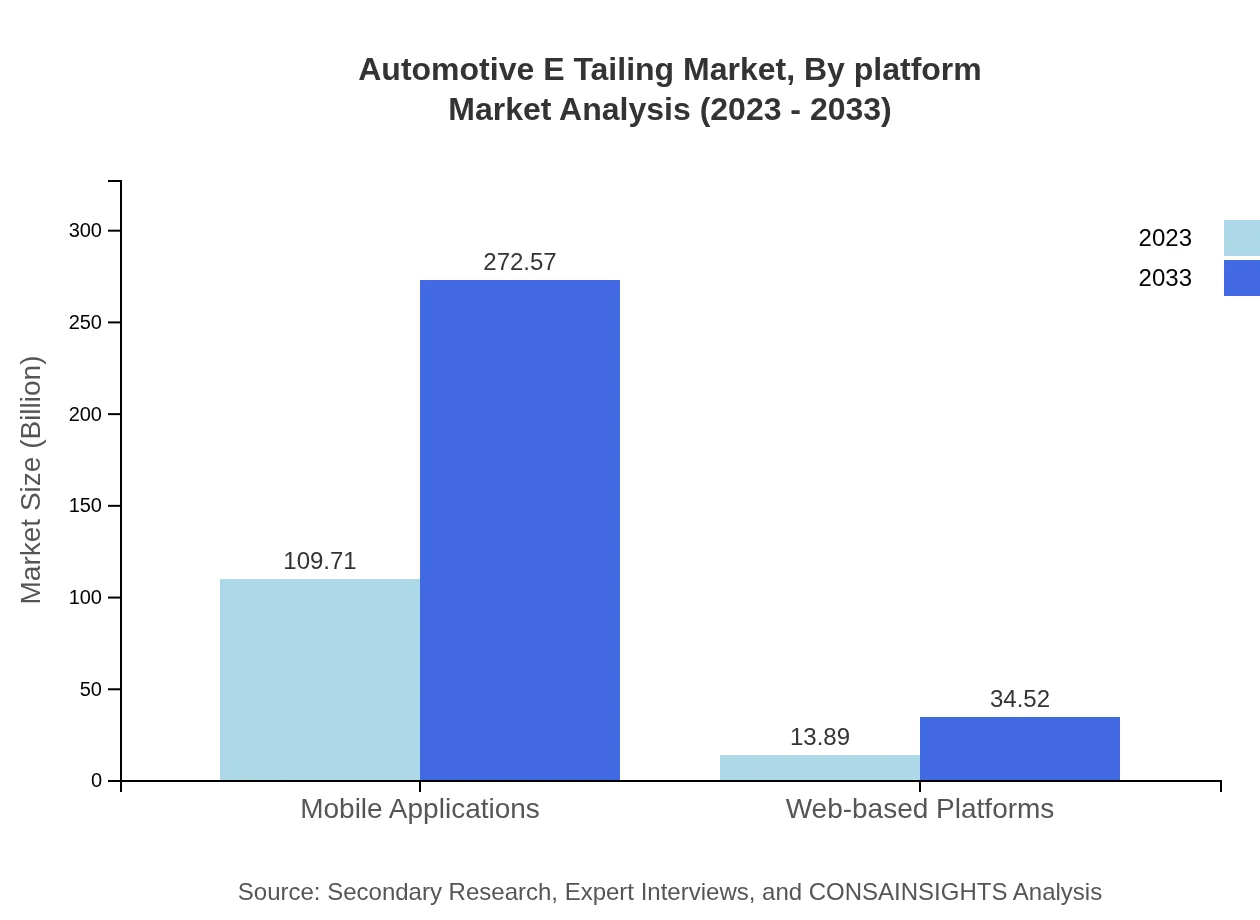

Automotive E Tailing Market Analysis By Platform

The market segmentation includes mobile applications, web-based platforms, and direct sales models. Mobile applications dominate the market, with a size of $109.71 billion in 2023 and anticipated to reach $272.57 billion by 2033. Web-based platforms follow, growing from $13.89 billion to $34.52 billion, reflecting a shift towards mobile-first strategies as consumer preferences evolve.

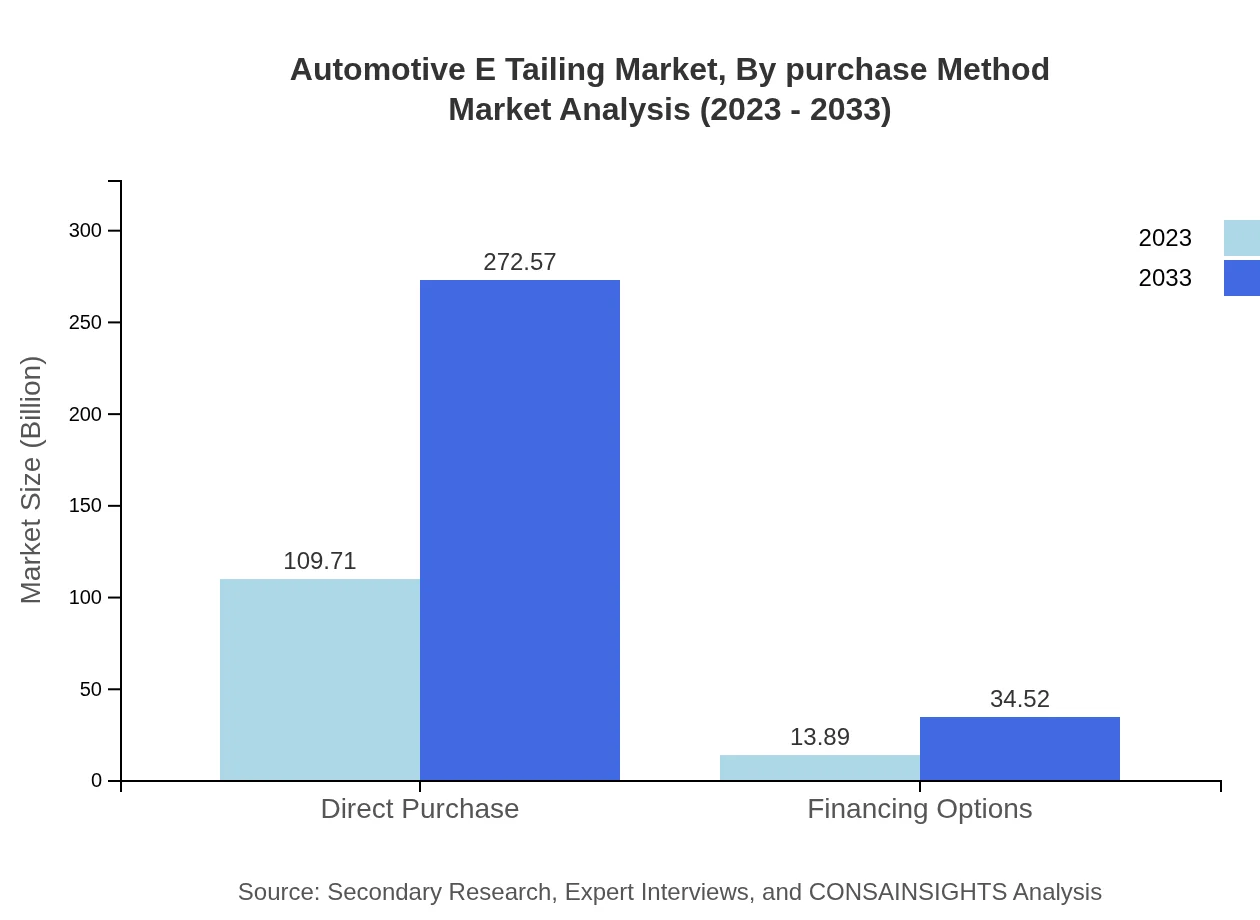

Automotive E Tailing Market Analysis By Purchase Method

This segment outlines the purchasing methods available, namely direct purchases and financing options. Direct purchase dominates with a total size of $109.71 billion in 2023 and forecasted for $272.57 billion by 2033, while financing options expand from $13.89 billion to $34.52 billion, catering to diverse financing needs of consumers.

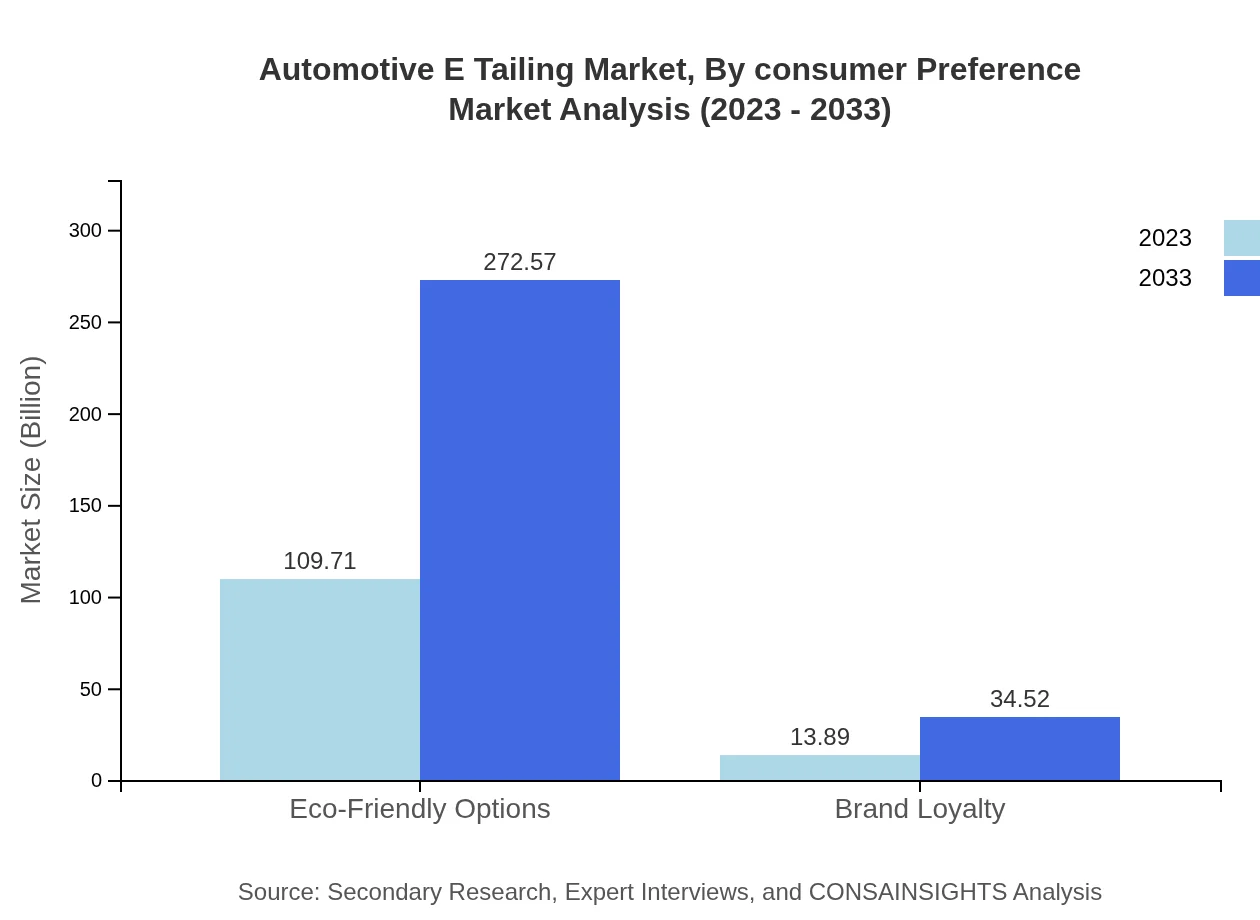

Automotive E Tailing Market Analysis By Consumer Preference

Consumer preferences play a vital role, influenced by aspects such as brand loyalty and eco-friendly options. Brand loyalty held a market share estimated at $13.89 billion in 2023, reflecting the importance of brand reputation in decision-making, while eco-friendly options are projected to grow rapidly as sustainability becomes central to purchase considerations.

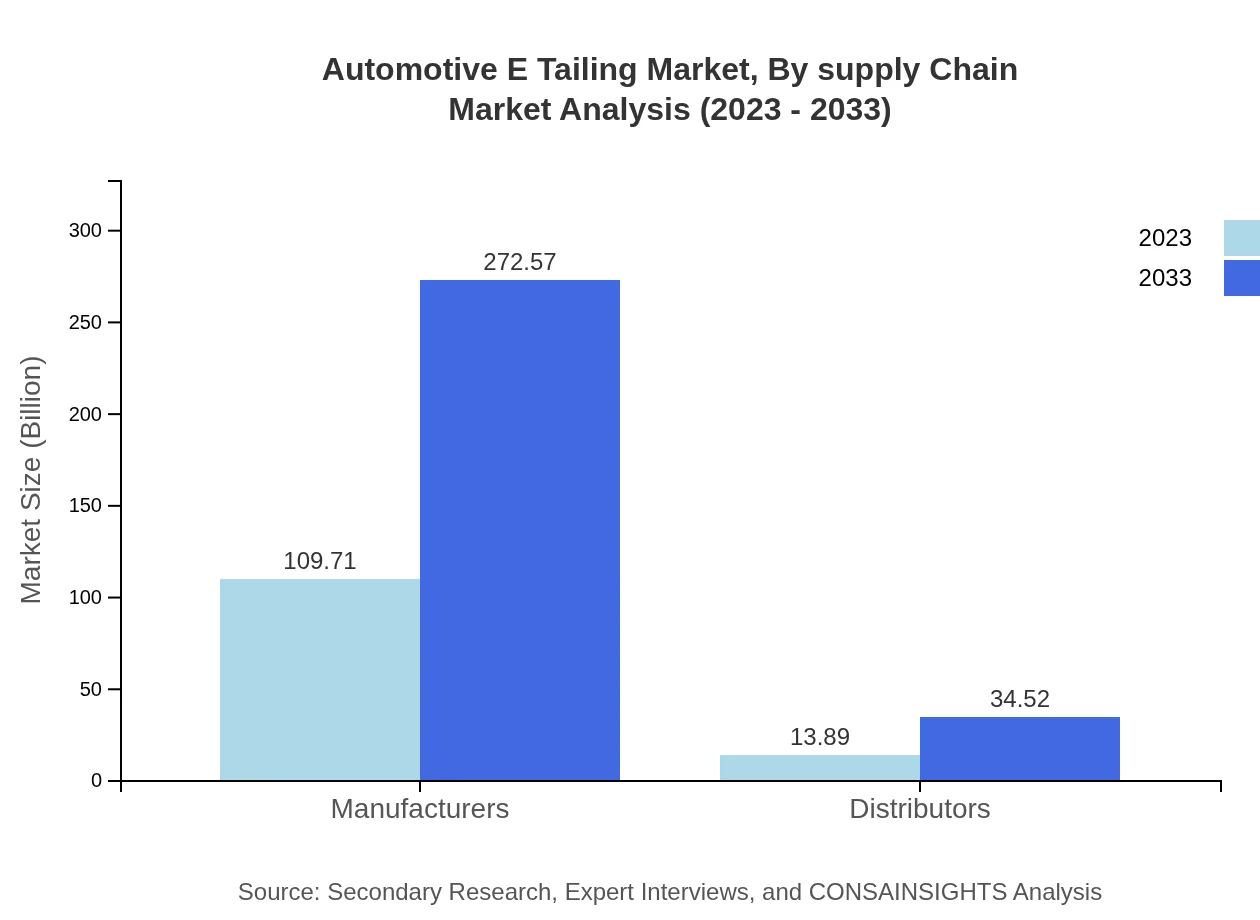

Automotive E Tailing Market Analysis By Supply Chain

The supply chain structure affects operational efficiency, with key players being manufacturers and distributors. Manufacturers represent a large market segment clocking $109.71 billion in 2023 and growing to $272.57 billion, indicating a shift towards more direct-to-consumer sales models that bypass traditional retailing.

Automotive E Tailing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive E Tailing Industry

Carvana:

Carvana is an innovative online vehicle retailer allowing customers to buy, sell, and finance vehicles entirely online, leveraging a seamless user experience.Vroom:

Vroom operates as a digital platform providing a comprehensive car buying experience, including transparent pricing and home delivery options.AutoTrader:

AutoTrader is a leading online marketplace for automotive sales, offering a vast selection and resources for consumers and dealerships alike.Cars.com:

Cars.com is a popular platform for evaluating and purchasing vehicles online, providing an extensive inventory up for sale across the USA.We're grateful to work with incredible clients.

FAQs

What is the market size of Automotive E-Tailing?

The market size of Automotive E-Tailing is projected to reach approximately $123.6 billion by 2033, growing at a robust CAGR of 9.2% from 2023 to 2033. This growth indicates a significant opportunity for businesses in this evolving sector.

What are the key market players or companies in the Automotive E-Tailing industry?

Key players in the Automotive E-Tailing industry include major automotive manufacturers, online retailers, and tech firms that provide e-commerce solutions. Notable companies include AutoTrader, CarGurus, and CARFAX, along with traditional automakers embracing online sales.

What are the primary factors driving the growth in the Automotive E-Tailing industry?

Primary growth factors in Automotive E-Tailing include increased internet penetration, consumer demand for convenience, advancements in e-commerce technologies, and the rising trend of digital retail. Additionally, younger consumers' preferences for online shopping are driving market expansion.

Which region is the fastest Growing in the Automotive E-Tailing?

The Asia Pacific region is currently the fastest-growing market for Automotive E-Tailing, expected to expand from $24.67 billion in 2023 to $61.29 billion by 2033. This growth is driven by increasing smartphone adoption and rising disposable incomes.

Does ConsaInsights provide customized market report data for the Automotive E-Tailing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Automotive E-Tailing industry. Clients can request insights based on their unique business models, target demographics, and market conditions.

What deliverables can I expect from this Automotive E-Tailing market research project?

Deliverables from the Automotive E-Tailing market research project include detailed reports on market trends, regional analyses, segment data, competitor analysis, and forecasts. These insights facilitate informed decision-making for businesses.

What are the market trends of Automotive E-Tailing?

Market trends in Automotive E-Tailing include a rise in mobile application usage, the growth of eco-friendly vehicle options, personalization through AI, and an increasing focus on customer experience. The shift towards online purchases is reshaping the automotive retail landscape.