Automotive Lubricants Market Report

Published Date: 02 February 2026 | Report Code: automotive-lubricants

Automotive Lubricants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Lubricants market from 2023 to 2033, covering market size, growth forecasts, segmentation, regional insights, and industry trends to offer valuable insights for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

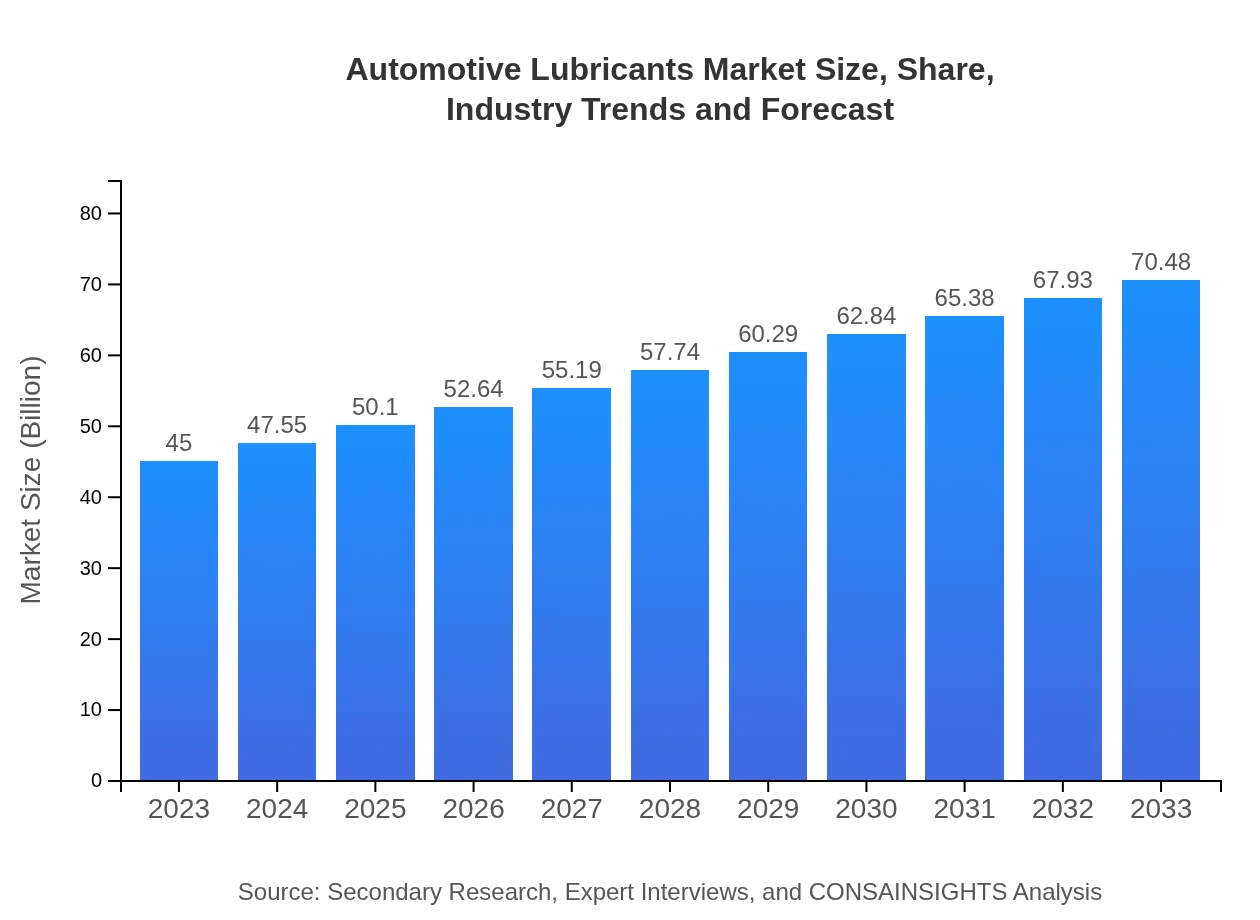

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $70.48 Billion |

| Top Companies | Castrol, ExxonMobil, Royal Dutch Shell, TotalEnergies, Chevron |

| Last Modified Date | 02 February 2026 |

Automotive Lubricants Market Overview

Customize Automotive Lubricants Market Report market research report

- ✔ Get in-depth analysis of Automotive Lubricants market size, growth, and forecasts.

- ✔ Understand Automotive Lubricants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Lubricants

What is the Market Size & CAGR of Automotive Lubricants market in 2023?

Automotive Lubricants Industry Analysis

Automotive Lubricants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Lubricants Market Analysis Report by Region

Europe Automotive Lubricants Market Report:

In Europe, the market size for automotive lubricants is anticipated to rise from $13.38 billion in 2023 to $20.95 billion by 2033. The emphasis on reducing carbon footprints and meeting EU emissions targets has spurred demand for advanced lubricants, with a notable increase in the preference for sustainable and bio-based products.Asia Pacific Automotive Lubricants Market Report:

The Asia Pacific region recorded a market size of $8.62 billion in 2023, projected to grow to $13.50 billion by 2033. Rapid industrialization and increasing vehicle production and sales are major factors contributing to this growth. The demand for high-performance lubricants is rising among manufacturers, propelled by issues like vehicle maintenance and environmental regulations.North America Automotive Lubricants Market Report:

North America's automotive lubricants market was valued at $16.22 billion in 2023, with projections of $25.41 billion by 2033. This growth is fueled by the high penetration of vehicles, alongside strict regulations promoting fuel efficiency. The trend towards synthetic oils and emerging markets of electric vehicles also contributes positively to this region's demand.South America Automotive Lubricants Market Report:

In South America, the market was valued at $1.95 billion in 2023, expected to reach $3.05 billion by 2033. Economic recovery and growing automotive ownership in countries such as Brazil and Argentina are driving the need for automotive lubricants. Moreover, expansion in transportation networks further supports the sector.Middle East & Africa Automotive Lubricants Market Report:

The Middle East and Africa region's market was valued at $4.83 billion in 2023, projected to grow to $7.57 billion by 2033. Growth factors include increased automotive manufacturing and rising disposable incomes, leading to greater vehicle ownership. Furthermore, the region's infrastructural investments further bolster the demand for automotive lubricants.Tell us your focus area and get a customized research report.

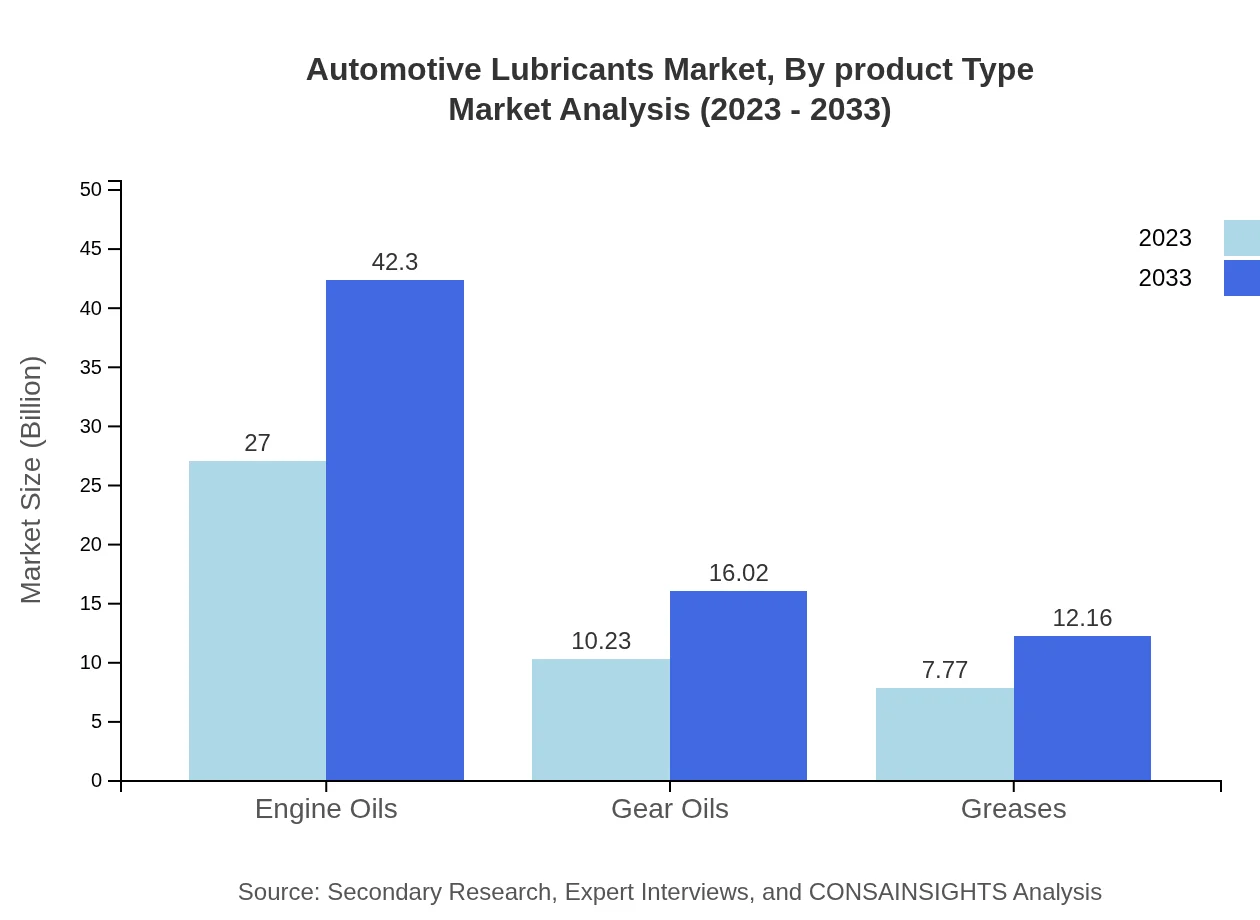

Automotive Lubricants Market Analysis By Product Type

The Automotive Lubricants market by product type includes Mineral Oils, Synthetic Oils, and Bio-Based Oils. Mineral Oils command significant market share, projected at $27 billion in 2023 and expected to reach $42.30 billion by 2033, highlighting their dominance due to established applications. Synthetic Oils are gaining traction, anticipated to grow from $10.23 billion in 2023 to $16.02 billion by 2033. Bio-Based Oils are also increasing in popularity, especially with environmentally conscious consumers, moving from $7.77 billion in 2023 to $12.16 billion in 2033.

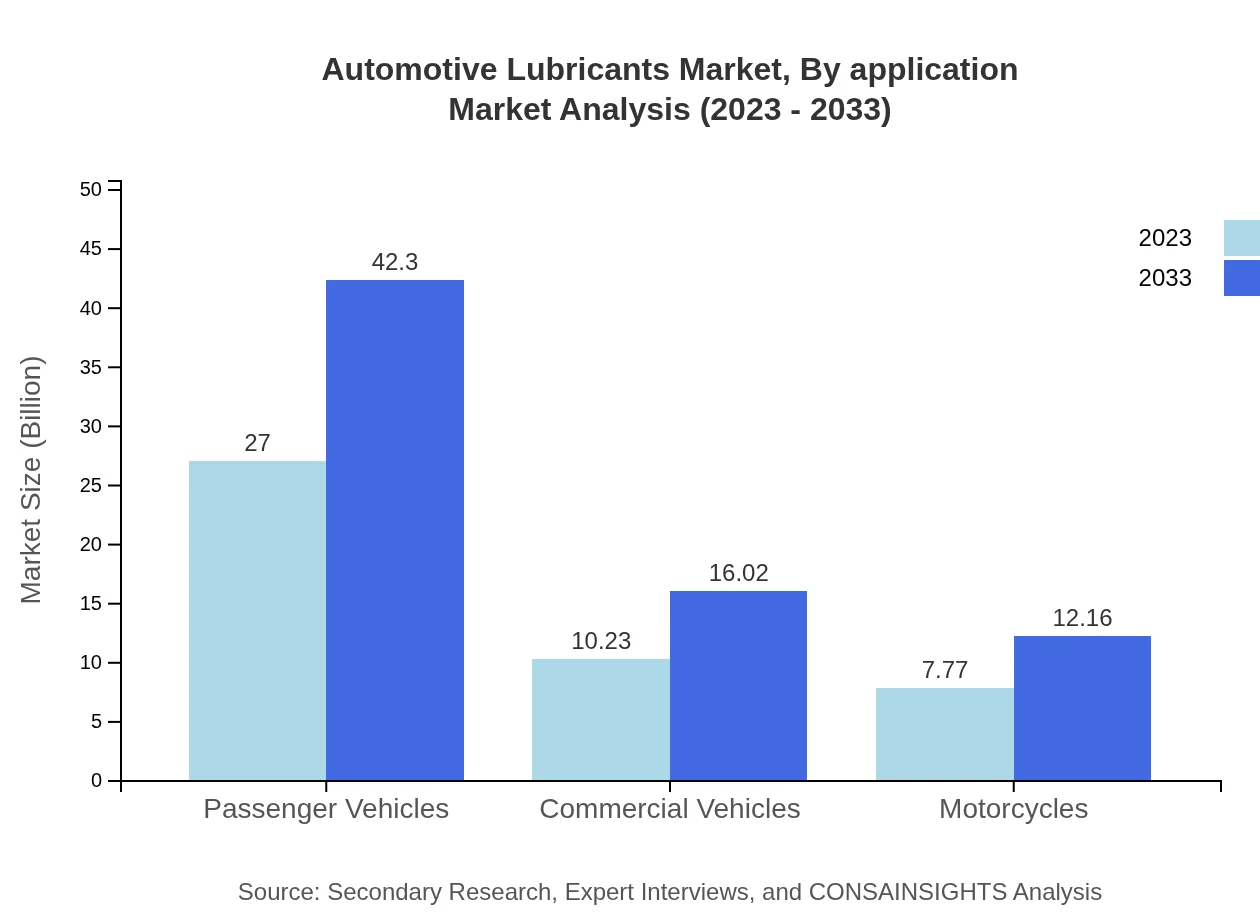

Automotive Lubricants Market Analysis By Application

In applications, the passenger vehicle segment is the leading segment, holding a significant portion of the market at 60% in 2023 and maintaining its dominance through 2033. The commercial vehicles segment represents 22.73% of the industry, predicting steady growth due to increased logistics operations. Motorcycles, while smaller in share, constitute a significant segment, especially in regions with robust motorcycle usage.

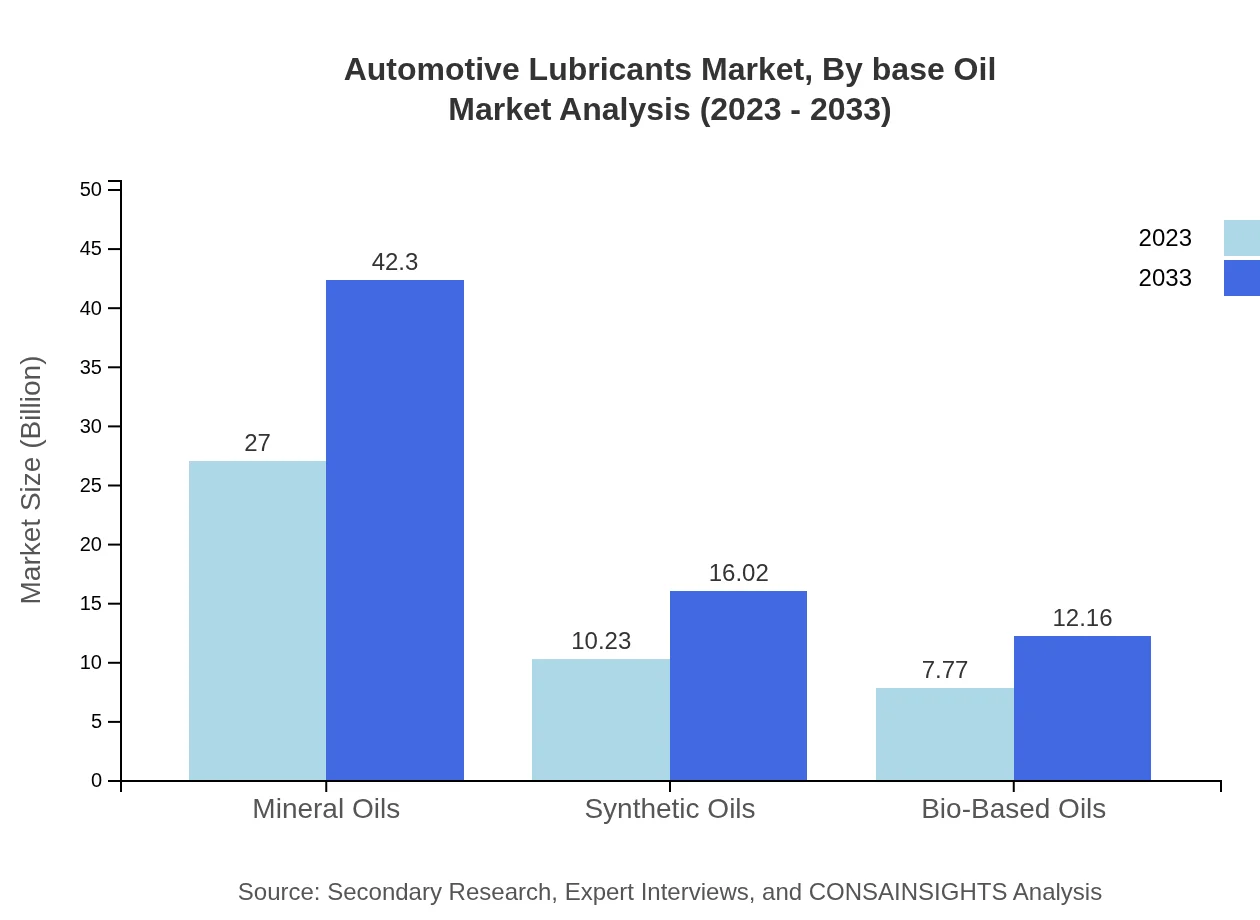

Automotive Lubricants Market Analysis By Base Oil

By base oil, the market showcases a preference for mineral and synthetic oils. Mineral oils, representing a share of 60% in 2023, are forecasted to remain dominant due to their wide-ranging applications. The share of synthetic oils is 22.73%, reflecting increased consumer demand for high-performance options, while bio-based oils are becoming increasingly important in eco-sensitive markets.

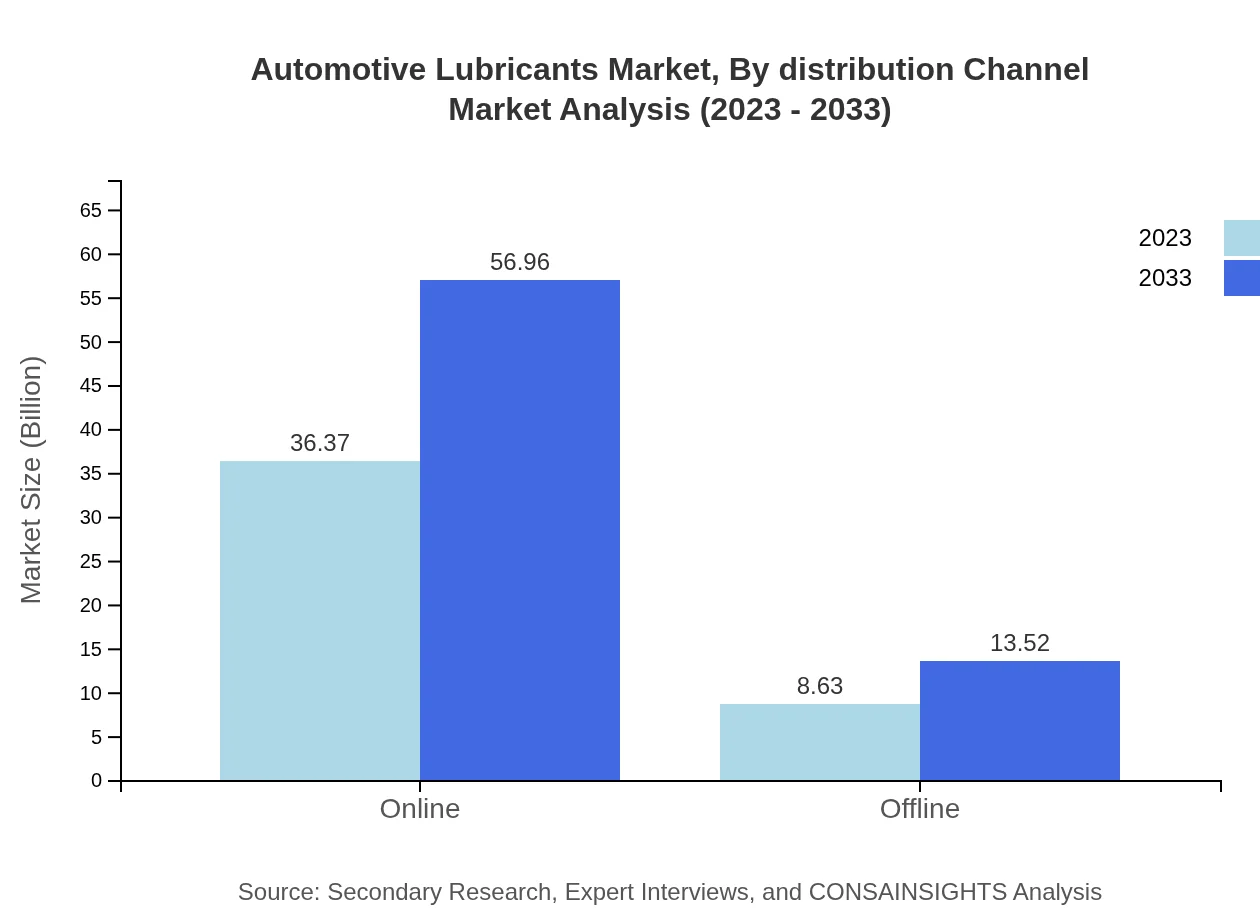

Automotive Lubricants Market Analysis By Distribution Channel

The distribution channel analysis highlights the significant shift towards online sales, capturing 80.82% of the market in 2023. This channel is projected to grow, illustrating a move towards e-commerce preferences. Offline sales, while still crucial with a 19.18% share, will increase gradually as traditional retail channels adapt to changing consumer habits.

Automotive Lubricants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Lubricants Industry

Castrol:

A leading manufacturer, Castrol boasts a wide variety of automotive lubricants including synthetic and bio-based products, known for their high performance and innovative technology.ExxonMobil:

ExxonMobil is a global leader offering a comprehensive range of automotive lubricants renowned for fuel efficiency and engine protection, heavily investing in sustainability initiatives.Royal Dutch Shell:

Shell provides high-quality automotive lubricants and has a significant focus on developing environmentally friendly products through its commitment to sustainability.TotalEnergies:

TotalEnergies specializes in a wide product range of automotive lubricants, focusing on advanced technologies that enhance engine performance and reduce emissions.Chevron:

Chevron produces high-performance automotive lubricants that prioritize engine life and efficiency, also involved in extensive R&D to foster innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Lubricants?

The global automotive lubricants market was valued at $45 billion in 2023, with a projected CAGR of 4.5% through 2033. This growth indicates increasing demand for high-performance lubricants in various automotive applications.

What are the key market players or companies in this automotive Lubricants industry?

Key players in the automotive lubricants industry include major companies such as ExxonMobil, Royal Dutch Shell, BP, and TotalEnergies, which dominate the market with their extensive product lines and innovations.

What are the primary factors driving the growth in the automotive Lubricants industry?

The growth of the automotive lubricants industry is driven by increasing vehicle production, heightened awareness of engine efficiency, and advancements in lubricant formulations enhancing performance and sustainability.

Which region is the fastest Growing in the automotive Lubricants?

The Asia Pacific region is expected to be the fastest-growing in the automotive lubricants market, with market size projected to expand from $8.62 billion in 2023 to $13.50 billion by 2033.

Does ConsaInsights provide customized market report data for the automotive Lubricants industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the automotive lubricants industry, enabling clients to gain detailed insights and strategic recommendations.

What deliverables can I expect from this automotive Lubricants market research project?

From the automotive lubricants market research project, you can expect comprehensive reports, market forecasts, segment analyses, regional insights, and competitor assessments, tailored to your specific business needs.

What are the market trends of automotive Lubricants?

Current trends in the automotive lubricants market include a shift towards synthetic and bio-based oils, increasing penetration of online sales channels, and growing consumer preference for eco-friendly lubricants.