Automotive Smart Glass Market Report

Published Date: 02 February 2026 | Report Code: automotive-smart-glass

Automotive Smart Glass Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Automotive Smart Glass market, covering key trends, regional insights, and market forecasts for the period 2023 to 2033. It aims to provide actionable data and insights to stakeholders in this evolving industry.

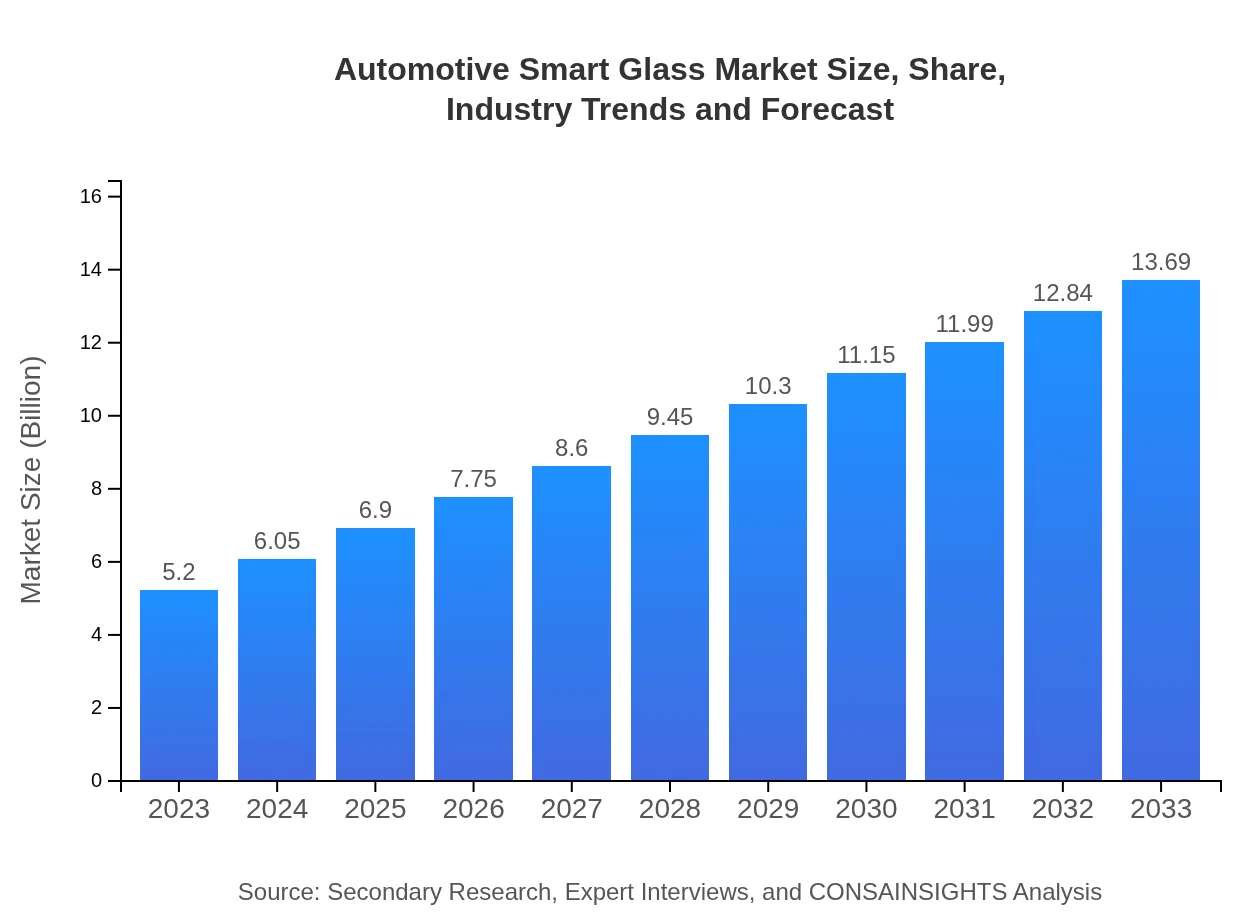

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $13.69 Billion |

| Top Companies | AGC Inc., Gentex Corporation, Corning Incorporated, Prelco Inc. |

| Last Modified Date | 02 February 2026 |

Automotive Smart Glass Market Overview

Customize Automotive Smart Glass Market Report market research report

- ✔ Get in-depth analysis of Automotive Smart Glass market size, growth, and forecasts.

- ✔ Understand Automotive Smart Glass's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Smart Glass

What is the Market Size & CAGR of Automotive Smart Glass market in 2023?

Automotive Smart Glass Industry Analysis

Automotive Smart Glass Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Smart Glass Market Analysis Report by Region

Europe Automotive Smart Glass Market Report:

Europe presents a significant growth opportunity, with the market valued at $1.76 billion in 2023 and projected to reach $4.65 billion by 2033. The increase is driven by the automotive industry's push towards eco-friendly innovations and technological advancements in smart glass solutions.Asia Pacific Automotive Smart Glass Market Report:

In 2023, the Asia Pacific Automotive Smart Glass market is valued at approximately $0.95 billion and is expected to grow to $2.51 billion by 2033. This region benefits from rising industrialization, increased automotive production, and a surge in electric vehicle initiatives, particularly in countries like China and Japan.North America Automotive Smart Glass Market Report:

The North American market for Automotive Smart Glass is anticipated to expand from $1.74 billion in 2023 to $4.58 billion by 2033. Robust demand for luxury vehicles and strict government regulations promoting energy-efficient technologies are expected to drive growth in this region.South America Automotive Smart Glass Market Report:

The South American region demonstrated a market size of $0.14 billion in 2023, with a projected growth to $0.38 billion by 2033. The market is influenced by slowly increasing vehicle production standards and the adoption of smart vehicle technologies.Middle East & Africa Automotive Smart Glass Market Report:

The Middle East and Africa's Automotive Smart Glass market is estimated to grow from $0.60 billion in 2023 to $1.58 billion by 2033. Growth is propelled by urbanization and rising investments in infrastructure, enhancing the demand for modern vehicles.Tell us your focus area and get a customized research report.

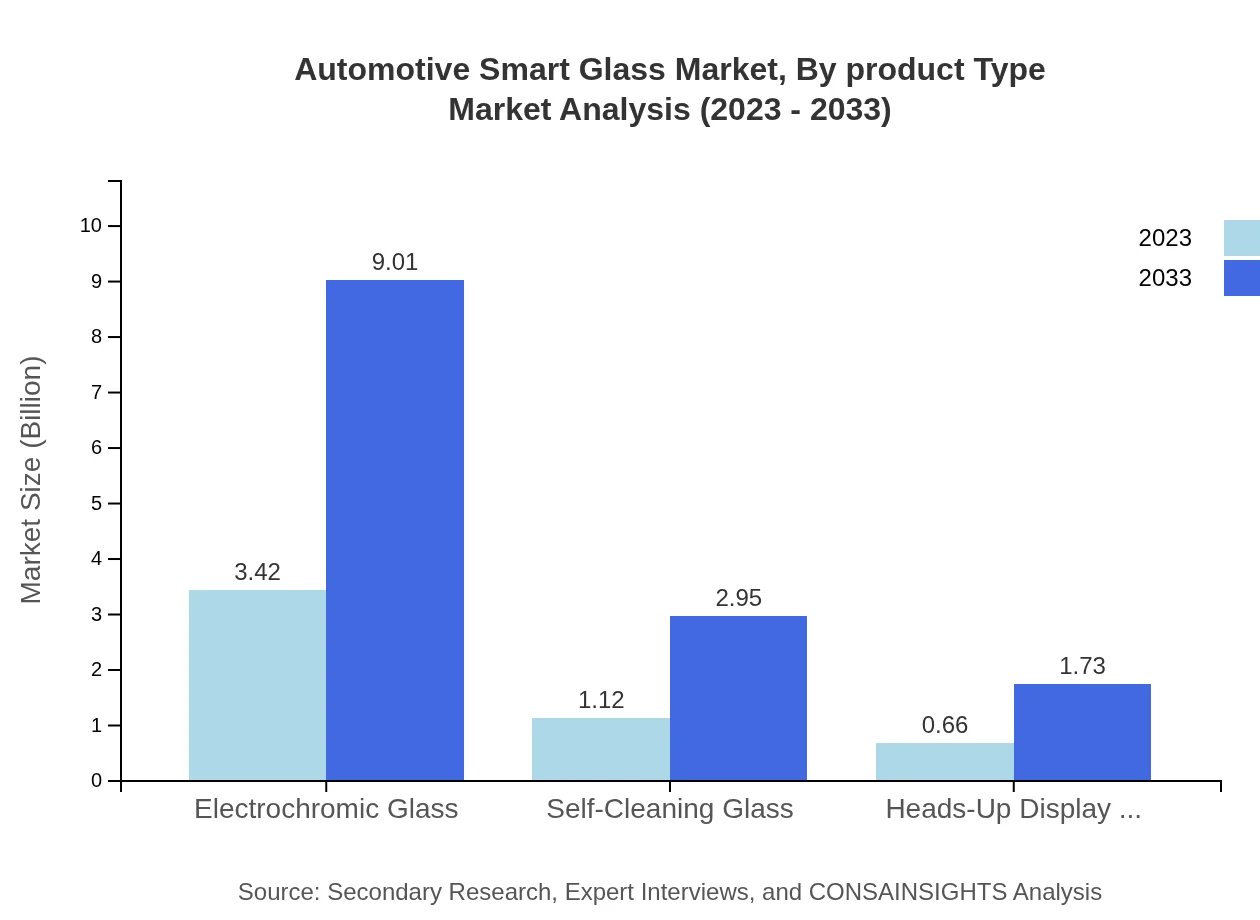

Automotive Smart Glass Market Analysis By Product Type

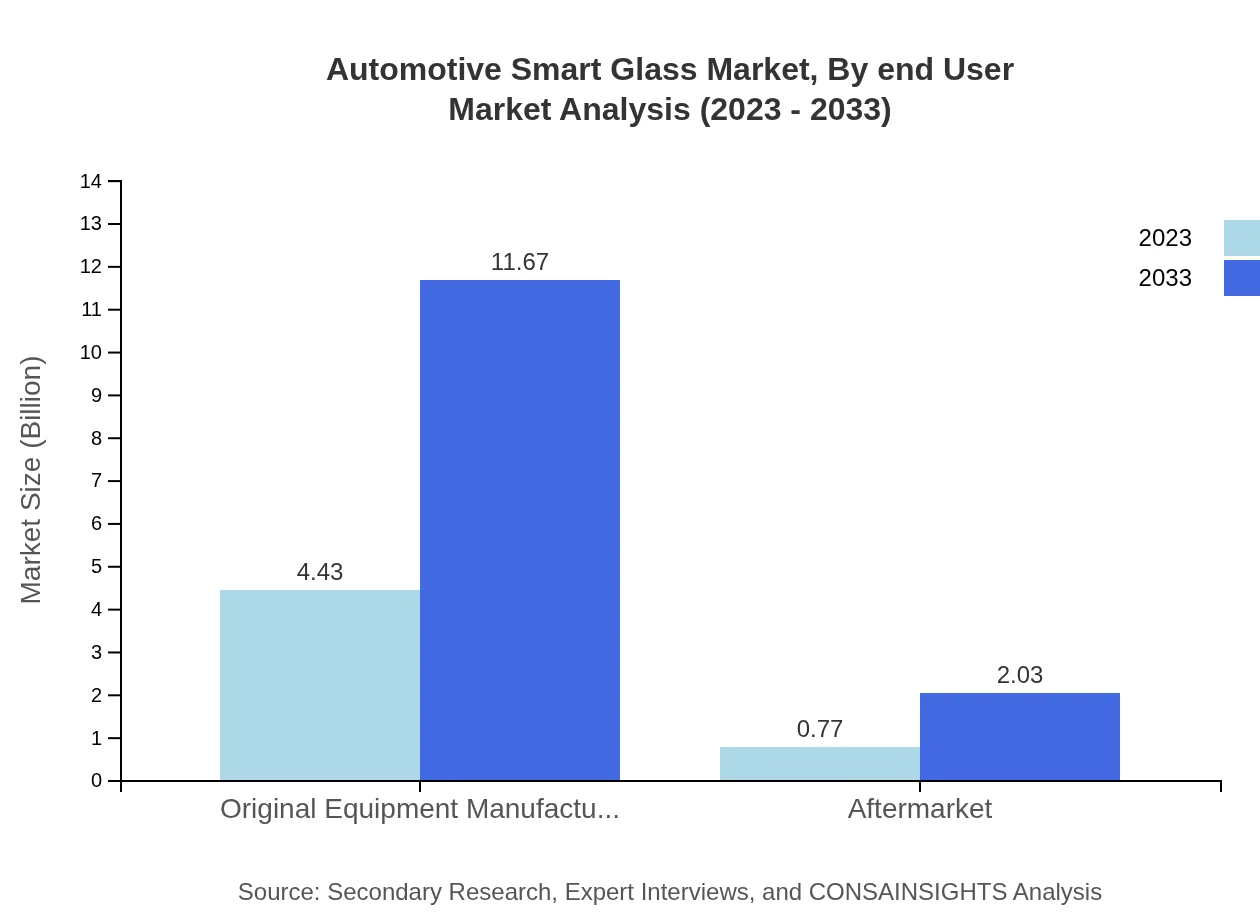

The market for Automotive Smart Glass, by product type, highlights the dominance of electrochromic and smart tinting technologies. In 2023, the size for OEMs was valued at $4.43 billion, growing to $11.67 billion by 2033, capturing 85.21% market share consistently. The aftermarket segment is also notable, initially valued at $0.77 billion and anticipated to grow to $2.03 billion in the same period.

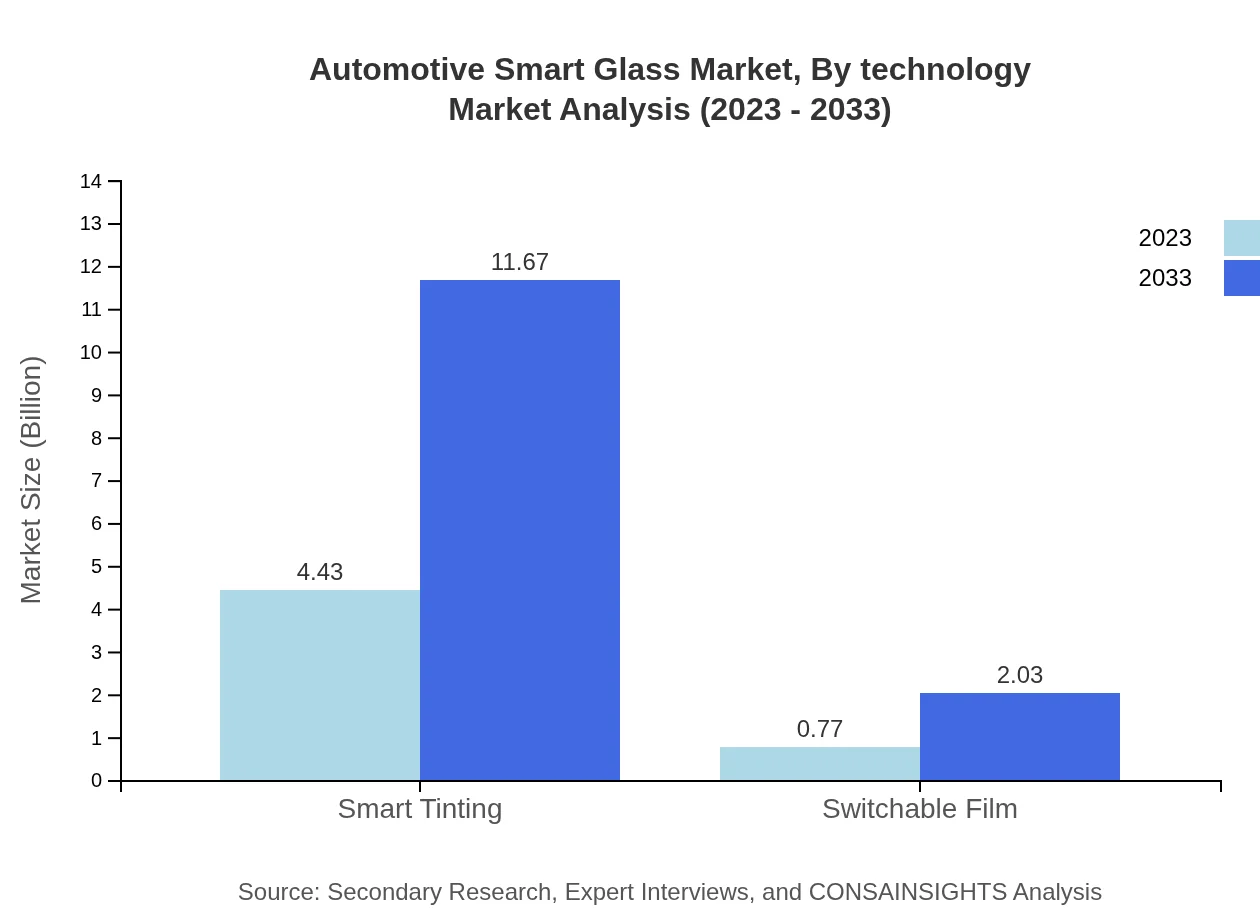

Automotive Smart Glass Market Analysis By Technology

Technology segmentation in the Automotive Smart Glass market primarily encompasses smart tinting and switchable film technologies. Both innovations account for significant market shares, with smart tinting technologies representing 85.21% of the total value by 2033, up from $4.43 billion. Switchable films, while smaller, show growth potential from $0.77 billion to $2.03 billion.

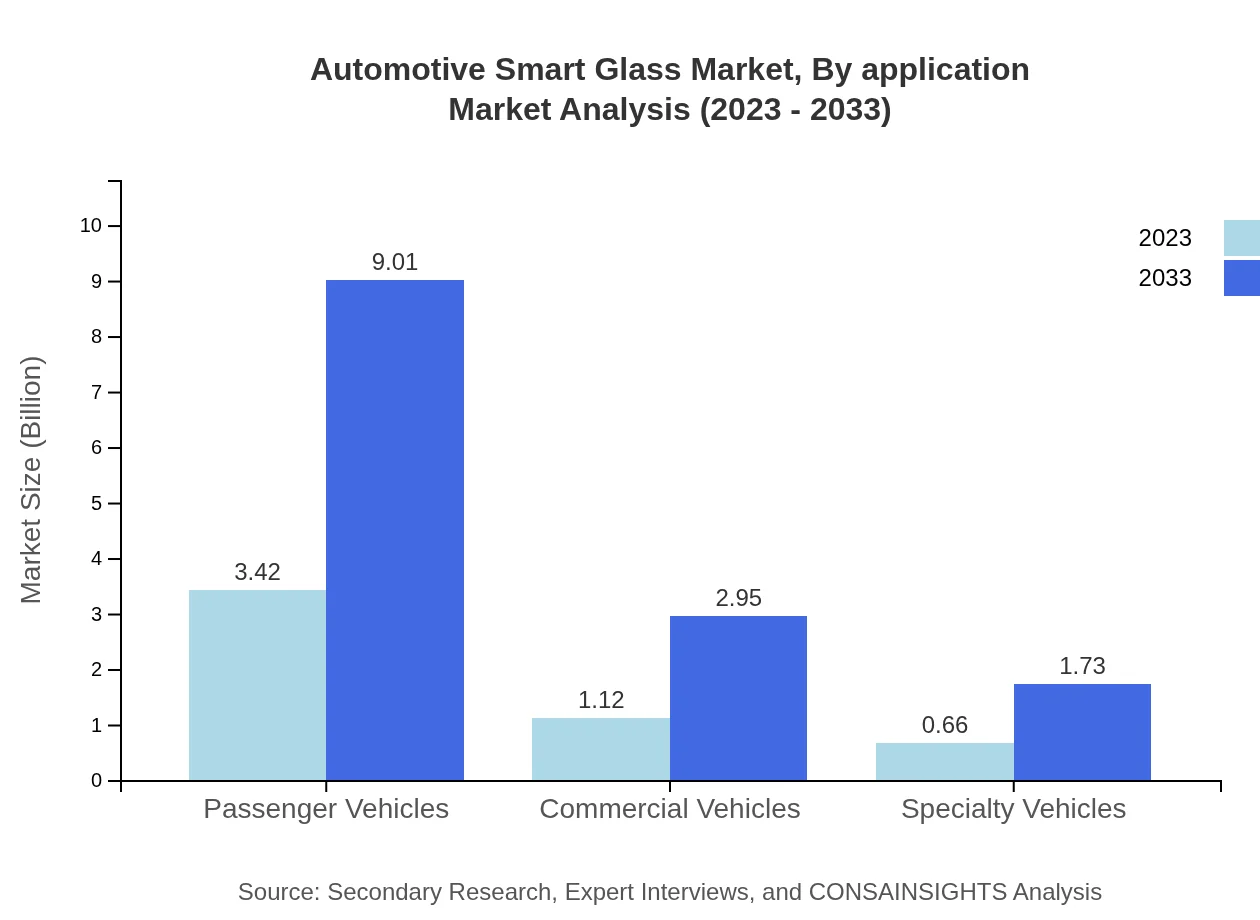

Automotive Smart Glass Market Analysis By Application

In terms of applications, passenger vehicles represent the largest segment, forecasted to expand from a market size of $3.42 billion in 2023 to $9.01 billion by 2033. The commercial vehicle segment is also expected to rise from $1.12 billion to $2.95 billion, as demand for smart technologies increases in commercial transportation.

Automotive Smart Glass Market Analysis By End User

End-users for Automotive Smart Glass predominantly include OEMs, which hold a substantial market share of 85.21%. This segment is expected to grow significantly over the coming decade, as automotive manufacturers adopt advanced glazing solutions to enhance vehicle efficiency and comfort.

Automotive Smart Glass Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Smart Glass Industry

AGC Inc.:

AGC Inc. is a leading global manufacturer of glass and chemicals known for its innovative automotive glass solutions, including electrochromic glass and other advanced technologies.Gentex Corporation:

Gentex Corporation specializes in automotive mirror and smart glass technologies, providing high-quality products that enhance vehicle safety and comfort.Corning Incorporated:

Corning is renowned for its specialty glass products, including automotive glass technologies that enhance durability and functionality.Prelco Inc.:

Prelco is recognized for its high-performance glass products aimed at automotive applications, with a commitment to research and development in smart glass technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Smart Glass?

The automotive smart glass market is estimated to be valued at approximately 5.2 billion in 2023. With a CAGR of 9.8%, it is projected to grow significantly by 2033, reflecting increased demand and technological advancements in the automotive sector.

What are the key market players or companies in the automotive Smart Glass industry?

Key players in the automotive smart glass industry include leading manufacturers such as AGC Inc., Saint-Gobain, and Research Frontiers Inc. These companies are leveraging innovative technologies to expand their product offerings and capture a larger market share.

What are the primary factors driving the growth in the automotive Smart Glass industry?

The main drivers of growth in the automotive smart glass market include rising demand for fuel-efficient vehicles, advancements in smart glass technology, and increasing consumer preferences for enhanced vehicle aesthetics and passenger comfort.

Which region is the fastest Growing in the automotive Smart Glass?

The fastest-growing region for automotive smart glass is Europe, expected to rise from 1.76 billion in 2023 to 4.65 billion by 2033. Asia Pacific also shows growth, increasing from 0.95 billion to 2.51 billion during the same period.

Does ConsaInsights provide customized market report data for the automotive Smart Glass industry?

Yes, ConsaInsights offers tailored market report data for the automotive smart glass industry. Clients can request specific insights based on their needs, including regional analyses, competitive landscape evaluation, and growth projections.

What deliverables can I expect from this automotive Smart Glass market research project?

Deliverables from the automotive smart glass market research project include detailed market analysis, comprehensive reports on market size, growth forecasts, and insights on industry trends and key players to support strategic decision-making.

What are the market trends of automotive Smart Glass?

Market trends for automotive smart glass include increased adoption of electrochromic technologies, rising interest in self-cleaning options, and growing awareness about energy efficiency among consumers, leading to an expanded use of smart glass in both passenger and commercial vehicles.