B2b Digital Payment

Published Date: 31 January 2026 | Report Code: b2b-digital-payment

B2b Digital Payment Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report offers an in-depth analysis of the B2b Digital Payment market over the forecast period from 2024 to 2033. It presents detailed insights into market trends, technological innovations, regional dynamics, and segmentation analysis, enabling stakeholders to make informed decisions and strategize for future growth in a rapidly evolving digital payments landscape.

| Metric | Value |

|---|---|

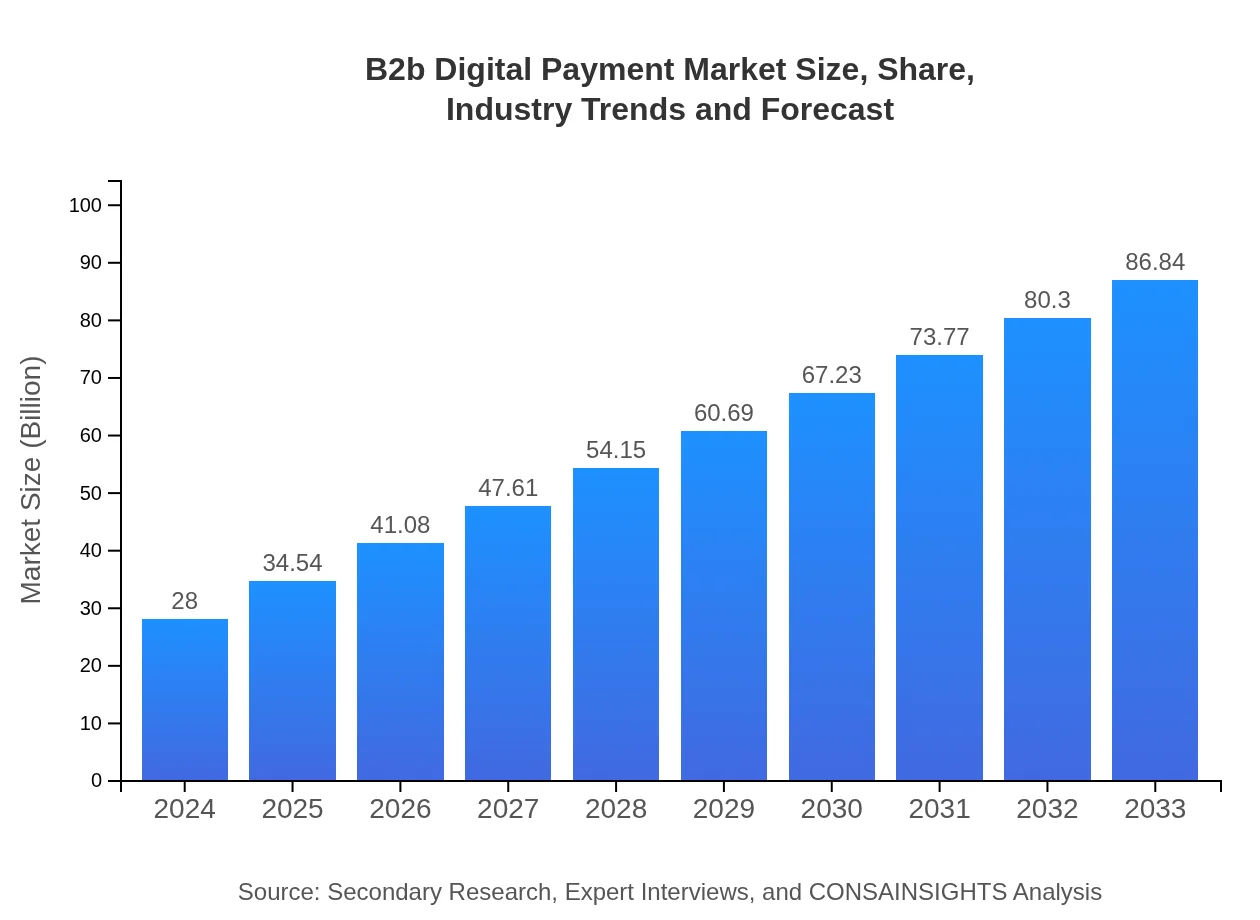

| Study Period | 2024 - 2033 |

| 2024 Market Size | $28.00 Billion |

| CAGR (2024-2033) | 12.8% |

| 2033 Market Size | $86.84 Billion |

| Top Companies | Company A, Company B, Company C, Company D |

| Last Modified Date | 31 January 2026 |

B2b Digital Payment Market Overview

Customize B2b Digital Payment market research report

- ✔ Get in-depth analysis of B2b Digital Payment market size, growth, and forecasts.

- ✔ Understand B2b Digital Payment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in B2b Digital Payment

What is the Market Size & CAGR of B2b Digital Payment market in 2024?

B2b Digital Payment Industry Analysis

B2b Digital Payment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

B2b Digital Payment Market Analysis Report by Region

Europe B2b Digital Payment:

Europe's market is robust and growing steadily, with figures rising from $8.89 billion in 2024 to $27.57 billion in 2033. A combination of strict regulatory standards and widespread digital adoption supports strong market performance in the region.Asia Pacific B2b Digital Payment:

Asia Pacific is witnessing rapid expansion in the B2b Digital Payment market, with values increasing from $5.13 billion in 2024 to an estimated $15.90 billion by 2033. This growth is fueled by rapid urbanization, improved digital infrastructure, and the rising adoption of digital solutions by small to medium enterprises.North America B2b Digital Payment:

North America continues to lead in digital payment adoption with market values growing from $9.83 billion in 2024 to $30.49 billion by 2033. Advanced technology infrastructure and significant investments in payment security contribute to its dominant position.South America B2b Digital Payment:

South America displays promising market potential with a progression from $1.26 billion in 2024 to $3.91 billion in 2033. The growth is largely driven by the ongoing efforts to modernize financial systems and an expanding base of digital-savvy consumers.Middle East & Africa B2b Digital Payment:

In the Middle East and Africa, modernization efforts are driving the market from $2.89 billion in 2024 to approximately $8.97 billion in 2033. Strategic investments in technology and an increasing demand for secure financial transactions fuel the region's growth.Tell us your focus area and get a customized research report.

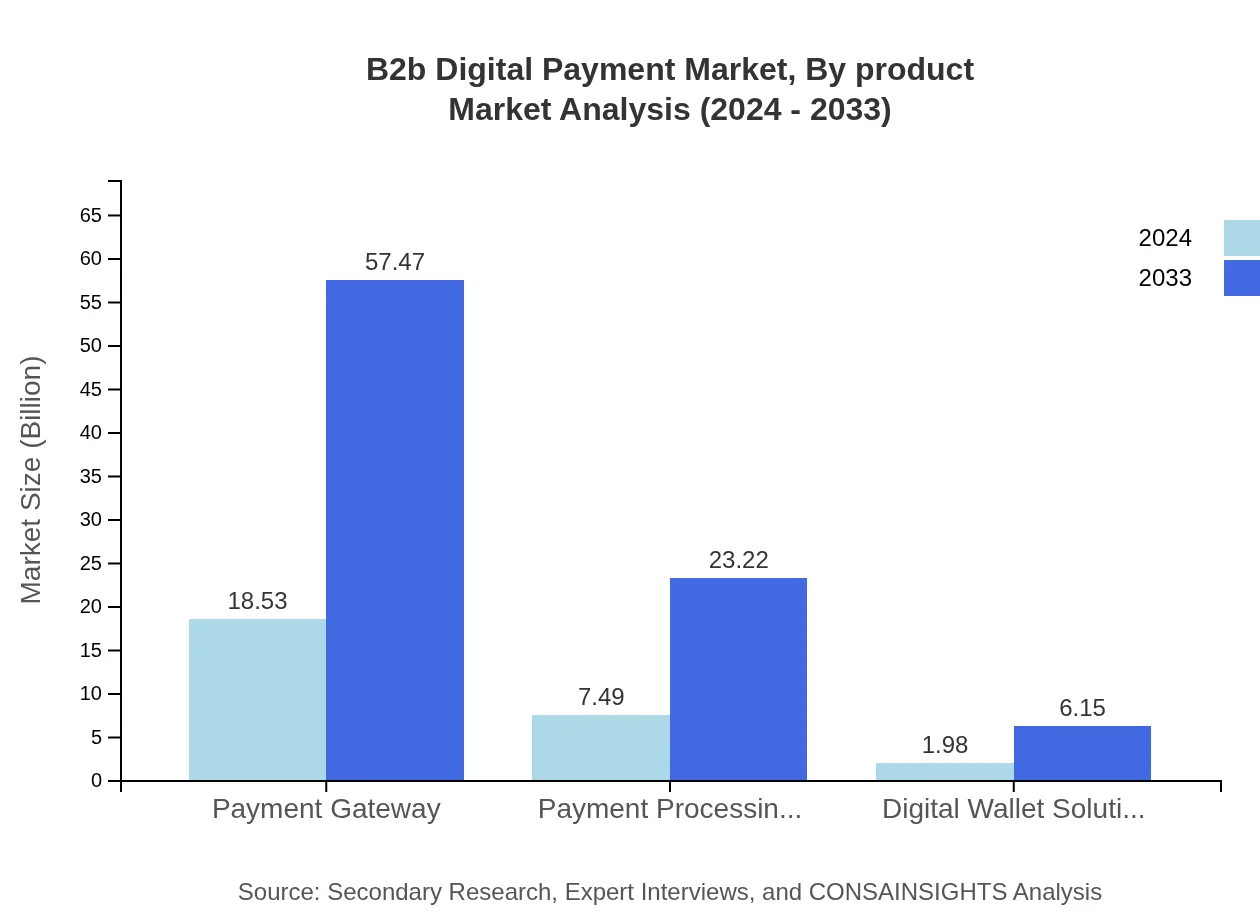

B2b Digital Payment Market Analysis By Product

The product segment focuses primarily on payment gateways, which have shown significant growth—from $18.53 billion in 2024 to an expected $57.47 billion in 2033. In addition, payment processing solutions, digital wallet solutions, and retail-specific applications are key contributors, each playing a vital role in addressing the diverse transactional needs of businesses.

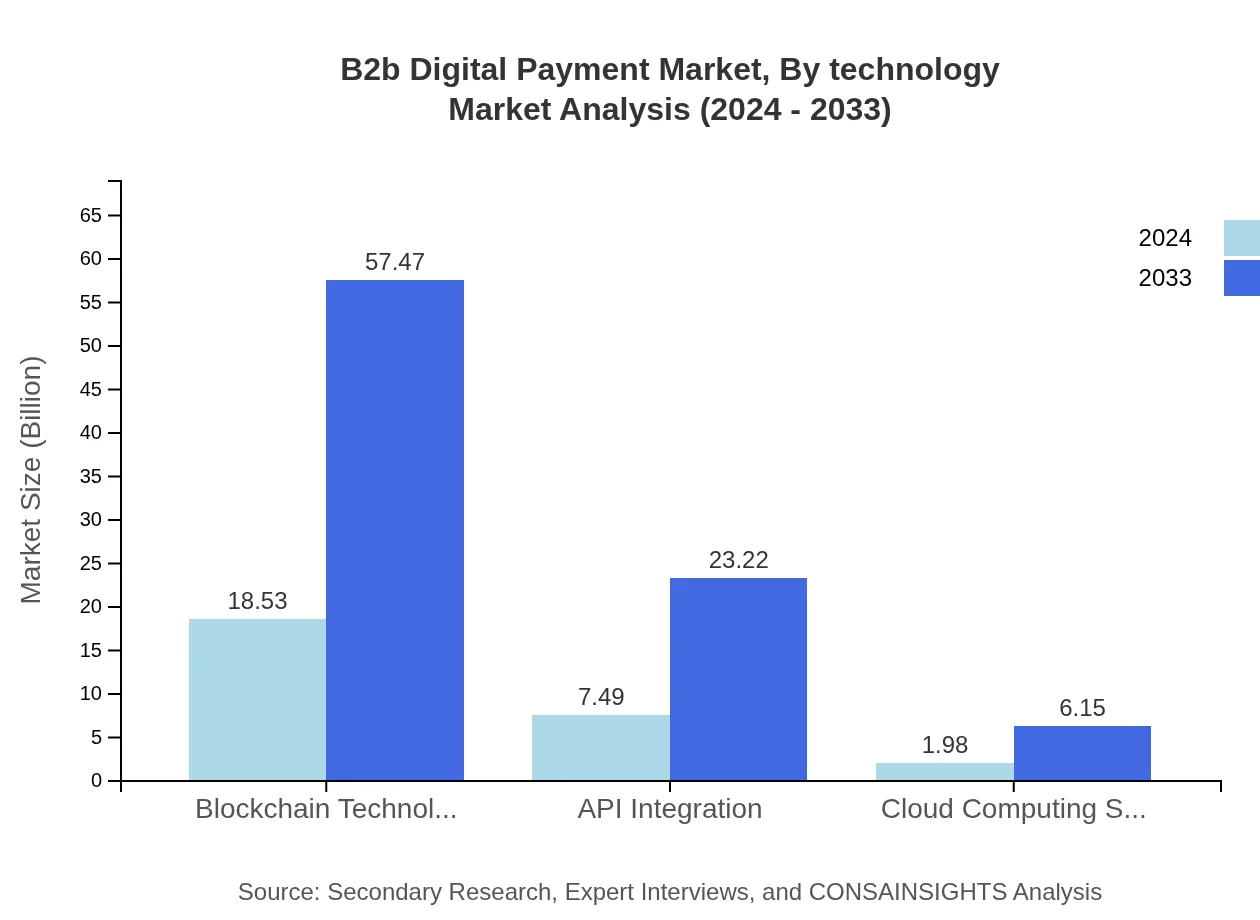

B2b Digital Payment Market Analysis By Technology

Technology plays a pivotal role with blockchain, API integration, and cloud computing driving innovation. Blockchain technology consistently maintains a strong market share, while API integration facilitates seamless connectivity. These advancements not only enhance data security and transparency but also contribute to operational efficiency across digital payment platforms.

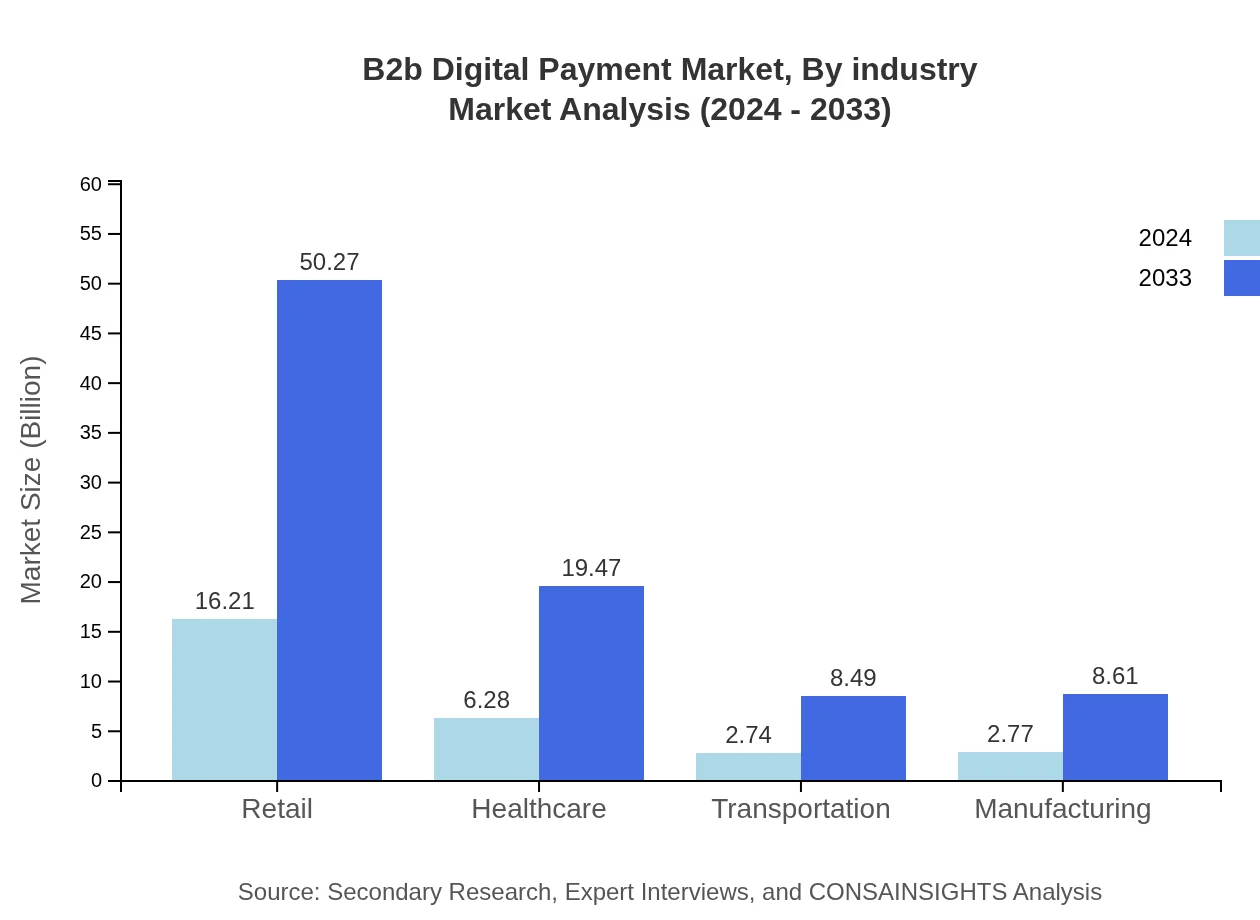

B2b Digital Payment Market Analysis By Industry

Diverse industries including retail, healthcare, transportation, and manufacturing are leveraging digital payment solutions to streamline operations and reduce transaction complexities. Retail, for instance, maintains a sizable market share thanks to its early adoption and extensive implementation, while other sectors experience steady growth through tailored payment solutions.

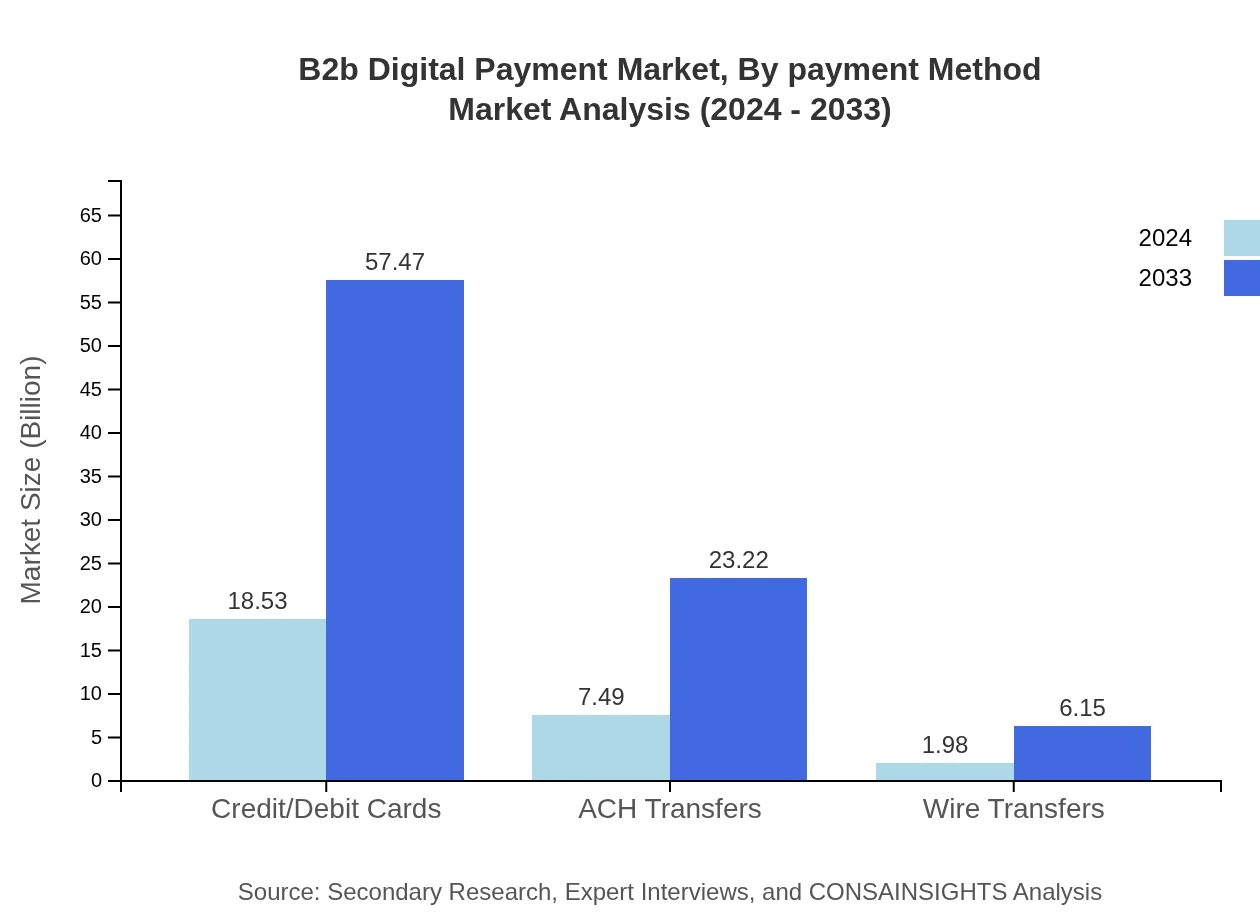

B2b Digital Payment Market Analysis By Payment Method

Various payment methods such as credit/debit cards, ACH transfers, and wire transfers are critical components of the digital payment ecosystem. Each method offers its benefits in terms of speed and cost-effectiveness. The stable market share across these channels underscores their continued importance even as digital innovations emerge.

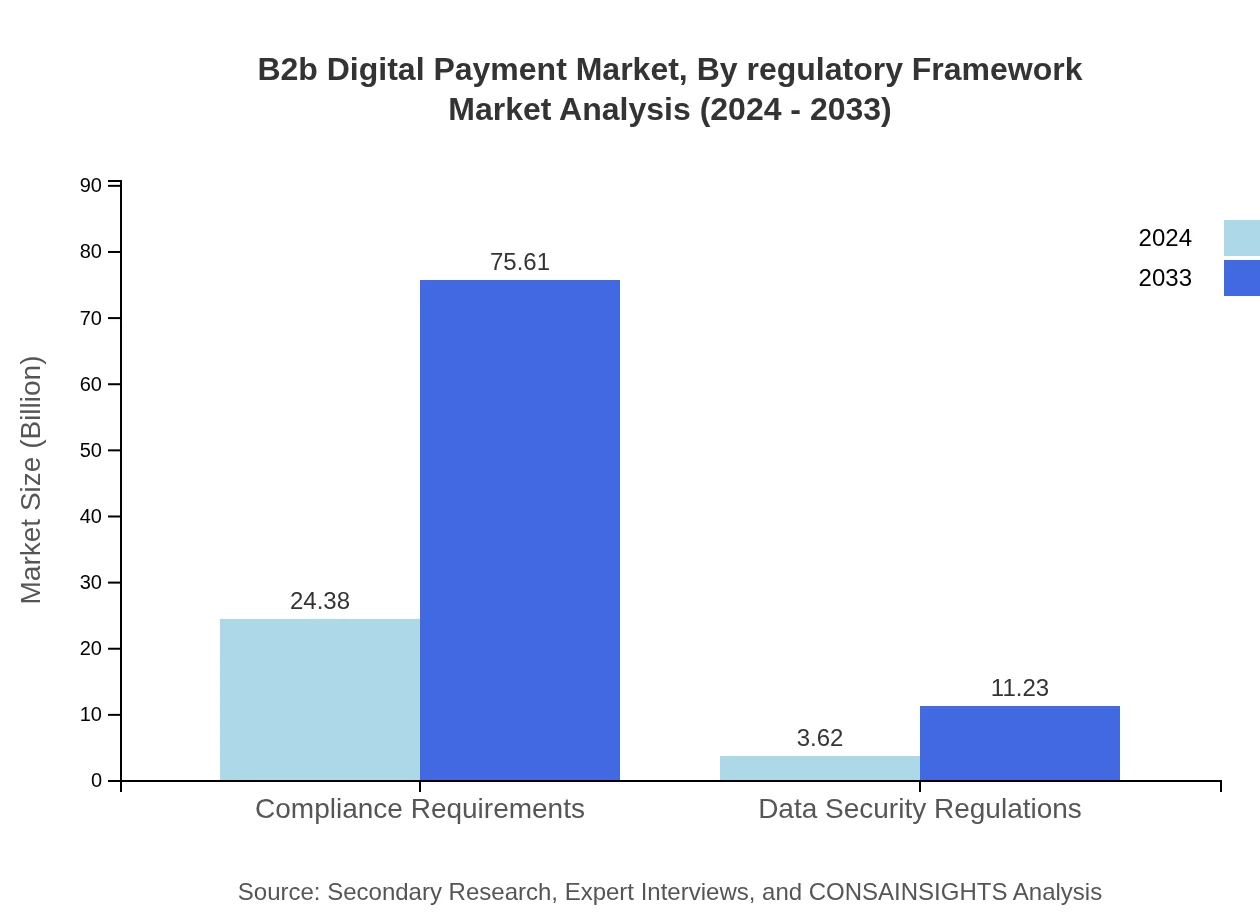

B2b Digital Payment Market Analysis By Regulatory Framework

Compliance requirements and data security regulations are fundamental in instilling market confidence and protecting transactional integrity. With compliance standards growing significantly and stringent data security measures in place, regulatory frameworks are essential to sustaining growth and ensuring that digital payment solutions remain secure and reliable.

B2b Digital Payment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in B2b Digital Payment Industry

Company A:

Company A leverages advanced technologies to optimize payment platforms, delivering secure and efficient solutions that meet global standards. Their innovative approach has positioned them as a key player in the digital payment arena.Company B:

Company B is renowned for its commitment to high-level data security and regulatory compliance. By constantly upgrading its systems, the firm has become synonymous with reliable and innovative digital payment solutions.Company C:

Focusing on scalable payment solutions, Company C integrates flexible technologies that cater to a diverse range of industries. Their solutions streamline complex transaction processes and drive operational excellence.Company D:

Company D has been instrumental in driving digital transformation through strategic partnerships and continuous innovation. Their comprehensive suite of payment solutions continues to reshape the competitive landscape.We're grateful to work with incredible clients.