Ballistic Missile Market Report

Published Date: 03 February 2026 | Report Code: ballistic-missile

Ballistic Missile Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the ballistic missile market, covering its size, growth forecast, industry dynamics, and key regional insights from 2023 to 2033. It highlights market trends, leaders, and future projections for stakeholders and decision-makers.

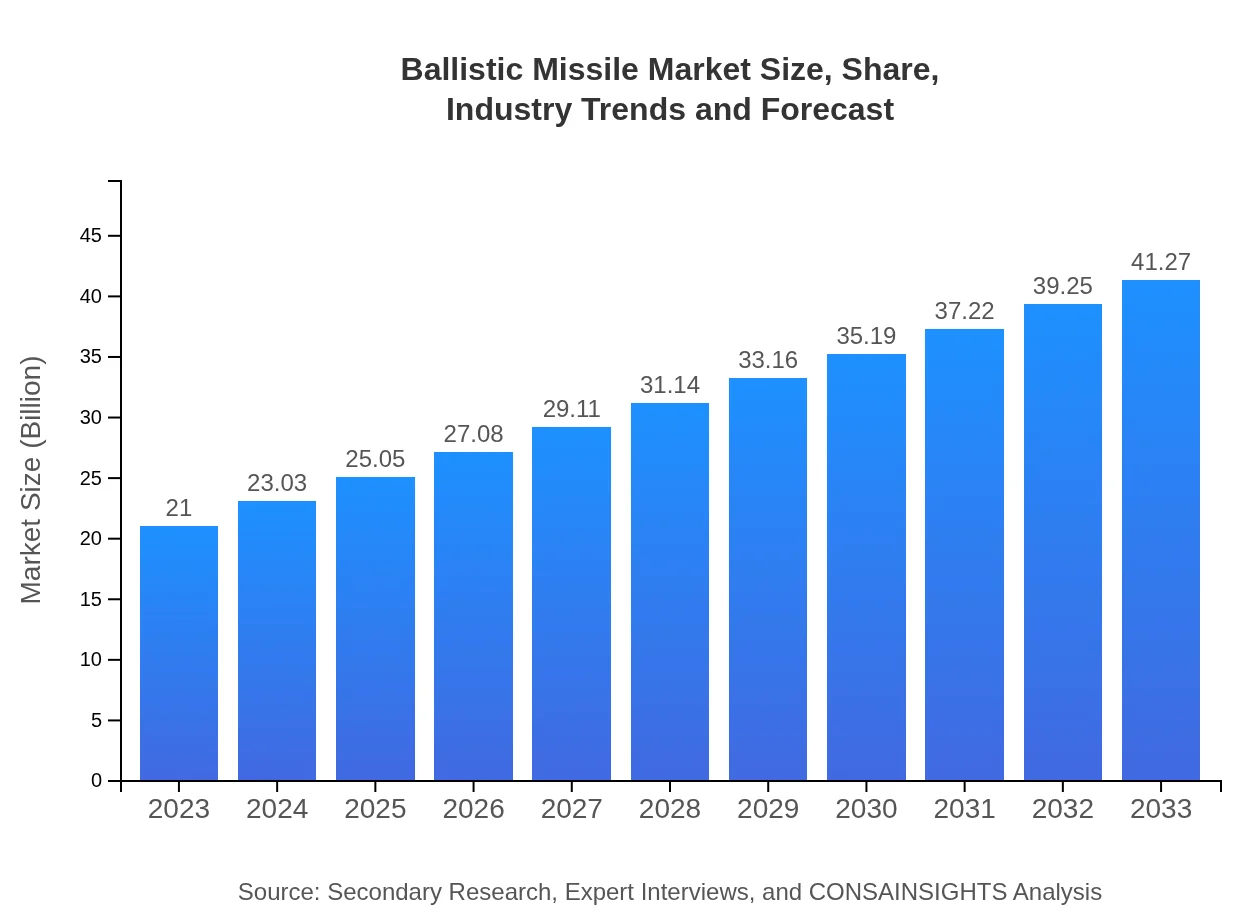

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $41.27 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing , Airbus Defence and Space |

| Last Modified Date | 03 February 2026 |

Ballistic Missile Market Overview

Customize Ballistic Missile Market Report market research report

- ✔ Get in-depth analysis of Ballistic Missile market size, growth, and forecasts.

- ✔ Understand Ballistic Missile's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ballistic Missile

What is the Market Size & CAGR of Ballistic Missile market in 2023?

Ballistic Missile Industry Analysis

Ballistic Missile Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ballistic Missile Market Analysis Report by Region

Europe Ballistic Missile Market Report:

Europe's market is valued at $7.09 billion in 2023, with projections indicating growth to $13.94 billion by 2033. European nations augment their missile capabilities due to emerging threats, aligning with NATO's defense initiatives.Asia Pacific Ballistic Missile Market Report:

In 2023, the Asia Pacific ballistic missile market is valued at approximately $3.87 billion. Advance to 2033, and this figure is projected to reach $7.61 billion. This growth is driven by countries like China and India expanding their military capabilities, focusing on indigenous missile development, and increasing defense budgets.North America Ballistic Missile Market Report:

North America's market value in 2023 is around $7.14 billion and is projected to reach $14.04 billion by 2033. The U.S.'s defense strategy, focusing on nuclear deterrence and missile defense systems, plays a pivotal role in this substantial growth.South America Ballistic Missile Market Report:

The South American market stands at about $0.58 billion in 2023, with expectations to grow to $1.13 billion by 2033, mainly driven by countries such as Brazil and Argentina, focusing on defense procurement and modernization efforts while enhancing regional defense partnerships.Middle East & Africa Ballistic Missile Market Report:

In 2023, the Middle East and Africa ballistic missile market sits at $2.32 billion, with forecasts suggesting it will grow to $4.55 billion by 2033. Heightened tensions in the region and military modernization initiatives contribute substantially to this growth.Tell us your focus area and get a customized research report.

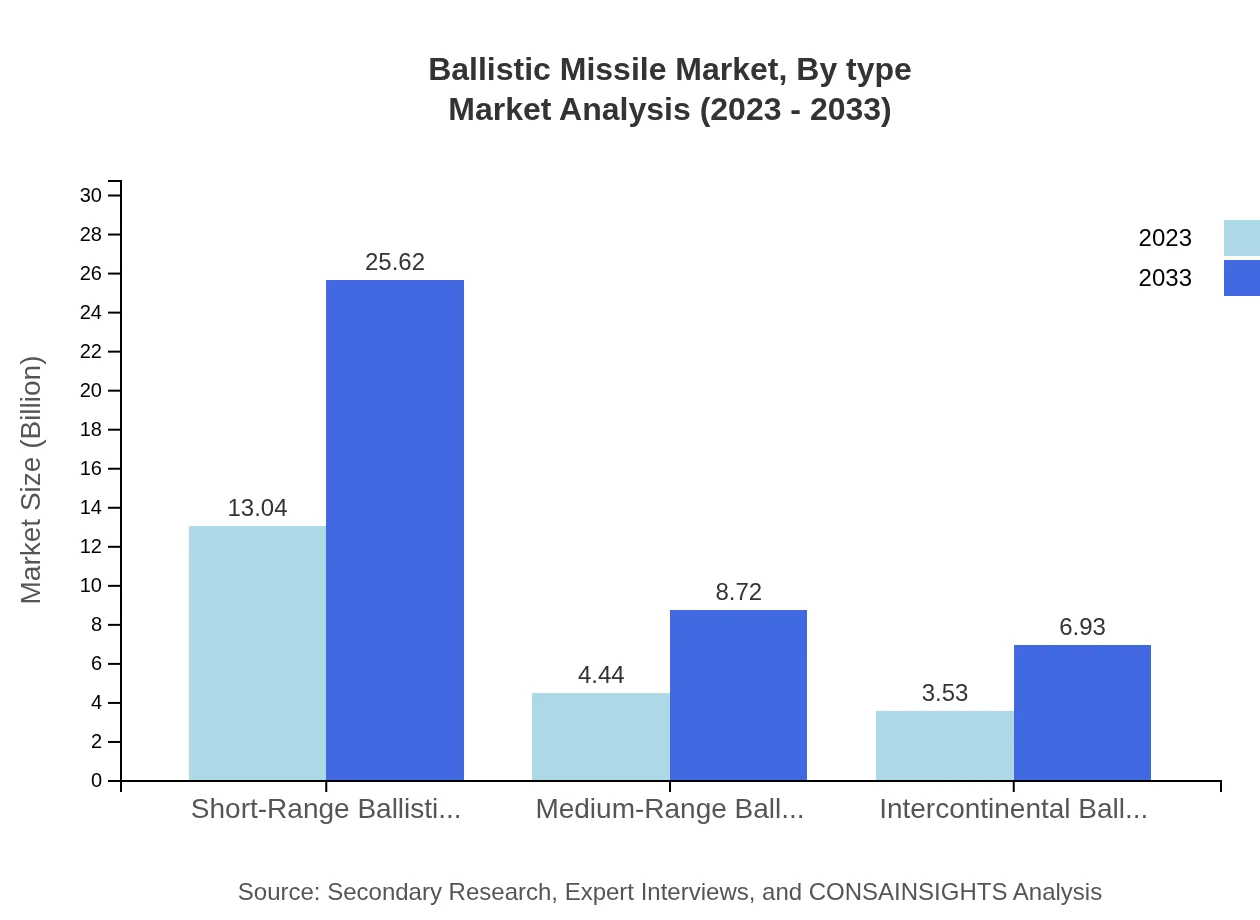

Ballistic Missile Market Analysis By Type

In the ballistic missile market by type, short-range ballistic missiles (SRBMs) dominate with a market size of $13.04 billion in 2023, expected to grow to $25.62 billion by 2033. Medium-range ballistic missiles (MRBMs) and intercontinental ballistic missiles (ICBMs) follow, focusing on strategic deterrence and regional defense needs.

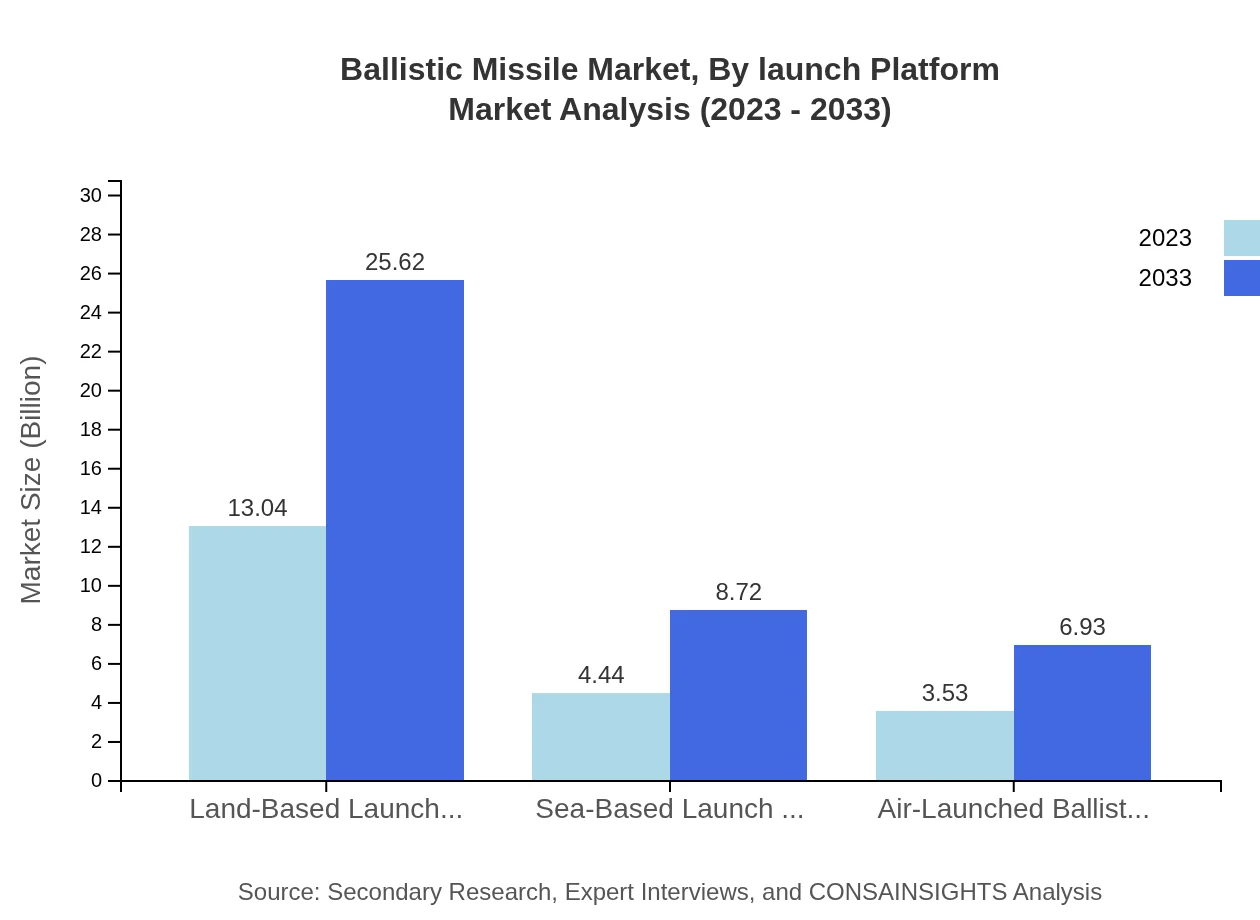

Ballistic Missile Market Analysis By Launch Platform

The analysis indicates that land-based launch platforms lead the segment with a market size of $13.04 billion in 2023, projected to rise to $25.62 billion by 2033. Sea-based and air-launched platforms represent critical segments due to their roles in enhancing strike capabilities.

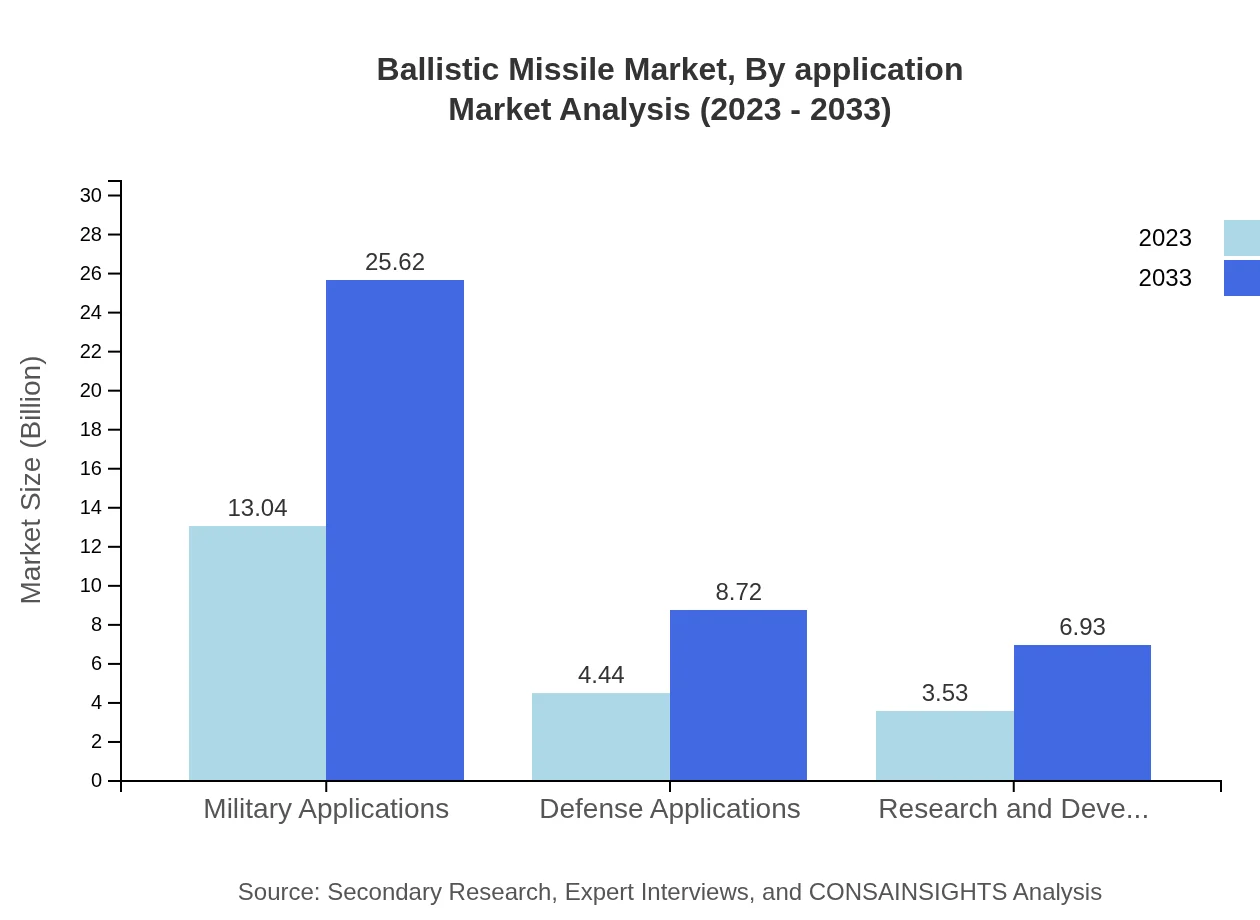

Ballistic Missile Market Analysis By Application

Military applications lead the market, with a size of $13.04 billion in 2023, expected to reach $25.62 billion by 2033. Defense and research applications also have significant shares, reflecting a broad scope of use in national security.

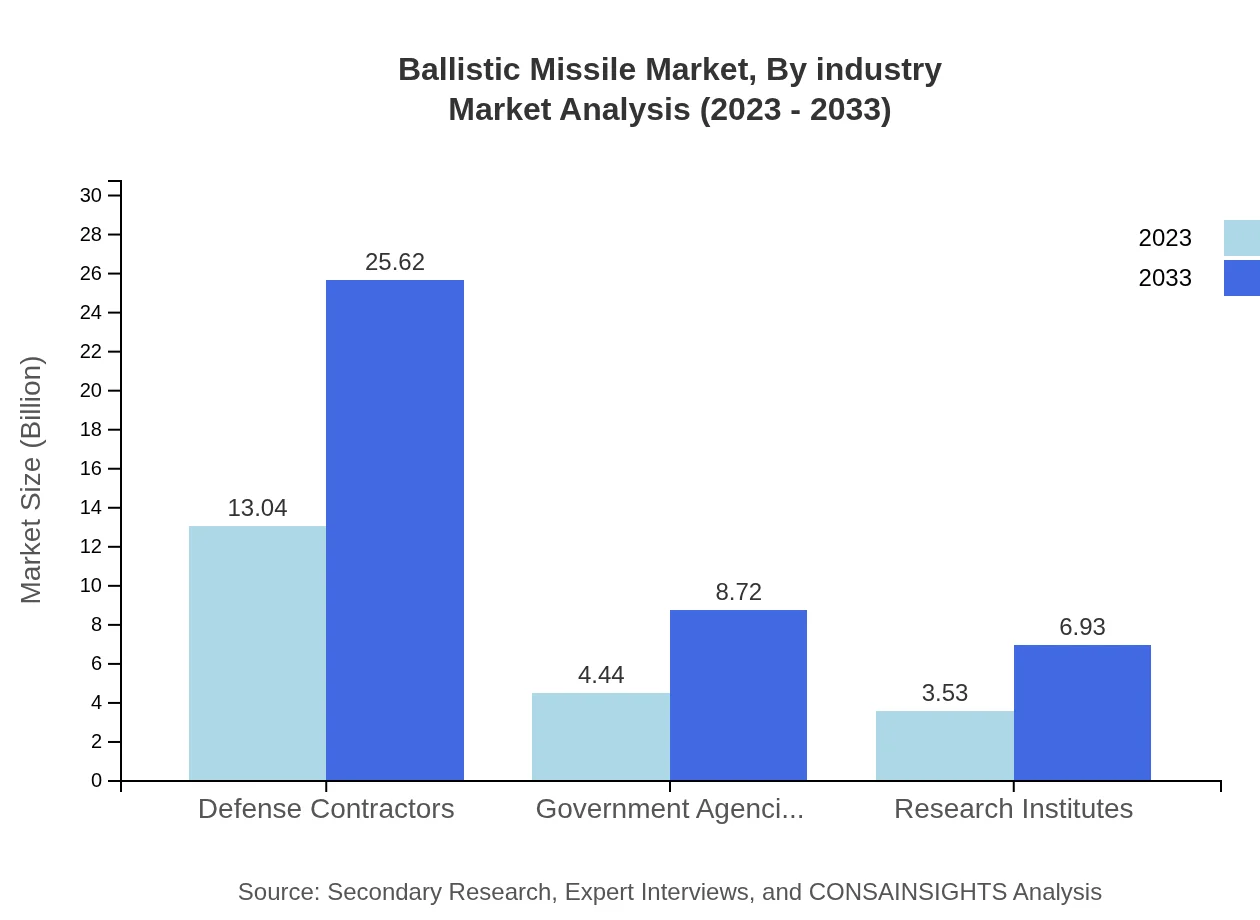

Ballistic Missile Market Analysis By Industry

The industry analysis identifies defense contractors as dominant players, with a market size of $13.04 billion in 2023, anticipated to grow to $25.62 billion by 2033. Government agencies and research institutions hold substantial shares, leveraging their roles in strategic planning and technological development.

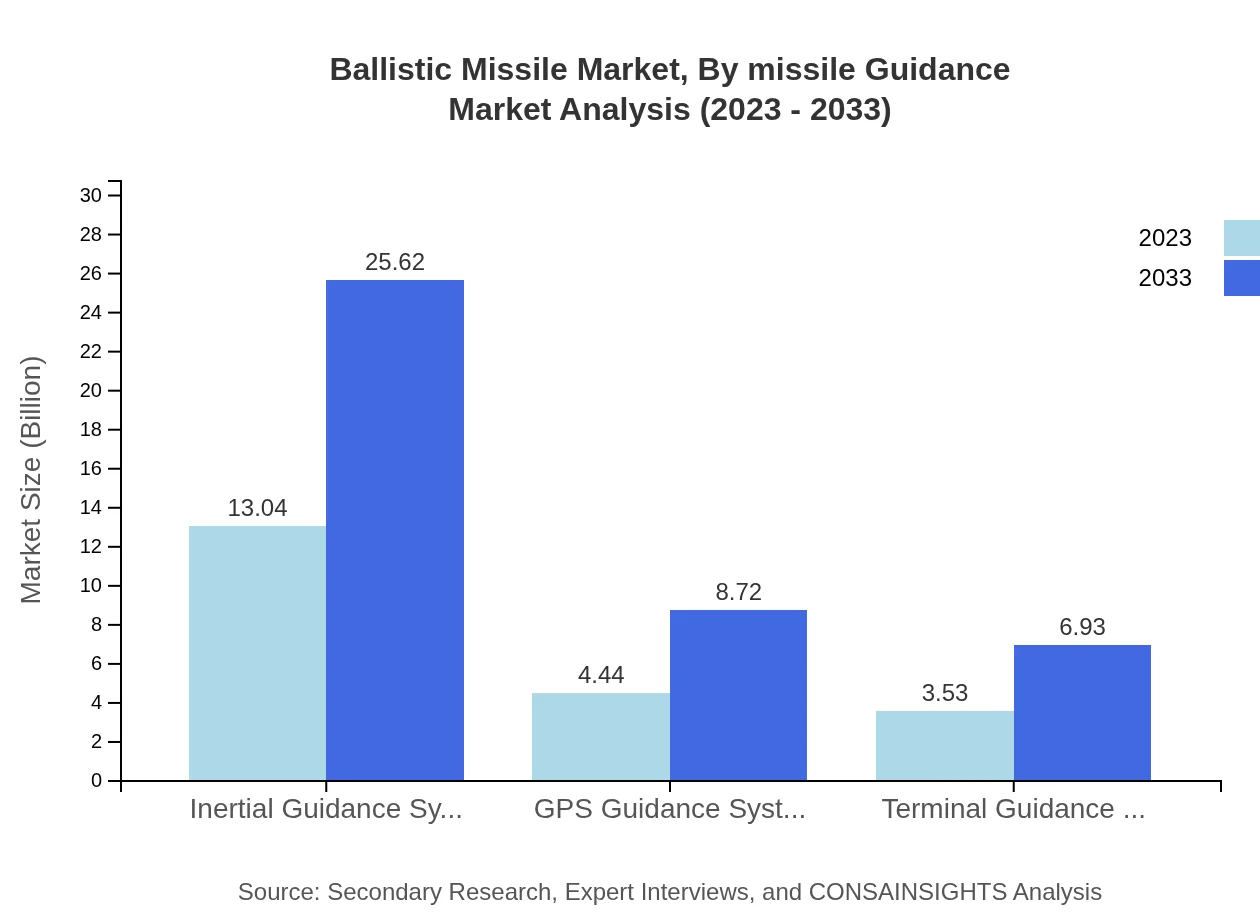

Ballistic Missile Market Analysis By Missile Guidance

In the guidance system segment, inertial guidance systems are the frontrunners, valued at $13.04 billion in 2023 and expected to reach $25.62 billion by 2033. GPS and terminal guidance systems are also critical owing to their improving precision capabilities.

Ballistic Missile Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ballistic Missile Industry

Lockheed Martin:

A leader in defense technologies, Lockheed Martin specializes in missile systems and advanced defense technologies, significantly contributing to the ballistic missile sector.Raytheon Technologies:

Raytheon focuses on missile systems, including guidance systems and warheads, playing a crucial role in the innovation and effectiveness of modern ballistic missiles.Northrop Grumman:

This contractor is renowned for developing next-gen ballistic missiles and systems technology, contributing to U.S. defense capabilities and strategic deterrence.Boeing :

Boeing's extensive work in global defense and aerospace sectors secures its position in the ballistic missile market, developing integrated missile systems and platforms.Airbus Defence and Space:

Airbus is a prominent player in Europe, focusing on developing high-tech missile systems and defense solutions catering to the evolving market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of ballistic Missile?

The global ballistic missile market is valued at approximately $21 billion in 2023 and is projected to grow at a CAGR of 6.8% over the next decade, indicating a significant increase in demand and development in missile technology.

What are the key market players or companies in this ballistic missile industry?

Key market players in the ballistic missile industry include Defense contractors, government agencies, and research institutes, each contributing to missile design, development, and military applications, ensuring advancements and growth in this sector.

What are the primary factors driving the growth in the ballistic missile industry?

Major drivers of ballistic missile market growth include increased defense spending, geopolitical tensions, and advancements in missile technology, which fuel the need for enhanced military capabilities among nations worldwide.

Which region is the fastest Growing in the ballistic missile market?

The Asia Pacific region is rapidly growing in the ballistic missile market, projected to expand from $3.87 billion in 2023 to $7.61 billion by 2033, driven by rising defense needs and technological advancements.

Does ConsaInsights provide customized market report data for the ballistic missile industry?

Yes, ConsaInsights offers customized market research reports for the ballistic missile industry, tailored to specific client needs, providing insights on market trends, regional data, and competitive analysis.

What deliverables can I expect from this ballistic missile market research project?

Clients can expect comprehensive deliverables such as detailed market analysis, segmentation, forecasts, regional insights, and competitive landscape information, all aimed at supporting strategic decision-making.

What are the market trends of ballistic missiles?

Current trends in the ballistic missile market include a focus on developing short-range and intercontinental missiles, advancements in guidance systems, and increasing investments in military R&D, reflecting a dynamic and evolving industry.