Bio Vanillin Market Report

Published Date: 31 January 2026 | Report Code: bio-vanillin

Bio Vanillin Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Bio Vanillin market from 2023 to 2033, covering market size, CAGR, industry insights, segmentation, regional breakdown, technological trends, product performance, key players, and future forecasts.

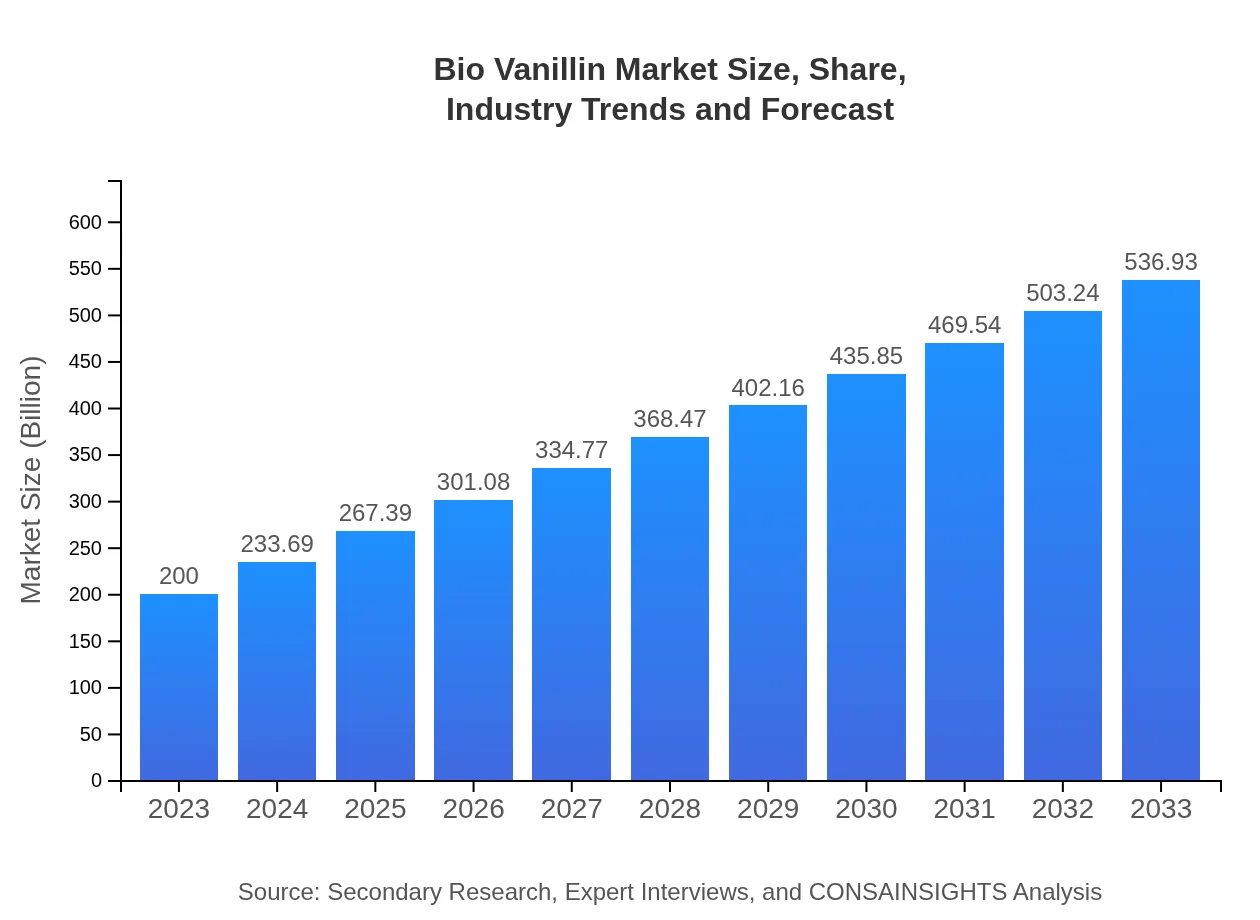

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Million |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $536.93 Million |

| Top Companies | Ajinomoto Co., Inc., Givaudan SA, Symrise AG, Firmenich SA |

| Last Modified Date | 31 January 2026 |

Bio Vanillin Market Overview

Customize Bio Vanillin Market Report market research report

- ✔ Get in-depth analysis of Bio Vanillin market size, growth, and forecasts.

- ✔ Understand Bio Vanillin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bio Vanillin

What is the Market Size & CAGR of Bio Vanillin market in 2023 and 2033?

Bio Vanillin Industry Analysis

Bio Vanillin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bio Vanillin Market Analysis Report by Region

Europe Bio Vanillin Market Report:

Europe is a leading market for Bio Vanillin, with an estimated value of $71.18 million in 2023, projected to grow to $191.09 million by 2033. This region shows robust demand for organic and natural flavors in food products, driven by consumer preferences and regulatory incentives.Asia Pacific Bio Vanillin Market Report:

The Asia Pacific Bio Vanillin market was valued at $37.20 million in 2023 and is projected to reach $99.87 million by 2033. This growth is driven by the expanding food and beverage sector in countries like China and India, where there is an increasing focus on using natural ingredients in products.North America Bio Vanillin Market Report:

The North American Bio Vanillin market, valued at approximately $65.82 million in 2023, is anticipated to reach $176.70 million by 2033. The region's growth is fueled by stringent regulations regarding synthetic ingredients and a growing trend of clean label products.South America Bio Vanillin Market Report:

In South America, the Bio Vanillin market is expected to grow from $2.48 million in 2023 to $6.66 million by 2033. The market is supported by rising health consciousness and a shift toward natural flavoring agents among consumers and manufacturers alike.Middle East & Africa Bio Vanillin Market Report:

In the Middle East and Africa, the Bio Vanillin market is forecasted to grow from $23.32 million in 2023 to $62.61 million by 2033. The growth is attributed to improved distribution networks and rising disposable incomes leading to increased expenditure on premium food products.Tell us your focus area and get a customized research report.

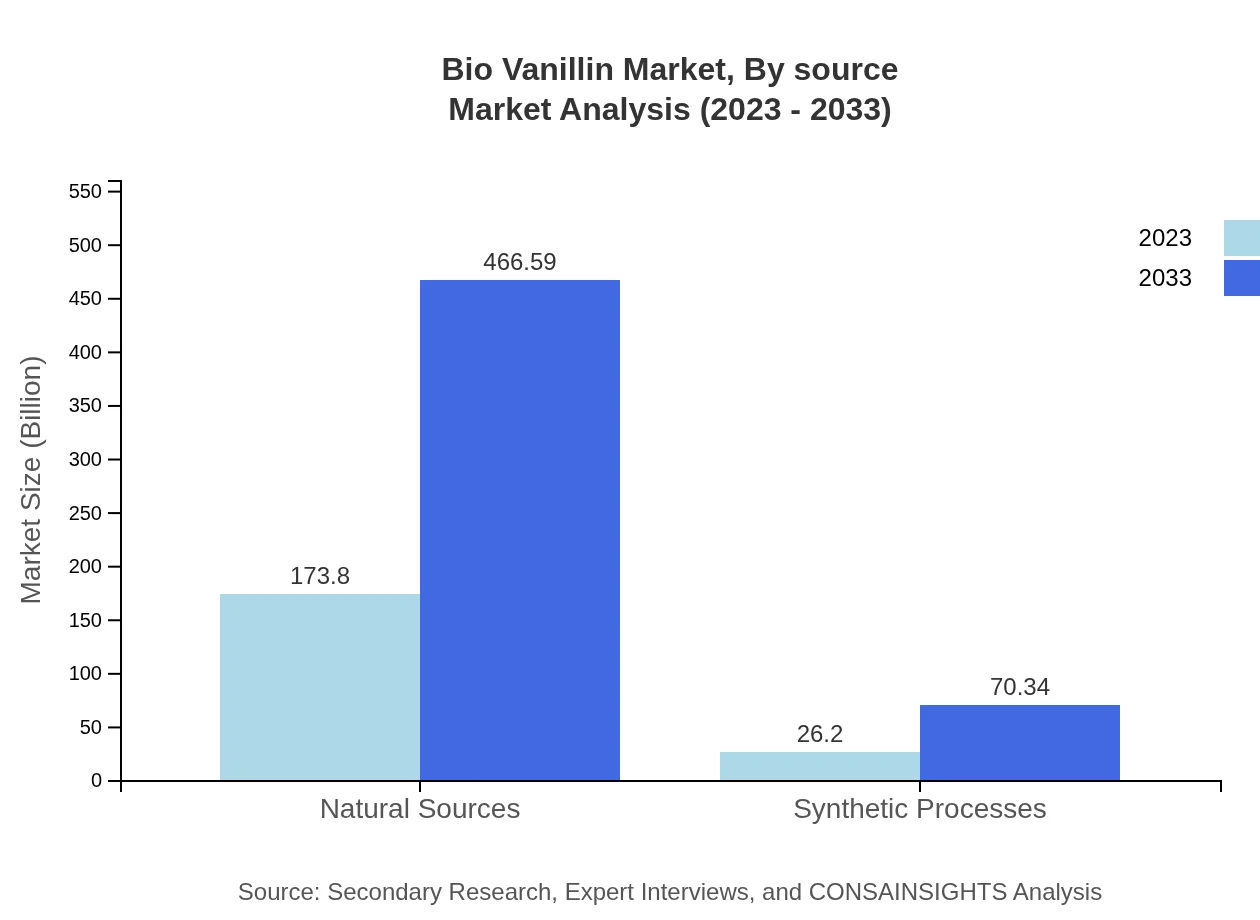

Bio Vanillin Market Analysis By Source

The Bio-Vanillin market, by source, is segmented into natural sources and synthetic processes. In 2023, the natural sources segment represented a significant share of the market, valued at $173.80 million, and is expected to grow to $466.59 million by 2033. The synthetic processes segment accounted for $26.20 million in 2023, with an anticipated increase to $70.34 million by 2033, reflecting a growing preference for natural ingredients.

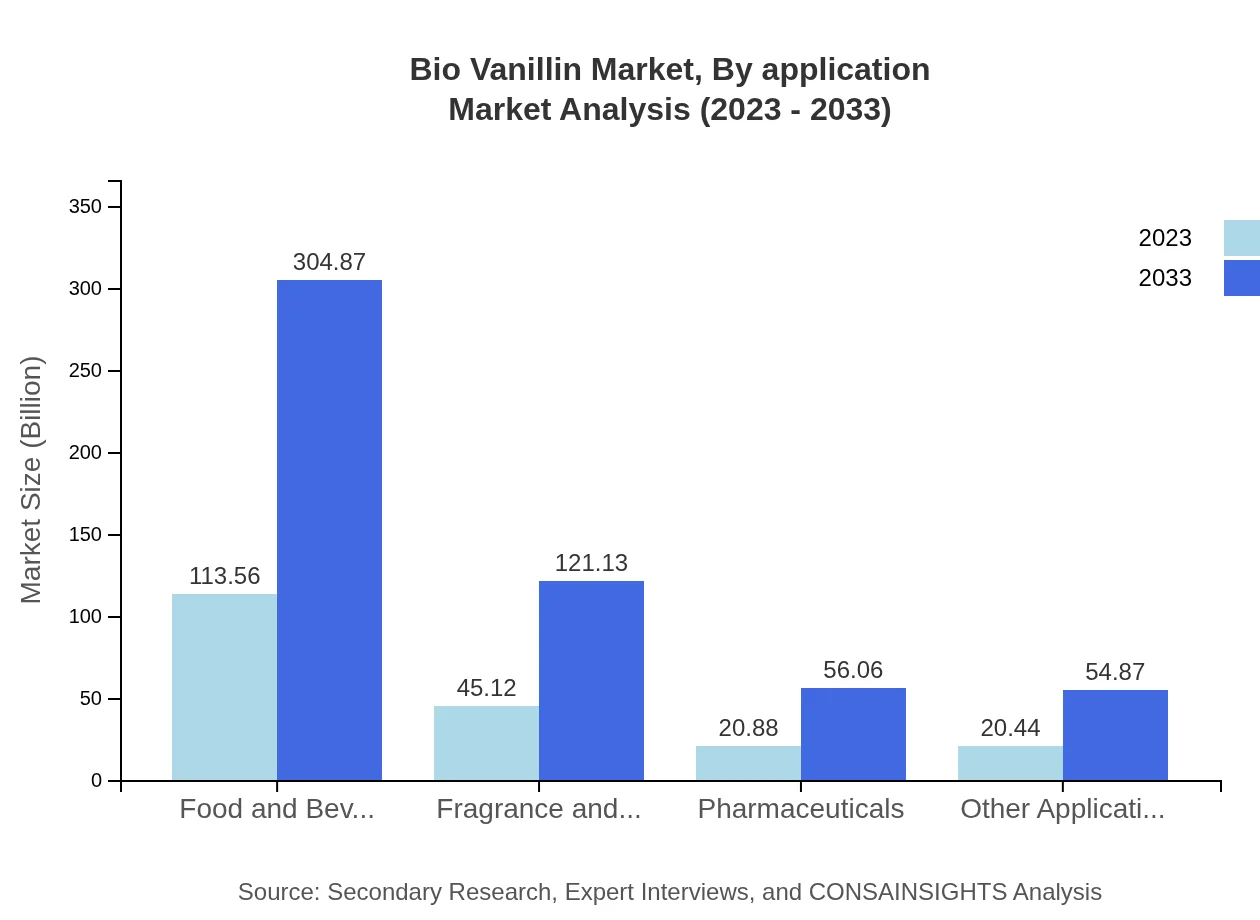

Bio Vanillin Market Analysis By Application

The market is prominently utilized in the food and beverages sector, which reached $113.56 million in 2023, projecting growth to $304.87 million by 2033. The fragrance and cosmetics sector is also significant, expected to expand from $45.12 million in 2023 to $121.13 million by 2033. Other applications include pharmaceuticals, valued at $20.88 million in 2023, set to rise to $56.06 million by 2033.

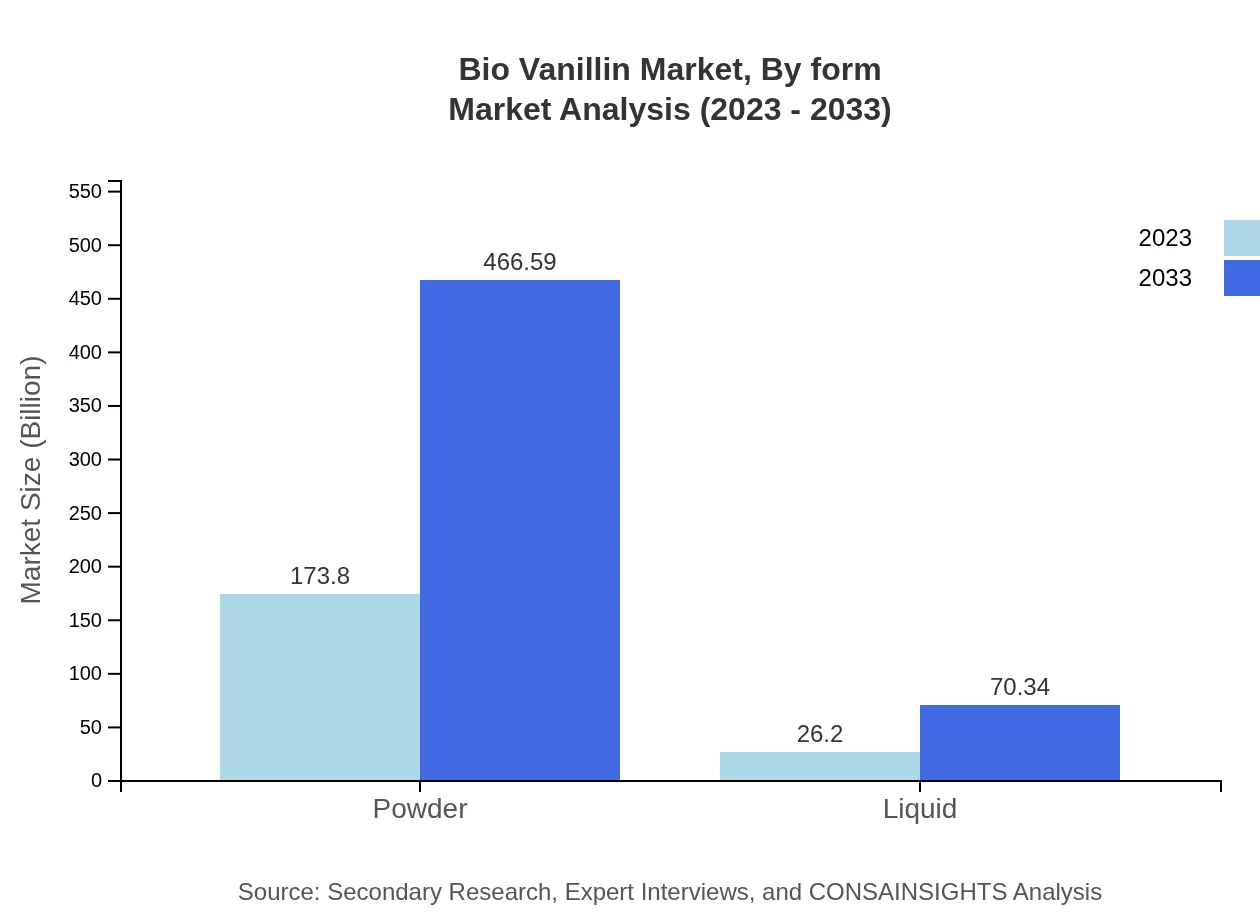

Bio Vanillin Market Analysis By Form

In terms of form, the powder segment is the dominant player in the market, with a size of $173.80 million in 2023 expected to enhance to $466.59 million by 2033. The liquid segment held a market size of $26.20 million in 2023, projected to grow to $70.34 million by 2033, representing emerging opportunities for liquid Bio Vanillin applications.

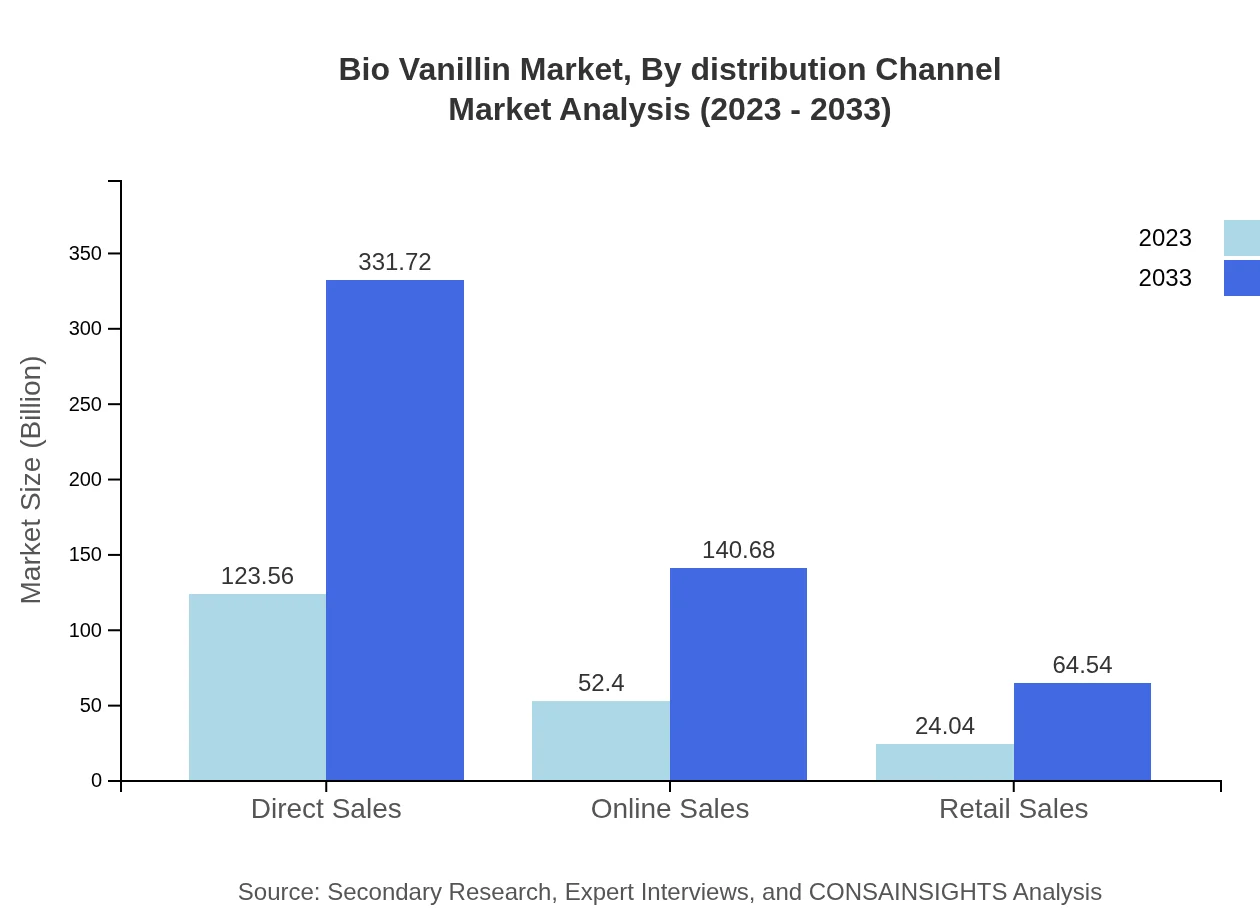

Bio Vanillin Market Analysis By Distribution Channel

The distribution channels for Bio Vanillin comprise direct sales, online sales, and retail sales. Direct sales commanded a market size of $123.56 million in 2023, projected to reach $331.72 million by 2033. Online sales are emerging significantly, from $52.40 million in 2023 to $140.68 million by 2033, driven by increasing e-commerce trends.

Bio Vanillin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bio Vanillin Industry

Ajinomoto Co., Inc.:

A global leader in the production of natural flavoring agents, Ajinomoto specializes in amino acids and other natural ingredients, including Bio Vanillin, catering to the food and beverage industry.Givaudan SA:

Givaudan is one of the largest flavors and fragrance companies worldwide, renowned for its innovative approach towards developing natural vanillin solutions, meeting the rising demand for clean label products.Symrise AG:

Symrise is a prominent player in the flavor and fragrance market, focused on sustainability and natural sourcing of ingredients, including Bio Vanillin, aiming to meet the evolving consumer preferences.Firmenich SA:

Firmenich is recognized for its expertise in flavor and fragrance creation, providing a range of sustainable vanillin solutions while driving innovation in the Bio Vanillin sector.We're grateful to work with incredible clients.

FAQs

What is the market size of bio Vanillin?

The bio-vanillin market is currently valued at approximately $200 million as of 2023. It is projected to grow at a CAGR of 10%, indicating strong future growth potential driven by increasing demand for natural flavoring agents.

What are the key market players or companies in the bio Vanillin industry?

Key companies in the bio-vanillin industry include major players like Evolva Holding SA, Solvay SA, and Givaudan, among others. These firms are pivotal in advancing bio-vanillin production technologies and expanding market reach through innovative product offerings.

What are the primary factors driving the growth in the bio Vanillin industry?

The growth in the bio-vanillin industry is primarily driven by the increasing consumer preference for natural and organic products, expanding applications in food and beverages, and stringent regulations against synthetic flavors that encourage the use of bio-based alternatives.

Which region is the fastest Growing in the bio Vanillin?

The Asia Pacific region is the fastest-growing market for bio-vanillin, projected to expand from $37.20 million in 2023 to $99.87 million by 2033, showcasing high demand in both food and pharmaceutical sectors as disposable incomes rise.

Does ConsaInsights provide customized market report data for the bio Vanillin industry?

Yes, Consainsights offers customized market report data for the bio-vanillin industry, allowing clients to gain tailored insights and detailed analyses based on specific market needs, competitive landscapes, and product segments.

What deliverables can I expect from this bio Vanillin market research project?

Deliverables from the bio-vanillin market research project include comprehensive market analysis reports, regional segmentation data, competitive landscape, growth forecasts, trend analysis, and tailored insights addressing specific strategic objectives.

What are the market trends of bio Vanillin?

Current trends in the bio-vanillin market include an increasing shift towards the use of natural and sustainable flavoring agents, rising demand in the fragrance industry, and innovative applications in pharmaceuticals, which are transforming market dynamics.