Microencapsulated Food Ingredient Market Report

Published Date: 31 January 2026 | Report Code: microencapsulated-food-ingredient

Microencapsulated Food Ingredient Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Microencapsulated Food Ingredient market, providing insights on current market trends, regional performance, and future forecasts for the period 2023 to 2033.

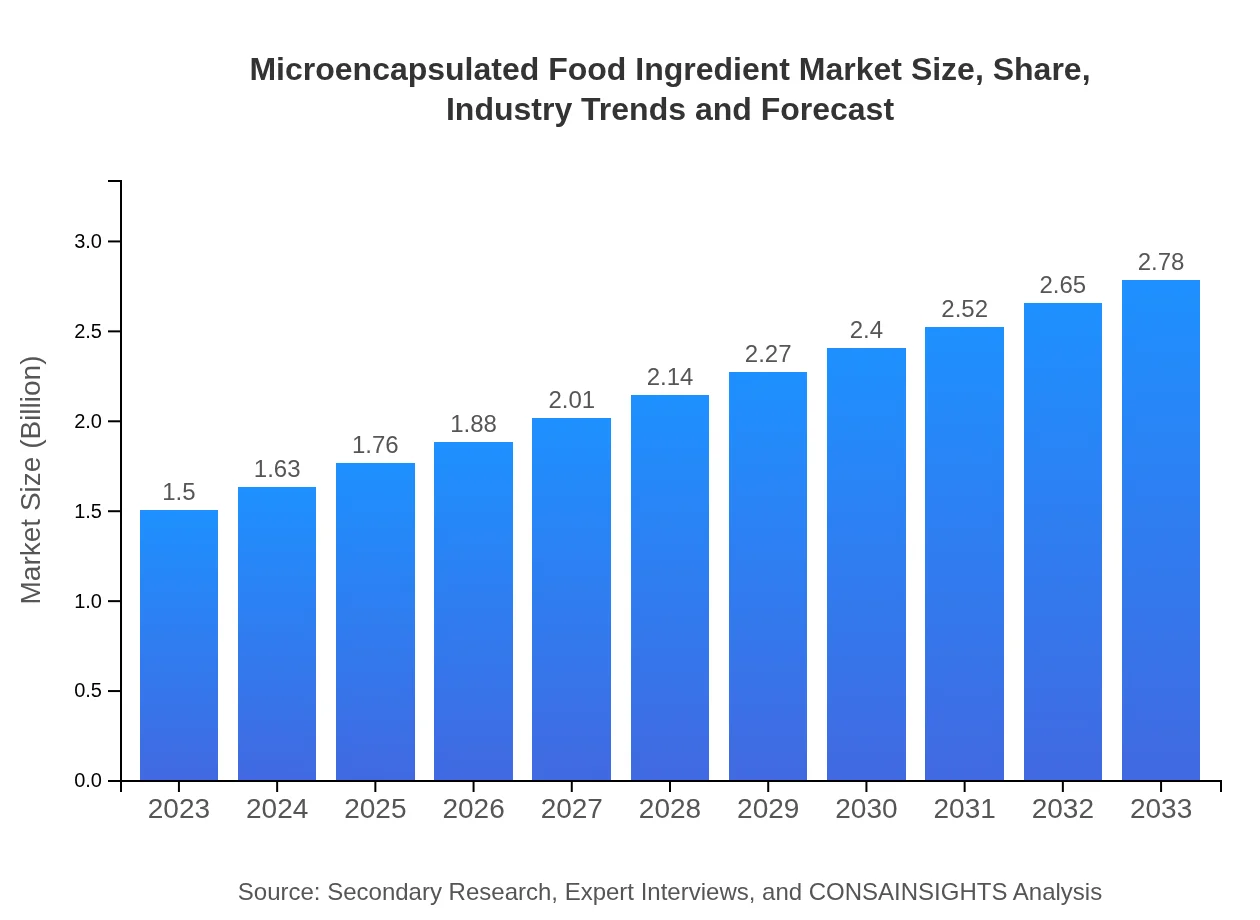

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Givaudan, Innova Health Foods, Söllner |

| Last Modified Date | 31 January 2026 |

Microencapsulated Food Ingredient Market Overview

Customize Microencapsulated Food Ingredient Market Report market research report

- ✔ Get in-depth analysis of Microencapsulated Food Ingredient market size, growth, and forecasts.

- ✔ Understand Microencapsulated Food Ingredient's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Microencapsulated Food Ingredient

What is the Market Size & CAGR of Microencapsulated Food Ingredient market in 2023?

Microencapsulated Food Ingredient Industry Analysis

Microencapsulated Food Ingredient Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Microencapsulated Food Ingredient Market Analysis Report by Region

Europe Microencapsulated Food Ingredient Market Report:

The European market is also set to experience growth, from $0.37 billion in 2023 to $0.68 billion in 2033. The demand for clean label products and enhanced flavors in gourmet foods is driving microencapsulation applications across Europe.Asia Pacific Microencapsulated Food Ingredient Market Report:

In the Asia Pacific region, the microencapsulated food ingredient market is forecasted to grow from $0.29 billion in 2023 to $0.53 billion in 2033. The growth is propelled by urbanization, increasing disposable income, and changing dietary preferences among consumers, particularly in countries such as China and India.North America Microencapsulated Food Ingredient Market Report:

North America is expected to witness significant market growth, with revenues projected to increase from $0.50 billion in 2023 to $0.92 billion in 2033. This growth is supported by a robust food processing sector and high consumer awareness of health-related issues, making microencapsulated ingredients increasingly relevant.South America Microencapsulated Food Ingredient Market Report:

The South American market, though smaller, is projected to expand from $0.14 billion in 2023 to $0.25 billion by 2033. Growing health consciousness and demand for functional food products are key drivers in this region, particularly in Brazil and Argentina.Middle East & Africa Microencapsulated Food Ingredient Market Report:

In the Middle East and Africa, the market will expand from $0.21 billion in 2023 to $0.39 billion in 2033. The growth is attributed to increasing investments in food innovations and a rising demand for health-oriented food products.Tell us your focus area and get a customized research report.

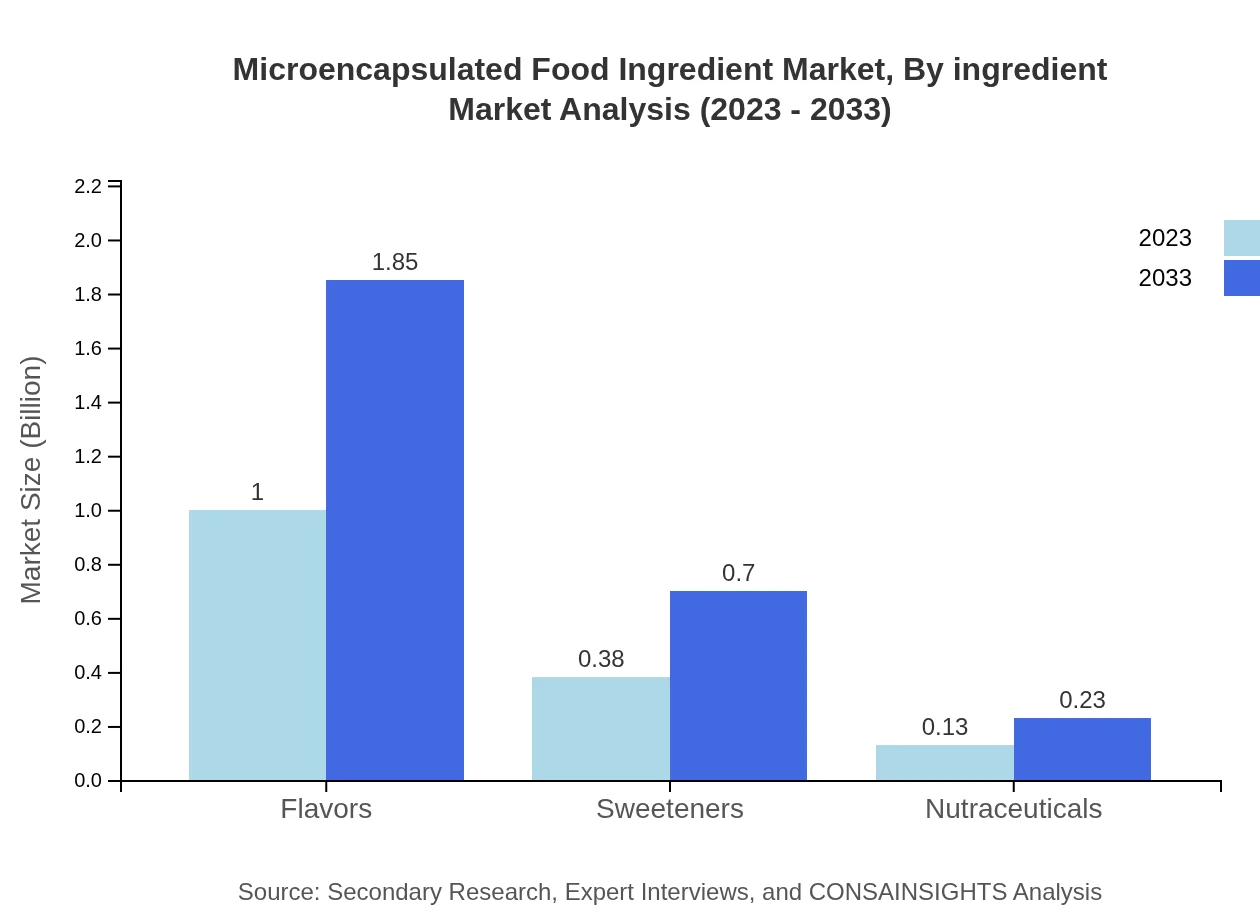

Microencapsulated Food Ingredient Market Analysis By Ingredient

Key ingredient types in the microencapsulated food ingredient market include: Flavors (valued at $1.00 billion in 2023), which are crucial for product enhancement and consumer appeal. Sweeteners (valued at $0.38 billion in 2023), focused on providing healthier alternatives to sugar. Nutraceuticals (valued at $0.13 billion in 2023), driven by demand in dietary supplements.

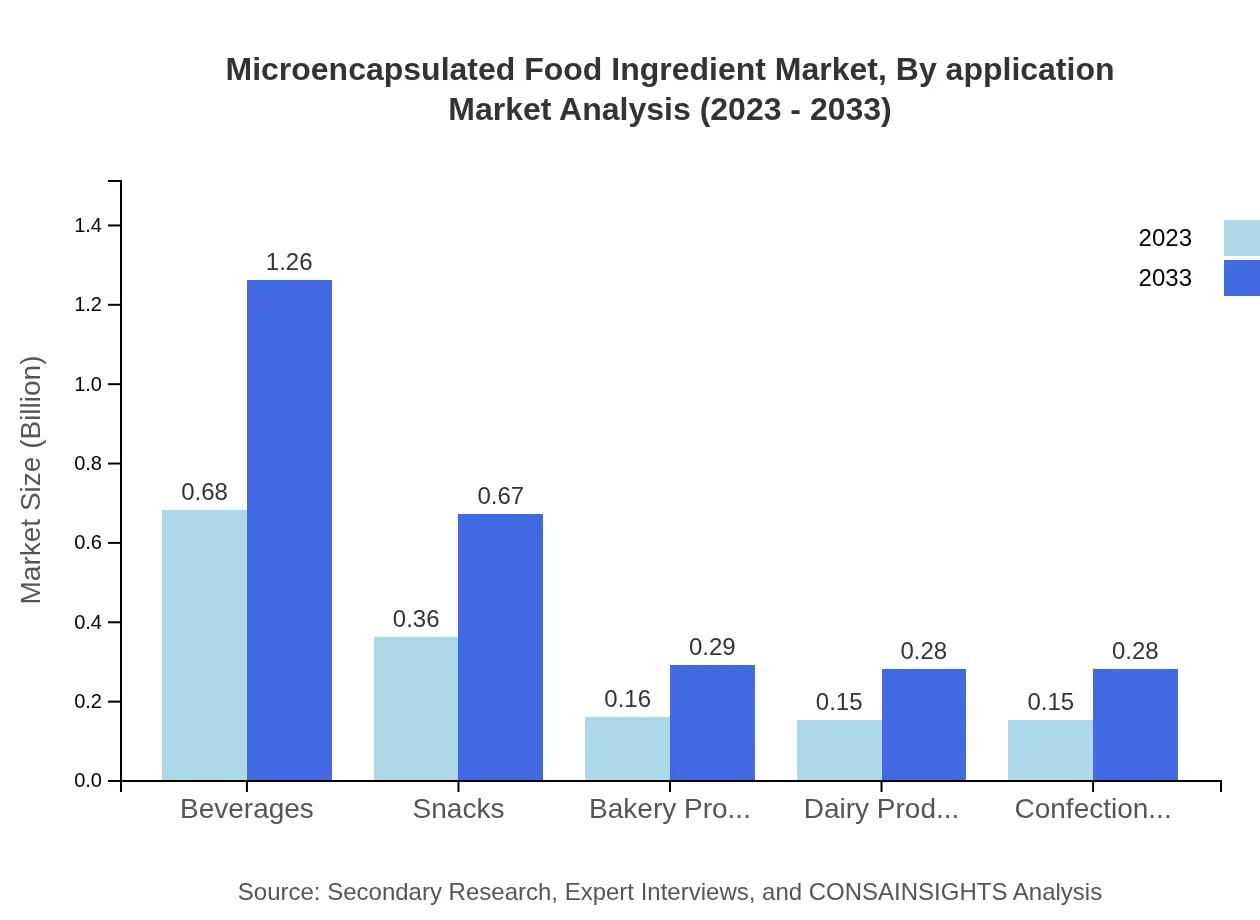

Microencapsulated Food Ingredient Market Analysis By Application

Popular applications include: Beverages (valued at $0.68 billion in 2023), which leverage microencapsulation for flavor enhancement and nutrient delivery. Snacks (valued at $0.36 billion in 2023), where texture and shelf stability are improved. Bakery Products and Dairy Products also play significant roles in application-based demand.

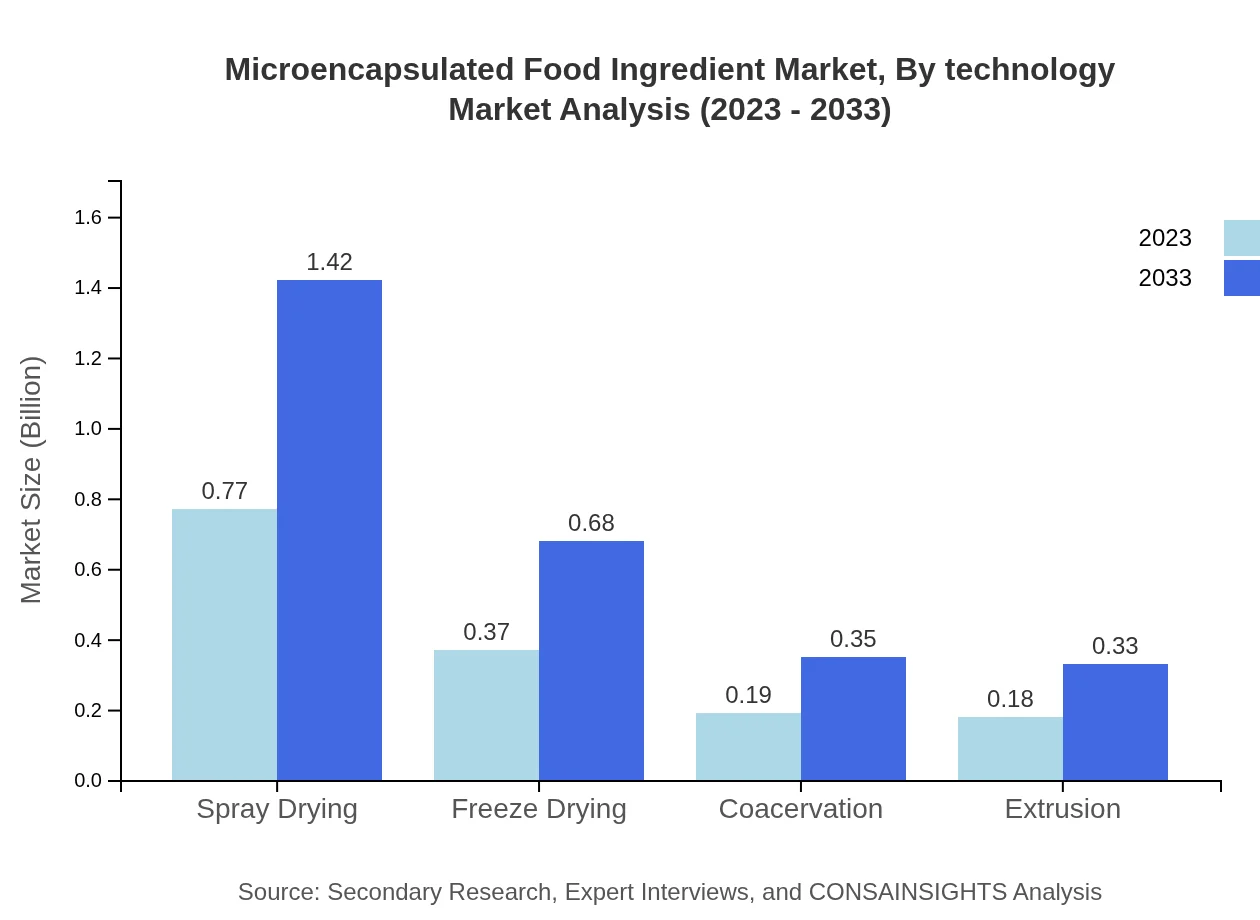

Microencapsulated Food Ingredient Market Analysis By Technology

The leading technology for microencapsulation includes: Spray Drying (accounting for 51.09% of the market), known for its efficiency and scalability. Freeze Drying (24.59% share), favored for preserving the integrity of sensitive nutrients. Coacervation and Extrusion also contribute notable shares to the technology segment.

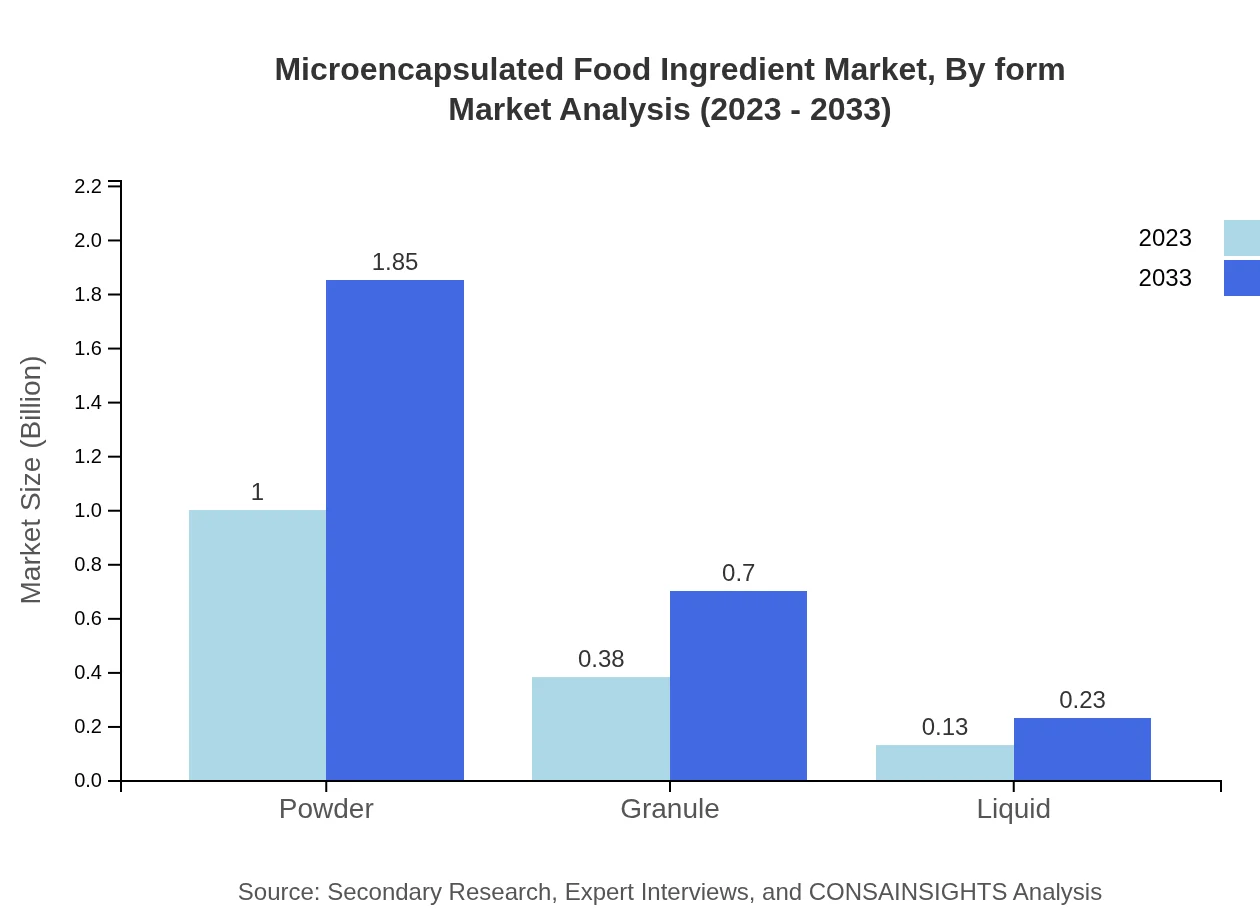

Microencapsulated Food Ingredient Market Analysis By Form

Market forms include: Powder (dominant at $1.00 billion in 2023), providing versatility in application. Granule form ($0.38 billion), which caters to specialty applications. Liquid form ($0.13 billion), utilized mainly in liquid food products like dressings and sauces.

Microencapsulated Food Ingredient Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Microencapsulated Food Ingredient Industry

Givaudan:

A leading flavor and fragrance company, Givaudan specializes in developing innovative microencapsulated ingredients that enhance taste and shelf life.Innova Health Foods:

Known for its expertise in nutrition and functional food, Innova provides a wide range of microencapsulated products, particularly for the dietary supplement sector.Söllner:

Söllner focuses on sustainable and organic microencapsulated ingredients, catering to the increasing demand for health-conscious food choices.We're grateful to work with incredible clients.

FAQs

What is the market size of microencapsulated Food Ingredient?

The global market size for microencapsulated food ingredients is projected to reach approximately $1.5 billion by 2033, growing at a CAGR of 6.2%. This growth reflects increasing demand for advanced food preservation and flavor enhancement technologies.

What are the key market players or companies in this microencapsulated Food Ingredient industry?

Key players in the microencapsulated food ingredient industry include companies like BASF, encapsulating technology experts, and specialized ingredient suppliers, which together influence market trends, innovation and growth trajectories.

What are the primary factors driving the growth in the microencapsulated Food Ingredient industry?

Growth in the microencapsulated food ingredient industry is driven by rising consumer demand for convenience foods, increased health awareness, and technological advancements in encapsulation methods that improve ingredient functionality and stability.

Which region is the fastest Growing in the microencapsulated Food Ingredient?

The Asia Pacific region is identified as the fastest-growing market for microencapsulated food ingredients, with market growth increasing from $0.29 billion in 2023 to $0.53 billion by 2033, reflecting a growing consumer base and innovative food applications.

Does ConsaInsights provide customized market report data for the microencapsulated Food Ingredient industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the microencapsulated food ingredient industry, providing clients with relevant insights and analysis for strategic decision-making.

What deliverables can I expect from this microencapsulated Food Ingredient market research project?

From the microencapsulated food ingredient market research project, clients can expect comprehensive reports featuring market size, trends, segment analysis, competitive landscape, and regional insights formatted for easy understanding and actionable strategies.

What are the market trends of microencapsulated Food Ingredient?

Current market trends in microencapsulated food ingredients include a shift towards plant-based encapsulation, innovations in delivery systems for nutraceuticals, and a growing emphasis on sustainability which is reshaping product development across markets.