Biometrics Market Report

Published Date: 31 January 2026 | Report Code: biometrics

Biometrics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biometrics market, detailing the current landscape, market size forecasts for 2023-2033, segmentation, regional insights, and industry trends influencing growth.

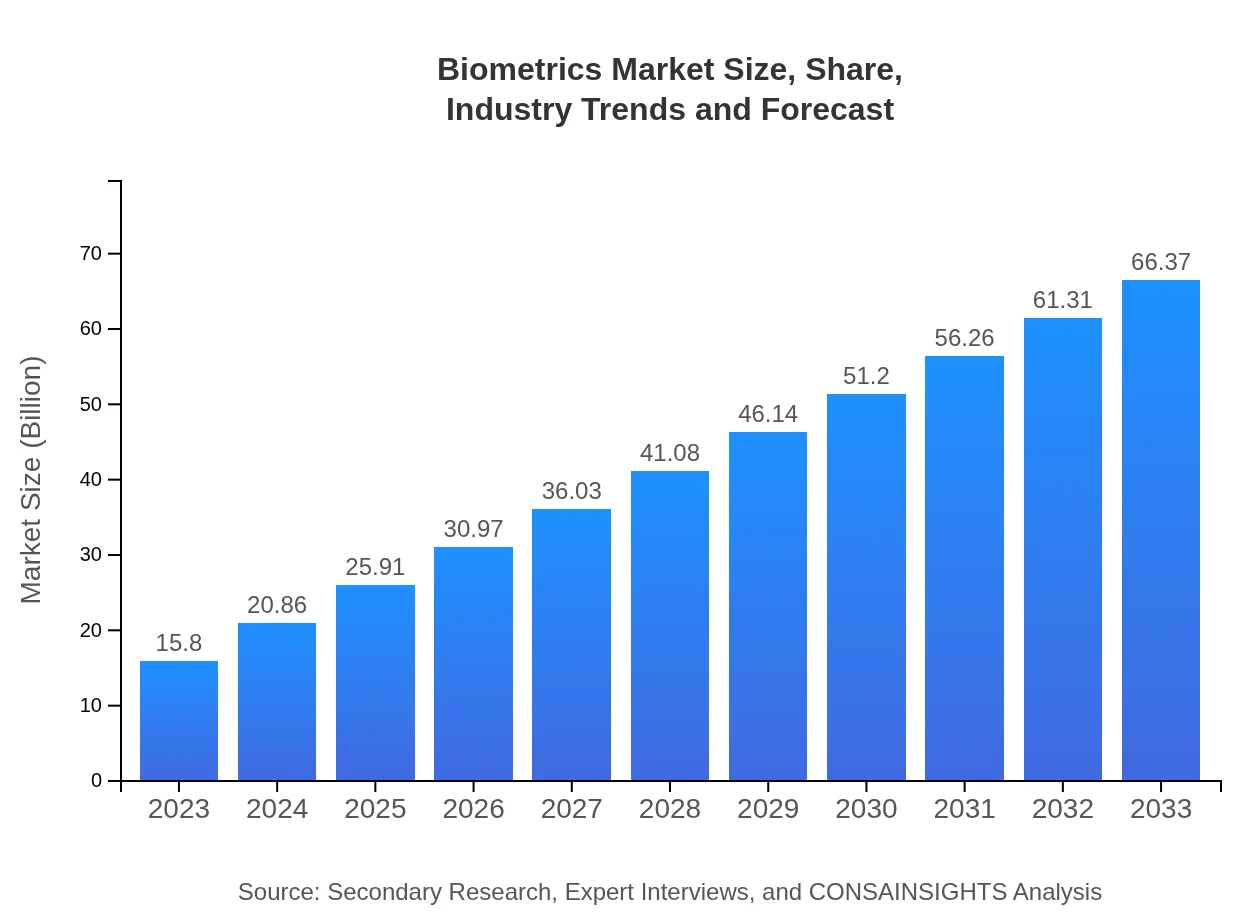

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.80 Billion |

| CAGR (2023-2033) | 14.7% |

| 2033 Market Size | $66.37 Billion |

| Top Companies | IDEMIA, Neurotechnology, Thales Group, Gemalto, Face++ |

| Last Modified Date | 31 January 2026 |

Biometrics Market Overview

Customize Biometrics Market Report market research report

- ✔ Get in-depth analysis of Biometrics market size, growth, and forecasts.

- ✔ Understand Biometrics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometrics

What is the Market Size & CAGR of Biometrics market in 2023?

Biometrics Industry Analysis

Biometrics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometrics Market Analysis Report by Region

Europe Biometrics Market Report:

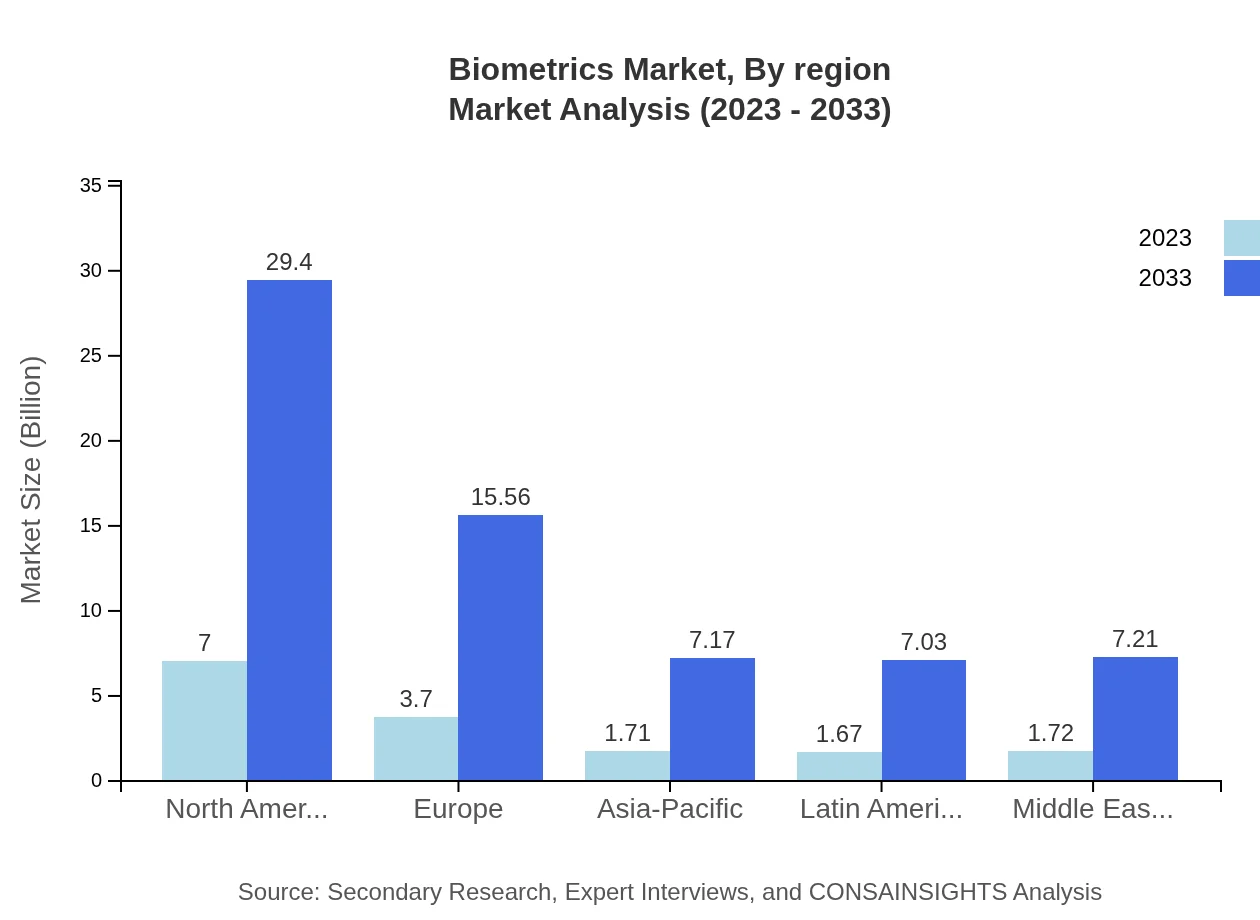

Europe is at the forefront of Biometrics with an estimated market size of USD 4.97 billion in 2023, anticipated to grow to USD 20.88 billion by 2033. The region's focus on stringent data protection regulations, coupled with a strong emphasis on innovative security solutions across industries, drives market growth.Asia Pacific Biometrics Market Report:

In 2023, the Asia-Pacific Biometrics market is valued at USD 3 billion and is expected to reach USD 12.6 billion by 2033. This growth is fueled by rising investments in smart city initiatives and increasing adoption of biometric authentication in mobile devices. Countries like China and India lead in market expansion due to their large populations and governmental push for enhanced security measures.North America Biometrics Market Report:

North America's Biometrics market is anticipated to expand from USD 5.7 billion in 2023 to USD 23.96 billion by 2033. This growth is attributed to the high penetration of advanced security solutions in various sectors, including financial services and law enforcement, alongside significant investments from technology companies.South America Biometrics Market Report:

The South American Biometrics market is projected to grow from USD 0.02 billion in 2023 to USD 0.1 billion in 2033. The region is gradually adopting biometric technologies, primarily driven by increasing governmental initiatives for national identification systems and improved airport security.Middle East & Africa Biometrics Market Report:

The Middle East and Africa Biometrics market is observed to be worth USD 2.1 billion in 2023, projected to grow to USD 8.83 billion by 2033. Growth is fueled by increasing security concerns, especially in the UAE and South Africa, where biometric systems are implemented in various sectors, including immigration and border control.Tell us your focus area and get a customized research report.

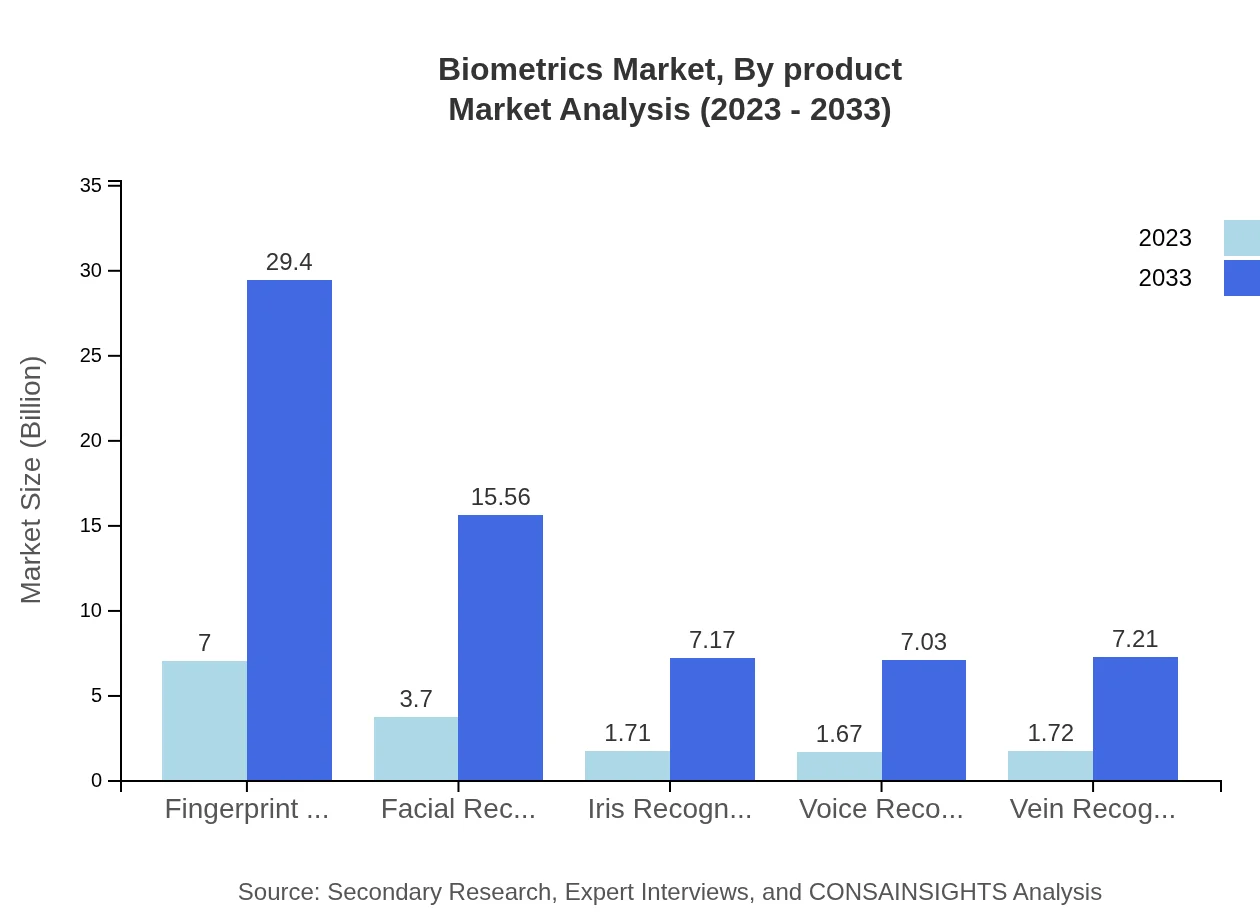

Biometrics Market Analysis By Product

Fingerprint recognition stands as the leading segment, reaching USD 7 billion in 2023, projected to grow to USD 29.4 billion by 2033. Facial recognition follows with a market size of USD 3.7 billion, expanding to USD 15.56 billion. Iris recognition technology is expected to grow from USD 1.71 billion to USD 7.17 billion, along with voice and vein recognition technologies also witnessing significant advancements and deployment.

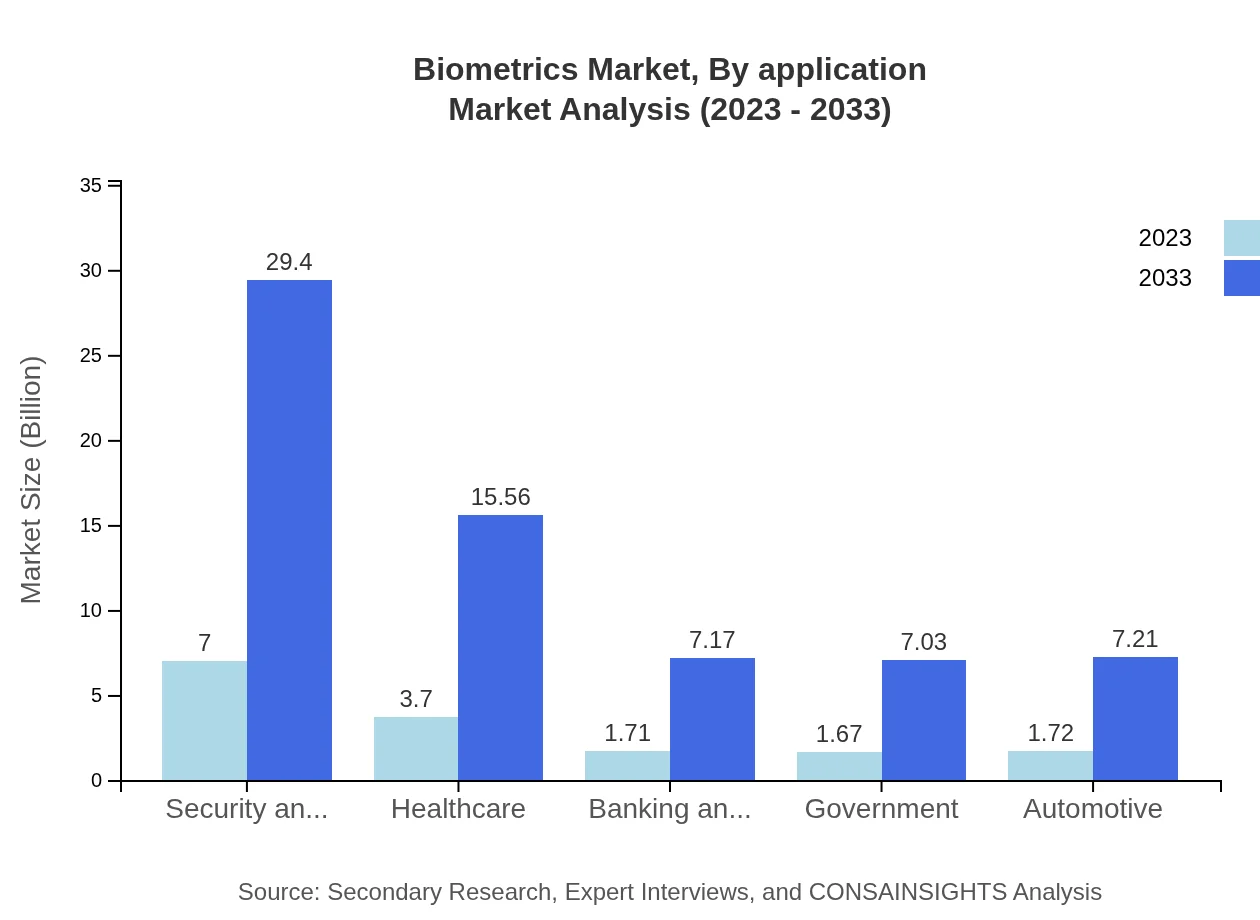

Biometrics Market Analysis By Application

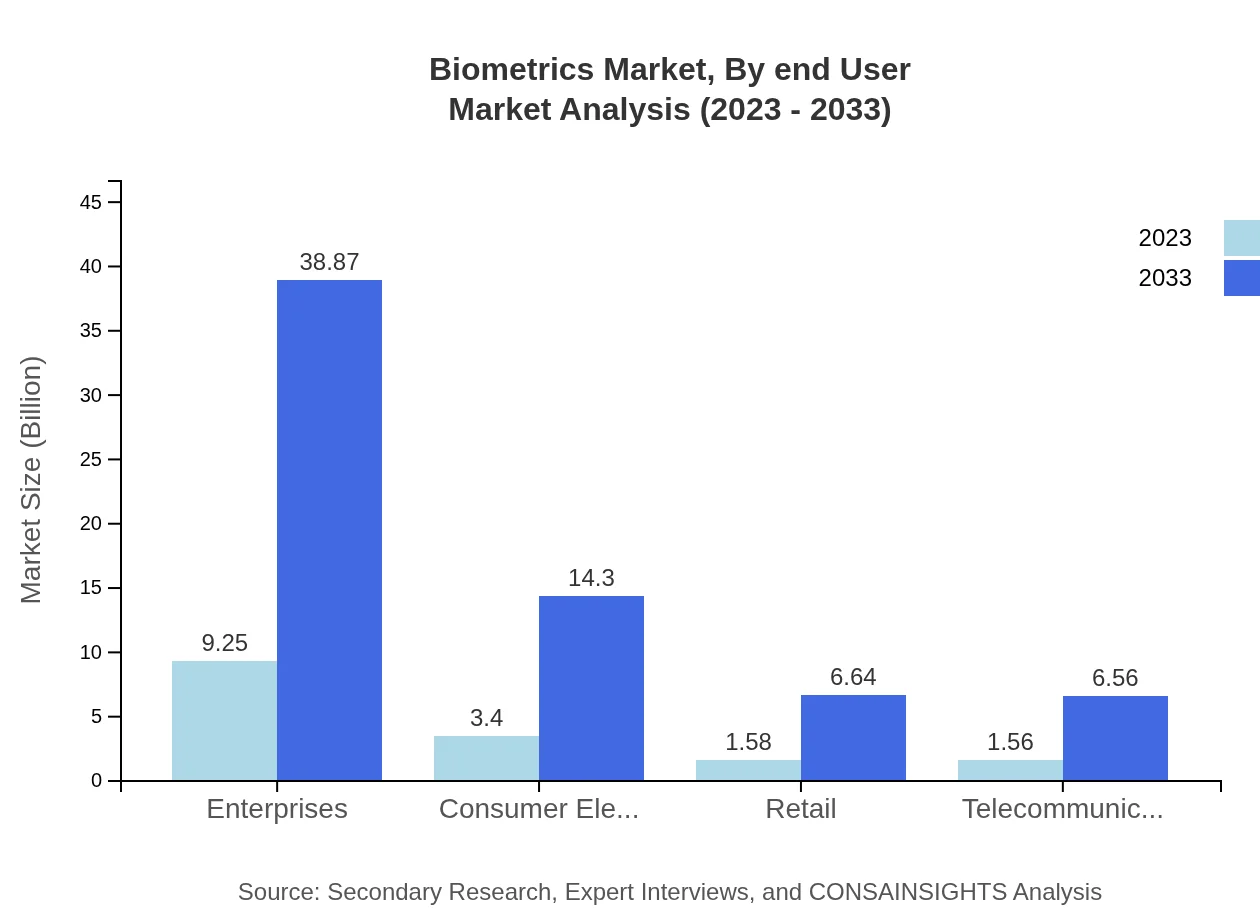

The enterprise segment leads the market accounting for USD 9.25 billion in 2023, predicted to grow to USD 38.87 billion by 2033. Government initiatives for secure verification processes also dominate with substantial growth expected in sectors like healthcare and banking as organizations increasingly adopt biometric systems to enhance security and streamline operations.

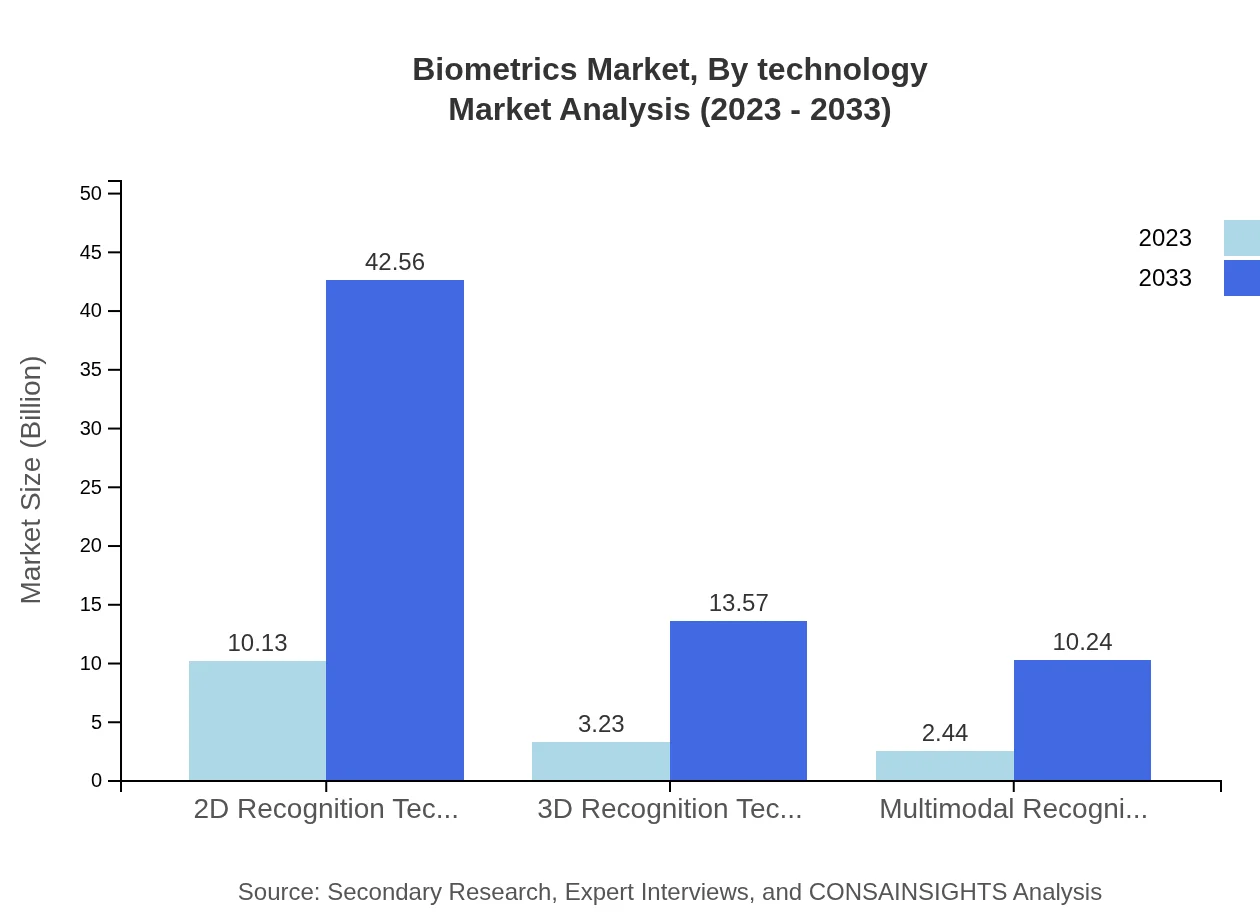

Biometrics Market Analysis By Technology

2D recognition technology leads with a market value of USD 10.13 billion in 2023, expected to expand to USD 42.56 billion. 3D recognition, gaining traction particularly in advanced security systems, is anticipated to grow from USD 3.23 billion to USD 13.57 billion. The rise of multimodal recognition technologies is also noteworthy, as more companies adopt them for layered security.

Biometrics Market Analysis By End User

In 2023, the largest share of the Biometrics market is driven by enterprises, constituting 58.57%. The consumer electronics sector follows with 21.55% market share, experiencing growth due to increased integration of biometric solutions within smartphones and IoT devices.

Biometrics Market Analysis By Region

The North American Biometrics market holds 44.3% share. Europe follows closely at 23.44%, while the Asia-Pacific region accounts for around 10.8% share. Each region showcases unique growth trends shaped by local regulations and security needs.

Biometrics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometrics Industry

IDEMIA:

IDEMIA specializes in augmented identity solutions, providing secure biometric technologies for government and commercial sectors globally.Neurotechnology:

Neurotechnology develops high-precision biometric solutions that address a variety of applications including security and identification systems.Thales Group:

Thales Group offers a broad range of biometrics technologies and solutions for secure access and identification across multiple industries.Gemalto:

A world leader in digital security, Gemalto integrates strong biometric technologies to enhance identity management and cybersecurity.Face++:

Face++ is a pioneering company in facial recognition technology, providing API services for a wide range of applications from security to smart devices.We're grateful to work with incredible clients.

FAQs

What is the market size of biometrics?

The biometrics market size is currently valued at approximately $15.8 billion and is expected to grow at a compound annual growth rate (CAGR) of 14.7% over the period from 2023 to 2033.

What are the key market players or companies in the biometrics industry?

Key players in the biometrics industry include major technology companies specializing in biometric solutions. These companies are continuously innovating to enhance security and authentication solutions across multiple sectors.

What are the primary factors driving the growth in the biometrics industry?

The growth in the biometrics industry is driven by increased security concerns, advancements in technology, and the growing adoption of biometrics across various sectors like healthcare, finance, and government for identification and security purposes.

Which region is the fastest Growing in the biometrics?

The fastest-growing region in the biometrics market is North America, projected to grow from $5.70 billion in 2023 to $23.96 billion by 2033, benefiting from high adoption rates of biometric systems.

Does ConsaInsights provide customized market report data for the biometrics industry?

Yes, ConsaInsights offers customized market report data for the biometrics industry, allowing clients to obtain tailored insights based on specific needs and requirements for strategic decision-making.

What deliverables can I expect from this biometrics market research project?

From the biometrics market research project, clients can expect comprehensive reports including market size analysis, growth forecasts, segmentation studies, regional insights, and competitive analysis tailored to their specific interests.

What are the market trends of biometrics?

Current market trends in biometrics include the rise of multimodal recognition technologies, the integration of biometric systems in consumer electronics and security solutions, and increased regulatory support for biometric implementations across various industries.