Blood And Fluid Warming Devices Market Report

Published Date: 31 January 2026 | Report Code: blood-and-fluid-warming-devices

Blood And Fluid Warming Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Blood and Fluid Warming Devices market, covering current trends, technological advancements, and growth forecasts from 2023 to 2033, alongside regional insights and key players shaping the industry.

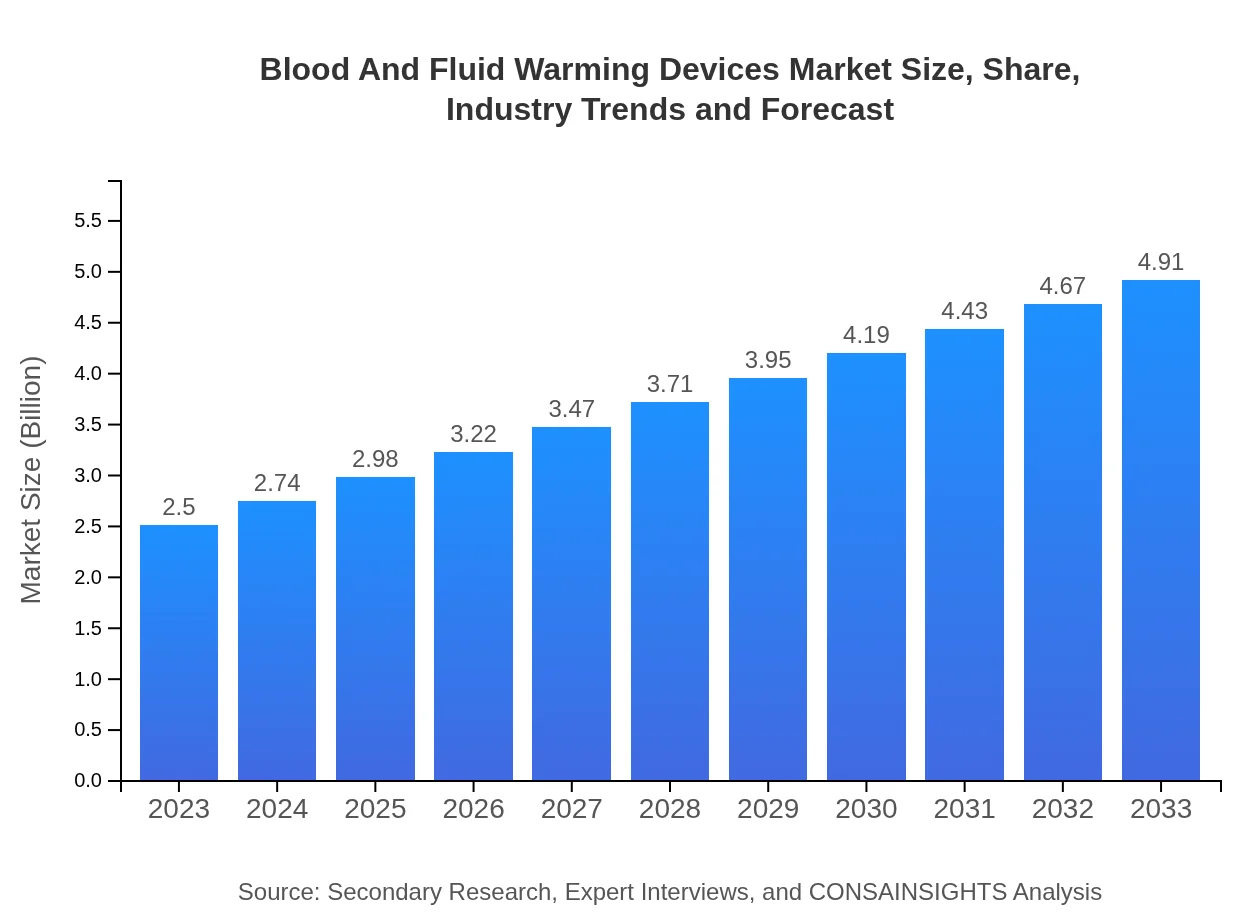

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Smiths Medical, ThermoLife, Bard Medical, Zoll Medical Corporation, Vyaire Medical |

| Last Modified Date | 31 January 2026 |

Blood And Fluid Warming Devices Market Overview

Customize Blood And Fluid Warming Devices Market Report market research report

- ✔ Get in-depth analysis of Blood And Fluid Warming Devices market size, growth, and forecasts.

- ✔ Understand Blood And Fluid Warming Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blood And Fluid Warming Devices

What is the Market Size & CAGR of Blood And Fluid Warming Devices market in 2023?

Blood And Fluid Warming Devices Industry Analysis

Blood And Fluid Warming Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blood And Fluid Warming Devices Market Analysis Report by Region

Europe Blood And Fluid Warming Devices Market Report:

Europe's market is expected to grow from $0.65 billion in 2023 to approximately $1.27 billion by 2033. Increasing surgical procedures and a growing emphasis on patient safety standards are pivotal in driving the growth of blood and fluid warming technologies in this region.Asia Pacific Blood And Fluid Warming Devices Market Report:

In 2023, the Asia Pacific market is valued at approximately $0.48 billion, projected to grow to $0.94 billion by 2033, owing to an increase in healthcare expenditure and infrastructure improvements in emerging economies. Rising awareness about the importance of thermal management in healthcare facilities enhances growth prospects in this region.North America Blood And Fluid Warming Devices Market Report:

In North America, the market size is approximately $0.91 billion in 2023 with significant growth to $1.79 billion anticipated by 2033. The region's advanced healthcare infrastructure, coupled with high surgical volumes and technological adoption, contributes to this substantial market expansion.South America Blood And Fluid Warming Devices Market Report:

The South American market starts at about $0.19 billion in 2023, expected to advance to $0.37 billion by 2033. Rising patient volumes and increasing investments in healthcare facilities are driving the demand for blood and fluid warming devices.Middle East & Africa Blood And Fluid Warming Devices Market Report:

The Middle East and Africa market is valued at around $0.27 billion in 2023 and projected to expand to $0.53 billion by 2033, where improving healthcare systems and rising awareness of thermal regulation in patient care enhance market growth strategies.Tell us your focus area and get a customized research report.

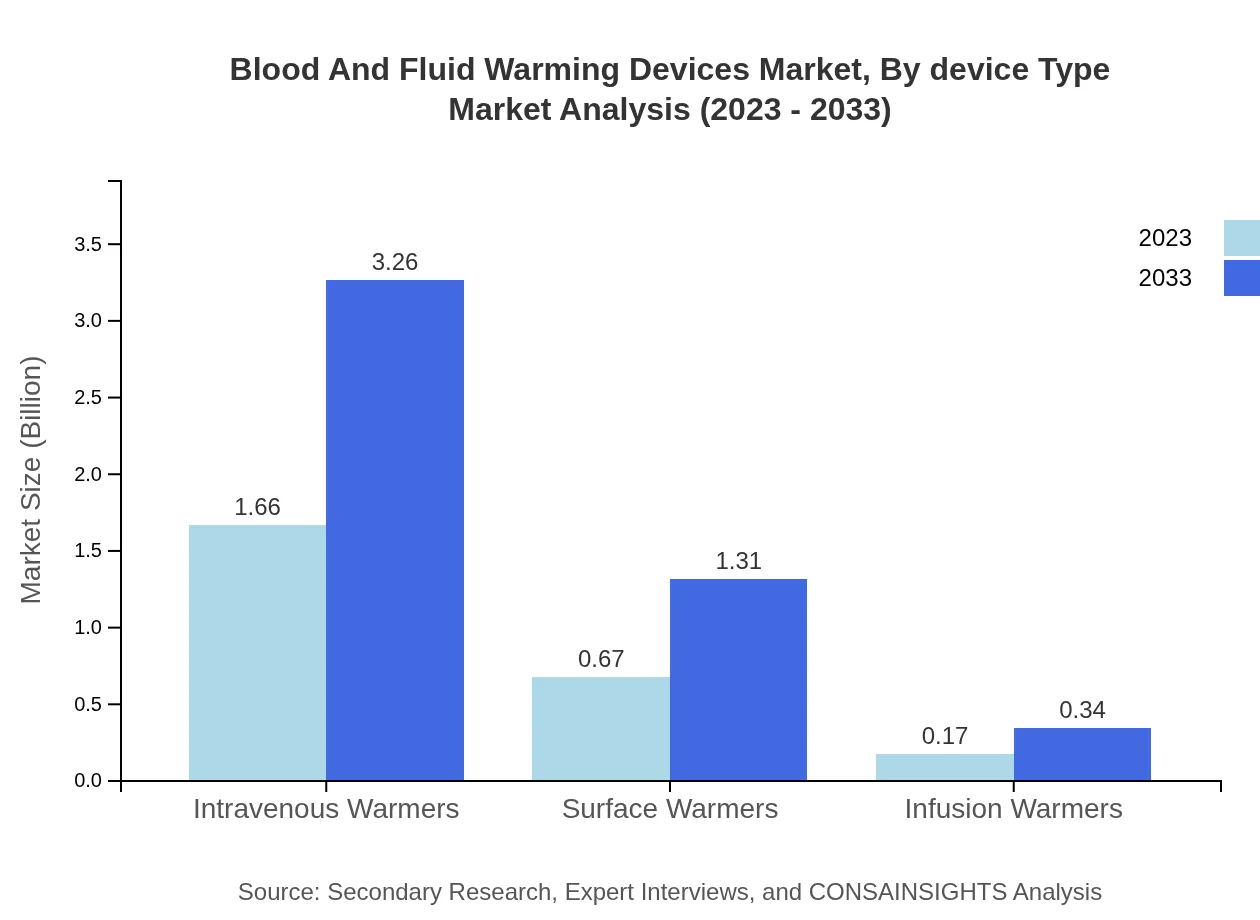

Blood And Fluid Warming Devices Market Analysis By Device Type

The market segmentation by device type illustrates a significant market share attributed to intravenous warmers, contributing $1.66 billion in 2023, expected to rise to $3.26 billion by 2033. Surface warmers hold a considerable share, with a projected increase from $0.67 billion to $1.31 billion during the same period. Infusion warmers, constituting a smaller segment, are also witnessing growth from $0.17 billion to $0.34 billion, highlighting the varied functionalities these devices serve.

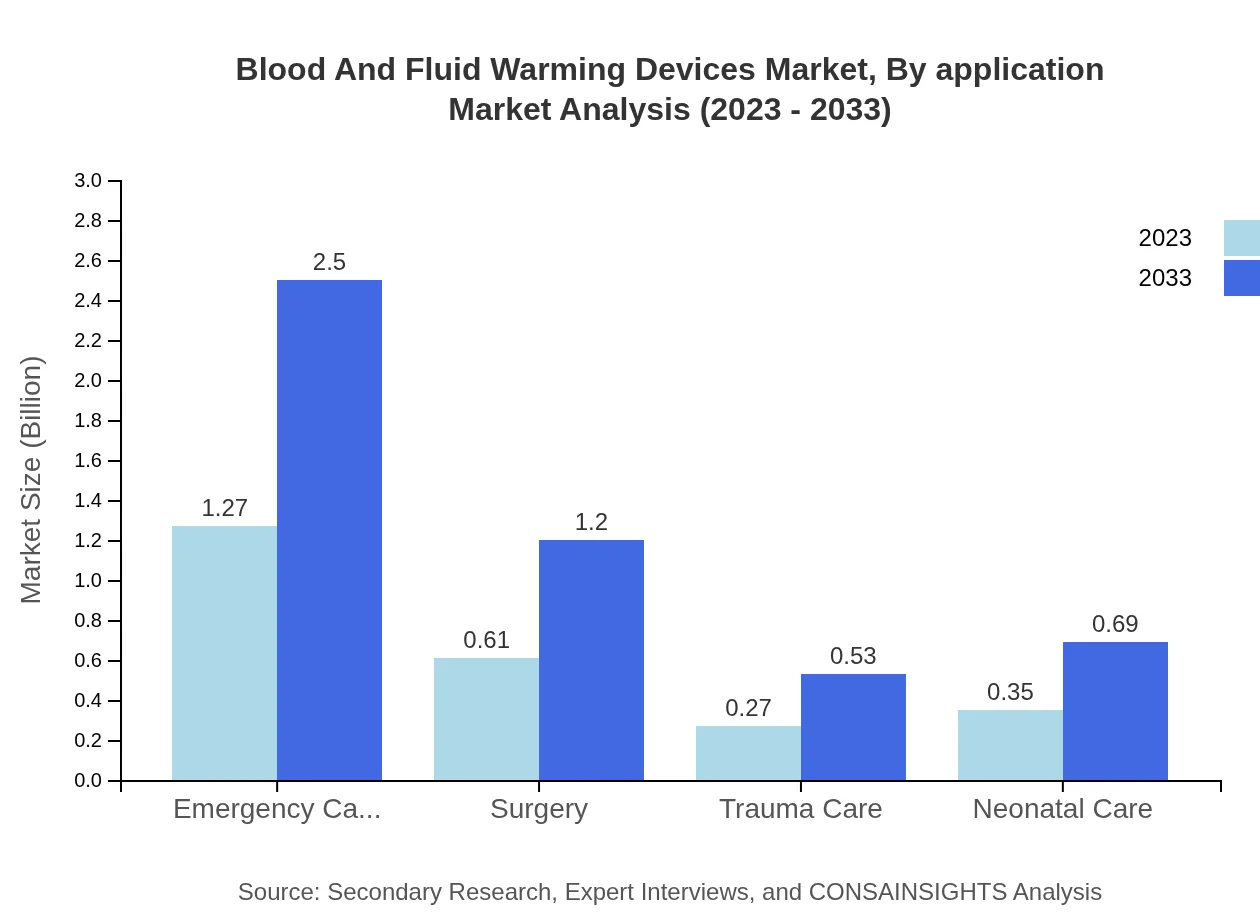

Blood And Fluid Warming Devices Market Analysis By Application

In the application segment, emergency care constitutes the largest share, starting at $1.27 billion in 2023, projected to reach $2.50 billion by 2033. Operating room implementations are also significant, driven by the increasing number of surgeries. This segment reflects the critical importance of maintaining normothermia for surgical success. Trauma care applications present notable growth potential with increasing incidents, estimated to rise from $0.27 billion to $0.53 billion over the forecast period.

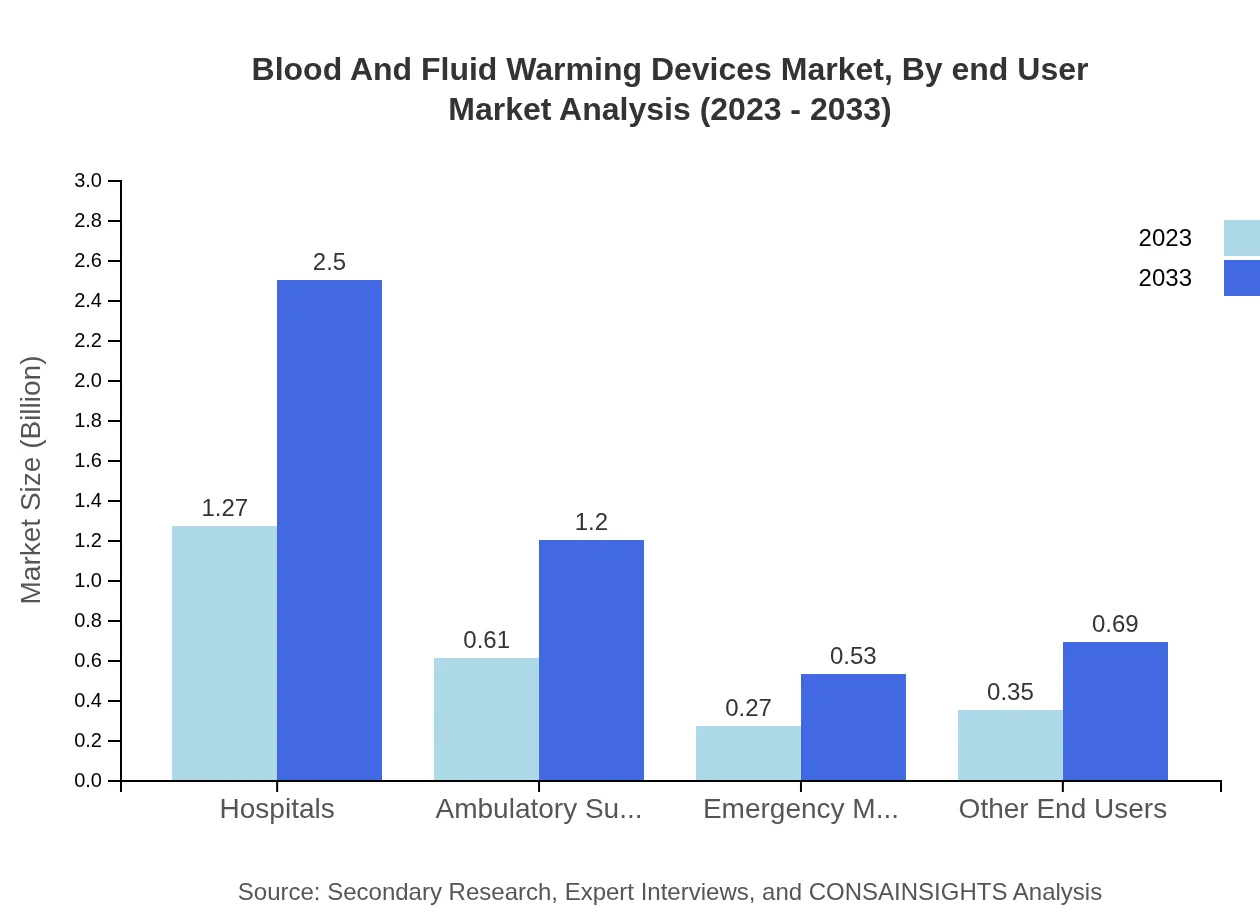

Blood And Fluid Warming Devices Market Analysis By End User

Hospitals dominate the market as end-users, valued at $1.27 billion in 2023, expected to expand to $2.50 billion by 2033, exhibiting a steady 50.93% market share throughout this period. Ambulatory surgical centers also show strong growth from $0.61 billion to $1.20 billion as outpatient procedures increase, demonstrating shifts in healthcare delivery methods towards more efficient and convenient settings.

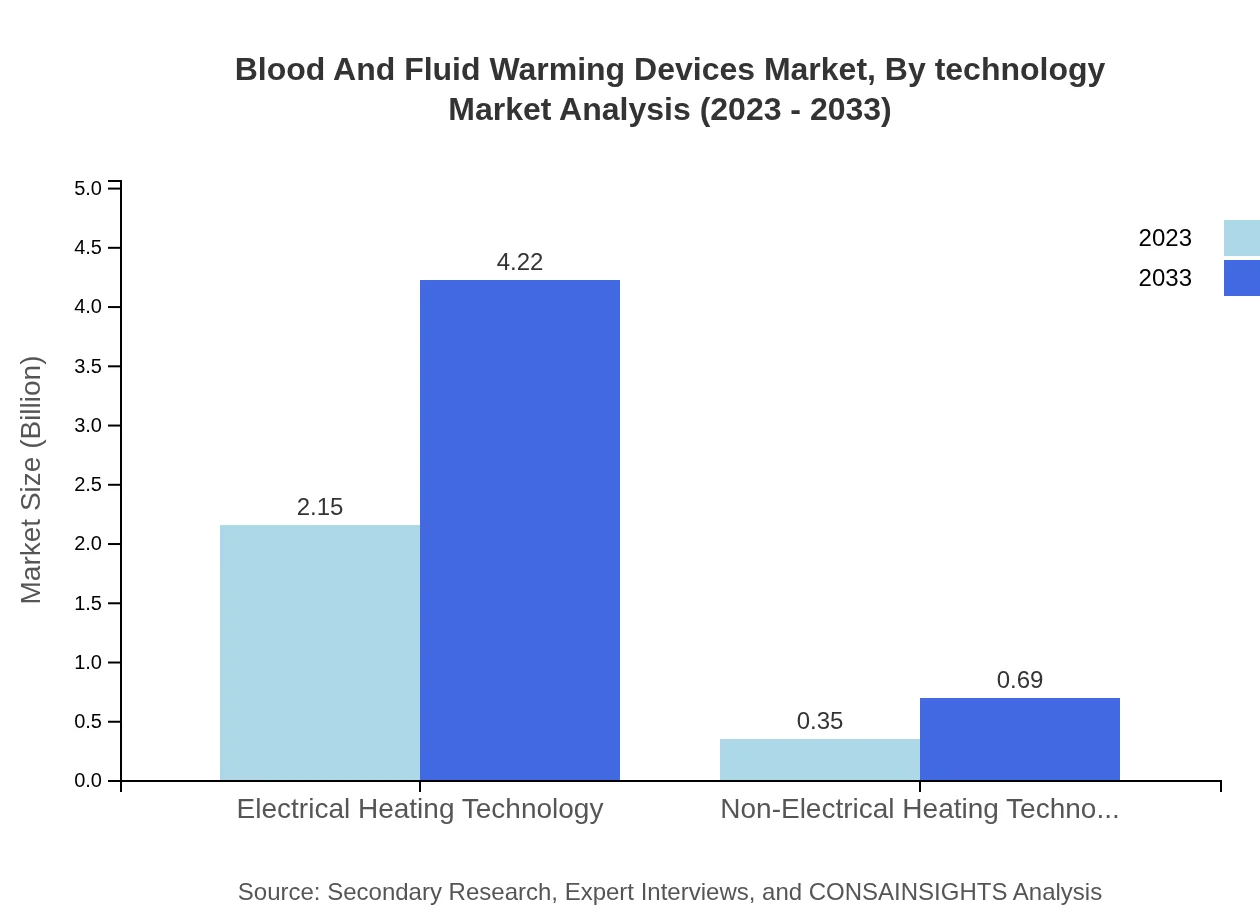

Blood And Fluid Warming Devices Market Analysis By Technology

The technology segment shows electrical heating technology as the leading method utilized in warming devices, contributing $2.15 billion in 2023, anticipated to rise to $4.22 billion by 2033, signifying a robust focus on high-efficiency solutions. Non-electrical heating technology exists within the market but remains a smaller percentage, indicating a niche requirement for certain medical applications while emphasizing the transition toward more energy-efficient systems.

Blood And Fluid Warming Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blood And Fluid Warming Devices Industry

Smiths Medical:

A global leader in medical device manufacturing specializing in infusion systems and warming devices, dedicated to enhancing patient care through innovation.ThermoLife:

Specializing in advanced blood and fluid warming technologies, ThermoLife focuses on providing reliable solutions to healthcare sectors where patient safety is critical.Bard Medical:

Renowned for quality medical products, Bard Medical also emphasizes fluid warming solutions aimed at improving surgical outcomes and emergency care.Zoll Medical Corporation:

Pioneering technologies in emergency medical services, Zoll Medical manufactures innovative warming systems designed for rapid deployment in critical situations.Vyaire Medical:

Vyaire Medical's product suite includes a range of warming devices tailored for neonatal and adult patients, focusing on maintaining optimal temperatures in various healthcare settings.We're grateful to work with incredible clients.

FAQs

What is the market size of blood And Fluid Warming Devices?

The blood and fluid warming devices market is projected to reach a size of $2.5 billion by 2033, growing at a CAGR of 6.8% from 2023 to 2033. This growth underscores the increasing demand for efficient warming solutions in medical settings.

What are the key market players or companies in this blood And Fluid Warming Devices industry?

Key players in the blood and fluid warming devices market include major medical device manufacturers specializing in patient care and warming technologies. These companies continually innovate to enhance product performance, ensuring safe and effective warming solutions.

What are the primary factors driving the growth in the blood And Fluid Warming Devices industry?

Growth in the blood and fluid warming devices market is driven by rising surgical procedures, increased awareness of patient safety, and technological advancements in warming technologies that enhance operational efficiency and effectiveness in hypothermia prevention.

Which region is the fastest Growing in the blood And Fluid Warming Devices?

The North American region is expected to be the fastest-growing market for blood and fluid warming devices. The market in North America is projected to grow from $0.91 billion in 2023 to $1.79 billion by 2033, reflecting robust healthcare infrastructure and demand.

Does ConsaInsights provide customized market report data for the blood And Fluid Warming Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the blood and fluid warming devices industry. This includes detailed analysis and insights that meet unique client requirements.

What deliverables can I expect from this blood And Fluid Warming Devices market research project?

Expect comprehensive reports including market size forecasts, segmentation analysis, competitive landscape, regional insights, and trends in the blood and fluid warming devices market, providing valuable information for strategic decisions.

What are the market trends of blood And Fluid Warming Devices?

Current trends in the blood and fluid warming devices market include the growing adoption of advanced technology, increasing focus on patient safety, and the expansion of applications in emergency care and surgical procedures, contributing to overall market growth.