Bullet Train High Speed Rail Market Report

Published Date: 31 January 2026 | Report Code: bullet-train-high-speed-rail

Bullet Train High Speed Rail Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Bullet Train High Speed Rail market, including insights into market size, growth trends, technology advancements, and regional analysis from 2023 to 2033.

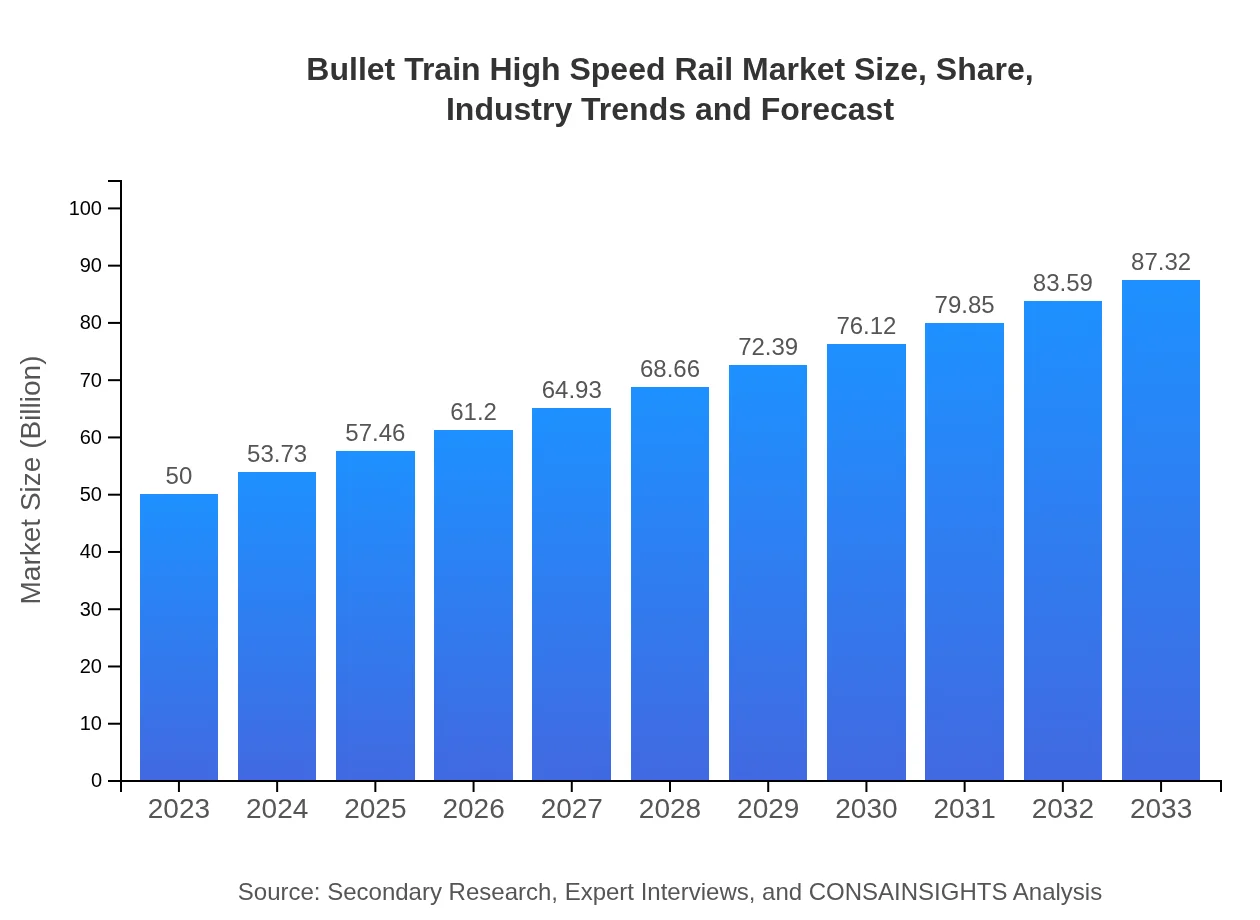

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $87.32 Billion |

| Top Companies | Siemens AG, Alstom SA, CRRC Corporation Limited, Bombardier Inc. |

| Last Modified Date | 31 January 2026 |

Bullet Train High Speed Rail Market Overview

Customize Bullet Train High Speed Rail Market Report market research report

- ✔ Get in-depth analysis of Bullet Train High Speed Rail market size, growth, and forecasts.

- ✔ Understand Bullet Train High Speed Rail's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bullet Train High Speed Rail

What is the Market Size & CAGR of Bullet Train High Speed Rail market in 2023?

Bullet Train High Speed Rail Industry Analysis

Bullet Train High Speed Rail Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bullet Train High Speed Rail Market Analysis Report by Region

Europe Bullet Train High Speed Rail Market Report:

The European market for Bullet Train High Speed Rail is estimated at $16.12 billion in 2023 and expected to grow to $28.15 billion by 2033. Extensive rail networks across countries like France, Spain, and Germany signify strong market growth driven by efficient transit systems.Asia Pacific Bullet Train High Speed Rail Market Report:

The Asia Pacific region is the largest market for high-speed rail, with a market size of $9.55 billion in 2023, expected to grow to $16.68 billion by 2033. Countries like Japan and China are leading the way in high-speed rail technology, significantly investing in expanding their networks to enhance connectivity.North America Bullet Train High Speed Rail Market Report:

North America, with a market size projected at $16.80 billion in 2023 and reaching $29.35 billion by 2033, is gradually adopting high-speed rail due to escalating passenger needs and infrastructure enhancements. Potential projects in California and Texas indicate a rising trend towards this mode of transportation.South America Bullet Train High Speed Rail Market Report:

In South America, the Bullet Train High Speed Rail market shows potential growth, moving from $3.81 billion in 2023 to $6.64 billion by 2033. Countries like Brazil and Argentina are exploring high-speed rail projects to reduce travel times between major cities.Middle East & Africa Bullet Train High Speed Rail Market Report:

The Middle East and Africa market is set to expand from $3.72 billion in 2023 to $6.50 billion by 2033. Initiatives such as the high-speed rail link in Saudi Arabia and Egypt's investments in rail infrastructure are indicative of a nascent but growing market.Tell us your focus area and get a customized research report.

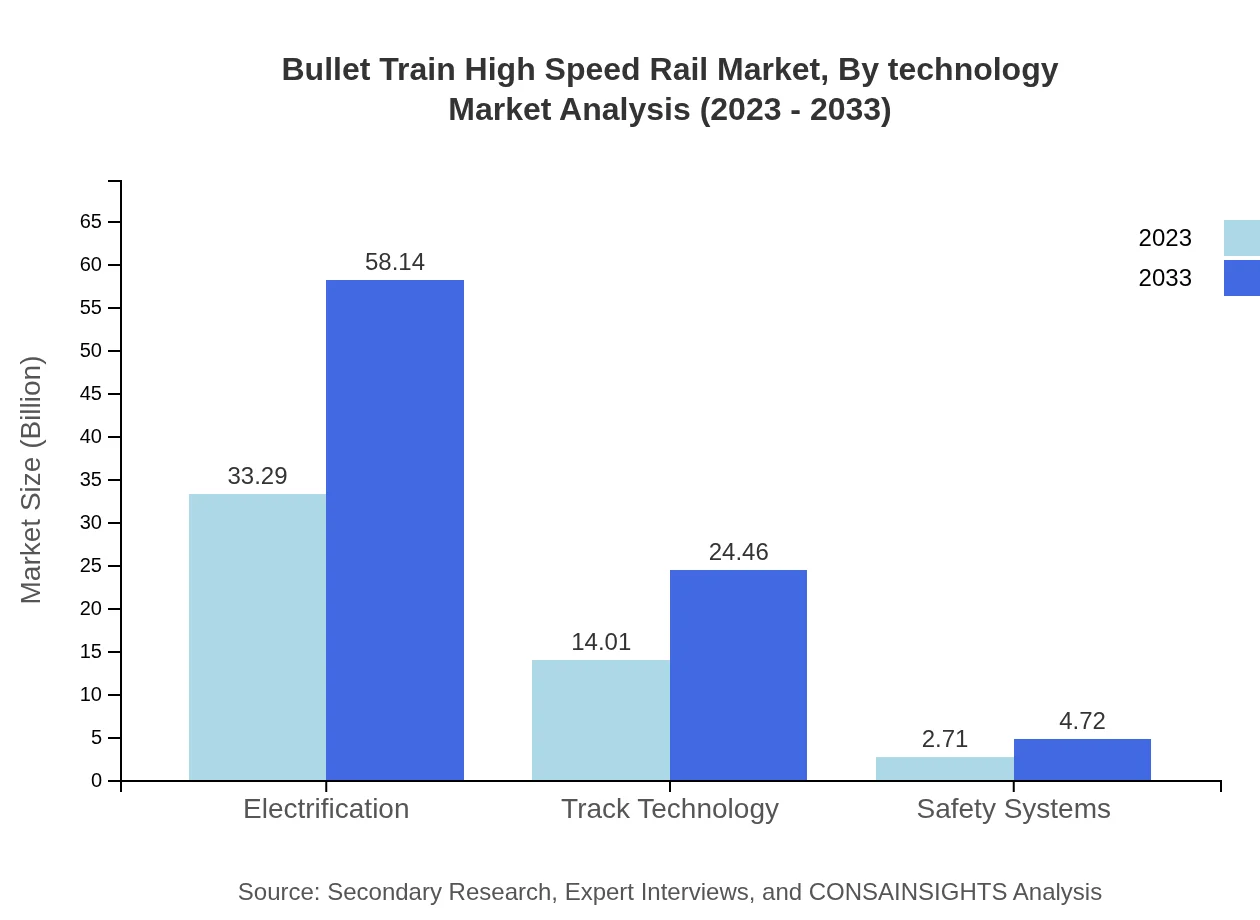

Bullet Train High Speed Rail Market Analysis By Technology

Electrification is a significant segment, projected to grow initially from $33.29 billion in 2023 to $58.14 billion by 2033, maintaining a market share of 66.58%. Track technology, which encompasses the tracks and signaling systems, is also crucial, with an increase from $14.01 billion to $24.46 billion during the same period.

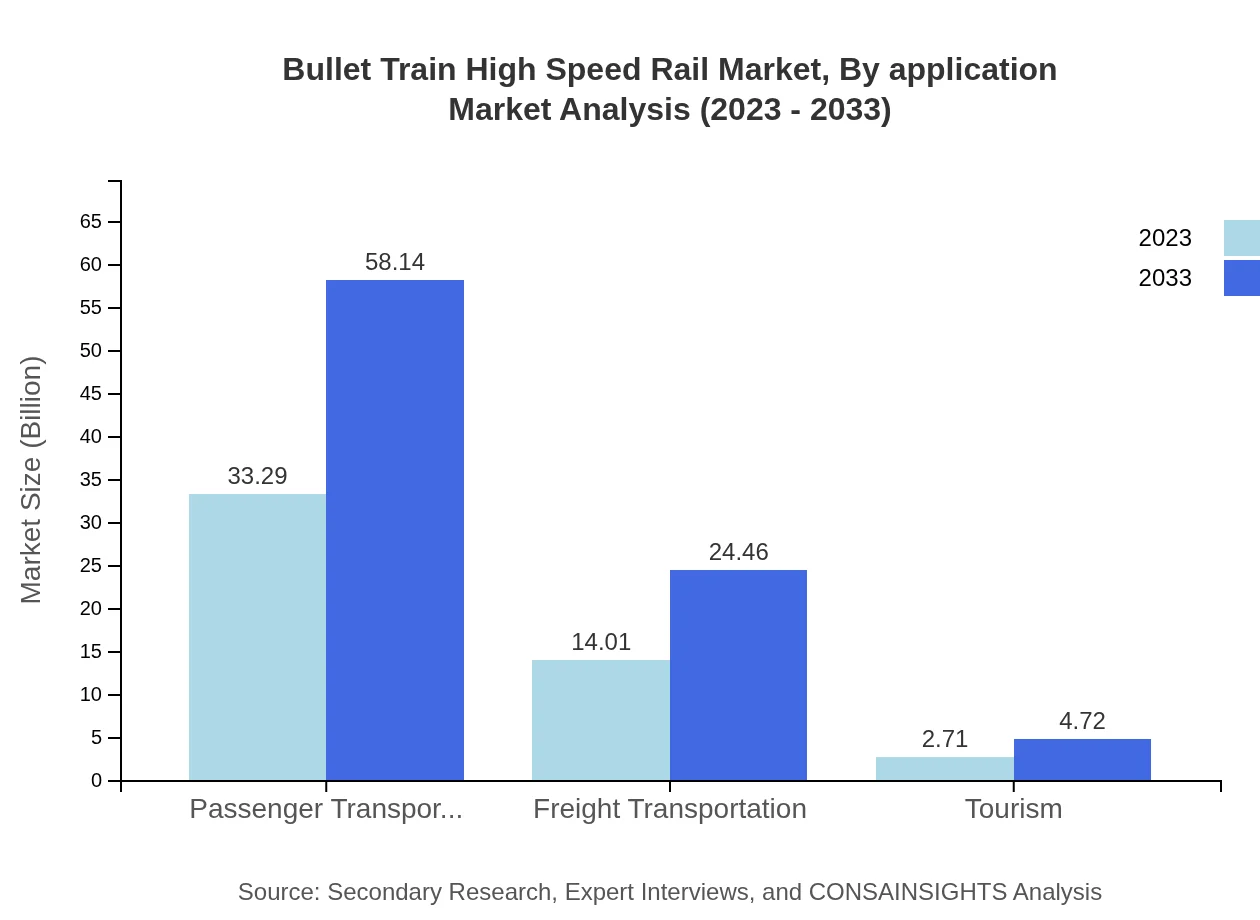

Bullet Train High Speed Rail Market Analysis By Application

Passenger transportation stands out as the leading application segment, expected to grow from $33.29 billion to $58.14 billion by 2033. Freight transportation and tourism applications are also on the rise but currently hold smaller market shares.

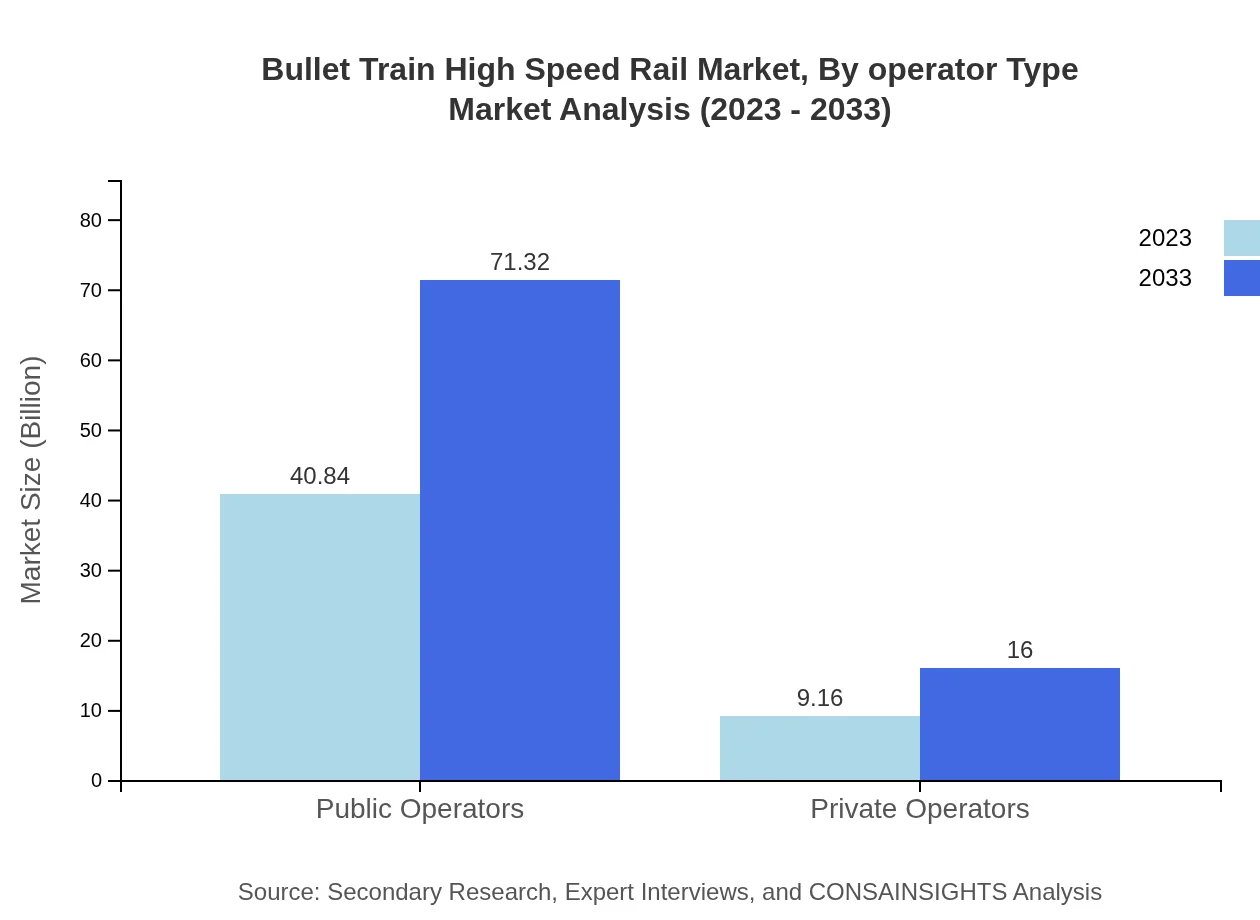

Bullet Train High Speed Rail Market Analysis By Operator Type

Public operators dominate this market segment, expected to expand from $40.84 billion in 2023 to $71.32 billion by 2033. Private operators, while smaller, are growing, projected to increase from $9.16 billion to $16.00 billion in the same period.

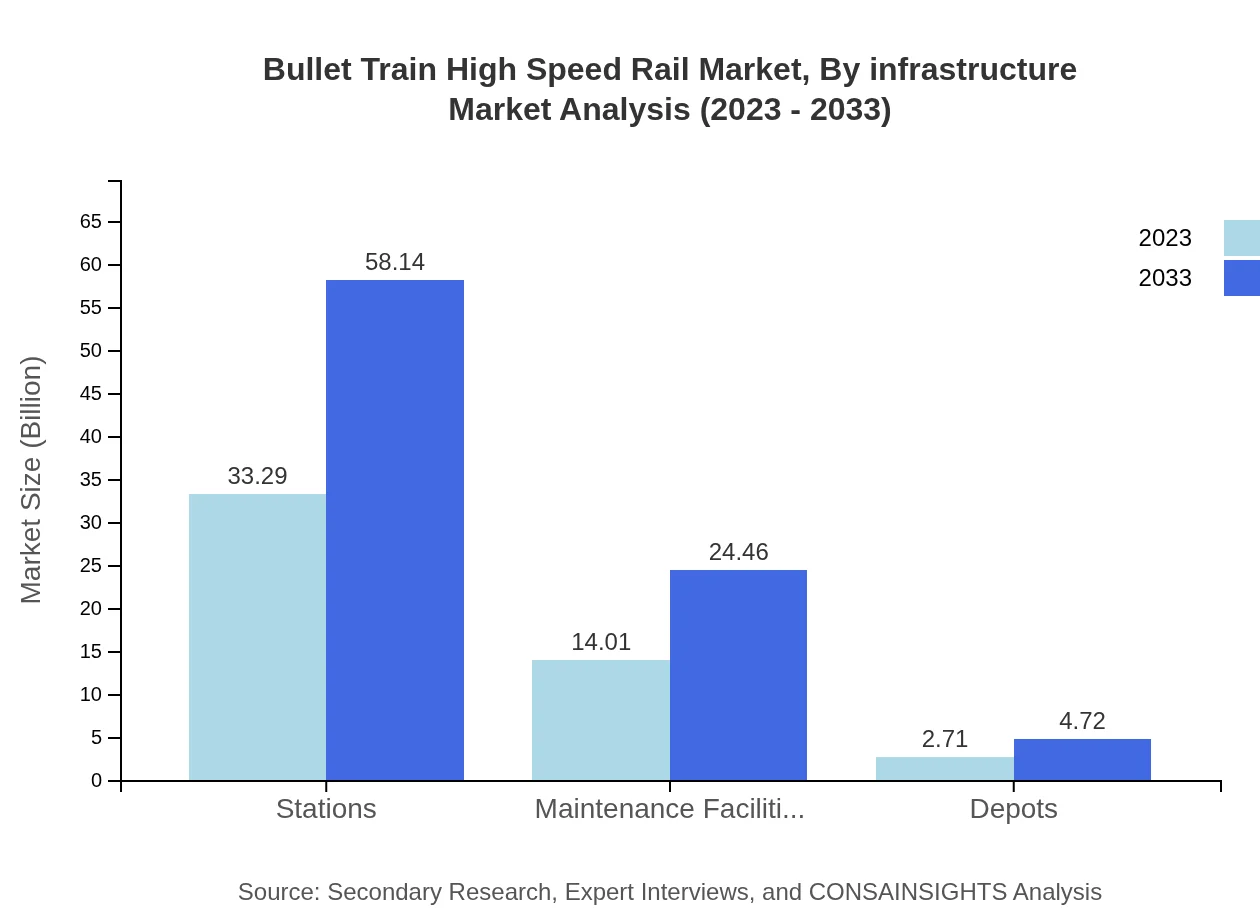

Bullet Train High Speed Rail Market Analysis By Infrastructure

Key infrastructures such as stations are projected to grow from $33.29 billion to $58.14 billion, while maintenance facilities are expected to increase from $14.01 billion to $24.46 billion, highlighting the essential nature of these assets in rail operation.

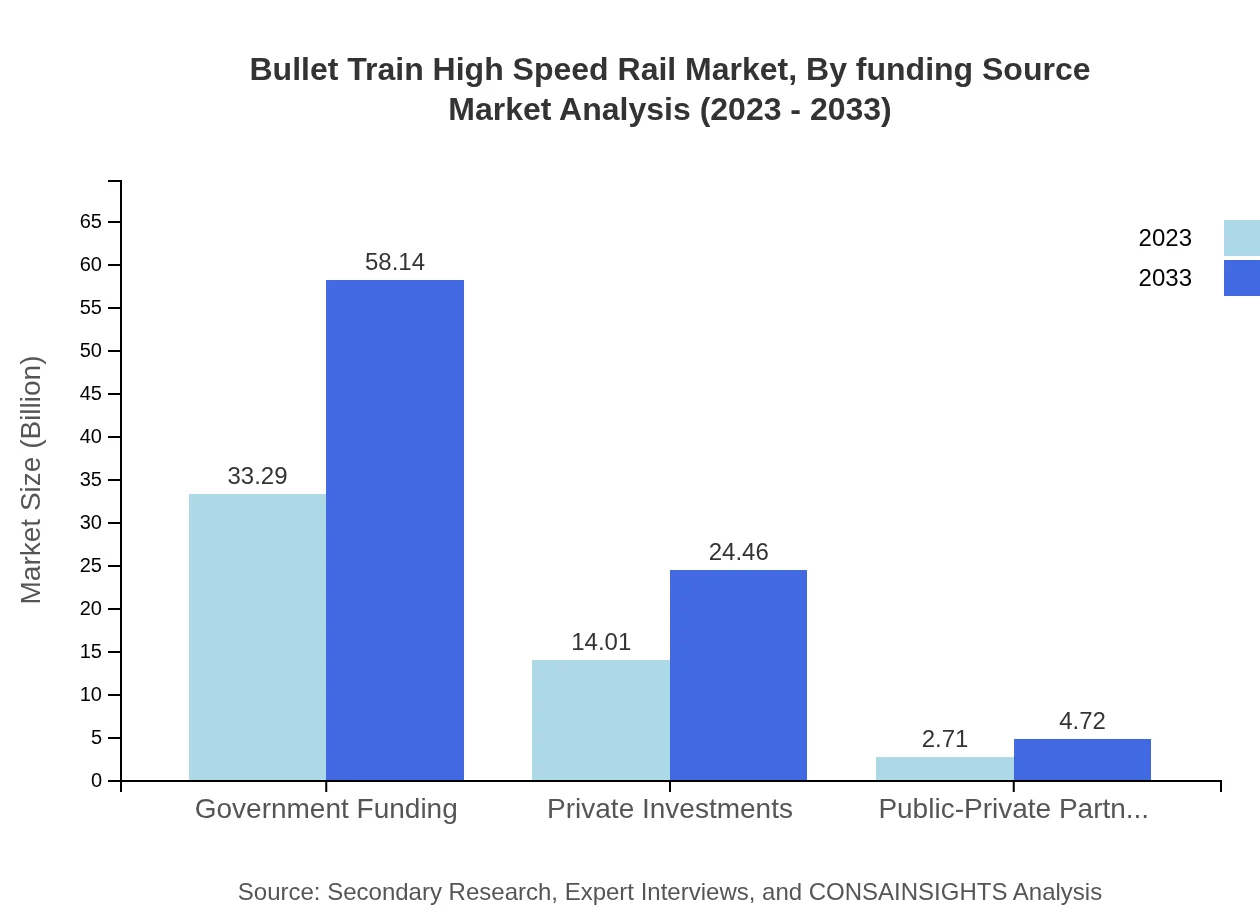

Bullet Train High Speed Rail Market Analysis By Funding Source

Different funding sources are crucial for project execution, with government funding expected to remain the largest segment growing from $33.29 billion to $58.14 billion, alongside increasing private investment growing from $14.01 billion to $24.46 billion.

Bullet Train High Speed Rail Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bullet Train High Speed Rail Industry

Siemens AG:

A leader in rail technology, Siemens AG provides advanced train control systems and high-speed trains, contributing significantly to the global high-speed rail infrastructure.Alstom SA:

A French multinational company specializing in rail transport, Alstom SA manufactures high-speed trains and offers cutting-edge signaling technology.CRRC Corporation Limited:

The world's largest manufacturer of rolling stock, CRRC Corporation is instrumental in high-speed rail projects primarily in China and overseas.Bombardier Inc.:

A prominent player in the aerospace and rail transport industry, Bombardier Inc. develops both trains and rolling stock technologies that enhance high-speed rail systems globally.We're grateful to work with incredible clients.

FAQs

What is the market size of bullet Train High Speed Rail?

The bullet train high-speed rail market is valued at approximately $50 billion in 2023, with an anticipated CAGR of 5.6% through 2033. This growth highlights the increasing demand for efficient transportation systems globally.

What are the key market players or companies in this bullet Train High Speed Rail industry?

Key players in the bullet train high-speed rail industry include major firms such as CRRC Corporation, Alstom, Siemens, Hitachi, and Bombardier. These companies are instrumental in developing advanced rail technology and infrastructure.

What are the primary factors driving the growth in the bullet Train High Speed Rail industry?

Growth in this industry is driven by urbanization, government investments in infrastructure, increased demand for faster travel options, and environmental concerns leading to a shift towards sustainable transport solutions.

Which region is the fastest Growing in the bullet Train High Speed Rail?

The Asia Pacific region is the fastest-growing market, with estimates showing a rise from $9.55 billion in 2023 to around $16.68 billion by 2033. This growth is led by countries like China and Japan.

Does ConsaInsights provide customized market report data for the bullet Train High Speed Rail industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements in the bullet train high-speed rail industry, ensuring clients receive relevant, actionable insights.

What deliverables can I expect from this bullet Train High Speed Rail market research project?

Expect comprehensive deliverables, including market analysis reports, segmentation data, trend identification, regional insights, and strategic recommendations tailored to bullet train high-speed rail advancements.

What are the market trends of bullet Train High Speed Rail?

Current market trends include increased electrification of rail systems, innovations in safety technology, investments in public-private partnerships, and a focus on sustainable and efficient rail solutions.