Cath Lab Services Market Report

Published Date: 31 January 2026 | Report Code: cath-lab-services

Cath Lab Services Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the Cath Lab Services industry, focusing on market trends, size, and growth forecasts from 2023 to 2033. Insights include regional analysis, key players, technology impacts, and market segmentation, crucial for stakeholders to make informed decisions.

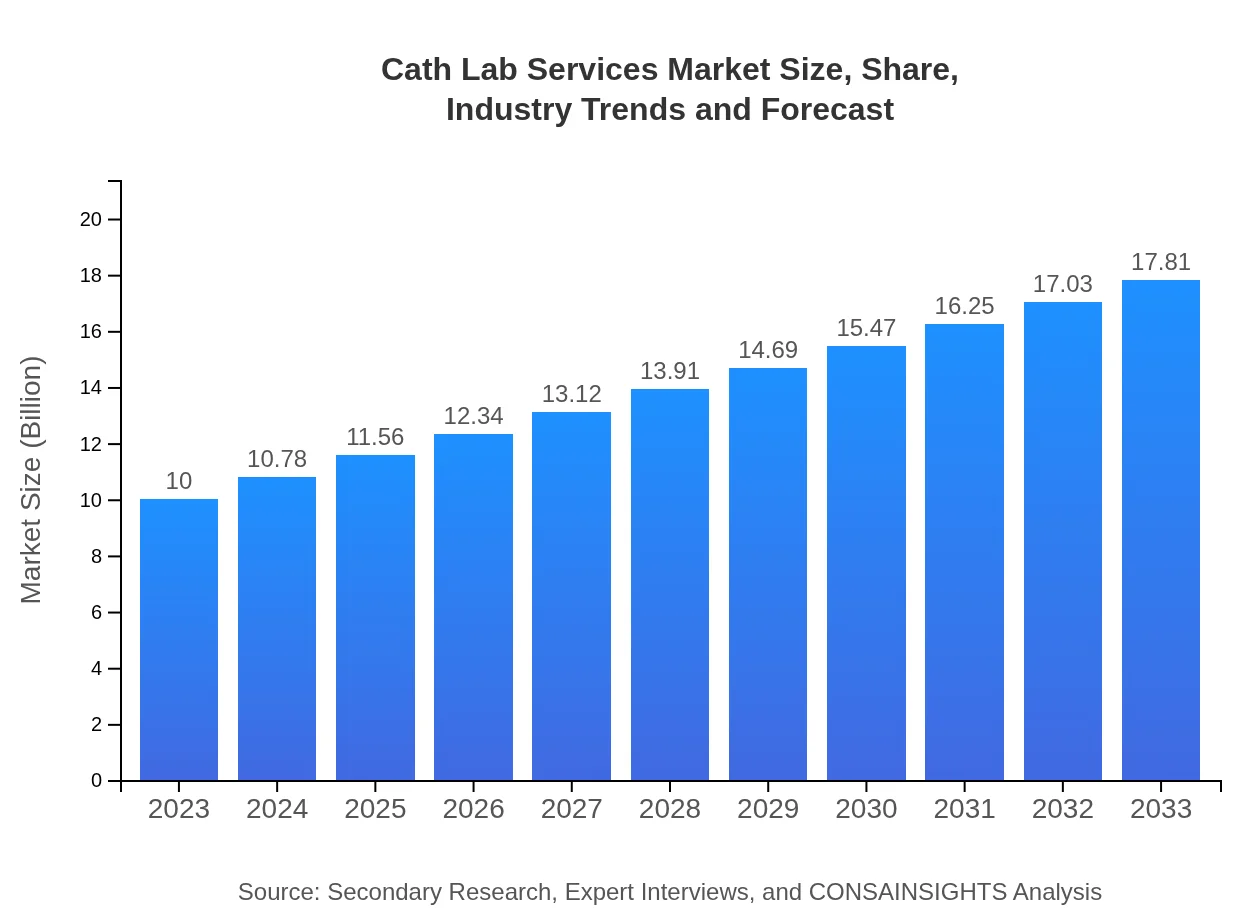

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $17.81 Billion |

| Top Companies | Abbott Laboratories, Siemens Healthineers, GE Healthcare, Philips Healthcare |

| Last Modified Date | 31 January 2026 |

Cath Lab Services Market Overview

Customize Cath Lab Services Market Report market research report

- ✔ Get in-depth analysis of Cath Lab Services market size, growth, and forecasts.

- ✔ Understand Cath Lab Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cath Lab Services

What is the Market Size & CAGR of Cath Lab Services market in 2023?

Cath Lab Services Industry Analysis

Cath Lab Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cath Lab Services Market Analysis Report by Region

Europe Cath Lab Services Market Report:

Europe's Cath Lab Services market, valued at $2.68 billion in 2023, projects to reach $4.78 billion by 2033. The market is driven by aging populations, increasing healthcare investments, and advancements in diagnostic imaging technologies across Western Europe.Asia Pacific Cath Lab Services Market Report:

In the Asia Pacific region, the Cath Lab Services market is anticipated to grow from $2.14 billion in 2023 to $3.81 billion by 2033, driven by the increasing prevalence of cardiovascular diseases and expanding healthcare infrastructure. Countries such as China and India are significantly investing in cardiac care facilities, enhancing accessibility.North America Cath Lab Services Market Report:

North America holds a prominent position in the Cath Lab Services market, with a size of $3.63 billion in 2023 expected to reach $6.47 billion by 2033. The U.S. market benefits from advanced healthcare systems, high demand for minimally invasive procedures, and significant research funding.South America Cath Lab Services Market Report:

The South America market is projected to grow from $0.74 billion in 2023 to $1.32 billion by 2033. Brazil accounts for the largest share, supported by increasing healthcare spending and adoption of novel treatment technologies, although economic volatility can pose threats to sustained growth.Middle East & Africa Cath Lab Services Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.81 billion in 2023 to $1.43 billion by 2033. Growth is stimulated by increasing investments in healthcare infrastructure and improving quality of care, particularly in Gulf Cooperation Council (GCC) countries.Tell us your focus area and get a customized research report.

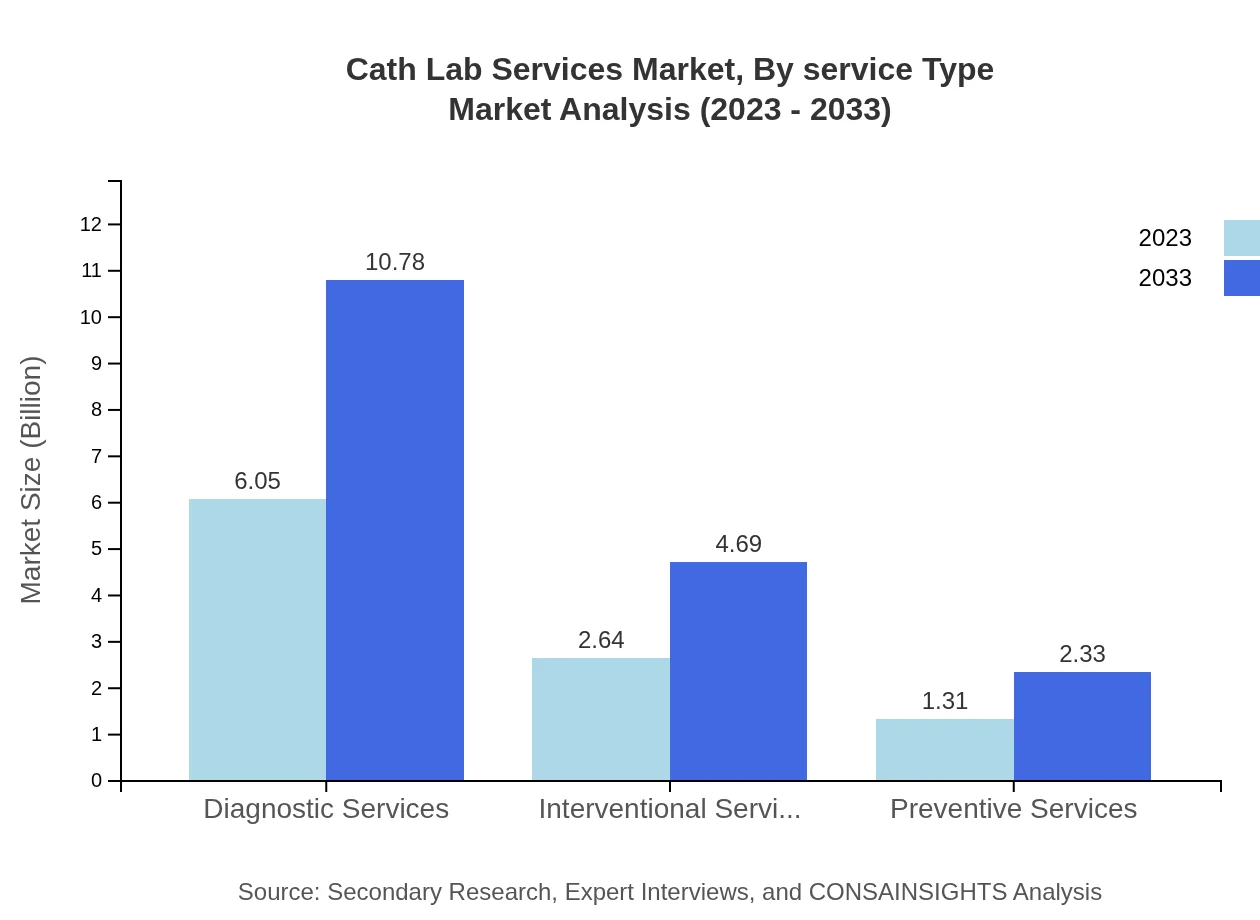

Cath Lab Services Market Analysis By Service Type

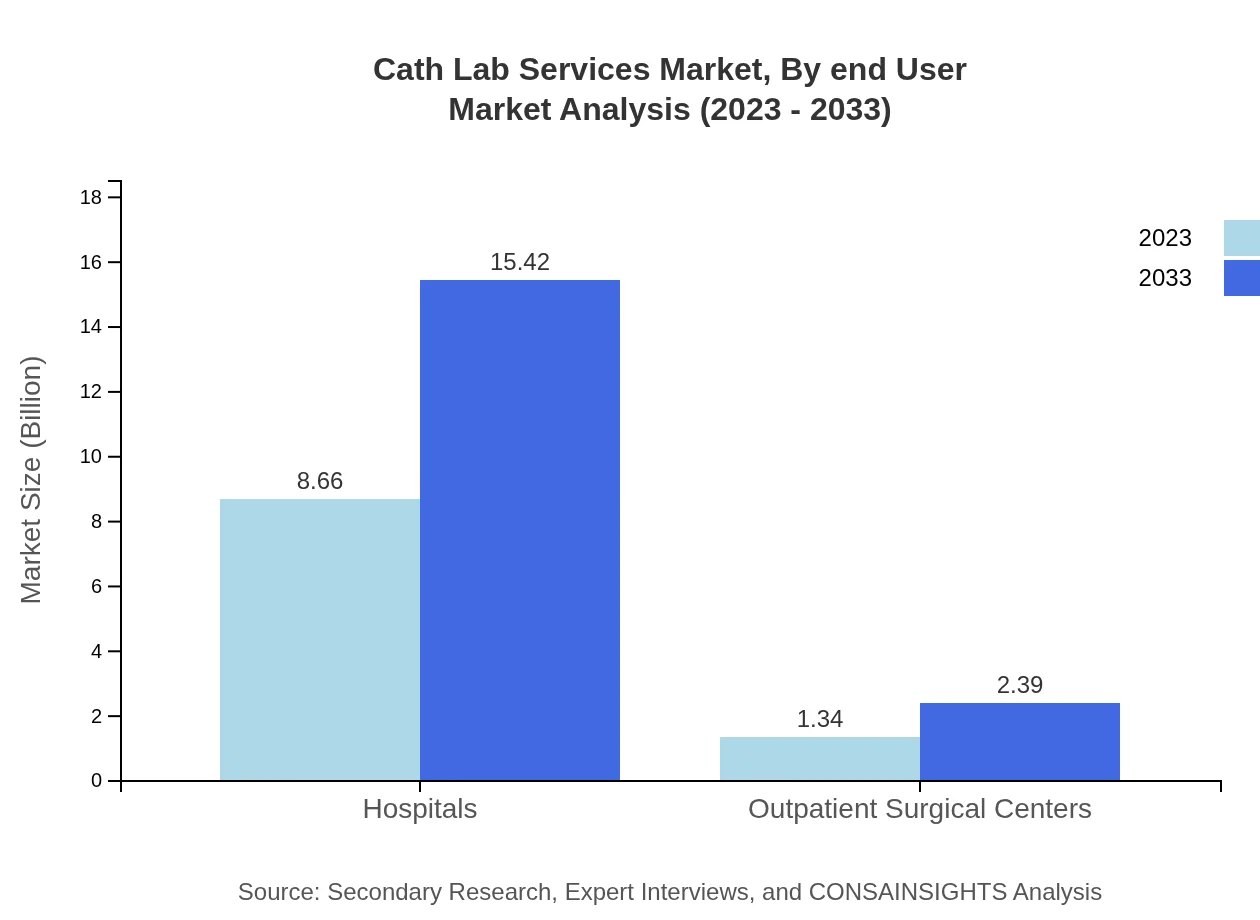

The market segment by service type includes Hospitals and Outpatient Surgical Centers. Hospitals represent the majority share, constituting 86.59% of the market in 2023 and expected to maintain this share by 2033. In terms of size, Hospitals accounted for approximately $8.66 billion in 2023, with growth expected to reach $15.42 billion. Outpatient Surgical Centers, while smaller, are gaining prominence due to patient preference for cost-effective, less invasive procedures.

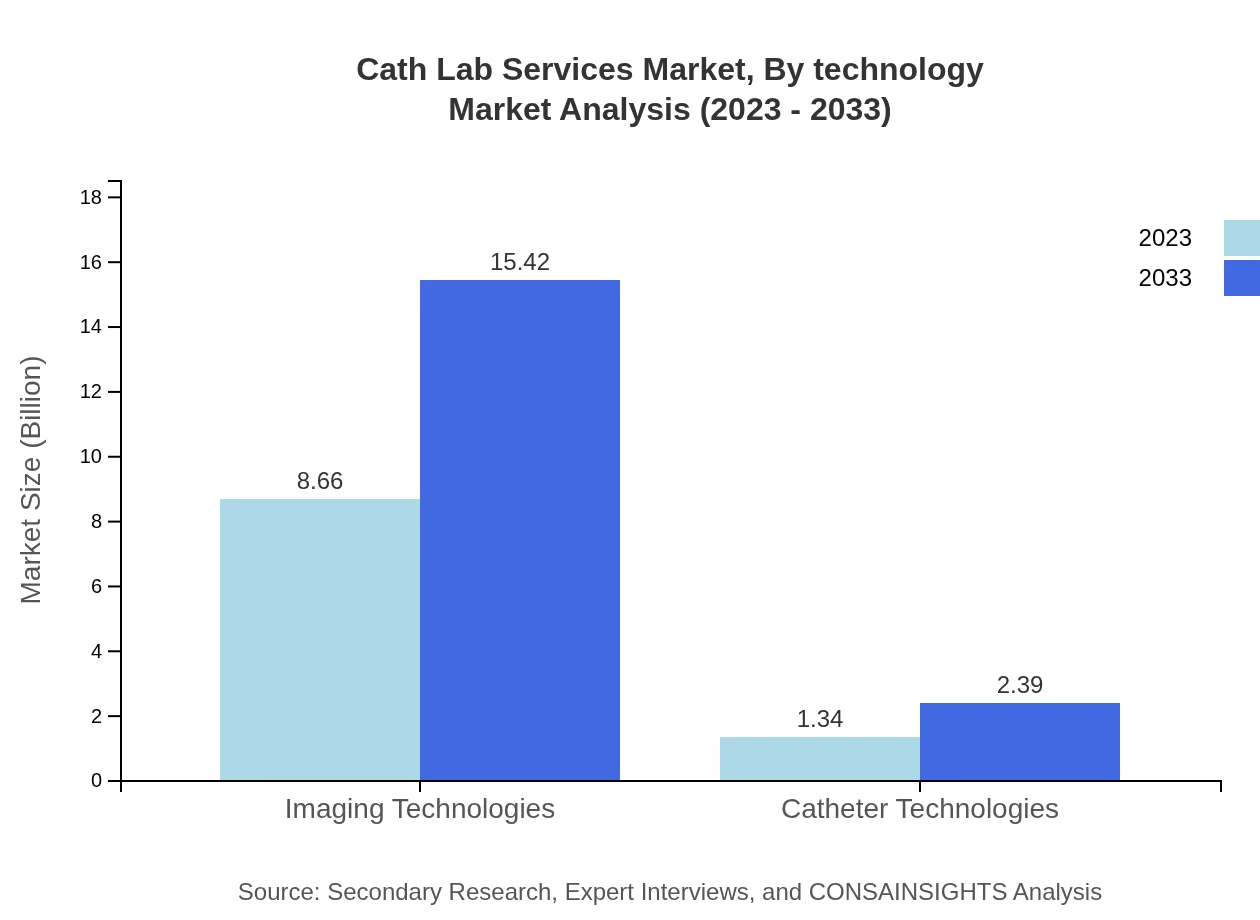

Cath Lab Services Market Analysis By Technology

This segment covers Imaging Technologies and Catheter Technologies. Imaging Technologies dominate the market, with a share of around 86.59% in 2023, expected to maintain this share by 2033. Total market size for Imaging Technologies is projected at $8.66 billion, growing to $15.42 billion by 2033. Catheter Technologies, holding a smaller share of 13.41%, reflects growth from $1.34 billion in 2023 to $2.39 billion by 2033, attributable to innovations in catheter design and performance.

Cath Lab Services Market Analysis By End User

End-user segmentation identifies Hospitals and Outpatient Surgical Centers as key players, with Hospitals commanding 86.59% of the market share in 2023. Operational growth reflects a market forecast from $8.66 billion to $15.42 billion by 2033, consolidating their vital role in patient treatment protocols compared to Outpatient Surgical Centers, which still demonstrate growth potential in the coming years.

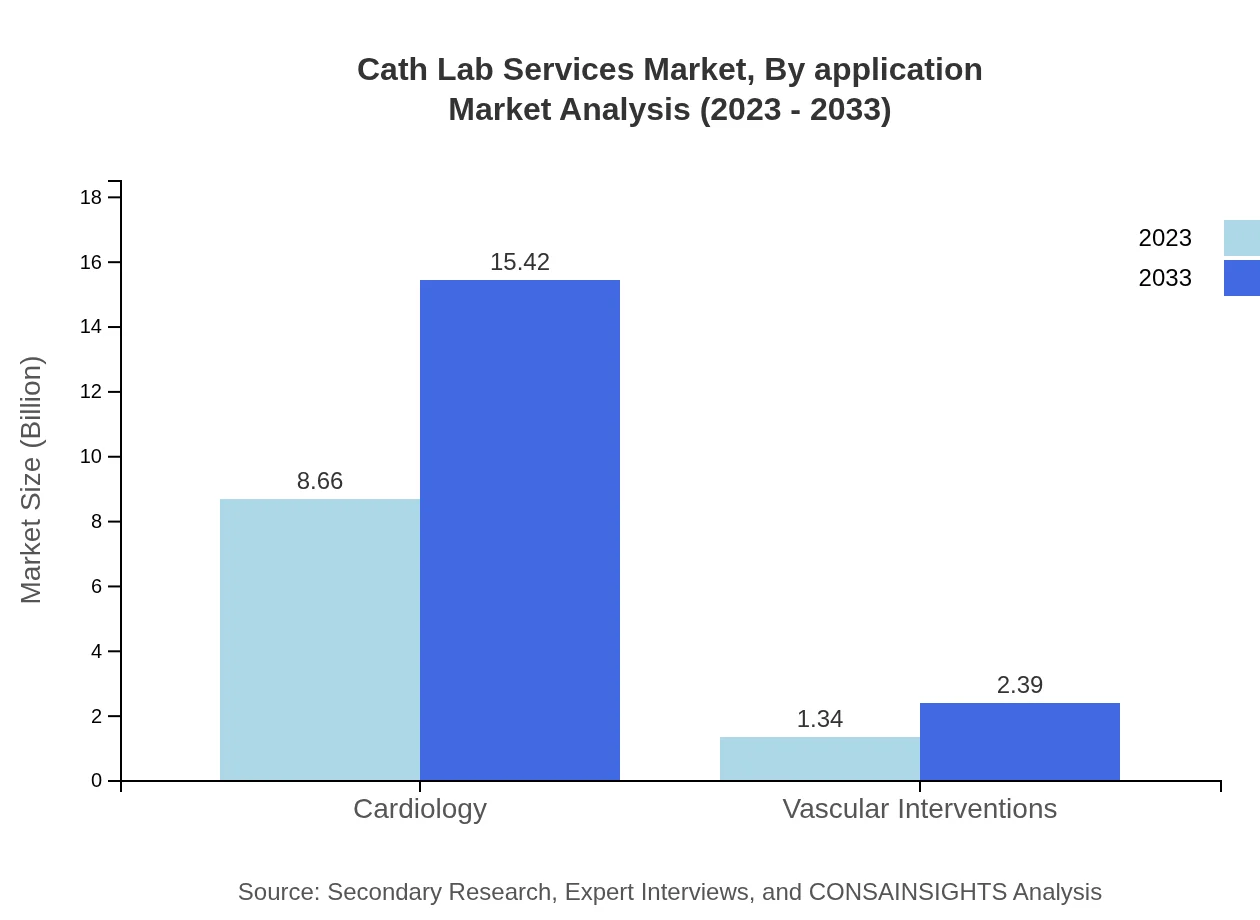

Cath Lab Services Market Analysis By Application

Applications for Cath Lab Services are predominantly in Cardiology and Vascular Interventions. Cardiology applications lead the market with a robust share of 86.59%, reflecting the critical role of cath labs in diagnosing and treating cardiac patients. Expected market growth reflects the need for interventional cardiology treatments, projected to expand from $8.66 billion in 2023 to $15.42 billion by 2033.

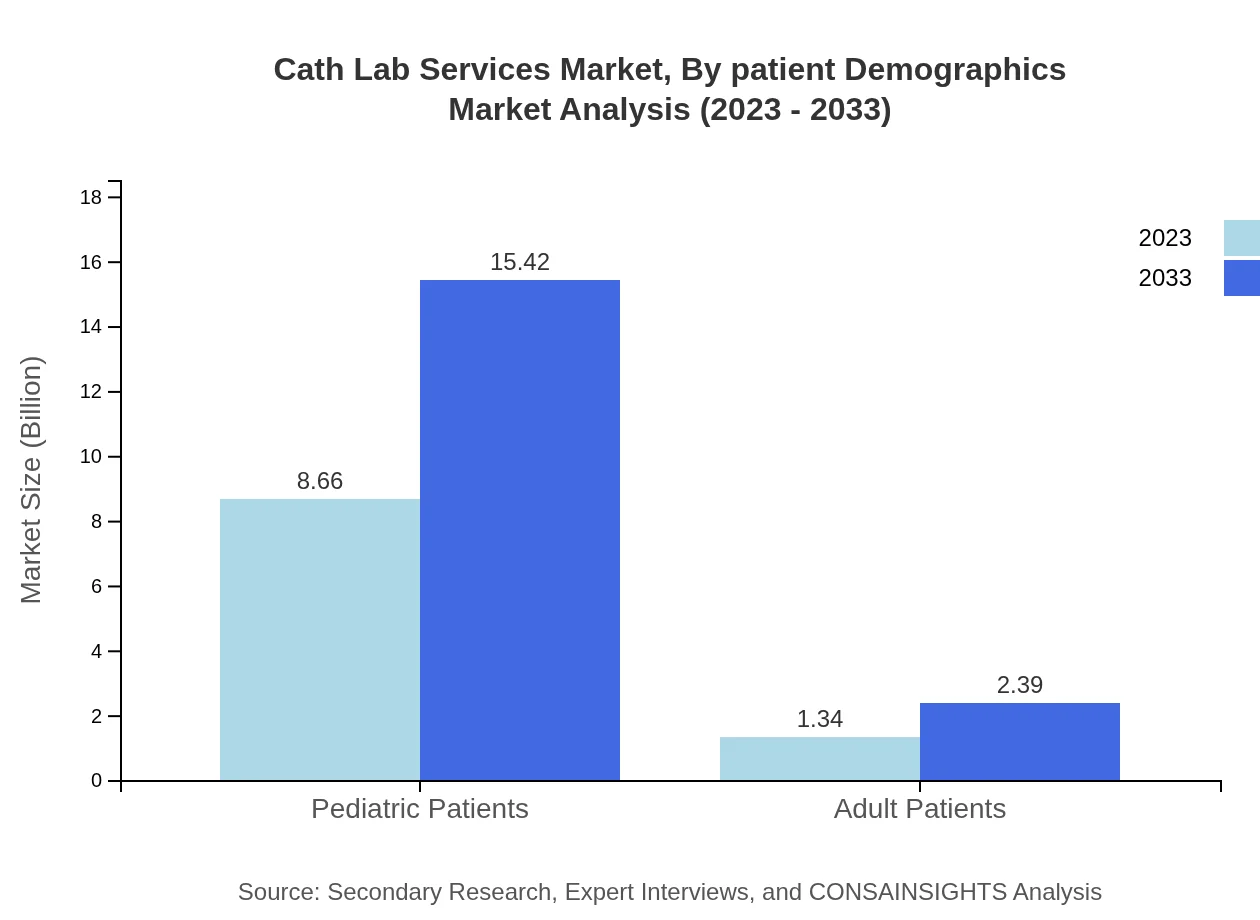

Cath Lab Services Market Analysis By Patient Demographics

Patient demographics focus on Pediatric and Adult Patients. Pediatric Patients take a leading segment with an 86.59% share, demonstrating a growing market from $8.66 billion to $15.42 billion. However, the Adult Patients segment, although smaller (13.41% share), also reflects promising growth, expanding from $1.34 billion in 2023 to $2.39 billion, driven by an increase in lifestyle diseases among adults.

Cath Lab Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cath Lab Services Industry

Abbott Laboratories:

Abbott Laboratories specializes in medical devices and provides a range of catheter-based platforms and imaging systems used in Cath Labs globally, emphasizing innovation in cardiac intervention technologies.Siemens Healthineers:

Siemens Healthineers is a major player delivering advanced imaging equipment and solutions for Cath Labs, enhancing procedural accuracy and efficiency through robust imaging technologies.GE Healthcare:

GE Healthcare provides comprehensive imaging and diagnostic solutions for Cath Labs, focusing on transforming patient care through innovative technologies and expanding their market footprint.Philips Healthcare:

Philips Healthcare is committed to advancing patient care with innovative Cath Lab technologies, providing integrated solutions that improve workflow and outcomes in cardiovascular health.We're grateful to work with incredible clients.

FAQs

What is the market size of Cath Lab Services?

The global market size of Cath Lab Services is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5.8%. This growth signifies an increasing demand for enhanced cardiovascular care and advanced diagnostic services.

What are the key market players or companies in the Cath Lab Services industry?

Key players in the Cath Lab Services industry include major healthcare companies such as Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others, each contributing to technological advancements and enhanced service delivery.

What are the primary factors driving the growth in the Cath Lab Services industry?

Primary factors influencing growth in the Cath Lab Services industry include an aging population, increasing prevalence of cardiovascular diseases, advancements in medical technologies, and a growing focus on preventive healthcare measures.

Which region is the fastest Growing in the Cath Lab Services?

North America is currently the fastest-growing region in the Cath Lab Services market, projected to grow from $3.63 billion in 2023 to $6.47 billion by 2033, spurred by technological advancements and increased healthcare spending.

Does ConsaInsights provide customized market report data for the Cath Lab Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Cath Lab Services industry, ensuring that businesses receive relevant and actionable insights for strategic decision-making.

What deliverables can I expect from this Cath Lab Services market research project?

Deliverables include comprehensive market analysis reports, segmentation data, trend evaluations, competitive landscape insights, and projections regarding future growth in the Cath Lab Services industry.

What are the market trends of Cath Lab Services?

Current trends in the Cath Lab Services market include increased adoption of minimally invasive procedures, integration of artificial intelligence in diagnostics, and a shift towards outpatient services, highlighting the sector's evolution.