Chemical Packaging Market Report

Published Date: 01 February 2026 | Report Code: chemical-packaging

Chemical Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Chemical Packaging market, covering key insights, trends, and data from 2023 to 2033. It explores market size, regional dynamics, segmentation, leading companies, and future forecasts to inform stakeholders in the industry.

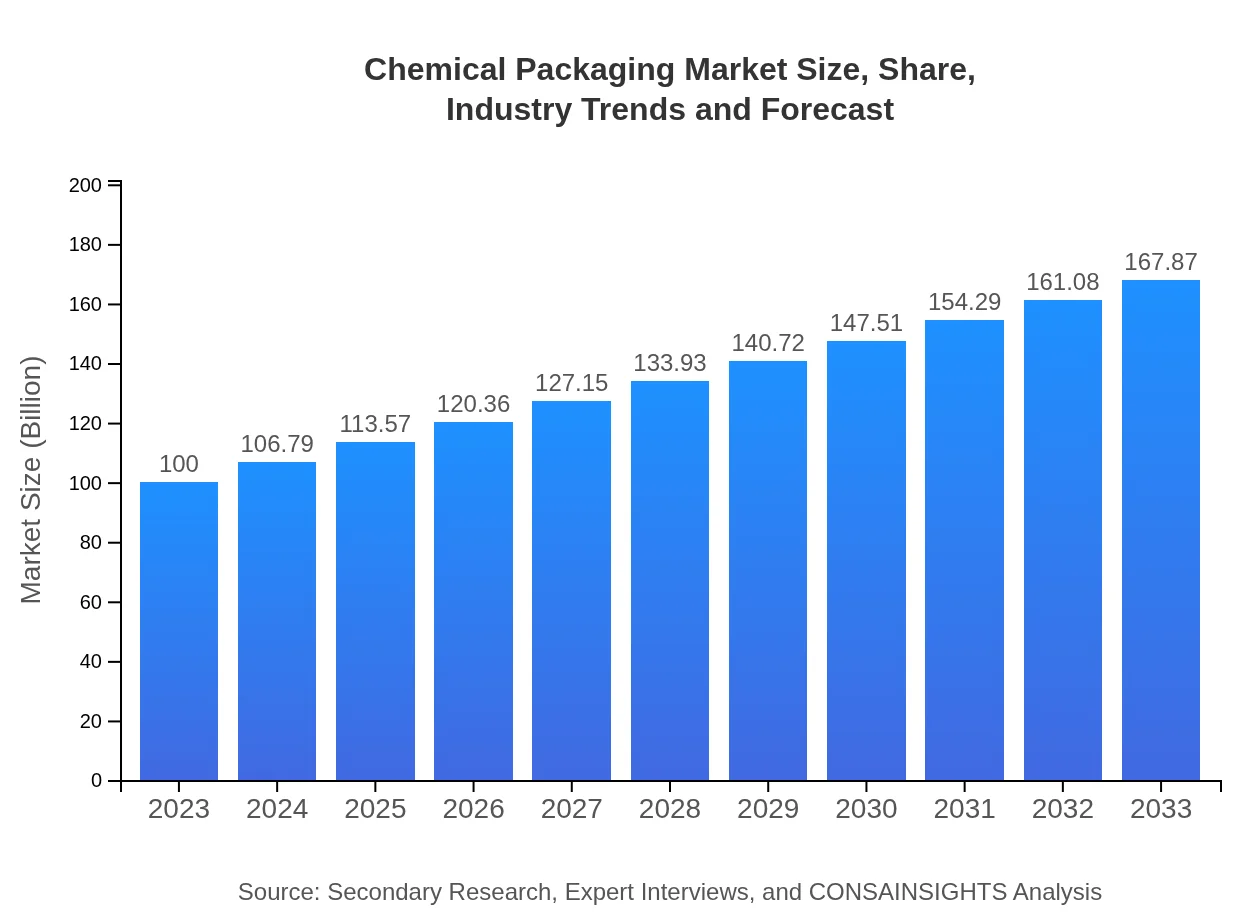

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $167.87 Billion |

| Top Companies | Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi Group, ePAC Flexible Packaging |

| Last Modified Date | 01 February 2026 |

Chemical Packaging Market Overview

Customize Chemical Packaging Market Report market research report

- ✔ Get in-depth analysis of Chemical Packaging market size, growth, and forecasts.

- ✔ Understand Chemical Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Chemical Packaging

What is the Market Size & CAGR of Chemical Packaging market in 2023?

Chemical Packaging Industry Analysis

Chemical Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Chemical Packaging Market Analysis Report by Region

Europe Chemical Packaging Market Report:

European market size was valued at $33.66 billion in 2023 and is expected to grow to $56.50 billion by 2033. The region is notably stringent on regulations related to packaging materials, especially regarding recycling and sustainability. Hence, manufacturers are compelled to adopt greener alternatives, driving market growth as environmental awareness rises across populations.Asia Pacific Chemical Packaging Market Report:

The Asia Pacific region is a significant player in the Chemical Packaging market, with a market size of approximately $18.18 billion in 2023, projected to grow to $30.52 billion by 2033. This growth is fueled by rapid industrialization, a booming chemical production sector, and increased consumer demand across nations like China and India. The focus on eco-friendly packaging materials is a notable trend in the region, with companies investing in sustainable practices.North America Chemical Packaging Market Report:

North America is leading in the Chemical Packaging market with $35.27 billion in 2023, expected to reach $59.21 billion by 2033. The region is characterized by advanced manufacturing technologies and stringent safety regulations. The U.S. chemical industry sets the standard for packaging requirements, driving innovation in materials and design to enhance safety and performance.South America Chemical Packaging Market Report:

The South American market is smaller, currently valued at $1.83 billion in 2023, with projections of growth to $3.07 billion by 2033. Brazil and Argentina are the primary contributors. The market faces challenges such as fluctuating raw material costs but sees growth driven by agricultural chemicals' packaging needs and regulatory compliance requirements.Middle East & Africa Chemical Packaging Market Report:

The market in the Middle East and Africa stands at $11.06 billion in 2023, projected to increase to $18.57 billion by 2033. The region's reliance on the oil and gas sector propels the demand for specialized chemical packaging solutions. Governments are increasingly implementing regulations aimed at improving environmental practices, compelling manufacturers to innovate.Tell us your focus area and get a customized research report.

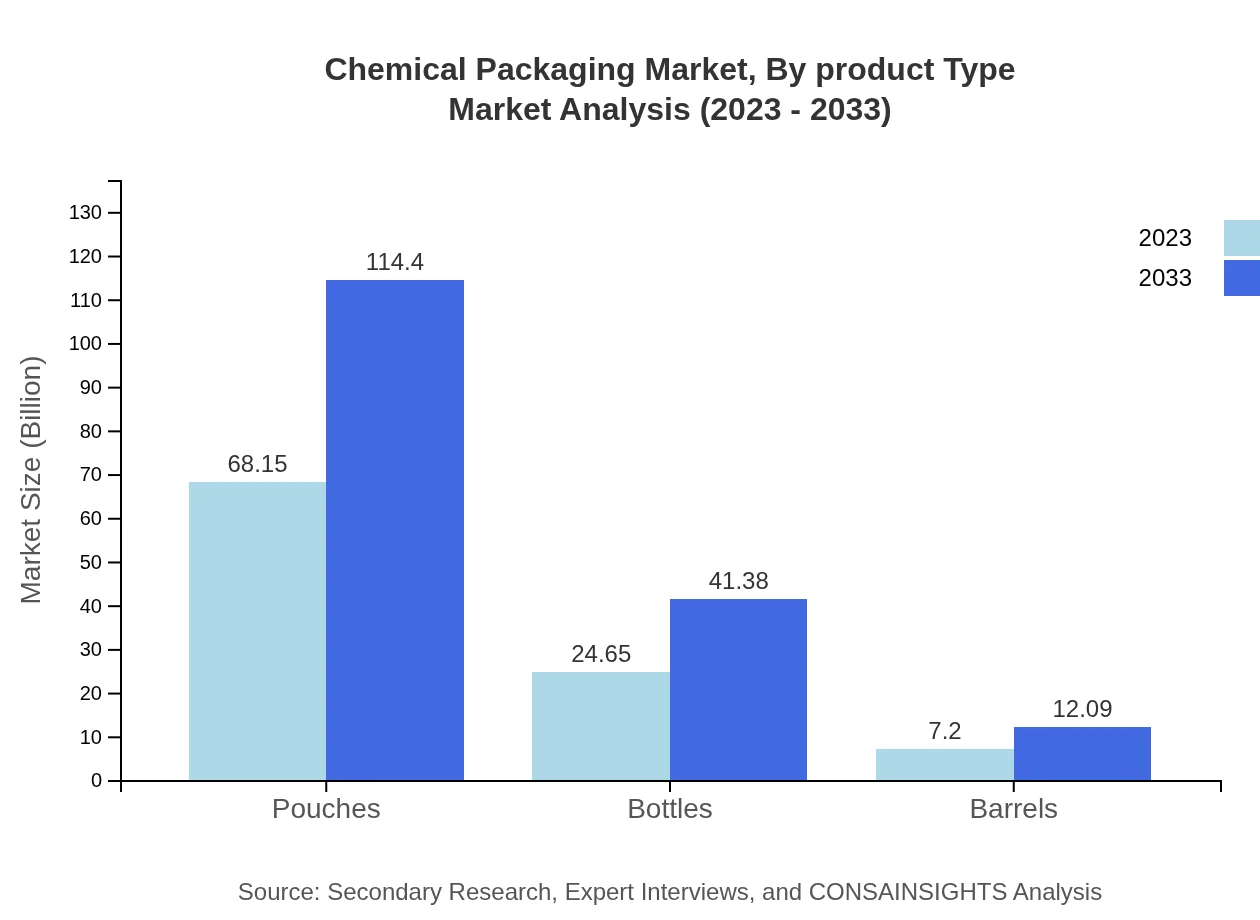

Chemical Packaging Market Analysis By Product Type

The market analysis shows that the pouches segment leads the market with a value of $68.15 billion in 2023, expected to reach $114.40 billion by 2033. Bottles and drums also hold substantial shares, with bottles estimated at $24.65 billion to $41.38 billion in the same period. These product types are essential for safe containment and convenient handling of various chemicals, thus reinforcing their significance in the industry.

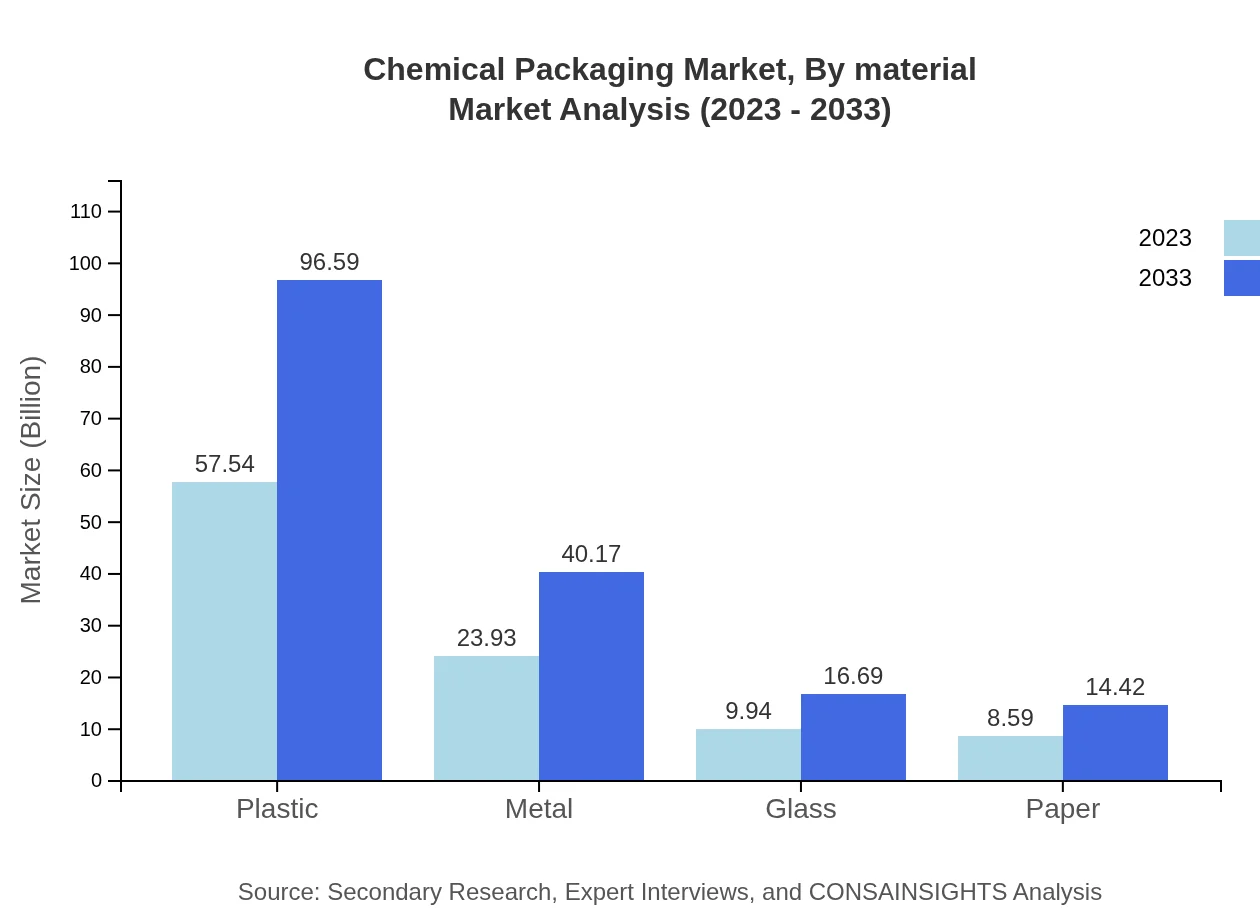

Chemical Packaging Market Analysis By Material

In terms of materials, the plastic segment dominates with a market size of $57.54 billion in 2023, forecasted to grow to $96.59 billion by 2033. Metal and glass segments also remain important, with metals growing from $23.93 billion to $40.17 billion. These materials are crucial due to their protective properties against chemical reactions, ensuring product integrity.

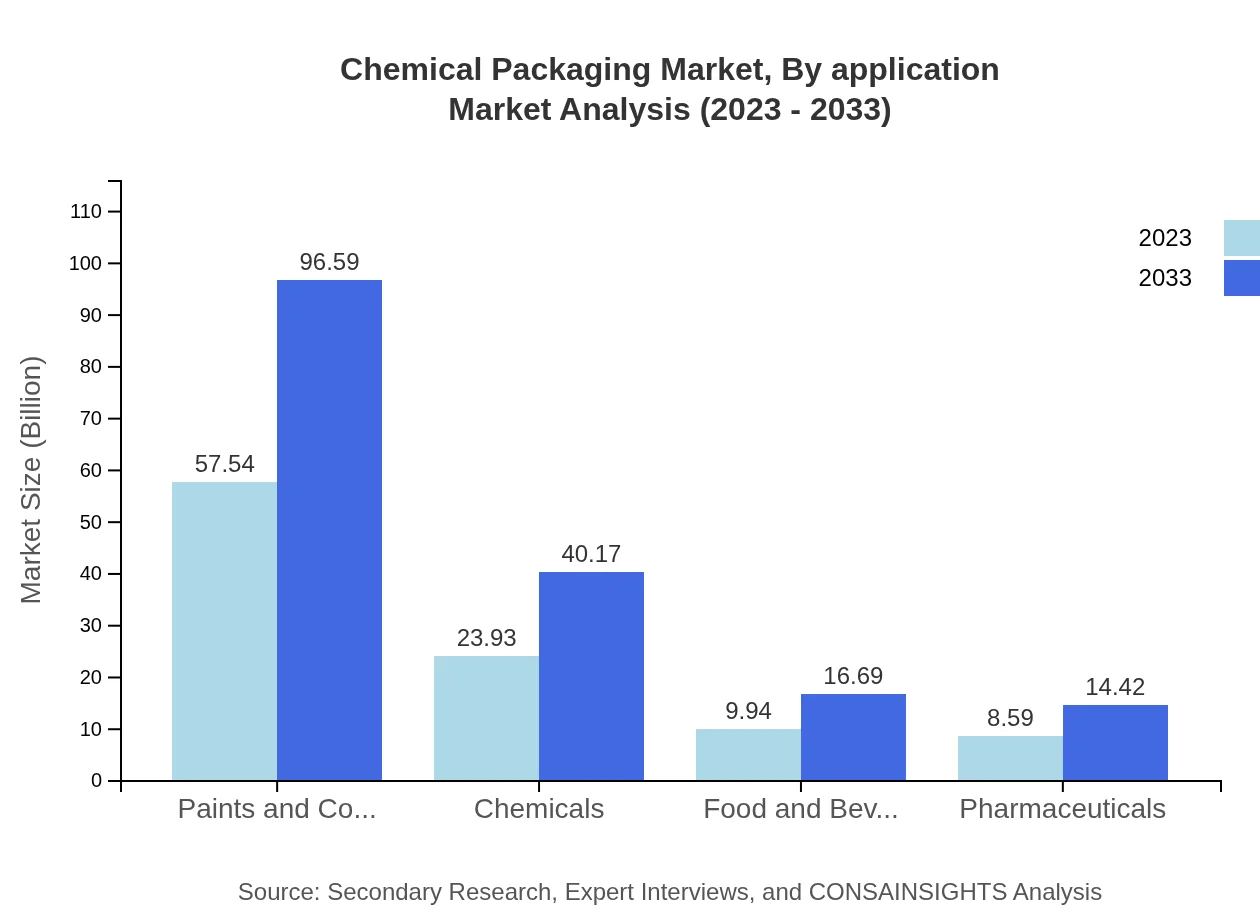

Chemical Packaging Market Analysis By Application

Sector-wise, the paints and coatings segment is a leader with significant valuation at $57.54 billion for 2023, expected to mirror growth similar to other high-demand chemicals as sustainability standards increase. The pharmaceuticals segment is also vital, anticipated to grow to $14.42 billion, demonstrating the crucial need for compliance and product safety in this regulated industry.

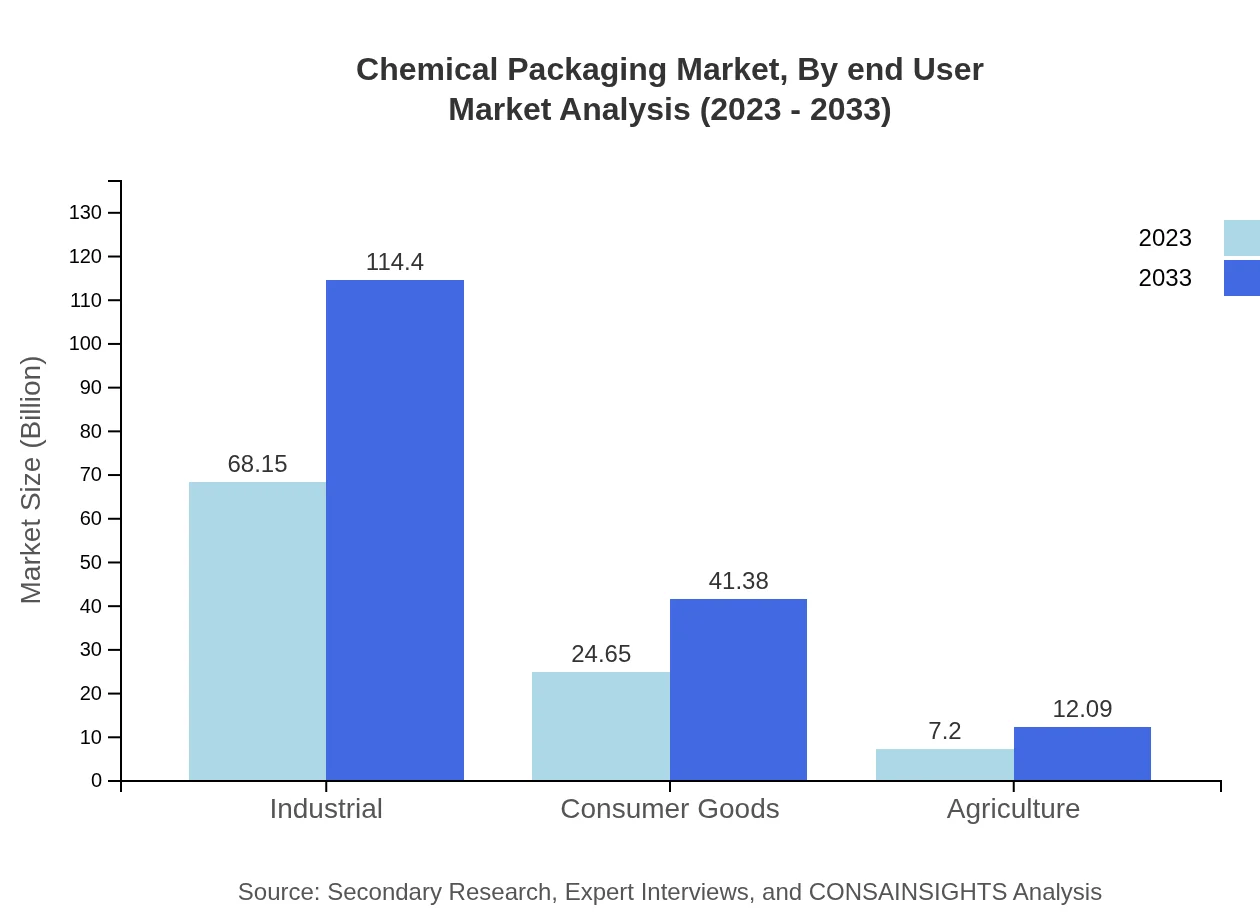

Chemical Packaging Market Analysis By End User

The industrial end-user sector is paramount, constituting a large share with a value of $68.15 billion, set to rise to $114.40 billion by 2033, showcasing robust demand for packaging solutions across numerous industries. The food and beverages and agricultural sectors are also crucial, representing consistent demand that fuels market growth and innovation.

Chemical Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Chemical Packaging Industry

Amcor plc:

A global leader in packaging solutions, Amcor provides a wide range of sustainable packaging products to various sectors including food, healthcare, and pharmaceuticals.Sealed Air Corporation:

Known for its innovative packaging solutions, Sealed Air specializes in food packaging and protective packaging technologies that enhance product safety and reduce waste.Berry Global, Inc.:

Berry Global focuses on sustainable product development and provides innovative packaging solutions that cater to the chemicals and personal care industries.Mondi Group:

Mondi is known for its paper and flexible plastic packaging innovations, focusing on responsible and sustainable solutions that meet diverse customer needs.ePAC Flexible Packaging:

ePAC specializes in digital flexible packaging solutions, offering fast and versatile options that serve small to medium-sized business across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of chemical Packaging?

The global chemical packaging market is projected to reach approximately $100 billion by 2033, with a compound annual growth rate (CAGR) of 5.2%. This growth reflects the increasing demand for safe and sustainable packaging solutions across various sectors.

What are the key market players or companies in this chemical Packaging industry?

Key players in the chemical packaging industry include well-established companies known for innovative packaging solutions. These companies focus on sustainability and technological advancements, which drive their competitive edge within the market.

What are the primary factors driving the growth in the chemical packaging industry?

Key growth drivers for the chemical packaging industry include increasing globalization, rising demand for consumer goods, and regulatory pressures for safer packaging solutions. Additionally, the industry's focus on sustainability significantly accelerates market expansion.

Which region is the fastest Growing in the chemical packaging?

The Asia Pacific region is the fastest-growing market for chemical packaging, projected to grow from $18.18 billion in 2023 to $30.52 billion by 2033. This growth is driven by industrialization and increased urbanization in the region.

Does ConsaInsights provide customized market report data for the chemical packaging industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the chemical packaging industry. This includes detailed insights, market forecasts, and strategic recommendations based on unique business objectives.

What deliverables can I expect from this chemical packaging market research project?

Expected deliverables from the chemical packaging market research project include comprehensive reports, data visualizations, trend analyses, and actionable insights tailored to your business requirements, enabling informed decision-making.

What are the market trends of chemical packaging?

Current trends in the chemical packaging market include the increased use of biodegradable materials, emphasis on smart packaging technologies, and innovations in design aimed at reducing waste and enhancing product protection across various industries.