Smart Packaging Market Report

Published Date: 01 February 2026 | Report Code: smart-packaging

Smart Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Packaging market from 2023 to 2033, offering insights into market trends, sizes, growth forecasts, and industry dynamics across various segments and regions.

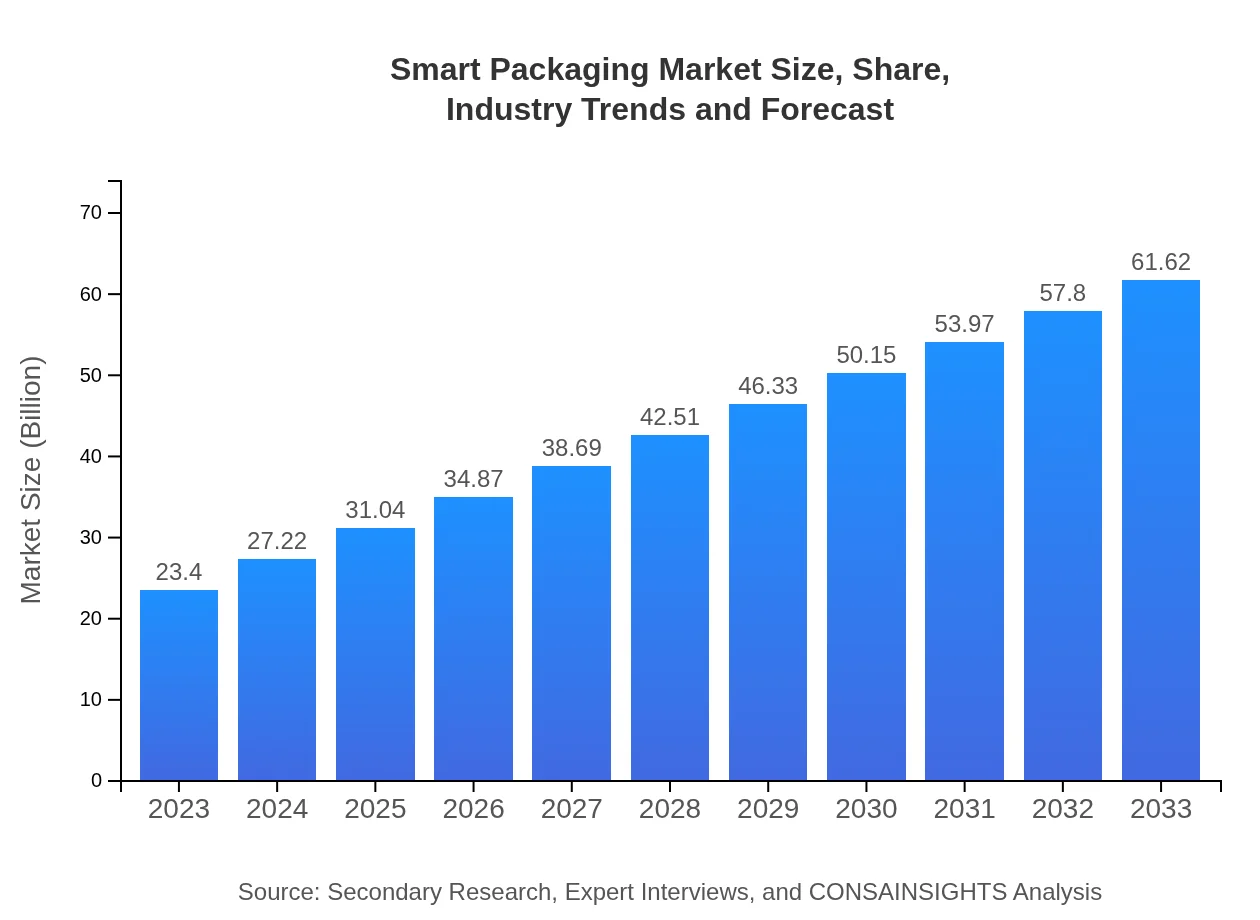

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.40 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $61.62 Billion |

| Top Companies | Amcor, Stora Enso, Tetra Pak, Sealed Air, Smurfit Kappa |

| Last Modified Date | 01 February 2026 |

Smart Packaging Market Overview

Customize Smart Packaging Market Report market research report

- ✔ Get in-depth analysis of Smart Packaging market size, growth, and forecasts.

- ✔ Understand Smart Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Packaging

What is the Market Size & CAGR of Smart Packaging market in 2033?

Smart Packaging Industry Analysis

Smart Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Packaging Market Analysis Report by Region

Europe Smart Packaging Market Report:

In Europe, the market size is set to increase from $6.51 billion in 2023 to $17.15 billion in 2033. The strong focus on sustainability and innovation in packaging solutions is a key factor stimulating growth. Moreover, various European nations are enforcing strict packaging regulations to minimize waste, thus driving demand for smart packaging solutions.Asia Pacific Smart Packaging Market Report:

In the Asia Pacific region, the Smart Packaging market was valued at $4.68 billion in 2023 and is projected to reach $12.32 billion by 2033. Rapid urbanization, increasing disposable incomes, and rising awareness of food safety are driving this growth. Additionally, countries like China and India are witnessing significant advances in technology adoption and market penetration.North America Smart Packaging Market Report:

North America dominated the Smart Packaging market with a valuation of $8.66 billion in 2023, anticipated to expand to $22.80 billion by 2033. The region's growth is largely driven by the developed food and beverage industry, stringent food safety regulations, and a booming pharmaceutical sector, coupled with a high level of technology adoption.South America Smart Packaging Market Report:

The South American Smart Packaging market is expected to grow from $0.48 billion in 2023 to $1.26 billion by 2033. This growth is attributed to rising consumer demand for packaged foods and increased awareness regarding sustainable practices within the packaging sector. Moreover, trade regulations are prompting manufacturers to invest in smart technologies.Middle East & Africa Smart Packaging Market Report:

The Middle East and Africa Smart Packaging market is projected to rise from $3.07 billion in 2023 to $8.09 billion in 2033. Growth is propelled by the increased adoption of modern packaging solutions across industries such as food and beverages and pharmaceuticals, along with the region's improving economic outlook and infrastructure development.Tell us your focus area and get a customized research report.

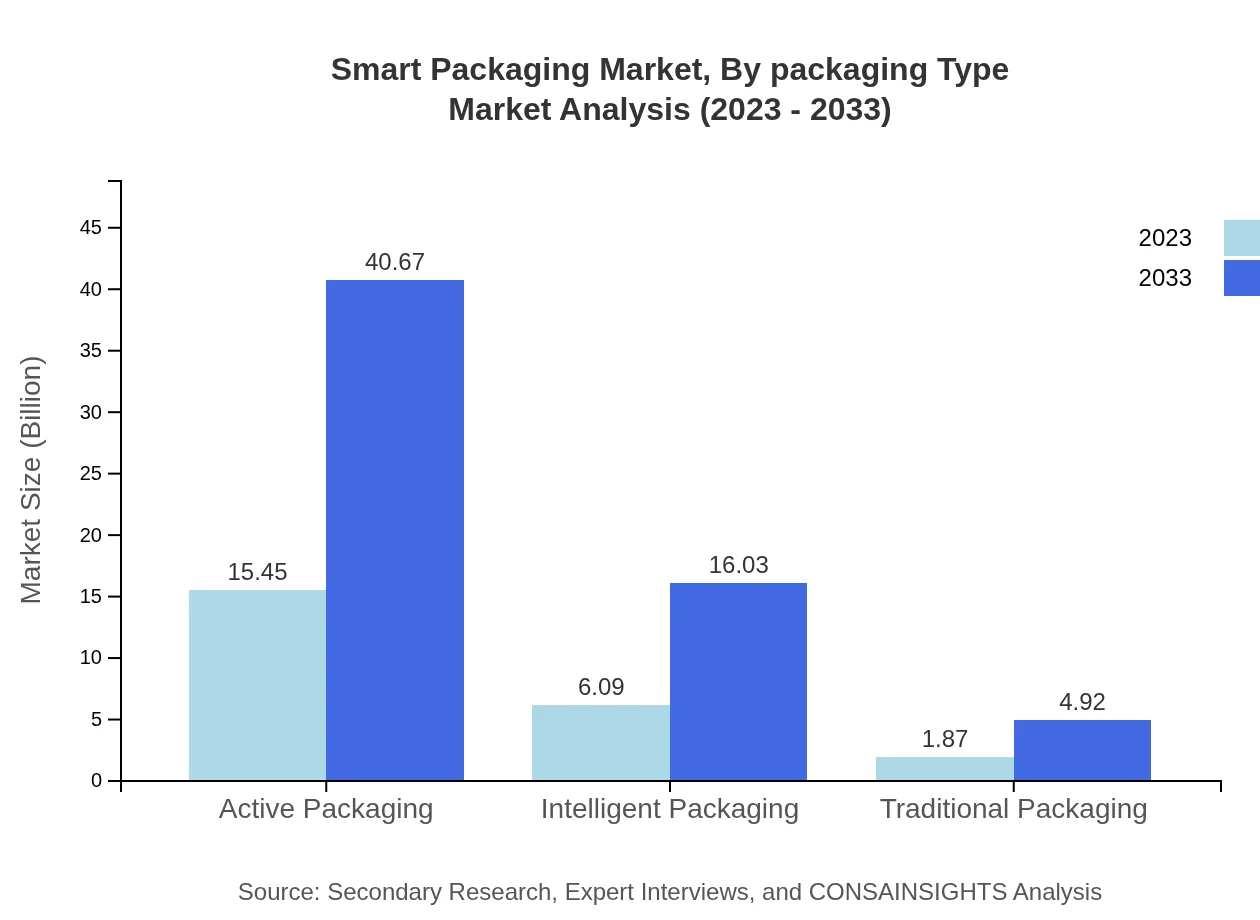

Smart Packaging Market Analysis By Packaging Type

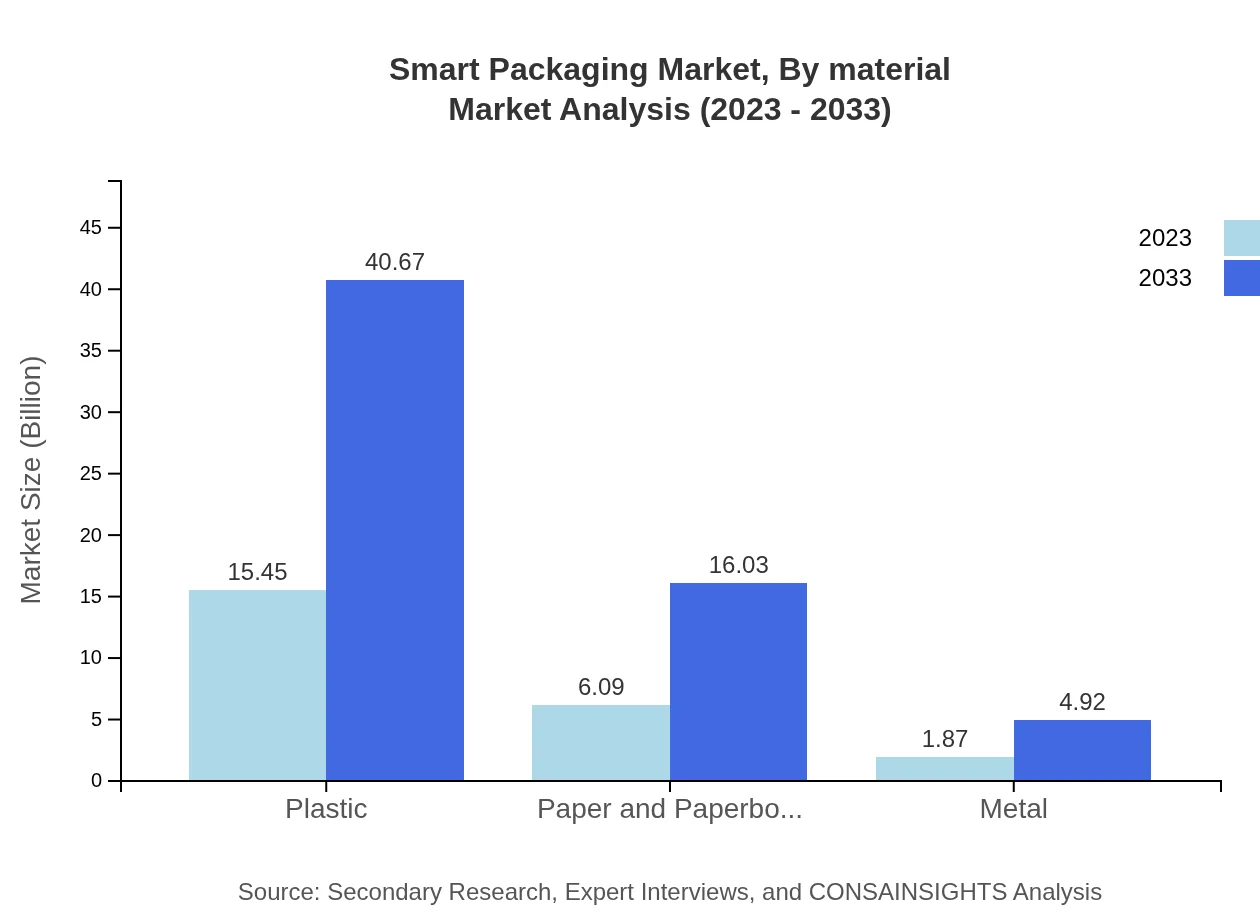

Active Packaging holds a significant portion of the market, growing from $15.45 billion in 2023 to $40.67 billion by 2033. This segment benefits from consumer demand for longer shelf life in food products. Intelligent Packaging follows, projected to expand from $6.09 billion to $16.03 billion. Traditional packaging remains notable but is gradually declining in share as new technologies emerge.

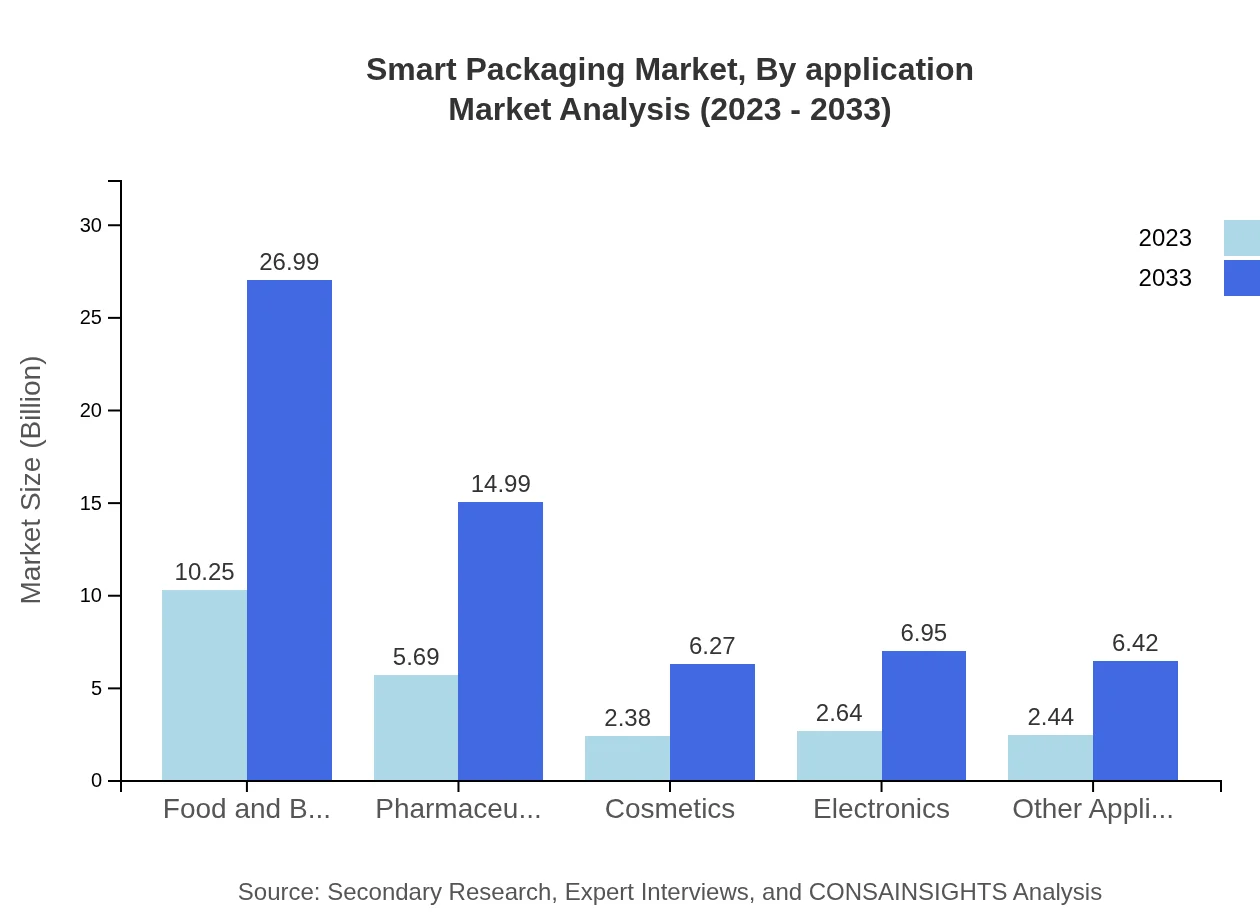

Smart Packaging Market Analysis By Application

The Food and Beverages sector is the largest, with a market size of $10.25 billion in 2023, expected to grow to $26.99 billion by 2033, holding 43.8% market share. Healthcare applications also show significant growth, moving from $5.12 billion to $13.49 billion, driven by the demand for secure and efficient pharmaceutical packaging.

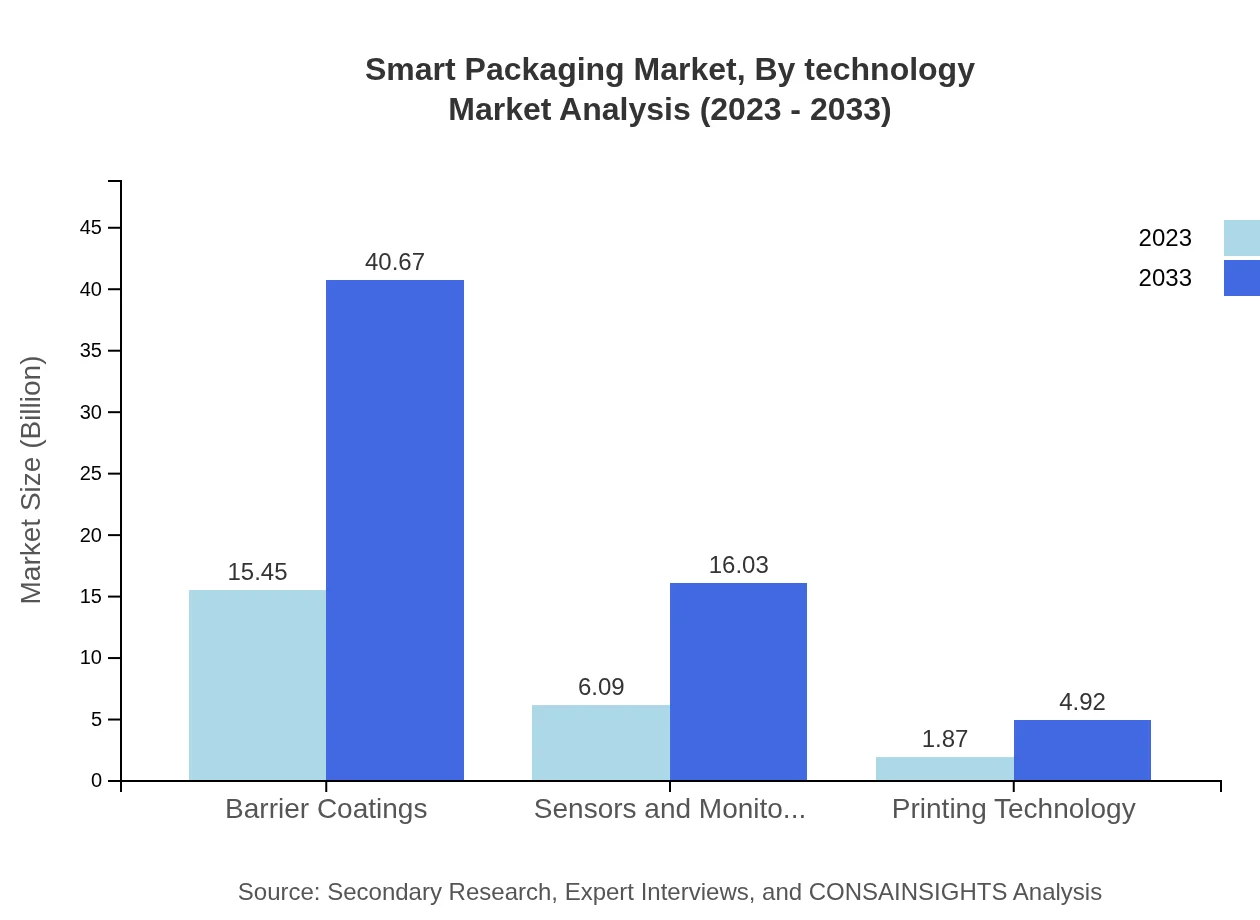

Smart Packaging Market Analysis By Technology

The sensors and monitoring segment is critical, experiencing growth from $6.09 billion in 2023 to $16.03 billion in 2033. As technology advances, more companies are integrating intelligent sensors that provide real-time data, influencing consumer safety and product quality.

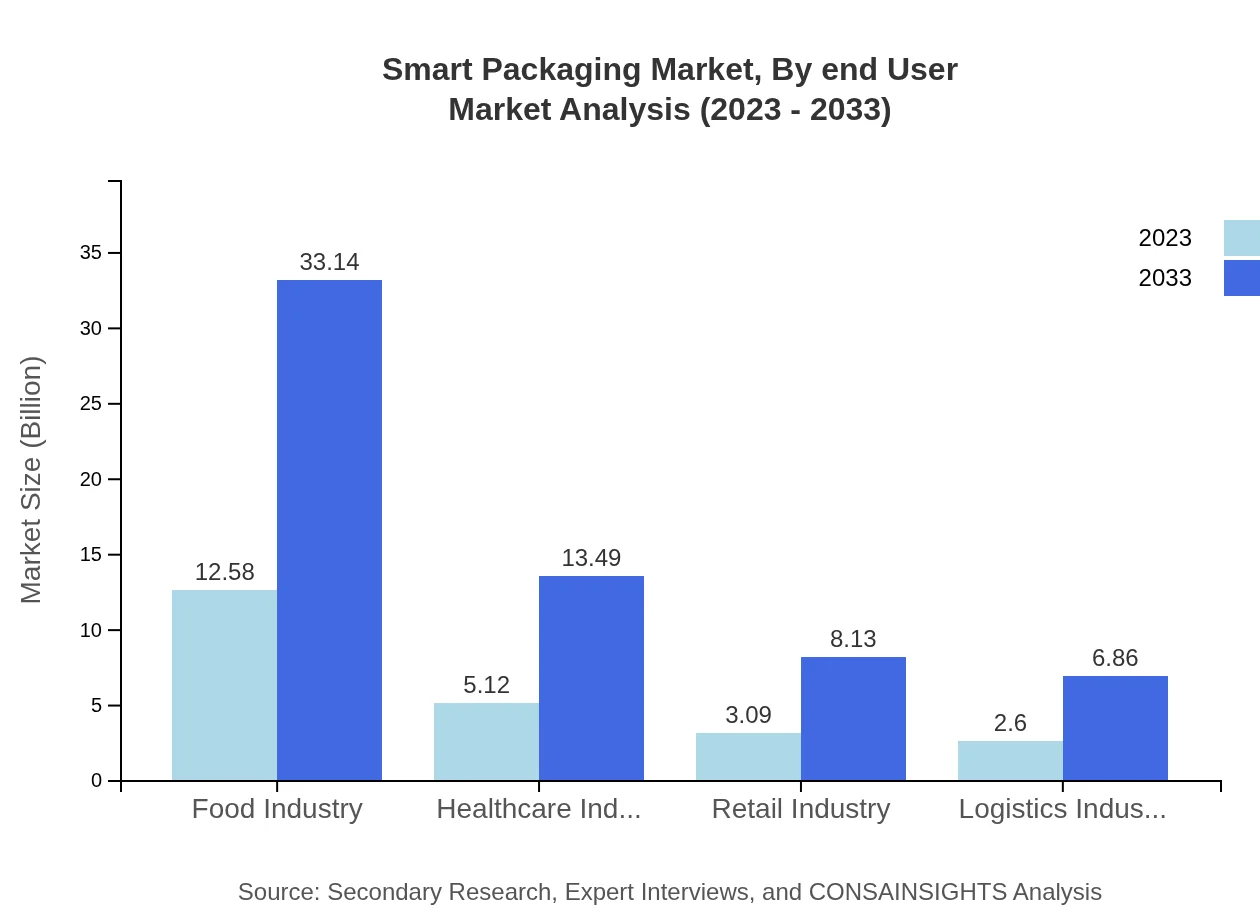

Smart Packaging Market Analysis By End User

Food Industry plays a vital role in the Smart Packaging market segment, expanding to $12.58 billion in size by 2033, while Healthcare Industry equally rises to $5.12 billion in size, given the emphasis on medical product safety.

Smart Packaging Market Analysis By Material

Plastics remain the dominant material in smart packaging, expected to grow from $15.45 billion to $40.67 billion by 2033, with its versatility and lightweight properties driving its acceptance across industries, especially in food and beverages.

Smart Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Packaging Industry

Amcor:

Amcor is a leading global packaging company known for its innovation in flexible and rigid packaging solutions, providing a wide range of smart packaging technologies for food and healthcare markets.Stora Enso:

Stora Enso specializes in renewable packaging solutions, focusing on developing sustainable smart packaging products to meet customer needs across the globe.Tetra Pak:

Tetra Pak is a prominent player in the food packaging industry, offering advanced smart packaging solutions aimed at preserving food quality and ensuring safety for consumers worldwide.Sealed Air:

Sealed Air Corporation focuses on food safety and protection through innovative smart packaging solutions, integrating technologies that enhance freshness and shelf-life.Smurfit Kappa:

Smurfit Kappa is known for its sustainable cardboard-based packaging solutions, increasingly adopting smart technologies to improve logistics and supply chain management.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Packaging?

The global smart packaging market is currently valued at approximately $23.4 billion and is forecasted to grow at a CAGR of 9.8% from 2023 to 2033, indicating strong potential within the industry due to emerging technologies.

What are the key market players or companies in this smart Packaging industry?

Key players in the smart packaging industry include Tetra Pak, Amcor, 3M, Sealed Air, and Smartrac, among others. These companies are at the forefront of developing innovative packaging solutions that cater to various sectors.

What are the primary factors driving the growth in the smart packaging industry?

Growth is primarily driven by rising demand for convenience products, increasing health consciousness, advancements in technology, and the need for sustainable solutions. Additionally, consumer expectations for enhanced product safety and shelf life are significant factors.

Which region is the fastest Growing in the smart packaging market?

The Asia Pacific region is expected to exhibit the fastest growth in the smart packaging market, with market size increasing from $4.68 billion in 2023 to $12.32 billion by 2033, reflecting substantial demand for innovative packaging solutions.

Does ConsaInsights provide customized market report data for the smart packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific industry needs. This service enables clients to gain insights that align with their unique business requirements and strategic objectives.

What deliverables can I expect from this smart packaging market research project?

Deliverables typically include detailed market analysis reports, regional insights, competitive landscape assessments, future trend forecasts, and segmented data to aid in strategic decision-making and market entry strategies.

What are the market trends of smart packaging?

Current trends in smart packaging include the rise of active and intelligent packaging solutions, growing emphasis on sustainability, increased use of IoT for real-time product tracking, and innovations in materials that improve product longevity.