Cold Remedies Market Report

Published Date: 31 January 2026 | Report Code: cold-remedies

Cold Remedies Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Cold Remedies market, providing detailed insights into its current state and future projections from 2023 to 2033, covering market trends, size, segmentation, and regional analyses.

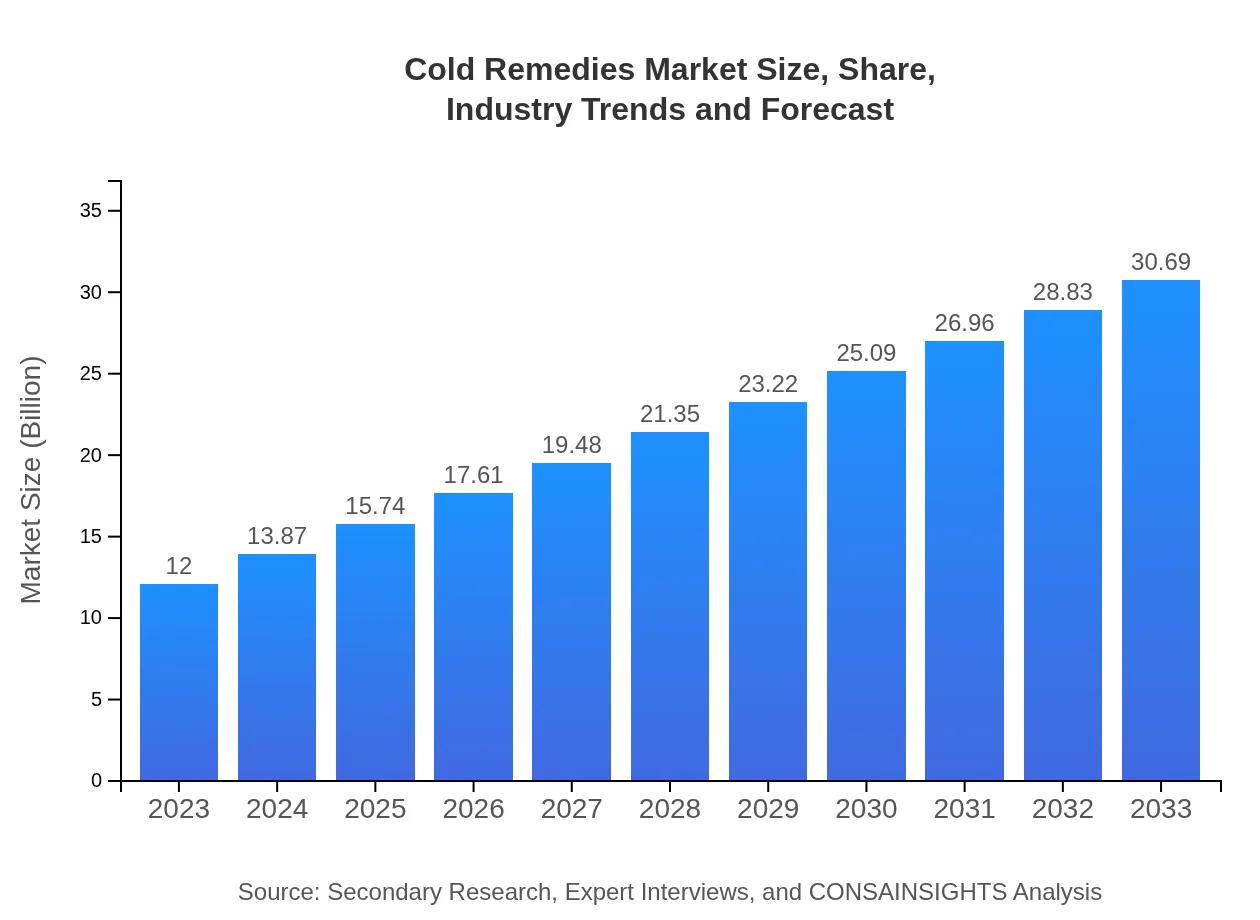

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Pfizer , Johnson & Johnson, Procter & Gamble, GSK |

| Last Modified Date | 31 January 2026 |

Cold Remedies Market Overview

Customize Cold Remedies Market Report market research report

- ✔ Get in-depth analysis of Cold Remedies market size, growth, and forecasts.

- ✔ Understand Cold Remedies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cold Remedies

What is the Market Size & CAGR of Cold Remedies market in 2023?

Cold Remedies Industry Analysis

Cold Remedies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cold Remedies Market Analysis Report by Region

Europe Cold Remedies Market Report:

The European Cold Remedies market is also robust, expected to rise from $3.13 billion in 2023 to $8.01 billion by 2033. Factors driving this growth include stringent health regulations, high standards of medical care, and a growing consumer base that favors self-care products.Asia Pacific Cold Remedies Market Report:

In the Asia Pacific region, the Cold Remedies market is projected to grow from $2.43 billion in 2023 to $6.20 billion by 2033. Increased urbanization, changing lifestyles, and a rise in self-medication practices contribute to this growth. Countries like China and India are significant contributors to the market expansion due to their large population base and expanding healthcare infrastructure.North America Cold Remedies Market Report:

North America, particularly the United States, currently represents the largest market, projected to grow from $4.51 billion in 2023 to $11.54 billion in 2033. The proliferation of retail pharmacies, increased healthcare expenditure, and a strong consumer preference for convenient, accessible health solutions fuel this demand.South America Cold Remedies Market Report:

The South American market, although smaller, is expected to show significant growth, moving from $0.66 billion in 2023 to $1.69 billion by 2033. This growth is driven by increasing health awareness and the rising prevalence of cold-related ailments, alongside an expanding availability of OTC products in pharmacies.Middle East & Africa Cold Remedies Market Report:

In the Middle East and Africa region, the market is expected to expand from $1.27 billion in 2023 to $3.25 billion by 2033. Increased healthcare investments and improved access to cold remedies are anticipated to be pivotal in stimulating growth across various countries, especially in the GCC nations.Tell us your focus area and get a customized research report.

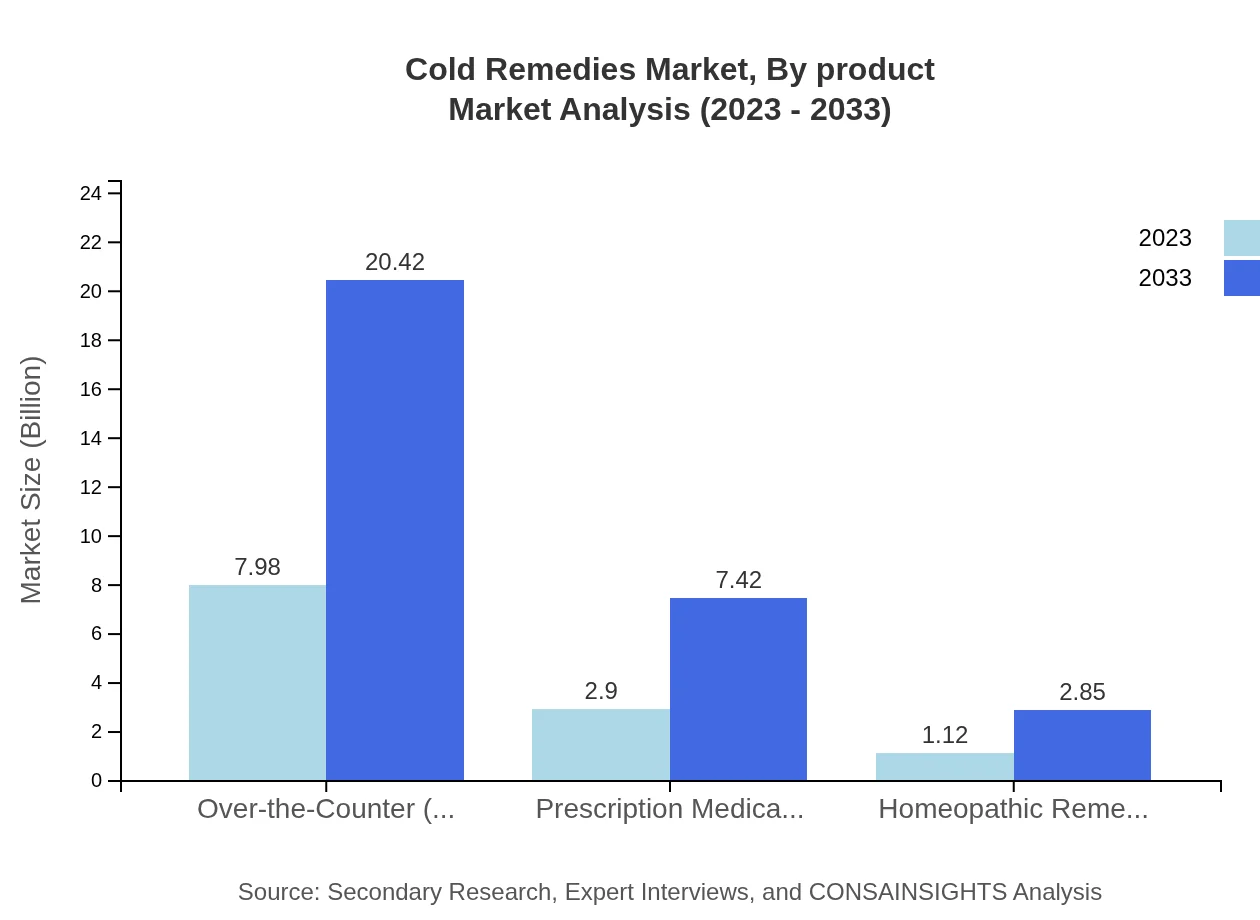

Cold Remedies Market Analysis By Product

The Cold Remedies market by product segment includes Over-the-Counter (OTC) preparations, Prescription medications, and Homeopathic remedies. OTC preparations hold the largest market share in both value and volume, accounting for approximately $7.98 billion in 2023 and projecting a rise to $20.42 billion by 2033. Prescription medications, while smaller, are growing in demand as healthcare providers increasingly recommend drug therapies for cold symptoms. Homeopathic remedies also present a growing niche, appealing to consumers seeking natural alternatives.

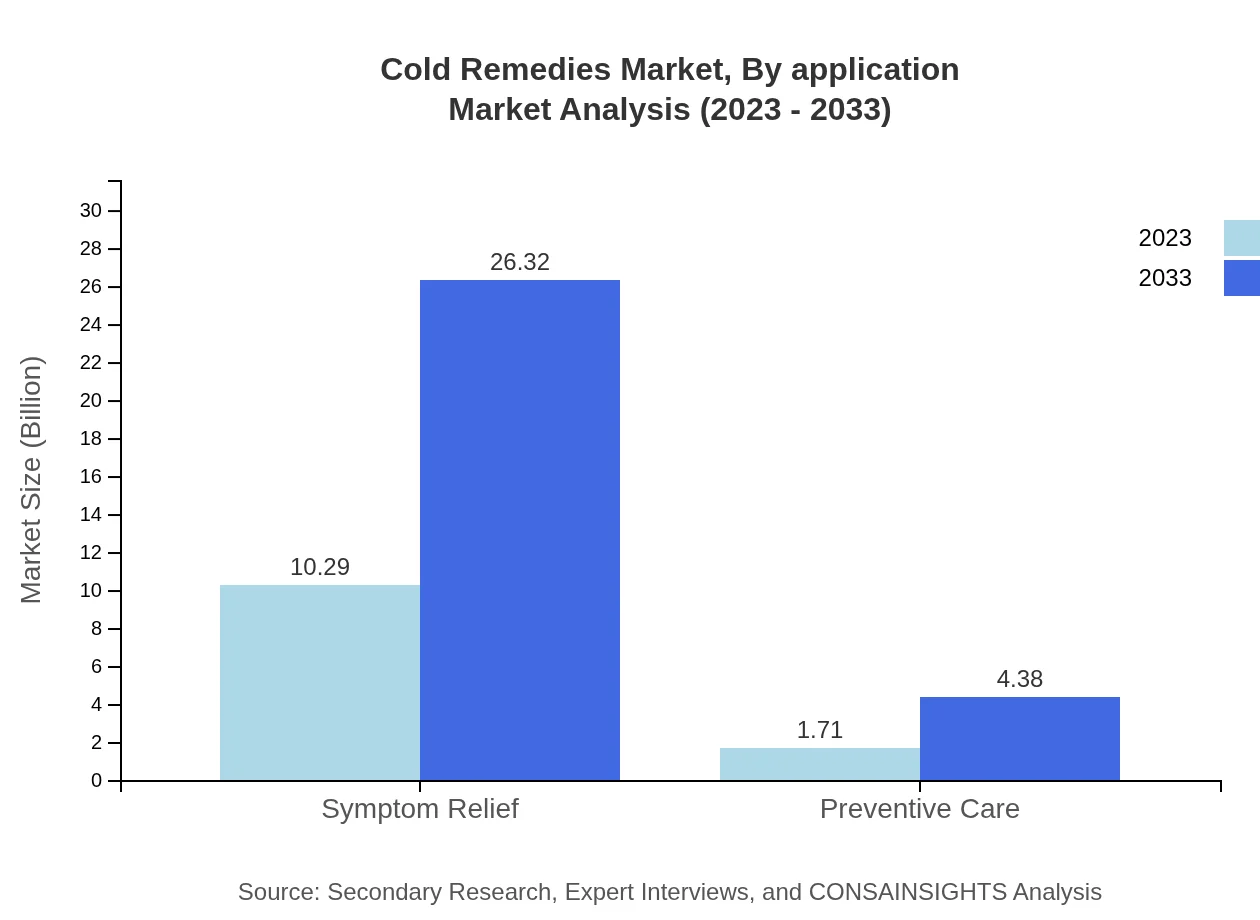

Cold Remedies Market Analysis By Application

The application segment covers Symptom relief and Preventive care. Symptom relief products dominate the market, accounting for $10.29 billion in 2023, with expected growth to $26.32 billion by 2033. Preventive care accounts for a smaller share but shows potential, growing from $1.71 billion to $4.38 billion during the same period. This growth reflects an increasing focus on preemptive health measures.

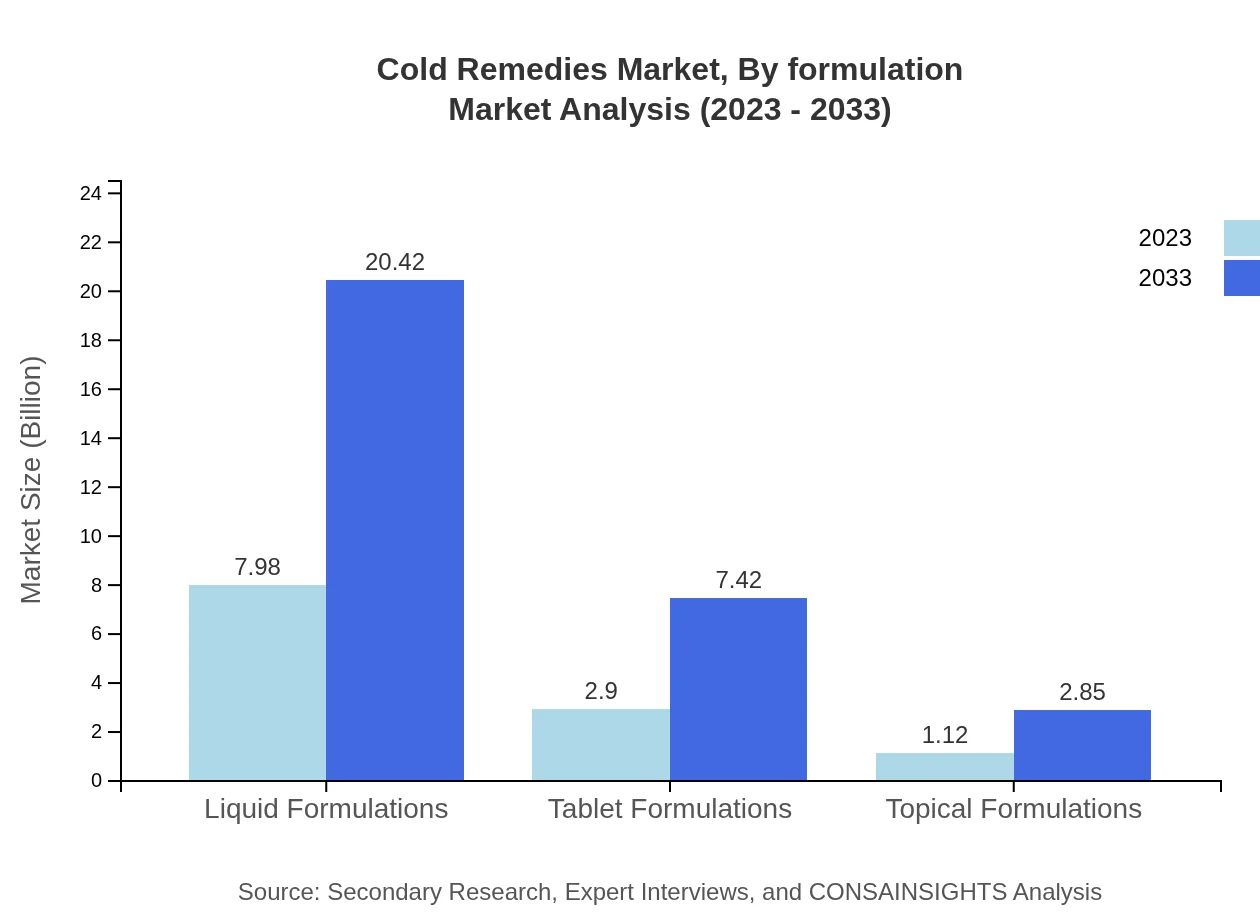

Cold Remedies Market Analysis By Formulation

Formulation types in the cold remedies market include Liquid formulations, Tablet formulations, and Topical formulations. Liquid formulations dominate the market in size and share, with a value of $7.98 billion in 2023. These are popular due to their ease of consumption. Tablet formulations are a close second, valued at $2.90 billion, while topical formulations offer specialized local relief, reflecting niche growth.

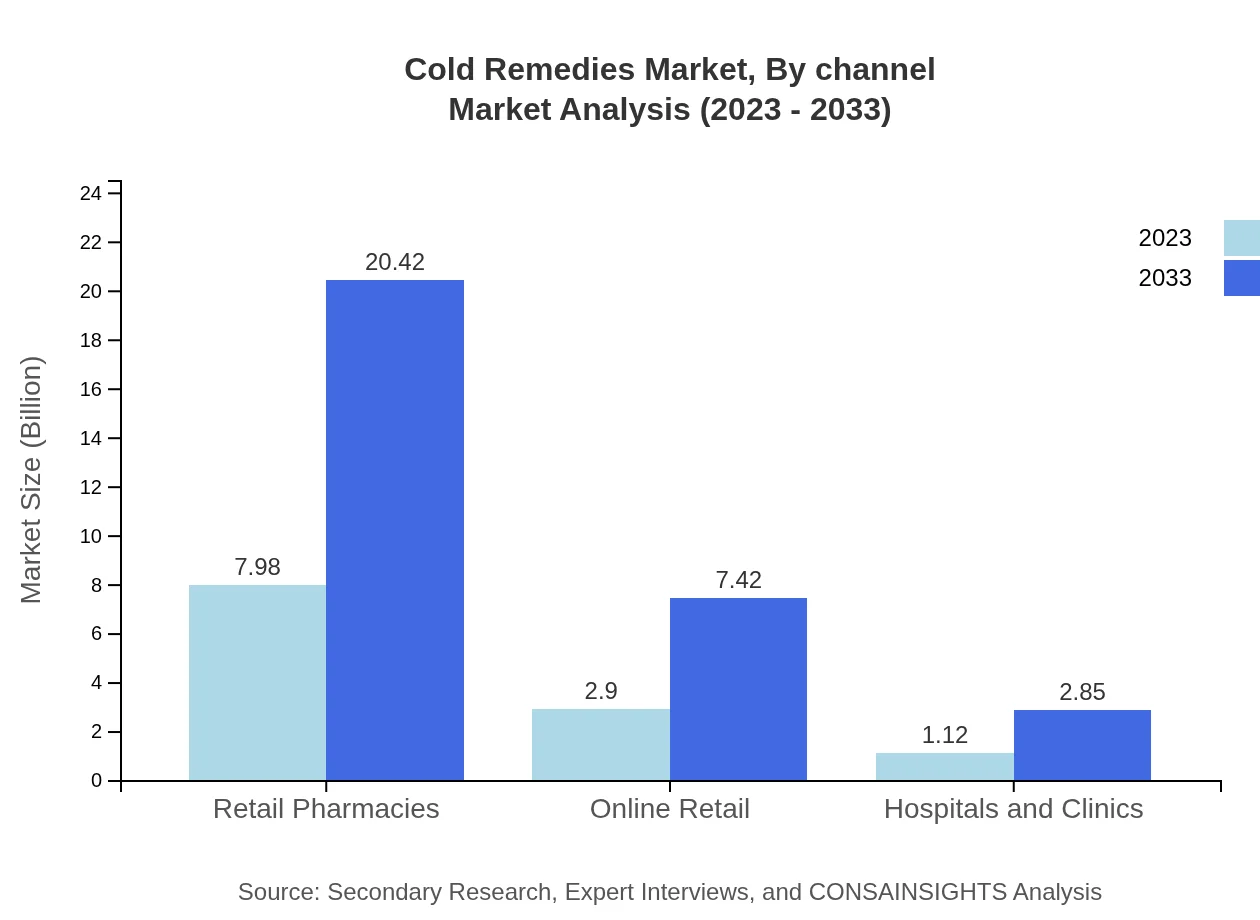

Cold Remedies Market Analysis By Channel

The distribution channels for cold remedies include Retail pharmacies, Online retail, and Hospitals and clinics. Retail pharmacies dominate the distribution landscape, holding a substantial share of approximately 66.53% in 2023, valued at $7.98 billion. Online retail channels have shown rapid growth potential, rising from $2.90 billion to $7.42 billion by 2033, illustrating changing consumer purchasing preferences towards digital platforms.

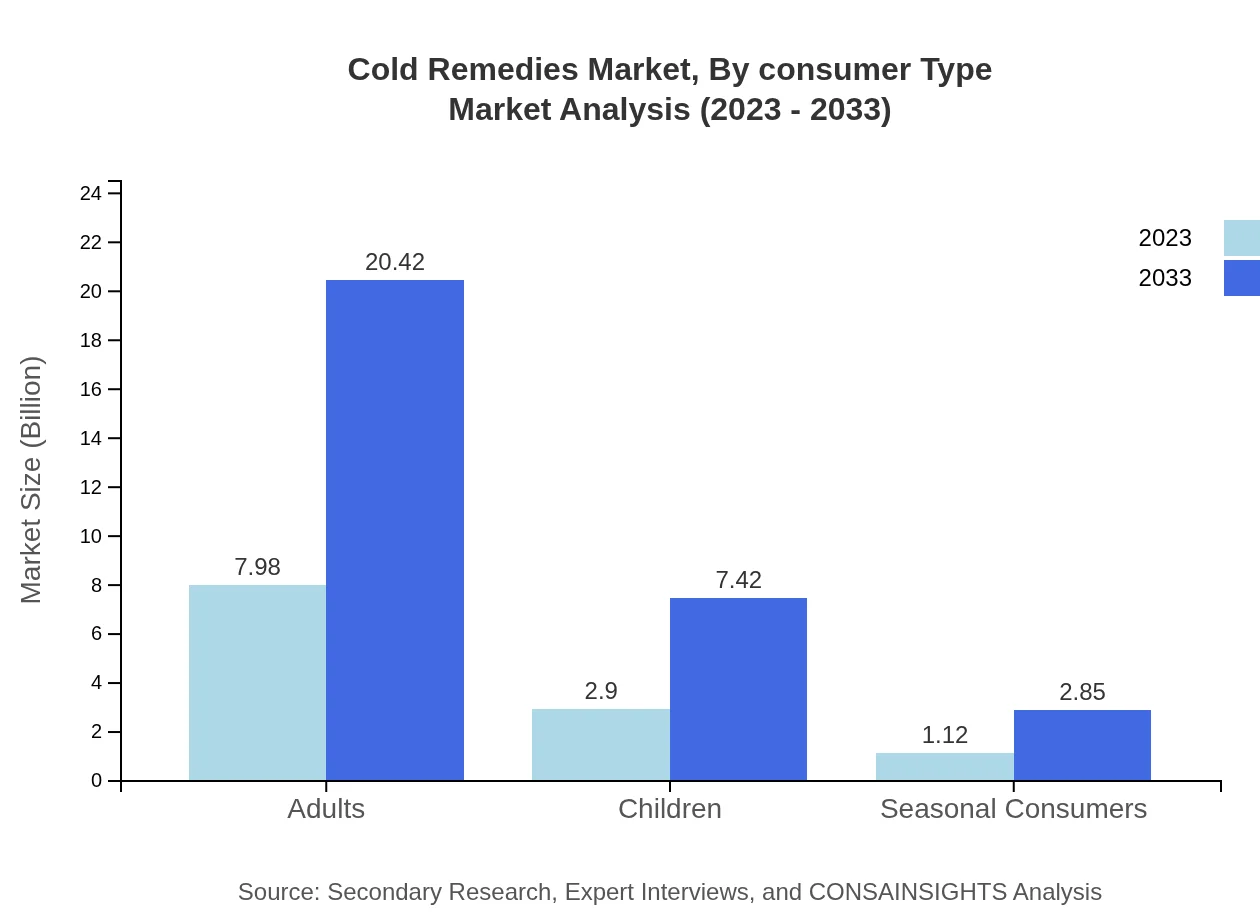

Cold Remedies Market Analysis By Consumer Type

The consumer type segmentation includes Adults, Children, and Seasonal consumers. Adults make up the largest segment, with a value of $7.98 billion in 2023, expected to expand to $20.42 billion by 2033. The children’s segment also shows growth potential, expanding from $2.90 billion to $7.42 billion, as parents increasingly turn to effective remedies for their children. Seasonal consumers represent a smaller segment, indicating steady but moderate demand.

Cold Remedies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cold Remedies Industry

Pfizer :

Pfizer is a multinational pharmaceutical corporation known for its wide range of healthcare products, including cold remedies that combine efficacy with consumer trust.Johnson & Johnson:

Johnson & Johnson is a diversified healthcare giant with a robust portfolio of cold remedy products, focusing on both OTC medications and holistic wellness solutions.Procter & Gamble:

Procter & Gamble is renowned for its consumer health products, including cold remedies, emphasizing innovative marketing and product development.GSK:

GlaxoSmithKline (GSK) is a top player in the Cold Remedies market, providing a range of OTC products that are well-known internationally.We're grateful to work with incredible clients.

FAQs

What is the market size of Cold Remedies?

The global cold remedies market is estimated to be worth approximately $12 billion in 2023, projecting a compound annual growth rate (CAGR) of 9.5%. By 2033, this market is expected to continue expanding, reflecting increasing consumer demand.

What are the key market players or companies in the Cold Remedies industry?

Some key players in the cold remedies market include major pharmaceutical companies, both global and regional, that focus on over-the-counter medications, herbal remedies, and homeopathic products. Their involvement drives innovation and market accessibility.

What are the primary factors driving the growth in the Cold Remedies industry?

Growth in the cold remedies market is driven by increasing cold incidence rates, rising healthcare awareness, and the proliferation of over-the-counter products. Furthermore, the ongoing trend towards preventive care bolsters market expansion, prompting innovation in remedy formulations.

Which region is the fastest Growing in the Cold Remedies market?

North America stands out as the fastest-growing region in the cold remedies market, with a projected growth from $4.51 billion in 2023 to $11.54 billion by 2033. Regions like Europe and Asia Pacific also exhibit significant growth trajectories.

Does ConsaInsights provide customized market report data for the Cold Remedies industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cold remedies industry. Our team can provide insights into niche segments, competitive landscape, and regional analyses according to client specifications.

What deliverables can I expect from this Cold Remedies market research project?

Deliverables from our cold remedies market research project include comprehensive reports, market projections, segmentation analysis, competitive landscape evaluations, and regional growth insights, enabling informed strategic decision-making.

What are the market trends of Cold Remedies?

The cold remedies market is exhibiting trends such as the growing preference for natural and homeopathic solutions, increased online retail sales, and the development of liquid formulations. These trends reflect shifting consumer preferences towards effective and accessible remedies.