Combination Truck Market Report

Published Date: 02 February 2026 | Report Code: combination-truck

Combination Truck Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Combination Truck market, covering market size, trends, and forecasts from 2023 to 2033. Insights include regional market performance, segmentation analysis, and profiles of key market players.

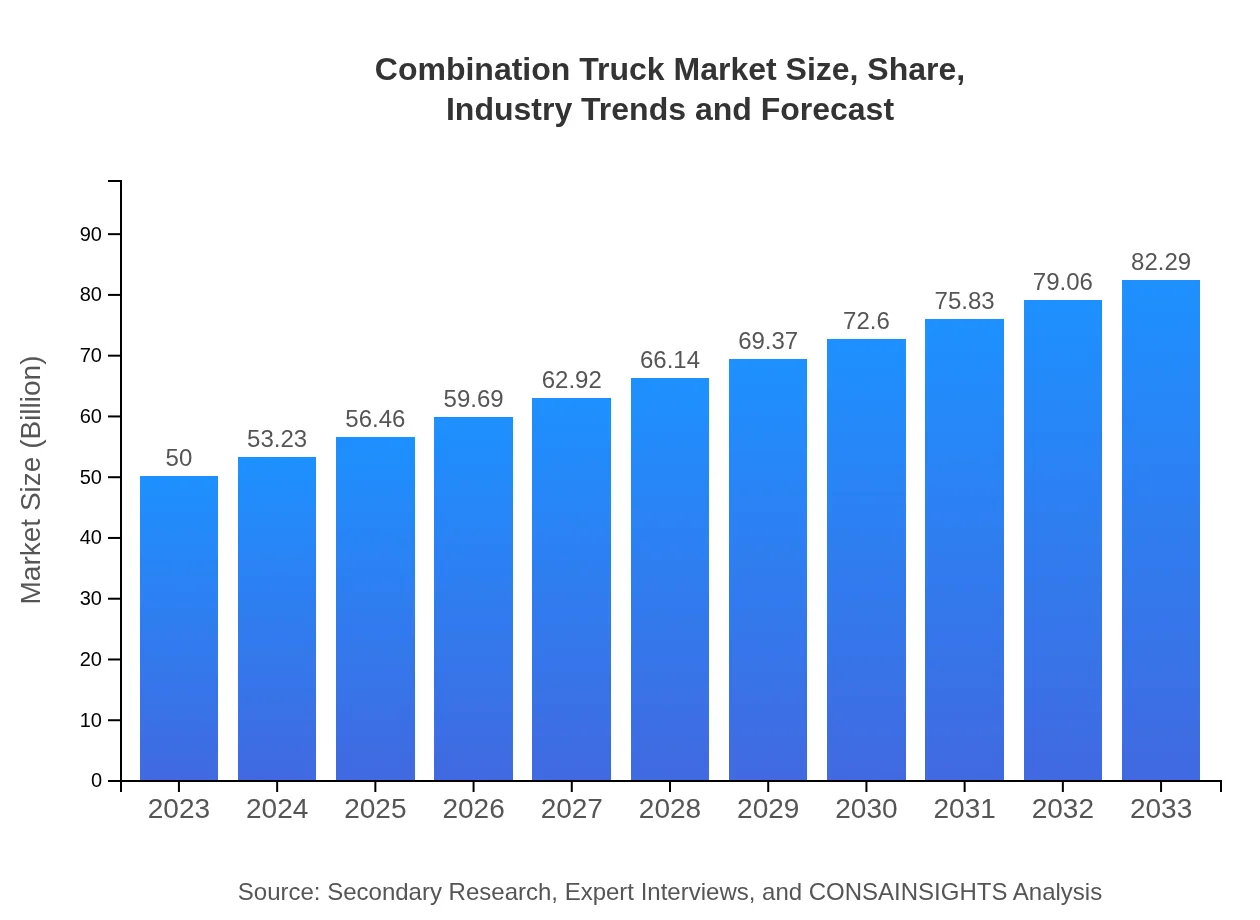

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $82.29 Billion |

| Top Companies | Daimler AG, Volvo Trucks, Paccar Inc., MAN Truck & Bus |

| Last Modified Date | 02 February 2026 |

Combination Truck Market Overview

Customize Combination Truck Market Report market research report

- ✔ Get in-depth analysis of Combination Truck market size, growth, and forecasts.

- ✔ Understand Combination Truck's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Combination Truck

What is the Market Size & CAGR of Combination Truck market in 2023?

Combination Truck Industry Analysis

Combination Truck Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Combination Truck Market Analysis Report by Region

Europe Combination Truck Market Report:

Europe's Combination Truck market stands at $14.89 billion in 2023, expected to grow to $24.50 billion by 2033. Stringent emission regulations and the strategic shift towards sustainable transportation are key drivers. Nations like Germany and France are at the forefront of adopting new technologies.Asia Pacific Combination Truck Market Report:

In 2023, the Asia Pacific Combination Truck market is valued at $9.20 billion, projected to grow to $15.14 billion by 2033. The region is witnessing rapid urbanization and industrial growth, leading to increased logistics demand. Key markets include China and India, where heavy investment in infrastructure and transportation networks is driving growth.North America Combination Truck Market Report:

North America shows a market value of $19.04 billion in 2023, growing to $31.34 billion by 2033. The U.S. is the largest market, boosted by high demand for logistics and e-commerce, alongside technological advancements in truck manufacturing, especially in electric vehicles.South America Combination Truck Market Report:

The South American market is valued at $1.22 billion in 2023 and expected to reach $2.01 billion by 2033. Brazil and Argentina lead the market, driven by expansion in agriculture and mining sectors. However, economic fluctuations pose challenges to sustained growth.Middle East & Africa Combination Truck Market Report:

The market in the Middle East and Africa is valued at $5.66 billion in 2023, increasing to $9.31 billion by 2033. Oil markets and investment in infrastructure development are pivotal for growth, primarily in countries like UAE and South Africa.Tell us your focus area and get a customized research report.

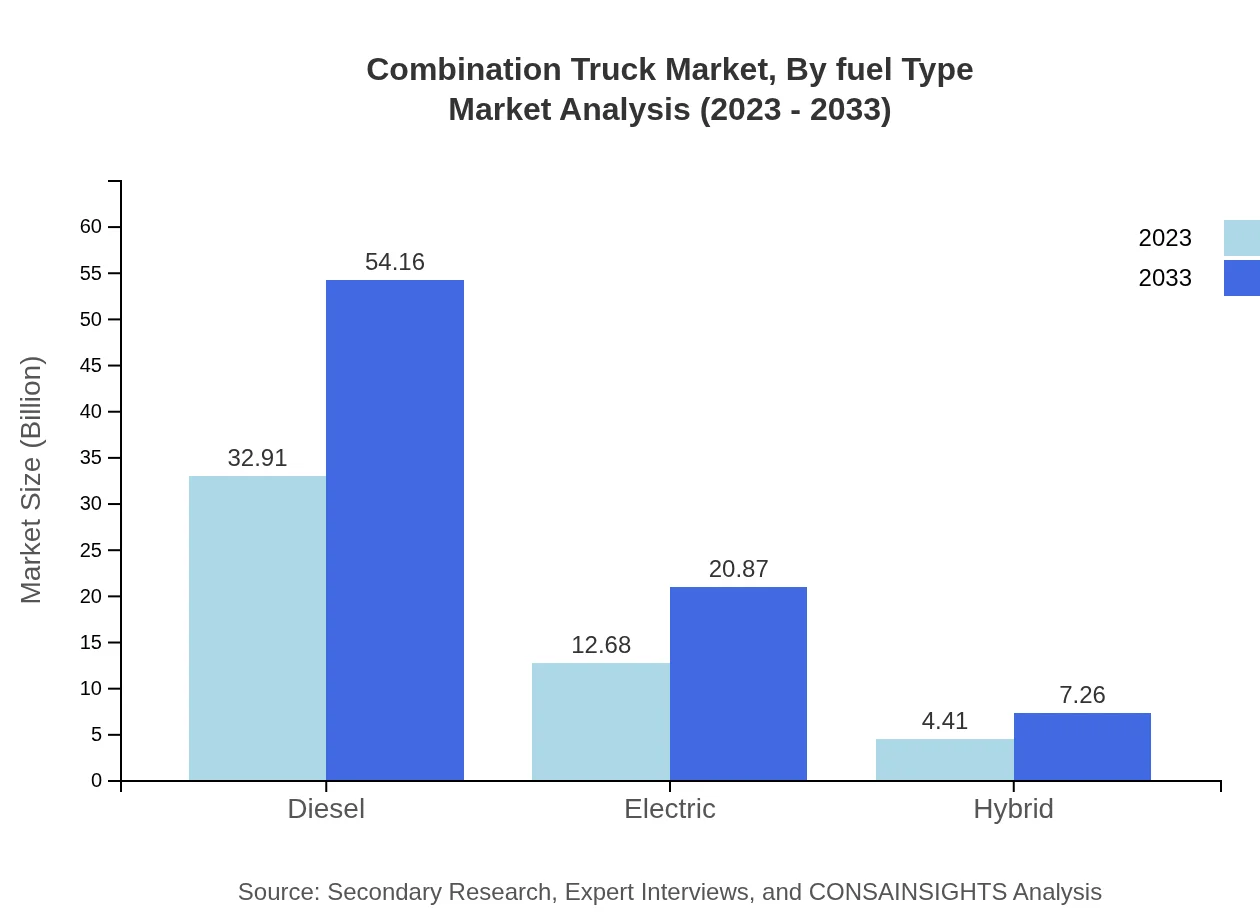

Combination Truck Market Analysis By Fuel Type

The fuel type segment reflects diverse preferences across regions. In 2023, Diesel trucks account for a significant market share valued at $32.91 billion, with a steady growth to $54.16 billion by 2033. Electric trucks are emerging with a market size of $12.68 billion in 2023, growing to $20.87 billion, acknowledging the shift towards cleaner energy. Hybrid trucks, though smaller in share, are forecasted to grow from $4.41 billion to $7.26 billion, showcasing the transitional phase for many operators.

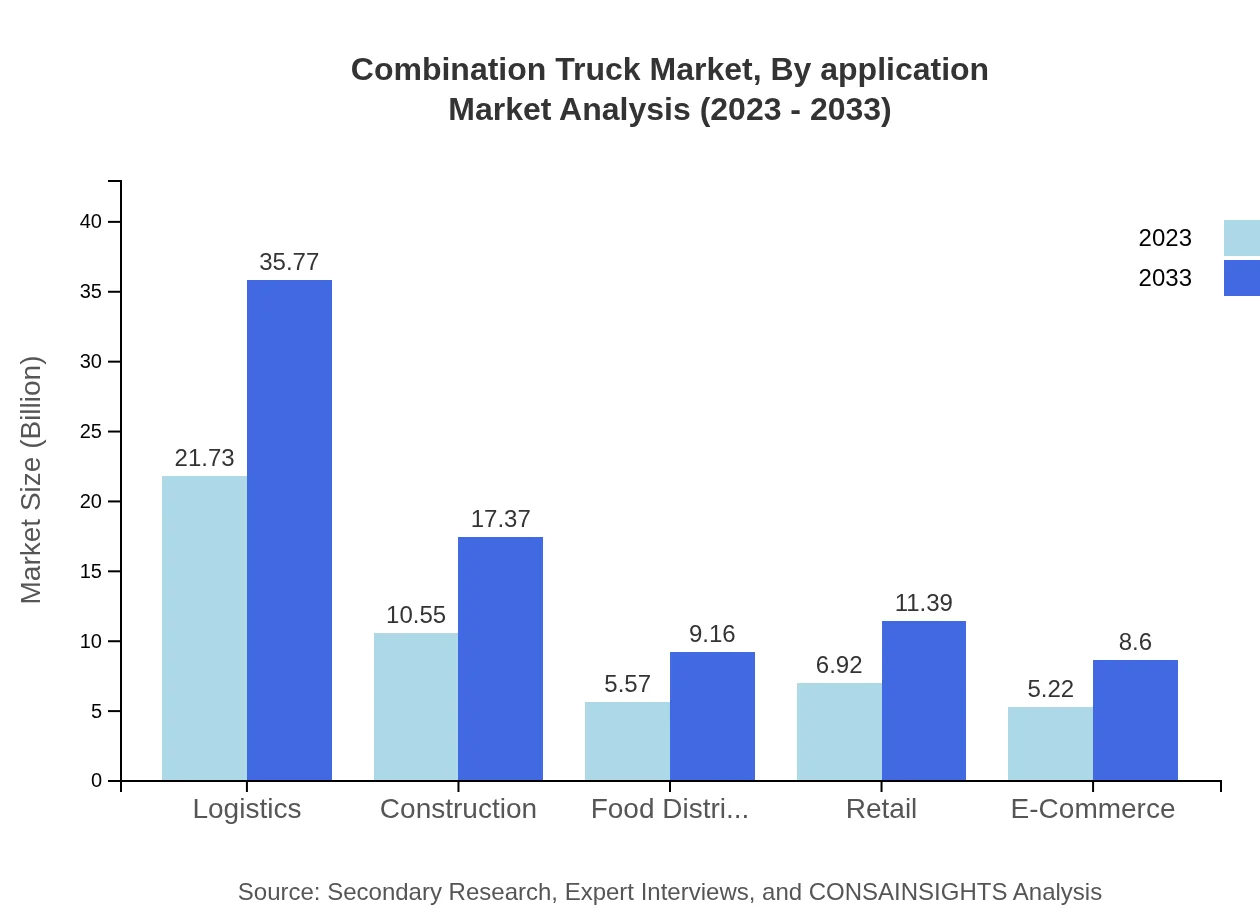

Combination Truck Market Analysis By Application

Logistics applications are the largest segment, holding a market size of $21.73 billion in 2023 and projected to grow to $35.77 billion by 2033. The construction sector follows, with current market size at $10.55 billion, expected to reach $17.37 billion. Food Distribution and Retail segments also show promise with forecasts reflecting steady growth, driven by increasing population and urban consumer trends.

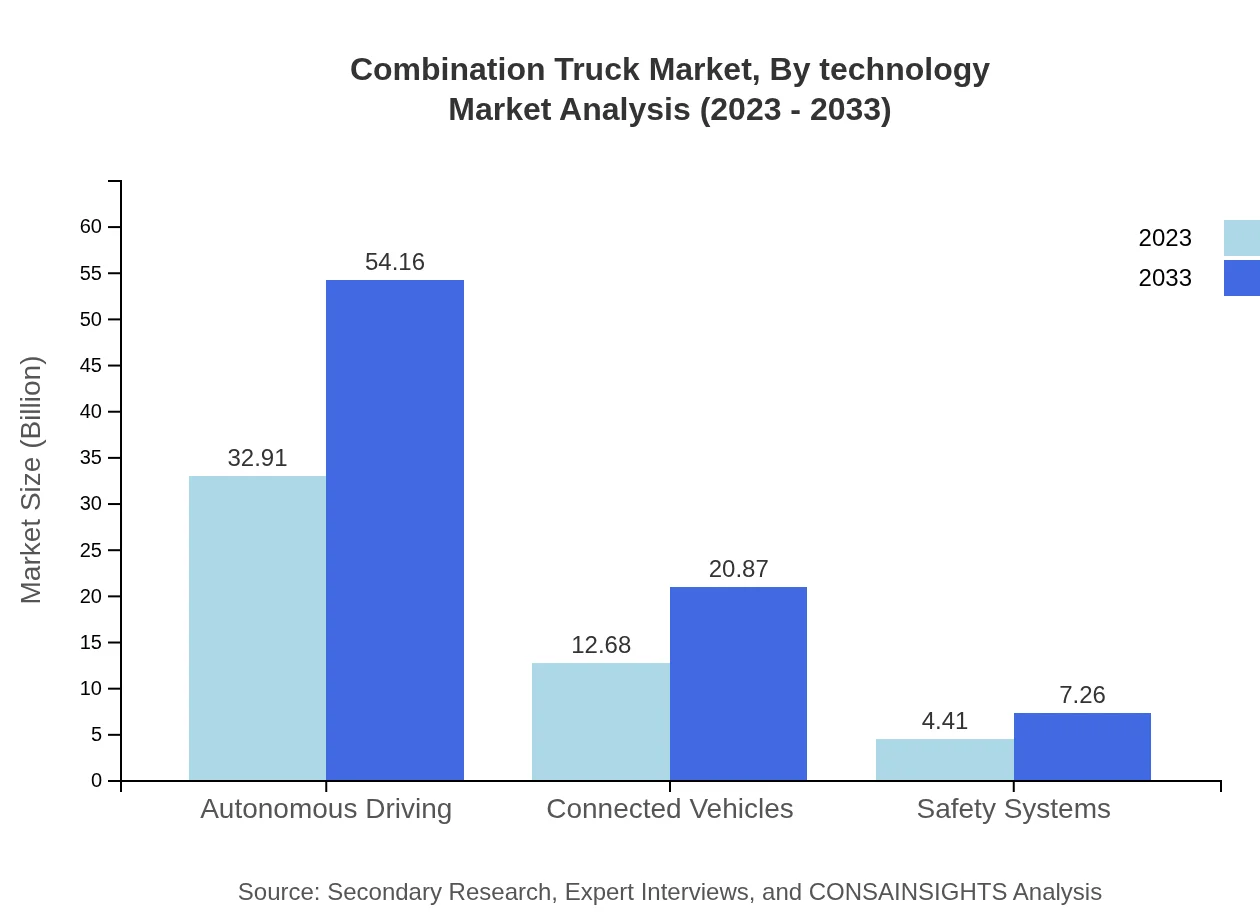

Combination Truck Market Analysis By Technology

Technological advancements significantly impact the market. Autonomous driving is projected to grow from $32.91 billion in 2023 to $54.16 billion by 2033. Connected vehicles and integrated safety systems are additional growth areas, anticipated to transform the operational landscape of the Combination Truck market. Innovations in technology not only boost efficiency but also enhance safety for drivers and cargo.

Combination Truck Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Combination Truck Industry

Daimler AG:

A dominant player in the trucking industry, Daimler AG leads in innovation with their Freightliner and Mercedes-Benz brands, significantly investing in electric and hybrid truck technology.Volvo Trucks:

Volvo Trucks is recognized for its commitment to sustainability and safety, offering a range of innovative Combination Trucks equipped with advanced safety features and fuel-efficient technologies.Paccar Inc.:

Paccar manufactures high-performance trucks under the Kenworth and Peterbilt brands, leveraging technology to enhance payload capacity and fuel efficiency.MAN Truck & Bus:

MAN focuses on developing efficiently powered trucks, promoting sustainable transport solutions through their efficient diesel and emerging electric truck offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of combination Truck?

The combination truck market is currently valued at approximately $50 billion, with a projected Compound Annual Growth Rate (CAGR) of 5% anticipated through 2033. This growth indicates a robust demand and increasing investment in the sector.

What are the key market players or companies in the combination Truck industry?

Key players in the combination truck industry include major manufacturers such as Volvo, Daimler AG, and Kenworth. These companies lead the market with advanced technologies and extensive distributions, contributing to the industry's overall growth and innovation.

What are the primary factors driving the growth in the combination truck industry?

Growth in the combination truck industry is primarily driven by the rise in e-commerce logistics demand, advancements in truck technologies like automation, and the need for sustainable transport solutions. Additionally, increasing freight transport needs bolster the industry's expansion.

Which region is the fastest Growing in the combination truck market?

North America is the fastest-growing region in the combination truck market, projected to increase from $19.04 billion in 2023 to $31.34 billion by 2033, reflecting a surge in transportation requirements and infrastructure developments in the area.

Does ConsaInsights provide customized market report data for the combination truck industry?

Yes, ConsaInsights offers customized market report data specifically tailored to the combination truck industry. Clients can dive deep into niche segments and specific regional data to make informed business decisions and strategic planning.

What deliverables can I expect from this combination truck market research project?

Clients can expect comprehensive deliverables, including detailed market analytics, segmented data, growth forecasts, competitor analysis, and tailored insights that address specific queries related to the combination truck market dynamics.

What are the market trends of combination trucks?

Current trends in the combination truck market include a shift towards electric and hybrid models, an emphasis on safety systems, and the adoption of autonomous driving technologies. These trends signify a broader move towards more efficient and environmentally friendly transportation solutions.