Heavy Duty Trucks Market Report

Published Date: 02 February 2026 | Report Code: heavy-duty-trucks

Heavy Duty Trucks Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Heavy Duty Trucks market from 2023 to 2033, shedding light on current trends, market dynamics, and future forecasts including market size and growth potential across various regions and segments.

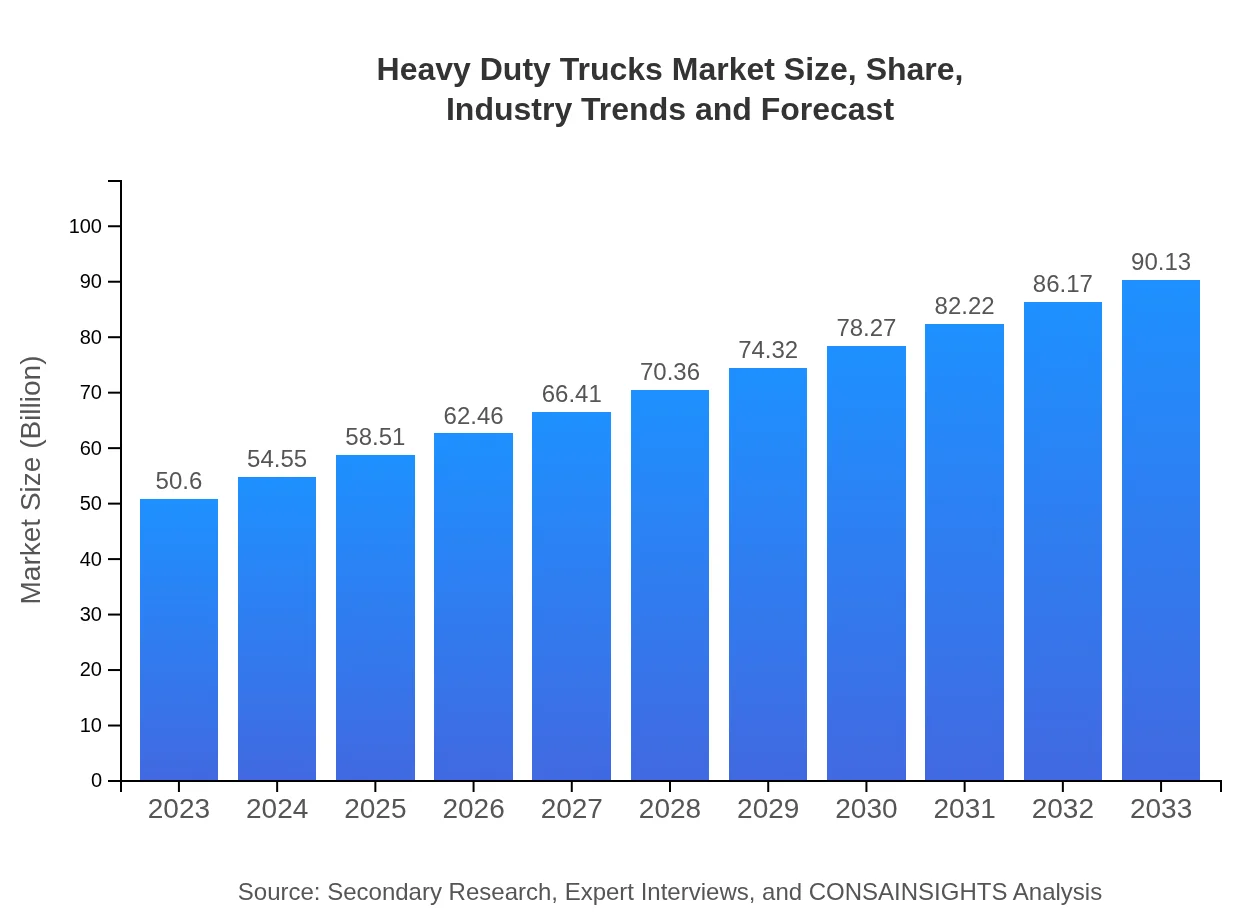

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $90.13 Billion |

| Top Companies | Daimler AG, Volvo Group, PACCAR Inc., Scania AB |

| Last Modified Date | 02 February 2026 |

Heavy Duty Trucks Market Overview

Customize Heavy Duty Trucks Market Report market research report

- ✔ Get in-depth analysis of Heavy Duty Trucks market size, growth, and forecasts.

- ✔ Understand Heavy Duty Trucks's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Heavy Duty Trucks

What is the Market Size & CAGR of Heavy Duty Trucks market in 2023?

Heavy Duty Trucks Industry Analysis

Heavy Duty Trucks Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Heavy Duty Trucks Market Analysis Report by Region

Europe Heavy Duty Trucks Market Report:

The European Heavy Duty Trucks market is forecasted to expand from $15.68 billion in 2023 to $27.93 billion by 2033, driven by stringent emission regulations and a shift towards sustainable transportation solutions. Significant investments in eco-friendly logistics will also support this growth.Asia Pacific Heavy Duty Trucks Market Report:

The Asia Pacific region's Heavy Duty Trucks market is expected to see significant growth, rising from $10.07 billion in 2023 to $17.94 billion by 2033. This growth is driven by rapid urbanization, infrastructure development, and an increase in freight transport requirements, particularly in countries like China and India, which are expanding their logistics networks.North America Heavy Duty Trucks Market Report:

North America remains the largest market for Heavy Duty Trucks, expected to grow from $17.26 billion in 2023 to $30.74 billion by 2033. The presence of major truck manufacturers and strong demand for freight services fuel this market, along with the striving for innovative diesel and alternative fuel technologies.South America Heavy Duty Trucks Market Report:

In South America, the market value is projected to grow from $4.98 billion in 2023 to $8.88 billion in 2033, thanks to the growing emphasis on improving road infrastructure and the mining sector's demand for heavy trucks to transport resources efficiently.Middle East & Africa Heavy Duty Trucks Market Report:

The Middle East and Africa region’s market is anticipated to grow from $2.61 billion in 2023 to $4.64 billion in 2033. This growth is attributed to rising investments in infrastructure projects and the increasing demand for robust transportation capabilities across various industries.Tell us your focus area and get a customized research report.

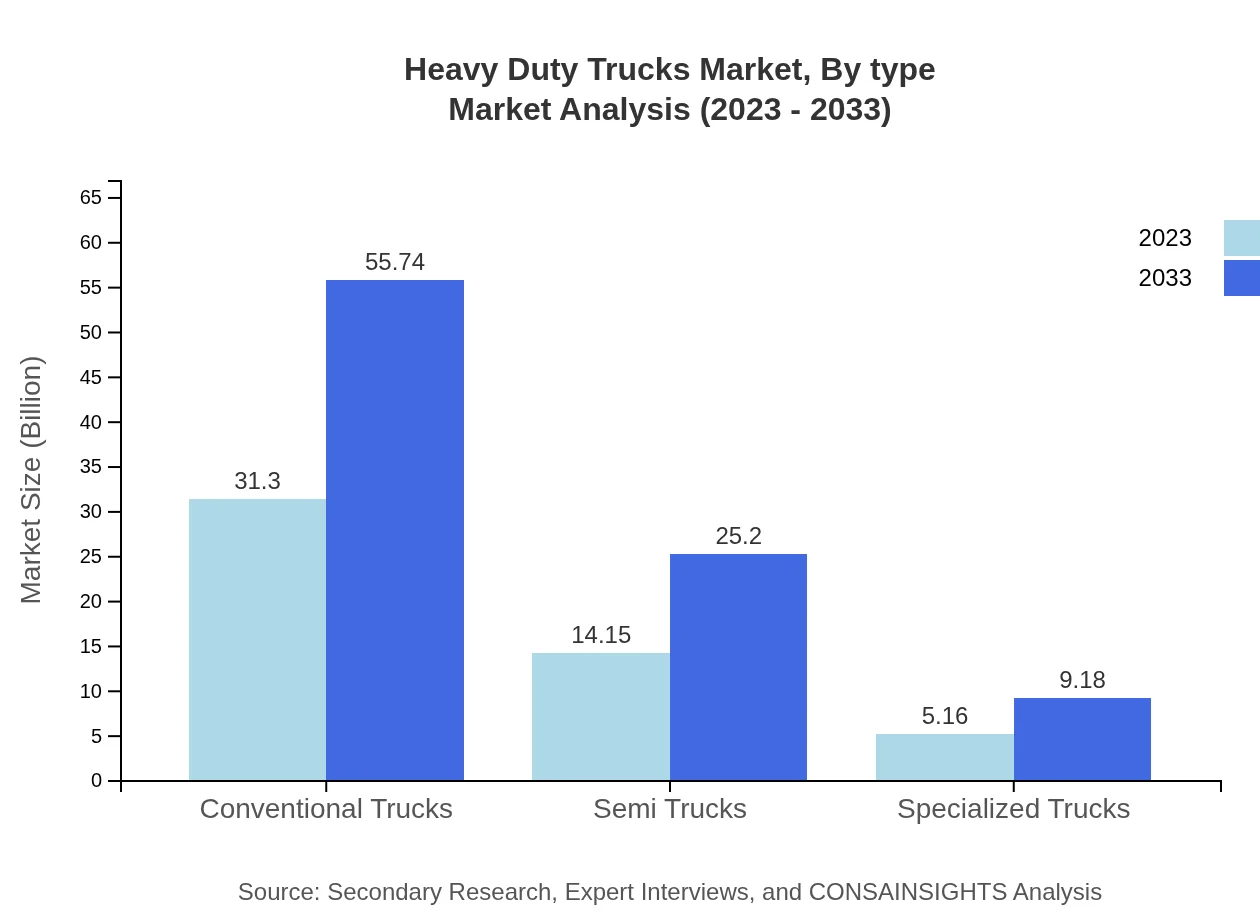

Heavy Duty Trucks Market Analysis By Type

The market shows significant performance across various truck categories, with Conventional Trucks leading the market size, expected to increase from $31.30 billion in 2023 to $55.74 billion by 2033. Semi Trucks, although smaller, maintain a crucial share, anticipated to grow from $14.15 billion to $25.20 billion, indicating the continued demand for specialized transportation needs. Specialized Trucks hold a valuable niche with growth from $5.16 billion to $9.18 billion over the same period.

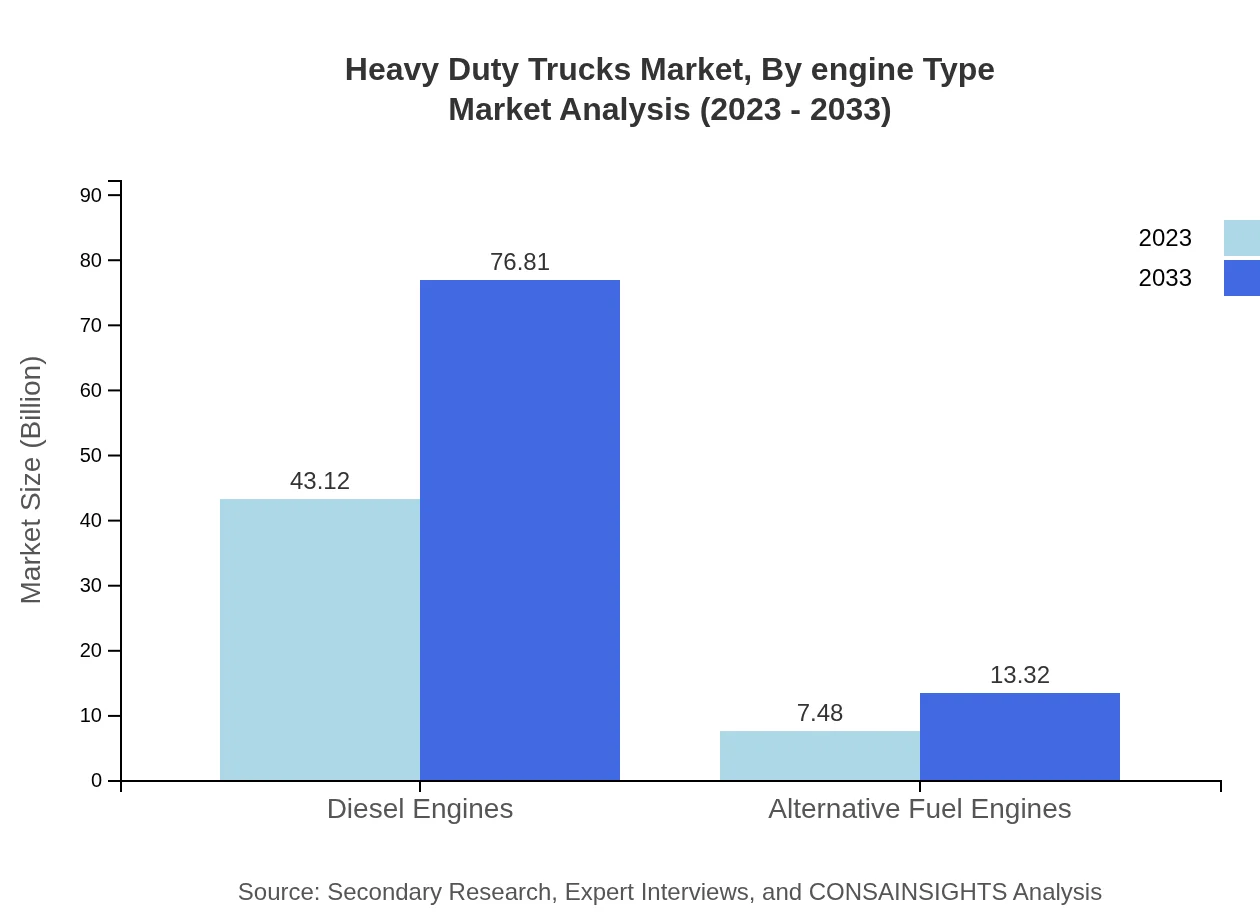

Heavy Duty Trucks Market Analysis By Engine Type

The engines segment in the Heavy Duty Trucks market shows a marked preference for Diesel Engines due to their efficiency and performance, expected to expand from $43.12 billion to $76.81 billion from 2023 to 2033. There is an increasing interest in Alternative Fuel Engines, set to grow from $7.48 billion to $13.32 billion, fueled by sustainability concerns.

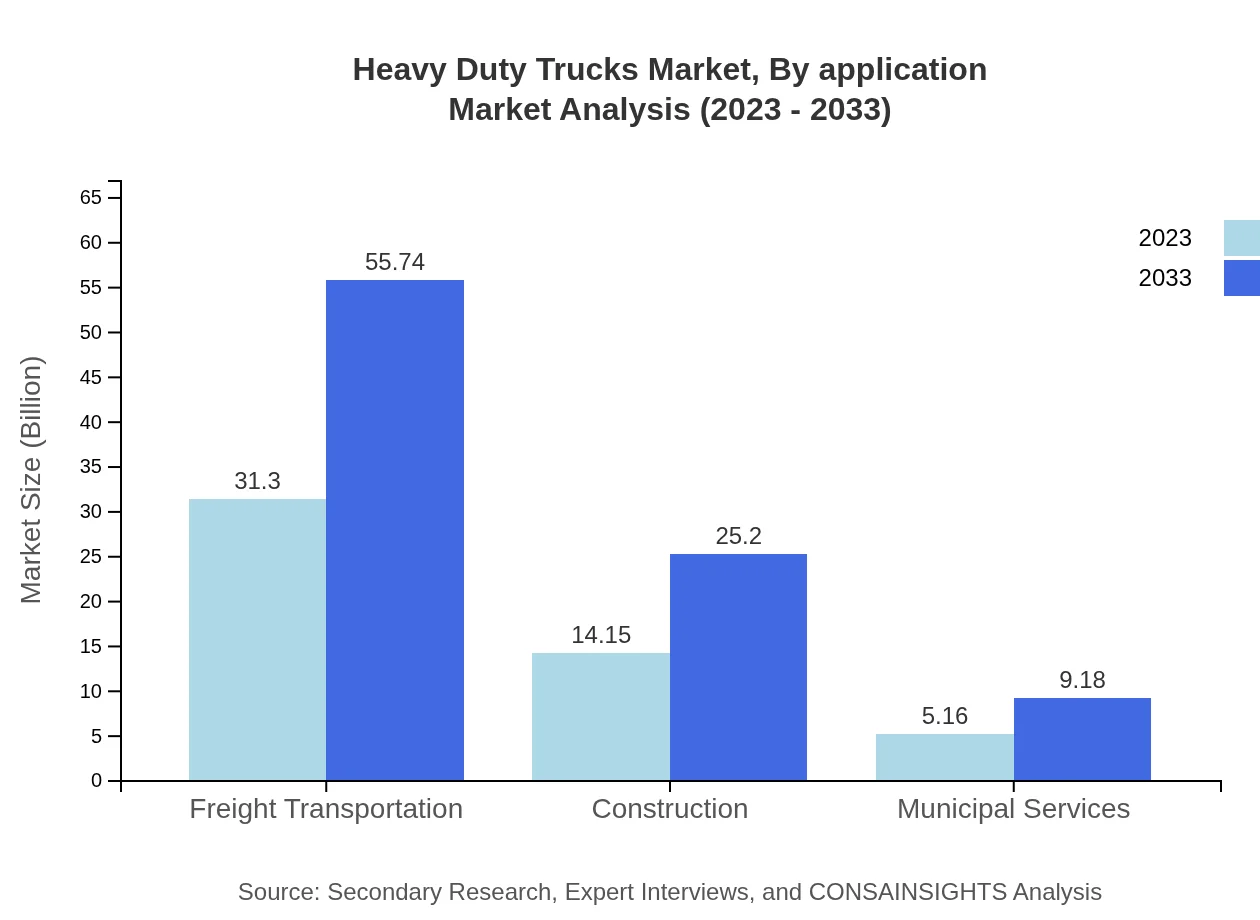

Heavy Duty Trucks Market Analysis By Application

The application segment reveals that Freight Transportation is the dominant sector, anticipated to escalate from $31.30 billion to $55.74 billion by 2033. The Construction application is expected to increase from $14.15 billion to $25.20 billion, while Municipal Services will see healthy growth from $5.16 billion to $9.18 billion, adapting to growing urbanization demands.

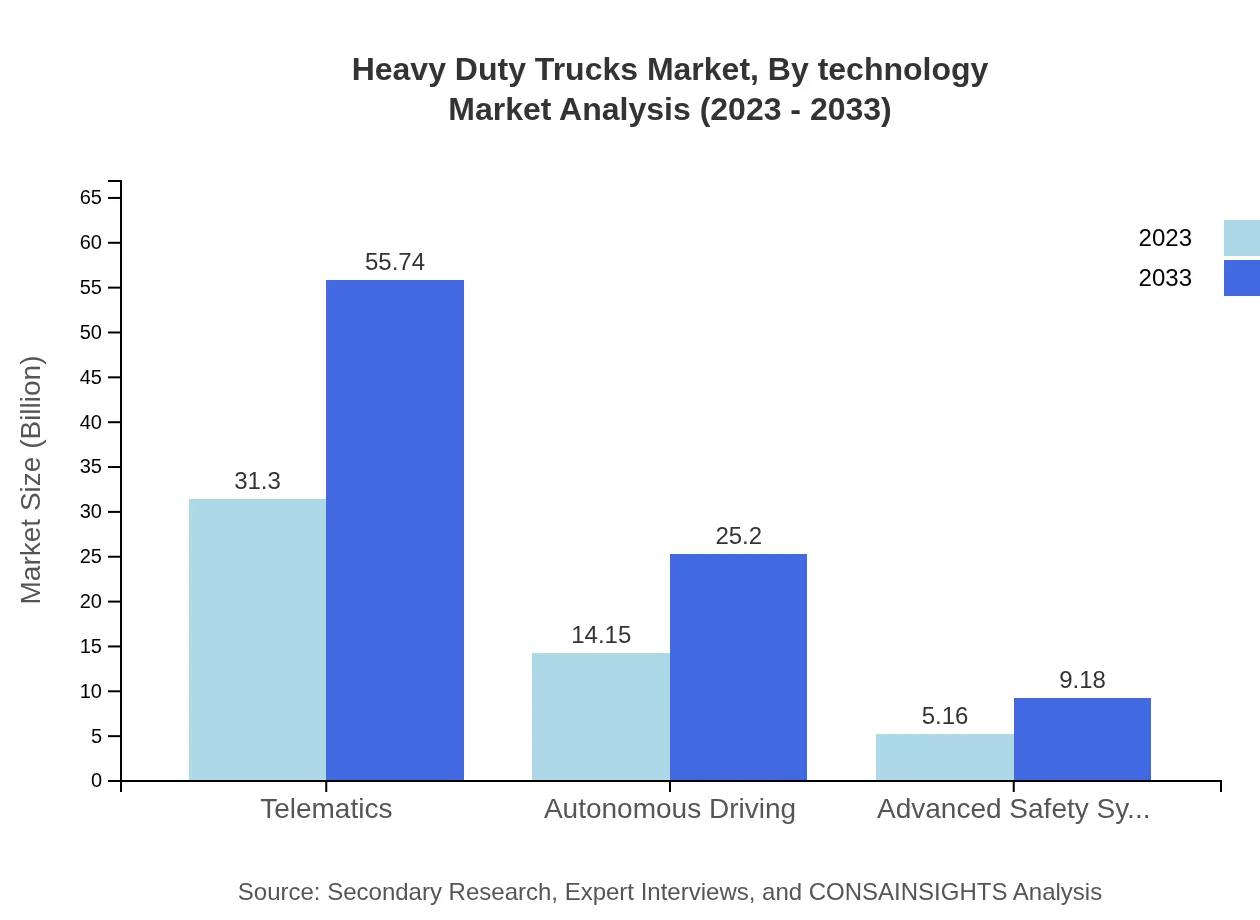

Heavy Duty Trucks Market Analysis By Technology

The technology landscape reflects a significant shift towards digital and automated solutions, notably with Telematics growing parallel to market demands, likely to rise from $31.30 billion to $55.74 billion. Autonomous Driving technologies and Advanced Safety Systems illustrate progressive advancements with respective projections from $14.15 billion to $25.20 billion and from $5.16 billion to $9.18 billion.

Heavy Duty Trucks Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Heavy Duty Trucks Industry

Daimler AG:

Daimler AG is one of the largest manufacturers of heavy-duty trucks globally and is recognized for its innovations in alternative fuel technologies and advanced safety features.Volvo Group:

Volvo Group is a significant player in the heavy-duty truck market, pushing advancements in fuel efficiency and autonomous driving capabilities.PACCAR Inc.:

PACCAR has established a solid reputation for producing high-quality heavy-duty trucks like Kenworth and Peterbilt, focusing on durability and performance.Scania AB:

Scania is known for its progressive approaches in sustainability and efficient engine designs, catering to the growing demand for eco-friendly solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of heavy Duty trucks?

The global market size for heavy-duty trucks is estimated at $50.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.8%. This robust growth indicates a strong demand in the coming years.

What are the key market players or companies in this heavy Duty truck industry?

Key players in the heavy-duty truck industry include leading manufacturers such as Daimler AG, Volvo Group, PACCAR Inc., and Navistar International Corporation. These companies dominate the market through innovation, quality, and extensive distribution networks.

What are the primary factors driving the growth in the heavy Duty truck industry?

Factors contributing to the growth of the heavy-duty truck industry include increasing demand for freight transport, advancements in technology, regulatory changes promoting eco-friendly vehicles, and expansion in construction and logistics sectors.

Which region is the fastest Growing in the heavy Duty truck market?

North America stands out as the fastest-growing region in the heavy-duty truck market, with the market expected to grow from $17.26 billion in 2023 to $30.74 billion by 2033, reflecting a strong upward trend.

Does Consainsights provide customized market report data for the heavy Duty truck industry?

Yes, Consainsights offers customized market report data tailored to specific client needs in the heavy-duty truck industry, ensuring that companies receive the insights necessary for informed decision-making and strategic planning.

What deliverables can I expect from this heavy Duty truck market research project?

Deliverables from the heavy-duty truck market research project include comprehensive market analysis reports, segmentation insights, forecasts, competitive landscape assessments, and actionable recommendations tailored to your business objectives.

What are the market trends of heavy Duty trucks?

Key market trends include the rise of telematics and autonomous driving technologies, increased investment in alternative fuel engines, and a growing emphasis on advanced safety systems, all aiming to enhance operational efficiency and sustainability.