Commercial Refrigeration Equipment Market Report

Published Date: 02 February 2026 | Report Code: commercial-refrigeration-equipment

Commercial Refrigeration Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Refrigeration Equipment market, covering key insights, trends, and data from 2023 to 2033. It includes market size, growth forecast, segmentation, regional analysis, and insights into leading players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

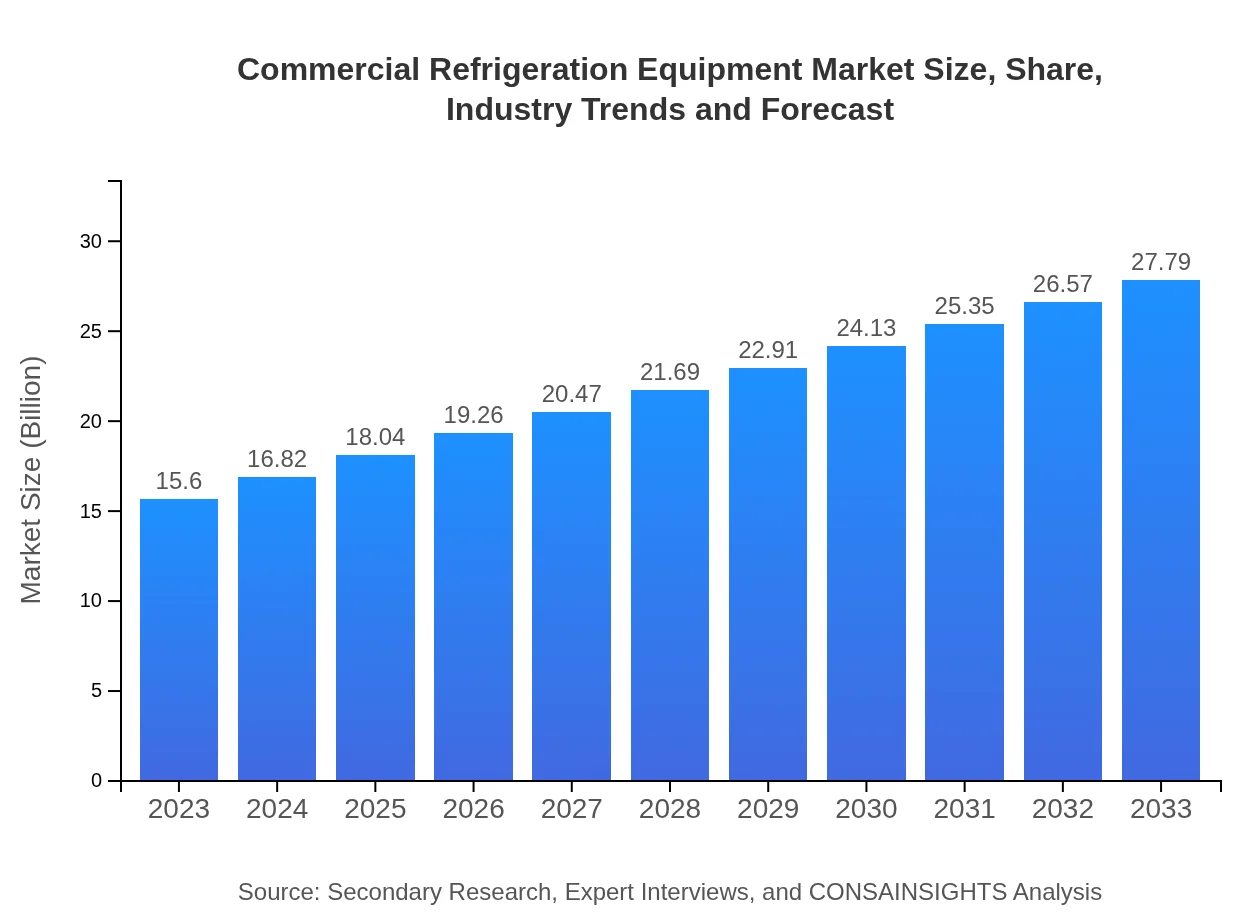

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Carrier Global Corporation, Electrolux Professional, Hoshizaki Corporation, True Manufacturing |

| Last Modified Date | 02 February 2026 |

Commercial Refrigeration Equipment Market Overview

Customize Commercial Refrigeration Equipment Market Report market research report

- ✔ Get in-depth analysis of Commercial Refrigeration Equipment market size, growth, and forecasts.

- ✔ Understand Commercial Refrigeration Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Refrigeration Equipment

What is the Market Size & CAGR of Commercial Refrigeration Equipment market in 2023?

Commercial Refrigeration Equipment Industry Analysis

Commercial Refrigeration Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Refrigeration Equipment Market Analysis Report by Region

Europe Commercial Refrigeration Equipment Market Report:

Europe is currently at $4.32 billion and is expected to rise to $7.70 billion by 2033. The market is influenced by strict environmental regulations and technological advancements in refrigeration equipment. Key countries like Germany, France, and the UK are pushing for energy-efficient systems due to increasing consumer awareness regarding sustainability.Asia Pacific Commercial Refrigeration Equipment Market Report:

In Asia Pacific, the market size was $3.00 billion in 2023, projected to reach $5.35 billion by 2033. The region benefits from rapid urbanization, increased disposable incomes, and a booming food service sector, driving demand for refrigeration solutions. Countries like China and India are leading the growth due to expansive retail networks and a rise in food safety standards.North America Commercial Refrigeration Equipment Market Report:

North America's market is valued at $5.73 billion in 2023, with forecasts suggesting it will expand to $10.21 billion by 2033. The U.S. and Canada lead in adopting advanced refrigeration technologies, driven by sustainability mandates, consumer demand for fresh food, and a growing trend in online grocery shopping requiring efficient distribution systems.South America Commercial Refrigeration Equipment Market Report:

The South American market starts at $1.24 billion in 2023 and is expected to grow to $2.21 billion by 2033. Brazil is the primary market in the region, benefiting from an increase in the food retail sector and hospitality services, amid efforts to improve logistics and infrastructure efficiency.Middle East & Africa Commercial Refrigeration Equipment Market Report:

The Middle East and Africa region has a market value of $1.31 billion in 2023, with a projected growth to $2.33 billion by 2033. The GCC countries are experiencing heightened investment in food retail and hospitality sectors, along with improved infrastructure that supports the refrigeration market's growth.Tell us your focus area and get a customized research report.

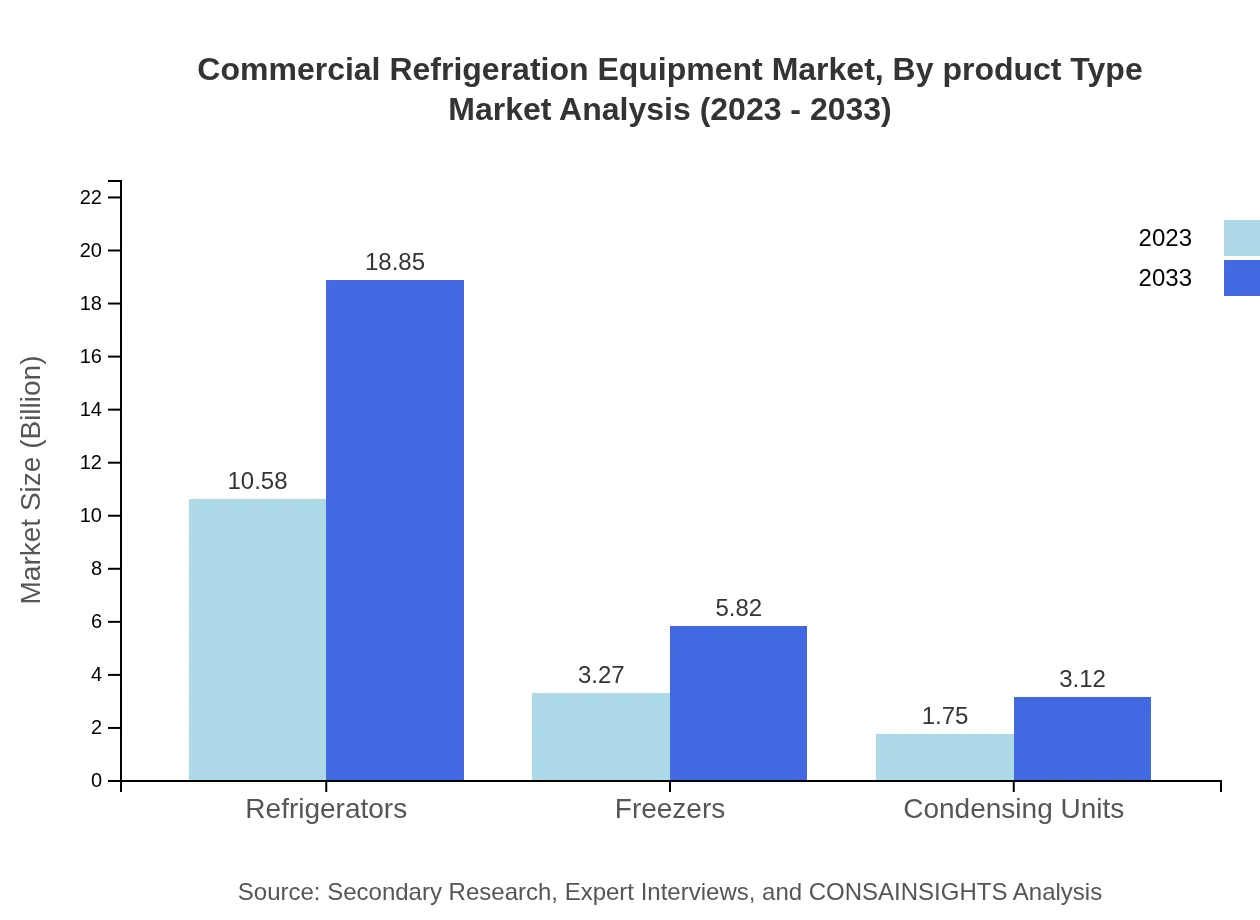

Commercial Refrigeration Equipment Market Analysis By Product Type

Refrigerators dominate the commercial refrigeration market with a size of $10.58 billion in 2023, set to rise to $18.85 billion by 2033, maintaining a significant market share of 67.83%. Freezers follow with a current market size of $3.27 billion, projected to grow to $5.82 billion, holding a market share of 20.93%, while condensing units are expected to reach $3.12 billion from $1.75 billion by 2033.

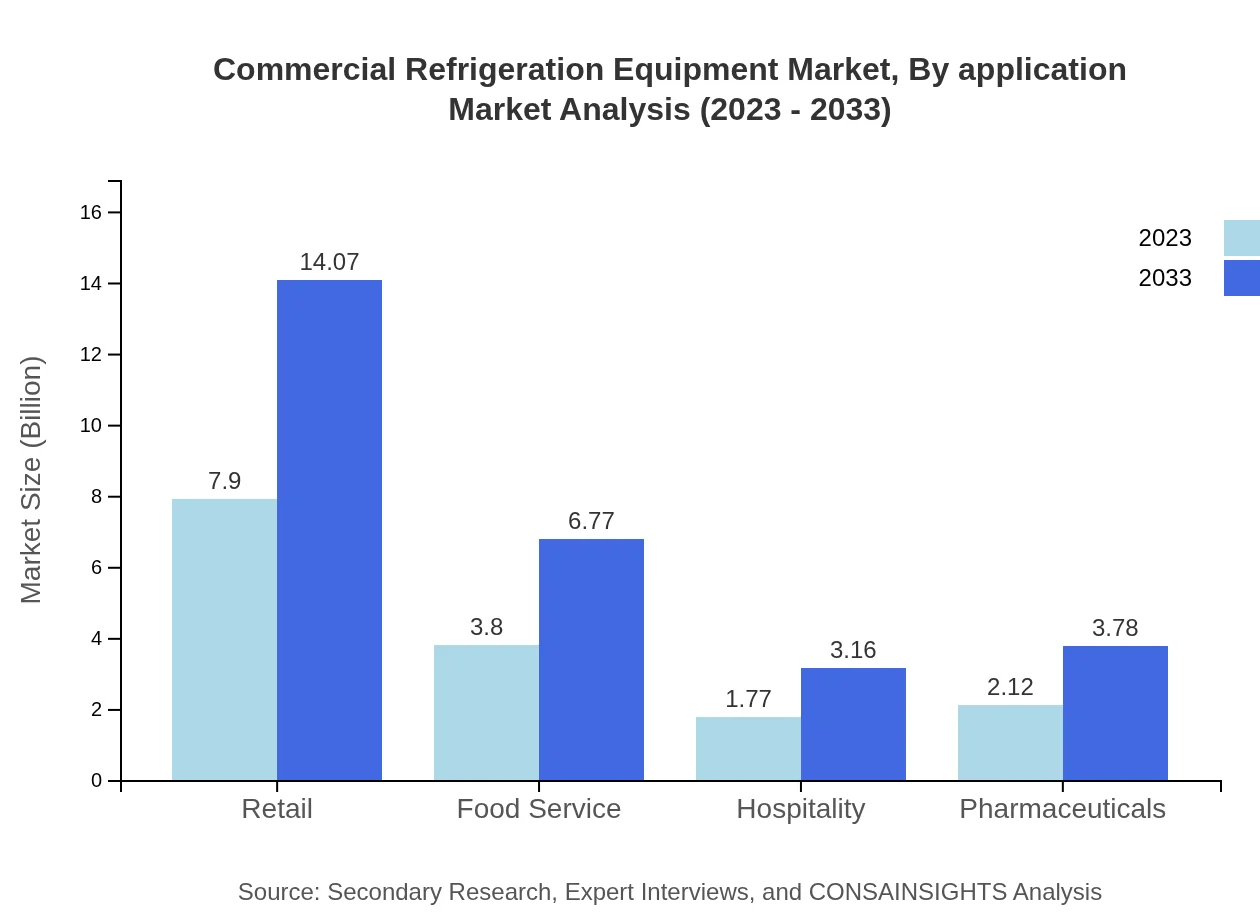

Commercial Refrigeration Equipment Market Analysis By Application

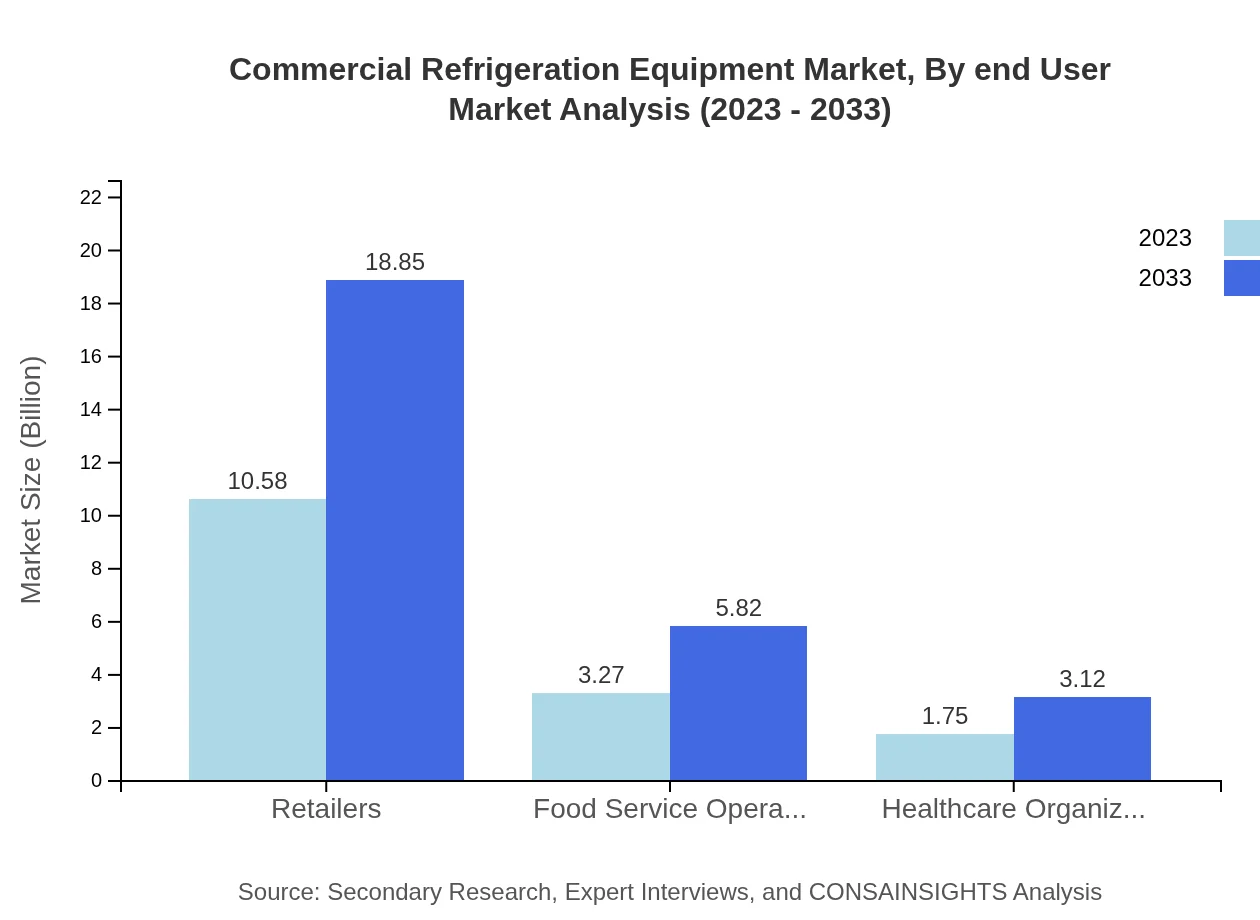

Retailers account for a substantial segment of the market size, valued at $10.58 billion in 2023, expanding to $18.85 billion by 2033. Food service operators, valued at $3.27 billion in 2023, are projected to increase to $5.82 billion, emphasizing the growing trend of convenience dining and food delivery services.

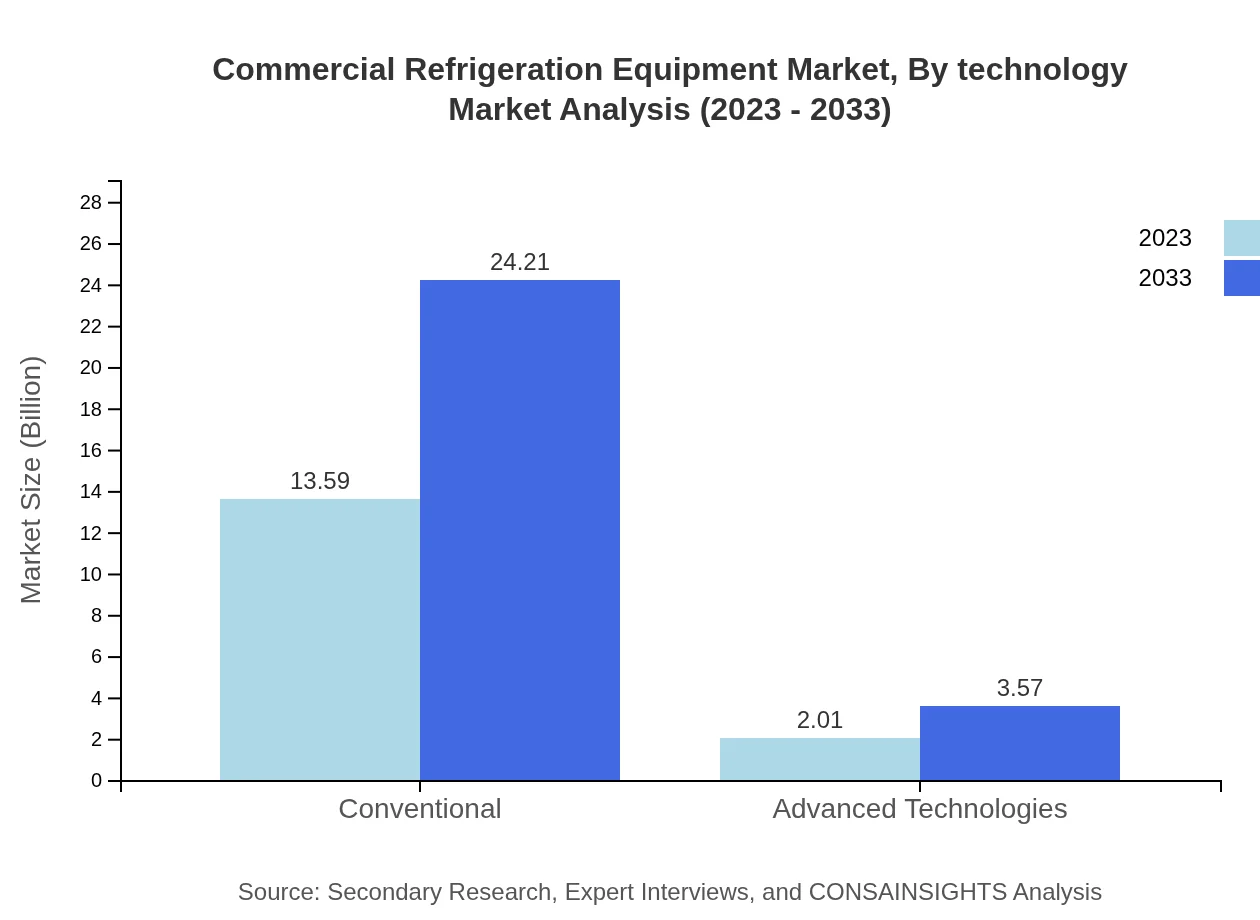

Commercial Refrigeration Equipment Market Analysis By Technology

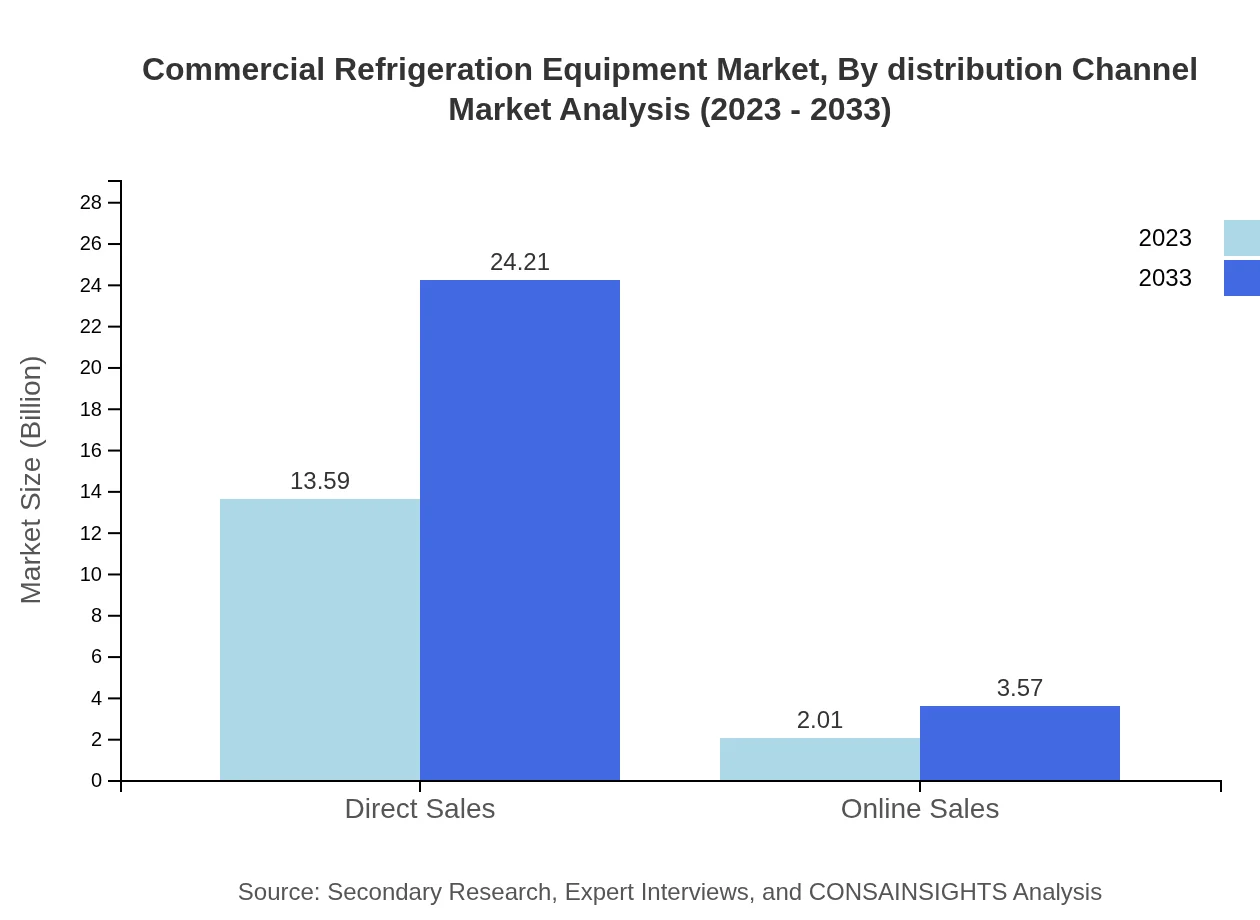

Conventional refrigeration technologies command a large share, currently at $13.59 billion, expected to rise to $24.21 billion by 2033, accounting for 87.14%. Meanwhile, advanced technologies are set to grow from $2.01 billion to $3.57 billion, indicating a shift towards more innovative, eco-friendly solutions.

Commercial Refrigeration Equipment Market Analysis By End User

Healthcare organizations represent a growing segment, from $1.75 billion in 2023 to $3.12 billion by 2033, highlighting the increased focus on biologics and pharmaceuticals that require strict temperature controls.

Commercial Refrigeration Equipment Market Analysis By Distribution Channel

Direct sales remain the dominant distribution channel, valued at $13.59 billion in 2023, set to grow to $24.21 billion by 2033. This reflects a preference for established manufacturers. Online sales, while smaller, show promise, increasing from $2.01 billion to $3.57 billion.

Commercial Refrigeration Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Refrigeration Equipment Industry

Carrier Global Corporation:

A pioneer in HVAC and refrigeration markets, Carrier is known for innovative solutions that enhance energy efficiency in commercial refrigeration.Electrolux Professional:

Electrolux provides premium commercial refrigeration solutions, focusing on sustainability and energy-efficient products.Hoshizaki Corporation:

Globally recognized for quality ice-making and storage equipment as well as professional refrigeration solutions for the food service industry.True Manufacturing:

Leading manufacturer of refrigeration products, provides high-quality, energy-efficient refrigeration solutions for the food service and retail sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial refrigeration equipment?

The global commercial refrigeration equipment market is valued at approximately $15.6 billion in 2023 and is projected to grow at a CAGR of 5.8% over the next decade. By 2033, the market size is expected to significantly increase, reflecting the growing demand.

What are the key market players or companies in the commercial refrigeration equipment industry?

Key players in the commercial refrigeration equipment industry include major manufacturers such as Carrier, Daikin, Trane, Hussmann, and Emerson. These companies lead the market with innovative technologies and a strong distribution network, contributing to a competitive landscape.

What are the primary factors driving the growth in the commercial refrigeration equipment industry?

The growth in the commercial refrigeration equipment market is driven by factors such as the rise in food safety regulations, increasing demand for frozen and refrigerated food products, and the expansion of the foodservice sector globally, fueling the need for efficient refrigeration solutions.

Which region is the fastest Growing in the commercial refrigeration equipment?

The fastest-growing region in the commercial refrigeration equipment market is North America, projected to reach $10.21 billion by 2033. This growth is attributed to high consumer demand and investments in advanced refrigeration technologies across the region.

Does ConsaInsights provide customized market report data for the commercial refrigeration equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the commercial refrigeration equipment industry. Clients can request detailed insights and analysis that align with their strategic objectives and market requirements.

What deliverables can I expect from this commercial refrigeration equipment market research project?

Deliverables from the commercial refrigeration equipment market research project include comprehensive reports, trend analysis, competitive landscape insights, market forecasts, and detailed segmentation data, ensuring valuable information for strategic decision-making.

What are the market trends of commercial refrigeration equipment?

Market trends in the commercial refrigeration equipment sector include increased adoption of energy-efficient solutions, a shift towards online sales channels, and the integration of advanced technologies such as IoT. These trends are shaping future developments.