Companion Animal Pharmaceuticals Market Report

Published Date: 31 January 2026 | Report Code: companion-animal-pharmaceuticals

Companion Animal Pharmaceuticals Market Size, Share, Industry Trends and Forecast to 2033

This market report covers the Companion Animal Pharmaceuticals industry, providing insights and data for the forecast period of 2023 to 2033. It includes comprehensive analysis on market trends, size, segmentation, and regional insights, along with a spotlight on key players in the field.

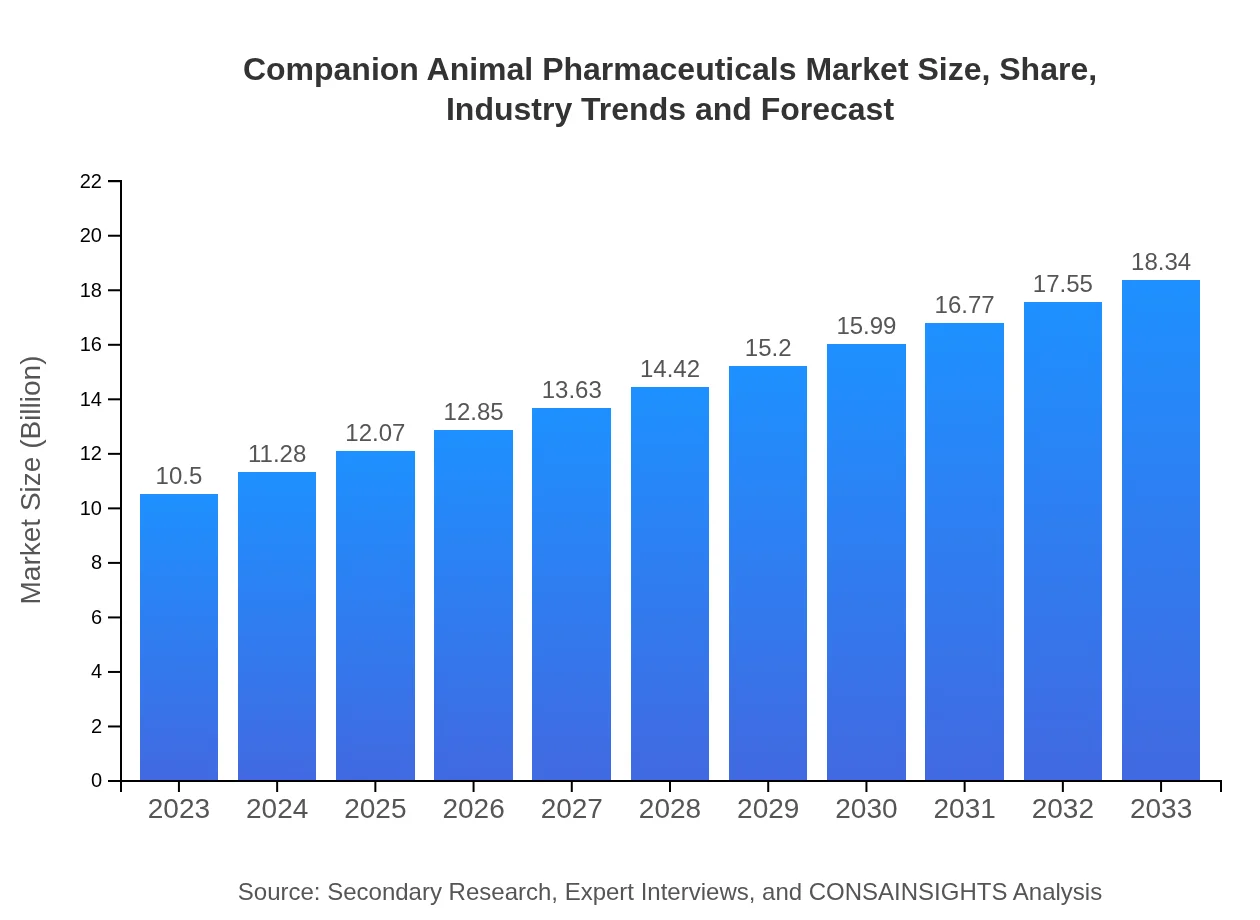

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $18.34 Billion |

| Top Companies | Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Elanco Animal Health, Vetoquinol |

| Last Modified Date | 31 January 2026 |

Companion Animal Pharmaceuticals Market Overview

Customize Companion Animal Pharmaceuticals Market Report market research report

- ✔ Get in-depth analysis of Companion Animal Pharmaceuticals market size, growth, and forecasts.

- ✔ Understand Companion Animal Pharmaceuticals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Companion Animal Pharmaceuticals

What is the Market Size & CAGR of Companion Animal Pharmaceuticals market in 2023?

Companion Animal Pharmaceuticals Industry Analysis

Companion Animal Pharmaceuticals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Companion Animal Pharmaceuticals Market Analysis Report by Region

Europe Companion Animal Pharmaceuticals Market Report:

In Europe, the market is anticipated to increase from $3.28 billion in 2023 to $5.72 billion by 2033. Strong regulatory frameworks and the presence of leading pharmaceutical companies are significant contributors to the market's growth. Europe’s focus on pet welfare and health standards parallels a rise in demand for high-quality pharmaceuticals and veterinary services.Asia Pacific Companion Animal Pharmaceuticals Market Report:

In the Asia Pacific region, the Companion Animal Pharmaceuticals market is projected to grow from $2.00 billion in 2023 to $3.49 billion by 2033. Factors driving this growth include increasing pet ownership rates and a growing middle class with disposable income. The region is seeing significant investment in veterinary services and awareness of animal healthcare, further bolstering market demand.North America Companion Animal Pharmaceuticals Market Report:

North America remains the largest market, with an estimated value of $3.54 billion in 2023, expected to reach $6.18 billion by 2033. This growth is propelled by the high per capita spending on pets and advancements in veterinary pharmaceuticals. The region is also a leader in innovation and regulatory compliance, contributing to a robust market landscape.South America Companion Animal Pharmaceuticals Market Report:

The Companion Animal Pharmaceuticals market in South America is expected to grow from $1.04 billion in 2023 to $1.81 billion in 2033. Rising pet ownership coupled with an increased focus on veterinary care are key factors influencing growth. However, challenges such as economic fluctuations in the region may affect spending on pet healthcare.Middle East & Africa Companion Animal Pharmaceuticals Market Report:

The Middle East and Africa market is estimated at $0.66 billion in 2023, growing to $1.14 billion by 2033. This region presents opportunities for growth through a rise in pet ownership and enhanced healthcare awareness. However, market growth may be constrained by limited access to veterinary services in underdeveloped areas.Tell us your focus area and get a customized research report.

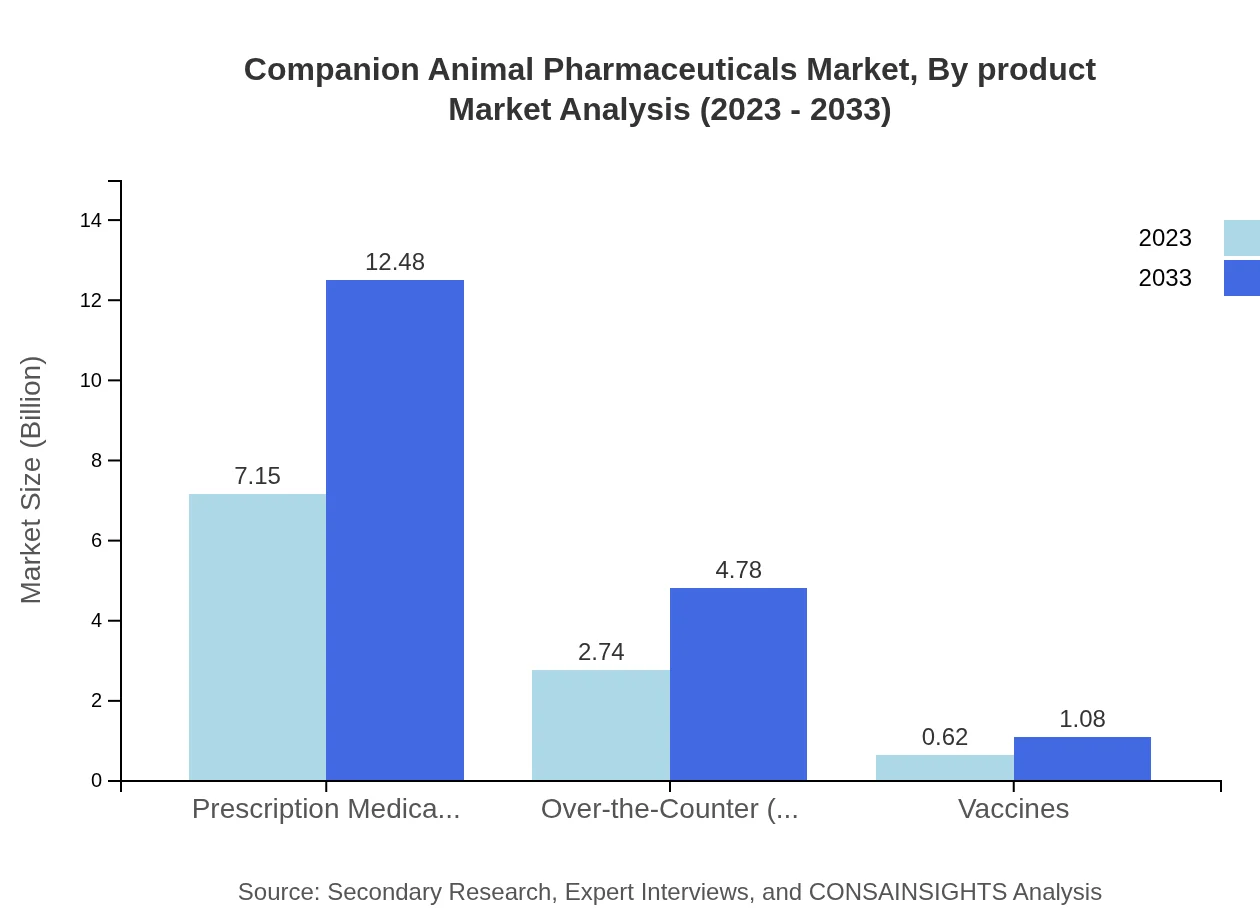

Companion Animal Pharmaceuticals Market Analysis By Product

The product segment of the Companion Animal Pharmaceuticals market includes prescription medications, over-the-counter (OTC) products, and vaccines. In 2023, prescription medications will hold a substantial market share valued at $7.15 billion, with predictions of reaching $12.48 billion by 2033. OTC products, valued at $2.74 billion in 2023, are also expected to grow significantly. Vaccines, though a smaller segment with $0.62 billion in 2023, will show robust growth as pet vaccination programs gain traction.

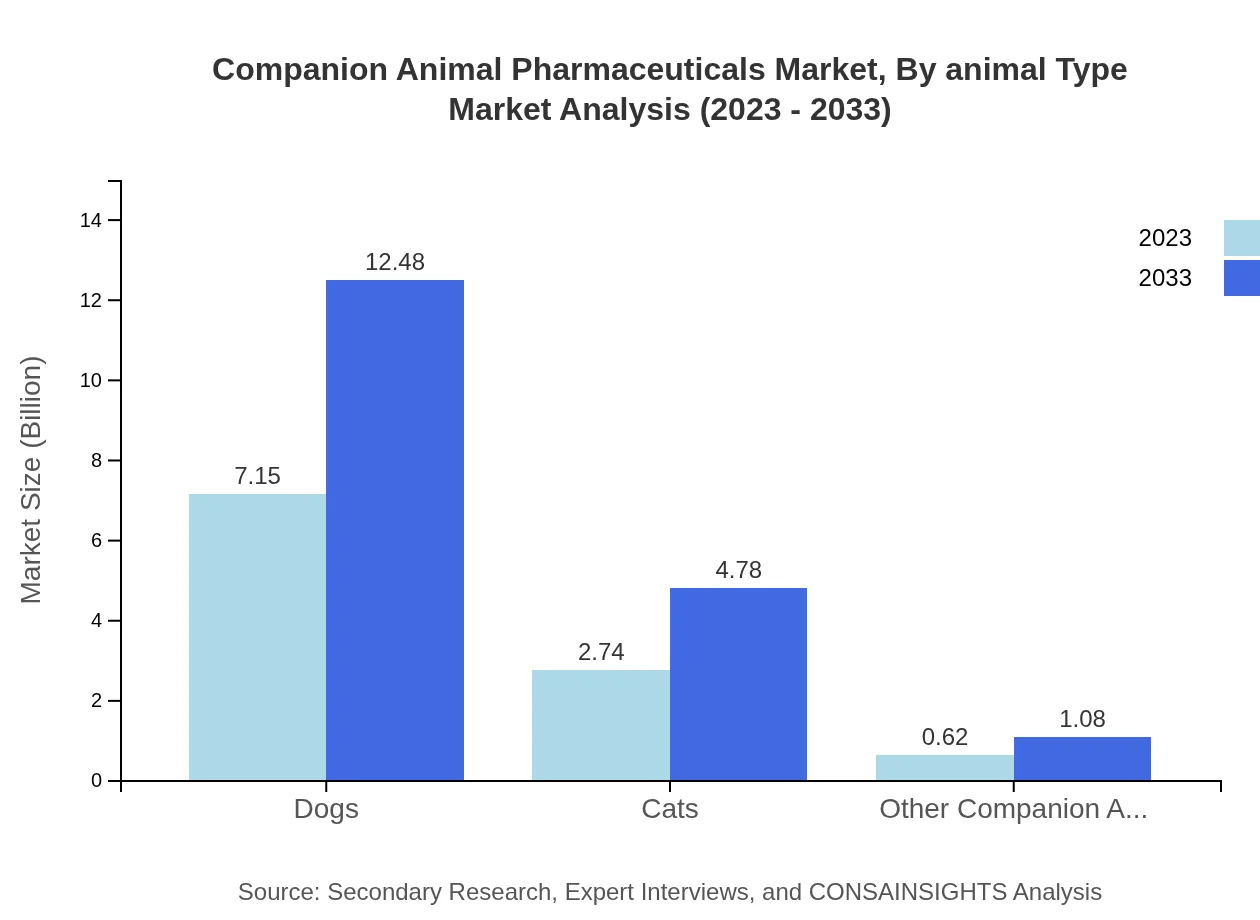

Companion Animal Pharmaceuticals Market Analysis By Animal Type

The market is further segmented based on the type of companion animals, primarily dogs, cats, and other pets. The segment for dogs commands a major share, with a size of $7.15 billion in 2023, likely to expand to $12.48 billion by 2033. The cat segment, currently valued at $2.74 billion, is also expected to showcase healthy growth, while other companion animals, valued at $0.62 billion, are capturing attention as pet ownership diversity increases.

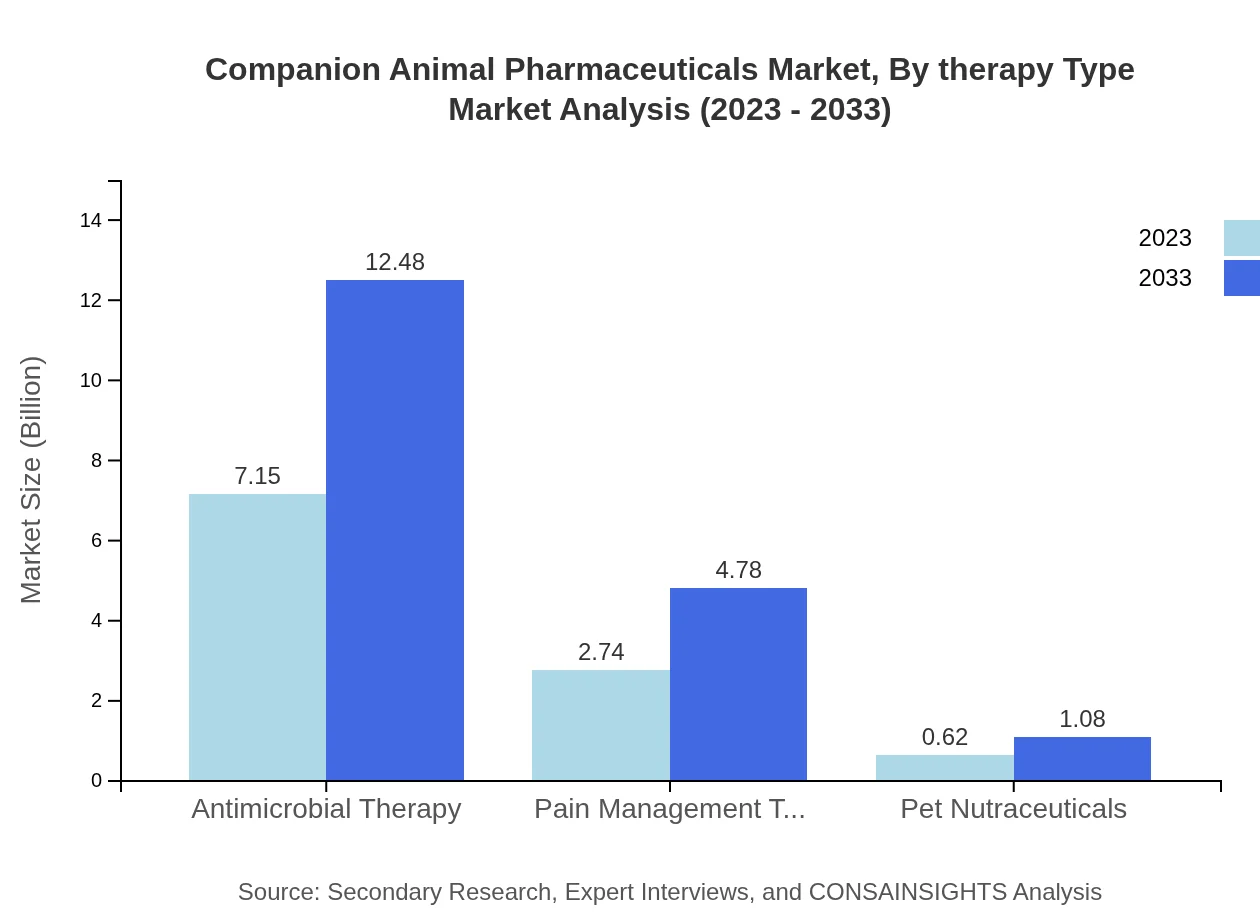

Companion Animal Pharmaceuticals Market Analysis By Therapy Type

In terms of therapies, antimicrobial therapy plays a leading role, with a market size of $7.15 billion in 2023 and an expected rise to $12.48 billion by 2033. Pain management therapy and nutraceuticals represent significant segments as well, attributed to the rising focus on comprehensive pet care that extends beyond traditional pharmaceuticals.

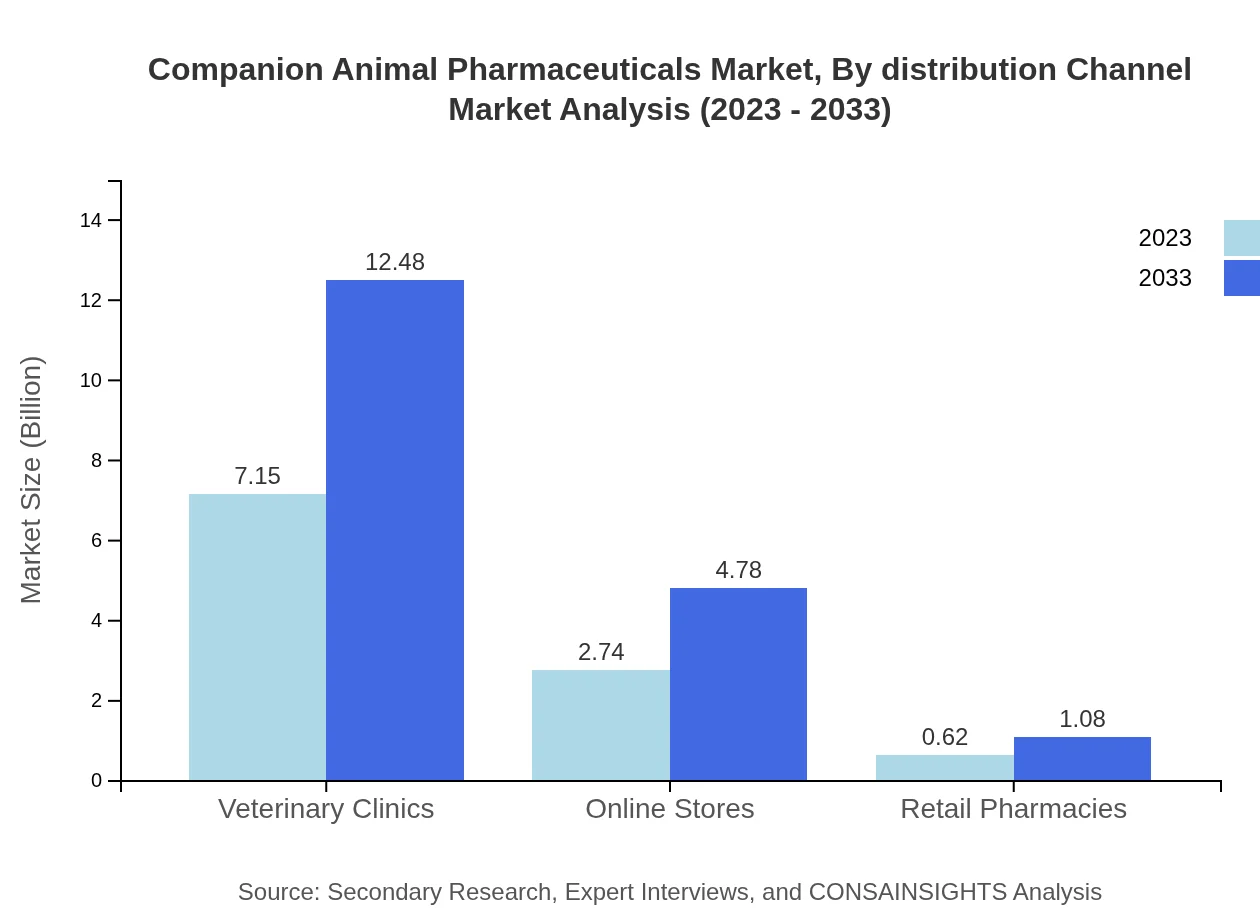

Companion Animal Pharmaceuticals Market Analysis By Distribution Channel

The distribution channels for companion animal pharmaceuticals primarily include veterinary clinics, online stores, and retail pharmacies. Veterinary clinics hold the largest share with a size of $7.15 billion in 2023, anticipated to maintain this position. Online stores are emerging as a valuable channel due to the growing trend of e-commerce, currently valued at $2.74 billion and projected to reach $4.78 billion by 2033.

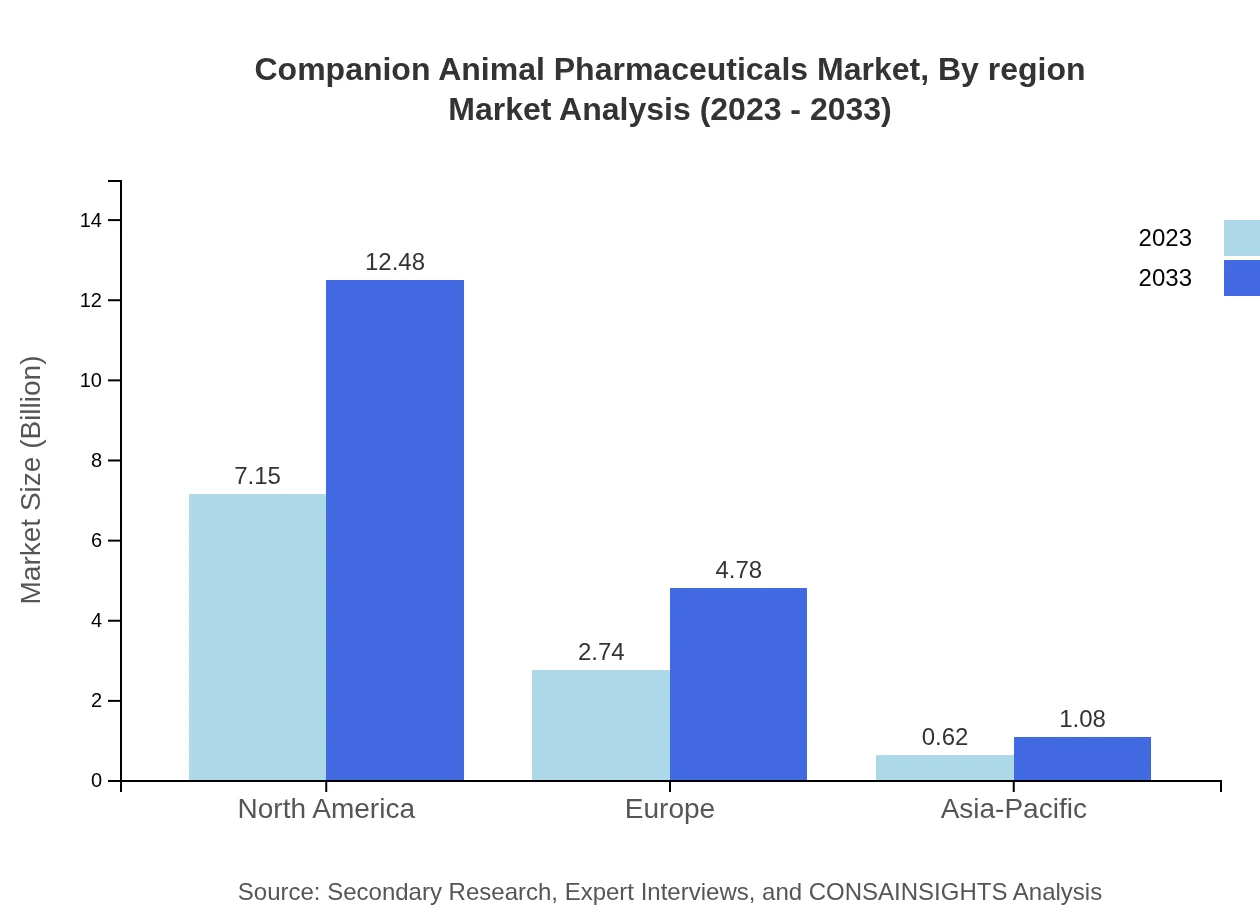

Companion Animal Pharmaceuticals Market Analysis By Region

Regional analysis further illustrates that North America, Europe, and Asia-Pacific dominate the companion animal pharmaceuticals market. Each of these regions has its unique growth dynamics driven by regional culture, regulatory environment, and the socioeconomic backdrop influencing pet ownership and animal health investment.

Companion Animal Pharmaceuticals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Companion Animal Pharmaceuticals Industry

Zoetis Inc.:

Zoetis Inc. is a leading global animal health company engaged in the discovery, development, manufacture, and commercialization of veterinary vaccines and medicines for pets and livestock.Merck Animal Health:

Merck Animal Health is a division of Merck & Co., Inc. and focuses on improving animal health through innovative products, ranging from vaccines to therapeutics targeting both pets and livestock.Boehringer Ingelheim:

Boehringer Ingelheim is committed to animal health and provides a broad range of vaccines, parasiticides, and therapeutic products for companion animals.Elanco Animal Health:

Elanco Animal Health develops and delivers a comprehensive range of pharmaceuticals for companion animals that help maintain animal health, productivity, and enhance pet livability.Vetoquinol:

Vetoquinol is an independent veterinary pharmaceuticals company providing innovative products and solutions tailored for animal well-being in the companion animal health sector.We're grateful to work with incredible clients.

FAQs

What is the market size of companion Animal Pharmaceuticals?

The global companion animal pharmaceuticals market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 5.6%, reaching around $17 billion by 2033.

What are the key market players or companies in the companion Animal Pharmaceuticals industry?

Key players in the companion animal pharmaceuticals market include major pharmaceutical companies that specialize in veterinary medicines, ensuring effective treatment options for various diseases affecting pets and improving their overall health.

What are the primary factors driving the growth in the companion Animal Pharmaceuticals industry?

Growth is primarily driven by increasing pet ownership, rising awareness of pet health and nutrition, and advancements in veterinary medicine, contributing to better treatment options and expanding veterinary services.

Which region is the fastest Growing in the companion Animal Pharmaceuticals market?

The North America region is projected to be the fastest-growing market, expanding from $3.54 billion in 2023 to $6.18 billion by 2033 due to high pet ownership rates and demand for advanced veterinary care.

Does ConsaInsights provide customized market report data for the companion Animal Pharmaceuticals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the companion animal pharmaceuticals industry, helping businesses gain deeper insights and competitive advantages.

What deliverables can I expect from this companion Animal Pharmaceuticals market research project?

Expect comprehensive reports that include market size, growth forecasts, competitive analysis, regional insights, and trends within prescription, OTC products, and vaccines related to companion animals.

What are the market trends of companion Animal Pharmaceuticals?

Current trends include increasing demand for pet nutraceuticals, growth in online sales channels, and a shift towards innovative treatment options such as advanced antimicrobials and pain management therapies.