Construction Machinery Telematics Market Report

Published Date: 02 February 2026 | Report Code: construction-machinery-telematics

Construction Machinery Telematics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Construction Machinery Telematics market from 2023 to 2033, including market trends, size, growth forecasts, regional insights, and competitive landscape analysis.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

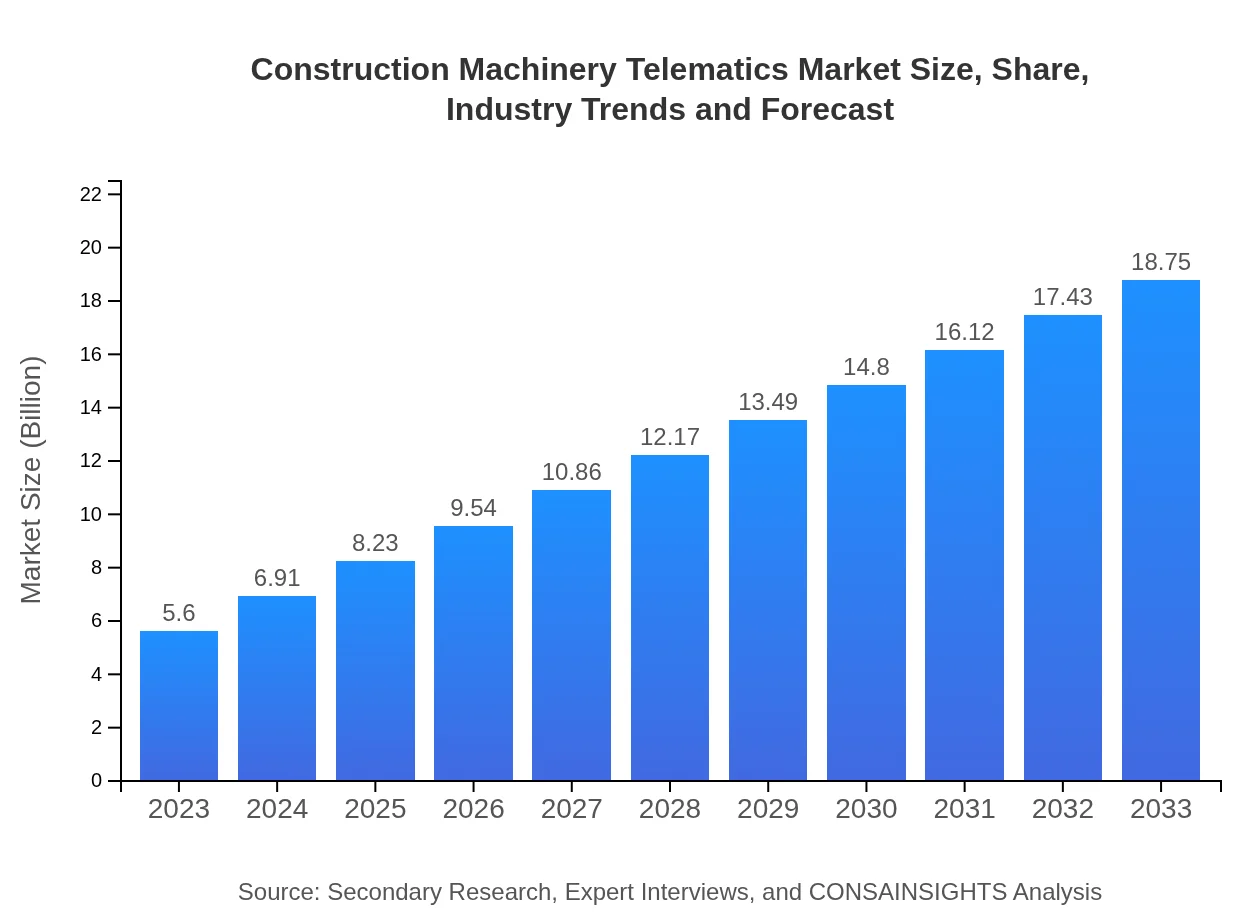

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $18.75 Billion |

| Top Companies | Teletrac Navman, Verizon Connect, Trimble Inc., Cat® Connect, Fleet Complete |

| Last Modified Date | 02 February 2026 |

Construction Machinery Telematics Market Overview

Customize Construction Machinery Telematics Market Report market research report

- ✔ Get in-depth analysis of Construction Machinery Telematics market size, growth, and forecasts.

- ✔ Understand Construction Machinery Telematics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Construction Machinery Telematics

What is the Market Size & CAGR of Construction Machinery Telematics market in 2023?

Construction Machinery Telematics Industry Analysis

Construction Machinery Telematics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Construction Machinery Telematics Market Analysis Report by Region

Europe Construction Machinery Telematics Market Report:

The European market is set to increase from USD 1.60 billion in 2023 to USD 5.36 billion in 2033. Strong emphasis on reducing emissions and improving safety in construction is propelling the demand for telematics solutions.Asia Pacific Construction Machinery Telematics Market Report:

In the Asia Pacific region, the Construction Machinery Telematics market is projected to grow from USD 1.07 billion in 2023 to USD 3.59 billion by 2033. Countries like China and India are leading the charge due to increased infrastructure investments and urban development projects.North America Construction Machinery Telematics Market Report:

North America holds a significant share with an expected growth from USD 2.01 billion in 2023 to USD 6.75 billion in 2033. The region is witnessing strong demand for telematics driven by technological advancements, as well as regulatory requirements for safety and efficiency.South America Construction Machinery Telematics Market Report:

The Latin American market is estimated at USD 0.31 billion in 2023 and is expected to achieve USD 1.03 billion by 2033. The uptake of telematics solutions here is driven by ongoing investments in construction and mining sectors amid economic recovery.Middle East & Africa Construction Machinery Telematics Market Report:

The Middle East and Africa market is projected to grow from USD 0.60 billion in 2023 to USD 2.01 billion by 2033, fueled by urbanization initiatives and infrastructure development projects across the region.Tell us your focus area and get a customized research report.

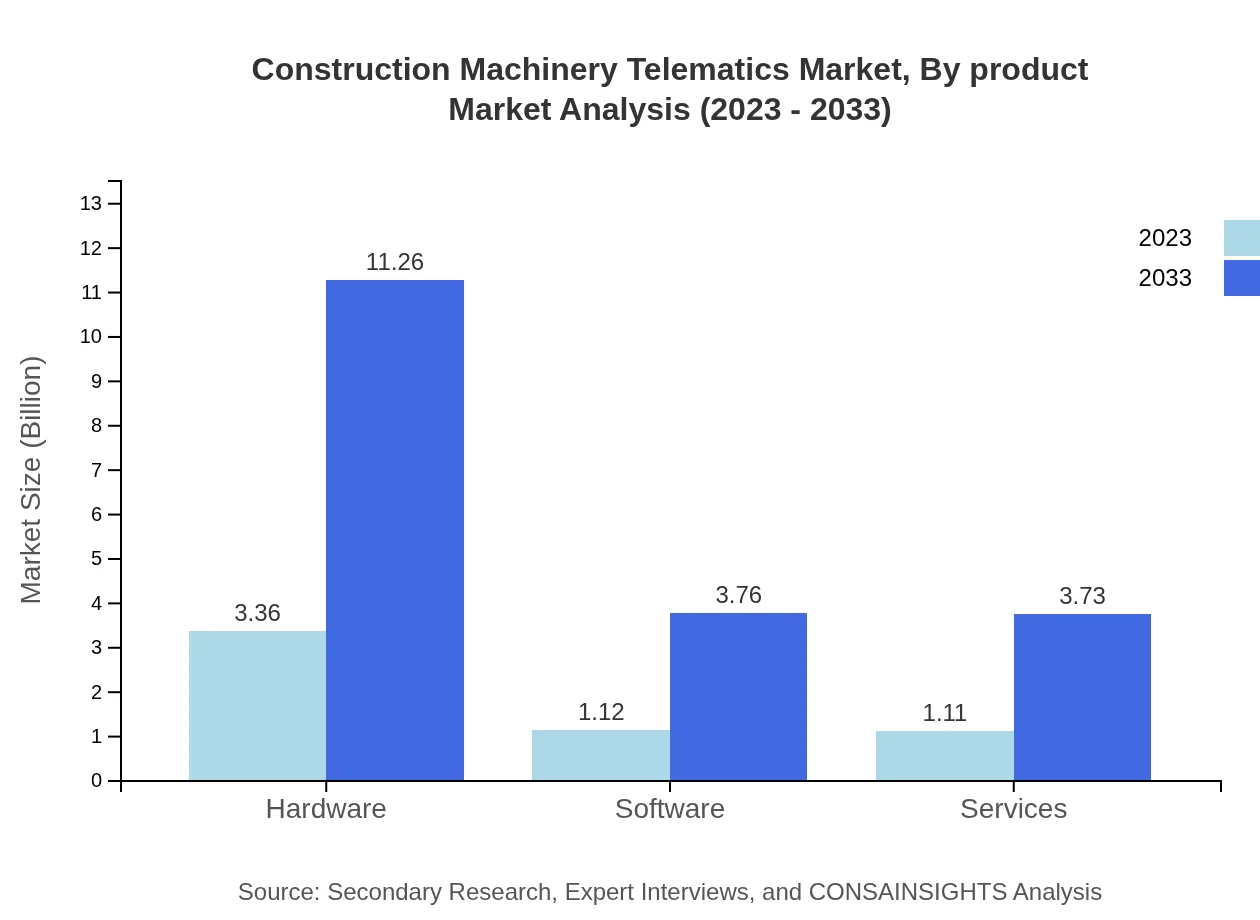

Construction Machinery Telematics Market Analysis By Product

The Hardware segment leads the market, valued at USD 3.36 billion in 2023 and expected to reach USD 11.26 billion by 2033, representing 60.06% of the market share. The Software segment, valued at USD 1.12 billion in 2023, is projected to grow to USD 3.76 billion, while Services will expand from USD 1.11 billion to USD 3.73 billion.

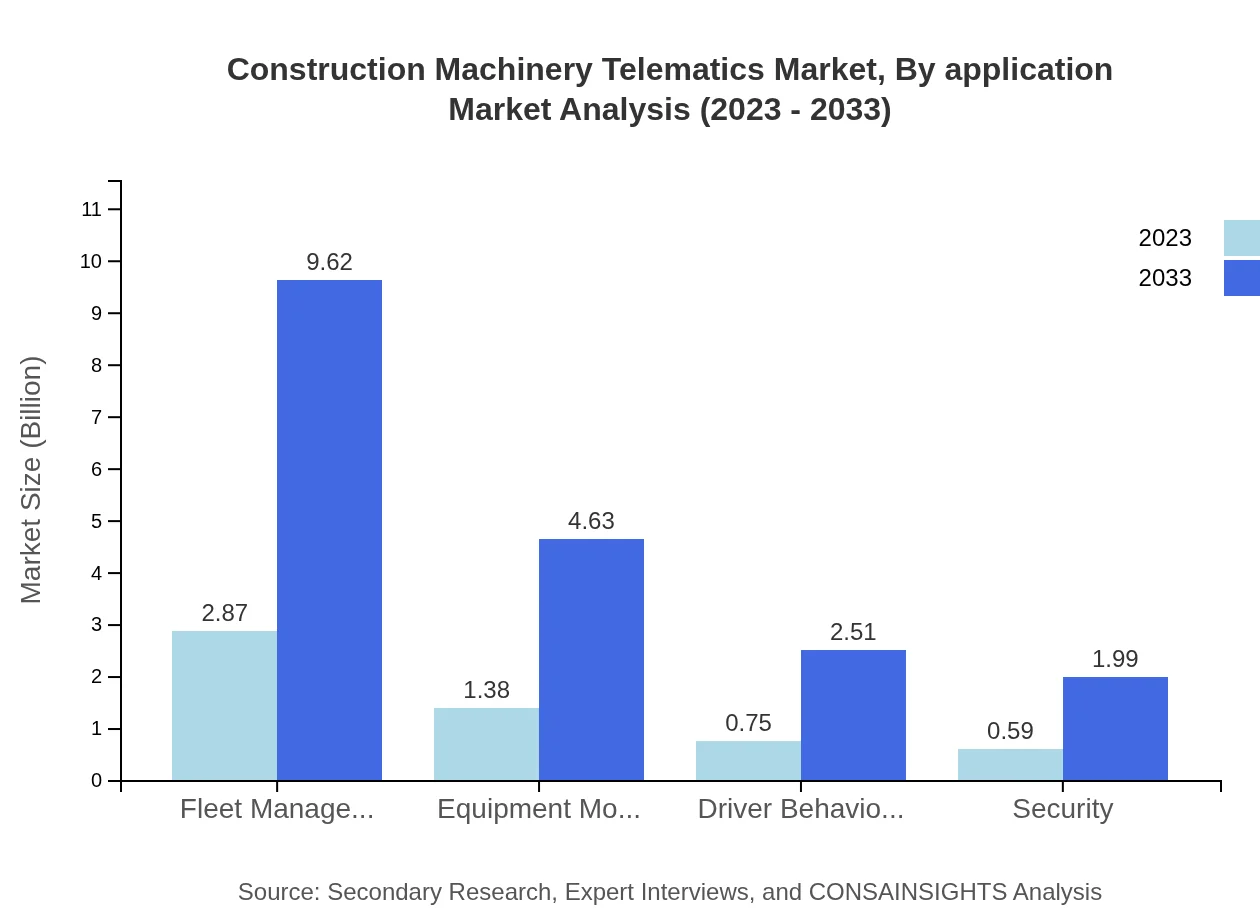

Construction Machinery Telematics Market Analysis By Application

Key applications in the telematics market include Fleet Management, which represents 51.31% of the market share, followed by Equipment Monitoring (24.7%), and Driver Behavior Monitoring (13.37%). Each application drives efficiency and productivity in respective operational domains.

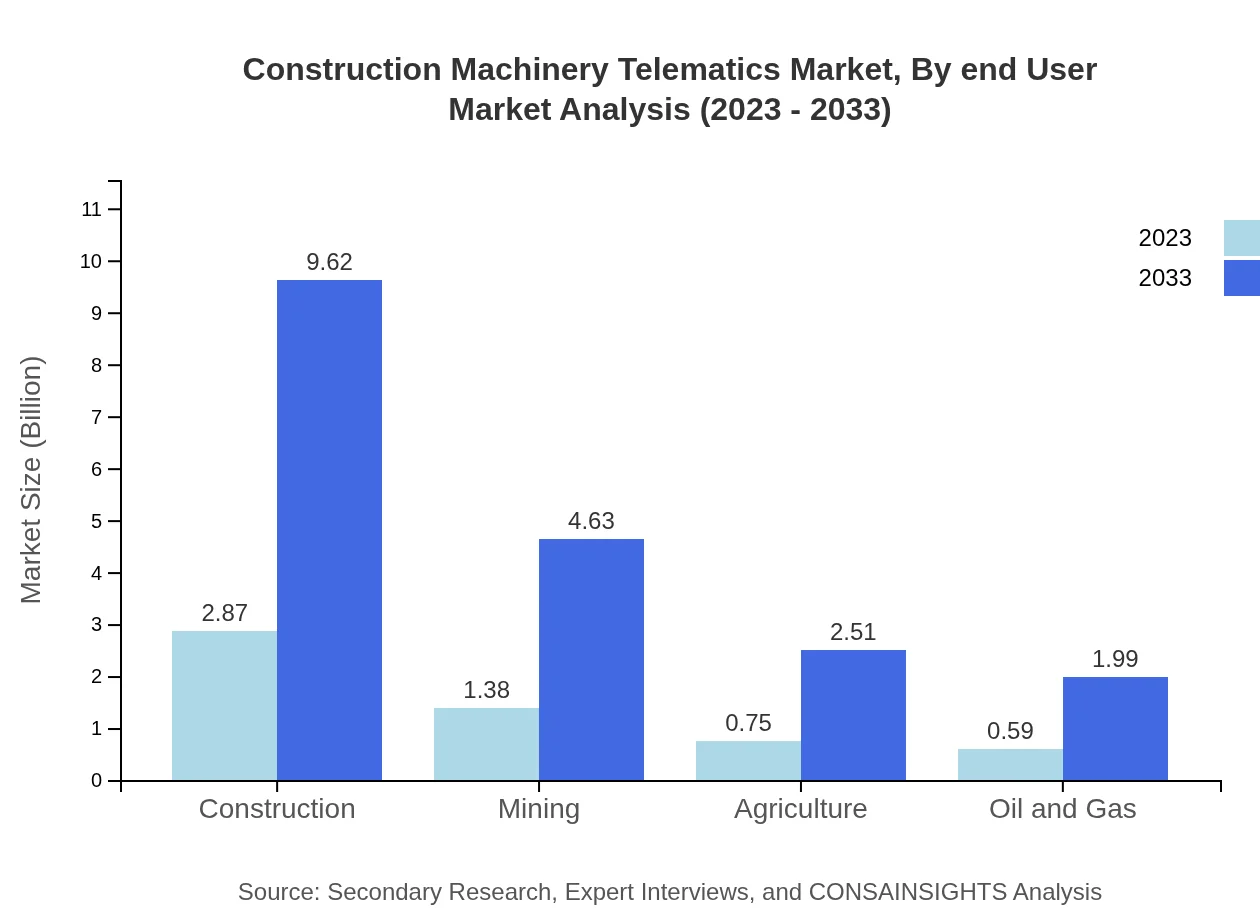

Construction Machinery Telematics Market Analysis By End User

The Construction sector is the largest end-user, holding a 51.31% market share, followed by Mining (24.7%) and Agriculture (13.37%). The adaptability of telematics in these industries ensures better project management and resource allocation.

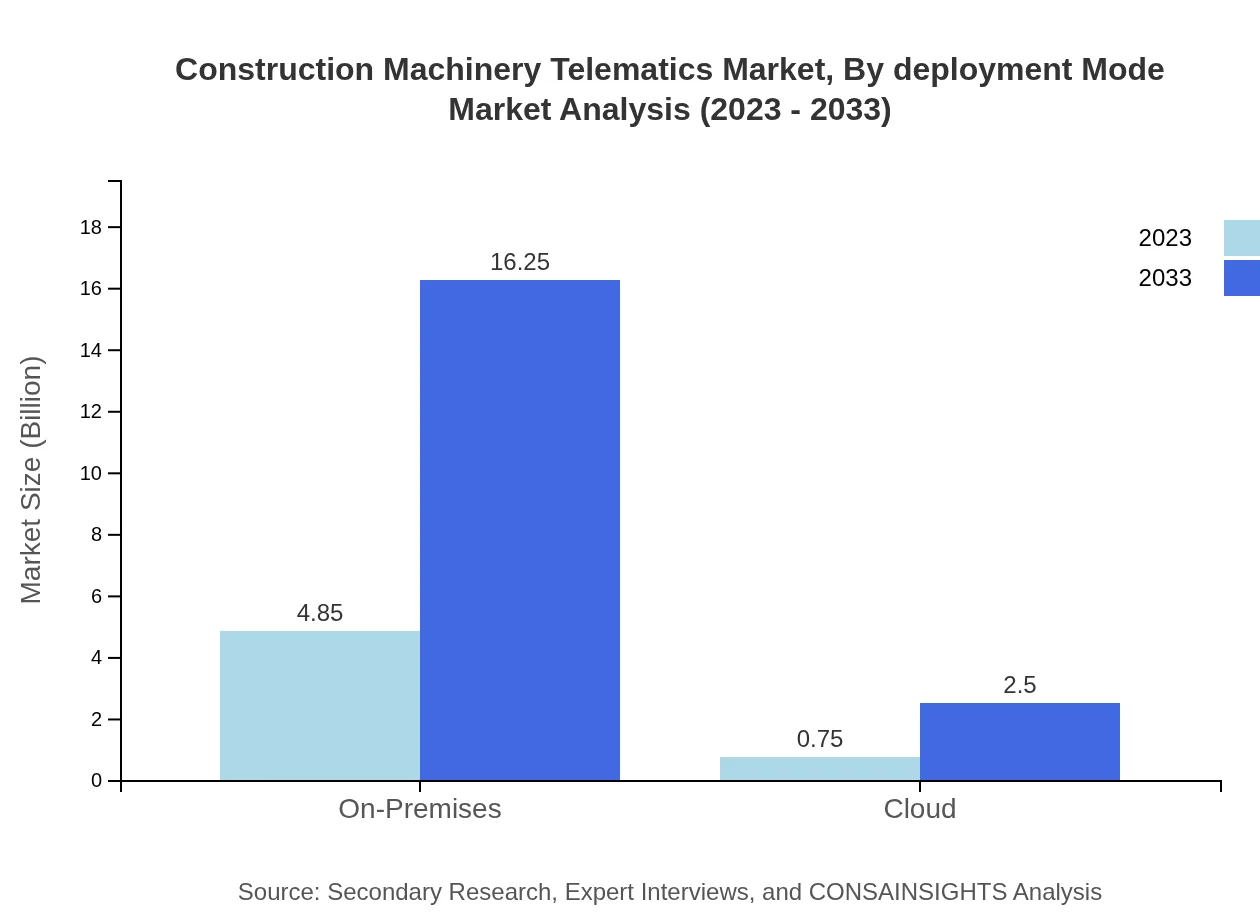

Construction Machinery Telematics Market Analysis By Deployment Mode

The On-Premises deployment mode dominates the market with an 86.66% share, growing from USD 4.85 billion in 2023 to USD 16.25 billion in 2033. The Cloud deployment mode, while smaller at a 13.34% share, is expected to grow significantly as businesses transition to flexibility and scalability in their operations.

Construction Machinery Telematics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Construction Machinery Telematics Industry

Teletrac Navman:

A leading provider of telematics solutions that enhance fleet management and operational efficiency through data analytics and tracking systems.Verizon Connect:

Under Verizon, this division specializes in telematics technology, offering comprehensive fleet tracking, driver management, and analytical tools for various industries.Trimble Inc.:

Innovative in the construction sector, Trimble leverages telematics with GPS and sensor technologies to improve job site efficiency and safety through data-driven decisions.Cat® Connect:

Caterpillar's telematics solution, Cat Connect, enables real-time machine monitoring, enhancing productivity and reducing operational costs for construction and mining applications.Fleet Complete:

Known for its fleet tracking and asset management solutions, Fleet Complete integrates telematics to deliver real-time insights that optimize operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of construction Machinery Telematics?

The construction machinery telematics market is currently valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 12.3%, indicating substantial growth opportunities in the coming years.

What are the key market players or companies in this construction Machinery Telematics industry?

Key players in the construction machinery telematics industry include Caterpillar, John Deere, Trimble Inc., Komatsu, and Hexagon AB, all of whom are instrumental in shaping market innovations and competitive dynamics.

What are the primary factors driving the growth in the construction machinery telematics industry?

The growth is primarily driven by advancements in IoT technology, increased demand for operational efficiency, real-time data analytics, and the need for enhanced fleet management in construction and related sectors.

Which region is the fastest Growing in the construction machinery telematics market?

The Asia Pacific region is witnessing rapid growth in the construction machinery telematics market, projected to expand from $1.07 billion in 2023 to $3.59 billion by 2033.

Does ConsaInsights provide customized market report data for the construction machinery telematics industry?

Yes, ConsaInsights offers tailored market report data for the construction machinery telematics industry, ensuring clients receive analysis and insights that meet their specific business needs.

What deliverables can I expect from this construction machinery telematics market research project?

Deliverables from this market research may include comprehensive market analysis reports, trend forecasts, competitive landscapes, and segment-specific insights suitable for strategic decision-making.

What are the market trends of construction machinery telematics?

Key trends include growing interest in cloud-based solutions, adoption of advanced telematics for predictive maintenance, and increasing integration of AI and data analytics for improved operational efficiency.