Containers As A Service Market Report

Published Date: 31 January 2026 | Report Code: containers-as-a-service

Containers As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Containers As A Service market from 2023 to 2033. It covers market size, CAGR, industry insights, regional analysis, and key trends shaping the future of this growing market.

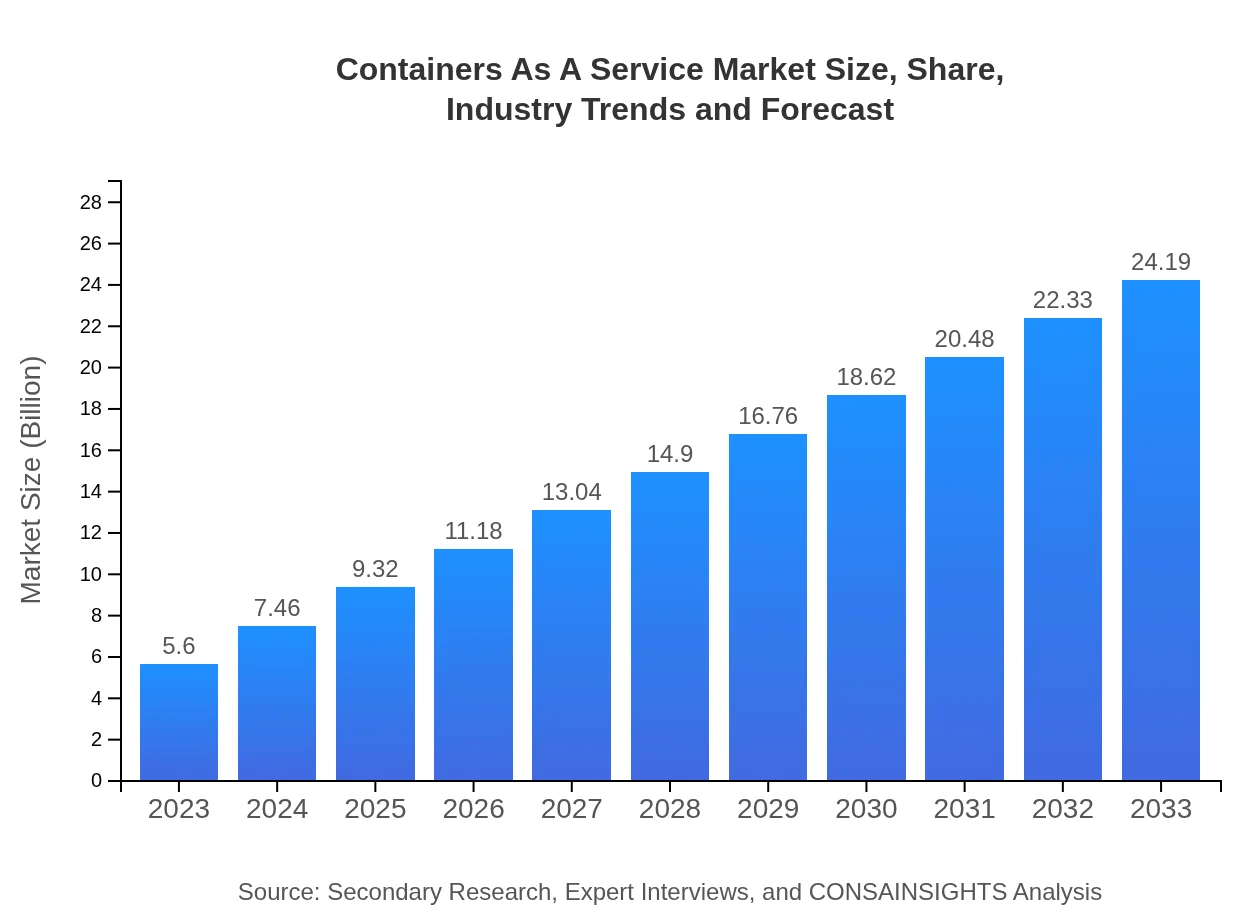

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $24.19 Billion |

| Top Companies | Amazon Web Services (AWS), Google Cloud Platform, Microsoft Azure, IBM Cloud, Red Hat OpenShift |

| Last Modified Date | 31 January 2026 |

Containers As A Service Market Overview

Customize Containers As A Service Market Report market research report

- ✔ Get in-depth analysis of Containers As A Service market size, growth, and forecasts.

- ✔ Understand Containers As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Containers As A Service

What is the Market Size & CAGR of Containers As A Service market in 2023?

Containers As A Service Industry Analysis

Containers As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Containers As A Service Market Analysis Report by Region

Europe Containers As A Service Market Report:

Europe’s market stands at $1.58 billion in 2023, forecasted to grow to $6.81 billion by 2033, driven by stringent regulations that promote cloud adoption and the demand for scalable application solutions.Asia Pacific Containers As A Service Market Report:

In 2023, the Containers As A Service market in Asia Pacific is valued at $1.19 billion, expected to grow to $5.16 billion by 2033, driven by digital transformation initiatives and cloud adoption across businesses.North America Containers As A Service Market Report:

North America leads the market with a 2023 valuation of $1.90 billion, expected to grow to $8.22 billion by 2033, fueled by large-scale enterprise adoption and significant investments in cloud infrastructure.South America Containers As A Service Market Report:

The South American market is currently valued at $0.56 billion in 2023, with projections to reach $2.42 billion by 2033, as local companies increasingly adopt cloud solutions to enhance operational efficiencies.Middle East & Africa Containers As A Service Market Report:

The market in the Middle East and Africa is valued at $0.37 billion in 2023, with an anticipated growth to $1.58 billion by 2033 as regional businesses explore cloud technologies to optimize costs.Tell us your focus area and get a customized research report.

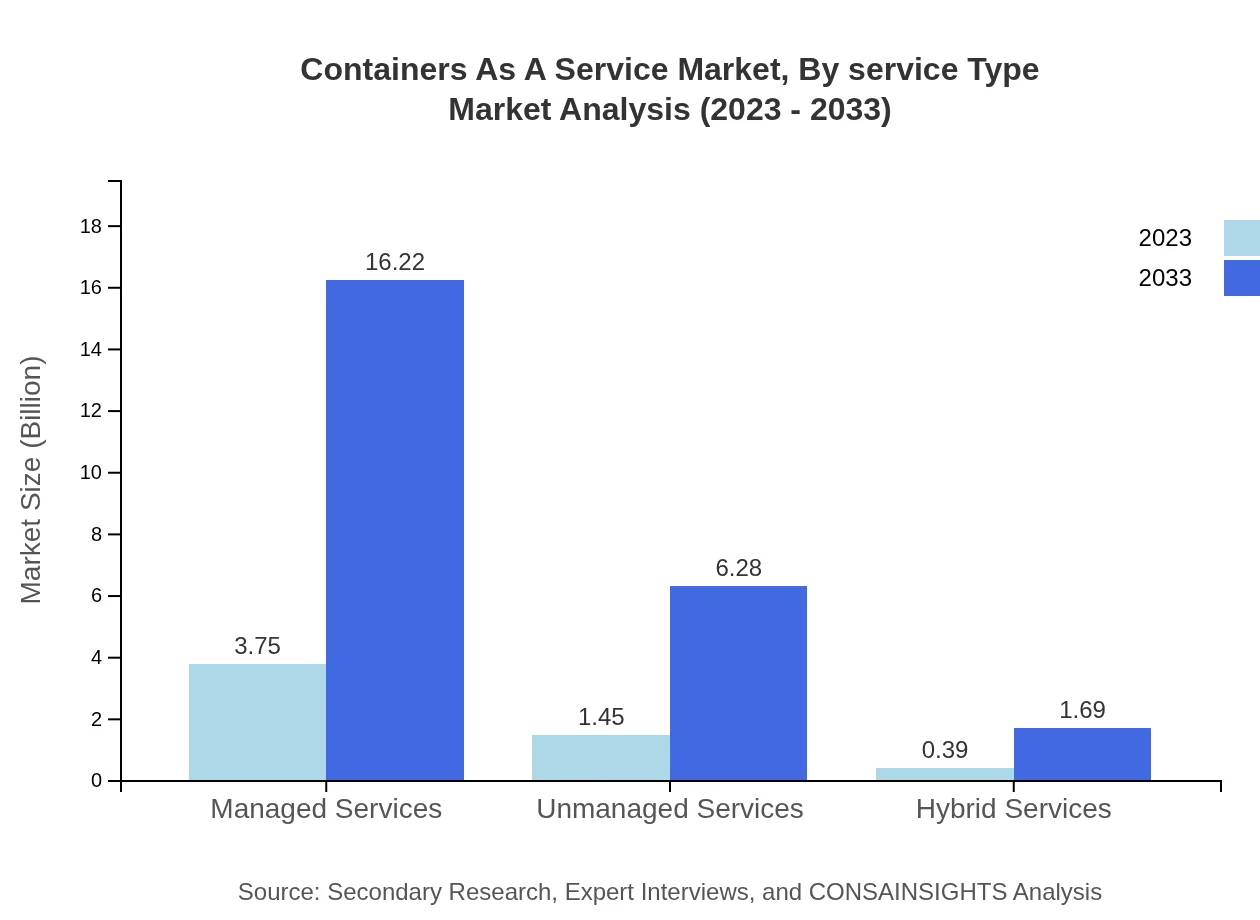

Containers As A Service Market Analysis By Service Type

The CaaS market is segmented into managed services, unmanaged services, and hybrid services. Managed services dominate this segment, showcasing a market size of $3.75 billion in 2023, growing to $16.22 billion by 2033.

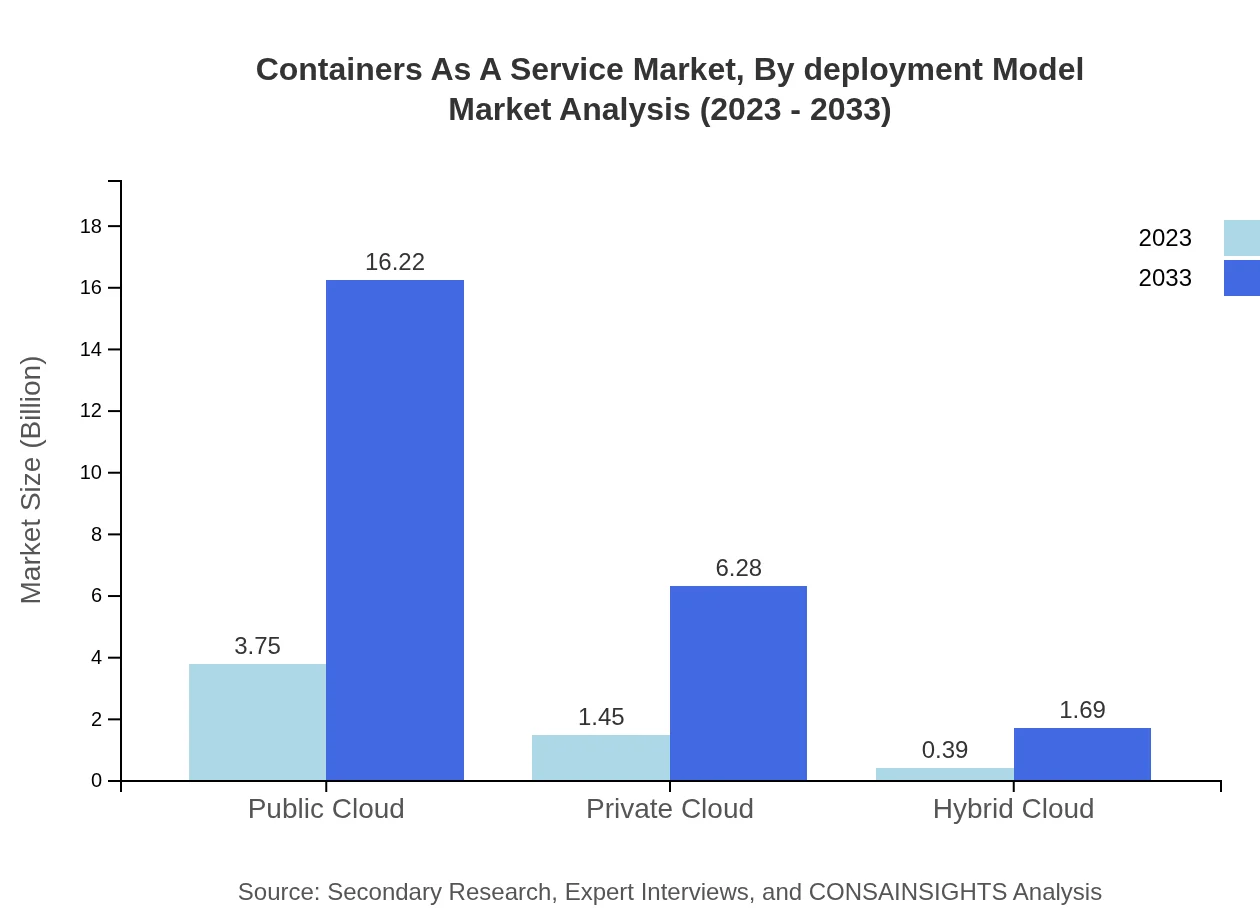

Containers As A Service Market Analysis By Deployment Model

The deployment models for CaaS include public cloud and private cloud. In 2023, the market size for public cloud services is $3.75 billion, which is projected to increase to $16.22 billion by 2033.

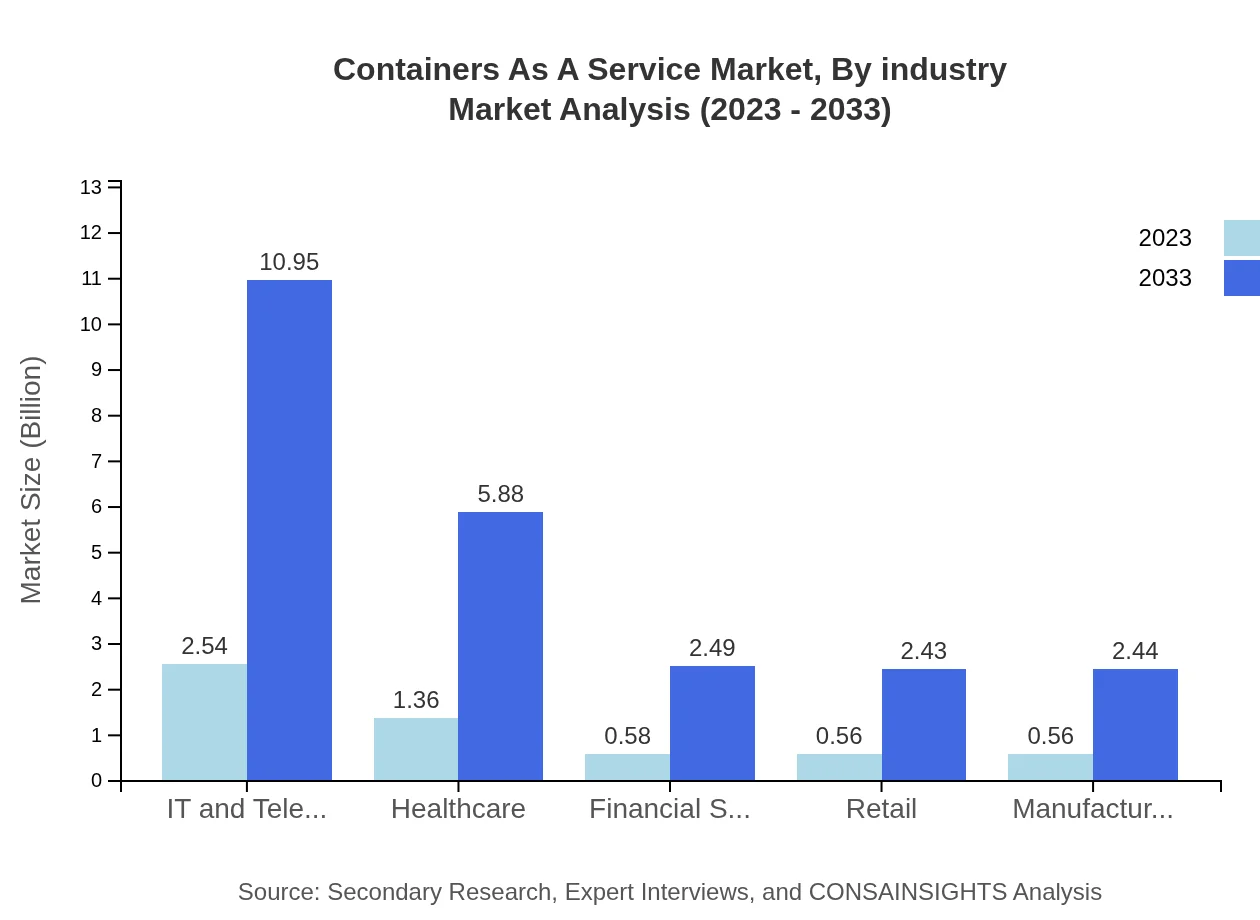

Containers As A Service Market Analysis By Industry

The industry segment shows strong performance in IT and telecommunications, which is expected to reach $10.95 billion by 2033 from $2.54 billion in 2023, highlighting the sector's aggressive digital transformation.

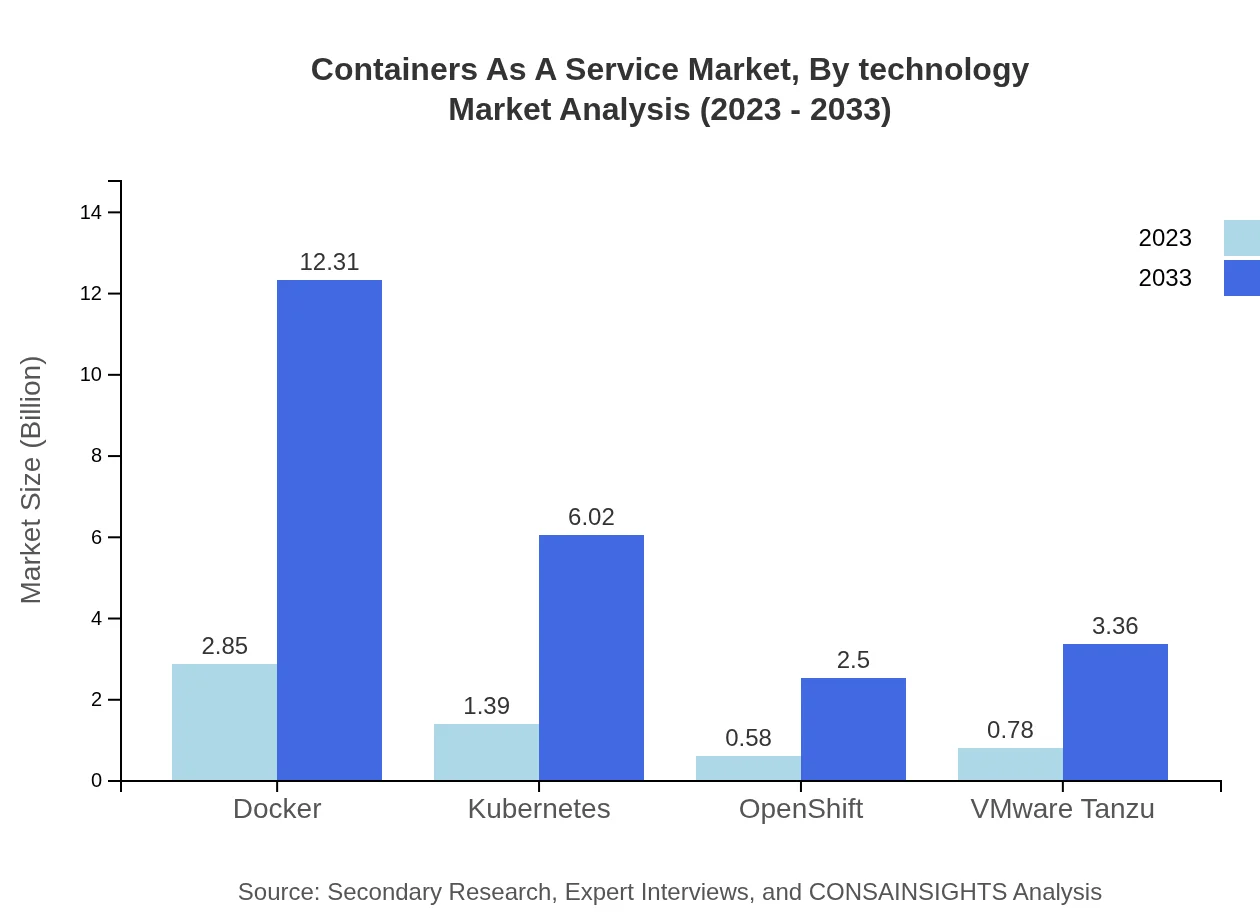

Containers As A Service Market Analysis By Technology

Key technologies include Docker, Kubernetes, OpenShift, and VMware Tanzu. Docker leads with a market size of $2.85 billion in 2023, expanding to $12.31 billion by 2033.

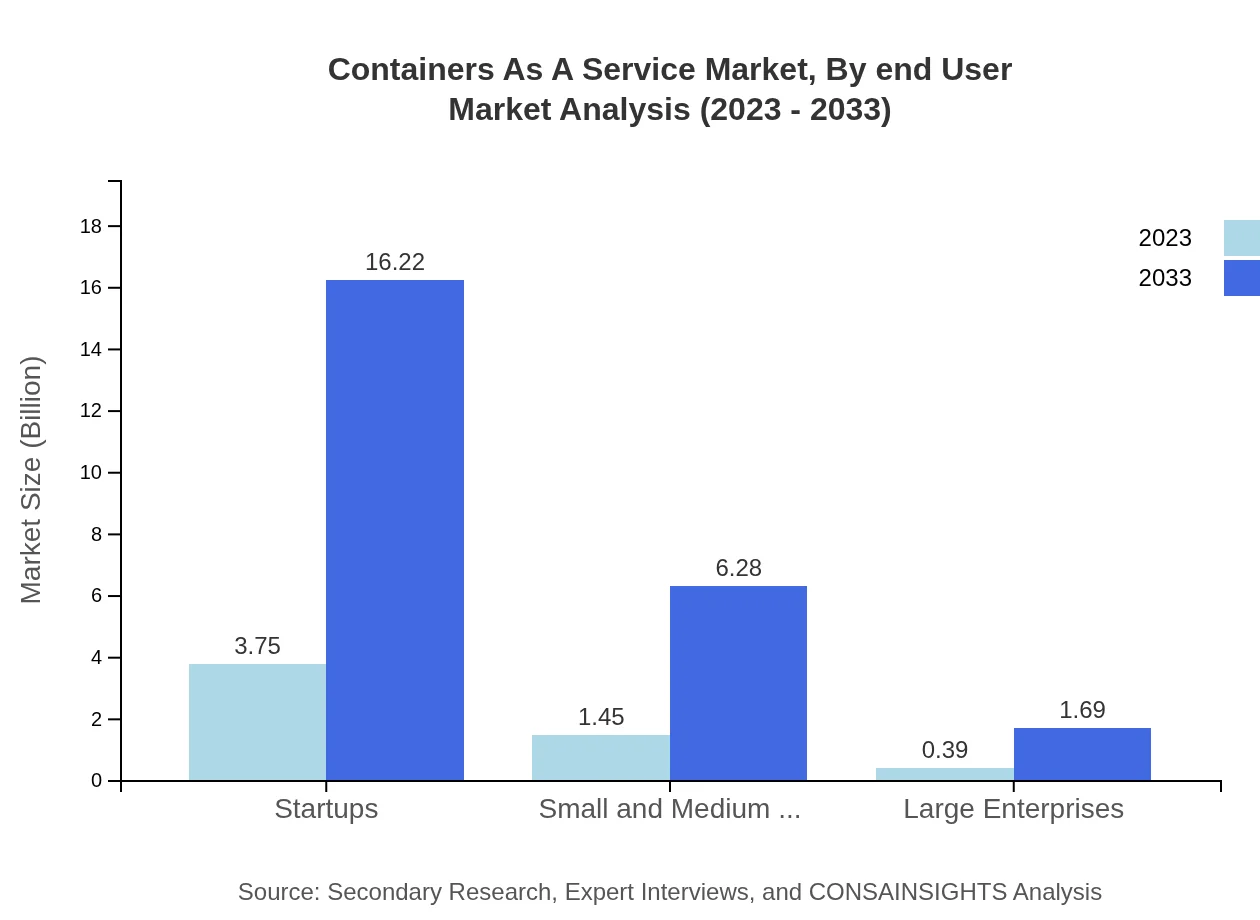

Containers As A Service Market Analysis By End User

The end-user segment primarily includes startups, small and medium enterprises, and large enterprises. Startups account for $3.75 billion in 2023, expected to grow to $16.22 billion by 2033.

Containers As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Containers As A Service Industry

Amazon Web Services (AWS):

AWS is a leader in cloud services, offering a variety of CaaS products that allow organizations to deploy containerized applications at scale.Google Cloud Platform:

Google's CaaS solutions like Google Kubernetes Engine (GKE) provide advanced orchestration capabilities for managing containers in the cloud.Microsoft Azure:

Azure's CaaS offerings facilitate seamless container management and integration with existing cloud services for enterprise clients.IBM Cloud:

IBM Cloud provides comprehensive CaaS solutions, focusing on hybrid cloud environments that leverage both on-premises and cloud resources.Red Hat OpenShift:

Red Hat OpenShift offers a robust CaaS platform with extensive developer support and integrated Kubernetes capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of containers As A Service?

The containers as a service market is projected to grow from $5.6 billion in 2023 to a significant size by 2033, with a robust CAGR of 15%. This growth indicates increasing adoption across various sectors, contributing to its market expansion.

What are the key market players or companies in the containers As A Service industry?

Key players in the containers as a service sector include Docker, Kubernetes, Red Hat OpenShift, VMware Tanzu, and various cloud service providers. These companies are pioneering advancements and innovations within the market, enhancing service delivery and user experience.

What are the primary factors driving the growth in the containers As A Service industry?

The growth in the containers as a service industry is driven by the increasing demand for scalable cloud solutions, the need for cost efficiency, and the rise in microservices architecture. Additionally, businesses are focusing on agility and speed in software development, further propelling market growth.

Which region is the fastest Growing in the containers As A Service market?

North America is the fastest-growing region in the containers as a service market, projected to expand from $1.90 billion in 2023 to $8.22 billion by 2033. This region's rapid growth is driven by high technological adoption and a strong presence of key market players.

Does ConsaInsights provide customized market report data for the containers As A Service industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the containers as a service industry. This includes in-depth analysis and insights relevant to unique business contexts and strategic objectives.

What deliverables can I expect from this containers As A Service market research project?

Deliverables from this market research project include comprehensive market analysis reports, segment insights, competitive landscape evaluations, and future growth predictions. These resources equip businesses with actionable intelligence for informed decision-making.

What are the market trends of containers As A Service?

Current trends in the containers as a service market include increasing adoption of hybrid and multi-cloud strategies, the rise of serverless computing, and growing emphasis on security. As businesses transition to cloud-native solutions, these trends shape future market dynamics.