Copper Market Report

Published Date: 02 February 2026 | Report Code: copper

Copper Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report analyzes the Copper industry, detailing market size, growth forecasts, and trends from 2023 to 2033. Insights provided will help stakeholders understand market dynamics and investment opportunities in the Copper sector.

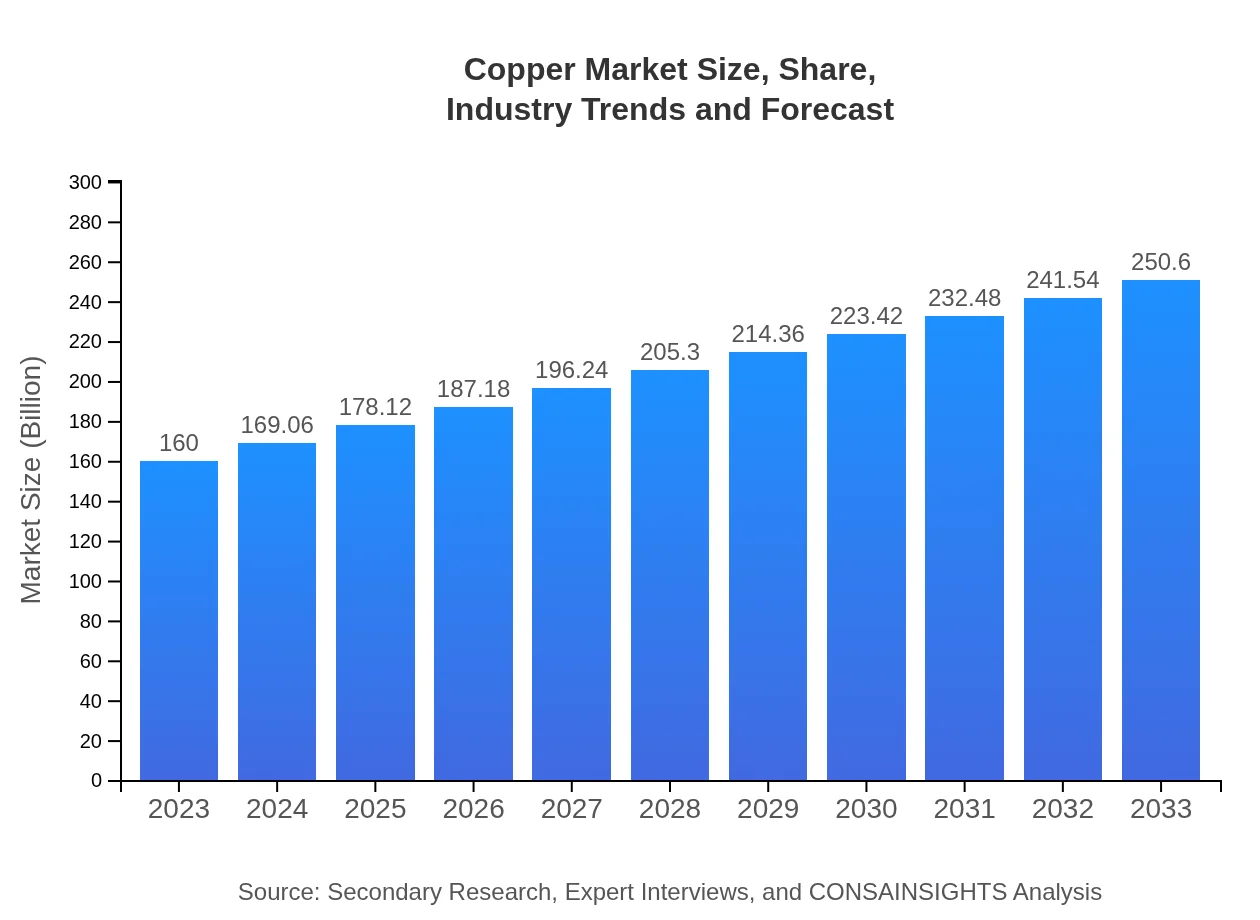

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $160.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $250.60 Billion |

| Top Companies | BHP Group, Freeport-McMoRan, Southern Copper Corporation, Rio Tinto |

| Last Modified Date | 02 February 2026 |

Copper Market Overview

Customize Copper Market Report market research report

- ✔ Get in-depth analysis of Copper market size, growth, and forecasts.

- ✔ Understand Copper's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Copper

What is the Market Size & CAGR of Copper market in 2023?

Copper Industry Analysis

Copper Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Copper Market Analysis Report by Region

Europe Copper Market Report:

In Europe, the Copper market is set to increase from $52.40 billion in 2023 to $82.07 billion in 2033. European nations are focusing on sustainable practices, thus boosting recycling activities and demand for Copper in electrical and construction applications.Asia Pacific Copper Market Report:

In the Asia Pacific region, the Copper market is expected to grow from $27.25 billion in 2023 to $42.68 billion in 2033. The surge is driven by rapid industrialization, urbanization, and demand in electronics and construction sectors. Countries like China and India are major consumers, significantly impacting market dynamics.North America Copper Market Report:

North America’s Copper market is anticipated to expand from $59.58 billion in 2023 to $93.32 billion in 2033, driven by investments in infrastructure and renewable energy. The United States is leading this growth, reflecting rising demands in the electrical and automotive industries.South America Copper Market Report:

The South American Copper market size is projected to rise from $11.41 billion in 2023 to $17.87 billion by 2033. This growth is largely attributed to the region’s vast Copper mining resources, particularly in Chile and Peru, which are among the world's largest producers.Middle East & Africa Copper Market Report:

The Middle East and Africa region is projected to witness growth from $9.36 billion in 2023 to $14.66 billion by 2033. The burgeoning construction industry and infrastructure development, particularly in GCC countries, are main drivers in this market.Tell us your focus area and get a customized research report.

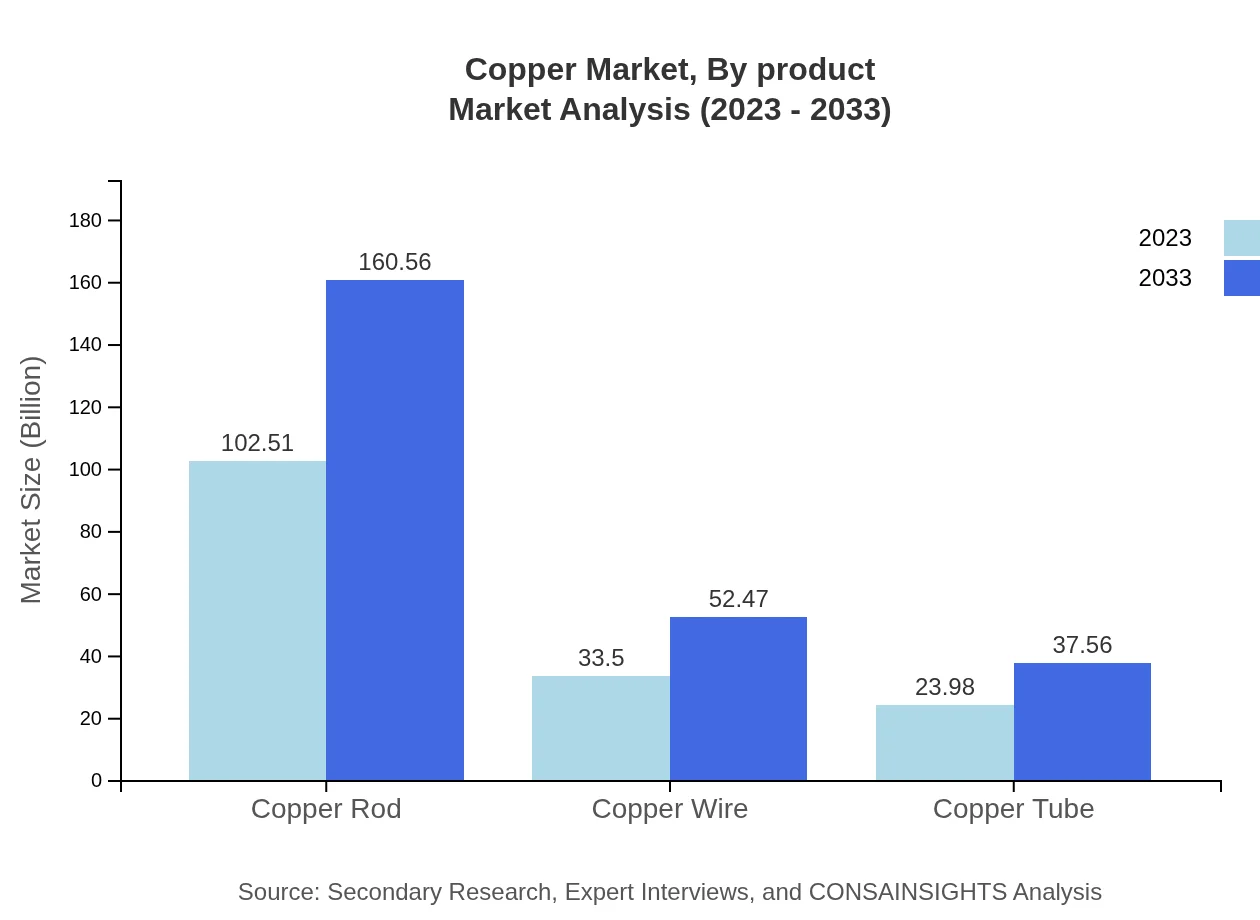

Copper Market Analysis By Product

The Copper market is categorized into several product segments, including Copper Grade 1, Copper Rod, Copper Wire, and Copper Tube. Copper Grade 1 is expected to reach $102.51 billion in 2023, growing to $160.56 billion by 2033. Copper Wire and Rods follow suit, with significant market shares due to their extensive use in electrical applications.

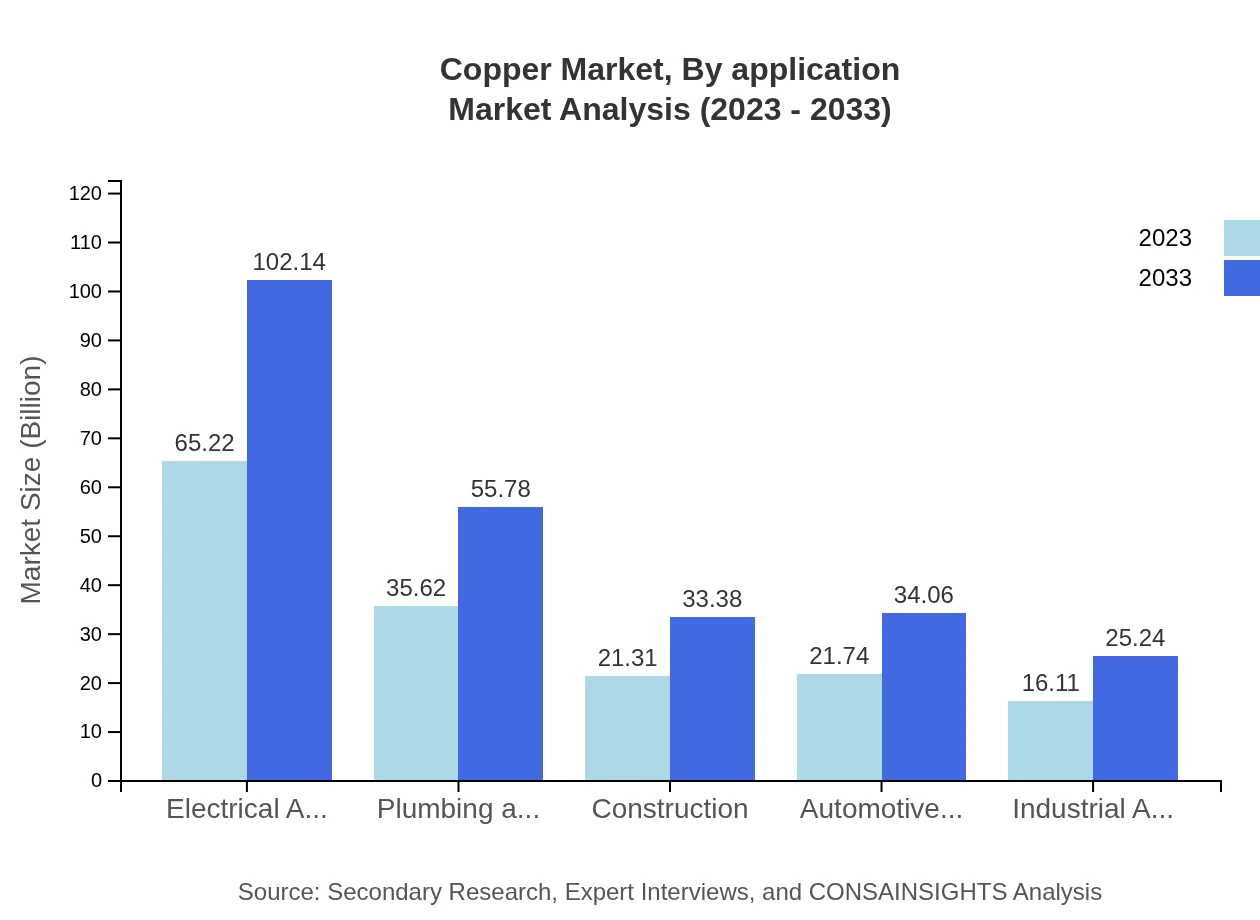

Copper Market Analysis By Application

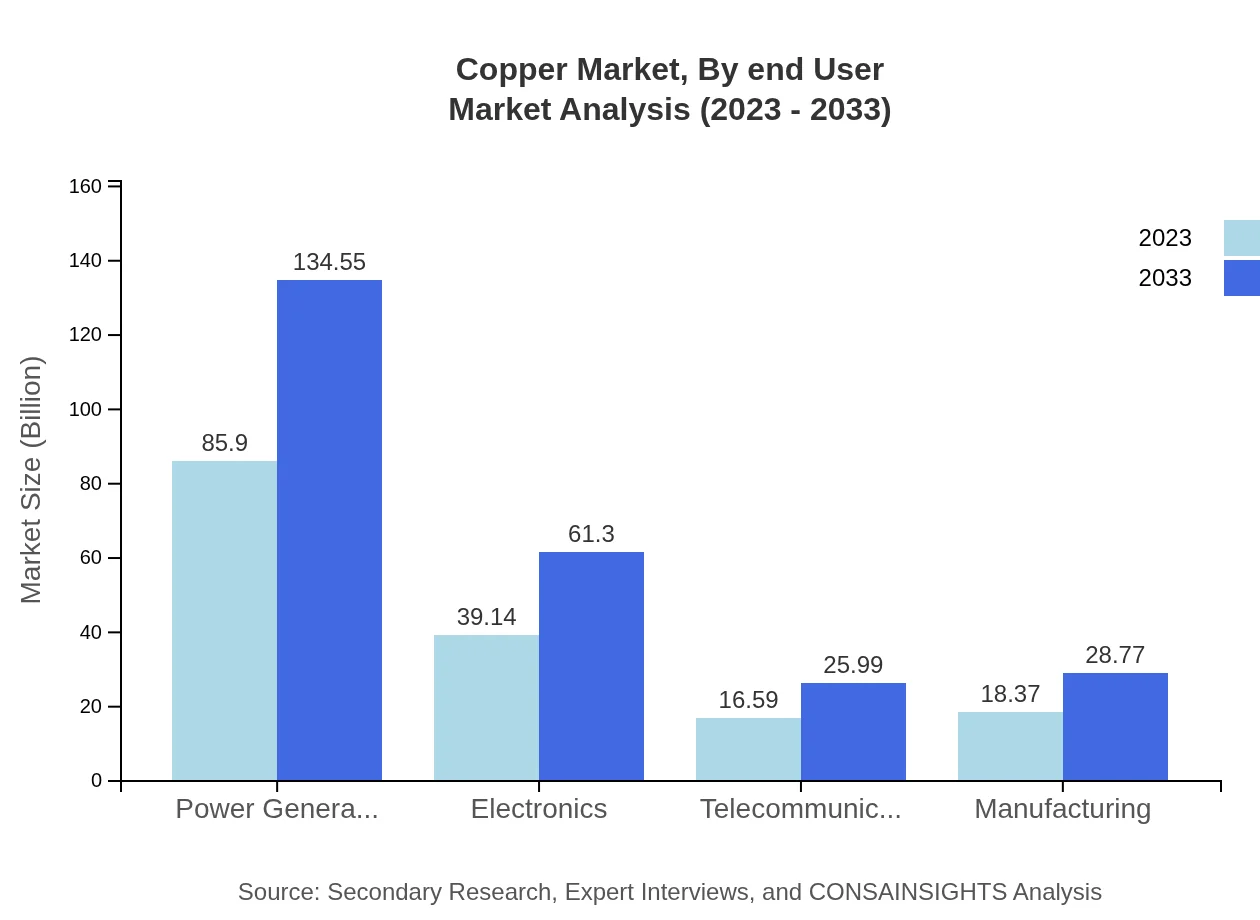

The application segment showcases diversification, with power generation, electronics, and telecommunications being the leading sectors. The power generation sector is projected to experience steady growth, reaching $85.90 billion in 2023 and expanding to $134.55 billion by 2033. Electronics and telecommunication applications are equally notable, demonstrating increasing reliance on Copper for connectivity and functionality.

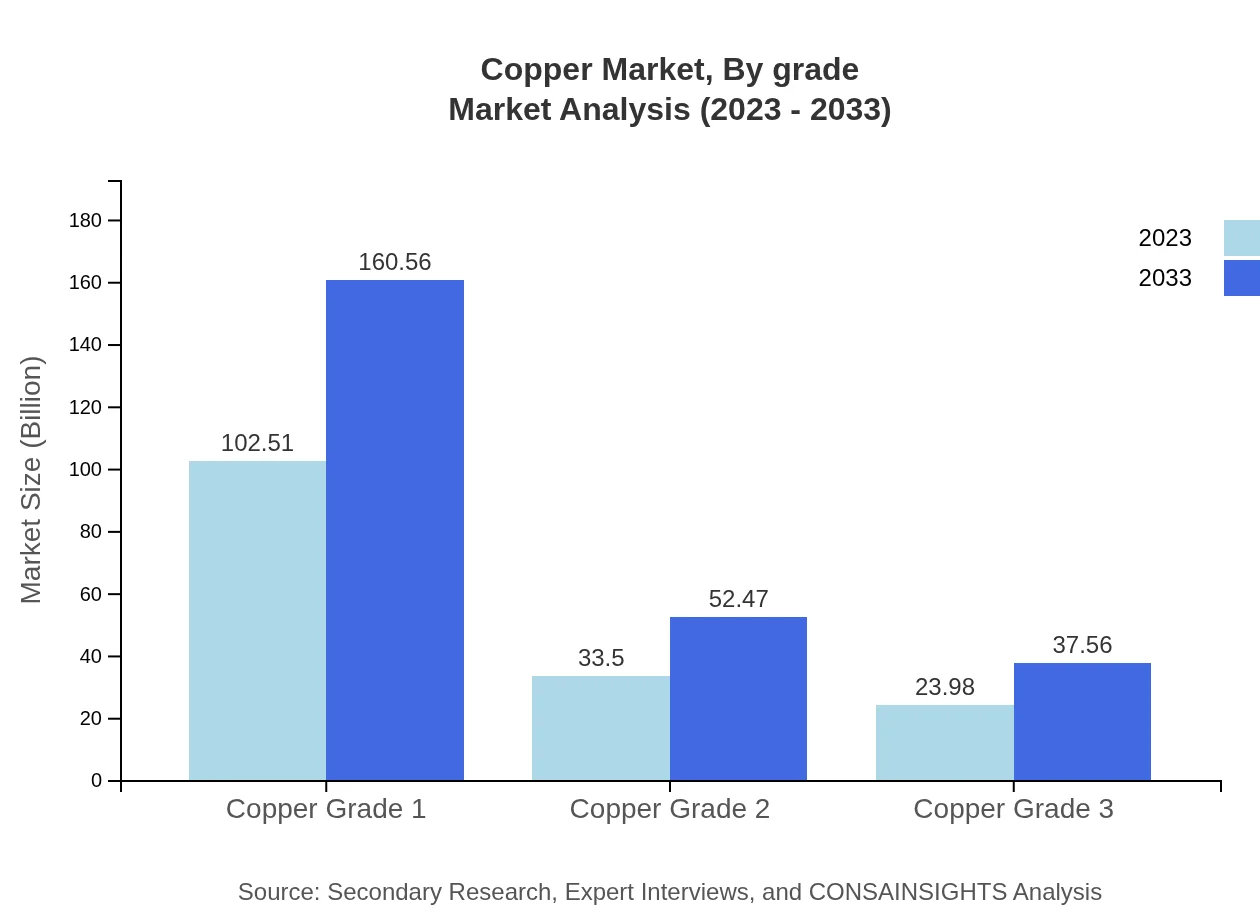

Copper Market Analysis By Grade

Copper is broadly classified into different grades such as Grade 1, Grade 2, and Grade 3. The market for Copper Grade 1 is expected to maintain a dominant share, with steady demand from high-quality applications as it reaches $102.51 billion in 2023 and $160.56 billion in 2033.

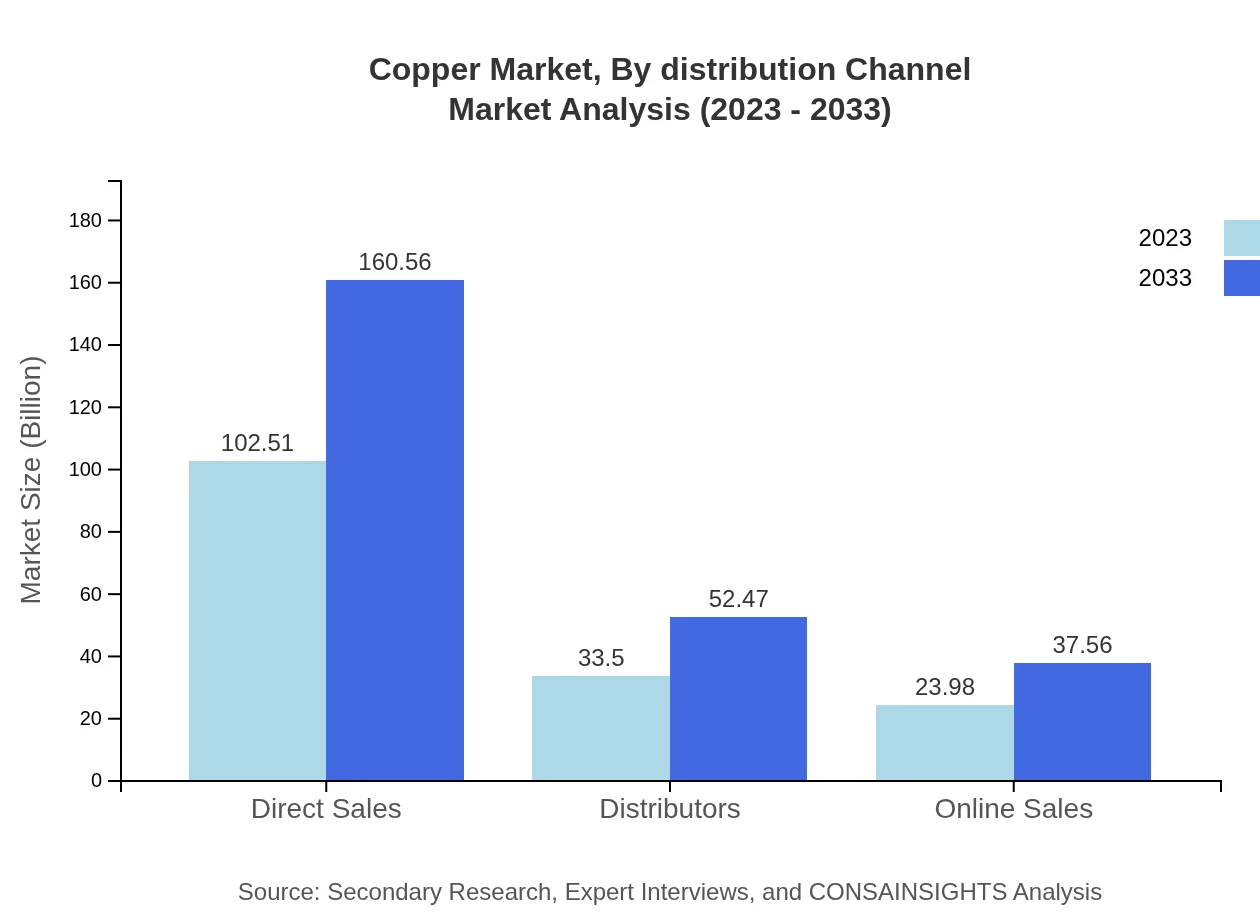

Copper Market Analysis By Distribution Channel

Distribution channels are vital for market penetration and sales. Direct sales are projected to account for significant size, valued at $102.51 billion in 2023 and reaching $160.56 billion by 2033. Online sales are growing rapidly as e-commerce transforms the buying landscape.

Copper Market Analysis By End User

Diverse end-user industries such as electrical applications, plumbing, HVAC, and construction are crucial. The electrical applications segment will reach $65.22 billion by 2023 and $102.14 billion by 2033, driven by electrification trends.

Copper Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Copper Industry

BHP Group:

BHP is a leading global resources company with significant operations in Copper mining, especially in Chile and the United States, known for its sustainability initiatives.Freeport-McMoRan:

This company is one of the world's largest publicly traded Copper producers. They focus on mining, milling, and processing Copper while emphasizing environmental stewardship.Southern Copper Corporation:

With substantial assets in Peru and Mexico, Southern Copper Corporation is a significant player in the global Copper market, recognized for utilizing cutting-edge technology in mining.Rio Tinto:

Known for its diversified mining activities, Rio Tinto's operations in Copper mining contribute significantly to global supply, complemented by innovative processing techniques.We're grateful to work with incredible clients.

FAQs

What is the market size of copper?

The global copper market is projected to reach approximately $160 billion by 2033, growing at a CAGR of 4.5%. The demand across various sectors is anticipated to drive this growth significantly over the next decade.

What are the key market players or companies in the copper industry?

Key players in the copper industry include major manufacturers and mining firms that contribute significantly to the market, encompassing various sectors such as power generation, construction, and electronics, among others.

What are the primary factors driving the growth in the copper industry?

The growth in the copper industry is primarily driven by increasing demand in electronics, electrical applications, and construction, along with rising renewable energy projects that require substantial copper inputs.

Which region is the fastest Growing in the copper market?

The Asia Pacific region is set to be the fastest-growing market for copper, with projections indicating growth from $27.25 billion in 2023 to $42.68 billion by 2033, due to rapid industrialization and infrastructure developments.

Does ConsaInsights provide customized market report data for the copper industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the copper industry, ensuring clients obtain precise insights and data relevant to their business objectives.

What deliverables can I expect from this copper market research project?

Deliverables from the copper market research project will include comprehensive market analysis, segment data, growth forecasts, competitive analysis, and tailored insights pertinent to your strategic needs.

What are the market trends of copper?

Market trends indicate a shift towards increasing adoption of copper in green technology and electronics, alongside a push for sustainable mining practices that cater to heightened environmental concerns.