Covid-19 Impact On Fraud Detection And Prevention Fdp

Published Date: 31 January 2026 | Report Code: covid-19-impact-on-fraud-detection-and-prevention-fdp

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Covid-19 Impact on Fraud Detection and Prevention (FDP) market, offering valuable insights into current trends, market size, regional dynamics, and technological advancements. The analysis spans various segments and industries with forecasts from 2024 to 2033, delivering in-depth data and strategic foresight. It assists stakeholders in navigating post-pandemic challenges and identifying profitable opportunities.

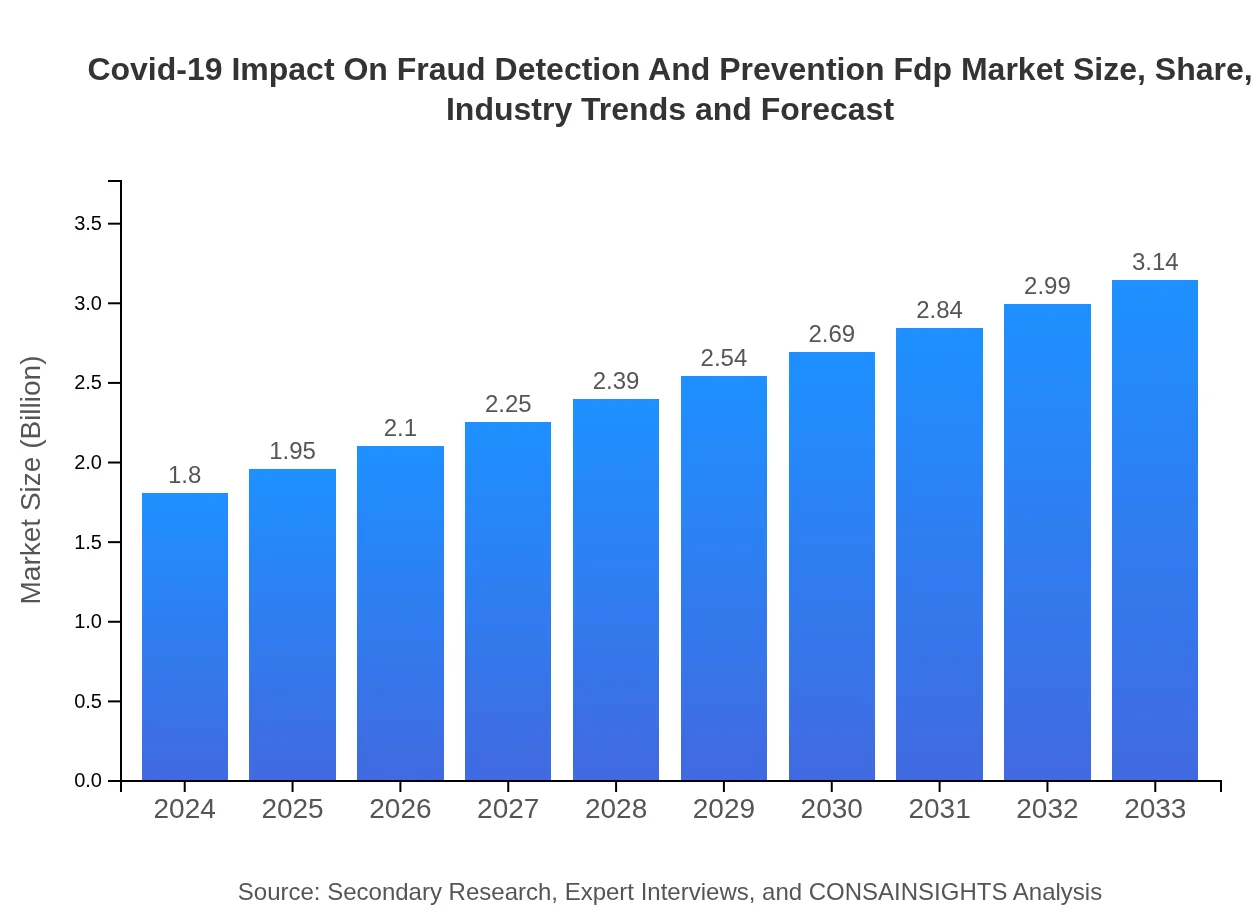

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 6.2% |

| 2033 Market Size | $3.14 Billion |

| Top Companies | TechGuard Solutions, SecureNet Analytics, FraudShield Innovations |

| Last Modified Date | 31 January 2026 |

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Overview

Customize Covid-19 Impact On Fraud Detection And Prevention Fdp market research report

- ✔ Get in-depth analysis of Covid-19 Impact On Fraud Detection And Prevention Fdp market size, growth, and forecasts.

- ✔ Understand Covid-19 Impact On Fraud Detection And Prevention Fdp's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Covid-19 Impact On Fraud Detection And Prevention Fdp

What is the Market Size & CAGR of Covid-19 Impact On Fraud Detection And Prevention Fdp market in {Year}?

Covid-19 Impact On Fraud Detection And Prevention Fdp Industry Analysis

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Analysis Report by Region

Europe Covid-19 Impact On Fraud Detection And Prevention Fdp:

Europe displays robust performance in the FDP market, with growth from 0.53 units in 2024 to 0.91 units by 2033. Strict regulatory frameworks and a strong focus on technological innovation contribute to its stable market expansion.Asia Pacific Covid-19 Impact On Fraud Detection And Prevention Fdp:

In Asia Pacific, the market is projected to expand from a base of 0.35 units in 2024 to around 0.61 units by 2033. This growth is driven by rapid digitalization, increasing internet penetration, and a rising demand for secure financial transactions, pushing organizations to adopt advanced fraud detection solutions.North America Covid-19 Impact On Fraud Detection And Prevention Fdp:

North America remains a dominant force in the FDP market, with growth from 0.64 units to 1.11 units expected over the forecasting period. Significant investments in cybersecurity, coupled with stringent regulatory requirements, are propelling market advancements.South America Covid-19 Impact On Fraud Detection And Prevention Fdp:

South America is witnessing steady progress within the FDP market, with figures expected to rise from 0.07 units in 2024 to 0.12 units by 2033. The improvement in security protocols along with increased digital adoption in banking and retail sectors is fuelling this gradual growth.Middle East & Africa Covid-19 Impact On Fraud Detection And Prevention Fdp:

In the Middle East and Africa, the market is expected to experience moderate growth, moving from 0.22 units in 2024 to 0.38 units by 2033. Investments in digital infrastructure and the adoption of modern fraud detection systems are key growth determinants in the region.Tell us your focus area and get a customized research report.

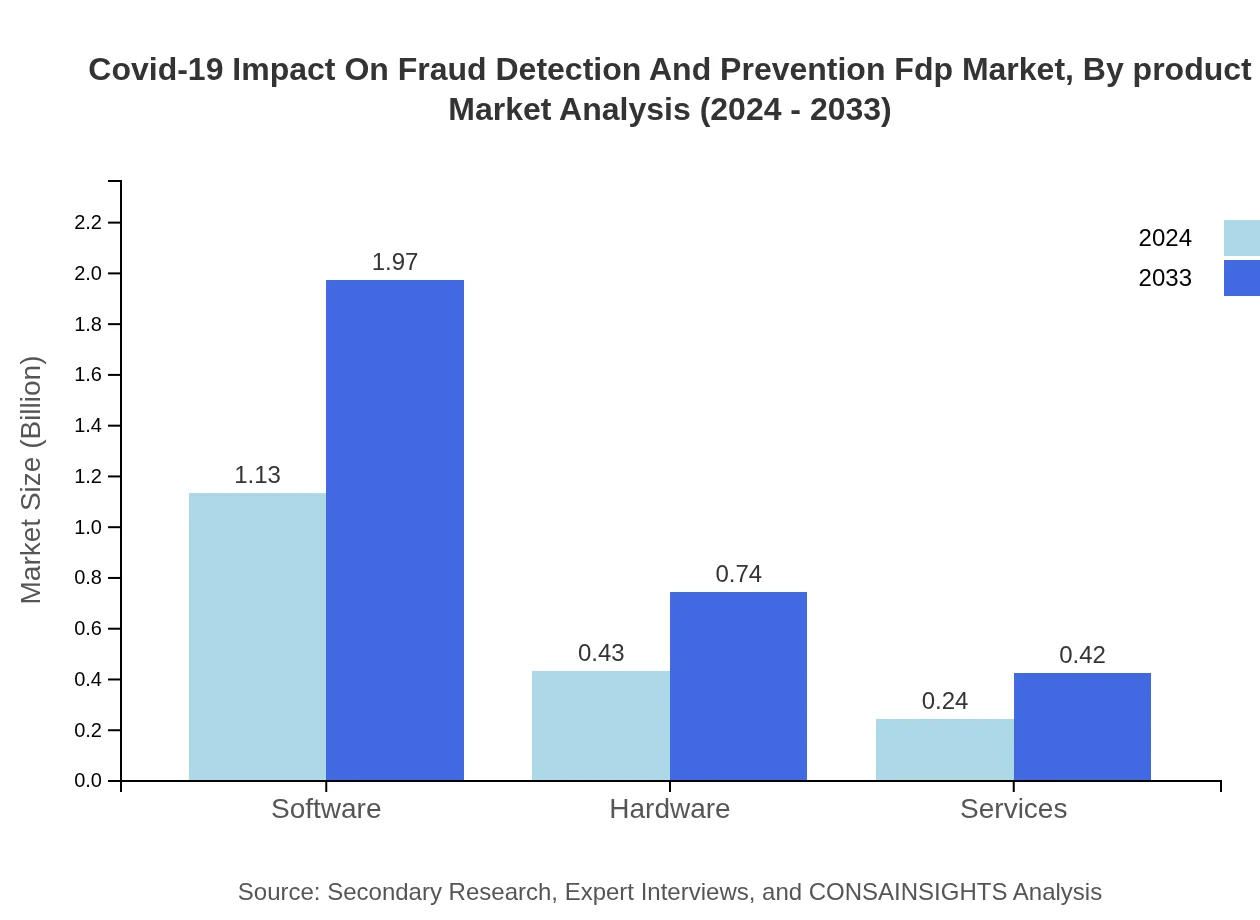

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Analysis By Product

The by-product segment in the Covid-19 Impact on Fraud Detection and Prevention (FDP) market focuses on analyzing the performance of individual product types including software, hardware, and services. Software dominates with a market size of 1.13 units in 2024, reaching 1.97 units by 2033, while maintaining a steady share of 62.82%. Hardware and services also play significant roles by complementing integrated fraud prevention solutions. This segment reflects how shifting customer demands and rapid technological integration are driving strategic product innovations, ultimately ensuring robust protection against fraud.

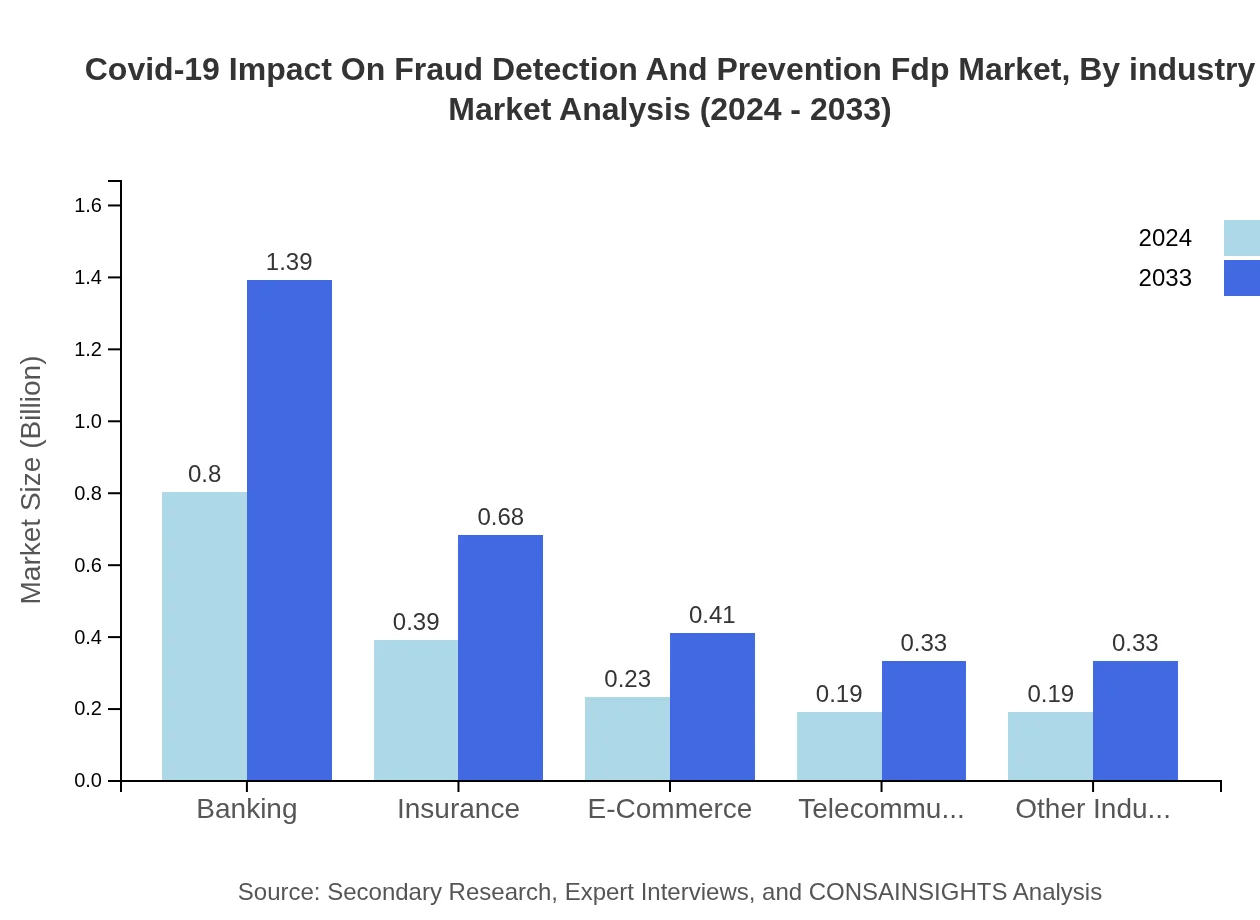

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Analysis By Industry

The by-industry segment provides a detailed examination of how different verticals contribute to the Covid-19 Impact on Fraud Detection and Prevention (FDP) market. Industries such as banking, insurance, e-commerce, telecommunications, and other sectors are critical to the market landscape. For example, the banking sector shows significant growth, with market size increasing from 0.80 to 1.39 units and contributing 44.33% to the overall market share. This analysis highlights the targeted investments and tailored fraud detection strategies that are driving industry-specific advancements and bolstering overall market growth.

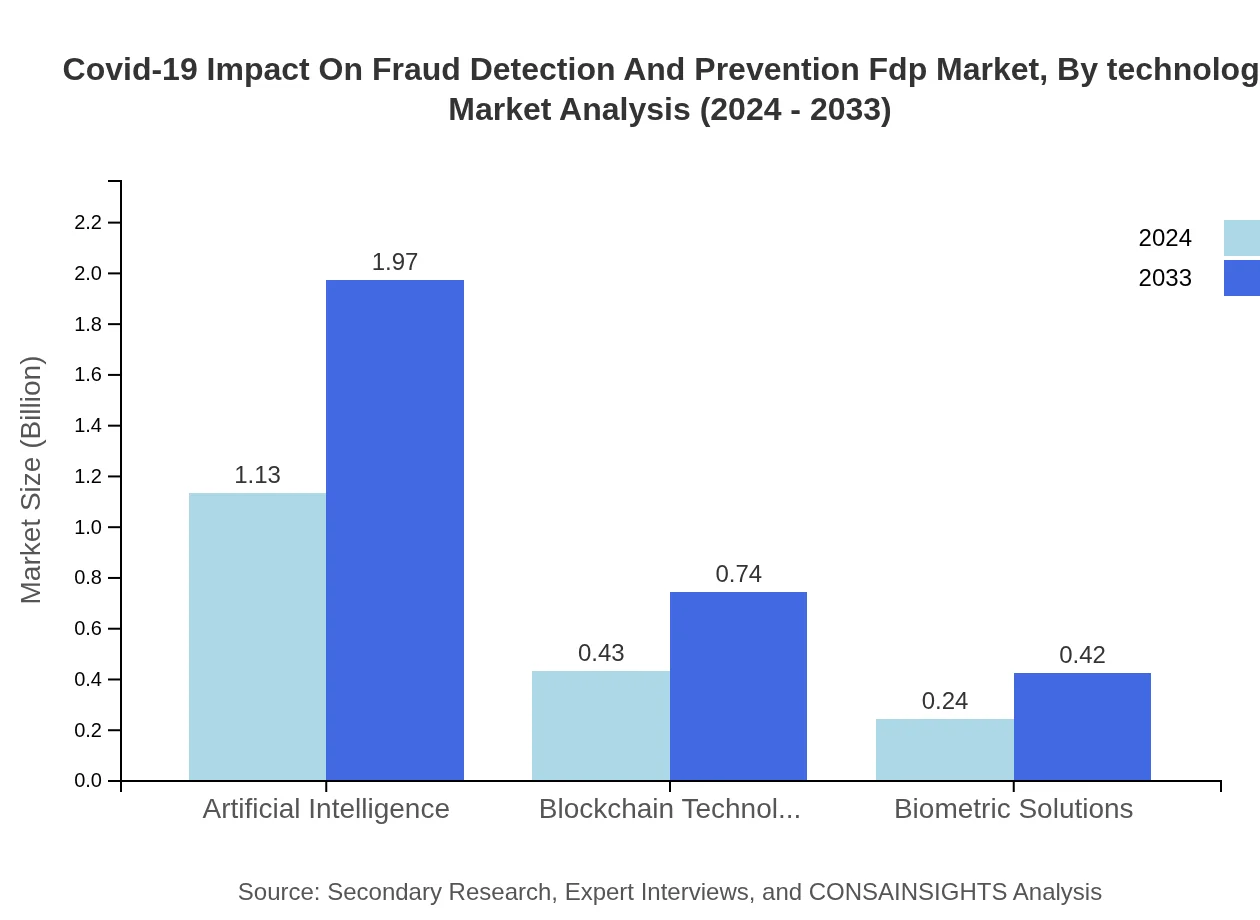

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Analysis By Technology

The by-technology segment delves into the technological advancements that are driving the evolution of the Covid-19 Impact on Fraud Detection and Prevention (FDP) market. Leading this charge is artificial intelligence, which sees a growth in market size from 1.13 to 1.97 units and maintains a dominant share of 62.82%. Alongside AI, innovations in blockchain technology and biometric solutions are also gaining traction. These technologies are being integrated to offer enhanced real-time analytics, improved pattern recognition, and overall stronger security frameworks, thus enabling more effective responses to emerging fraud schemes.

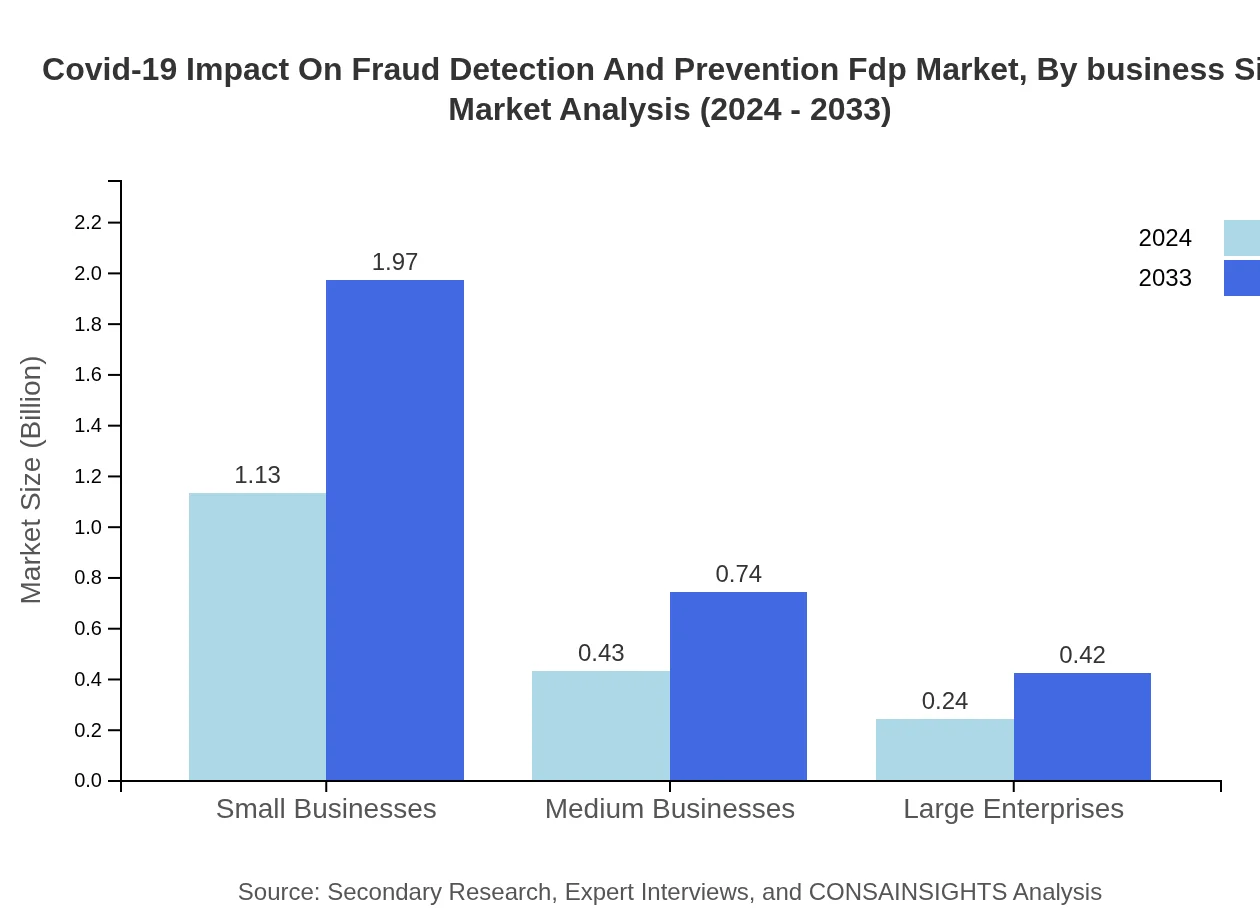

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Analysis By Business Size

The by-business-size segment examines how organizations of various sizes are adapting to the challenges of fraud detection and prevention post-Covid-19. Small businesses lead with a market size growing from 1.13 to 1.97 units, capturing 62.82% of the overall share. Medium and large enterprises contribute with market sizes of 0.43 and 0.24 units, representing shares of 23.74% and 13.44% respectively. This segmentation underscores the need for customizable and scalable fraud prevention solutions tailored to the specific operational requirements and risk profiles of different business sizes.

Covid-19 Impact On Fraud Detection And Prevention Fdp Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Covid-19 Impact On Fraud Detection And Prevention Fdp Industry

TechGuard Solutions:

TechGuard Solutions has established itself as a leader by integrating advanced fraud detection systems with innovative AI and blockchain technologies, setting industry benchmarks.SecureNet Analytics:

SecureNet Analytics is renowned for its robust security frameworks and comprehensive fraud management tools, offering end-to-end solutions that safeguard critical infrastructures.FraudShield Innovations:

FraudShield Innovations leverages cutting-edge technology to provide real-time monitoring and predictive analytics, making it a key player in revolutionizing fraud prevention strategies globally.We're grateful to work with incredible clients.