Data Converter Market Report

Published Date: 22 January 2026 | Report Code: data-converter

Data Converter Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Data Converter industry, highlighting key insights, market dynamics, and growth forecasts from 2023 to 2033. It covers market sizes, segmentation, technological innovations, regional insights, and major players in the industry.

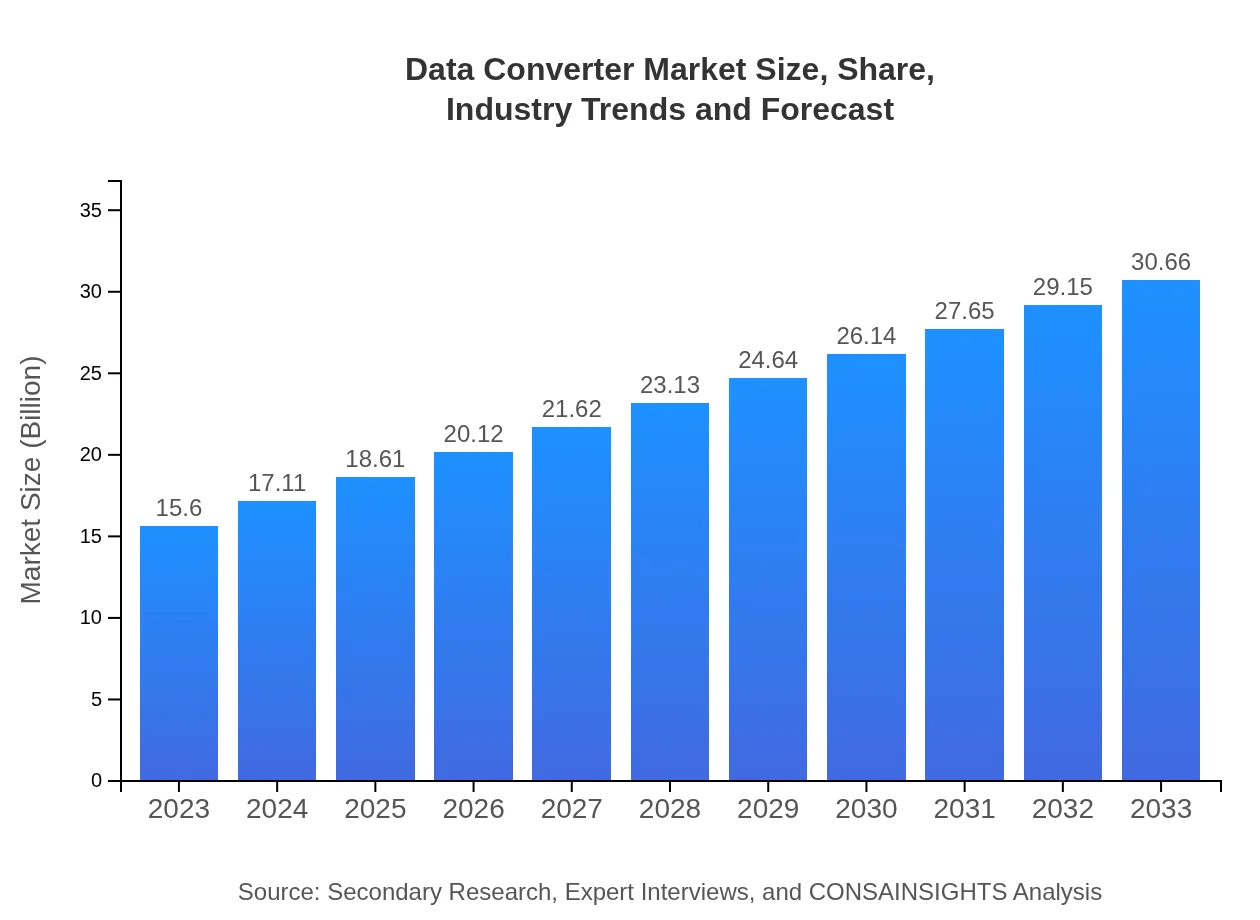

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Texas Instruments, Analog Devices, Inc., Maxim Integrated, NXP Semiconductors |

| Last Modified Date | 22 January 2026 |

Data Converter Market Overview

Customize Data Converter Market Report market research report

- ✔ Get in-depth analysis of Data Converter market size, growth, and forecasts.

- ✔ Understand Data Converter's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Converter

What is the Market Size & CAGR of Data Converter market in 2023?

Data Converter Industry Analysis

Data Converter Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Converter Market Analysis Report by Region

Europe Data Converter Market Report:

Europe is anticipated to experience steady growth in the Data Converter sector, with market size forecasts escalating from USD 4.91 billion in 2023 to USD 9.66 billion by 2033. This growth is attributed to stringent industrial standards and heightened focus on automation in manufacturing.Asia Pacific Data Converter Market Report:

The Asia-Pacific region is projected to witness significant growth, driven by the burgeoning consumer electronic market and increasing industrial automation. The market size is anticipated to grow from USD 2.58 billion in 2023 to USD 5.07 billion by 2033, fueled by rising demand for ADCs in smartphones and IoT devices.North America Data Converter Market Report:

North America remains a pivotal hub for the Data Converter market with a market size projected to escalate from USD 5.96 billion in 2023 to USD 11.72 billion by 2033, propelled by significant investments in R&D from key technology firms and increasing adoption of advanced automotive technologies.South America Data Converter Market Report:

The South American market for data converters is poised for growth, although at a slower pace compared to other regions. The estimated size in 2023 is USD 0.84 billion, expected to increase to USD 1.64 billion by 2033, largely due to expansion in telecommunications and automotive sectors.Middle East & Africa Data Converter Market Report:

The market in the Middle East and Africa is expected to see growth from USD 1.31 billion in 2023 to USD 2.57 billion by 2033. This growth is primarily driven by advancements in telecommunications infrastructure and a gradual increase in technology adoption in industrial applications.Tell us your focus area and get a customized research report.

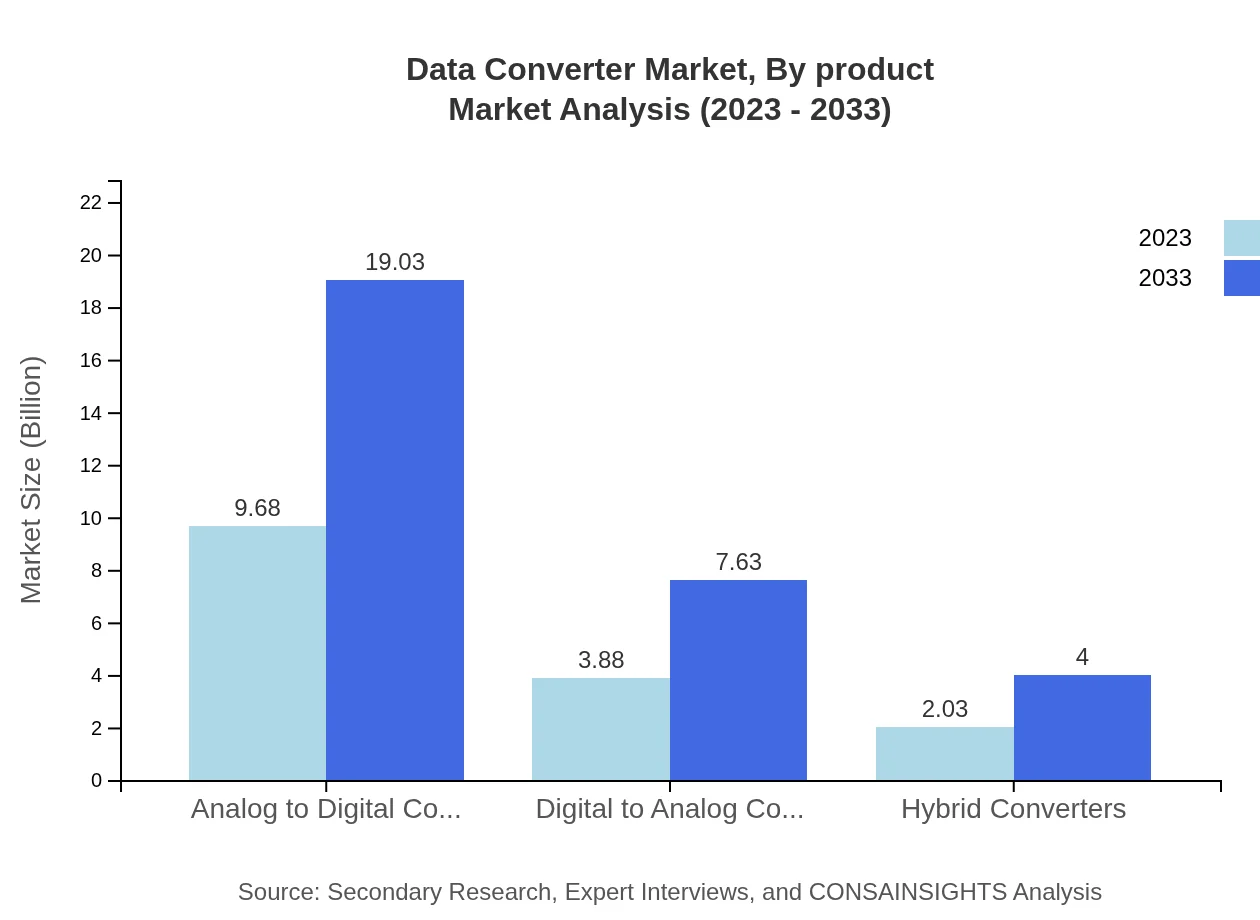

Data Converter Market Analysis By Product

The Data Converter market by product type includes Analog to Digital Converters (ADCs), Digital to Analog Converters (DACs), and Hybrid Converters. ADCs dominate the market with a projected size of USD 9.68 billion in 2023, expected to rise to USD 19.03 billion by 2033. DACs account for a substantial share, performing well owing to their applications in audio devices and telecommunication systems, projected to increase from USD 3.88 billion to USD 7.63 billion over the same period.

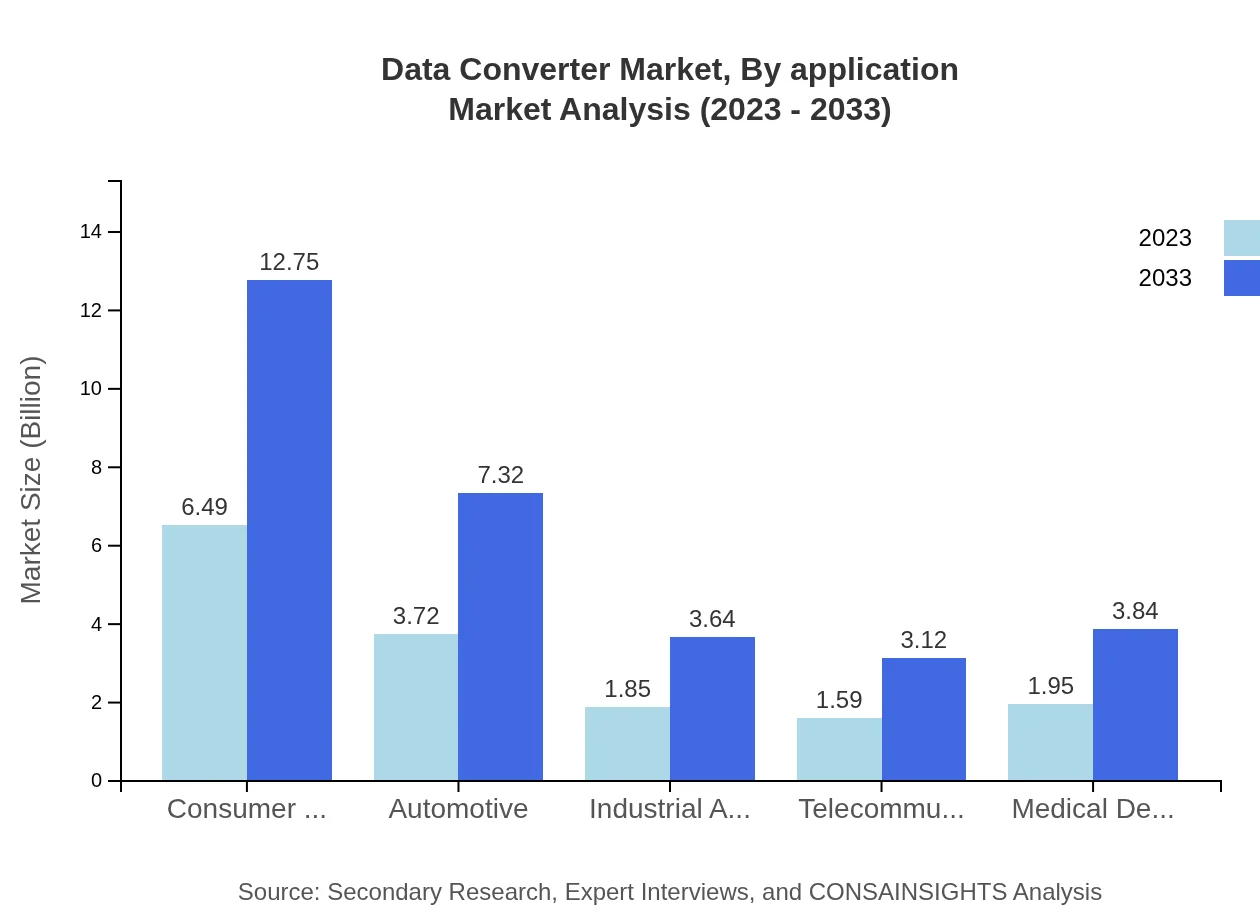

Data Converter Market Analysis By Application

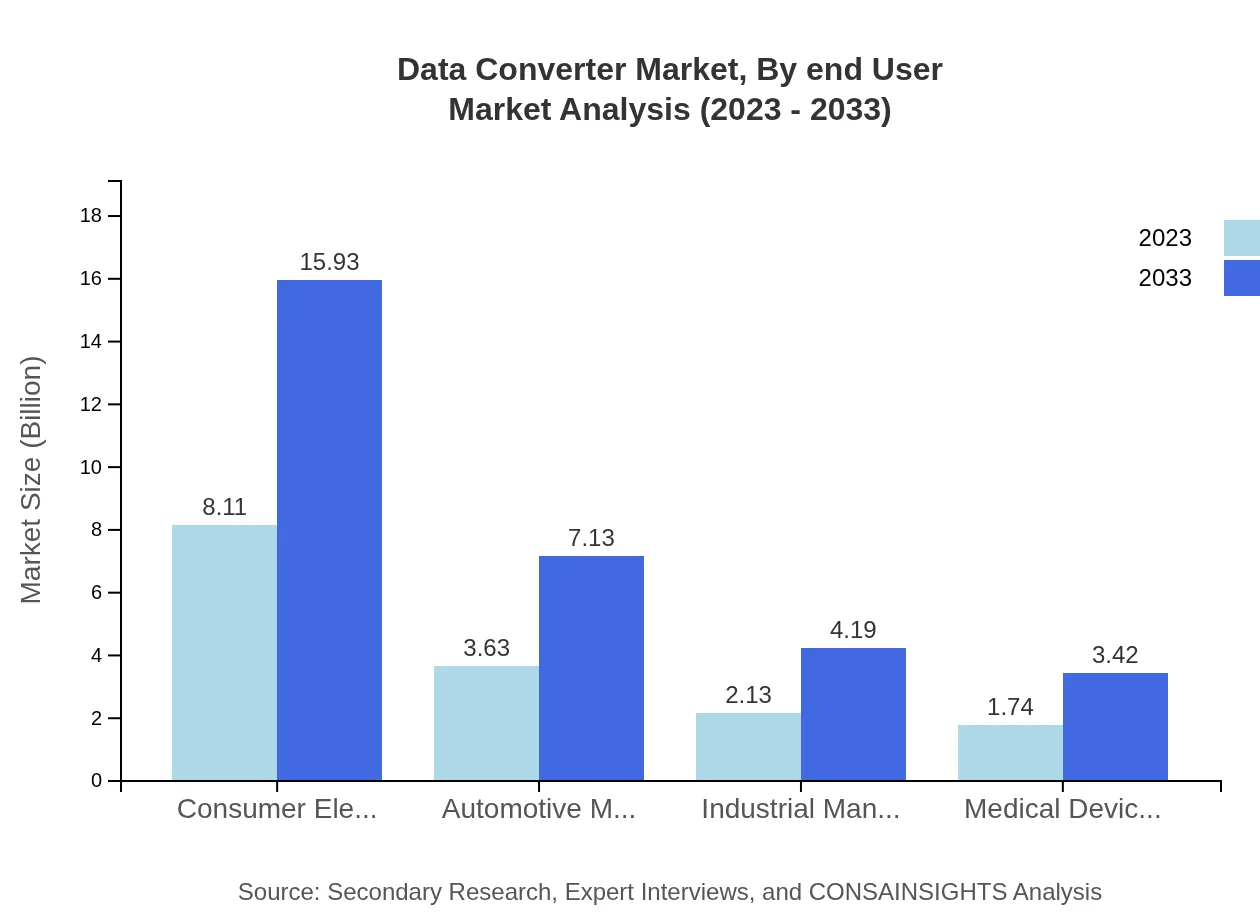

By application, the Data Converter market demonstrates significant revenue generation through diverse sectors including consumer electronics, automotive, industrial automation, telecommunications, and medical devices. Consumer electronics represent a leading application with revenues estimated at USD 8.11 billion in 2023, expected to grow to USD 15.93 billion by 2033, driven by demand for high-fidelity audio and video processing. The automotive segment is also vital, currently valued at USD 3.63 billion and projected to reach USD 7.13 billion.

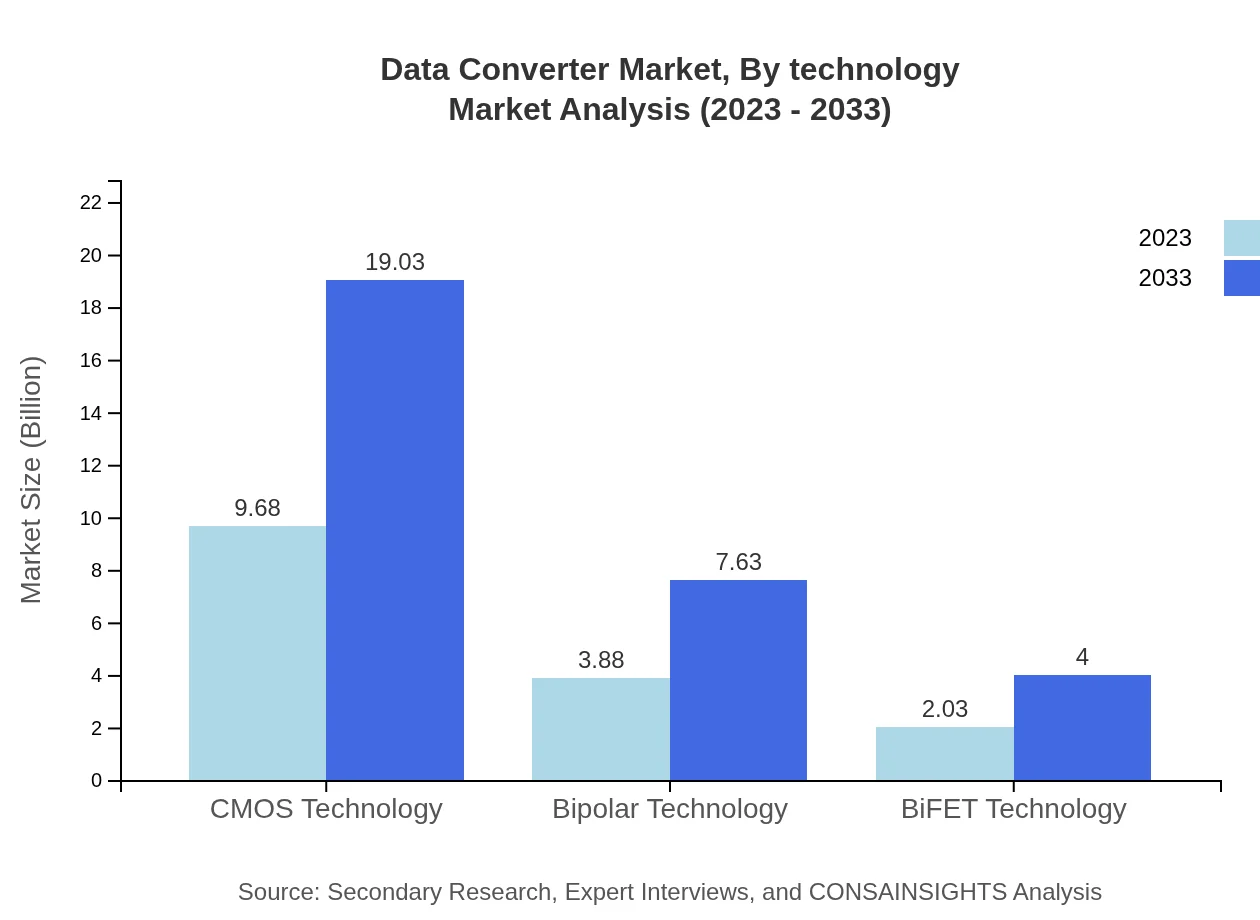

Data Converter Market Analysis By Technology

The Data Converter market by technology includes CMOS, Bipolar, and BiFET technologies, where CMOS technology holds the largest market share, valued at USD 9.68 billion in 2023, set to grow to USD 19.03 billion by 2033. Bipolar technology, catering to specific high-precision applications, is expected to grow from USD 3.88 billion to USD 7.63 billion, highlighting the ongoing innovations in precision data conversion solutions.

Data Converter Market Analysis By End User

End-user analysis showcases substantial demand from sectors such as consumer electronics, automotive, and industrial automation. The consumer electronics sector's share is anticipated to remain significant, accounting for approximately 51.96% of the market in 2023. Moreover, automotive manufacturers' demand for data converters remains strong, projected to escalate from USD 3.72 billion to about USD 7.32 billion by 2033, emphasizing the critical role data converters play in advanced vehicle technologies.

Data Converter Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Converter Industry

Texas Instruments:

A prominent player in the semiconductor industry, Texas Instruments is known for its extensive portfolio of data converters, addressing a broad spectrum of applications from consumer electronics to automotive systems.Analog Devices, Inc.:

Specializing in high-performance analog, mixed-signal, and digital signal processing technologies, Analog Devices offers a comprehensive range of data converters widely employed in industrial and telecommunications sectors.Maxim Integrated:

Maxim Integrated focuses on designing data converters that emphasize low power consumption and high efficiency, catering primarily to the consumer electronics and automotive markets.NXP Semiconductors:

NXP is a leader in advanced automotive and industrial applications, providing innovative data conversion solutions integral to next-generation automotive systems.We're grateful to work with incredible clients.

FAQs

What is the market size of data Converter?

The data converter market is sized at approximately $15.6 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033. It is anticipated to experience significant growth, driven by technology advancements and the increasing demand for data conversion solutions.

What are the key market players or companies in the data Converter industry?

Key players in the data converter market include Analog Devices, Texas Instruments, and Maxim Integrated. These companies dominate market shares with their innovative solutions in analog-to-digital and digital-to-analog converters.

What are the primary factors driving the growth in the data Converter industry?

Growth in the data converter industry is primarily driven by rising demand in consumer electronics, advancements in telecommunications technology, and the increase in industrial automation. Additionally, the growing automotive sector and medical devices market contribute significantly to this growth.

Which region is the fastest Growing in the data Converter market?

The fastest-growing region in the data converter market is North America, expected to grow from $5.96 billion in 2023 to $11.72 billion by 2033. This growth is fueled by increased adoption of advanced technologies in various sectors.

Does ConsaInsights provide customized market report data for the data Converter industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the data converter industry, ensuring that clients receive detailed insights and analysis aligned with their strategic goals.

What deliverables can I expect from this data Converter market research project?

Deliverables from the data converter market research project include detailed market analysis reports, insights on trends, forecasts, and competitive landscape assessments, along with segment-specific data and tailored recommendations.

What are the market trends of data Converter?

Current trends in the data converter market include a move towards miniaturization of devices, increased integration of data converters in IoT applications, and the rise of hybrid conversion technologies, enabling enhanced performance across various applications.