Data Room Vendors

Published Date: 02 February 2026 | Report Code: data-room-vendors

Data Room Vendors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Room Vendors market with deep insights into market dynamics, segmentation, and regional performance over the forecast period 2024 to 2033. The analysis encompasses market size, growth trends, industry challenges, technological innovations, and competitive landscapes to assist stakeholders in strategic decision-making.

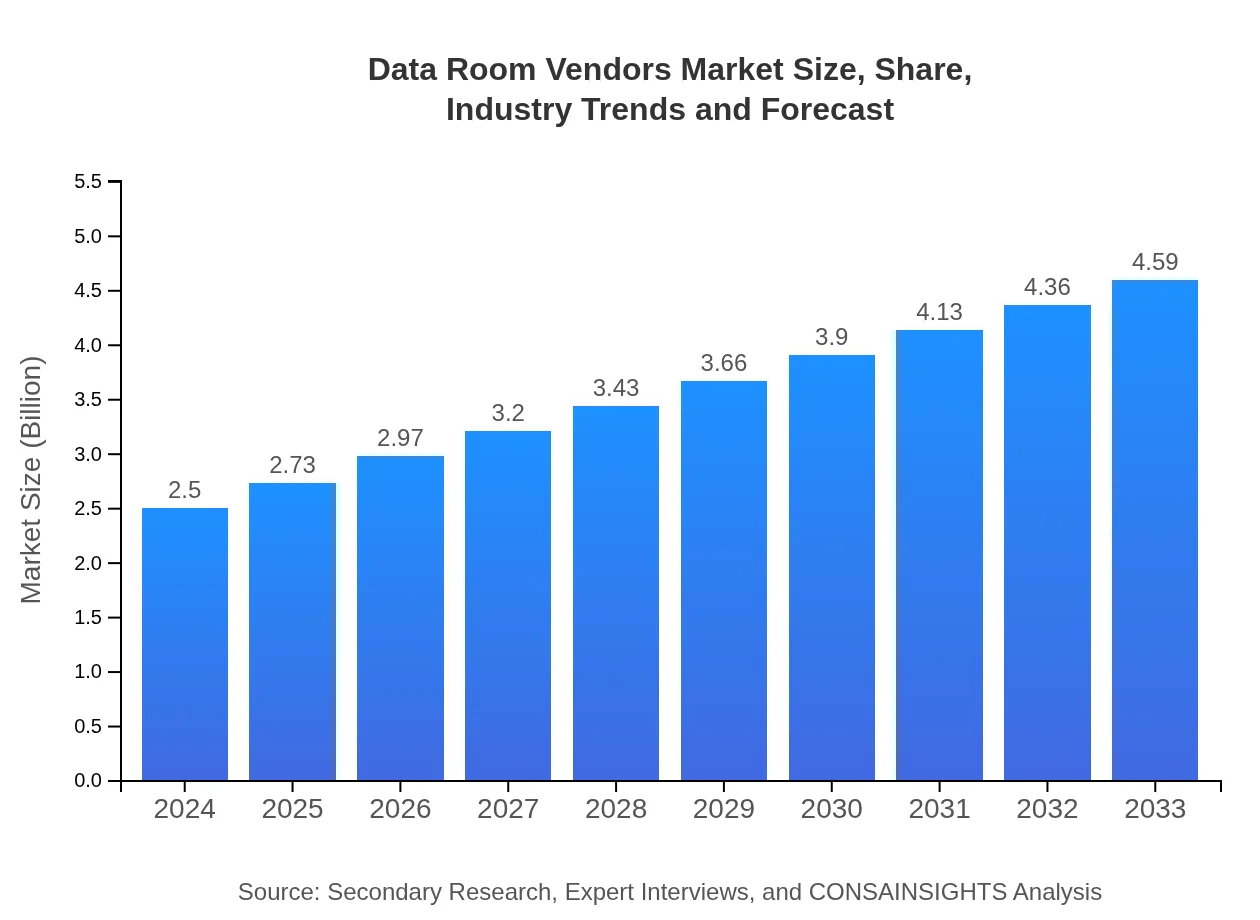

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.50 Billion |

| CAGR (2024-2033) | 6.8% |

| 2033 Market Size | $4.59 Billion |

| Top Companies | InfoSecure Solutions, VirtualVault Technologies, SecureDocs International |

| Last Modified Date | 02 February 2026 |

Data Room Vendors Market Overview

Customize Data Room Vendors market research report

- ✔ Get in-depth analysis of Data Room Vendors market size, growth, and forecasts.

- ✔ Understand Data Room Vendors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Room Vendors

What is the Market Size & CAGR of Data Room Vendors market in 2024?

Data Room Vendors Industry Analysis

Data Room Vendors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Room Vendors Market Analysis Report by Region

Europe Data Room Vendors:

The European market is expected to witness substantial growth, rising from 0.79 in 2024 to 1.46 in 2033. Stringent data protection regulations, coupled with a high concentration of corporate headquarters and a robust legal industry, have spurred significant investments in advanced data room solutions. Moreover, innovation and digital integration initiatives continue to drive market expansion.Asia Pacific Data Room Vendors:

In the Asia Pacific region, the market is anticipated to nearly double from a base value of 0.39 in 2024 to 0.72 by 2033. The growth is fueled by rapid digitalization, expanding economies, and increased adoption of cloud-based solutions across emerging markets in the region. Investment in IT infrastructure and regulatory reforms are creating an environment conducive to innovation and expansion.North America Data Room Vendors:

North America leads the technology adoption curve in the Data Room Vendors market, with market figures increasing from 0.95 in 2024 to 1.75 by 2033. This growth is supported by strong infrastructure investments, regulatory compliance needs, and a mature technological ecosystem that prioritizes data security and efficiency in document management.South America Data Room Vendors:

South America’s contribution to the Data Room Vendors market is set to expand significantly from 0.19 in 2024 to 0.35 in 2033. The region is leveraging digital transformation for improved efficiency and security in financial and legal transactions, driven by increased cross-border investments and a growing number of M&A activities.Middle East & Africa Data Room Vendors:

The Middle East and Africa regions, while currently representing a smaller share of the market, are projected to grow from 0.18 in 2024 to 0.32 by 2033. This growth is indicative of emerging economies embracing digital tools to enhance compliance and efficiency in deal-making and legal due diligence processes, supported by increasing investments in technology infrastructure.Tell us your focus area and get a customized research report.

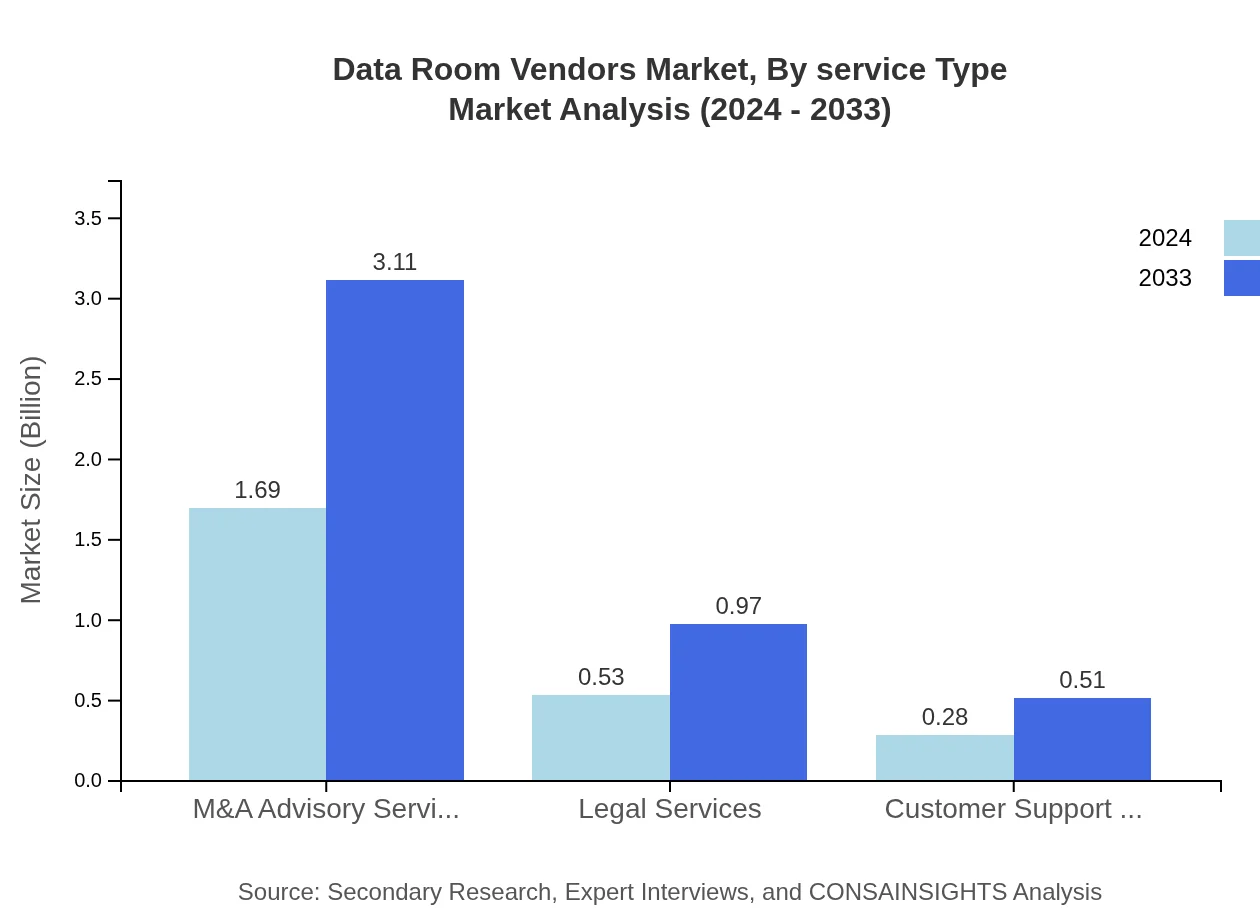

Data Room Vendors Market Analysis By Service Type

Under the service type segmentation, the market is primarily driven by offerings in M&A Advisory Services, Legal Services, and Customer Support Services. M&A Advisory Services, representing a significant share with a size growing from 1.69 in 2024 to 3.11 by 2033 and maintaining a share of 67.79%, is a key driver due to the increasing frequency of mergers and acquisitions. Legal Services also play a crucial role, supporting transactions with precise documentation and expertise, with market sizes increasing from 0.53 to 0.97 and consistently holding a 21.02% share. Additionally, Customer Support Services are integral for ensuring smooth operational transition and risk mitigation in data handling, with market figures growing from 0.28 to 0.51, making up 11.19% of the market. These services collectively contribute to a comprehensive, secure, and efficient transaction process, building customer trust and market resilience.

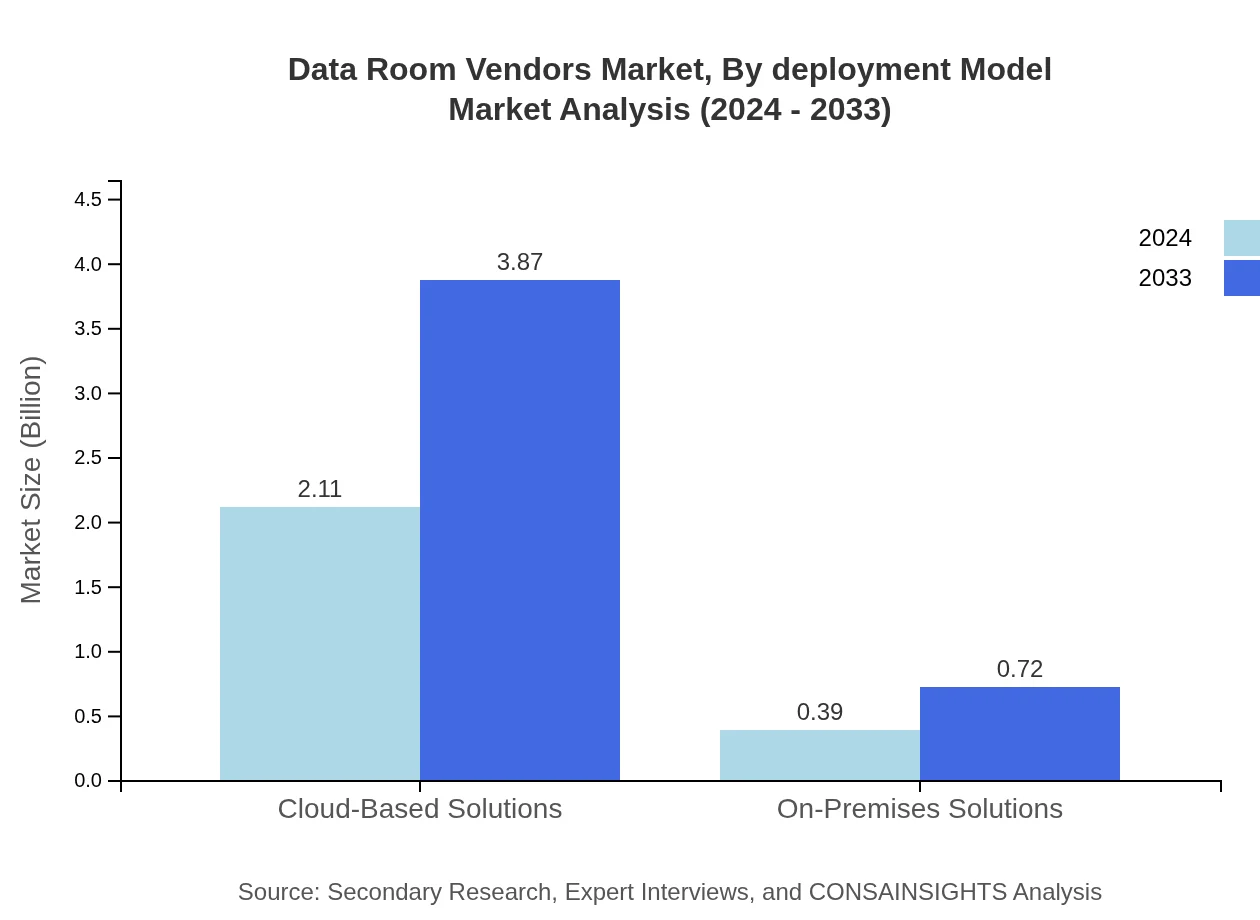

Data Room Vendors Market Analysis By Deployment Model

In terms of deployment models, the market analysis divides solutions into Cloud-Based Solutions and On-Premises Solutions. Cloud-Based Solutions exhibit robust growth, with market size increasing from 2.11 in 2024 to 3.87 by 2033 and dominating with an 84.27% share. This segment benefits from the scalability and cost-efficiency of cloud platforms, making it highly attractive to enterprises across diverse sectors. On-Premises Solutions, while representing a smaller segment at 15.73%, are preferred by organizations with stringent security requirements and legacy system dependencies. The ability to host data internally allows for enhanced control and compliance with local data protection laws. This dual approach in deployment ensures that the market caters to both innovative cloud adopters and organizations maintaining traditional IT infrastructures.

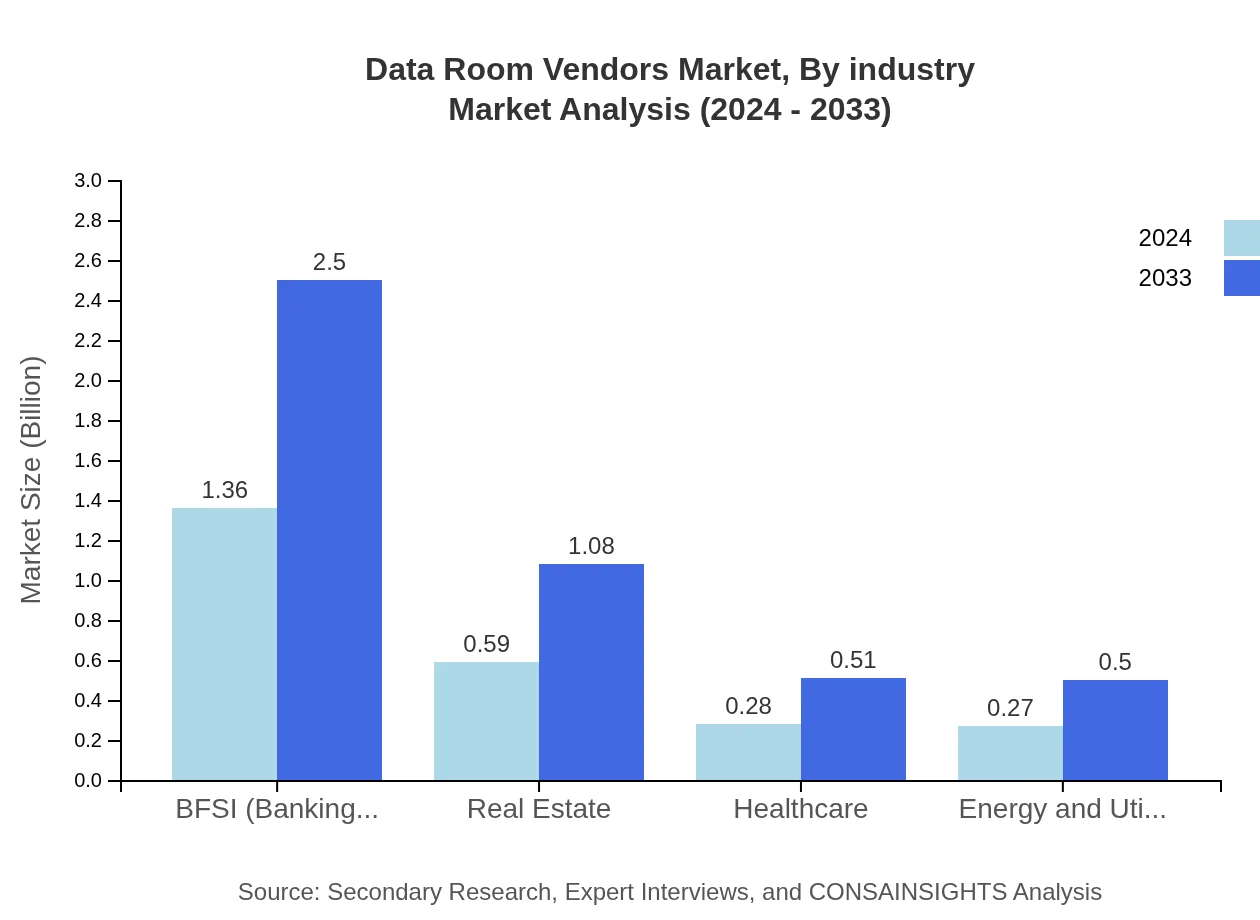

Data Room Vendors Market Analysis By Industry

The by-industry segmentation encompasses key sectors such as BFSI, Real Estate, Healthcare, and Energy and Utilities. The BFSI segment, with a market size growing from 1.36 to 2.50 and a stable share of 54.5%, is at the forefront due to the critical need for secure transactional data management. Real Estate, another vital segment, shows growth from 0.59 to 1.08 with a consistent share of 23.59%, driven by the increasing complexity of property transactions and due diligence requirements. Healthcare demands secure data room solutions for compliance and patient data protection, growing from 0.28 to 0.51 and accounting for 11.01% of the market. Energy and Utilities, though modest with a growth from 0.27 to 0.50 and a share of 10.9%, remain important due to the regulatory and operational needs inherent in the sector. Each industry uses data room solutions to manage voluminous, sensitive information and support critical business transactions.

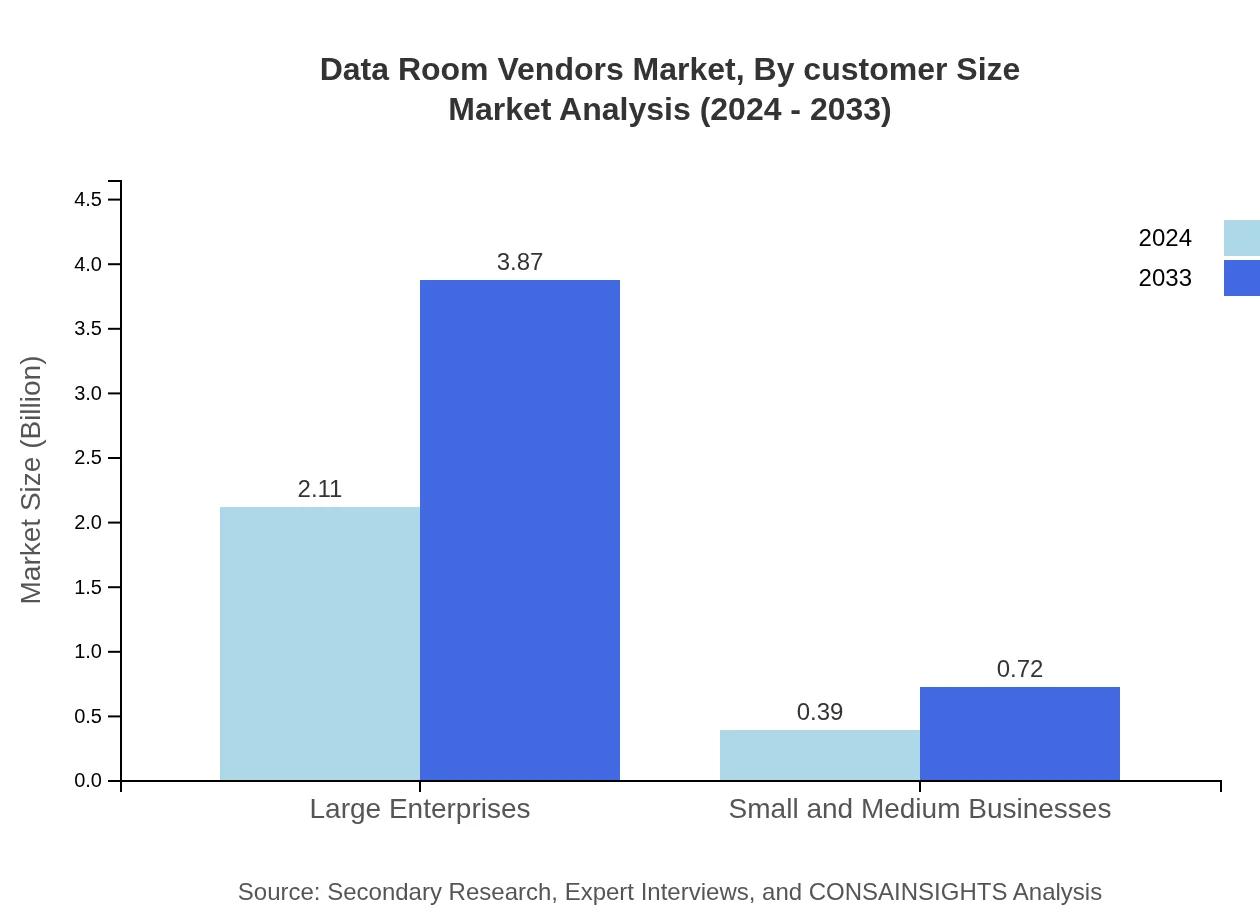

Data Room Vendors Market Analysis By Customer Size

Customer size segmentation divides the market into Large Enterprises and Small and Medium Businesses (SMBs). Large Enterprises dominate the market with a significant presence, evidenced by a market size rising from 2.11 to 3.87 and a commanding share of 84.27%. These organizations require comprehensive, scalable data room solutions to support their extensive transaction volumes and stringent compliance standards. In contrast, Small and Medium Businesses, with market sizes growing from 0.39 to 0.72 and a smaller share of 15.73%, have begun increasingly adopting sophisticated platforms as they modernize their operations. This segmentation highlights how solution providers are tailoring their products to meet the varied needs and budgets of different business sizes, ensuring robust security protocols and streamlined functionalities across the board.

Data Room Vendors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Room Vendors Industry

InfoSecure Solutions:

A leading provider of integrated data room solutions, InfoSecure Solutions is known for its cutting-edge technology and robust security features. The company has successfully catered to multinational corporations and legal institutions, continuously innovating its product offerings to meet evolving regulatory requirements.VirtualVault Technologies:

VirtualVault Technologies specializes in cloud-based data room solutions with a strong focus on ease of use and compliance. Their platform is widely adopted in the M&A advisory and legal sectors, providing secure, scalable, and user-friendly services that align with the needs of a diverse clientele.SecureDocs International:

SecureDocs International has built a reputation for reliability and top-tier customer support. With a comprehensive suite of tools designed for secure document management, the company caters to industries such as BFSI, real estate, and healthcare, driving market standards in data security and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of data Room Vendors?

The market size of data-room vendors is currently estimated at $2.5 billion, with a compound annual growth rate (CAGR) of 6.8%. This growth reflects the increasing demand for secure data storage solutions across various industries.

What are the key market players or companies in this data Room Vendors industry?

Key players in the data-room vendors industry include established technology firms and emerging startups, known for their innovative solutions in secure document storage and data management, catering especially to sectors like finance, real estate, and legal services.

What are the primary factors driving the growth in the data Room Vendors industry?

Factors driving growth in the data-room industry include an increase in mergers & acquisitions, heightened cybersecurity concerns, and the expanding digitization of businesses, which necessitates secure and efficient data management solutions across various sectors.

Which region is the fastest Growing in the data Room Vendors?

North America is currently the fastest-growing region in the data-room vendors market, projected to grow from $0.95 billion in 2024 to $1.75 billion by 2033, driven by the rapid adoption of cloud services and stringent data security regulations.

Does ConsaInsights provide customized market report data for the data Room Vendors industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the data-room vendors industry, enabling businesses to gain detailed insights relevant to their unique operational requirements and strategic goals.

What deliverables can I expect from this data Room Vendors market research project?

From the data-room vendors market research project, clients can expect comprehensive reports including market size estimates, growth forecasts, competitive analysis, and insights into emerging trends and customer demographics to inform strategic decisions.

What are the market trends of data Room Vendors?

Current trends in the data-room vendors market include a shift towards cloud-based solutions, an emphasis on enhanced security features, and growing integration with artificial intelligence to improve data management efficiency and analytics capabilities.