Dc Chargers Market Report

Published Date: 31 January 2026 | Report Code: dc-chargers

Dc Chargers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the DC Chargers market, focusing on market size, trends, and projections from 2023 to 2033. It explores key market segments, regional insights, technological advancements, and identifies leading market players.

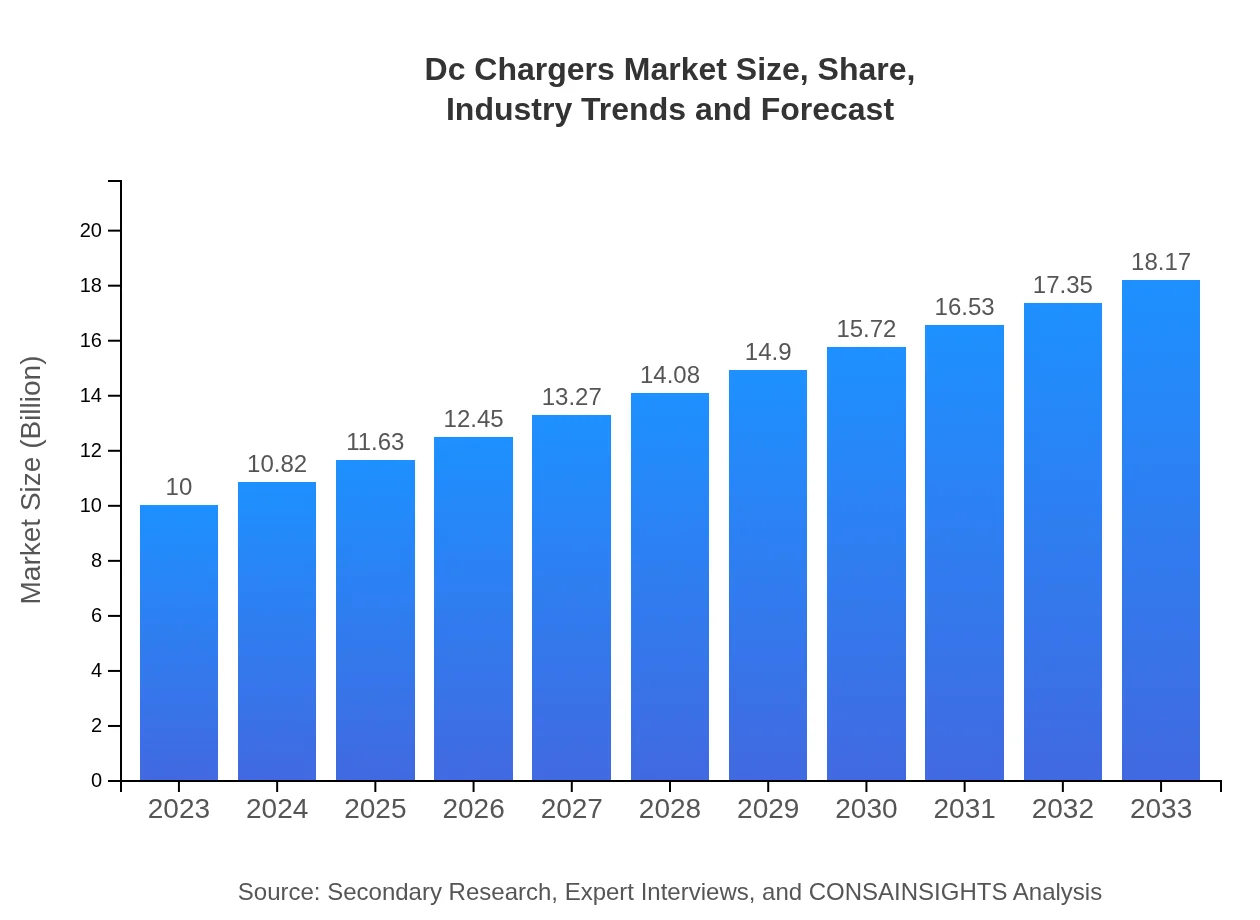

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | ChargePoint Inc., ABB Ltd., Siemens AG, Tesla Inc., Blink Charging Co. |

| Last Modified Date | 31 January 2026 |

DC Chargers Market Overview

Customize Dc Chargers Market Report market research report

- ✔ Get in-depth analysis of Dc Chargers market size, growth, and forecasts.

- ✔ Understand Dc Chargers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dc Chargers

What is the Market Size & CAGR of DC Chargers market in 2023?

DC Chargers Industry Analysis

DC Chargers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

DC Chargers Market Analysis Report by Region

Europe Dc Chargers Market Report:

Europe's DC Chargers market is forecasted to expand from $2.98 billion in 2023 to $5.42 billion by 2033. With stringent environmental policies and a robust EV market, countries like Germany, Norway, and the Netherlands are significant contributors to this growth.Asia Pacific Dc Chargers Market Report:

In 2023, the Asia Pacific DC Chargers market size is estimated at $1.90 billion and expected to grow to $3.45 billion by 2033. The region's booming EV market, particularly in countries like China and Japan, boosts the demand for charging infrastructure. Government policies favoring EV adoption provide a supportive environment for market growth.North America Dc Chargers Market Report:

In North America, the DC Chargers market size is anticipated to grow from $3.38 billion in 2023 to $6.13 billion by 2033. The United States leads this growth with extensive investments in charging infrastructure and favorable government regulations promoting electric vehicle adoption.South America Dc Chargers Market Report:

The South American DC Chargers market, valued at $0.60 billion in 2023, is projected to reach $1.09 billion by 2033. Increasing urbanization, coupled with a push for sustainable energy, is driving interest in EV chargers. Brazil and Argentina are at the forefront of this transition.Middle East & Africa Dc Chargers Market Report:

The Middle East and Africa's market is expected to increase from $1.14 billion in 2023 to $2.07 billion by 2033. Emerging markets are gradually adopting EV technologies, primarily driven by urbanization and government initiatives in the Gulf Cooperation Council (GCC) countries.Tell us your focus area and get a customized research report.

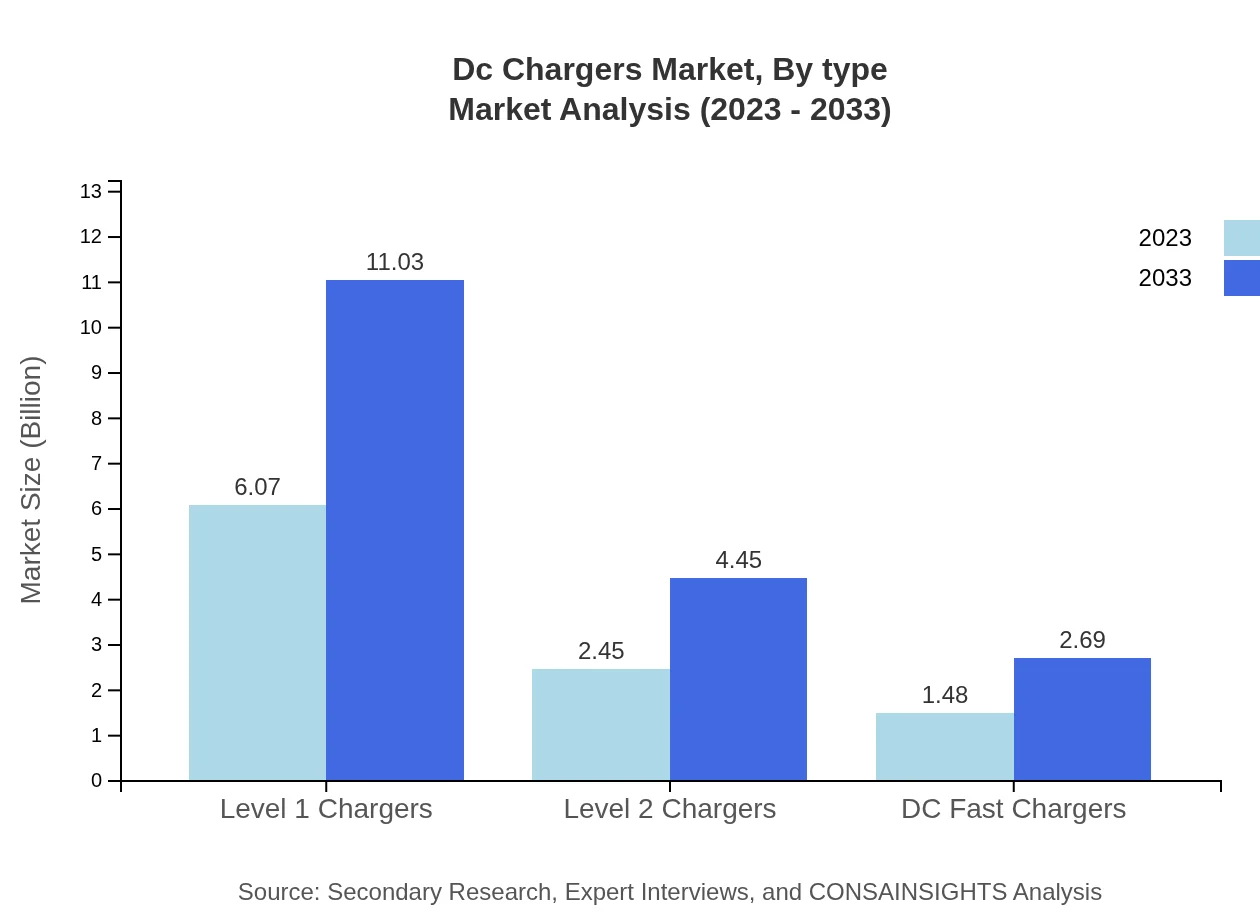

Dc Chargers Market Analysis By Type

The DC Chargers market by type identifies three primary segments - Level 1 Chargers, Level 2 Chargers, and DC Fast Chargers. Level 1 Chargers currently hold a significant share, valued at $6.07 billion in 2023 and expected to increase to $11.03 billion by 2033. Level 2 Chargers follow with a market size of $2.45 billion, projected to reach $4.45 billion in the same period. DC Fast Chargers are also gaining traction with growing demand, moving from $1.48 billion in 2023 to $2.69 billion by 2033.

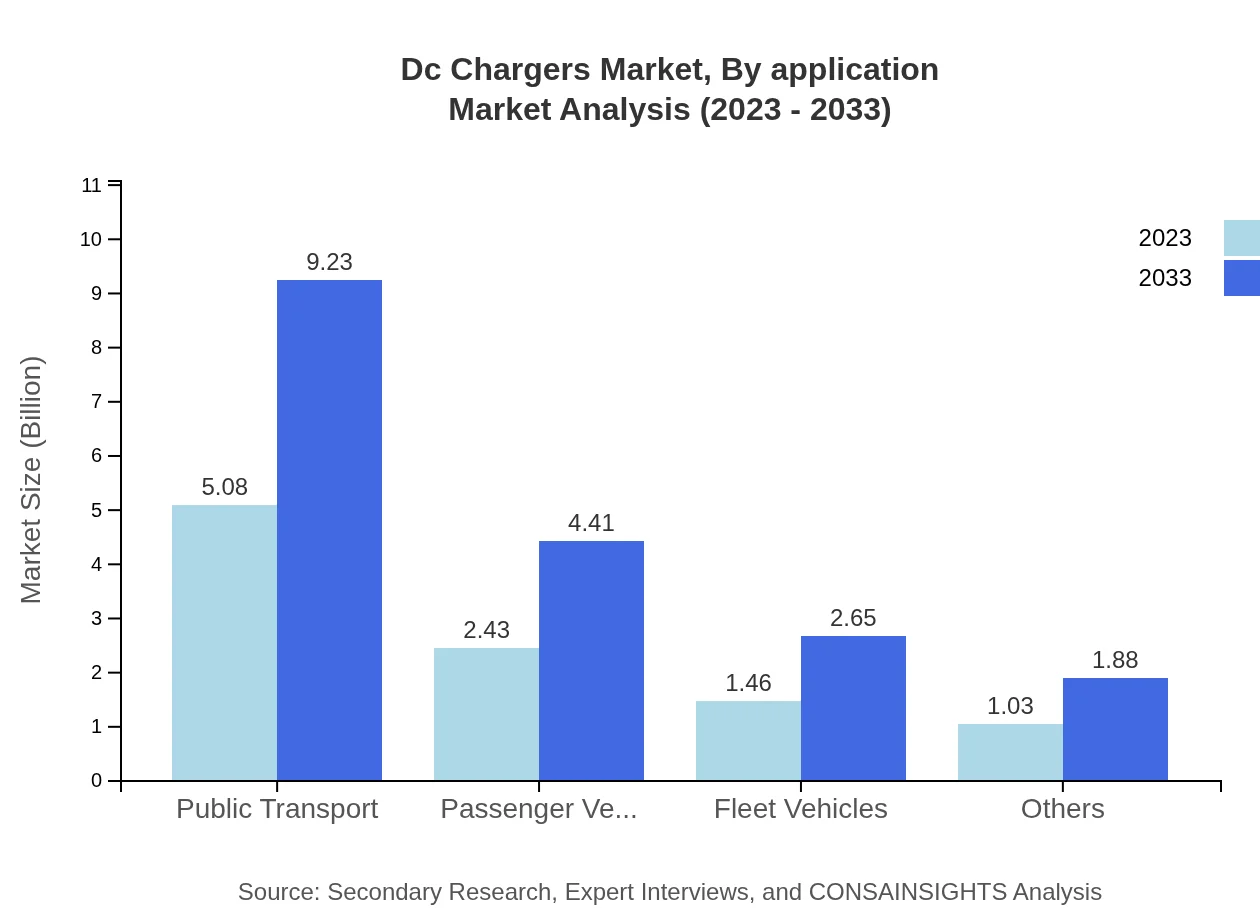

Dc Chargers Market Analysis By Application

Application segmentation reveals critical insights into the end user categories including Public Transport, Passenger Vehicles, Fleet Vehicles, and Others. The Public Transport segment currently accounts for $5.08 billion in 2023, expected to rise to $9.23 billion by 2033, mainly due to expanding urban public transport networks. The Passenger Vehicles segment holds significant potential, moving from $2.43 billion to $4.41 billion over the forecast period.

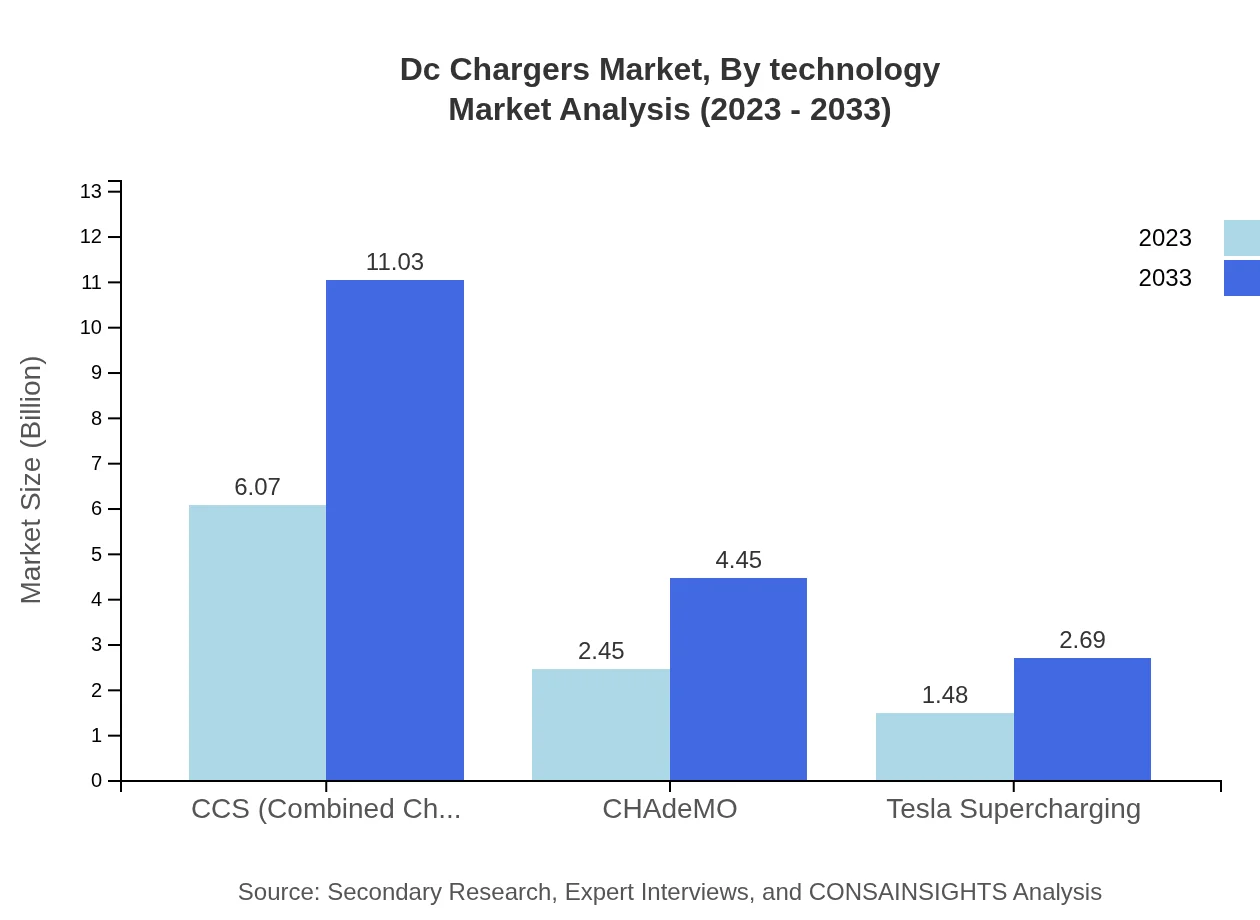

Dc Chargers Market Analysis By Technology

Technology analysis focuses on various charging technologies such as CCS, CHAdeMO, and Tesla Supercharging. CCS leads the market with a 60.69% share, translating to a revenue of $6.07 billion in 2023, expected to grow to $11.03 billion by 2033. CHAdeMO, primarily in Japan, accounts for 24.49% of the market, while Tesla Supercharging maintains a 14.82% share, emphasizing the need for more universal charging protocols.

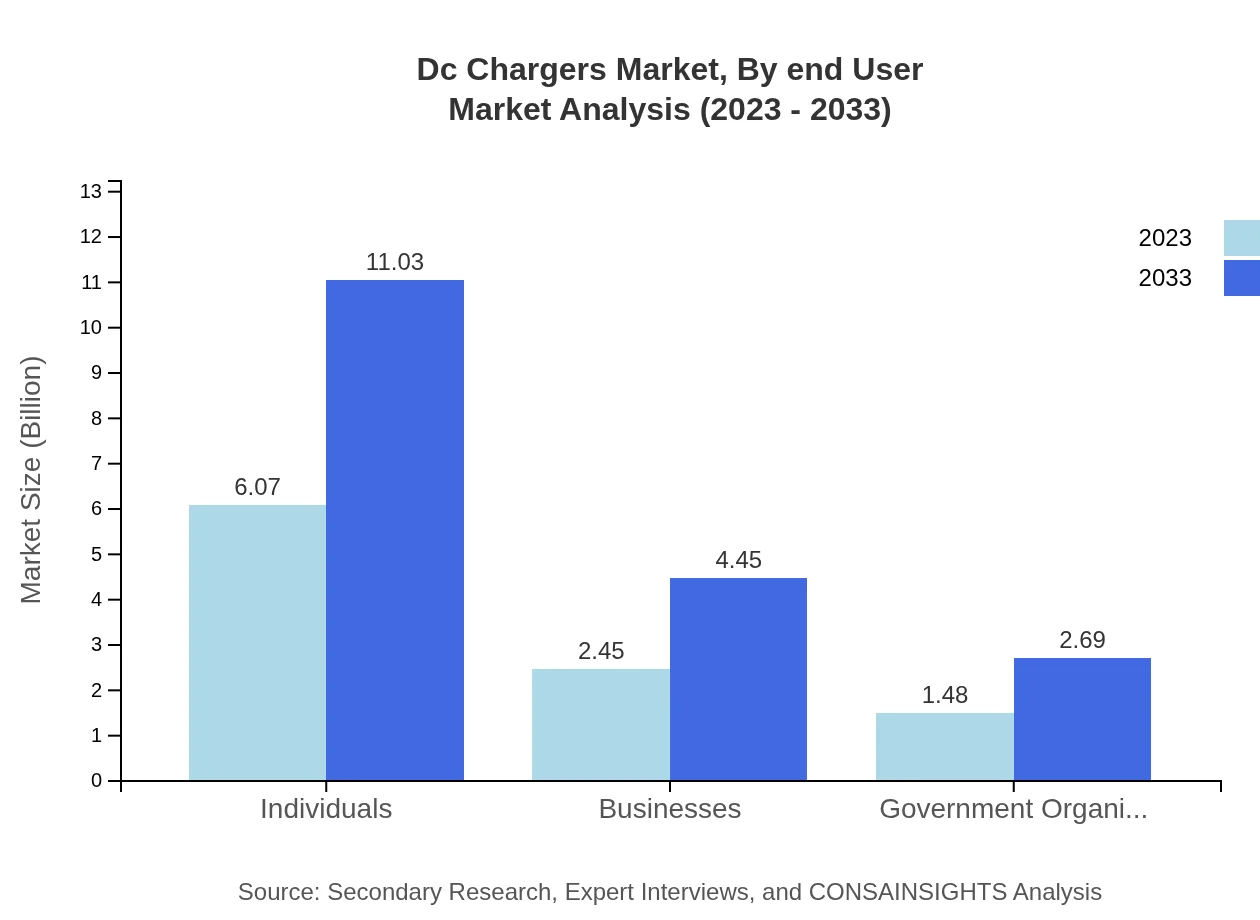

Dc Chargers Market Analysis By End User

End-user segmentation includes Individuals, Businesses, and Government Organizations. The Individual segment dominates with a market size of $6.07 billion in 2023, anticipated at $11.03 billion by 2033. Businesses and Government organizations follow, with sizes of $2.45 billion and $1.48 billion, respectively in 2023, both projected to grow significantly by 2033.

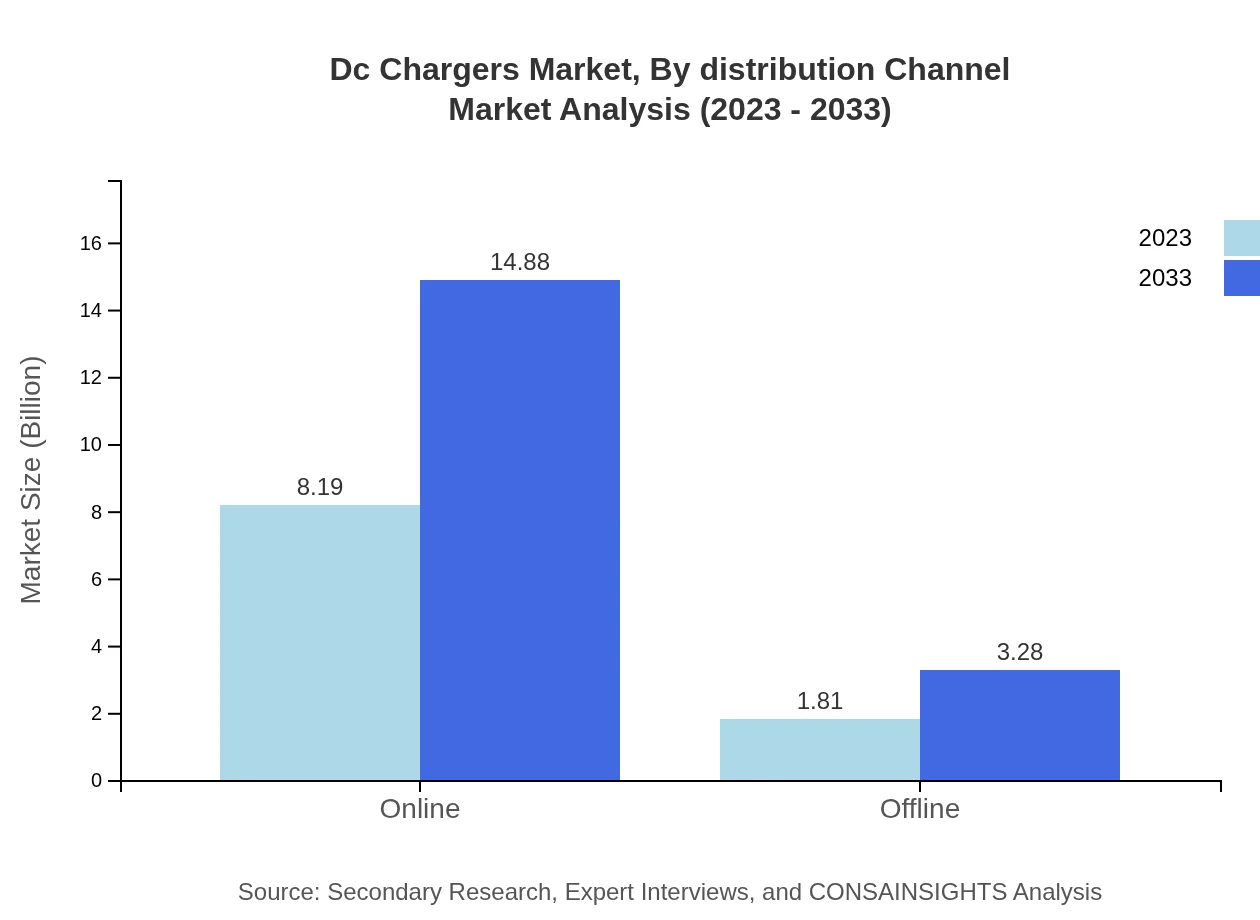

Dc Chargers Market Analysis By Distribution Channel

The distribution channel analysis categorizes the market into Online and Offline channels. The Online segment holds a dominating share of 81.93% in 2023, estimated to grow from $8.19 billion to $14.88 billion by 2033. Offline channels currently experience a market size of $1.81 billion, projected to grow to $3.28 billion by 2033.

DC Chargers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in DC Chargers Industry

ChargePoint Inc.:

ChargePoint is a leading provider of electric vehicle charging infrastructure, known for its extensive network of charging stations and advanced charging technology.ABB Ltd.:

ABB is a global technology company that excels in providing solutions for electrification and automation, including DC fast chargers and related services.Siemens AG:

Siemens is a prominent player in the electrification sector, offering a wide range of products and solutions for electric vehicle charging, including smart infrastructure.Tesla Inc.:

Tesla is not only a leading EV manufacturer but also a key player in the charging market, known for its proprietary charging technology and extensive Supercharger network.Blink Charging Co.:

Blink specializes in electric vehicle charging infrastructure and service, offering smart charging solutions across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of dc Chargers?

The global market size for DC chargers is projected at approximately $10 billion in 2023, with a compound annual growth rate (CAGR) of 6% expected through 2033, highlighting significant growth potential in the coming decade.

What are the key market players or companies in the dc Chargers industry?

Key market players in the DC chargers industry include established companies like ABB, Schneider Electric, and Siemens, along with emerging startups that focus on innovative charging solutions and the development of faster, more efficient charging technologies.

What are the primary factors driving the growth in the dc Chargers industry?

Growth in the DC chargers market is primarily driven by the increasing adoption of electric vehicles, advancements in charging technology, and government initiatives aimed at expanding charging infrastructure to support sustainable transportation.

Which region is the fastest Growing in the dc Chargers market?

The fastest-growing region in the DC chargers market is North America, with market size expanding from $3.38 billion in 2023 to $6.13 billion by 2033, fueled by rising electric vehicle sales and robust infrastructure investments.

Does ConsaInsights provide customized market report data for the dc Chargers industry?

Yes, ConsaInsights offers customized market report data for the DC chargers industry, allowing clients to obtain tailored insights that meet specific needs and preferences across various segments and regions.

What deliverables can I expect from this dc Chargers market research project?

Deliverables from the DC chargers market research project include comprehensive market analysis reports, segment data, regional insights, growth forecasts, competitive landscape evaluations, and strategic recommendations for market entry and expansion.

What are the market trends of dc Chargers?

Current market trends in the DC chargers sector include the rise of fast-charging technologies, increased investment in charging infrastructure, and growing partnerships among automakers, technology firms, and energy providers to enhance electric vehicle adoption.