Diamond Coatings Market Report

Published Date: 02 February 2026 | Report Code: diamond-coatings

Diamond Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Diamond Coatings market, including market size, segmentation, industry analysis, and regional insights. Covering the forecast period from 2023 to 2033, the report highlights trends, key players, and future growth projections.

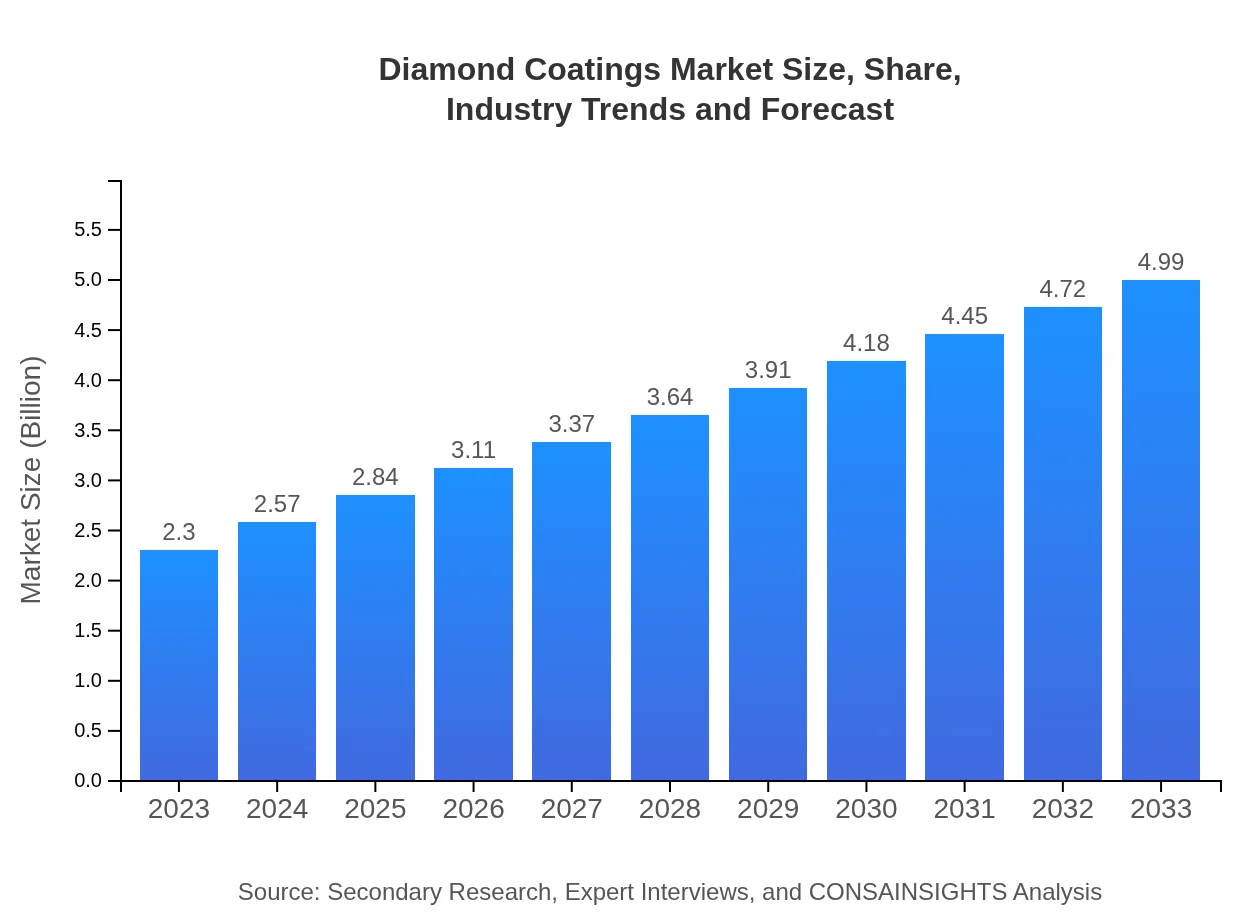

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $4.99 Billion |

| Top Companies | Element Six, Sumitomo Electric Industries, De Beers Group, DMT |

| Last Modified Date | 02 February 2026 |

Diamond Coatings Market Overview

Customize Diamond Coatings Market Report market research report

- ✔ Get in-depth analysis of Diamond Coatings market size, growth, and forecasts.

- ✔ Understand Diamond Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diamond Coatings

What is the Market Size & CAGR of Diamond Coatings market in 2023?

Diamond Coatings Industry Analysis

Diamond Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diamond Coatings Market Analysis Report by Region

Europe Diamond Coatings Market Report:

Europe's Diamond Coatings market is anticipated to grow from $0.58 billion in 2023 to $1.26 billion by 2033. The demand for high-performance coating solutions in the automotive and manufacturing industries is a significant driver in this region.Asia Pacific Diamond Coatings Market Report:

In Asia Pacific, the Diamond Coatings market is projected to grow from $0.48 billion in 2023 to $1.04 billion by 2033. This growth is driven by increasing industrial infrastructure and the rising demand for advanced manufacturing technologies in countries like China and India.North America Diamond Coatings Market Report:

North America holds significant market potential, with a size forecasted to rise from $0.89 billion in 2023 to $1.93 billion by 2033. The robust aerospace and automotive sectors in this region are key contributors to market growth.South America Diamond Coatings Market Report:

The South American market is set to reach $0.38 billion by 2033, up from $0.18 billion in 2023. The region's growth is supported by expanding mining and oil sectors requiring durable materials for tools and equipment.Middle East & Africa Diamond Coatings Market Report:

In the Middle East and Africa, the market is expected to see growth from $0.17 billion in 2023 to $0.37 billion by 2033, influenced by developments in the oil and gas sectors, where enhanced durability of tools is increasingly vital.Tell us your focus area and get a customized research report.

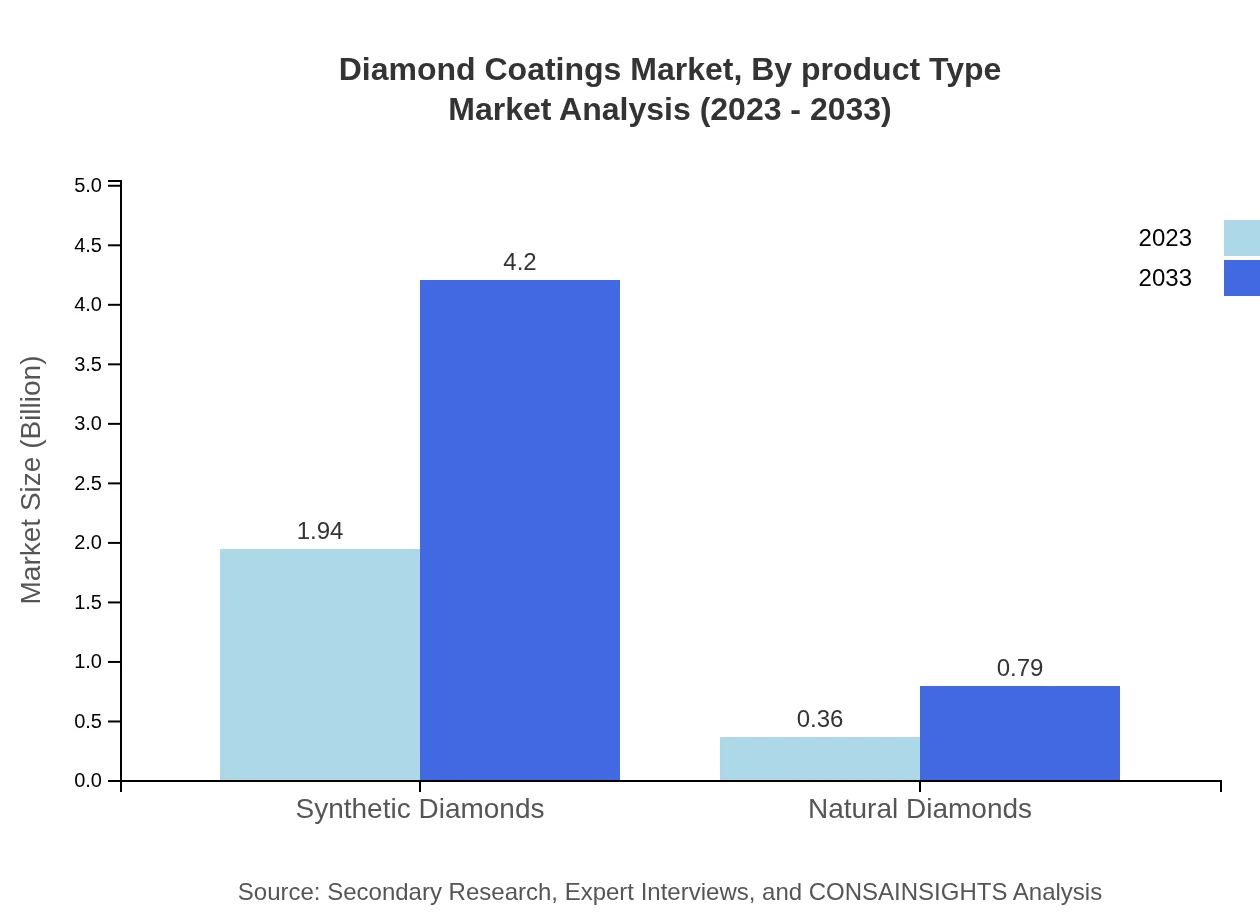

Diamond Coatings Market Analysis By Product Type

The product segment consists of Synthetic Diamonds, accounting for 84.21% market share, valued at $1.94 billion in 2023. Natural Diamonds comprise the remaining 15.79% with a market size of $0.36 billion. By 2033, Synthetic Diamonds will grow to $4.20 billion, while Natural Diamonds are expected to reach $0.79 billion.

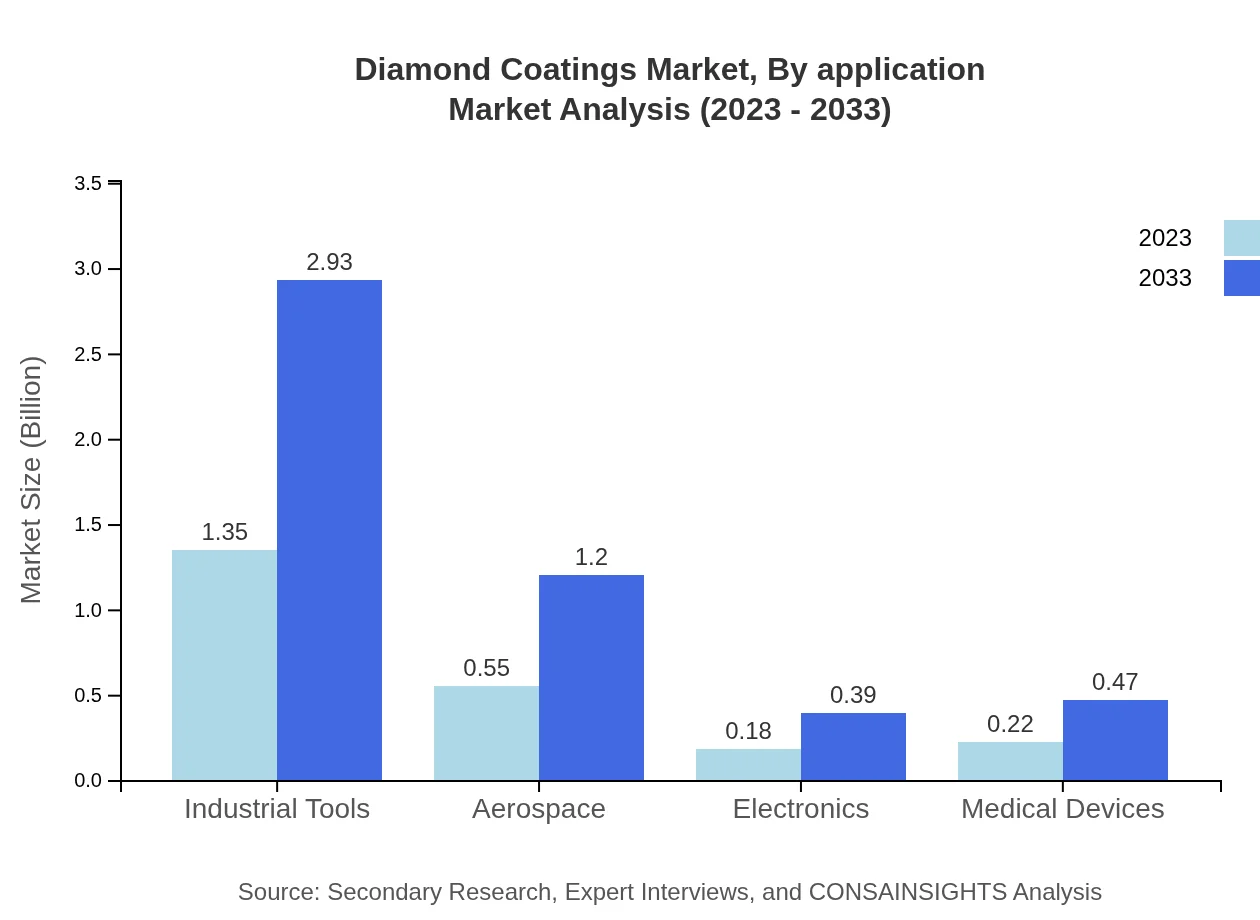

Diamond Coatings Market Analysis By Application

Key applications include Industrial Tools, Aerospace, Automotive, Electronics, Medical Devices, and Oil & Gas. The Industrial Tools segment will expand in size from $1.35 billion to $2.93 billion by 2033, maintaining a 58.68% share. Aerospace is projected to grow from $0.55 billion to $1.20 billion, with a steady share of 23.97%.

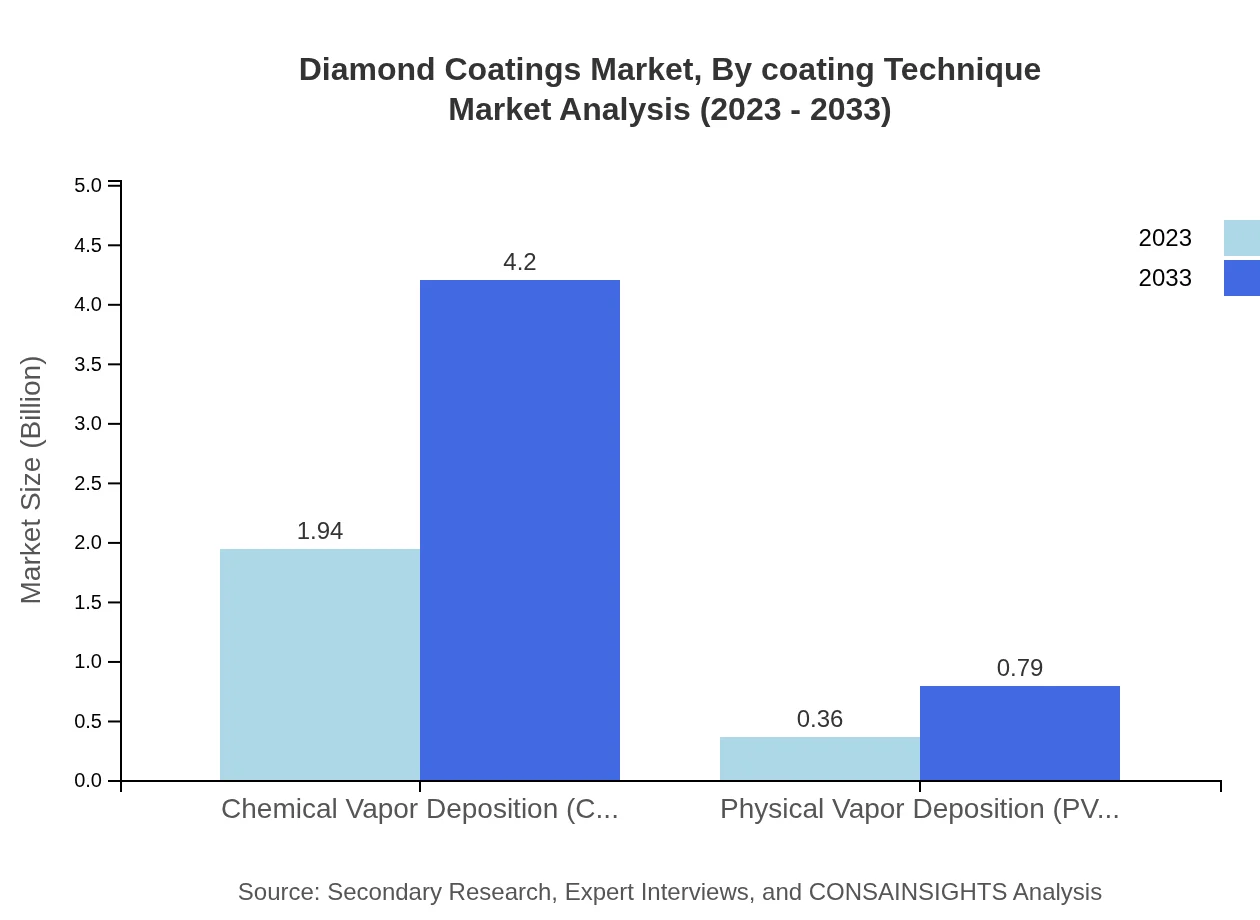

Diamond Coatings Market Analysis By Coating Technique

The two main coating techniques are Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD). CVD technology will dominate with an expected size of $4.20 billion in 2033, equating to 84.21% market share, and PVD will grow from $0.36 billion to $0.79 billion, holding a 15.79% share.

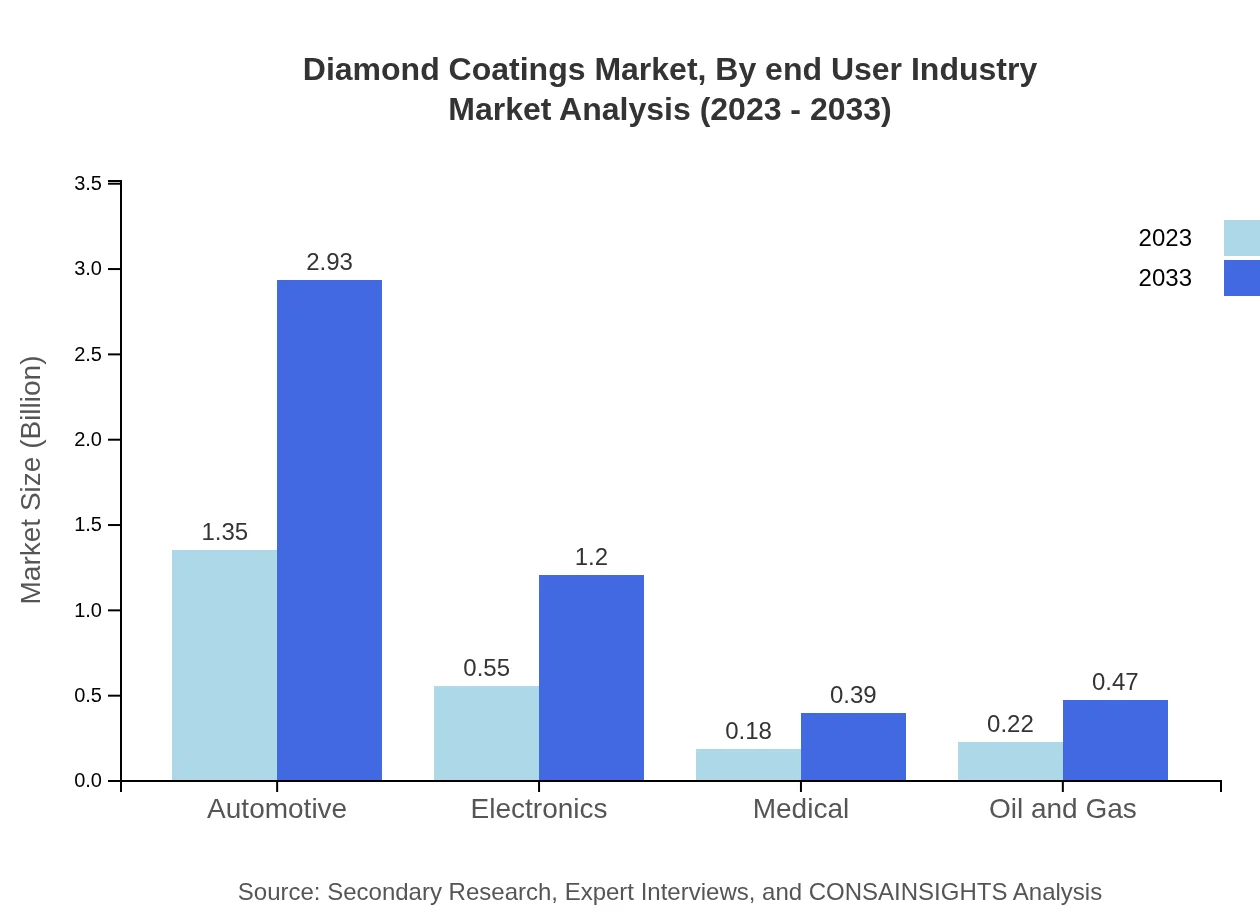

Diamond Coatings Market Analysis By End User Industry

Major end-user industries include Automotive, Aerospace, Electronics, and Medical Devices. The Automotive segment is projected to lead with a market size growth from $1.35 billion to $2.93 billion by 2033, representing a significant portion of the market.

Diamond Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diamond Coatings Industry

Element Six:

Element Six is a global leader in synthetic diamond supermaterials, providing advanced solutions for various applications, including electronics and industrial tools.Sumitomo Electric Industries:

With a significant focus on research and development, Sumitomo Electric is known for its innovative diamond coating technologies, primarily used in cutting tools and aerospace applications.De Beers Group:

A name synonymous with diamonds, the De Beers Group extends its expertise into diamond coatings, focusing on enhancing the durability of industrial tools.DMT:

DMT specializes in diamond-coated rotary tools and is known for its sustainability initiatives and commitment to reducing environmental impacts.We're grateful to work with incredible clients.

FAQs

What is the market size of diamond Coatings?

The diamond coatings market is valued at approximately $2.3 billion in 2023, with a projected CAGR of 7.8% through 2033, indicating robust growth potential in various sectors like industrial tools and electronics.

What are the key market players or companies in the diamond Coatings industry?

Key players in the diamond coatings market include organizations focused on advanced materials technology and surface engineering. Notable companies may include major manufacturers and innovators in coating technologies that drive market growth.

What are the primary factors driving the growth in the diamond coatings industry?

Growth in the diamond coatings industry is driven by increasing demand in industries such as automotive, aerospace, and electronics, alongside technological advancements that enhance coating performance and durability.

Which region is the fastest Growing in the diamond coatings?

The fastest-growing region in the diamond coatings market is expected to be Asia Pacific, with market growth from $0.48 billion in 2023 to $1.04 billion by 2033, indicating strong industry development in the area.

Does ConsaInsights provide customized market report data for the diamond coatings industry?

Yes, ConsaInsights offers customized market report data for the diamond coatings industry, catering to clients' specific needs and providing tailored insights and analyses for informed decision-making.

What deliverables can I expect from this diamond coatings market research project?

Deliverables from the diamond coatings market research project will typically include a comprehensive report, market data analysis, insights on trends, forecasts, and strategic recommendations tailored to client needs.

What are the market trends of diamond coatings?

Current trends in the diamond coatings market include increasing adoption in cutting-edge applications, advancements in coating technologies, and a shift towards environmentally sustainable practices across sectors such as automotive and medical.