Digital Lending

Published Date: 31 January 2026 | Report Code: digital-lending

Digital Lending Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Digital Lending provides an in-depth analysis of the market’s evolution, key trends, and detailed regional insights. It covers market size, growth parameters, segmentation by product, application, channel, customer type, and technology, while forecasting the industry’s trajectory for the period 2024 to 2033. The report furnishes actionable data for industry stakeholders.

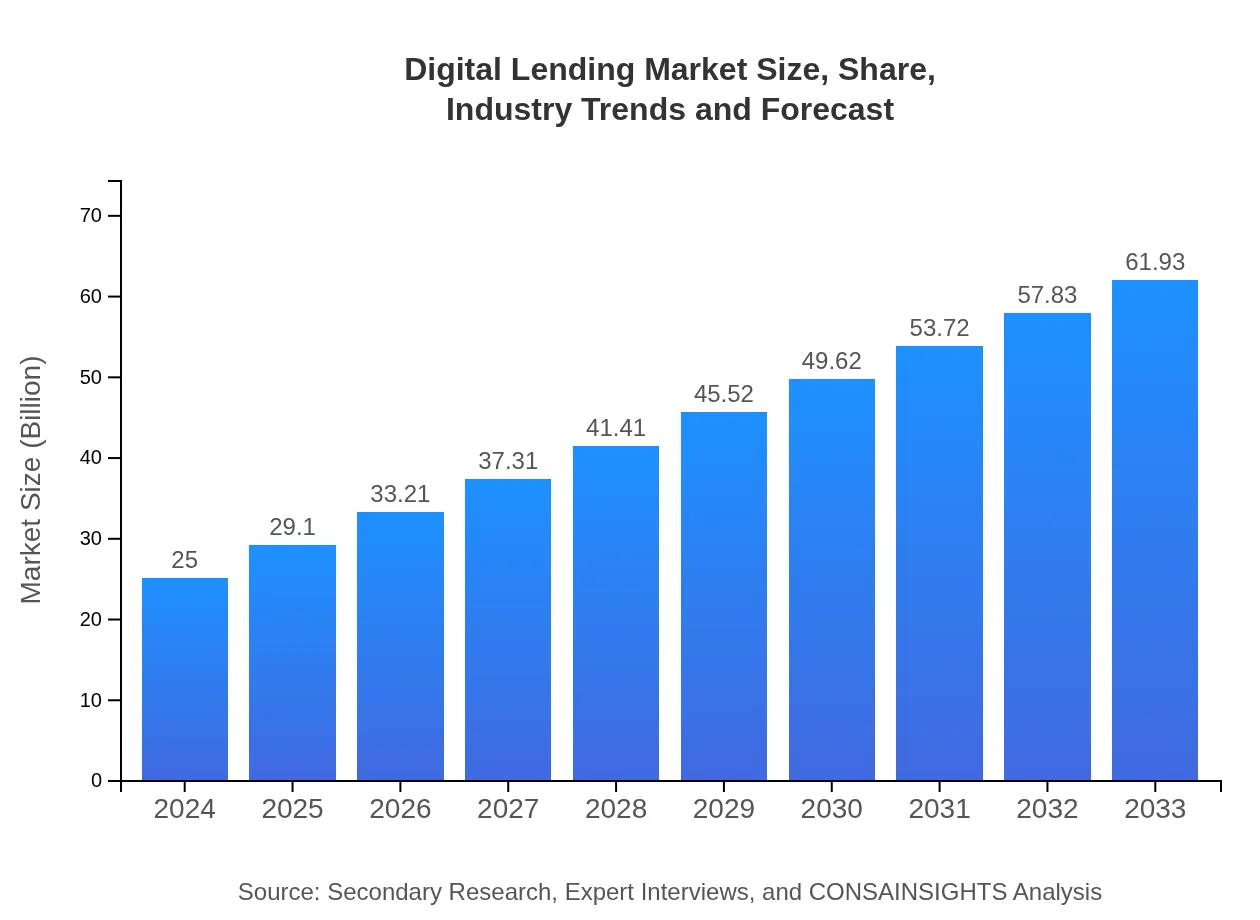

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $25.00 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $61.93 Billion |

| Top Companies | LendTech Innovations, Digital Finance Corp |

| Last Modified Date | 31 January 2026 |

Digital Lending Market Overview

Customize Digital Lending market research report

- ✔ Get in-depth analysis of Digital Lending market size, growth, and forecasts.

- ✔ Understand Digital Lending's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Lending

What is the Market Size & CAGR of Digital Lending market in 2024?

Digital Lending Industry Analysis

Digital Lending Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Lending Market Analysis Report by Region

Europe Digital Lending:

Europe's digital lending market is marked by a blend of traditional banking robustness and innovative fintech disruptions. The region benefits from a strong regulatory framework that promotes consumer protection while encouraging technological advancements. Progressive digitalization initiatives and high internet penetration rates have enabled significant market expansion. Moreover, cross-border collaborations and digital banking initiatives play a crucial role in advancing the adoption of digital lending platforms throughout various European economies.Asia Pacific Digital Lending:

In Asia Pacific, the Digital Lending market is propelled by rapid technological adoption and favorable demographics. The region has experienced significant growth due to increasing smartphone penetration and internet connectivity, which have facilitated access to digital financial services. Regulatory reforms and government initiatives are further stimulating market expansion. Additionally, the shift from traditional banking systems towards innovative fintech models is fostering a competitive environment, making the region one of the most dynamic and promising markets for digital lending solutions.North America Digital Lending:

North America remains one of the most mature and competitive digital lending markets. Here, established financial institutions and agile fintech companies are continuously refining their digital platforms to deliver faster, more efficient loan approvals and customer service. A strong focus on regulatory compliance, coupled with advanced technological integration, has driven significant market penetration. Innovation in risk assessment models and customer data analytics has further consolidated market leadership in this region, ensuring steady growth and consumer trust.South America Digital Lending:

South America is witnessing a burgeoning interest in digital financing, spurred by evolving consumer behavior and economic necessities. Despite challenges related to economic volatility and regulatory issues, innovative fintech solutions are making digital lending more accessible to a broader population. Rapid urbanization and a growing middle class are fueling demand, with fintech startups and traditional lenders increasingly collaborating to introduce streamlined credit solutions that cater to an underserved market.Middle East & Africa Digital Lending:

The Middle East and Africa region is emerging as an exciting frontier for digital lending, marked by rapid mobile adoption and increasing digital literacy. The market is experiencing a digital revolution as financial services are modernized to meet a growing demand for access to credit. Investments in fintech infrastructure and favorable government policies are accelerating market growth. As a result, even traditionally underbanked populations are gaining access to innovative lending solutions, setting the stage for significant market expansion in the coming years.Tell us your focus area and get a customized research report.

Digital Lending Market Analysis By Product

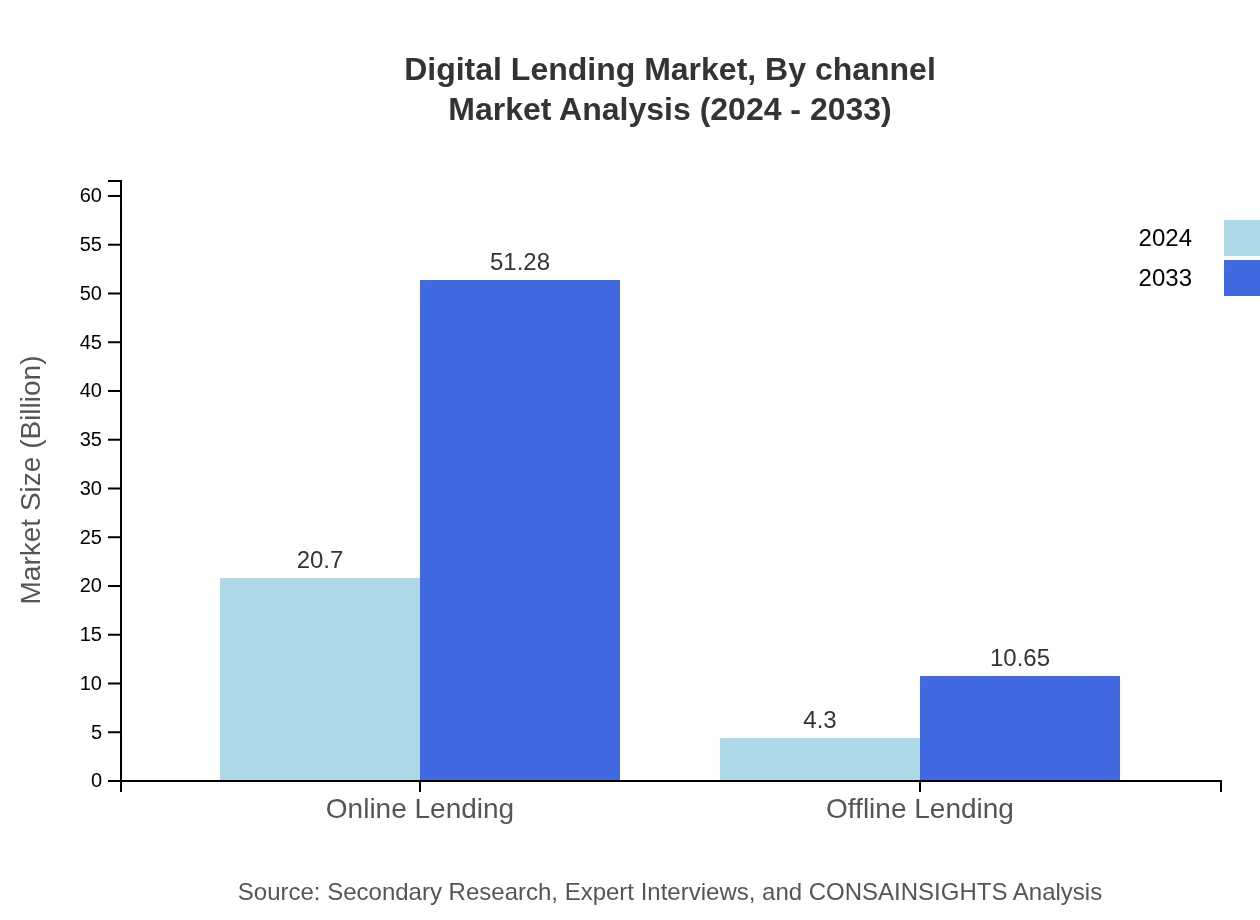

The by-product segment analysis covers the diverse array of lending products shaping the Digital Lending landscape. Online lending, with its dominant market share of 82.8% in both 2024 and 2033, is central to this analysis. Additionally, offline lending, though representing a smaller portion at 17.2%, continues to serve niche market requirements. Detailed figures indicate that online lending is estimated to grow from a market size of 20.70 units in 2024 to 51.28 units by 2033, while offline lending is expected to expand from 4.30 units to 10.65 units over the same period. Other key products such as personal, business, and consumer loans further enrich the product portfolio, offering significant revenue streams and diversified risk profiles.

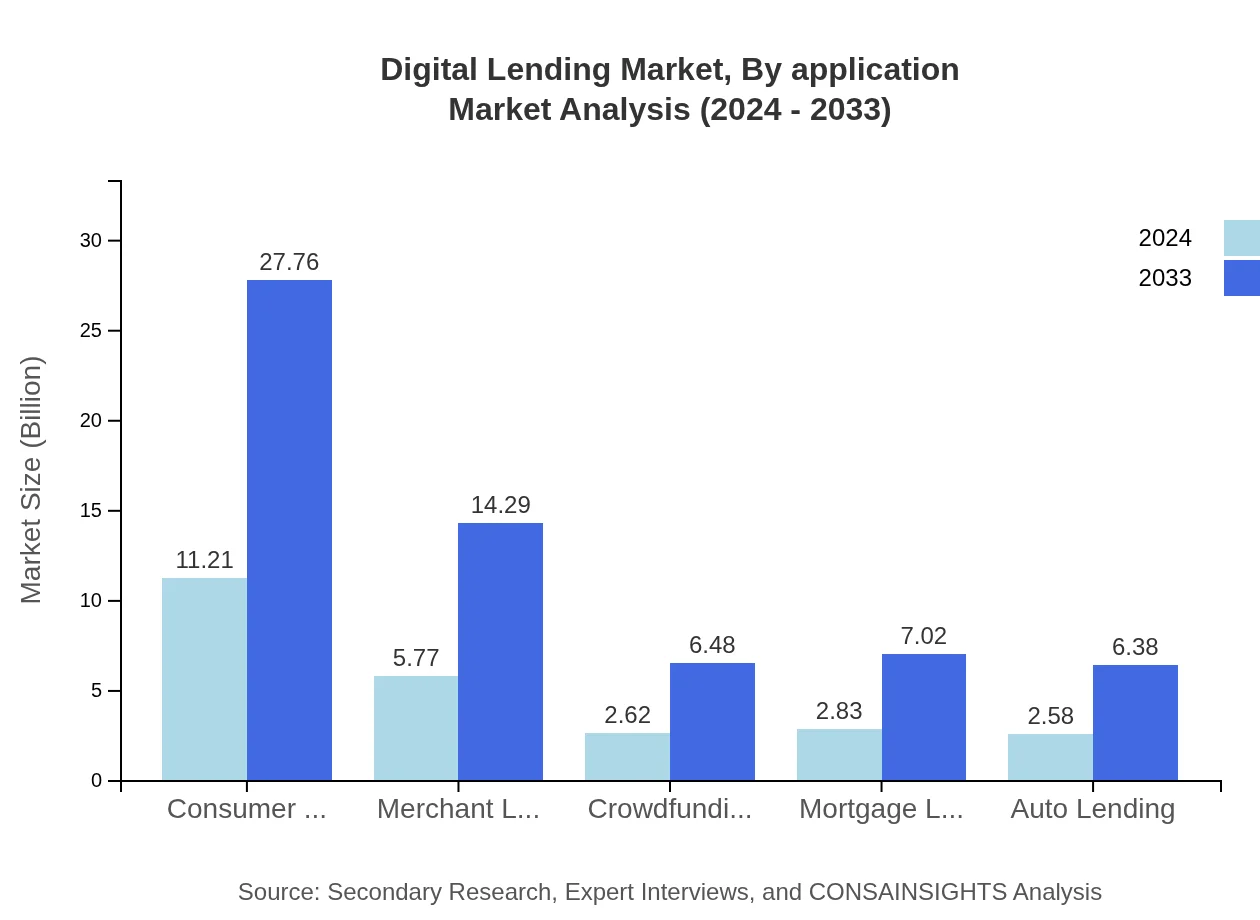

Digital Lending Market Analysis By Application

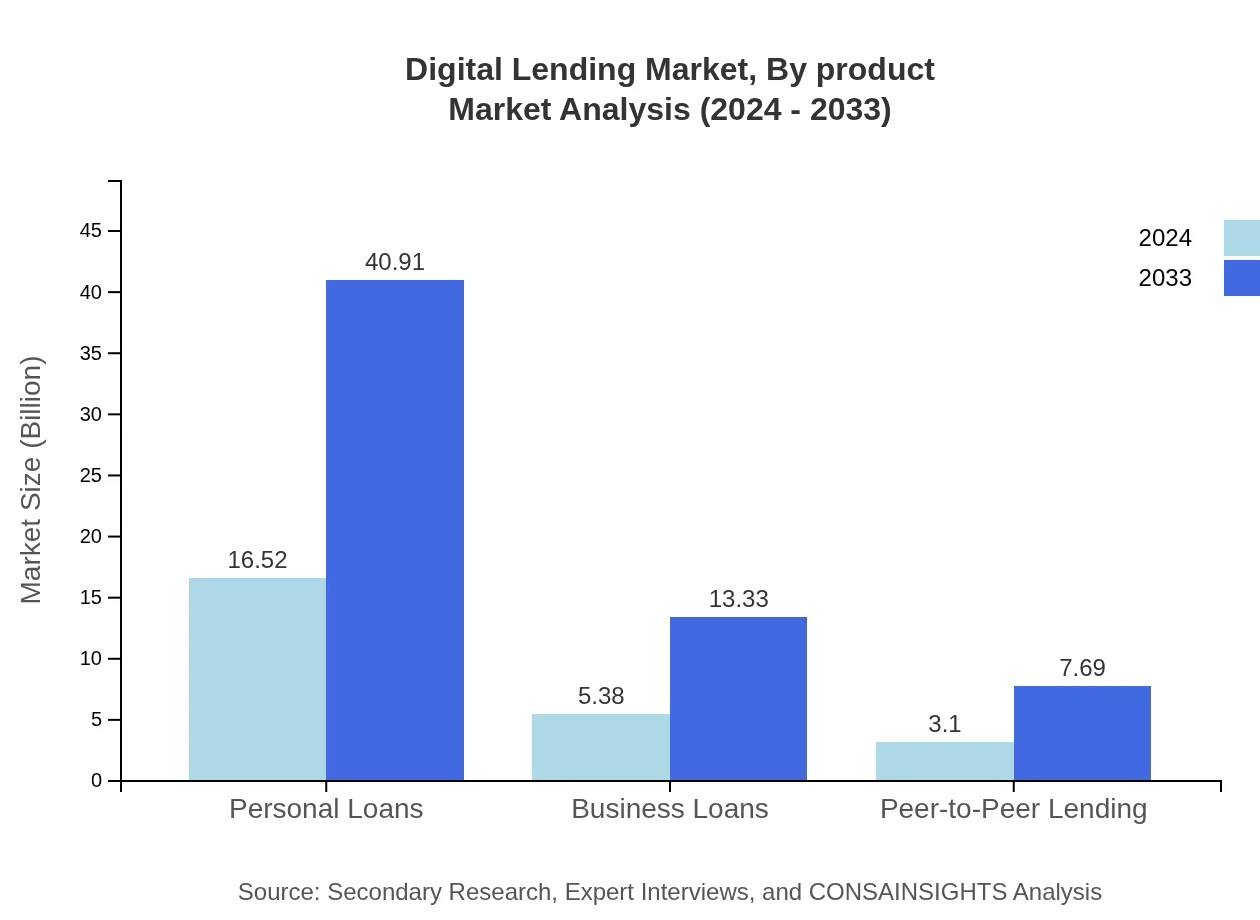

The by-application segment focuses on the end-use areas of digital lending, including applications for personal loans, business loans, and consumer financing. Personal loans command a major share with market projections rising from 16.52 units in 2024 to 40.91 units in 2033, reflecting strong consumer demand. Business loans, while smaller in absolute terms, maintain a robust share and demonstrate consistent growth. The varying applications of digital lending provide critical insights into consumer behaviors and financing needs, enabling industry players to tailor solutions that enhance user satisfaction and operational performance.

Digital Lending Market Analysis By Channel

The channel analysis examines the pathways through which digital lending services reach end users. Primarily, the channels are bifurcated into online and offline avenues. The online channel, bolstered by high adoption rates and superior accessibility, remains dominant, while offline channels continue to serve segments requiring personalized engagements. Data indicates stability in market share distribution with online channels holding 82.8% and offline channels 17.2% across forecast years, underlining the persistent relevance of traditional methods in complementing digital strategies. This balanced channel approach enhances market resilience and caters to a broad spectrum of customer preferences.

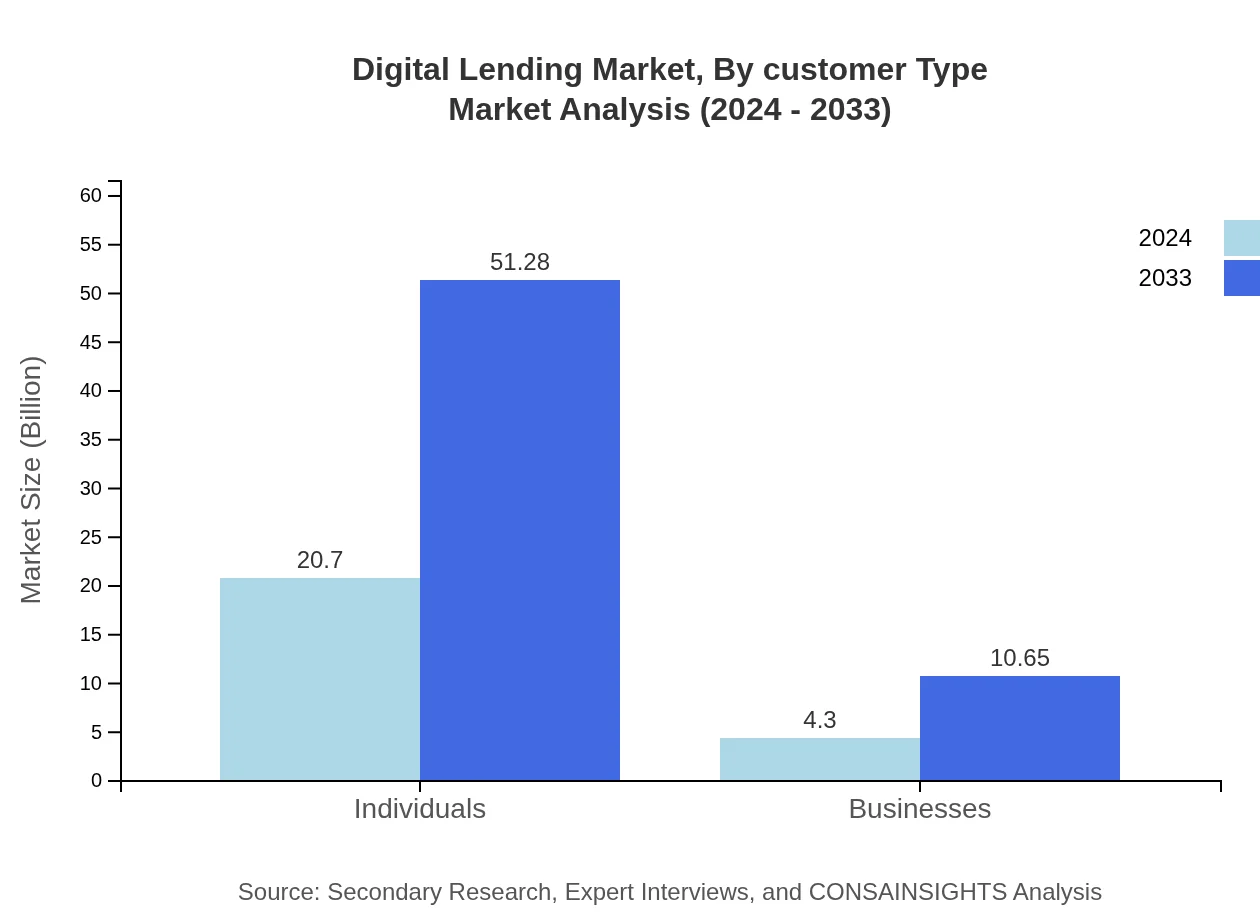

Digital Lending Market Analysis By Customer Type

Analysis by customer type reveals distinct trends among individuals and businesses. Individual consumers, accounting for 82.8% market share, are significantly driving the demand for accessible, quick, and customized lending solutions. In contrast, the business segment, while smaller at 17.2%, represents a critical niche with specialized financing requirements. The market size for individuals is projected to surge from 20.70 units in 2024 to 51.28 units by 2033, whereas the business segment is expected to grow from 4.30 units to 10.65 units. Understanding these dynamics aids stakeholders in refining product offerings and targeted marketing strategies.

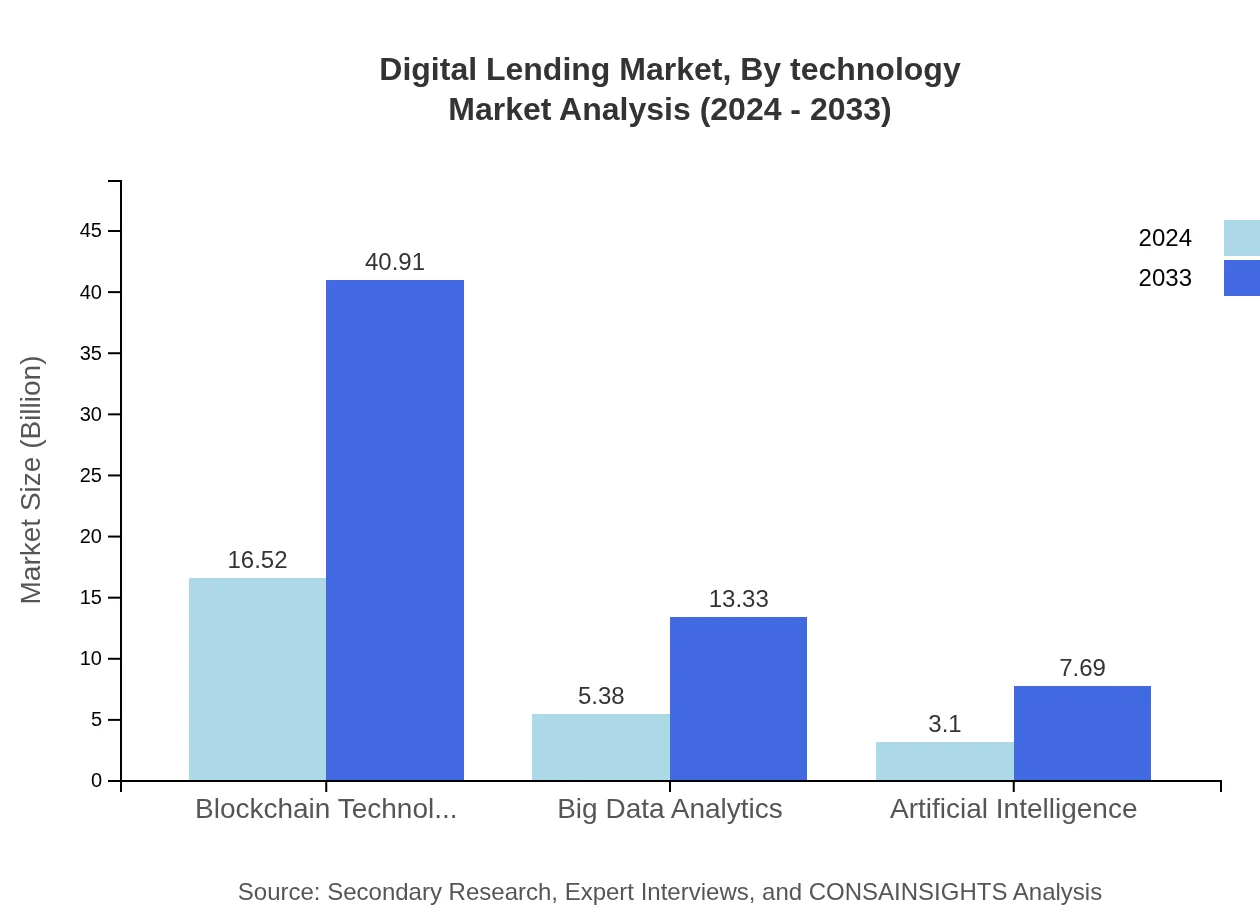

Digital Lending Market Analysis By Technology

The by-technology segment is a vital component of the digital lending ecosystem, focusing on technological enablers such as blockchain, big data analytics, and artificial intelligence. Blockchain technology, for instance, is projected to grow from a market size of 16.52 units to 40.91 units by 2033, underlining its importance in improving security and transparency. Similarly, big data analytics and artificial intelligence, both maintaining equal market shares of 21.52% and 12.42% respectively, are critical in refining risk assessment capabilities and optimizing customer service. These technological advances are instrumental in driving operational efficiencies and fostering innovation.

Digital Lending Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Lending Industry

LendTech Innovations:

A pioneering firm that leverages digital technologies to transform the lending process, reducing turnaround times and enhancing customer engagement through state-of-the-art fintech platforms and risk management analytics.Digital Finance Corp:

An established leader in digital lending, offering comprehensive financial solutions anchored by advanced data analytics and innovative credit scoring models to ensure seamless and secure lending operations globally.We're grateful to work with incredible clients.

FAQs

How can the digital lending report help align our marketing strategy with customer adoption trends?

The digital lending market, valued at $25 billion with a CAGR of 10.2%, reveals insights into shifting customer preferences. By analyzing growth areas, marketers can tailor content and offerings to meet emerging needs and facilitate targeted engagement strategies leading to improved adoption.

What product features are in highest demand according to the digital lending trends?

In the digital lending space, convenience, speed, and user-friendly interfaces drive demand. Advanced features like AI integration, instant loan approvals, and robust security measures are prime considerations for customers, aligning with overall market growth trends as observed in the report.

Which regions offer the best market entry and expansion opportunities in the digital lending industry?

North America leads with a market size expected to grow from $9.39 billion in 2024 to $23.26 billion by 2033. Europe and Asia-Pacific follow, indicating lucrative expansion potential due to increasing adoption of digital lending solutions across these regions.

What emerging technologies and innovations are shaping the digital lending market?

Technologies such as blockchain, AI, and big data analytics are pivotal in digital lending, enhancing data security, streamlining processes, and improving customer experiences. These innovations are vital for capturing the increasing market share and adapting to consumer demands.

Does the digital lending report include competitive landscape and market share analysis?

Yes, the report offers comprehensive analysis of the competitive landscape, providing insights into market shares across segments, including online and offline lending, essential for identifying key players and understanding their positioning in the expanding market.

How can executives use the digital lending report to evaluate investment risks and ROI?

Executives can utilize market data, including growth forecasts, segment performance, and regional insights, to assess potential risks. By analyzing these factors, informed decisions regarding funding allocations, market strategies, and expected ROI can be made.

What is the market size for digital lending segmented by different categories?

In 2024, the online lending market is projected at $20.70 billion, whereas offline lending is at $4.30 billion. By 2033, these are expected to reach $51.28 billion and $10.65 billion, respectively, highlighting significant trends in consumer preferences.