Enterprise Mobility In Banking Market Report

Published Date: 31 January 2026 | Report Code: enterprise-mobility-in-banking

Enterprise Mobility In Banking Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Enterprise Mobility in Banking market from 2023 to 2033, providing insights into growth trends, market size, regional dynamics, industry analysis, and key market players. Its comprehensive data aims to inform stakeholders in making competitive strategic decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

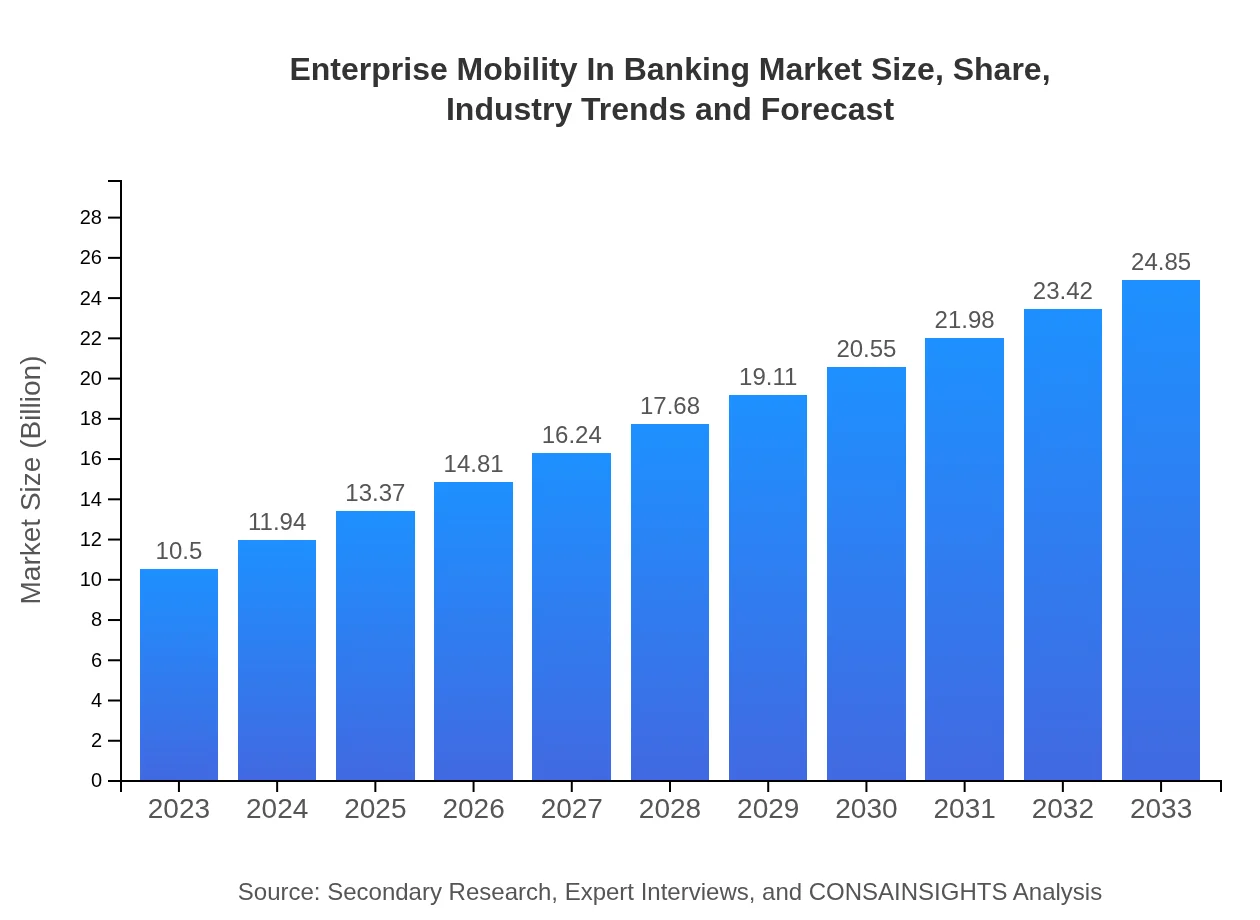

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $24.85 Billion |

| Top Companies | IBM, SAP, Microsoft, Oracle, Salesforce |

| Last Modified Date | 31 January 2026 |

Enterprise Mobility In Banking Market Overview

Customize Enterprise Mobility In Banking Market Report market research report

- ✔ Get in-depth analysis of Enterprise Mobility In Banking market size, growth, and forecasts.

- ✔ Understand Enterprise Mobility In Banking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Mobility In Banking

What is the Market Size & CAGR of Enterprise Mobility In Banking market in 2023?

Enterprise Mobility In Banking Industry Analysis

Enterprise Mobility In Banking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Mobility In Banking Market Analysis Report by Region

Europe Enterprise Mobility In Banking Market Report:

Europe's market size stands at $2.72 billion in 2023, with a projection to reach $6.43 billion by 2033. The demand for innovative banking technology and a competitive market landscape encourage banks to invest in enterprise mobility. The ongoing digital transformation and regulatory compliance requirements will further stimulate market adoption and growth.Asia Pacific Enterprise Mobility In Banking Market Report:

In 2023, the Asia Pacific region holds a market size of $2.19 billion, projected to grow to $5.18 billion by 2033. The growth is driven by increasing smartphone penetration, an evolving regulatory landscape, and rising investments in digital banking solutions. Countries like China and India are at the forefront of this growth, with banks rapidly adopting mobile technologies to enhance customer accessibility and services.North America Enterprise Mobility In Banking Market Report:

North America is estimated to have a market size of $3.44 billion in 2023, anticipated to grow to $8.13 billion by 2033. The presence of leading banks and a strong inclination towards adopting advanced technologies propels market growth in this region. Additionally, increasing concerns about cybersecurity drive investment in secure mobile solutions.South America Enterprise Mobility In Banking Market Report:

The South America region reports a market size of $0.89 billion in 2023, expected to reach $2.10 billion by 2033. Growing demand for mobile banking solutions among consumers, especially in Brazil and Argentina, is a significant growth driver. The emphasis on financial inclusion is prompting banks to offer mobile services that cater to underserved populations.Middle East & Africa Enterprise Mobility In Banking Market Report:

In the Middle East and Africa, the market is valued at $1.27 billion in 2023, forecasted to increase to $3.01 billion by 2033. The region's growing banking sector adopted mobile solutions to enhance customer engagement, while digital transformation initiatives by various governments are fostering market growth.Tell us your focus area and get a customized research report.

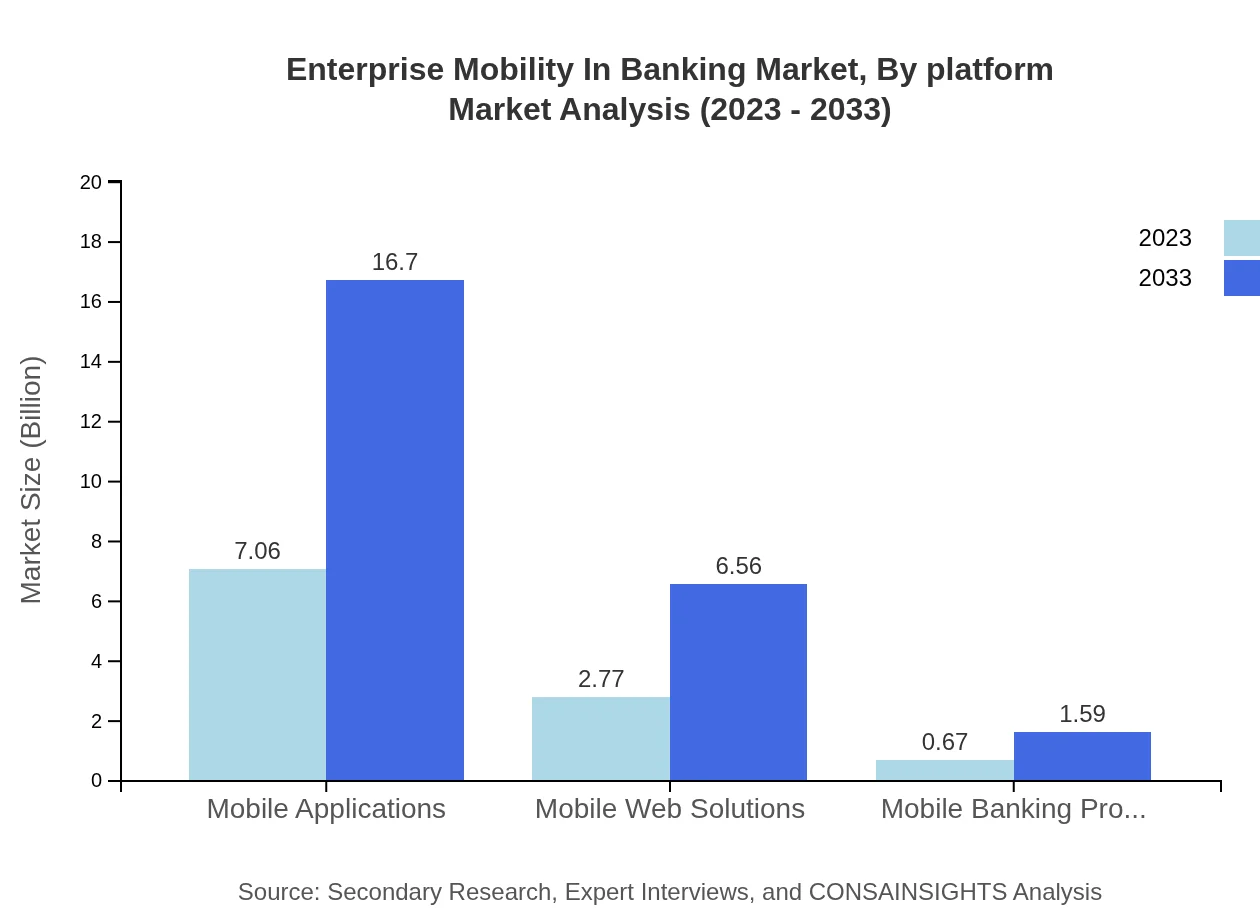

Enterprise Mobility In Banking Market Analysis By Platform

Mobile applications dominate the Enterprise Mobility in Banking market, with a size of $7.06 billion in 2023, expected to grow to $16.70 billion by 2033. The share of mobile applications remains stable at approximately 67.2%. Mobile web solutions account for $2.77 billion in 2023, projected to reach $6.56 billion by 2033, maintaining about 26.41% market share. Mobile banking products, while smaller, are expected to double their size from $0.67 billion in 2023 to $1.59 billion in 2033, representing the growing significance of specialized mobile offerings.

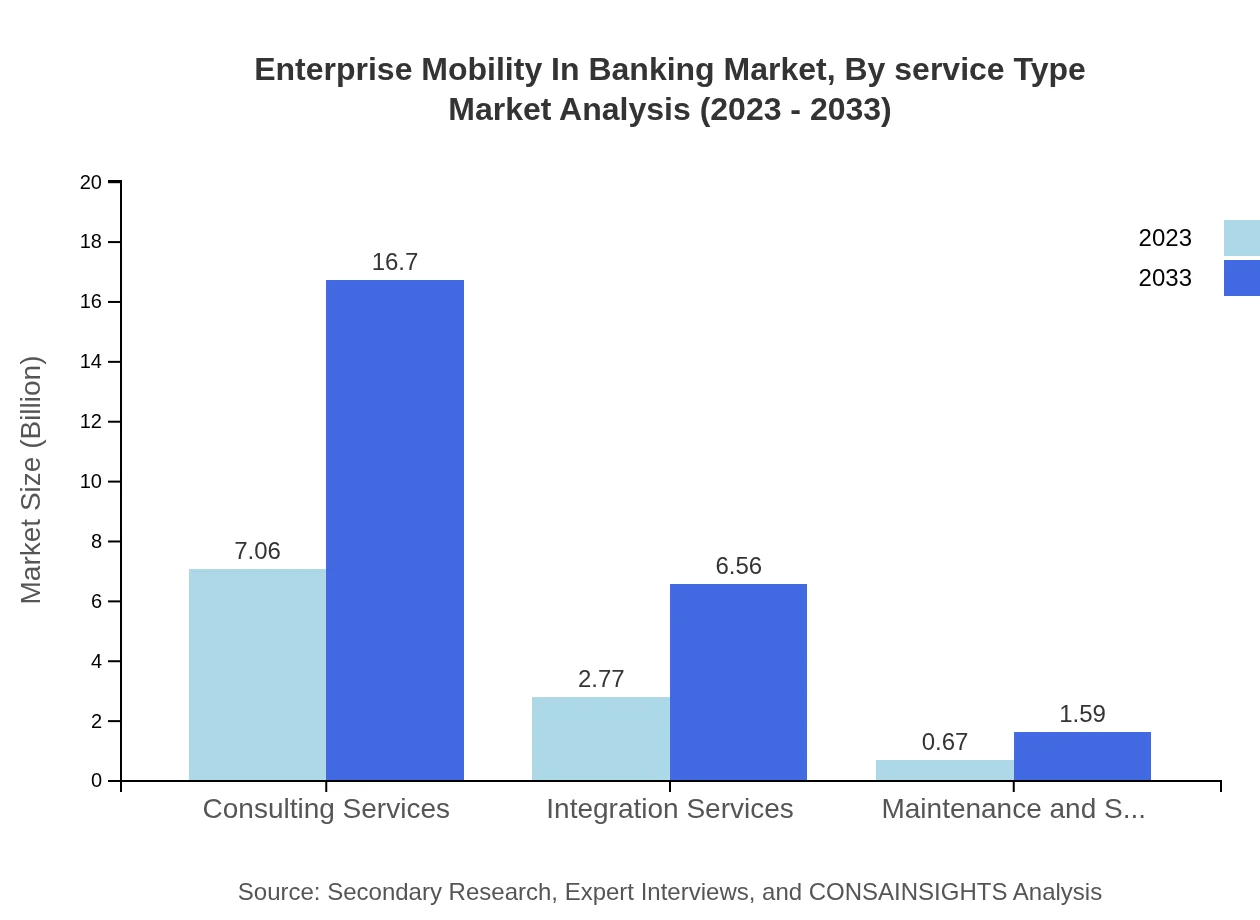

Enterprise Mobility In Banking Market Analysis By Service Type

Consulting services lead the service type market with an estimated size of $7.06 billion in 2023, projected to grow to $16.70 billion by 2033, holding a share of 67.2%. Integration services and maintenance and support services also show promising growth trajectories, with sizes of $2.77 billion and $0.67 billion in 2023, respectively. Their participation is crucial for providing value-added services in mobile solutions.

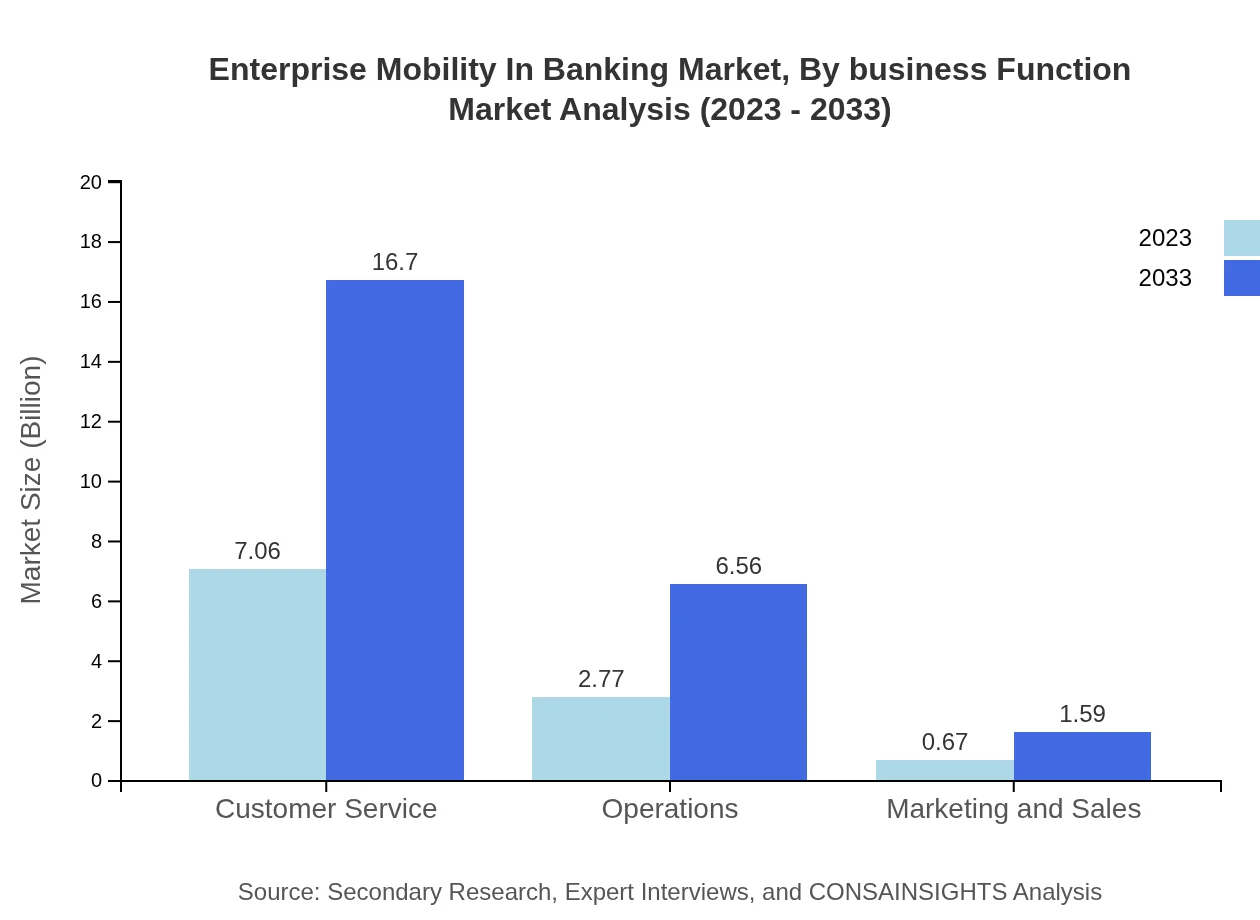

Enterprise Mobility In Banking Market Analysis By Business Function

Customer service is a critical function supported by enterprise mobility, with a size of $7.06 billion in 2023, expected to grow to $16.70 billion by 2033. Operational improvements will also stem from mobile applications, with changes in marketing and sales strategies enhancing overall business functions.

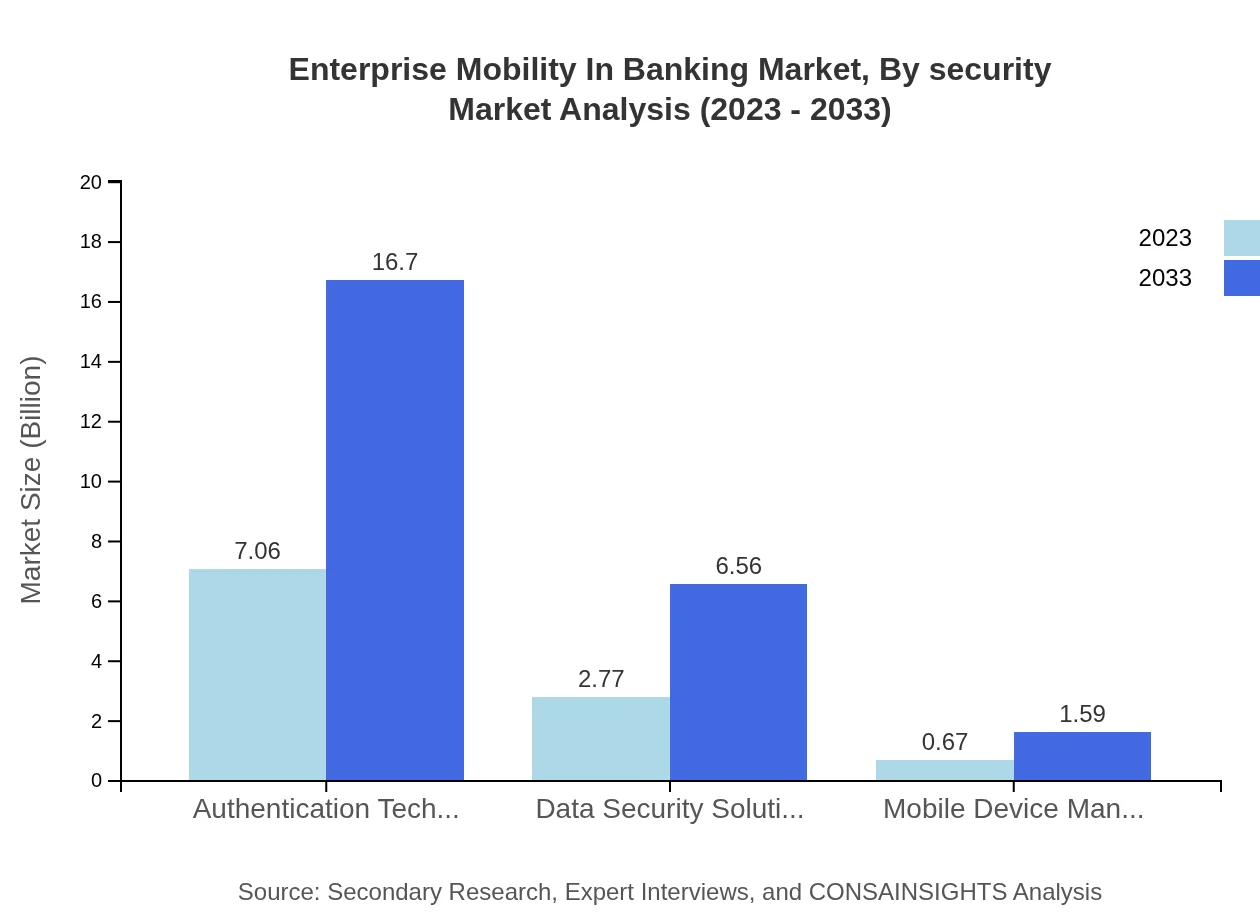

Enterprise Mobility In Banking Market Analysis By Security

Authentication technologies and data security solutions form the backbone of enterprise mobility security, with both segments projected to grow substantially. Their importance is highlighted through rigorous security measures, primarily safeguarding customer data and transactions, a primary concern for all banks.

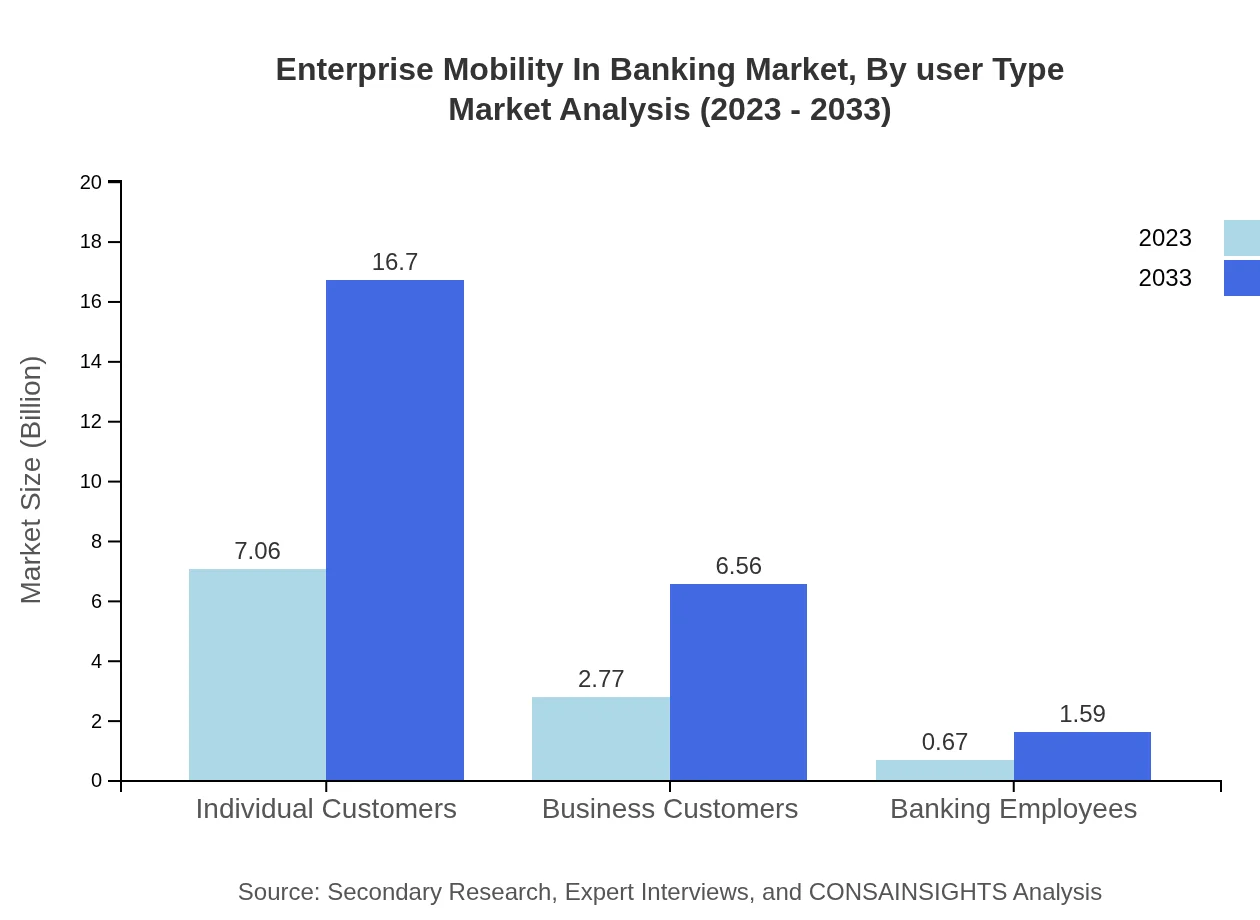

Enterprise Mobility In Banking Market Analysis By User Type

Individual customers are the largest segment, valued at $7.06 billion in 2023, expected to reach $16.70 billion by 2033. Business customers and banking employees also contribute significantly, pushing for tailored mobility solutions catering to diverse needs within the banking ecosystem.

Enterprise Mobility In Banking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Mobility In Banking Industry

IBM:

IBM provides cutting-edge enterprise mobility solutions that enhance banking operations with artificial intelligence and robust security measures.SAP:

SAP provides innovative enterprise mobility platforms that enable banks to manage customer relationships and operational complexities effectively.Microsoft:

Microsoft offers a range of mobile solutions leveraging cloud technology and integrating seamlessly with banking systems to boost productivity.Oracle:

Oracle specializes in providing comprehensive mobile banking applications that ensure high performance and security for financial institutions.Salesforce:

Salesforce enables banks to leverage its mobile CRM solutions for optimized customer engagement and service delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of the Enterprise Mobility in Banking?

The Enterprise Mobility in Banking market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 8.7% through 2033, illustrating its significant growth potential in the banking sector.

What are the key market players or companies in the Enterprise Mobility in Banking industry?

Key players in the Enterprise Mobility in Banking sector include IBM, SAP, Microsoft, Cisco, and Oracle. These companies are pivotal in driving innovations and implementing advanced mobile solutions tailored for the banking industry.

What are the primary factors driving the growth in the Enterprise Mobility in Banking industry?

The growth drivers for Enterprise Mobility in Banking include the increasing demand for mobile banking services, enhanced customer engagement through mobile applications, security advancements, and regulatory compliance facilitating better mobile solutions.

Which region is the fastest Growing in the Enterprise Mobility in Banking?

The fastest-growing region for Enterprise Mobility in Banking is North America, projected to grow from $3.44 billion in 2023 to $8.13 billion by 2033, reflecting a rise in mobile banking adoption among consumers.

Does ConsaInsights provide customized market report data for the Enterprise Mobility in Banking industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Enterprise Mobility in Banking industry, ensuring clients access the most relevant and actionable insights for strategic planning.

What deliverables can I expect from this Enterprise Mobility in Banking market research project?

Deliverables from the Enterprise Mobility in Banking market research project include comprehensive reports, executive summaries, detailed regional analyses, competitive landscape assessments, and trend identification tailored to client requirements.

What are the market trends of Enterprise Mobility in Banking?

Current trends in the Enterprise Mobility in Banking market include the integration of advanced analytics, the emphasis on enhanced data security measures, the growth of mobile applications, and a shift towards cloud-based solutions to improve operational efficiency.