Enterprise Monitoring

Published Date: 31 January 2026 | Report Code: enterprise-monitoring

Enterprise Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Enterprise Monitoring provides an in‐depth analysis of market dynamics, key trends, and competitive landscape from 2024 to 2033. It offers valuable insights into market size, segmentation, regional performance, and forecast projections. Readers will gain critical understanding of both technology innovations and application segments within the evolving Enterprise Monitoring ecosystem.

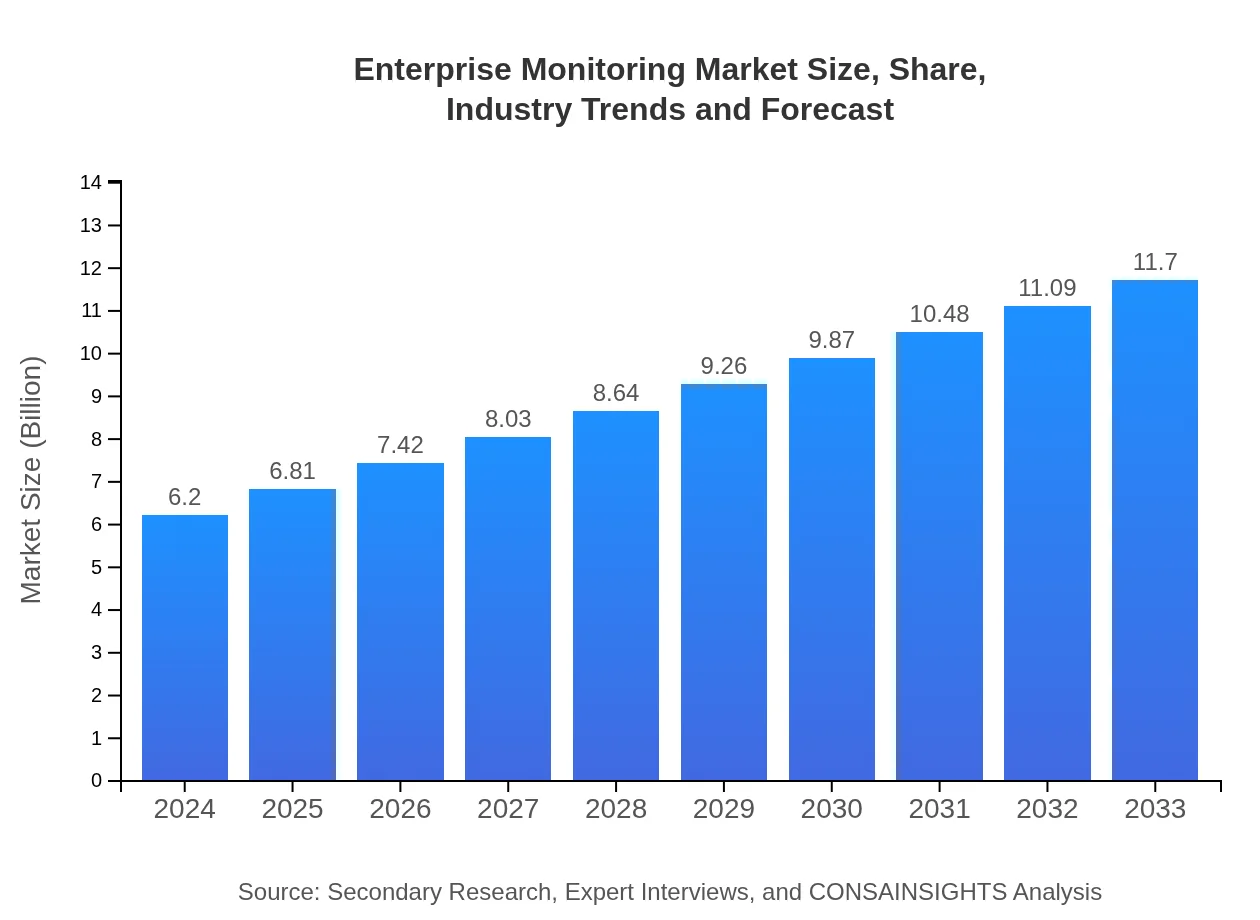

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $6.20 Billion |

| CAGR (2024-2033) | 7.1% |

| 2033 Market Size | $11.70 Billion |

| Top Companies | TechGuard Solutions, InnovaMon Inc. |

| Last Modified Date | 31 January 2026 |

Enterprise Monitoring Market Overview

Customize Enterprise Monitoring market research report

- ✔ Get in-depth analysis of Enterprise Monitoring market size, growth, and forecasts.

- ✔ Understand Enterprise Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Monitoring

What is the Market Size & CAGR of Enterprise Monitoring market in 2024?

Enterprise Monitoring Industry Analysis

Enterprise Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Monitoring Market Analysis Report by Region

Europe Enterprise Monitoring:

Europe remains a key market with a strong focus on regulatory compliance and digital infrastructure modernization. With the market rising from 2.00 in 2024 to 3.78 in 2033, enterprises across the region are investing in scalable and secure monitoring solutions. Economic stability combined with stringent data protection laws fosters a conducive environment for market growth and innovation.Asia Pacific Enterprise Monitoring:

In the Asia Pacific region, the market is witnessing steady growth driven by rapid digital transformation and expanding IT infrastructure investments. With an increase in the adoption of cloud and hybrid deployments, countries in this region are aggressively embracing Enterprise Monitoring solutions to enhance operational efficiency. Growth from 1.09 in 2024 to an estimated 2.06 in 2033 reflects strong market dynamics influenced by economic expansion and supportive government initiatives.North America Enterprise Monitoring:

North America continues to lead due to advanced technological ecosystems, higher IT investments, and robust cybersecurity frameworks. The market in this region expands from 2.23 in 2024 to 4.21 in 2033, driven by early adoption of cutting-edge monitoring solutions, rapid cloud migration, and substantial support for R&D initiatives to counter increasing operational complexities.South America Enterprise Monitoring:

South America presents a niche yet growing market for Enterprise Monitoring solutions. While starting at a modest 0.05 market size in 2024, the region is expected to double its market potential to 0.10 by 2033. Focus on digital transformation and the need for enhanced system reliability are key factors driving growth in this region despite economic and infrastructural challenges.Middle East & Africa Enterprise Monitoring:

The Middle East and Africa region demonstrates substantial potential through progressive investments in digital transformation and technology modernization. Although beginning at 0.82 in 2024, market size is anticipated to reach 1.55 by 2033. Government initiatives to bolster IT infrastructure and increased focus on cybersecurity are prompting enterprises to adopt comprehensive monitoring solutions, contributing to gradual yet consistent market growth.Tell us your focus area and get a customized research report.

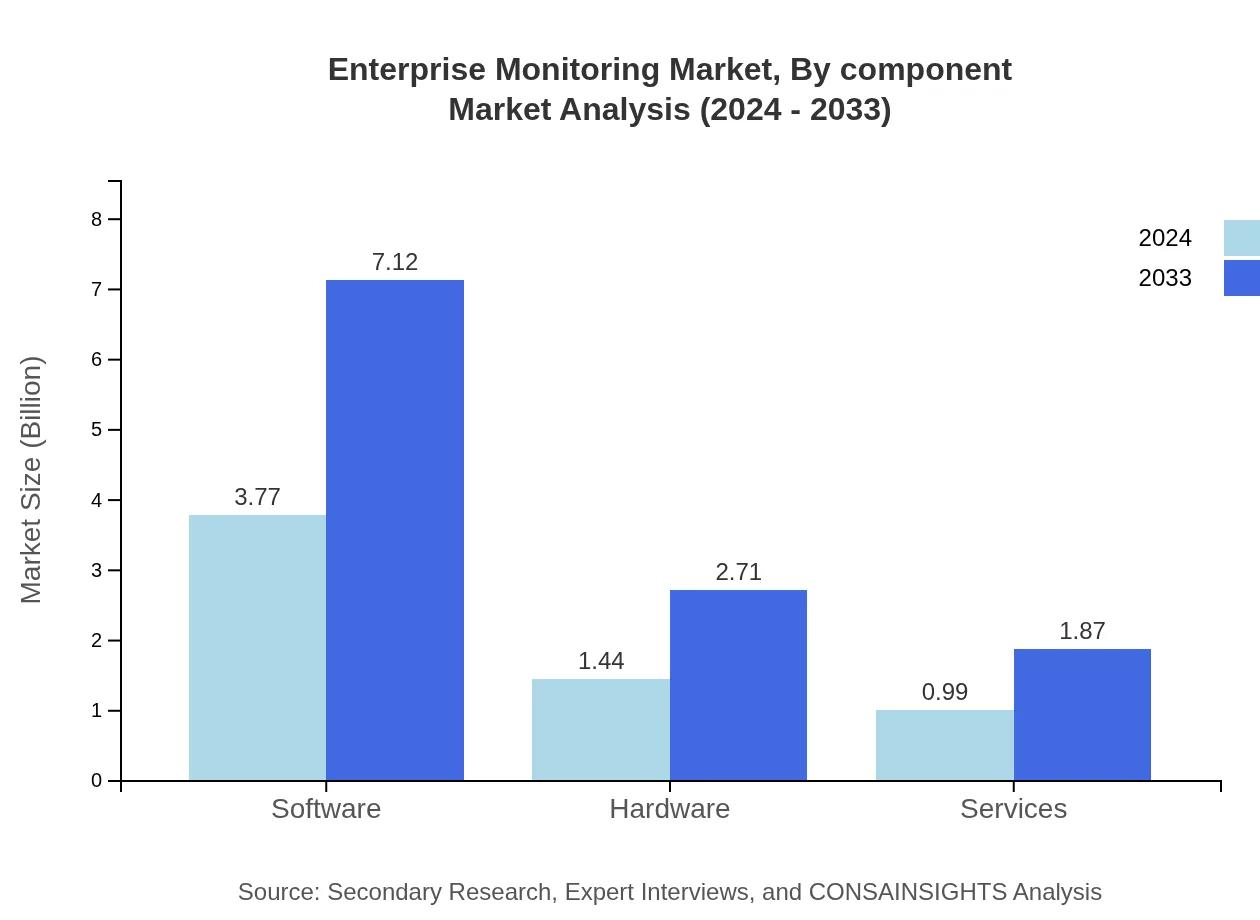

Enterprise Monitoring Market Analysis By Component

The component segmentation includes software, hardware, and services. Software dominates the market with a size of 3.77 in 2024, growing to 7.12 by 2033, capturing a significant share of 60.86%. Hardware constitutes 1.44 in 2024 with an expected increase to 2.71, representing 23.17% share, while services account for 0.99 in 2024, rising to 1.87 by 2033 with a 15.97% share. This balanced mix underscores the critical role each component plays in delivering robust monitoring solutions.

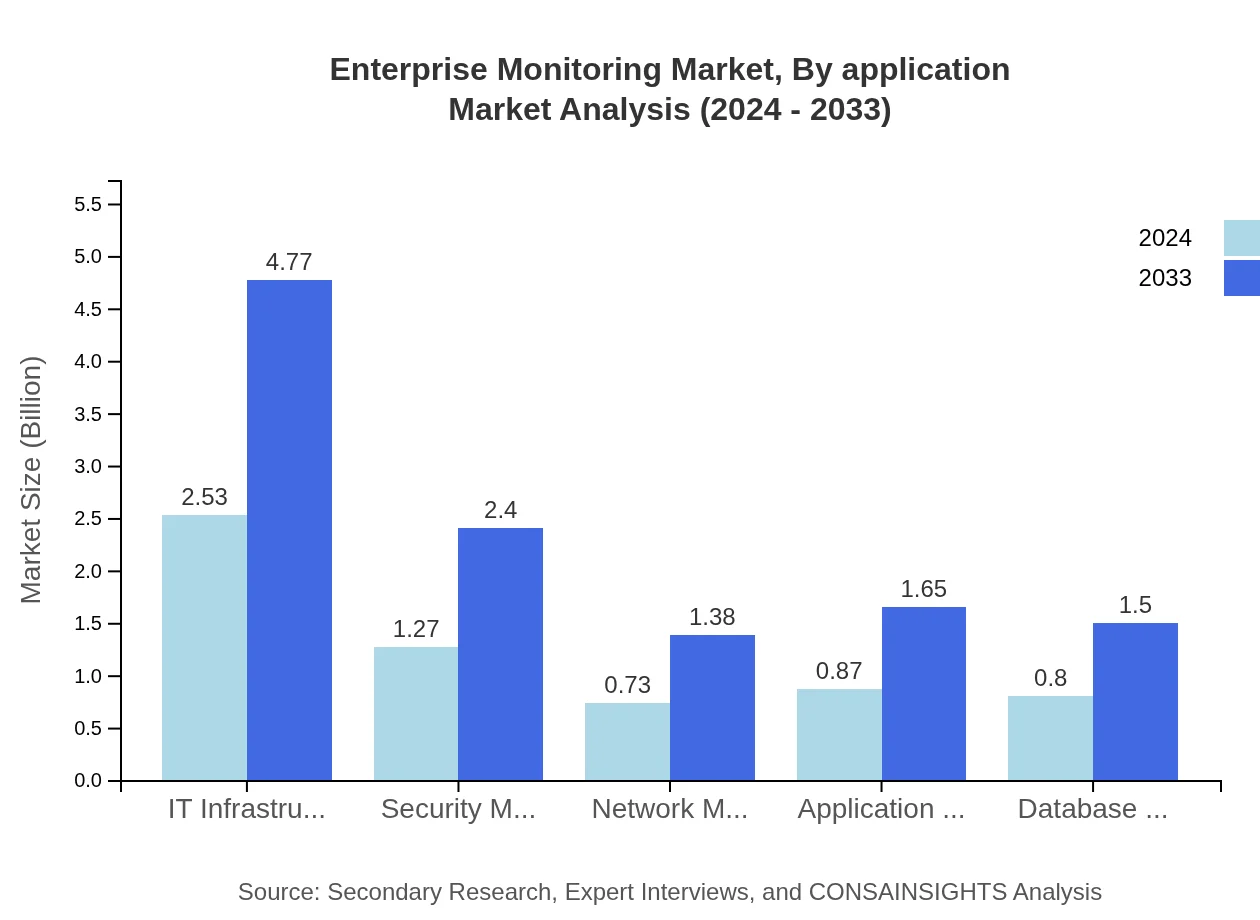

Enterprise Monitoring Market Analysis By Application

The application segment divides into various monitoring categories such as IT Infrastructure Monitoring, Security Monitoring, Network Monitoring, Application Performance Monitoring, and Database Monitoring. IT Infrastructure Monitoring leads with a market size of 2.53 in 2024, escalating to 4.77 by 2033 with a 40.73% share. Security Monitoring and Network Monitoring also maintain steady growth, while Application Performance Monitoring and Database Monitoring illustrate significant potential, each contributing proportionally to the market share. This segmentation reflects the varied and critical demands across different operational areas.

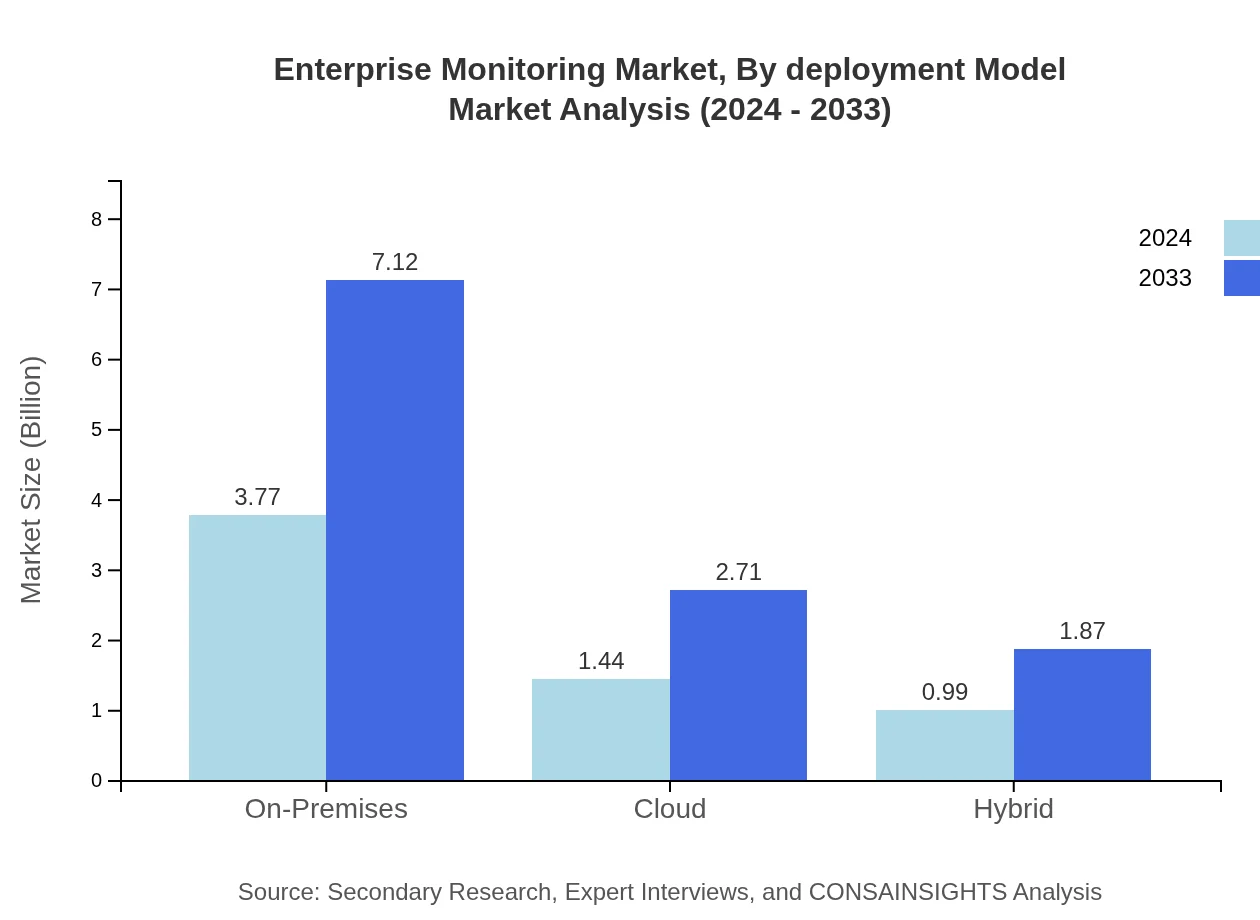

Enterprise Monitoring Market Analysis By Deployment Model

The market caters to varied deployment models including On-Premises, Cloud, and Hybrid solutions. On-Premises continues to maintain a dominant position with a market size of 3.77 in 2024 growing substantially to 7.12 by 2033, holding a 60.86% share. Cloud deployments, accounting for 1.44 in 2024 and growing to 2.71 by 2033 (23.17% share), provide flexibility and scalability. Hybrid models offer complementary benefits with a market size of 0.99 in 2024, increasing to 1.87 by 2033, representing 15.97% share, thereby enabling enterprises to balance between traditional and modern deployment methodologies.

Enterprise Monitoring Market Analysis By Region

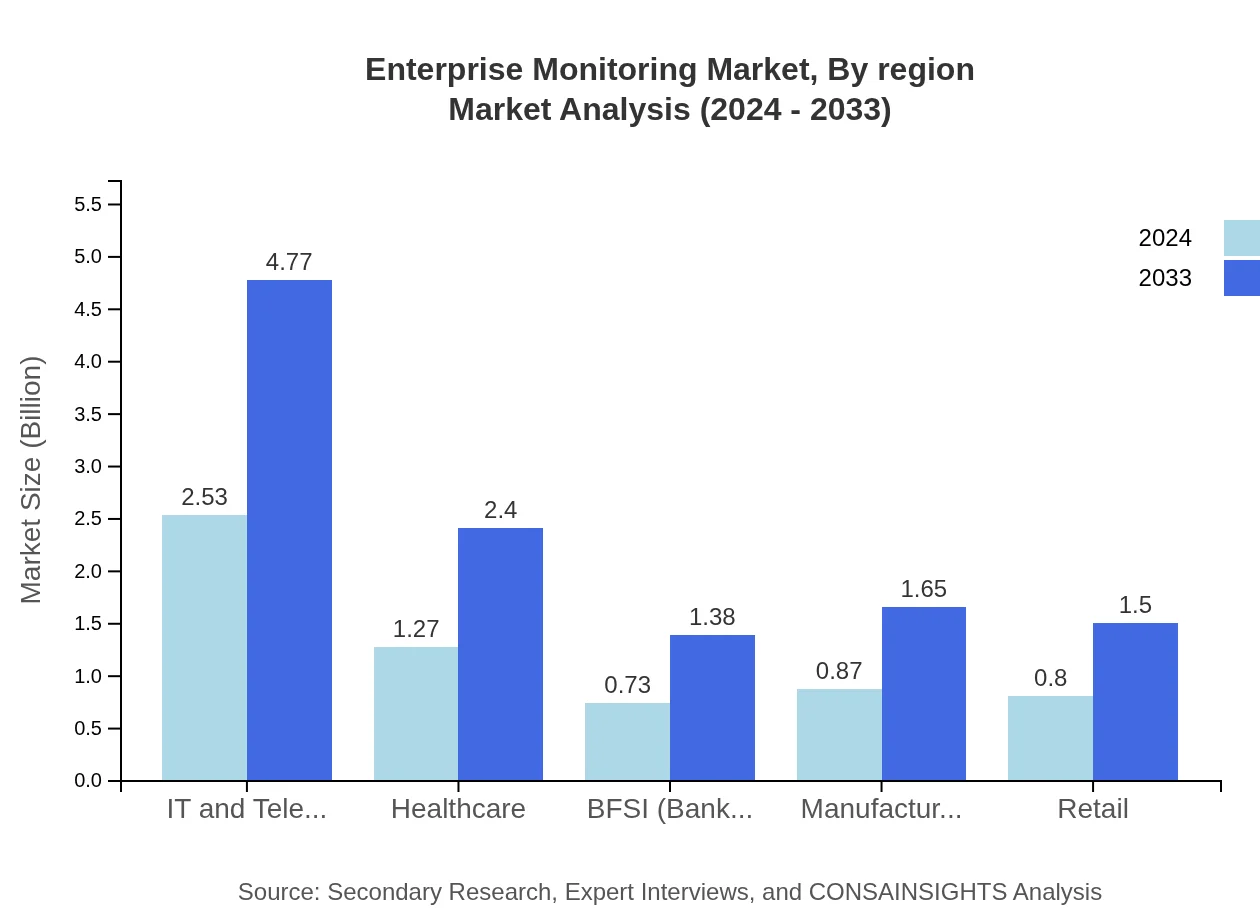

The end-user sector is segmented into industries such as IT and Telecom, Healthcare, BFSI, Manufacturing, and Retail. IT and Telecom remains the largest segment with a market size of 2.53 in 2024, projecting significant growth to 4.77 by 2033 and holding a 40.73% share. Healthcare is positioned as a key growth area, moving from a market size of 1.27 in 2024 to 2.40 by 2033. BFSI, Manufacturing, and Retail sectors display steady market demand and robust participation in adopting monitoring solutions to enhance operational efficiency and security.

Enterprise Monitoring Market Analysis By End User

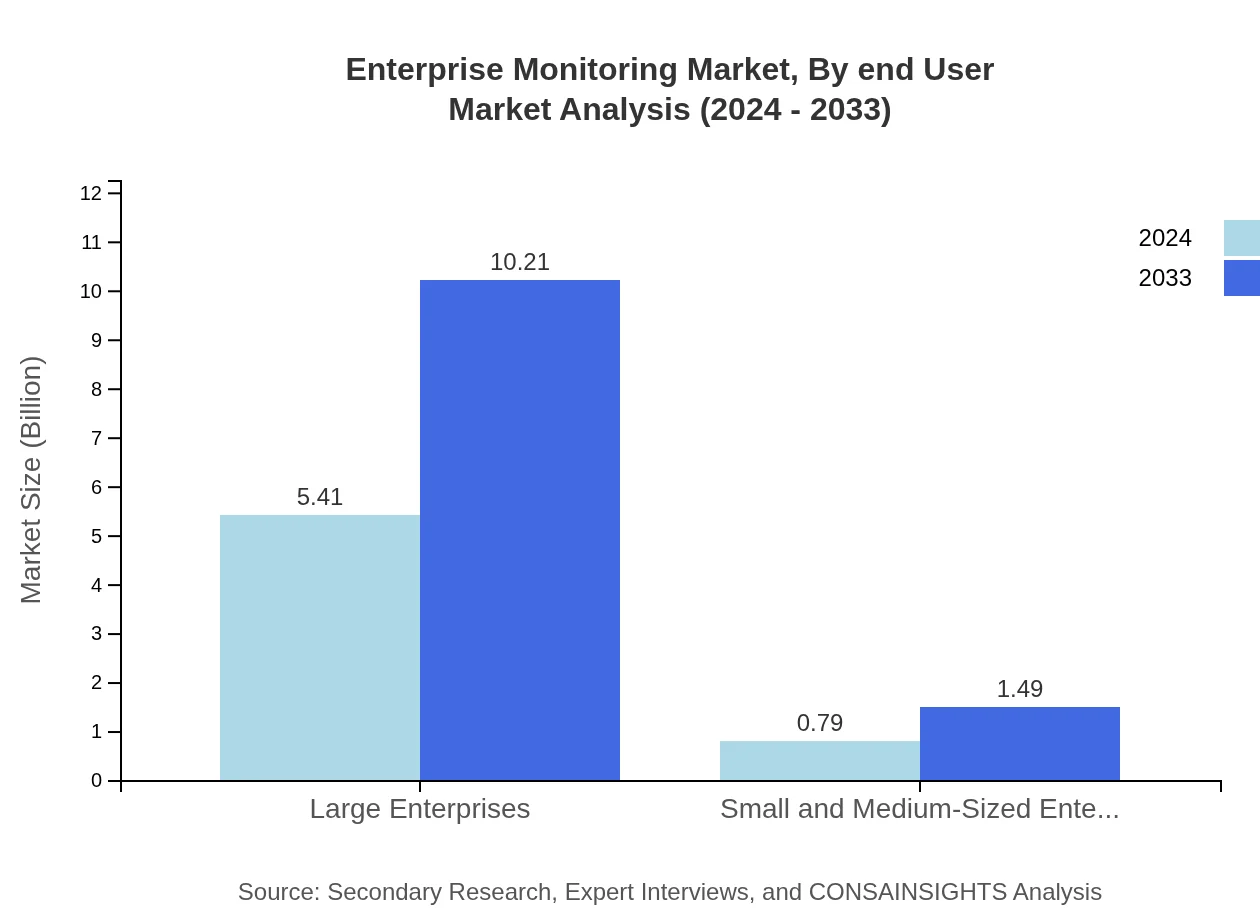

Organizational segmentation divides the market into Large Enterprises and Small & Medium-Sized Enterprises (SMEs). Large Enterprises dominate the landscape with a market size of 5.41 in 2024, expected to rise to 10.21 by 2033, capturing an overwhelming 87.24% share. In contrast, SMEs, though smaller, exhibit consistent growth with their market size increasing from 0.79 in 2024 to 1.49 in 2033, representing a 12.76% share. This distribution highlights the readiness and capital availability of large organizations to invest heavily in enterprise monitoring infrastructure.

Enterprise Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Monitoring Industry

TechGuard Solutions:

TechGuard Solutions is recognized as a pioneer in the Enterprise Monitoring space, offering state-of-the-art monitoring software and integrated services. Their continuous investment in R&D and commitment to innovation has helped global enterprises secure and optimize their IT infrastructures.InnovaMon Inc.:

InnovaMon Inc. has established itself as a key player with robust solutions that blend hardware, software, and managed services. Their customer-centric approach and focus on scalable, AI-driven technologies have significantly advanced industry standards and practices in enterprise monitoring.We're grateful to work with incredible clients.

FAQs

How can the enterprise monitoring report help align our marketing strategy with customer adoption trends?

The enterprise monitoring market is projected to reach $6.2 billion by 2024 with a CAGR of 7.1%. Understanding customer adoption through this report allows marketers to refine strategies, identifying key features and regional preferences that enhance customer engagement and drive growth.

What product features are in highest demand according to the enterprise monitoring trends?

The report reveals high demand for IT infrastructure monitoring, accounting for approximately 40.73% of the market share in 2024, and software solutions (60.86%). This indicates customers prioritize robust monitoring capabilities and software integration for enhanced operational efficiency.

Which regions offer the best market entry and expansion opportunities in the enterprise monitoring industry?

North America leads, expected to grow from $2.23 billion in 2024 to $4.21 billion by 2033. Europe follows with a rise from $2.00 billion to $3.78 billion. Asia-Pacific provides notable potential, expanding from $1.09 billion to $2.06 billion in the same timeframe.

What emerging technologies and innovations are shaping the enterprise monitoring market?

Emerging technologies such as AI-driven analytics and IoT integration are pivotal. These innovations significantly enhance monitoring capabilities, allowing for proactive threat detection and efficient resource management, thereby addressing growing cybersecurity concerns within the enterprise monitoring space.

Does the enterprise monitoring report include competitive landscape and market share analysis?

Yes, the report provides a comprehensive analysis of the competitive landscape, detailing market shares across various segments. This includes key players' strategies and market dynamics, which can help businesses identify strategic opportunities and competitive challenges within the industry.

How can executives use the enterprise monitoring report to evaluate investment risks and ROI?

Executives can leverage this report by assessing market trends, projected growth rates, and segment performances, aiding in identifying promising investments. Understanding the competitive landscape further enables strategic decision-making to optimize ROI and minimize potential risks.

What does the segment breakdown indicate for enterprise monitoring growth areas?

Segments like IT and Telecom ($2.53 billion in 2024) and Healthcare ($1.27 billion) showcase significant market shares. Growth in software solutions and on-premises deployments (60.86% market share) highlights areas ripe for investment and technology advancements as businesses seek comprehensive monitoring solutions.