Enterprise Wlan Market Report

Published Date: 31 January 2026 | Report Code: enterprise-wlan

Enterprise Wlan Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise WLAN market from 2023 to 2033, offering insights into market trends, size, technological advancements, and regional developments. It aims to equip stakeholders with the necessary data for informed decision-making.

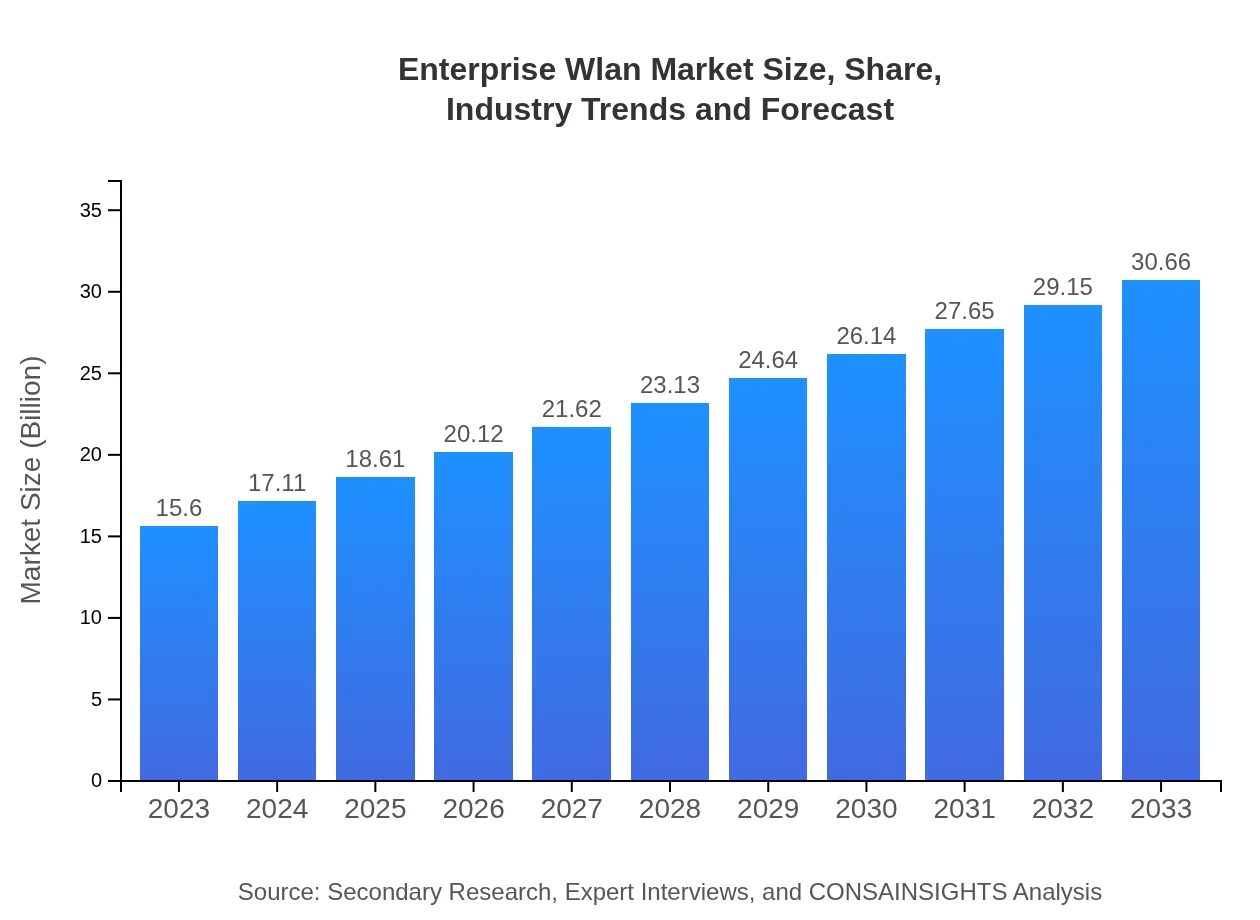

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Cisco Systems Inc., Aruba Networks (HPE), Ruckus Networks (CommScope), Ubiquiti Networks |

| Last Modified Date | 31 January 2026 |

Enterprise Wlan Market Overview

Customize Enterprise Wlan Market Report market research report

- ✔ Get in-depth analysis of Enterprise Wlan market size, growth, and forecasts.

- ✔ Understand Enterprise Wlan's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Wlan

What is the Market Size & CAGR of Enterprise Wlan market in 2023?

Enterprise Wlan Industry Analysis

Enterprise Wlan Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Wlan Market Analysis Report by Region

Europe Enterprise Wlan Market Report:

Europe's Enterprise WLAN market is valued at $3.77 billion in 2023 and is projected to grow to $7.40 billion by 2033. The increasing focus on smart workplace solutions and stringent regulations regarding data security are pushing enterprises to invest in robust WLAN systems. Countries like Germany and the UK are spearheading this growth, supported by substantial investments in digital innovation.Asia Pacific Enterprise Wlan Market Report:

In 2023, the Asia Pacific region's Enterprise WLAN market is valued at $3.03 billion, projected to grow to $5.96 billion by 2033. The rapid digitalization of enterprises, coupled with government initiatives to enhance ICT infrastructure, bolsters market demand. Countries like China and India lead this growth, fueled by technological advancements and a burgeoning tech-savvy consumer base.North America Enterprise Wlan Market Report:

North America dominates the Enterprise WLAN market, with a valuation of $5.02 billion in 2023, expected to reach $9.87 billion by 2033. The region's advanced infrastructure, high adoption of cloud technologies, and continuous innovation in cybersecurity solutions support this growth. Key players and tech hubs in the U.S. and Canada are also fostering a competitive environment.South America Enterprise Wlan Market Report:

The South American Enterprise WLAN market is assessed at $1.58 billion in 2023, with a forecasted growth to $3.10 billion by 2033. Increasing internet penetration and mobile connectivity are primary growth drivers, along with investments in smart city initiatives. However, economic challenges and political instability may hinder some growth prospects in the region.Middle East & Africa Enterprise Wlan Market Report:

The Middle East and Africa (MEA) market, valued at $2.20 billion in 2023, aims for growth to $4.33 billion by 2033. With a rising acceptance of digital transformation and urbanization, MEA is witnessing an uptick in WLAN adoption. Government initiatives in UAE and Saudi Arabia promoting smart technologies further drive the market, despite the challenges arising from regional conflicts.Tell us your focus area and get a customized research report.

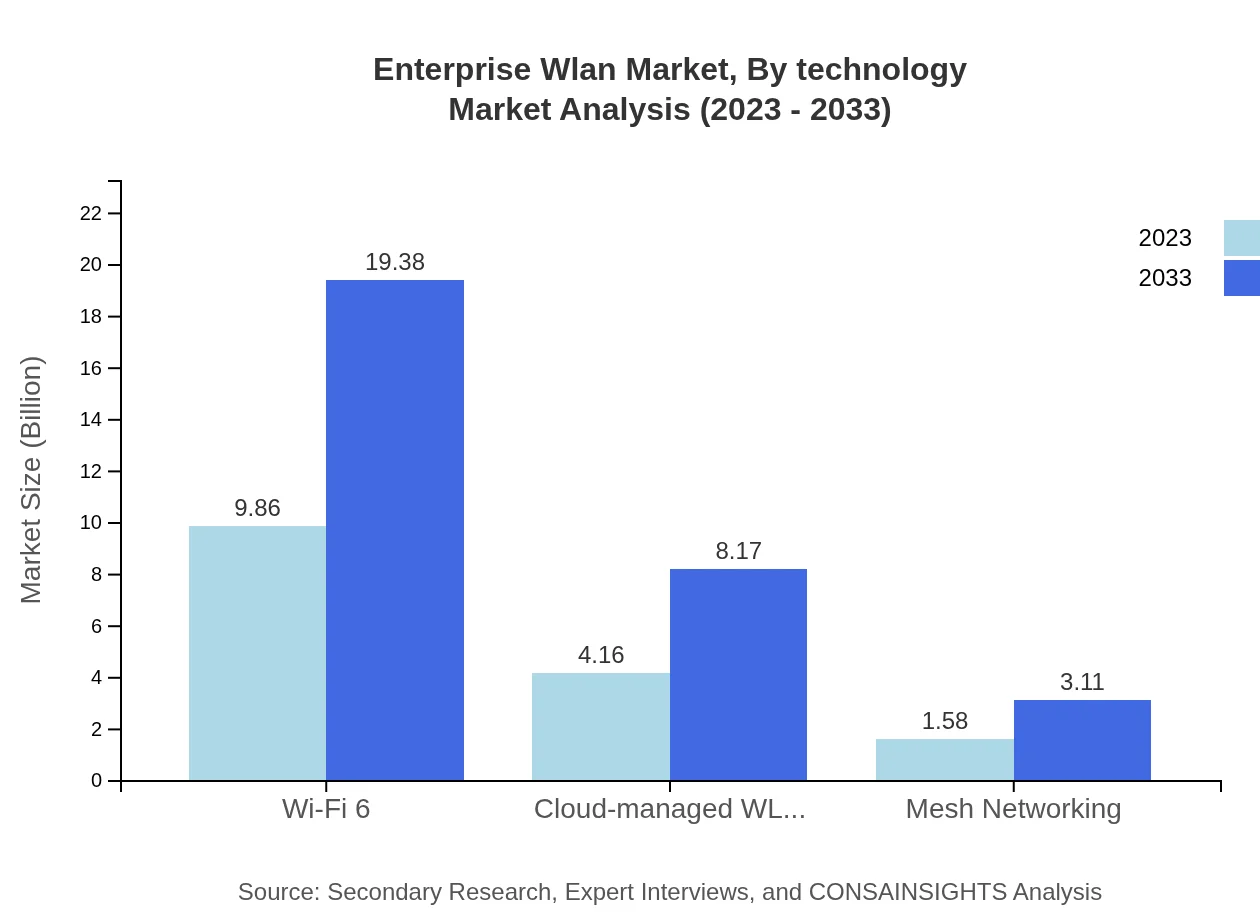

Enterprise Wlan Market Analysis By Technology

This segment emphasizes the adoption of Wi-Fi 6 technology, which is expected to dominate with a market size of $9.86 billion in 2023, reaching $19.38 billion by 2033, capturing a 63.21% market share. Other technologies like cloud-managed WLAN and mesh networking are gaining traction, reflecting the need for enhanced network efficiency and coverage.

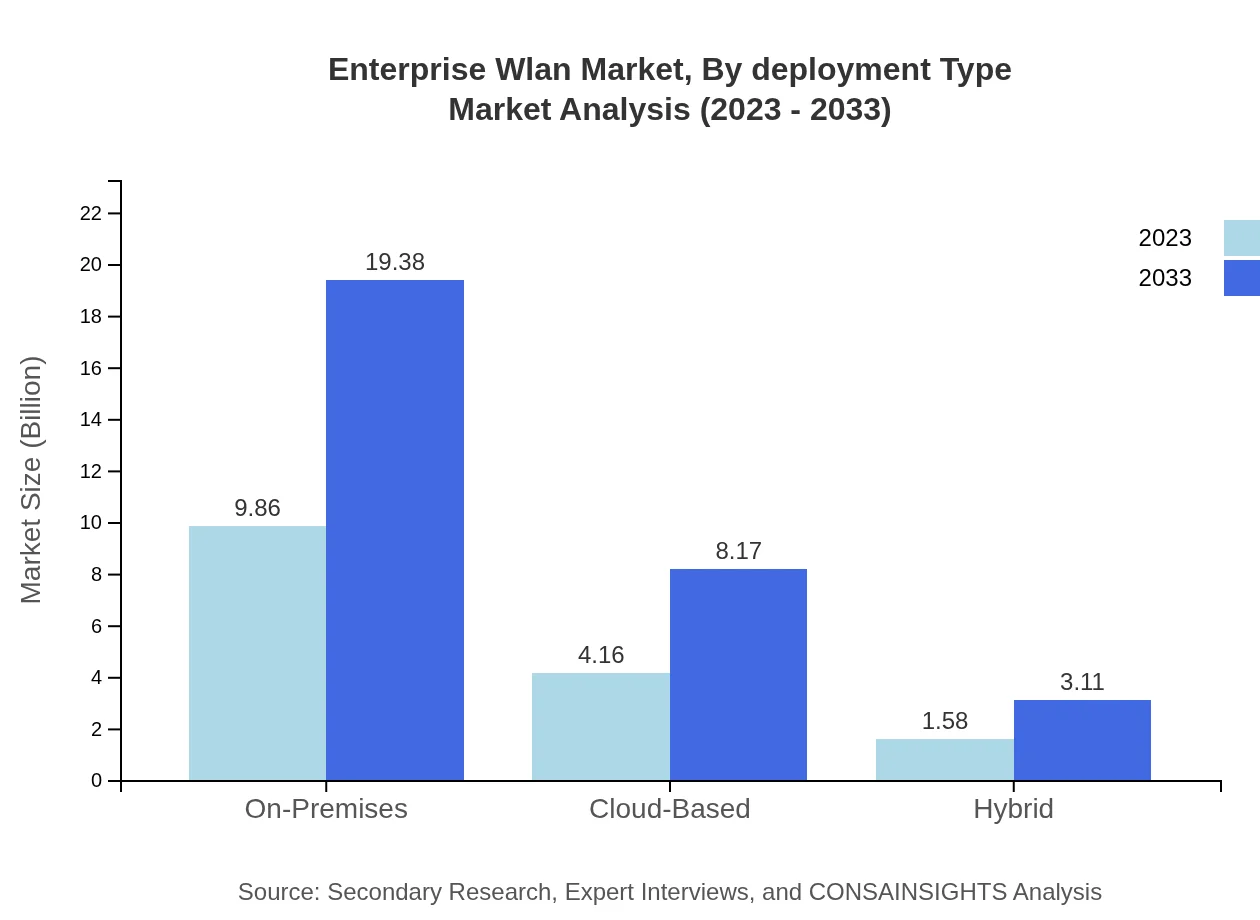

Enterprise Wlan Market Analysis By Deployment Type

The market is divided into on-premises and cloud-based deployment types. On-premises WLAN solutions are valued at $9.86 billion in 2023 and are projected to grow to $19.38 billion by 2033, maintaining a 63.21% market share. Cloud-based solutions are also growing, expected to move from $4.16 billion in 2023 to $8.17 billion in 2033, indicating a shift towards more flexible deployment options.

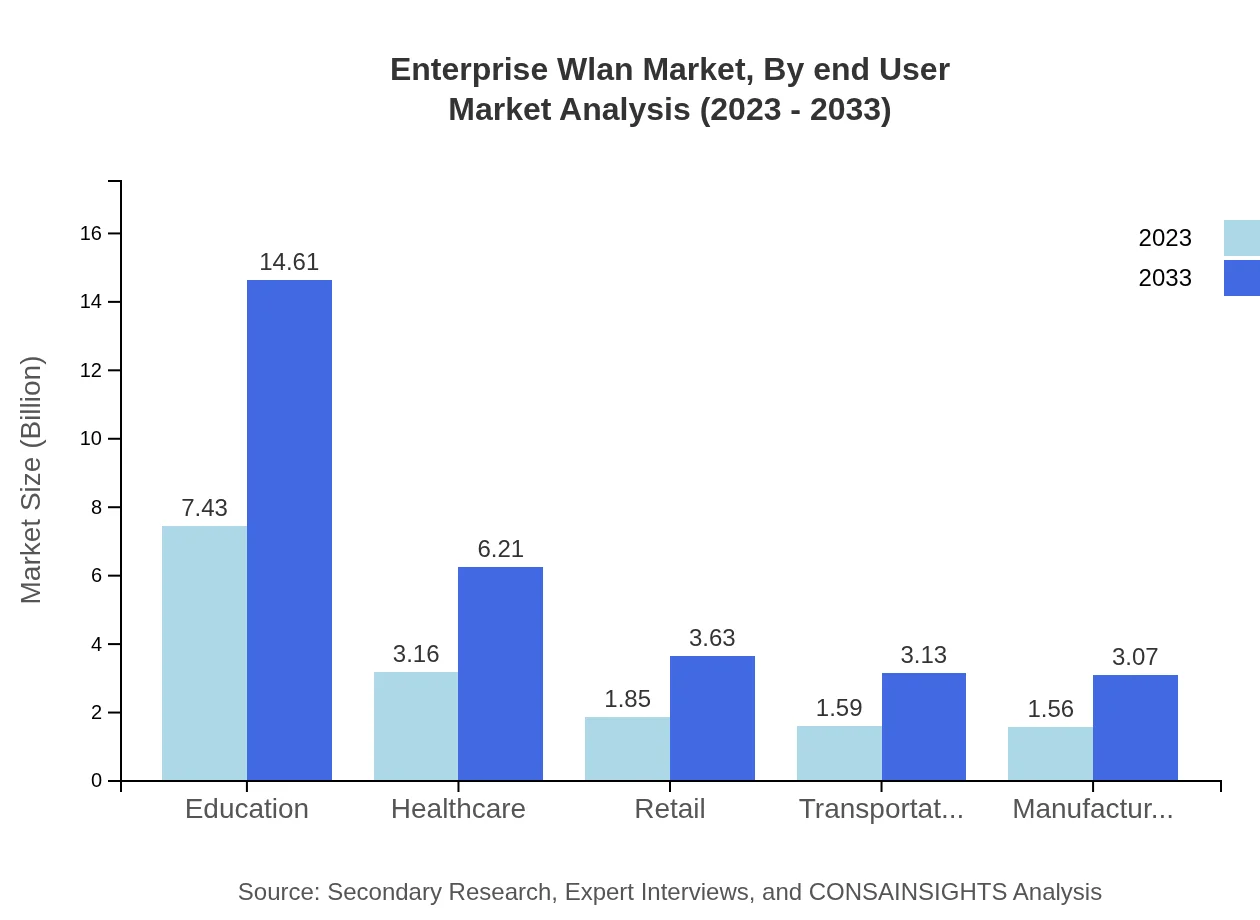

Enterprise Wlan Market Analysis By End User

Segmented by end-user, the education sector leads with a market size of $7.43 billion in 2023, expected to rise to $14.61 billion by 2033, capturing a considerable market share of 47.66%. Other notable sectors include healthcare and retail, which also demonstrate robust growth as they enhance connectivity and operational efficiency.

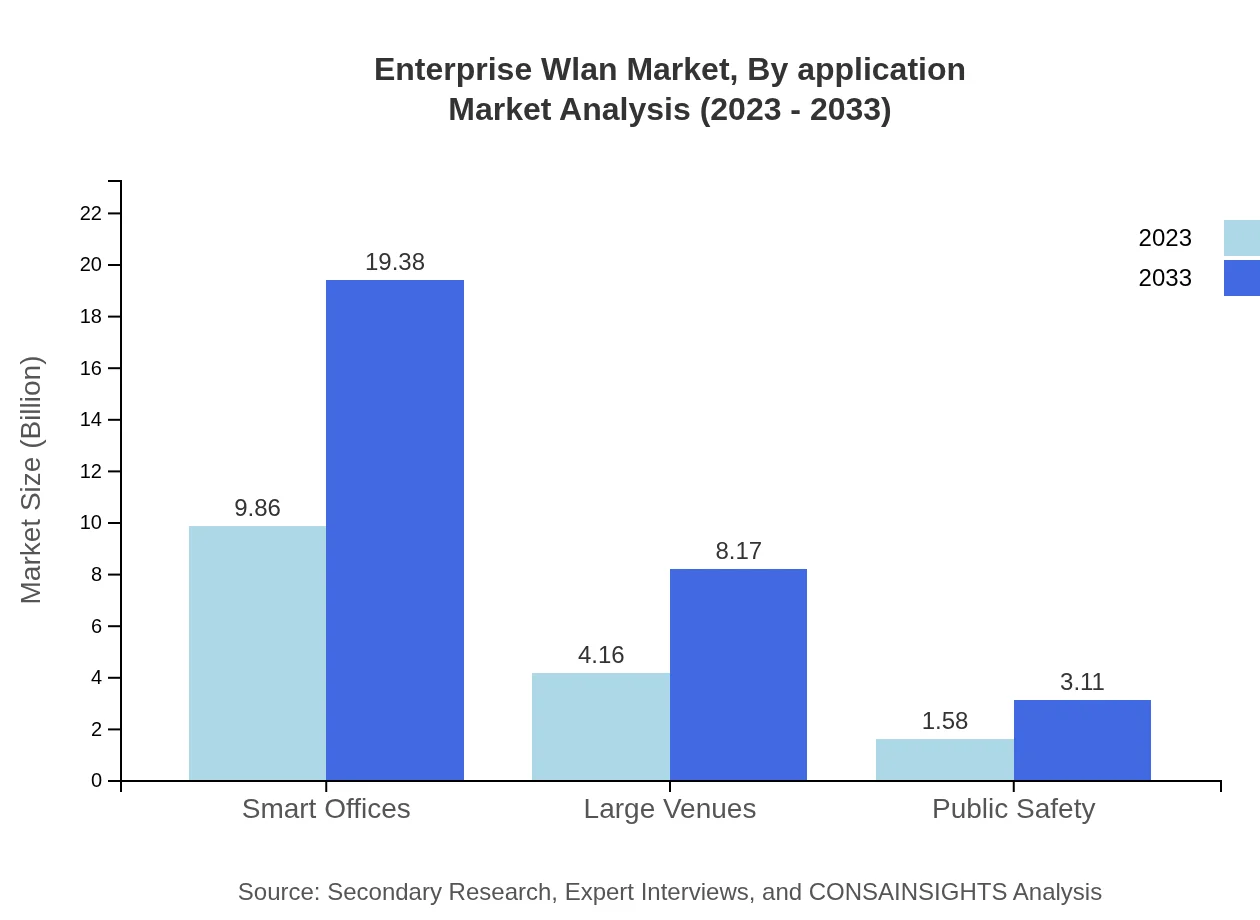

Enterprise Wlan Market Analysis By Application

Applications such as smart offices and large venues are critical in the Enterprise WLAN landscape. Smart offices are anticipated to expand from $9.86 billion in 2023 to $19.38 billion by 2033, supported by the global trend towards remote work and automation. Large venues are also witnessing growth, reflecting rising demand for high-capacity networks.

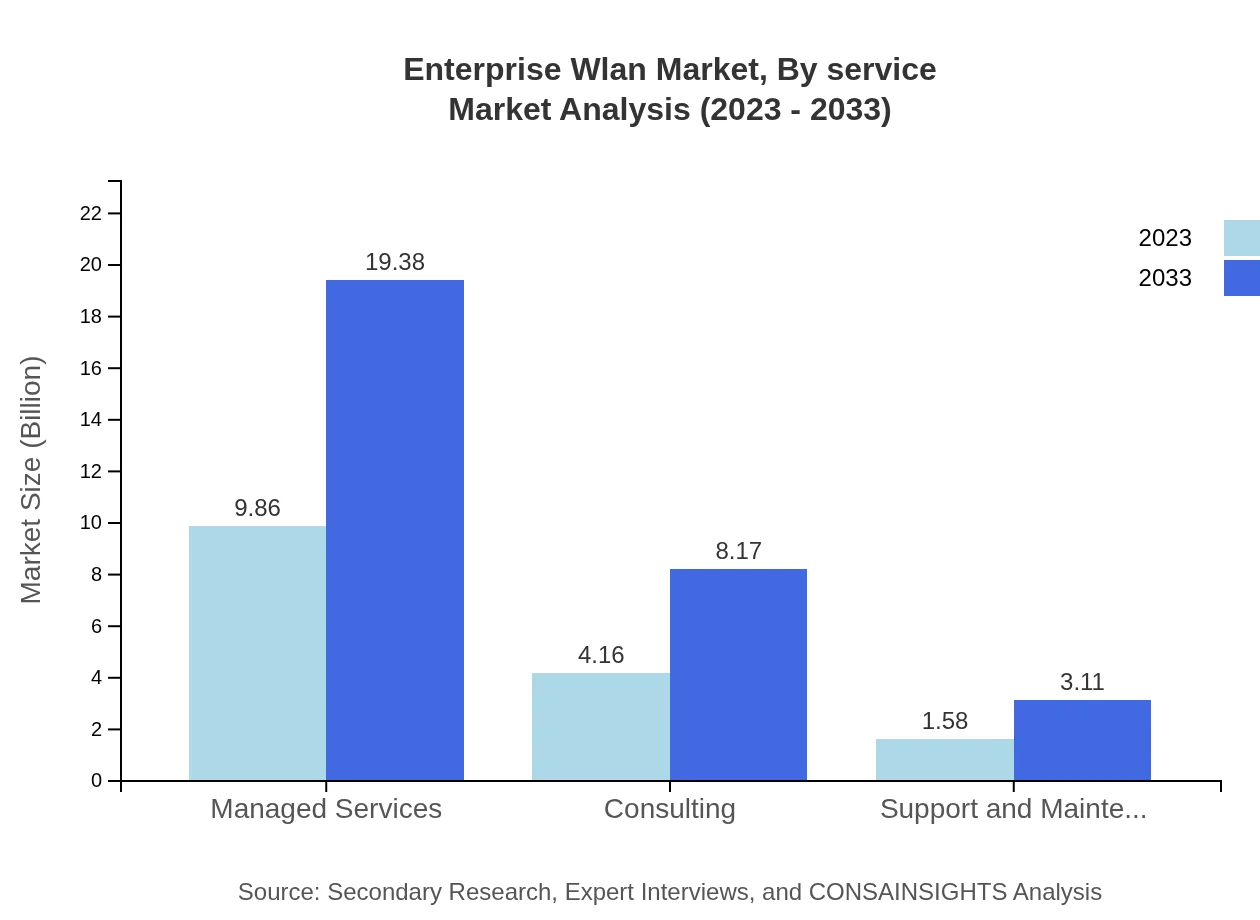

Enterprise Wlan Market Analysis By Service

Services such as managed services dominate the market, valued at $9.86 billion in 2023 and expected to reach $19.38 billion by 2033, holding a significant market share of 63.21%. This is followed by consulting and support and maintenance services, both of which are crucial in maintaining network integrity and performance.

Enterprise Wlan Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Wlan Industry

Cisco Systems Inc.:

A leading provider of networking hardware and software, Cisco offers comprehensive WLAN solutions including the latest Wi-Fi 6 technology aimed at enhancing connectivity and security.Aruba Networks (HPE):

A subsidiary of Hewlett-Packard Enterprise, Aruba specializes in wireless networking solutions, focusing on AI-driven features for efficient WLAN management and performance optimization.Ruckus Networks (CommScope):

Ruckus offers innovative WLAN solutions, catering to high-density environments such as schools and retail venues, with a strong emphasis on reliable connectivity and network management.Ubiquiti Networks:

Known for providing affordable, high-performance WLAN solutions, Ubiquiti is a strong contender in both consumer and enterprise markets, emphasizing ease of deployment and scalability.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Wlan?

The enterprise WLAN market is projected to grow from $15.6 billion in 2023 to significant size by 2033, with a compound annual growth rate (CAGR) of 6.8%. This growth reflects the increasing need for reliable wireless networks in enterprises.

What are the key market players or companies in the enterprise Wlan industry?

Key players in the enterprise WLAN market include established firms such as Cisco Systems, Aruba Networks (Hewlett Packard Enterprise), Ubiquiti Networks, and Ruckus Wireless. These companies dominate the market with their innovative products and extensive service offerings.

What are the primary factors driving the growth in the enterprise Wlan industry?

Factors driving growth in the enterprise WLAN industry include increasing mobile device penetration, demand for high-speed internet connectivity, adoption of cloud services, and the need for robust cybersecurity measures to protect enterprise networks.

Which region is the fastest Growing in the enterprise Wlan?

The fastest-growing region in the enterprise WLAN market is North America, with market growth estimates from $5.02 billion in 2023 to $9.87 billion by 2033. Notably, the Asia Pacific region also shows rapid growth, projected from $3.03 billion to $5.96 billion.

Does ConsInsights provide customized market report data for the enterprise Wlan industry?

Yes, ConsInsights offers tailored market report data for the enterprise WLAN industry. This customization allows organizations to obtain specific insights relevant to their unique requirements, ensuring they make informed decisions based on accurate market information.

What deliverables can I expect from this enterprise Wlan market research project?

Expect comprehensive deliverables including detailed reports with market size, segment data, trends, forecasts, and key player analysis. Clients will receive actionable insights and visual representations to aid strategic planning within the enterprise WLAN landscape.

What are the market trends of enterprise Wlan?

Current trends in the enterprise WLAN market include the shift towards cloud-managed solutions, increased adoption of Wi-Fi 6 technology, and the rise of smart office deployments. These trends highlight the growing demand for efficient and scalable wireless networking solutions.