Smart Office Market Report

Published Date: 31 January 2026 | Report Code: smart-office

Smart Office Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Smart Office market, covering key insights, market sizes, and trends from 2023 to 2033. It explores segmentation, regional dynamics, and leading players in the industry, offering comprehensive data for stakeholders to understand market potential and forecast growth.

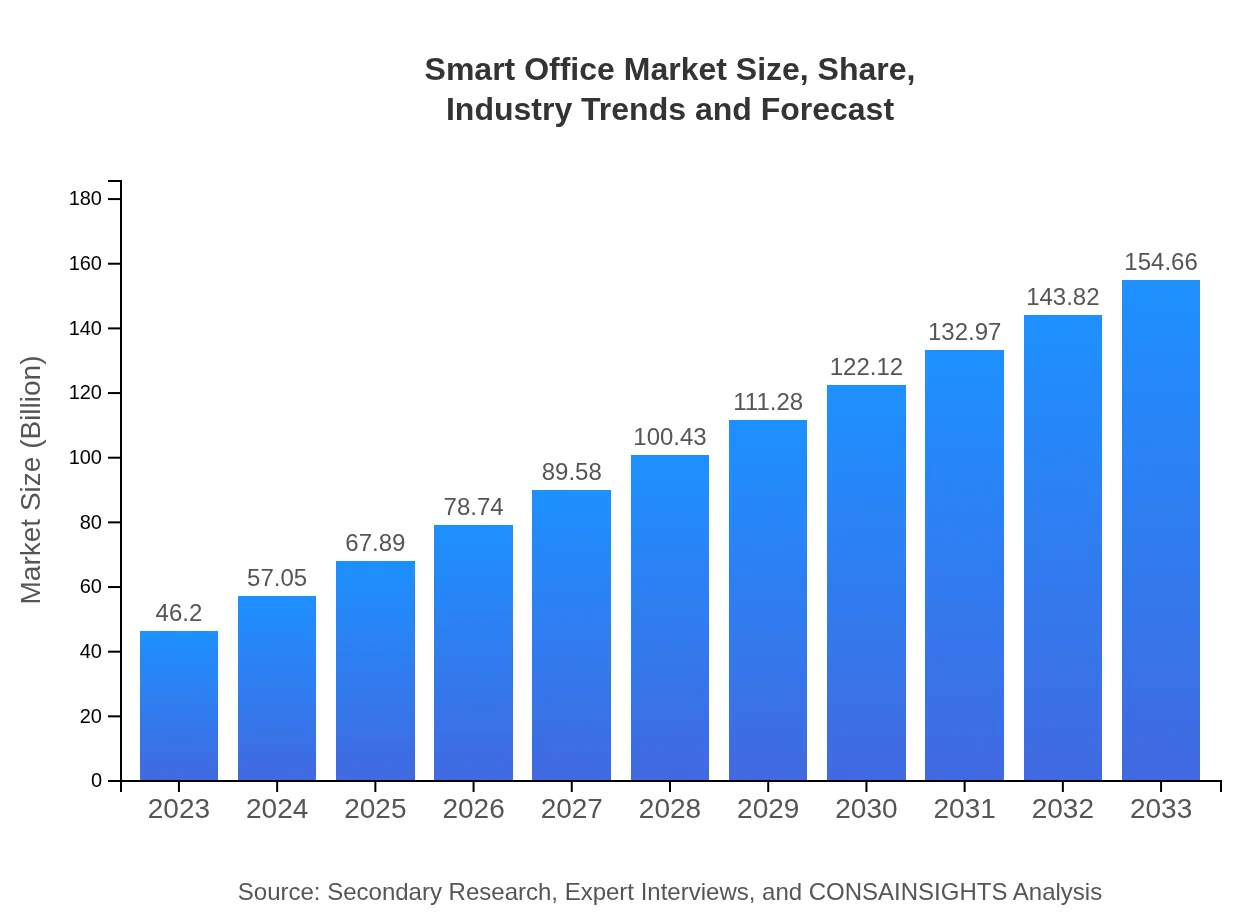

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $46.20 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $154.66 Billion |

| Top Companies | Cisco Systems, Inc., Schneider Electric, Microsoft Corporation, Honeywell International Inc. |

| Last Modified Date | 31 January 2026 |

Smart Office Market Overview

Customize Smart Office Market Report market research report

- ✔ Get in-depth analysis of Smart Office market size, growth, and forecasts.

- ✔ Understand Smart Office's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Office

What is the Market Size & CAGR of Smart Office market in 2023?

Smart Office Industry Analysis

Smart Office Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Office Market Analysis Report by Region

Europe Smart Office Market Report:

Europe’s Smart Office market is anticipated to grow from $15.48 billion in 2023 to $51.83 billion by 2033. The region is characterized by stringent environmental regulations encouraging companies to seek energy-efficient solutions. Government policies supporting smart technology in workplaces also enhance growth prospects, alongside an increasing focus on employee well-being and productivity.Asia Pacific Smart Office Market Report:

In the Asia Pacific region, the Smart Office market is projected to grow significantly from an estimated value of $8.21 billion in 2023 to approximately $27.47 billion by 2033. The increasing adoption of advanced technologies, coupled with government initiatives to transform workplaces, is driving this growth. Countries like China and India are leading in adopting smart office solutions, with rapid urbanization and investments in infrastructure fueling demand.North America Smart Office Market Report:

In North America, the Smart Office market is expected to expand from $15.95 billion in 2023 to over $53.39 billion by 2033. The region is at the forefront of technological adoption, with major corporate investments in building smart infrastructures. Factors including sustainability goals, urban development projects, and the need for remote work adaptations contribute significantly to North America’s growth.South America Smart Office Market Report:

South America is witness to a growing interest in smart office solutions, with a market size increasing from $3.25 billion in 2023 to $10.89 billion by 2033. Despite slower adoption rates compared to other regions, rising investment in digital infrastructure and a focus on enhancing employee experiences are acting as catalysts for growth in this sector.Middle East & Africa Smart Office Market Report:

The Smart Office market in the Middle East and Africa is projected to rise from $3.31 billion in 2023 to approximately $11.09 billion by 2033. Initiatives aimed at modernizing the workplace and insights into global technology trends are spurring investments in smart systems. Additionally, companies are beginning to recognize the long-term benefits of smart technology deployments, reflecting a positive shift within the region.Tell us your focus area and get a customized research report.

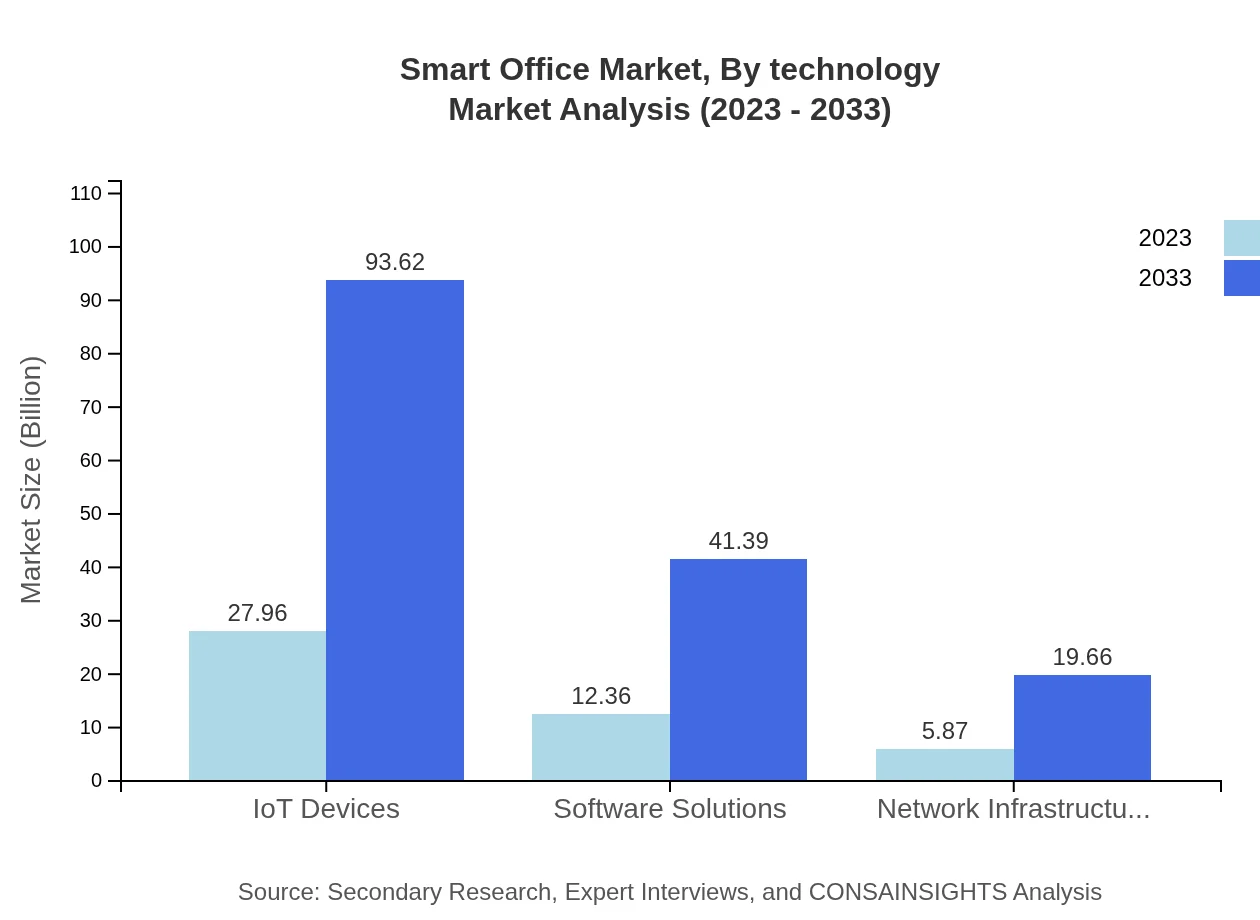

Smart Office Market Analysis By Technology

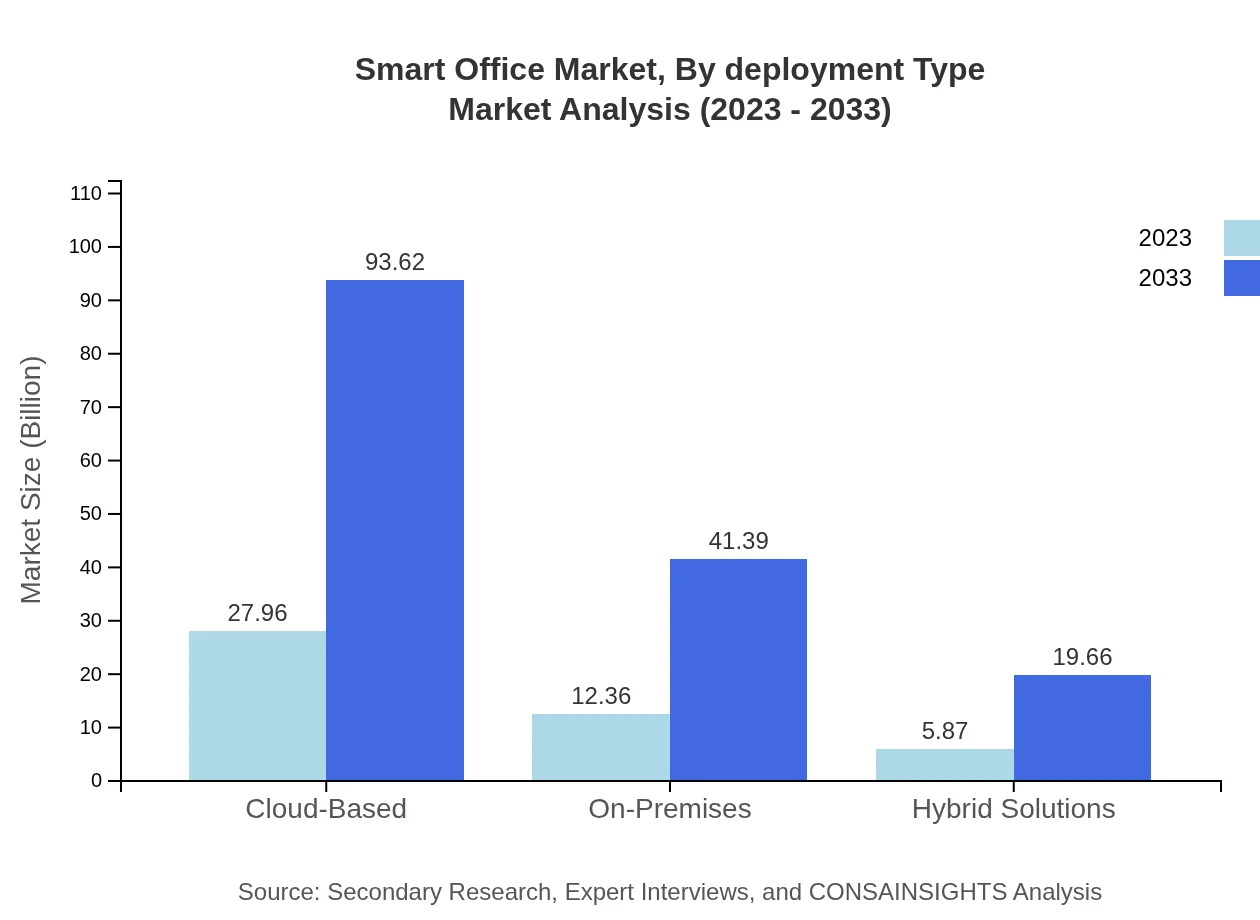

The Smart Office segment by technology is predominantly driven by IoT devices, which are projected to grow from $27.96 billion in 2023 to $93.62 billion by 2033, holding a substantial market share. Cloud-based solutions are also gaining traction, expected to increase from $27.96 million in 2023 to $93.62 million in 2033. As companies prioritize flexible, scalable solutions, investment in software solutions, network infrastructure, and security systems is equally crucial.

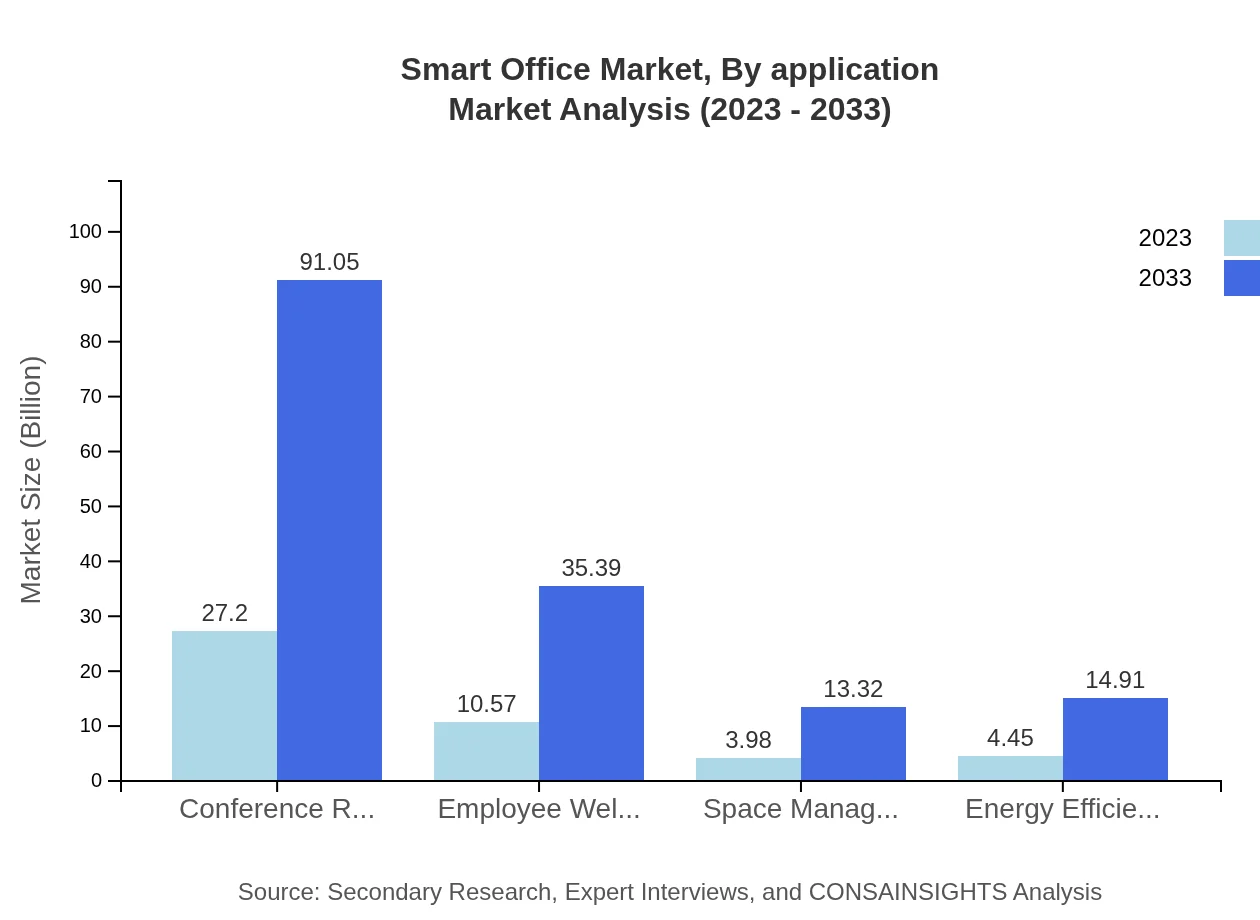

Smart Office Market Analysis By Application

In terms of application, corporate offices are a leading segment in the Smart Office market, anticipated to grow from $27.20 billion in 2023 to $91.05 billion by 2033. Other significant segments include co-working spaces, which are expected to grow from $10.57 billion to $35.39 billion, and educational institutions, showcasing a shift towards smart-enabled learning environments due to rising remote engagement trends.

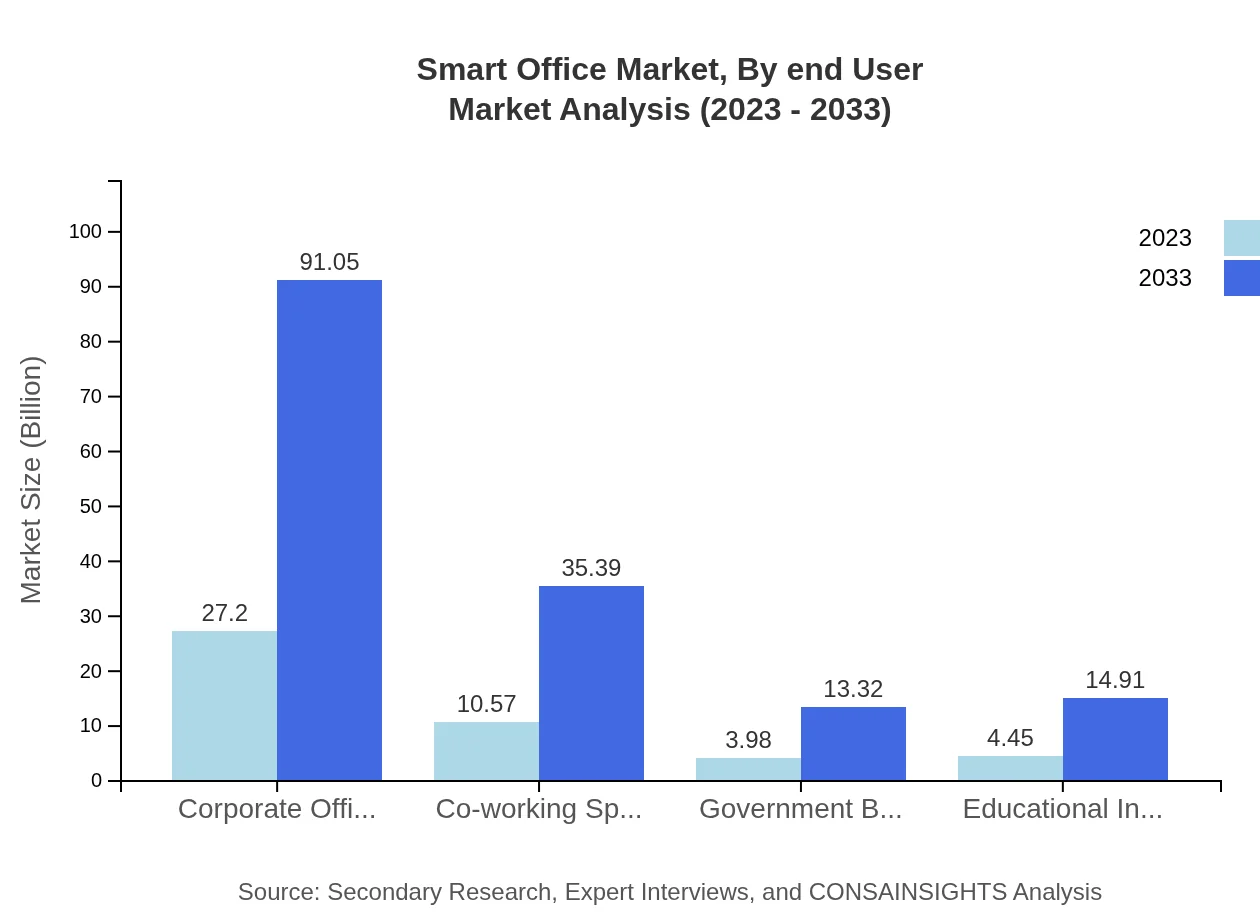

Smart Office Market Analysis By End User

The end-user segment highlights that private companies dominate the Smart Office market, with growth driven by the need for enhanced productivity and efficiency. Educational institutions and government buildings are gradually increasing their share, reflecting a shift in focus towards creating interactive and technologically advanced environments for students and employees, respectively.

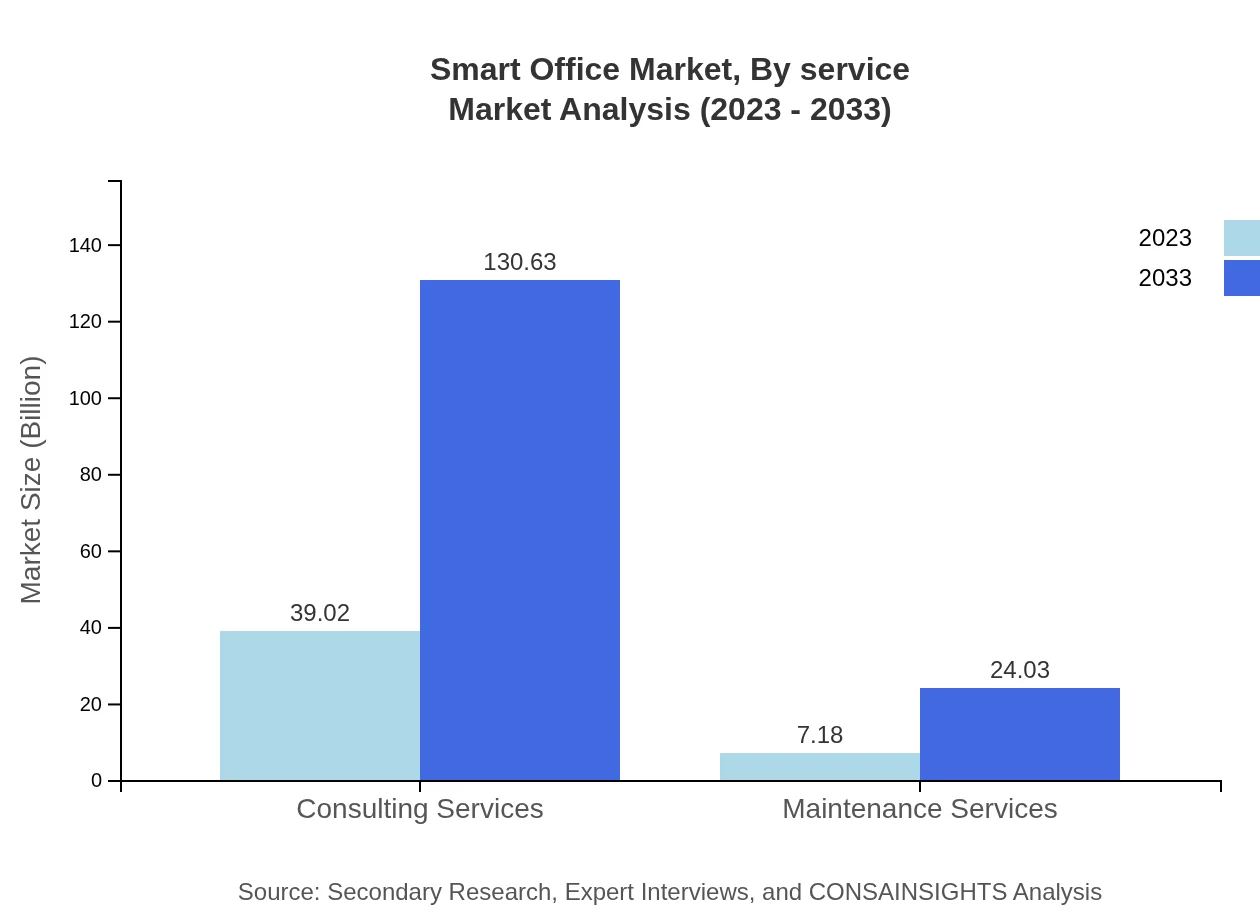

Smart Office Market Analysis By Service

Consulting services represent a major segment in the Smart Office market, with anticipated growth from $39.02 billion in 2023 to $130.63 billion in 2033. Maintenance services also play a critical role, expected to rise significantly as companies seek continuous optimization of their smart office investments amidst evolving technology landscapes.

Smart Office Market Analysis By Deployment Type

Hybrid solutions and cloud-based deployments are increasingly preferred in the Smart Office market. With projected growth from $5.87 billion in 2023 to $19.66 billion by 2033 for hybrid solutions, organizations are looking to implement flexible systems that can accommodate both remote and in-office users effectively.

Smart Office Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Office Industry

Cisco Systems, Inc.:

Cisco is a pioneer in networking and security products, providing smart collaboration tools and IoT solutions that enhance workplace efficiency. Its innovative strategies cater to evolving smart office needs.Schneider Electric:

A leader in energy management and automation, Schneider Electric integrates IoT technologies to provide sustainability-focused solutions in smart workplaces, contributing significantly to the industry's evolution.Microsoft Corporation:

Microsoft leverages its software capabilities to offer advanced solutions for productivity and collaboration in smart office environments, driving digital transformation across sectors.Honeywell International Inc.:

Honeywell’s smart building technologies and IoT solutions ensure energy efficiency, safety, and comfort in modern workplaces, positioning the company as a key player in the smart office market.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Office?

The smart office market is projected to reach a size of $46.2 billion, growing at a remarkable CAGR of 12.3%. This growth indicates a promising future for technology integration in workplace environments, fostering efficiency and innovation.

What are the key market players or companies in the smart Office industry?

The smart office industry features a diverse array of players including technology giants, software developers, and IoT hardware manufacturers. They lead in developing solutions like automated lighting, HVAC systems, and workspace management tools crucial for market evolution.

What are the primary factors driving the growth in the smart Office industry?

Key factors driving growth in the smart office industry include increasing demand for energy efficiency, advancements in IoT technology, and the rising trend of remote work. These elements collectively push organizations to adopt smarter, more adaptable office solutions.

Which region is the fastest Growing in the smart Office market?

The fastest-growing region in the smart office market is North America, projected to increase from $15.95 billion in 2023 to $53.39 billion by 2033. This growth reflects the region's strong infrastructure and demand for innovative office solutions.

Does ConsaInsights provide customized market report data for the smart Office industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the smart office industry. These reports provide in-depth analysis and insights tailored to market segments that can drive business decision-making.

What deliverables can I expect from this smart Office market research project?

Deliverables from the smart office market research project typically include comprehensive data reports, market trend analysis, competitor benchmarks, and strategic insights tailored to enhance decision-making and market positioning for businesses.

What are the market trends of smart Office?

Current market trends in the smart office space include the rising adoption of cloud-based solutions, increased focus on employee wellness, and the integration of AI for operational efficiencies. These trends signify a shift toward more connected and intelligent work environments.