Fiber Optic Test Equipment Market Report

Published Date: 31 January 2026 | Report Code: fiber-optic-test-equipment

Fiber Optic Test Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Fiber Optic Test Equipment market, highlighting the insights and data from 2023 to 2033. It provides an overview of market size, growth trends, and regional analyses to aid stakeholders in making informed decisions.

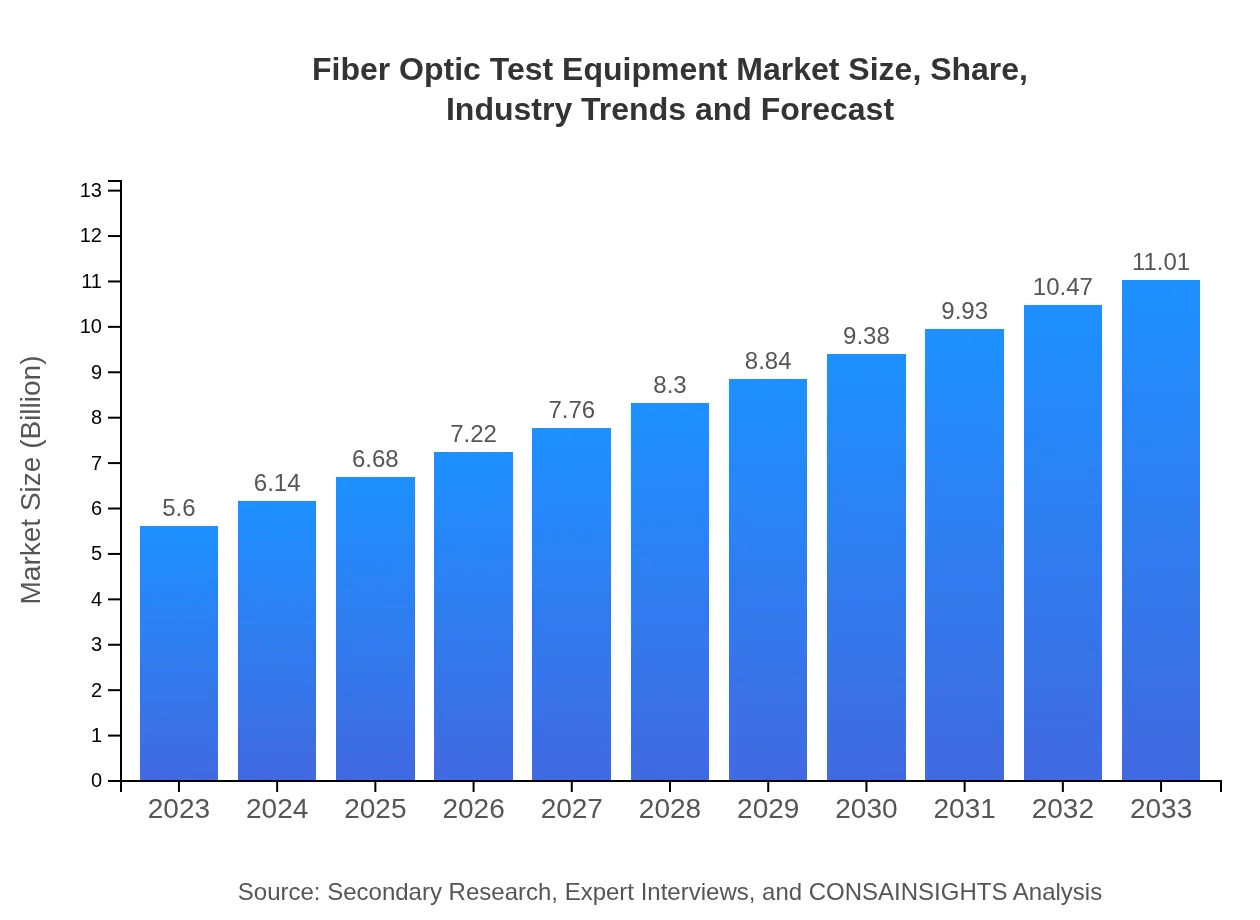

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Fluke Networks, EXFO Inc., VIAVI Solutions, AOI, Primus Cable |

| Last Modified Date | 31 January 2026 |

Fiber Optic Test Equipment Market Overview

Customize Fiber Optic Test Equipment Market Report market research report

- ✔ Get in-depth analysis of Fiber Optic Test Equipment market size, growth, and forecasts.

- ✔ Understand Fiber Optic Test Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fiber Optic Test Equipment

What is the Market Size & CAGR of Fiber Optic Test Equipment market in 2023?

Fiber Optic Test Equipment Industry Analysis

Fiber Optic Test Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fiber Optic Test Equipment Market Analysis Report by Region

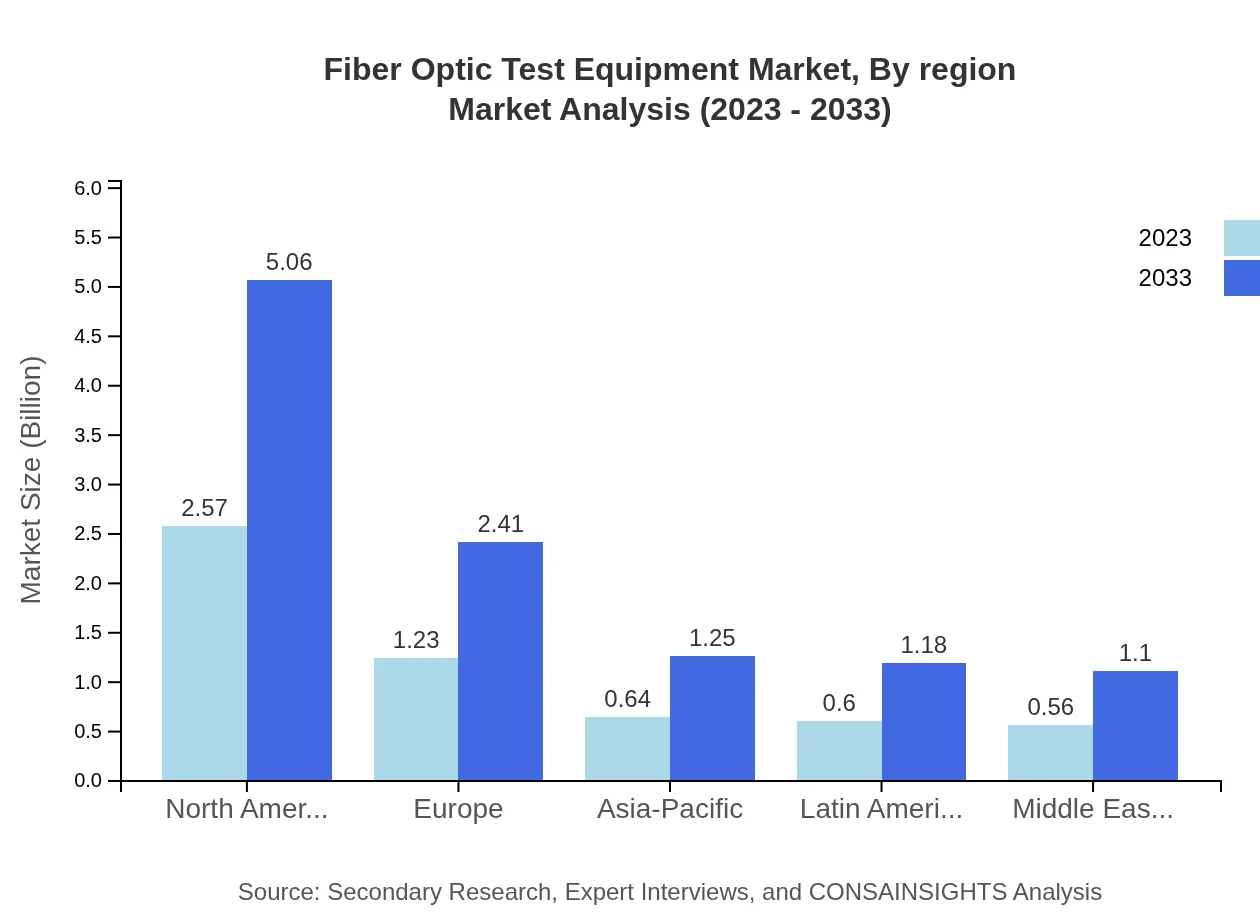

Europe Fiber Optic Test Equipment Market Report:

Europe's market is valued at $1.77 billion in 2023 and is expected to double to $3.47 billion by 2033. The EU's strategic initiatives towards digital infrastructure and the shift towards renewable energy sources are pivotal in driving market growth.Asia Pacific Fiber Optic Test Equipment Market Report:

The Asia Pacific region is projected to grow significantly, from $1.00 billion in 2023 to $1.96 billion in 2033, driven by increasing investments in telecommunications infrastructure and data center expansions. The rising demand for reliable internet services has also bolstered the adoption of fiber optic testing equipment.North America Fiber Optic Test Equipment Market Report:

North America remains the largest market, with a size of $2.15 billion in 2023, anticipated to reach $4.23 billion by 2033. The region benefits from advanced technological infrastructure, high-speed internet penetration, and increasing demand from data centers and telecommunications networks.South America Fiber Optic Test Equipment Market Report:

In South America, the market is expected to grow from $0.19 billion in 2023 to $0.37 billion in 2033. Factors such as emerging telecommunications markets and infrastructural development are contributing to this growth, as countries upgrade their existing legacy systems.Middle East & Africa Fiber Optic Test Equipment Market Report:

The Middle East and Africa market will see growth from $0.50 billion in 2023 to $0.98 billion in 2033, propelled by investments in smart cities and IoT infrastructure projects across the region.Tell us your focus area and get a customized research report.

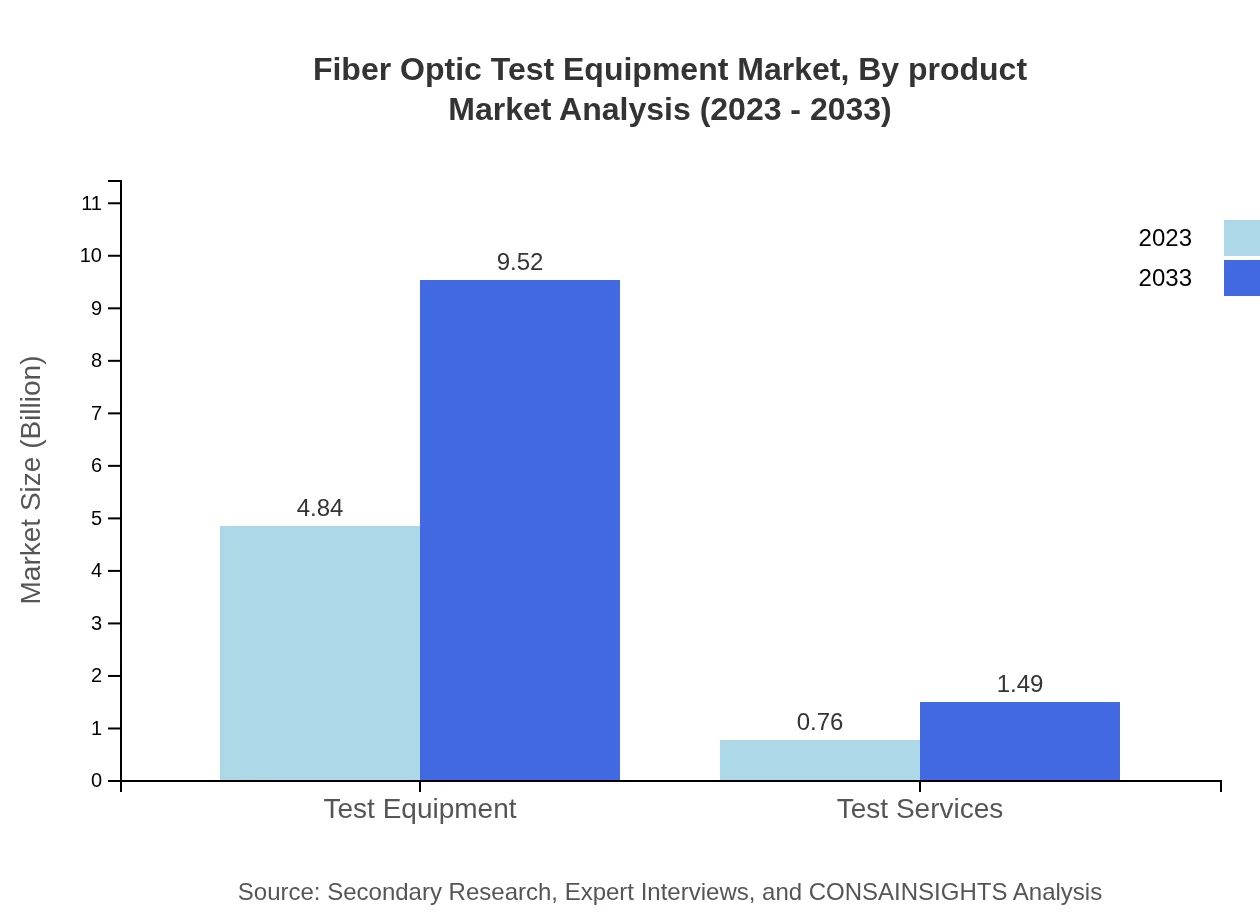

Fiber Optic Test Equipment Market Analysis By Product

The market is primarily divided into two segments: test equipment and test services. Test equipment dominates the market, accounting for approximately 86.5% of the market share in 2023, translating to $4.84 billion. Test services, while smaller, represent a growing segment as organizations seek outsourcing options for specialized testing tasks.

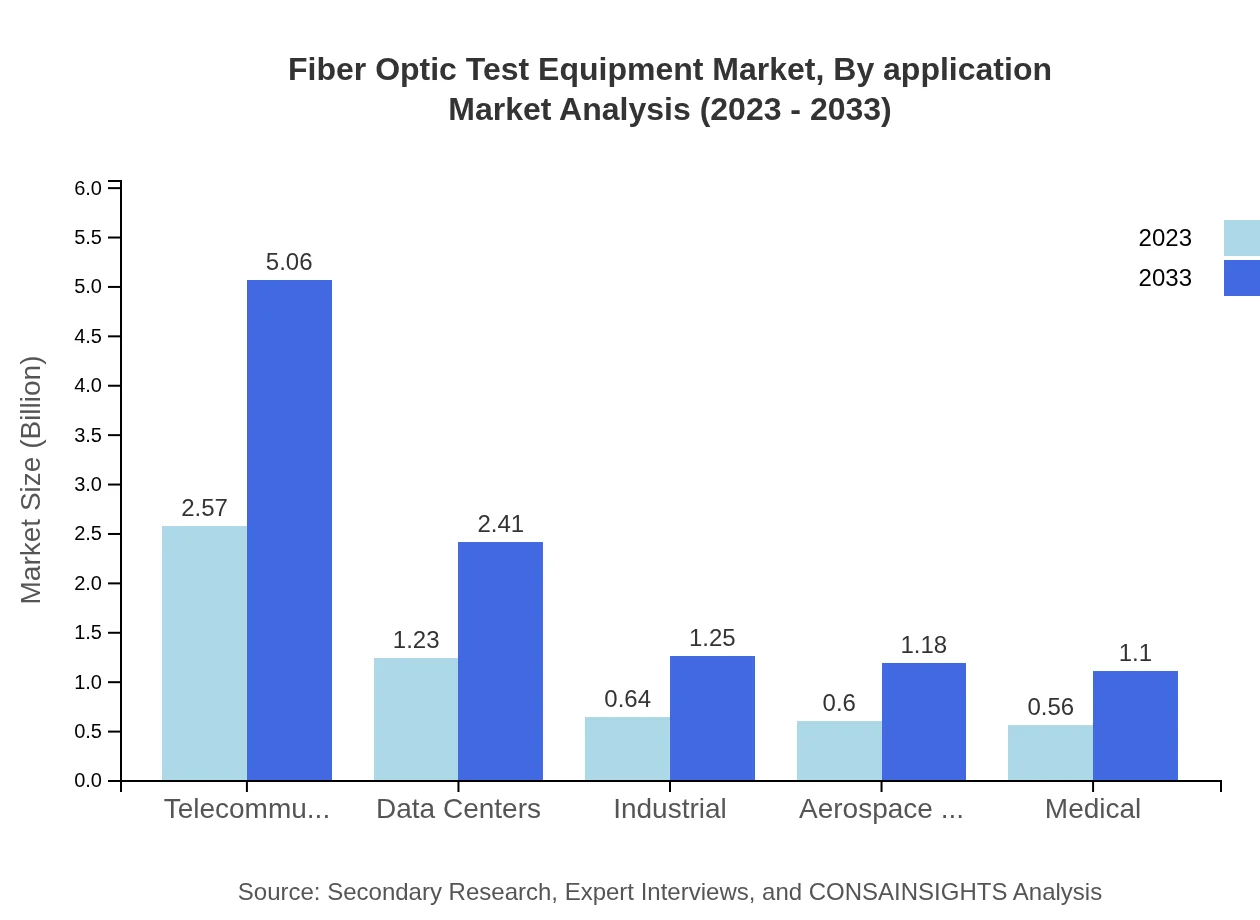

Fiber Optic Test Equipment Market Analysis By Application

Main application areas include telecommunications, data centers, industrial processes, and military uses. The telecommunications segment leads the market, capturing around 45.93% of the share as companies seek efficient and reliable communication systems.

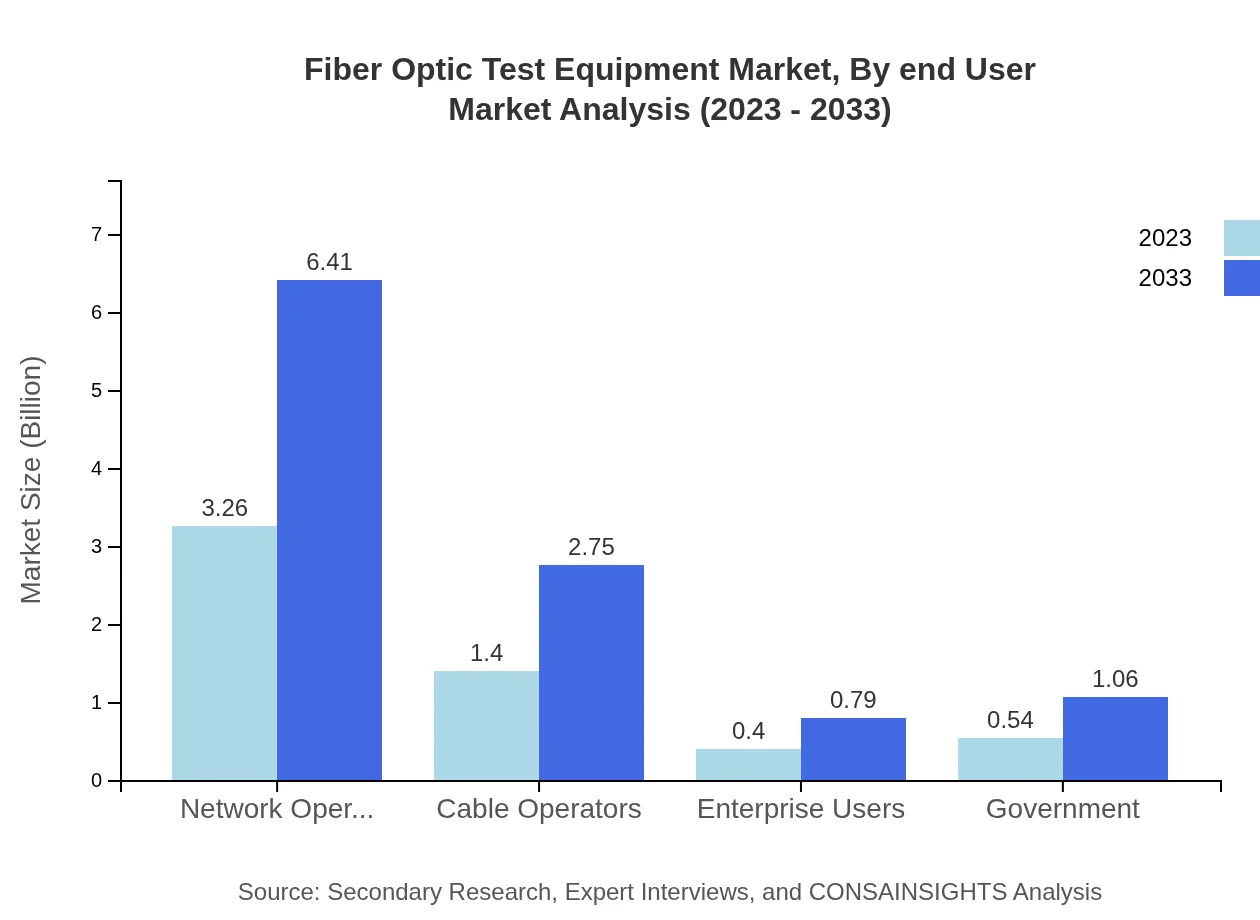

Fiber Optic Test Equipment Market Analysis By End User

Significant end-users include network operators, cable operators, enterprise users, and government. Network operators hold the largest share (58.26% in 2023) due to increasing need for broadband services that rely heavily on fiber optic technology.

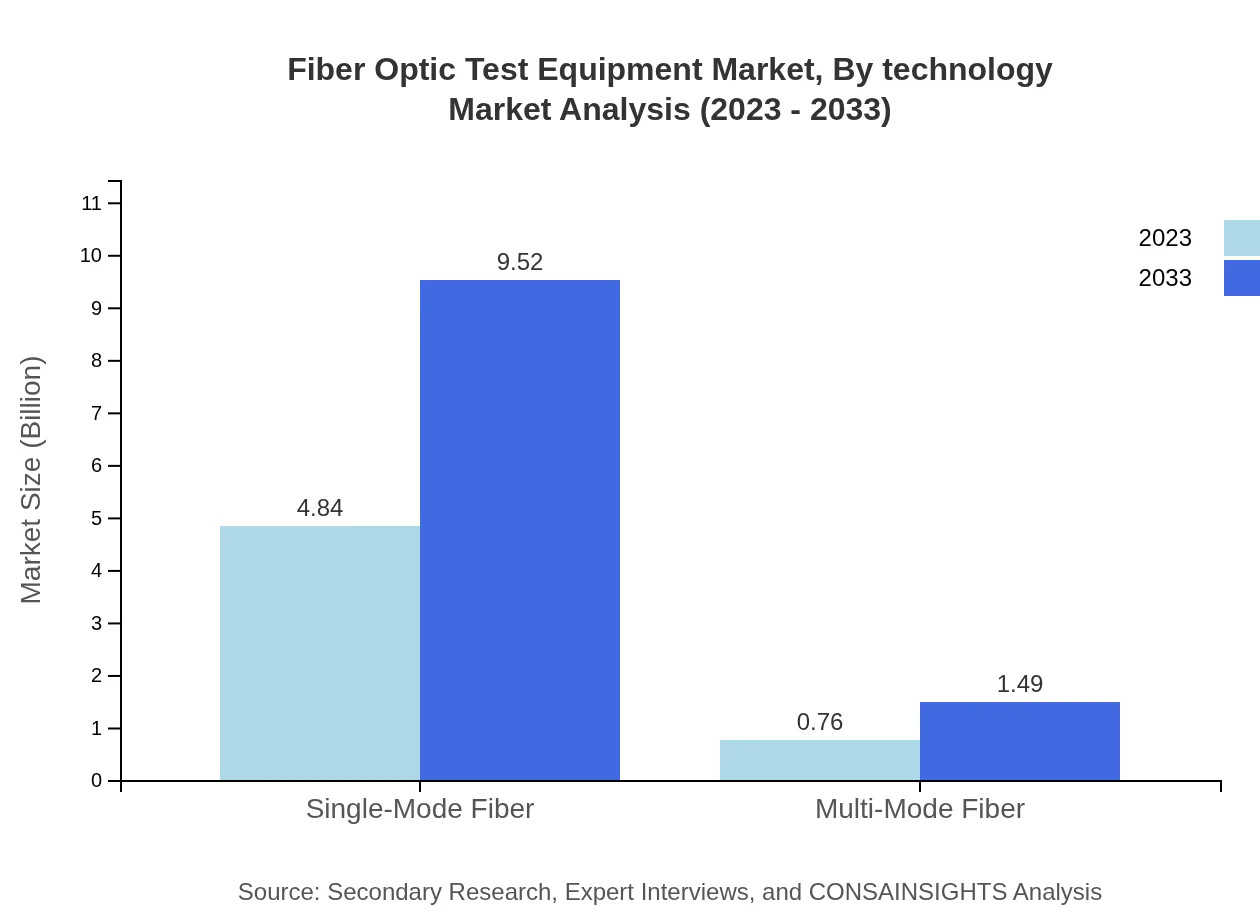

Fiber Optic Test Equipment Market Analysis By Technology

The market primarily consists of single-mode and multi-mode fibers. Single-mode fiber accounts for an impressive 86.5% of the market share due to its ability to transmit data over long distances with low attenuation.

Fiber Optic Test Equipment Market Analysis By Region

Regional insights reveal North America as the leading market player, followed by Europe and Asia-Pacific. Each region presents unique growth opportunities backed by advancements in technology and increased investment in fiber optic infrastructures.

Fiber Optic Test Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fiber Optic Test Equipment Industry

Fluke Networks:

Fluke Networks is a leader in network testing equipment, providing solutions designed for effective testing and troubleshooting of fiber optic systems.EXFO Inc.:

EXFO Inc. specializes in fiber optics testing with an extensive range of products. Their solutions help in managing network readiness for service across various sectors.VIAVI Solutions:

VIAVI Solutions offers comprehensive test and measurement solutions. Their advanced equipment assists in the deployment and maintenance of fiber optic networks worldwide.AOI:

AOI focuses on providing innovative testing instruments for fiber optics, ensuring high performance and reliability in measurements.Primus Cable:

Primus Cable delivers a wide selection of fiber optic cables and testing products, known for excellent quality and industry standards adherence.We're grateful to work with incredible clients.

FAQs

What is the market size of fiber Optic Test Equipment?

The global fiber-optic test equipment market is projected to reach $5.6 billion by 2033, growing at a CAGR of 6.8% from 2023. This growth indicates a robust demand for advanced optical testing technologies driven by data transmission needs.

What are the key market players or companies in this fiber Optic Test Equipment industry?

Key players in the fiber-optic test equipment market include leading manufacturers and technology providers such as VIAVI Solutions, EXFO Inc., and Fluke Networks. Their innovation and product offerings significantly influence market dynamics and customer preferences.

What are the primary factors driving the growth in the fiber Optic Test Equipment industry?

Key drivers include the increasing demand for high-speed internet, the expansion of telecommunication networks, and advancements in optical technologies. Additionally, the rise in data centers and IoT applications bolster the necessity for robust testing solutions.

Which region is the fastest Growing in the fiber Optic Test Equipment?

North America is currently the largest market, valued at $2.15 billion in 2023 and expected to reach $4.23 billion by 2033. Europe and Asia-Pacific also show significant growth potential due to increased fiber installations and upgrades.

Does ConsaInsights provide customized market report data for the fiber Optic Test Equipment industry?

Yes, ConsaInsights offers tailored market reports to meet specific client needs, allowing for in-depth analysis of market trends, competitive landscape, and regional insights, ensuring clients obtain actionable intelligence suited to their strategic goals.

What deliverables can I expect from this fiber Optic Test Equipment market research project?

Deliverables typically include a comprehensive market report, detailed segmentation analysis, competitive landscape assessments, future growth projections, and customized data insights tailored to specific client requirements within the fiber-optic test equipment sector.

What are the market trends of fiber Optic Test Equipment?

Current trends include the digitization of networks, the shift toward smart technologies, and the increased focus on sustainable practices. These trends drive innovations in testing solutions to maximize efficiency and reliability in fiber-optic deployments.