Fiber Reinforced Polymer Frp Panels Sheets Market Report

Published Date: 02 February 2026 | Report Code: fiber-reinforced-polymer-frp-panels-sheets

Fiber Reinforced Polymer Frp Panels Sheets Market Size, Share, Industry Trends and Forecast to 2033

This report delivers in-depth insights into the Fiber Reinforced Polymer (FRP) Panels and Sheets market, covering market trends, growth forecasts, and regional analyses from 2023 to 2033.

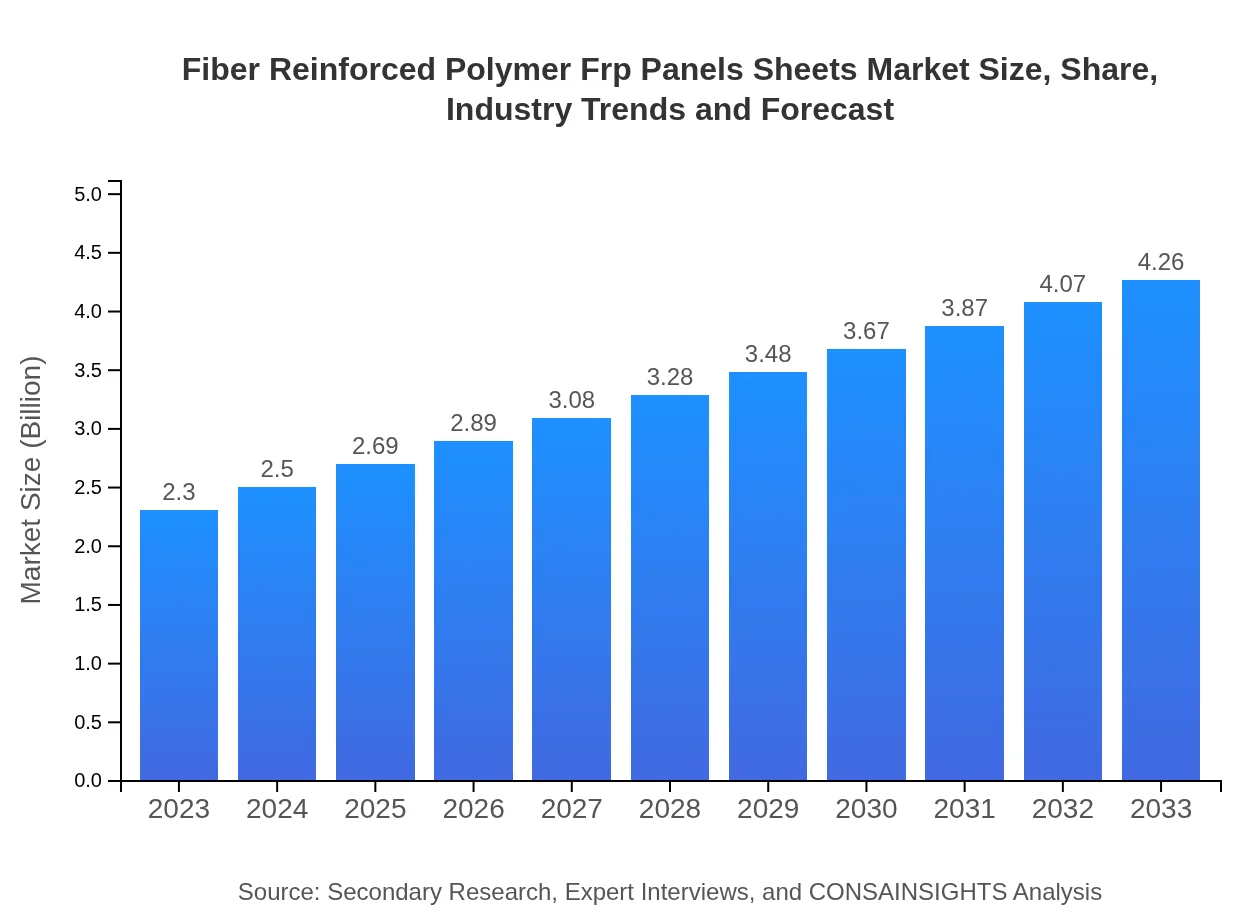

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.26 Billion |

| Top Companies | Sika AG, Owens Corning, Hexcel Corporation, Gurit Holding AG |

| Last Modified Date | 02 February 2026 |

Fiber Reinforced Polymer Frp Panels Sheets Market Overview

Customize Fiber Reinforced Polymer Frp Panels Sheets Market Report market research report

- ✔ Get in-depth analysis of Fiber Reinforced Polymer Frp Panels Sheets market size, growth, and forecasts.

- ✔ Understand Fiber Reinforced Polymer Frp Panels Sheets's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fiber Reinforced Polymer Frp Panels Sheets

What is the Market Size & CAGR of Fiber Reinforced Polymer Frp Panels Sheets market in 2023?

Fiber Reinforced Polymer Frp Panels Sheets Industry Analysis

Fiber Reinforced Polymer Frp Panels Sheets Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fiber Reinforced Polymer Frp Panels Sheets Market Analysis Report by Region

Europe Fiber Reinforced Polymer Frp Panels Sheets Market Report:

Europe's market is expected to expand from $0.76 billion in 2023 to $1.41 billion in 2033. This growth is driven by the region's focus on renewable technologies and materials in response to climate change efforts and infrastructure renovation initiatives.Asia Pacific Fiber Reinforced Polymer Frp Panels Sheets Market Report:

In the Asia Pacific region, the FRP Panels and Sheets market is projected to grow from $0.41 billion in 2023 to $0.76 billion in 2033. The growth is supported by expanding construction activities, rising infrastructure development, and increasing adoption of FRP in automotive applications.North America Fiber Reinforced Polymer Frp Panels Sheets Market Report:

North America is anticipated to witness growth from $0.82 billion in 2023 to $1.52 billion in 2033, fueled by stringent regulations promoting the use of sustainable materials and significant advancements in manufacturing technologies across industries.South America Fiber Reinforced Polymer Frp Panels Sheets Market Report:

South America's market is expected to rise from $0.07 billion in 2023 to $0.13 billion in 2033. The growth is primarily driven by limited but increasing industrialization and demand for lightweight materials in construction projects.Middle East & Africa Fiber Reinforced Polymer Frp Panels Sheets Market Report:

The Middle East and Africa market is forecasted to increase from $0.24 billion in 2023 to $0.44 billion in 2033. The growth is driven by ongoing construction projects and the region's increasing focus on innovative, durable building materials amidst rapid urbanization.Tell us your focus area and get a customized research report.

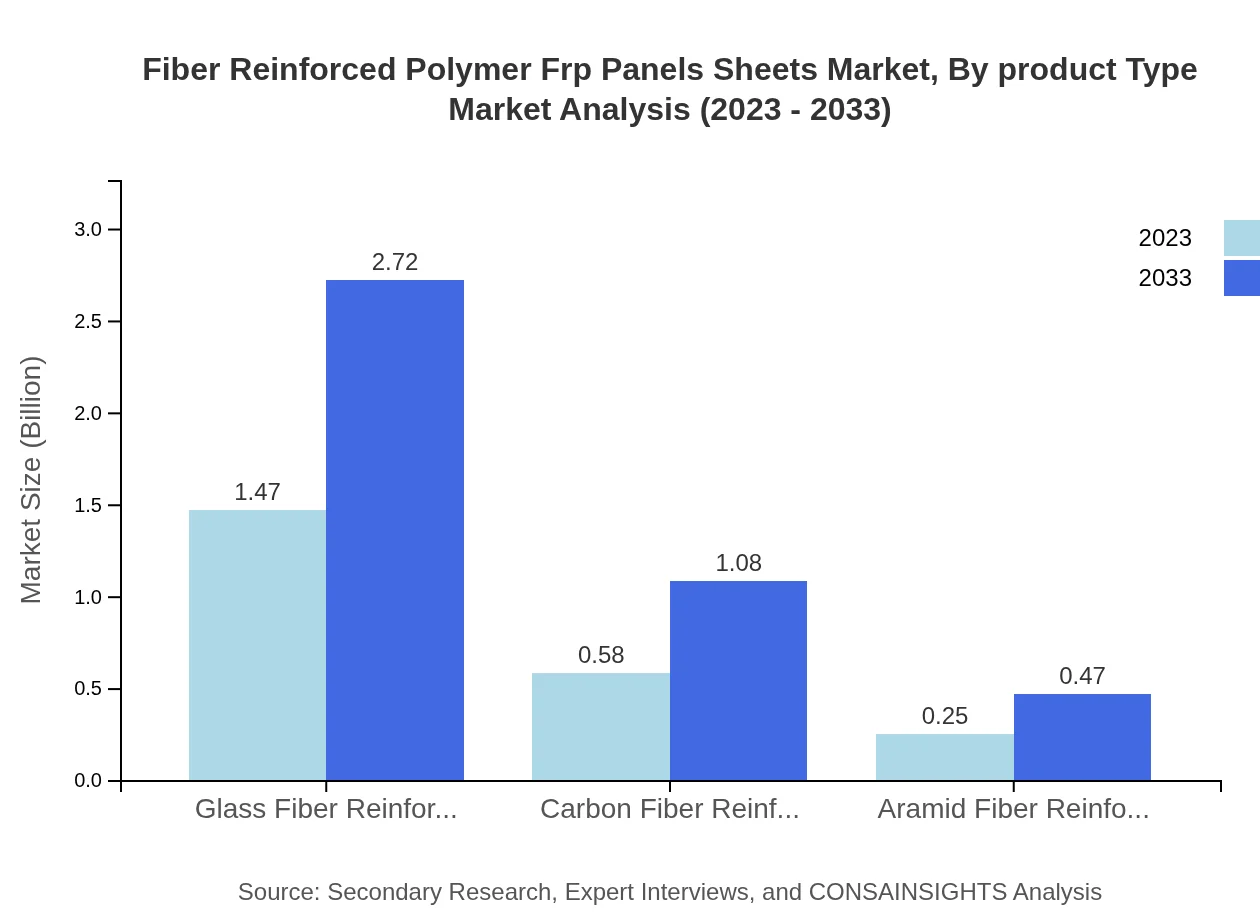

Fiber Reinforced Polymer Frp Panels Sheets Market Analysis By Product Type

The FRP Panels and Sheets market, segmented by product type, features Glass Fiber Reinforced Polymer (GFRP) leading with a market share of approximately 63.72% in 2023, projected to grow to 63.72% by 2033. Carbon Fiber Reinforced Polymer (CFRP) follows with a share of 25.31%, also showing significant growth potential from $0.58 billion in 2023 to $1.08 billion in 2033. Lastly, Aramid Fiber Reinforced Polymer (AFRP) captures 10.97% of the market, growing modestly alongside increasing demand for specialized applications.

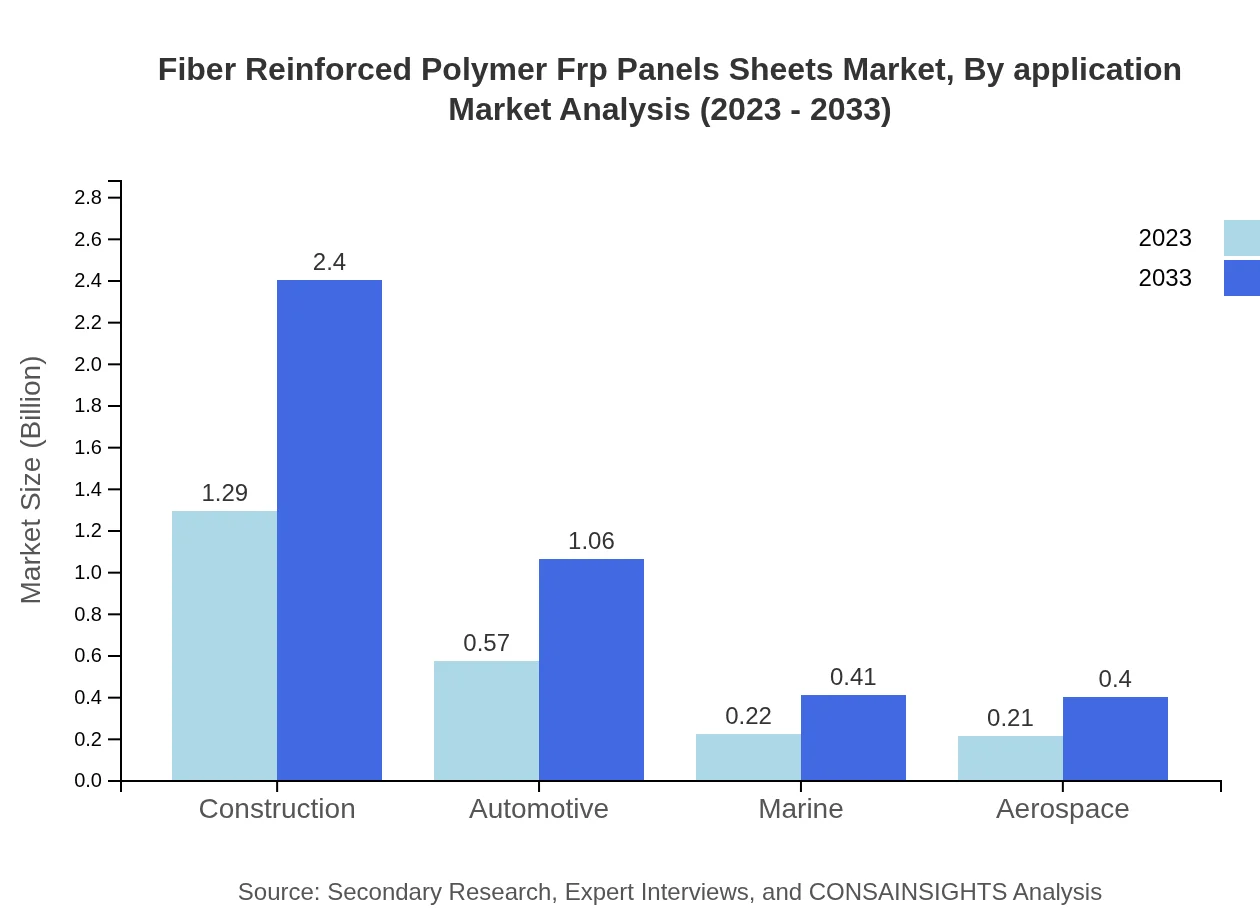

Fiber Reinforced Polymer Frp Panels Sheets Market Analysis By Application

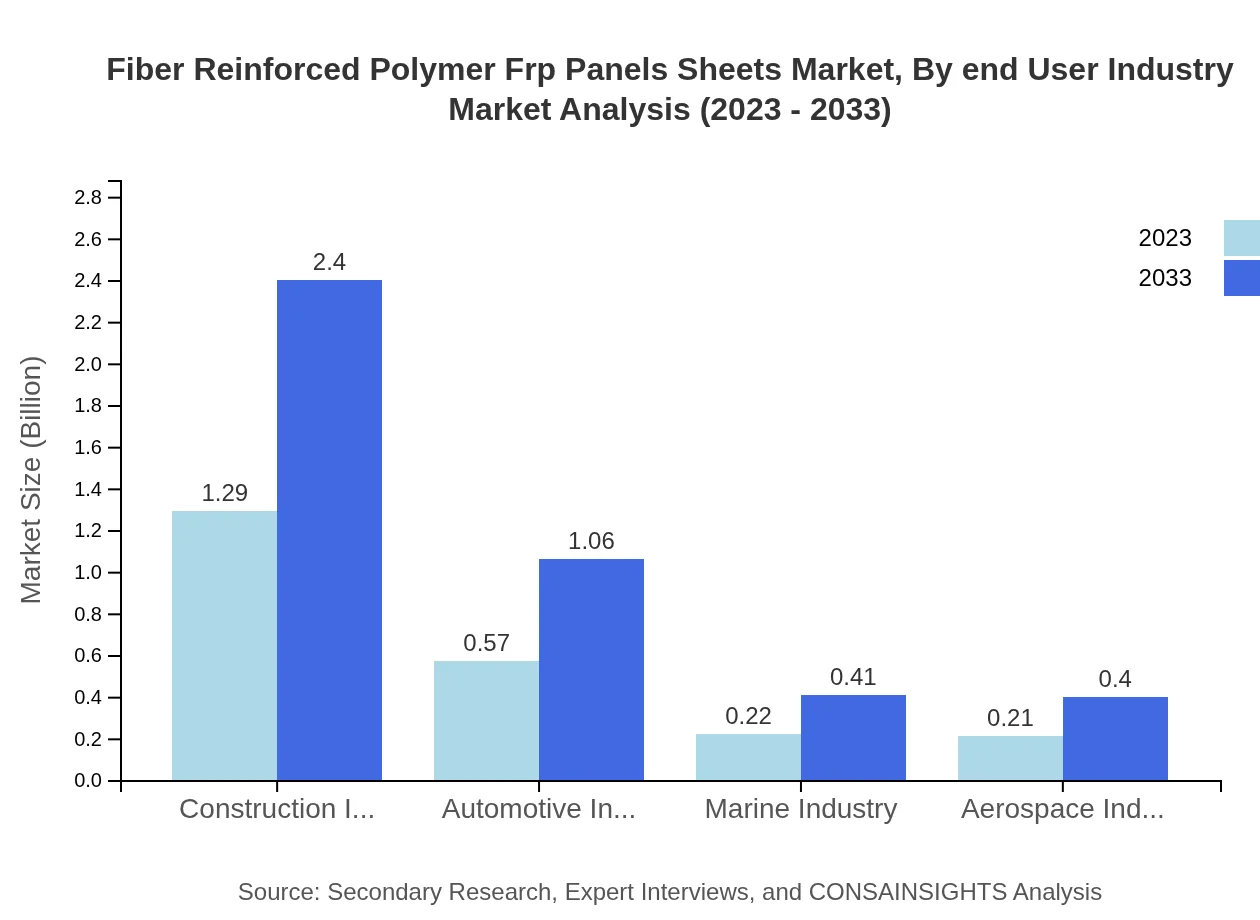

In the applications segment, the construction industry stands out, commanding a size of $1.29 billion in 2023, set to rise to $2.40 billion in 2033, maintaining a share of 56.27%. The automotive segment, valuable at $0.57 billion in 2023, is anticipated to increase to $1.06 billion over the decade. The marine and aerospace applications also contribute steadily, focusing on specialized lightweight materials emphasizing safety and performance.

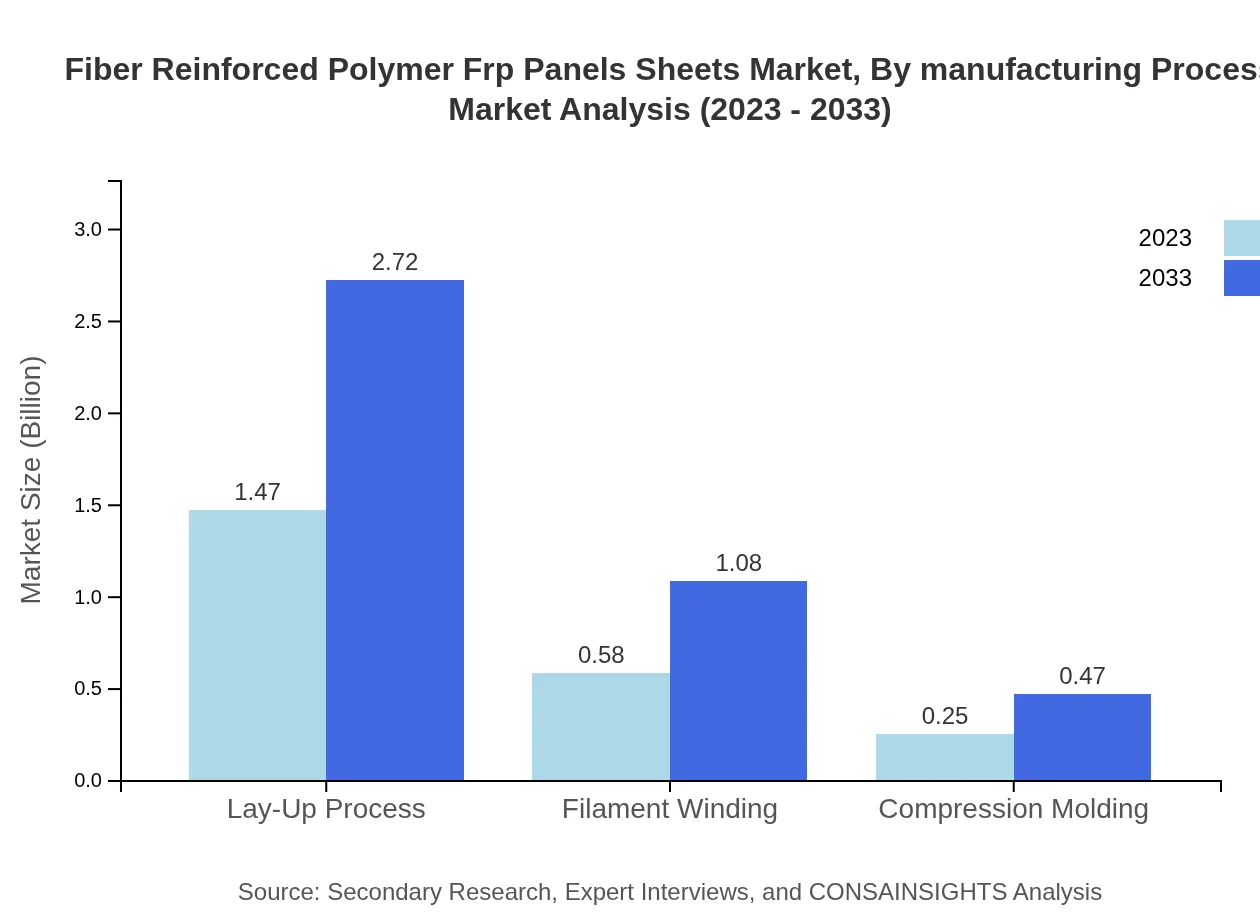

Fiber Reinforced Polymer Frp Panels Sheets Market Analysis By Manufacturing Process

In terms of manufacturing processes, the Lay-Up Process dominates with a size of $1.47 billion in 2023 and is projected to reach $2.72 billion by 2033, holding a consistent market share of 63.72%. Filament winding contributes $0.58 billion initially, with growth to $1.08 billion by the forecasted period, while compression molding offers niche applications, expected to expand from $0.25 billion to $0.47 billion.

Fiber Reinforced Polymer Frp Panels Sheets Market Analysis By End User Industry

The end-user industry segmentation reveals significant adoption in construction, automotive, marine, and aerospace sectors. The construction industry sizably influences the market, while automotive applications are catching up, reflecting trends toward lightweight materials. Marine and aerospace industries continue to explore FRP for suasive performance characteristics, indicating collective growth across multiple sectors in the years ahead.

Fiber Reinforced Polymer Frp Panels Sheets Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fiber Reinforced Polymer Frp Panels Sheets Industry

Sika AG:

Sika AG specializes in engineered solutions that enhance construction and industry applications, focusing on adhesives and sealants, with a significant presence in the global FRP market.Owens Corning:

Owens Corning is a leading manufacturer of insulation and roofing materials, actively producing glass fiber and composites, known for their innovative FRP solutions.Hexcel Corporation:

Hexcel Corporation specializes in advanced composites and has a well-established presence in aerospace and industrial segments, contributing to innovative FRP applications.Gurit Holding AG:

Gurit focuses on composite materials and engineering services, with a strong portfolio in the marine and wind energy sectors, manufacturing high-performance FRP panels and sheets.We're grateful to work with incredible clients.

FAQs

What is the market size of fiber Reinforced Polymer Frp Panels Sheets?

In 2023, the global market size for fiber-reinforced polymer (FRP) panels and sheets is valued at approximately $2.3 billion, with a projected CAGR of 6.2% from 2023 to 2033. This growth reflects increased adoption across multiple industries.

What are the key market players or companies in this fiber Reinforced Polymer Frp Panels Sheets industry?

Key players in the fiber-reinforced polymer panels and sheets market include companies specializing in composite materials, such as Scott Bader Company Ltd, AGY Holding Corp, and RTP Company. These players focus on innovation and expanding their product offerings.

What are the primary factors driving the growth in the fiber Reinforced Polymer Frp Panels Sheets industry?

Growth in the FRP panels and sheets industry is driven by rising demand in construction for lightweight and durable materials, advancements in manufacturing technologies, and increased awareness of benefits such as corrosion resistance, leading to broader applications across sectors.

Which region is the fastest Growing in the fiber Reinforced Polymer Frp Panels Sheets?

The fastest-growing region for FRP panels and sheets is North America, projected to increase from $0.82 billion in 2023 to $1.52 billion by 2033. This growth is driven by heightened construction activity and a shift toward sustainable materials.

Does ConsaInsights provide customized market report data for the fiber Reinforced Polymer Frp Panels Sheets industry?

Yes, ConsaInsights offers customized market report data for the fiber-reinforced polymer FRP panels and sheets industry. Clients can request tailored analyses, reports, and insights based on specific needs and market segments.

What deliverables can I expect from this fiber Reinforced Polymer Frp Panels Sheets market research project?

From the FRP panels and sheets market research project, you can expect comprehensive deliverables, including market size analysis, growth forecasts, segment data, competitive landscape reviews, and regional insights to support strategic decision-making.

What are the market trends of fiber Reinforced Polymer Frp Panels Sheets?

Current market trends in the FRP panels and sheets sector include increasing adoption in various applications like construction and automotive, innovative manufacturing processes such as filament winding, and a growing focus on lightweight and high-strength materials.