Field Device Management Market Report

Published Date: 31 January 2026 | Report Code: field-device-management

Field Device Management Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Field Device Management market from 2023 to 2033, providing insights on market trends, sizing, segmentation, and future forecasts, aimed at understanding growth opportunities and challenges within the industry.

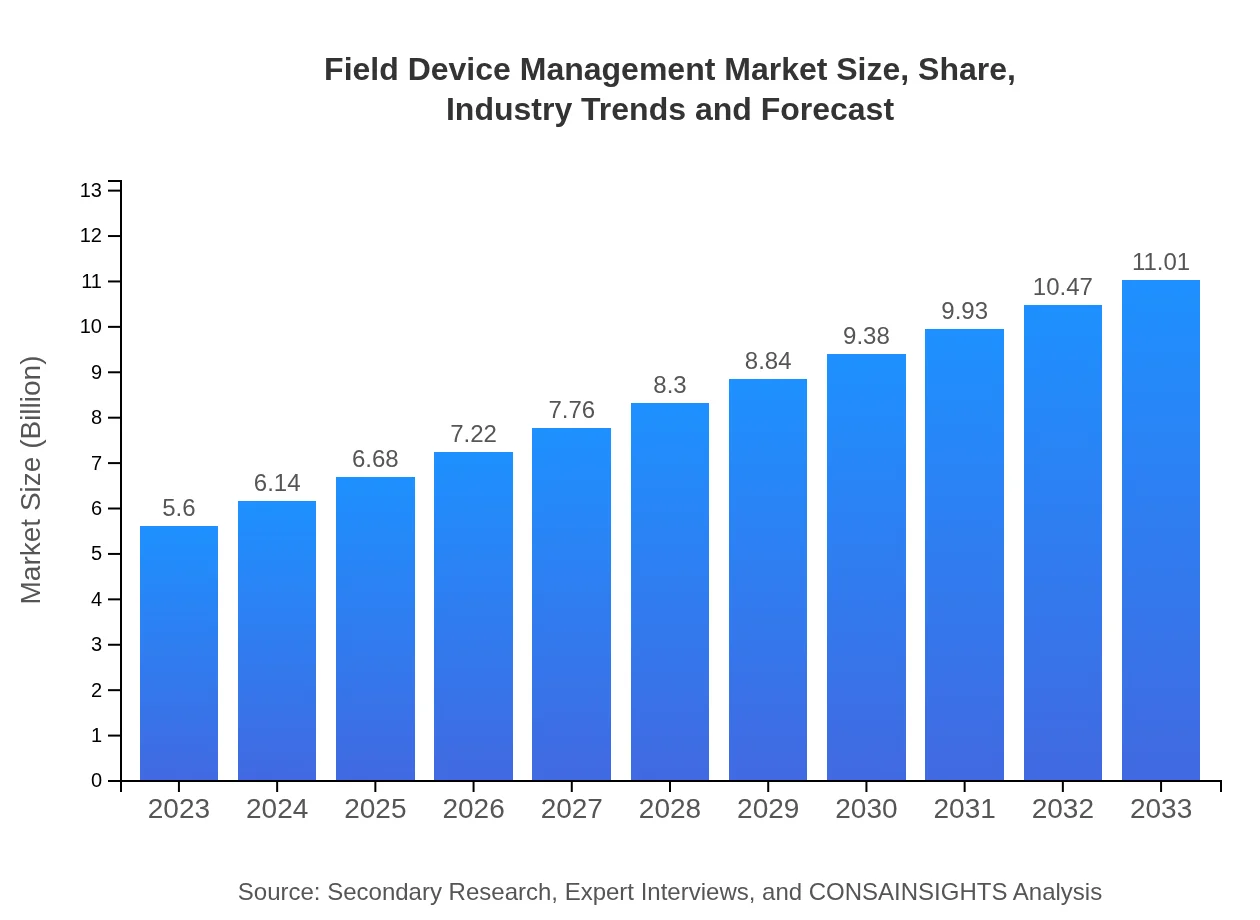

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Emerson Electric Co., Honeywell International Inc., Siemens AG, Schneider Electric SE, Rockwell Automation, Inc. |

| Last Modified Date | 31 January 2026 |

Field Device Management Market Overview

Customize Field Device Management Market Report market research report

- ✔ Get in-depth analysis of Field Device Management market size, growth, and forecasts.

- ✔ Understand Field Device Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Field Device Management

What is the Market Size & CAGR of Field Device Management market in 2023?

Field Device Management Industry Analysis

Field Device Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Field Device Management Market Analysis Report by Region

Europe Field Device Management Market Report:

Europe's Field Device Management market is projected to grow from USD 1.69 billion in 2023 to USD 3.33 billion by 2033. The region is characterized by stringent regulations for safety and environmental compliance, increasing the need for efficient device management systems across various sectors.Asia Pacific Field Device Management Market Report:

In the Asia Pacific region, the Field Device Management market is anticipated to grow from USD 1.03 billion in 2023 to USD 2.02 billion by 2033. The region is witnessing significant investments in industrial automation, particularly in manufacturing and energy sectors, driven by the need for enhanced operational efficiency and safety.North America Field Device Management Market Report:

North America leads the market with an expected growth from USD 2.05 billion in 2023 to USD 4.02 billion by 2033. The region benefits from advanced technological infrastructure and a strong presence of key market players. The high adoption of digital solutions in industries such as oil and gas significantly boosts the market.South America Field Device Management Market Report:

South America remains a smaller market for Field Device Management, estimated to rise from USD 0.06 billion in 2023 to USD 0.11 billion by 2033. The growth is attributed to the increasing focus on improving operational processes in various industries, despite facing economic challenges.Middle East & Africa Field Device Management Market Report:

The Middle East and Africa market is expected to grow from USD 0.78 billion in 2023 to USD 1.53 billion by 2033. With ongoing investments in oil and gas infrastructure and other industries, there is a rising demand for advanced management solutions to optimize operations and ensure compliance.Tell us your focus area and get a customized research report.

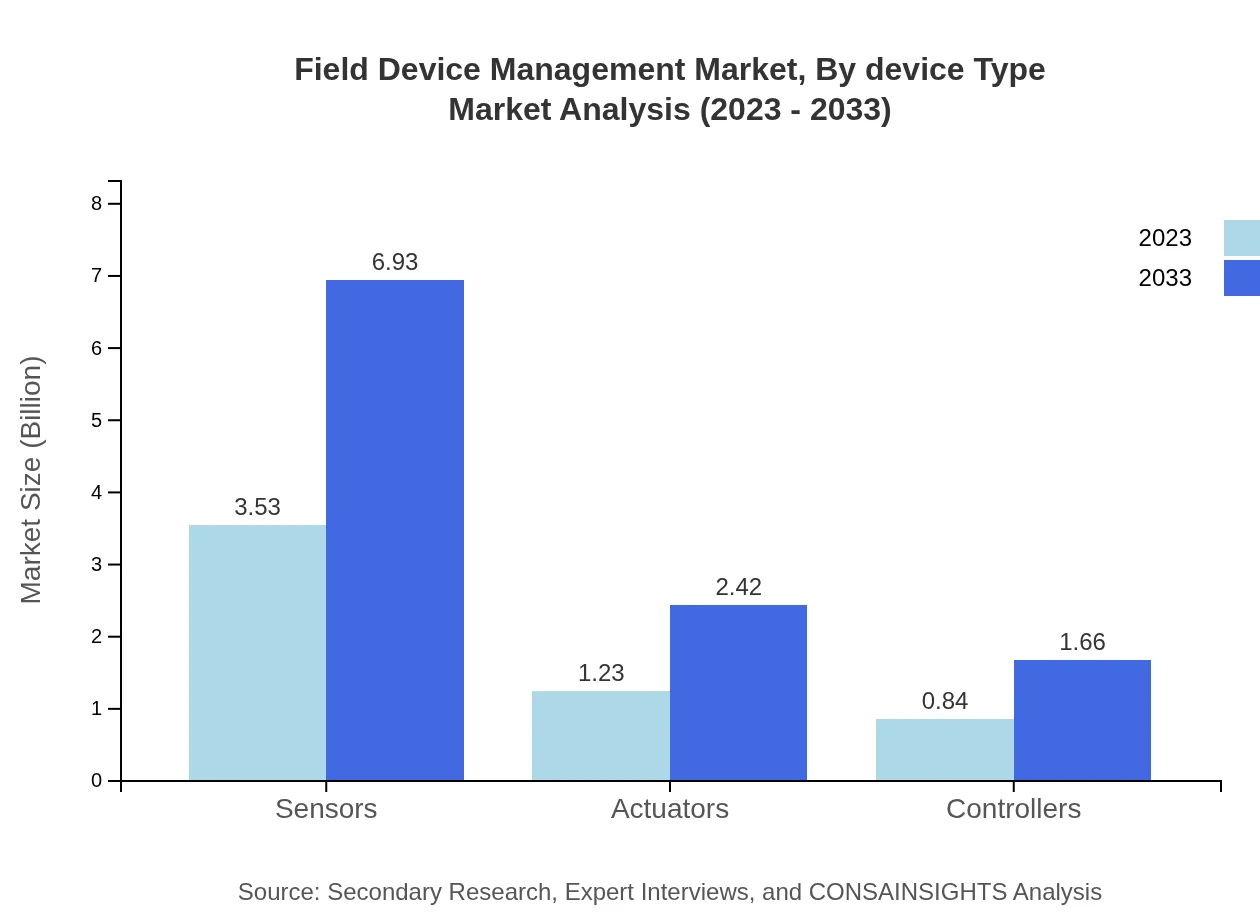

Field Device Management Market Analysis By Device Type

Sensor devices constitute a significant portion of the Field Device Management market, with a market size of USD 3.53 billion in 2023, expanding to USD 6.93 billion by 2033. Following sensors, actuators and controllers also show notable growth. Actuators are expected to grow from USD 1.23 billion in 2023 to USD 2.42 billion in 2033, demonstrating their critical role in industrial automation.

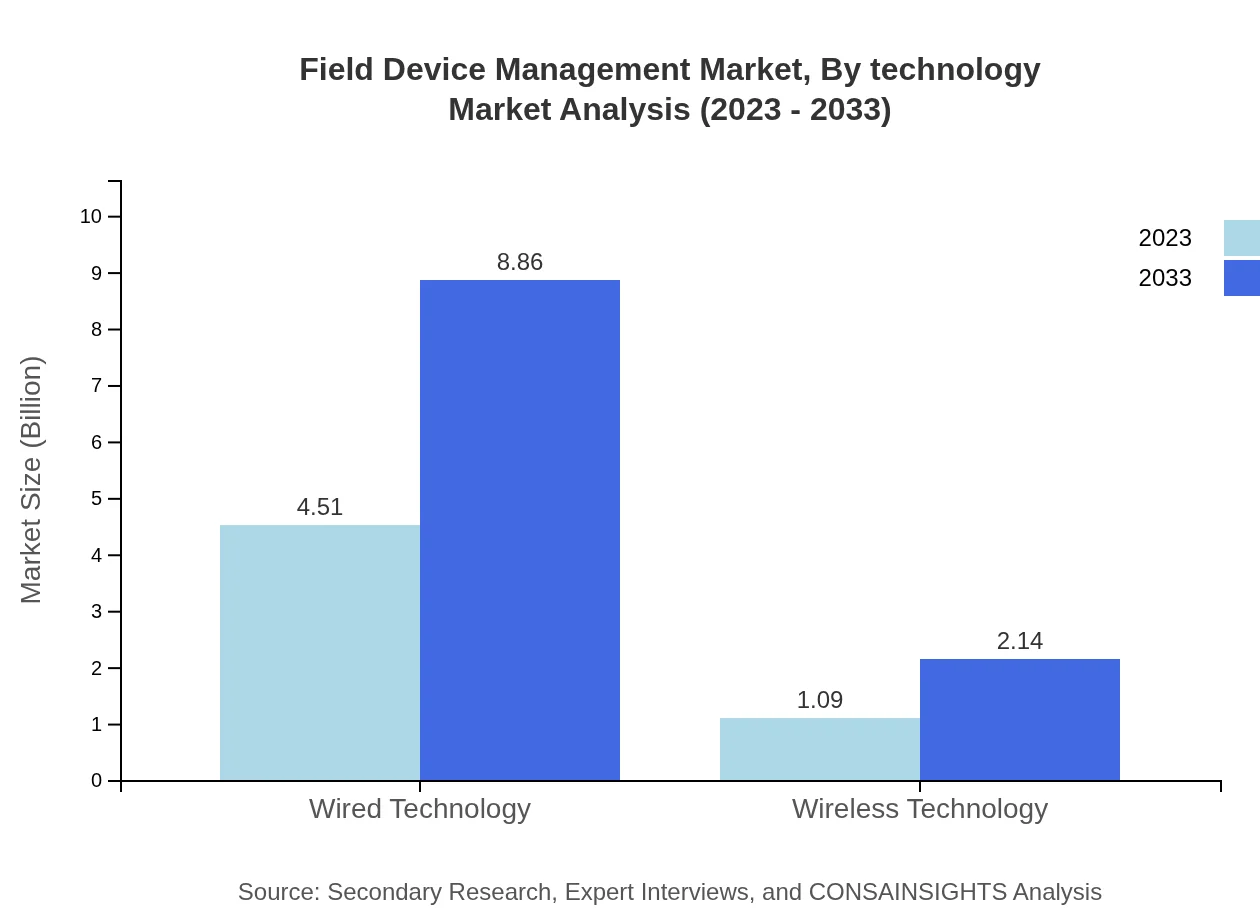

Field Device Management Market Analysis By Technology

Wired technology currently dominates the Field Device Management market with a total size of USD 4.51 billion in 2023, and it is anticipated to reach USD 8.86 billion by 2033. Wireless technology, while smaller initially at USD 1.09 billion in 2023, is projected to grow to USD 2.14 billion by 2033, driven by the increasing adoption of IoT devices.

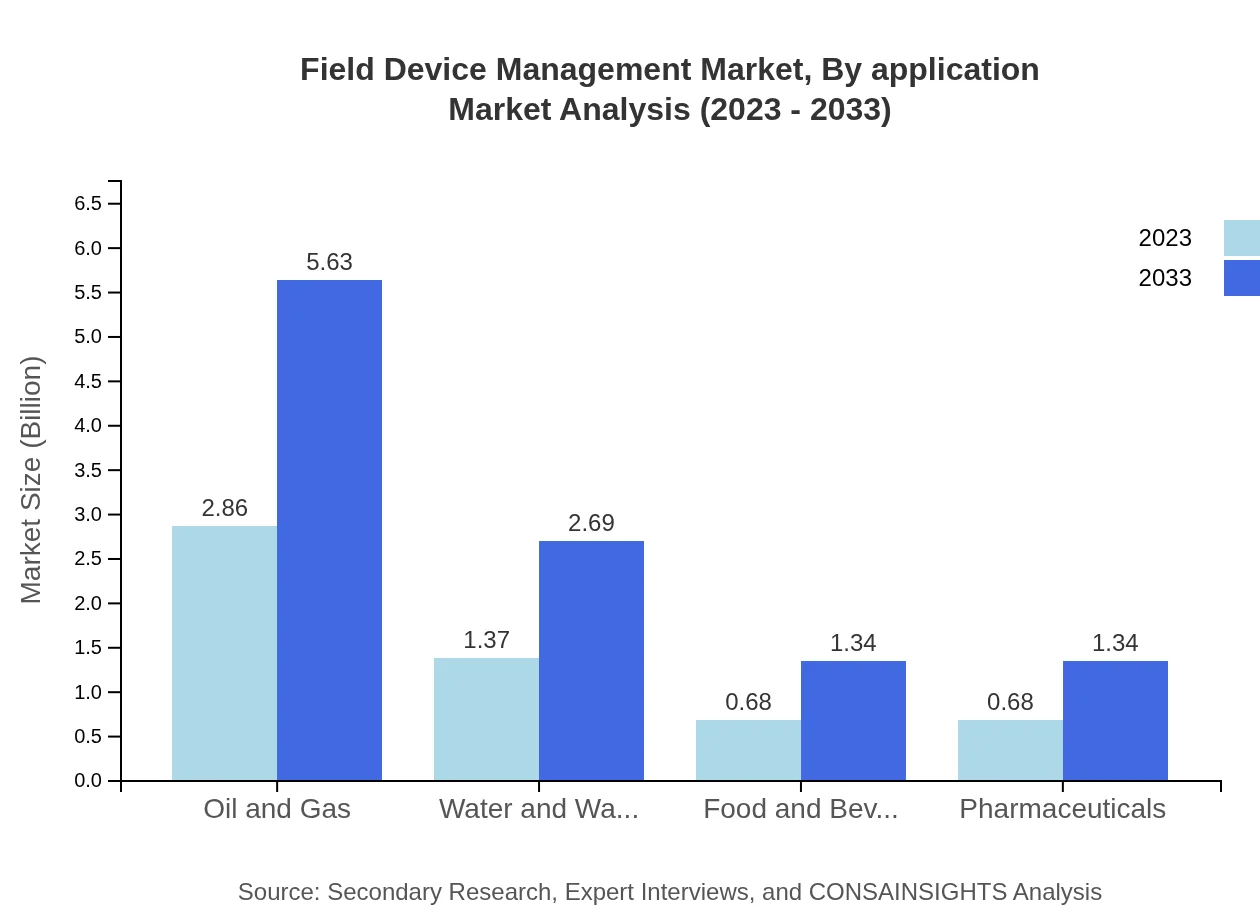

Field Device Management Market Analysis By Application

Oil and gas applications hold a substantial market share, sized at USD 2.86 billion in 2023, expected to grow to USD 5.63 billion by 2033. Water and wastewater management follows, providing a significant contribution, growing from USD 1.37 billion in 2023 to USD 2.69 billion by 2033.

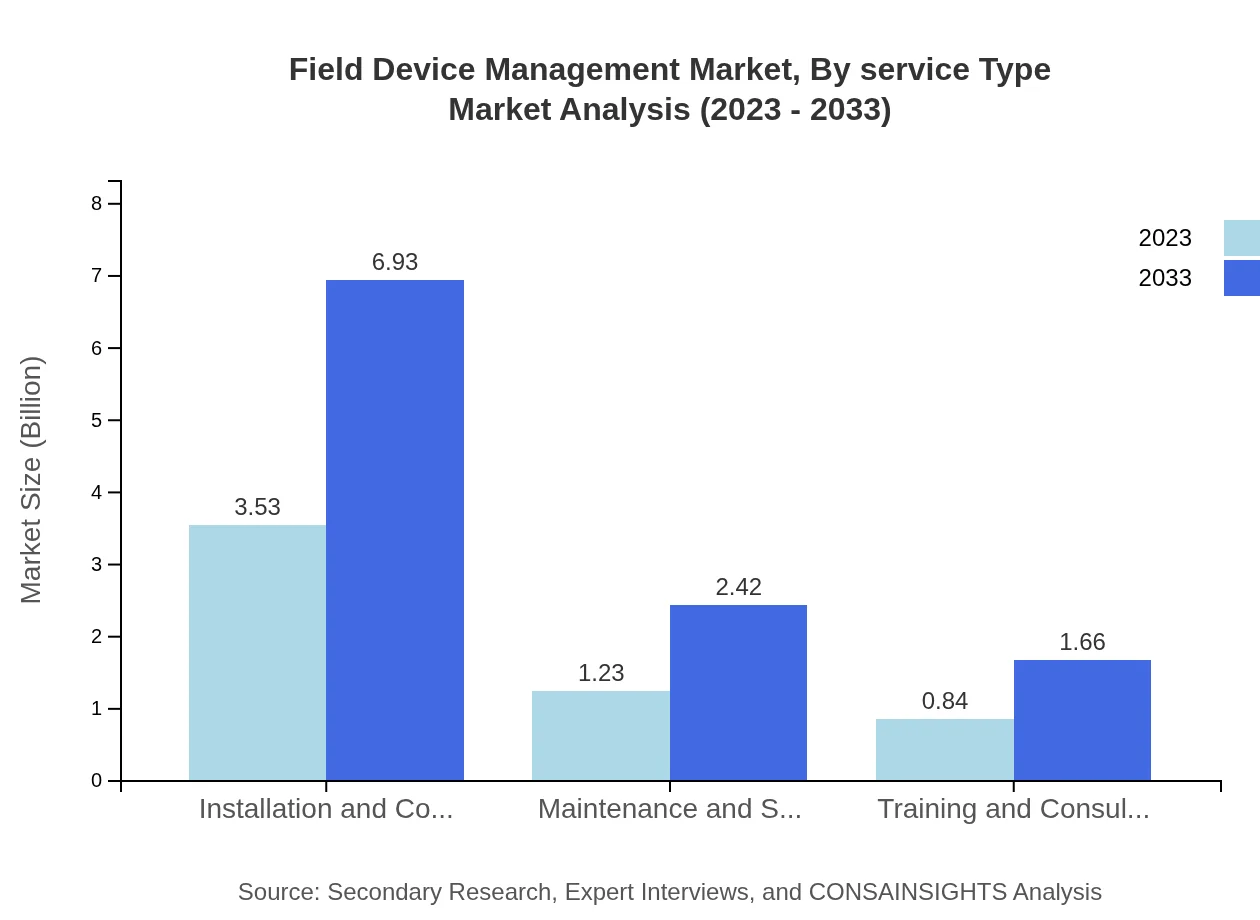

Field Device Management Market Analysis By Service Type

Installation and commissioning services covered USD 3.53 billion in 2023, and the demand is anticipated to grow to USD 6.93 billion by 2033. Maintenance and support services follow, growing from USD 1.23 billion in 2023 to USD 2.42 billion by 2033, highlighting ongoing support needs for efficient operations.

Field Device Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Field Device Management Industry

Emerson Electric Co.:

A leader in automation solutions, Emerson provides cutting-edge FDM solutions tailored for varied industrial applications, driving efficiency and safety.Honeywell International Inc.:

Honeywell delivers innovative FDM solutions that enhance process control and streamline field device operations, catering to multiple sectors globally.Siemens AG:

Siemens is at the forefront of automation technology, offering advanced FDM systems that integrate seamlessly into existing infrastructures for improved performance.Schneider Electric SE:

Schneider Electric specializes in energy management and automation solutions, including FDM systems that focus on sustainability and operational efficiency.Rockwell Automation, Inc.:

Rockwell Automation provides comprehensive FDM solutions designed to improve productivity and reduce operational risks across industries.We're grateful to work with incredible clients.

FAQs

What is the market size of Field Device Management?

The global market size for Field Device Management is projected to reach approximately $5.6 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from 2023 to 2033.

What are the key market players or companies in the Field Device Management industry?

Key players in the Field Device Management market include major companies such as Honeywell, Siemens, Schneider Electric, and ABB. These companies are recognized for their innovative solutions and robust presence in the industrial automation and control sector.

What are the primary factors driving the growth in the Field Device Management industry?

The growth in the Field Device Management industry is driven by factors such as increasing automation in industries, the need for real-time data analysis, rising demand for efficient asset management, and regulatory requirements promoting the use of advanced monitoring technologies.

Which region is the fastest Growing in the Field Device Management?

The fastest-growing region in the Field Device Management market is North America, anticipated to grow from $2.05 billion in 2023 to $4.02 billion by 2033. This growth is attributed to technological advancements and increasing adoption of IoT.

Does ConsaInsights provide customized market report data for the Field Device Management industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs. Clients can request specific regional data, segmentation analysis, and industry trends according to their business interests and objectives.

What deliverables can I expect from this Field Device Management market research project?

Expected deliverables include detailed market reports, trend analysis, competitive landscape assessments, forecasts, and customized insights specific to your targeting segments and geographic regions.

What are the market trends of Field Device Management?

Current trends in the Field Device Management market include increased integration of AI and machine learning for predictive maintenance, a shift towards cloud-based solutions, and a growing emphasis on cybersecurity measures in device management.