Filtration And Contamination Control Market Report

Published Date: 02 February 2026 | Report Code: filtration-and-contamination-control

Filtration And Contamination Control Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Filtration and Contamination Control market, covering significant trends, market size, growth forecasts, and competitive landscape from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

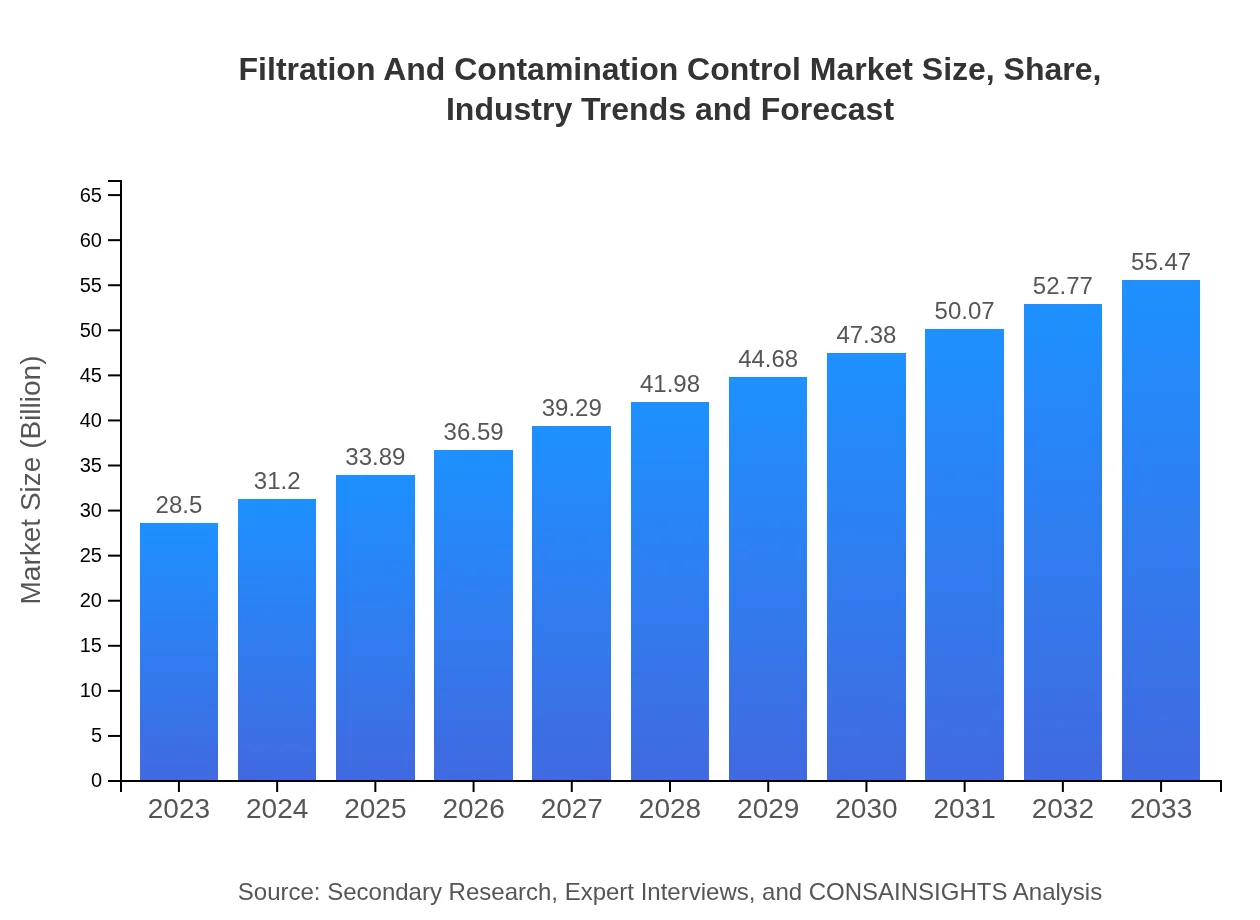

| 2023 Market Size | $28.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $55.47 Billion |

| Top Companies | 3M Company, Parker Hannifin Corporation, Evoqua Water Technologies, SUEZ Water Technologies & Solutions, Veolia |

| Last Modified Date | 02 February 2026 |

Filtration And Contamination Control Market Overview

Customize Filtration And Contamination Control Market Report market research report

- ✔ Get in-depth analysis of Filtration And Contamination Control market size, growth, and forecasts.

- ✔ Understand Filtration And Contamination Control's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Filtration And Contamination Control

What is the Market Size & CAGR of Filtration And Contamination Control market in 2023?

Filtration And Contamination Control Industry Analysis

Filtration And Contamination Control Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Filtration And Contamination Control Market Analysis Report by Region

Europe Filtration And Contamination Control Market Report:

Europe is expected to grow from $8.04 billion in 2023 to $15.65 billion by 2033, supported by rigorous environmental legislation and the necessity for industrial compliance, particularly in Germany and the UK.Asia Pacific Filtration And Contamination Control Market Report:

The Asia Pacific region is expected to witness significant market growth, with a projected size of $11.28 billion by 2033, up from $5.80 billion in 2023. This surge can be attributed to rapid industrialization, urbanization, and improving water quality standards across emerging economies such as China and India.North America Filtration And Contamination Control Market Report:

The North American market is one of the largest, valued at $9.48 billion in 2023 and projected to reach $18.45 billion by 2033. The dominant presence of key players and their focus on innovative filtration technologies are major growth drivers.South America Filtration And Contamination Control Market Report:

In South America, the Filtration and Contamination Control market is set to grow from $1.75 billion in 2023 to $3.40 billion by 2033. Increasing investments in infrastructure development, especially in water treatment facilities, are pivotal for this growth.Middle East & Africa Filtration And Contamination Control Market Report:

The Middle East and Africa market shows potential for growth, with revenue expected to increase from $3.43 billion in 2023 to $6.68 billion by 2033, driven by investments in water purification systems and growing awareness of pollution control.Tell us your focus area and get a customized research report.

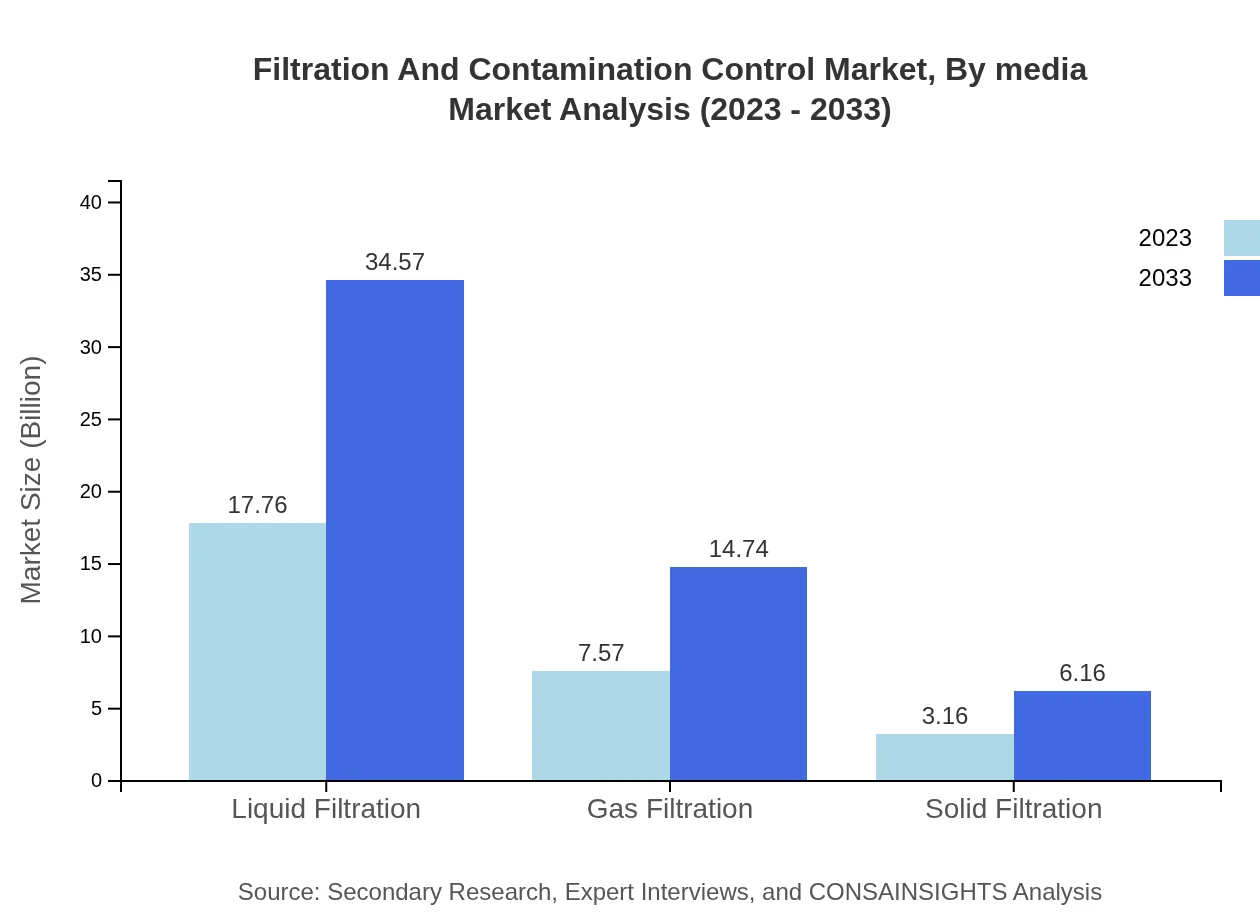

Filtration And Contamination Control Market Analysis By Media

In 2023, liquid filtration dominates the market with a value of $17.76 billion and is projected to grow to $34.57 billion by 2033, capturing a 62.33% market share. Gas filtration follows with current market value of $7.57 billion, expected to rise to $14.74 billion by 2033, representing 26.57% of the market share. Solid filtration remains smaller yet significant, with sizes of $3.16 billion in 2023 and rising to $6.16 billion by 2033, holding an 11.1% share. This segmentation highlights the crucial role of media types in addressing coverage and effectiveness in various sectors.

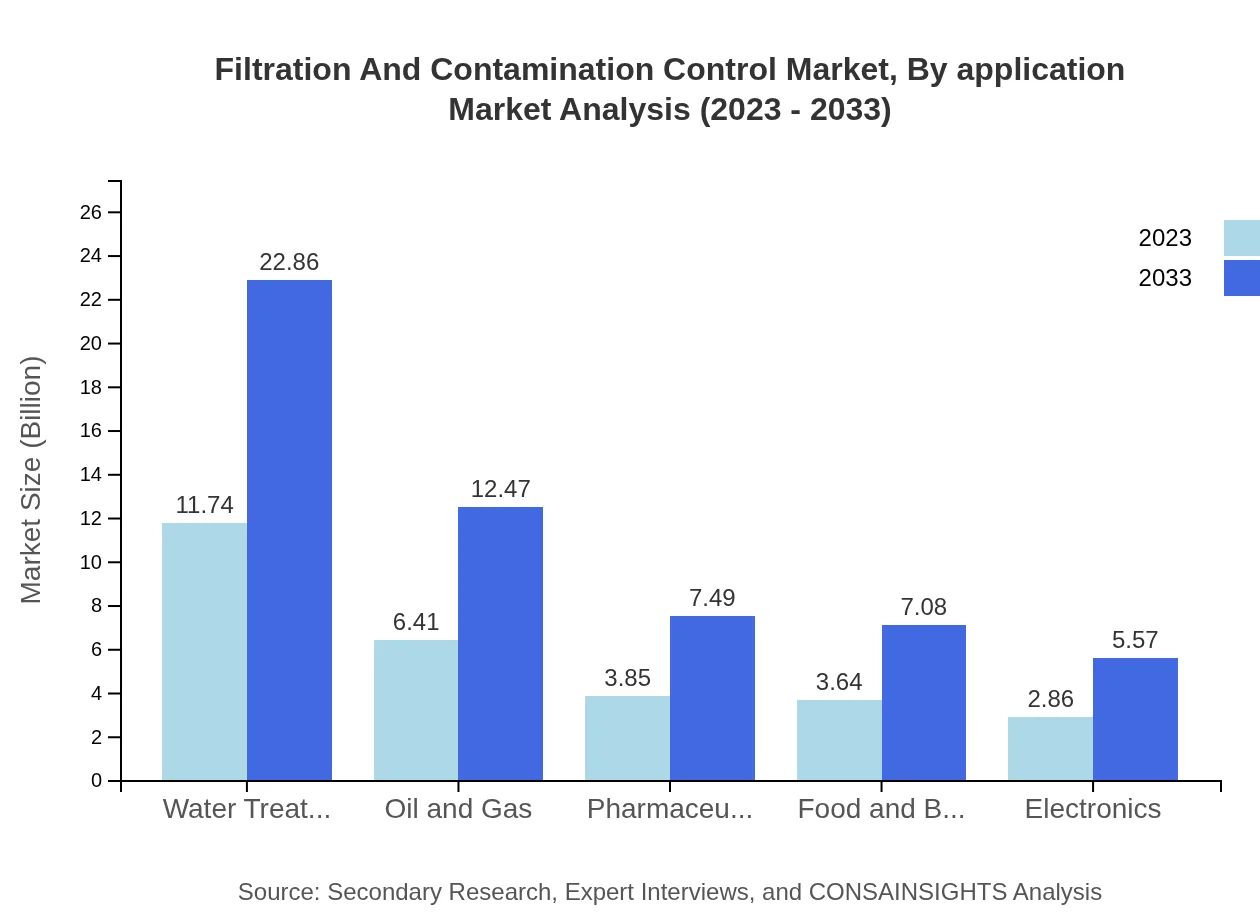

Filtration And Contamination Control Market Analysis By Application

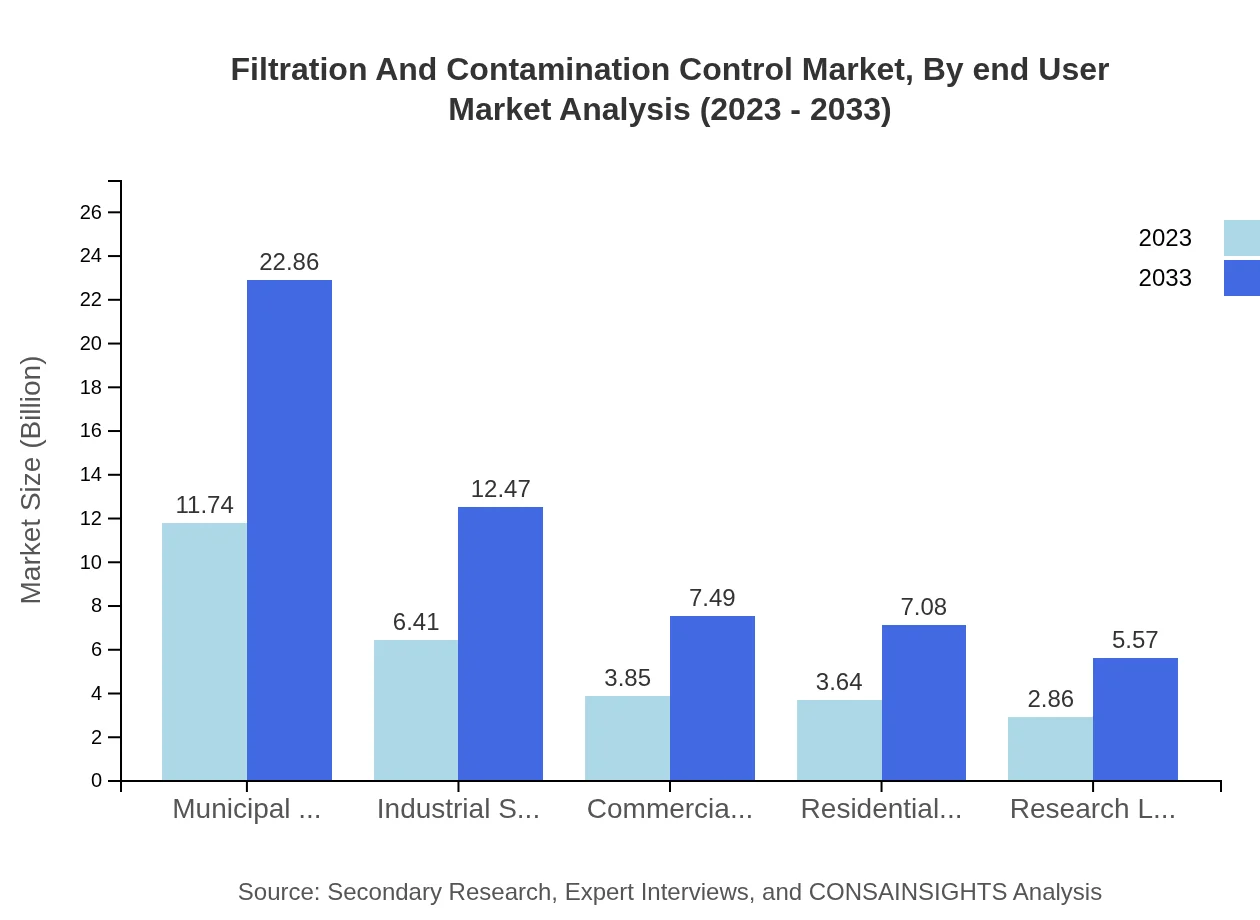

The municipal water supply segment leads the market at $11.74 billion in 2023, forecasted to reach $22.86 billion by 2033, accounting for 41.21% of the overall market share. Following this, the industrial sector is valued at $6.41 billion (22.48% share), expected to grow to $12.47 billion in 2033. The commercial and residential segments also reflect steady growth, currently valued at $3.85 billion (13.51%) and $3.64 billion (12.76%), respectively. Research labs, although smaller at $2.86 billion (10.04%), are crucial for innovation and development in filtration technologies.

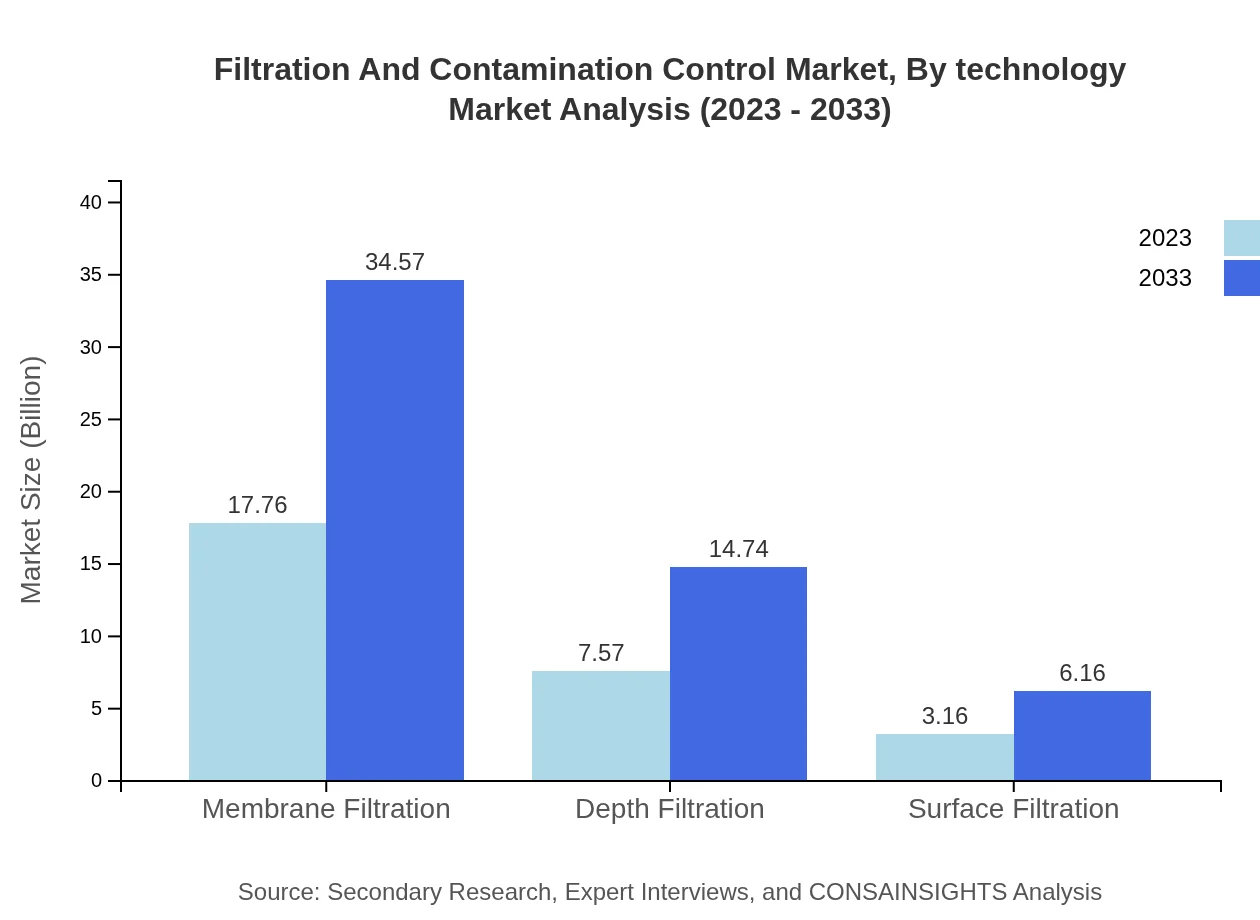

Filtration And Contamination Control Market Analysis By Technology

Membrane filtration is the market leader with revenues of $17.76 billion in 2023, projected to grow to $34.57 billion by 2033, maintaining a significant 62.33% share. Depth filtration is also important, currently valued at $7.57 billion and expected to reach $14.74 billion by 2033 (26.57% share). Surface filtration, while smaller, is valued at $3.16 billion (11.1% share) in 2023, set to rise to $6.16 billion by 2033. The technological advancements in these segments are pivotal for enhancing filtration efficiencies and applications.

Filtration And Contamination Control Market Analysis By End User

The pharmaceuticals segment is expected to reach $7.49 billion by 2033 from $3.85 billion in 2023, at a 13.51% share. The food and beverage industry follows closely, expanding from $3.64 billion to $7.08 billion (12.76% share). The electronics segment, while smaller, is experiencing growth from $2.86 billion to $5.57 billion (10.04% share), indicating increasing demand for contamination control in sensitive production processes.

Filtration And Contamination Control Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Filtration And Contamination Control Industry

3M Company:

Renowned for its filtration and separation technologies across industrial, healthcare, and consumer markets, 3M continues to innovate, offering efficient filtration solutions for various industries.Parker Hannifin Corporation:

A leading global manufacturer providing filtration solutions that enhance product quality and protect processes across diverse applications, emphasizing oil and gas, water, and industrial markets.Evoqua Water Technologies:

Specializing in water treatment solutions, Evoqua offers integrated filtration systems tailored for municipalities and industrial applications, showcasing a robust commitment to sustainability.SUEZ Water Technologies & Solutions:

SUEZ focuses on smart and automated filtration technologies, including membrane filtration, delivering advanced solutions to improve water quality and operational efficiency.Veolia:

A global leader in optimized resource management, Veolia provides filtration solutions aimed at increasing environmental performance and ensuring regulatory compliance across sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of filtration And Contamination Control?

The filtration and contamination control market is currently valued at approximately $28.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.7%, indicating significant growth potential through 2033.

What are the key market players or companies in this filtration And Contamination Control industry?

Key players in the filtration and contamination control market include established companies such as 3M Company, Eaton Corporation, Pall Corporation, and Donaldson Company among others, all of which contribute significantly to market innovation and product offerings.

What are the primary factors driving the growth in the filtration And Contamination Control industry?

Major factors driving growth include increasing industrialization, heightened environmental concerns prompting stricter regulations, and the demand for clean water and air. Technologies are advancing rapidly, allowing for more efficient filtration systems and contaminant control.

Which region is the fastest Growing in the filtration And Contamination Control?

The Asia Pacific region is the fastest-growing market for filtration and contamination control, projected to grow from $5.80 billion in 2023 to approximately $11.28 billion by 2033, buoyed by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the filtration And Contamination Control industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the filtration and contamination control market, allowing businesses to make informed decisions based on precise, actionable insights.

What deliverables can I expect from this filtration And Contamination Control market research project?

From this market research project, expect detailed insights including comprehensive market analysis, segmentation data, trend analysis, competitive landscape evaluations, and projections over the coming years.

What are the market trends of filtration And Contamination Control?

Key trends include the increased adoption of membrane filtration technologies, advancements in depth and surface filtration, and a strong demand for water treatment solutions across various sectors like pharmaceuticals and municipality services.