Financial Services Application Market Report

Published Date: 31 January 2026 | Report Code: financial-services-application

Financial Services Application Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Financial Services Application market, detailing insights, trends, and forecasts for the period 2023 to 2033. It presents a comprehensive analysis of market size, segments, regional dynamics, key players, and emerging technologies.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

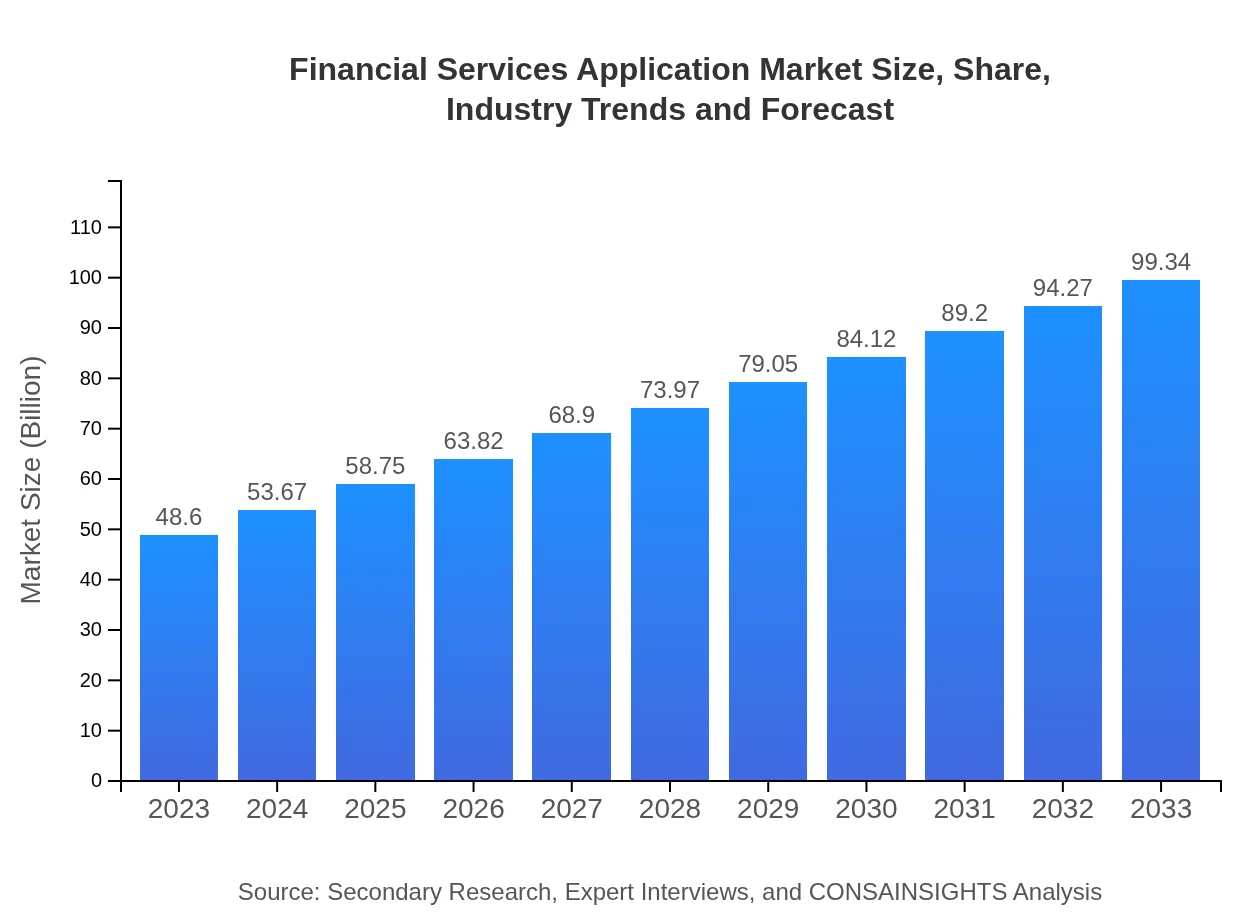

| 2023 Market Size | $48.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $99.34 Billion |

| Top Companies | IBM, Oracle, Microsoft, SAP, Salesforce |

| Last Modified Date | 31 January 2026 |

Financial Services Application Market Overview

Customize Financial Services Application Market Report market research report

- ✔ Get in-depth analysis of Financial Services Application market size, growth, and forecasts.

- ✔ Understand Financial Services Application's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Financial Services Application

What is the Market Size & CAGR of Financial Services Application market in 2023-2033?

Financial Services Application Industry Analysis

Financial Services Application Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Financial Services Application Market Analysis Report by Region

Europe Financial Services Application Market Report:

The European market stands at $16.77 billion in 2023, projected to see substantial growth to $34.27 billion by 2033. The demand for compliance solutions, digital banking, and personalized financial services is propelling this market forward, alongside initiatives to enhance cybersecurity measures in financial applications.Asia Pacific Financial Services Application Market Report:

In 2023, the Financial Services Application market in the Asia Pacific region is valued at $8.67 billion and is projected to grow to $17.72 billion by 2033. This growth is fueled by a surge in digital banking adoption, increasing smartphone penetration, and a burgeoning middle class, driving demand for efficient financial applications.North America Financial Services Application Market Report:

North America leads the market with a valuation of $16.17 billion in 2023, anticipated to reach $33.06 billion by 2033. The region's growth is primarily driven by technological advancements, consumer demand for online financial services, and regulatory changes that encourage innovation within established financial institutions.South America Financial Services Application Market Report:

South America has shown potential with a market size of $0.64 billion in 2023 and an expected growth to $1.30 billion by 2033. This growth stems from expanding access to financial services and embracing digital solutions tailored to local market needs, including mobile payment platforms and microfinance.Middle East & Africa Financial Services Application Market Report:

In the Middle East and Africa, the market is valued at $6.35 billion in 2023 and is expected to double to $12.98 billion by 2033, reflecting increasing investments in fintech and government initiatives aimed at expanding financial inclusion across the region.Tell us your focus area and get a customized research report.

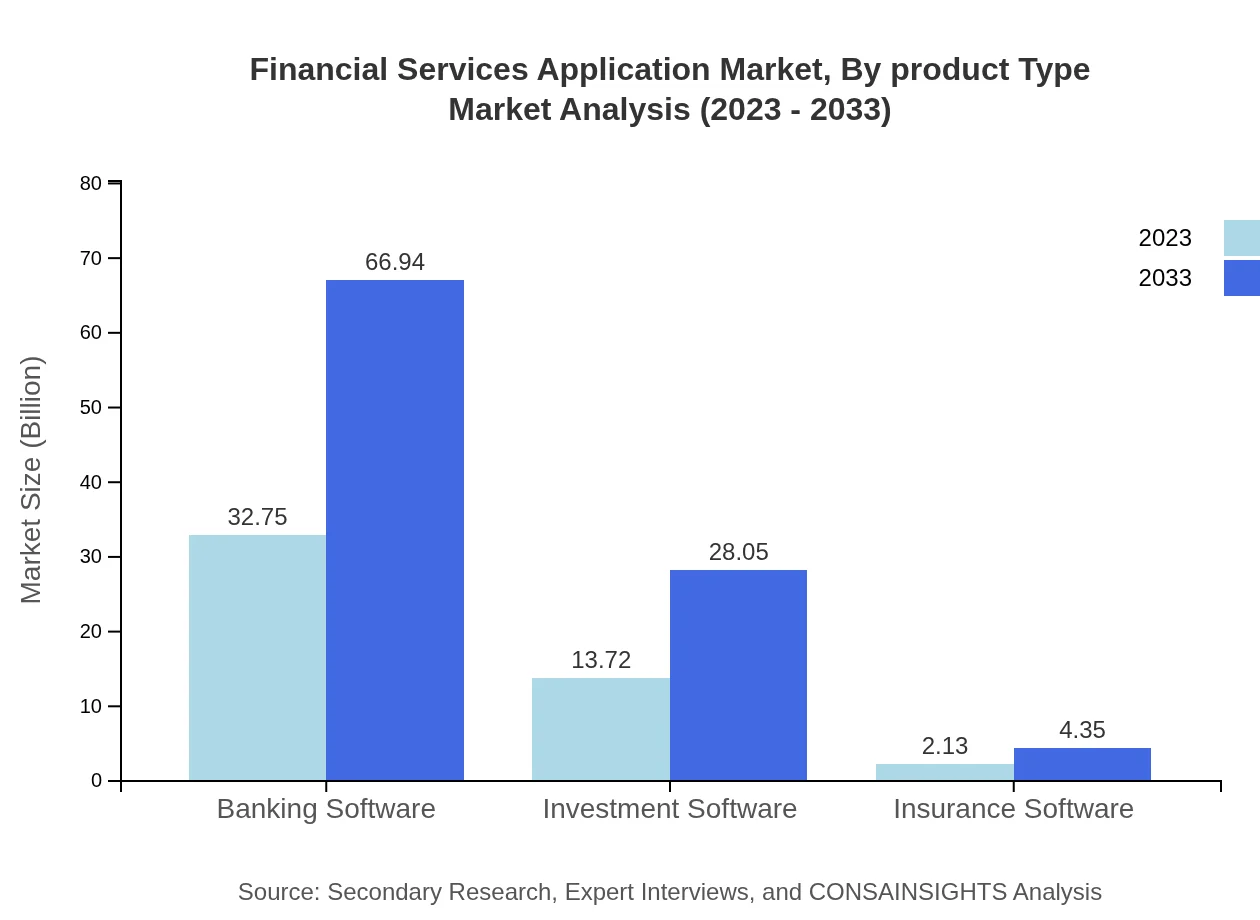

Financial Services Application Market Analysis By Product Type

The diverse product types in the financial services applications market include areas such as banking software, investment software, insurance software, and solutions focused on financial planning. For instance, banking software is a crucial segment, with a market size of $32.75 billion in 2023, expected to almost double to $66.94 billion by 2033, showcasing significant demand for such solutions as digital banking transforms traditional services.

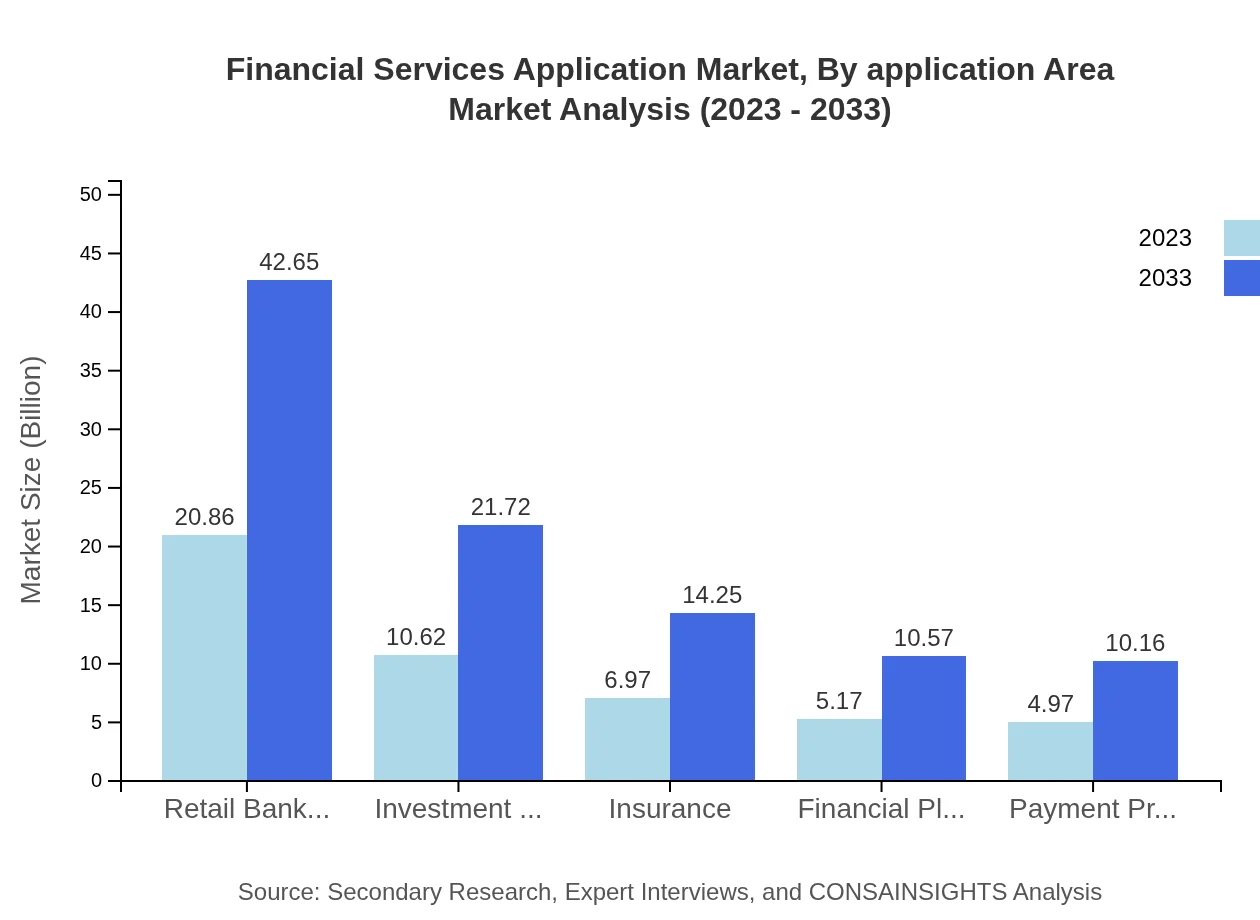

Financial Services Application Market Analysis By Application Area

The application areas of financial services applications encompass retail banking, investment banking, and insurance services. Retail banking is projected to grow from $20.86 billion in 2023 to $42.65 billion by 2033, driven by enhanced customer experiences delivered through mobile technologies and AI.

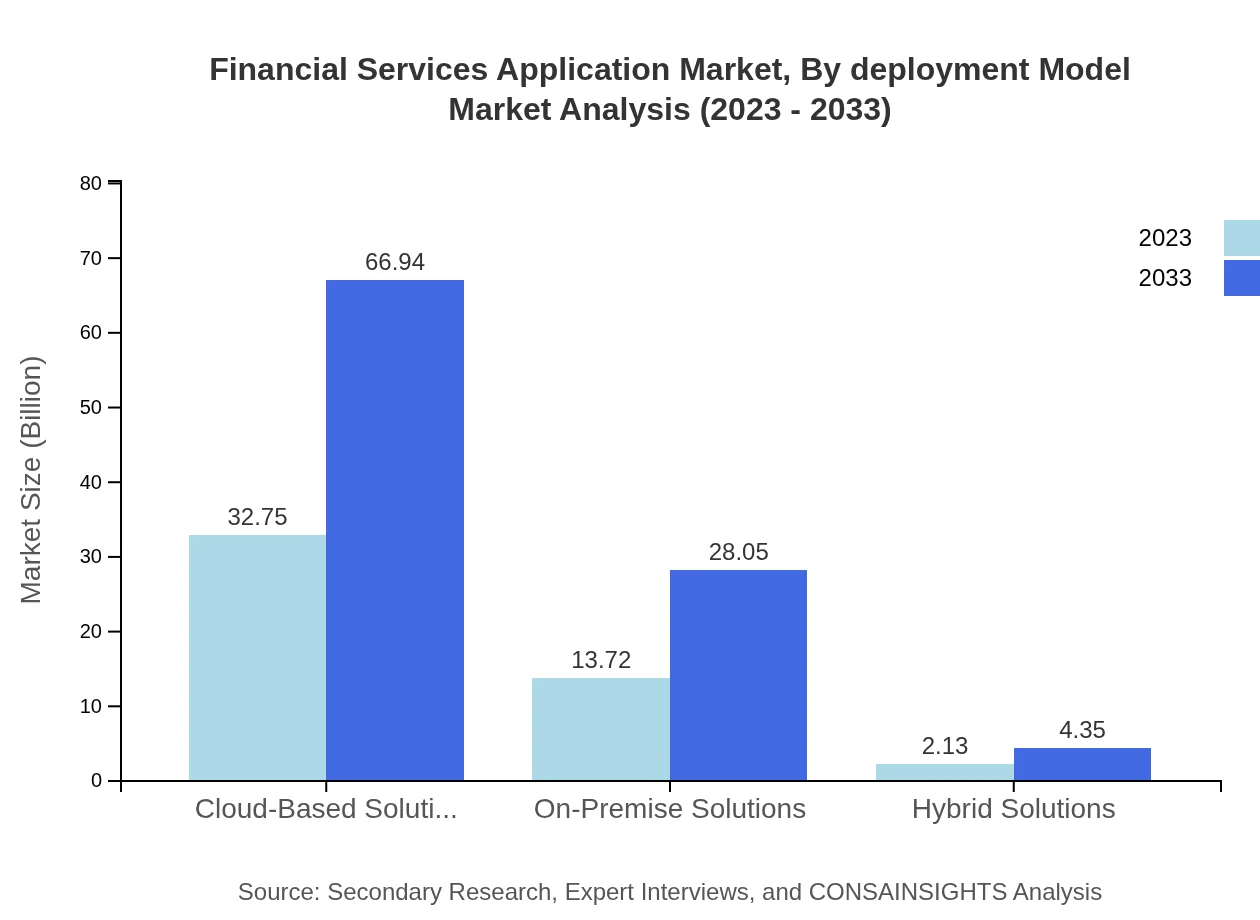

Financial Services Application Market Analysis By Deployment Model

The deployment models include cloud-based, on-premise, and hybrid solutions. Cloud-based solutions dominate the market with a size of $32.75 billion in 2023, set to rise to $66.94 billion by 2033 due to their scalability and cost-effectiveness, which appeals to both traditional banks and fintech startups.

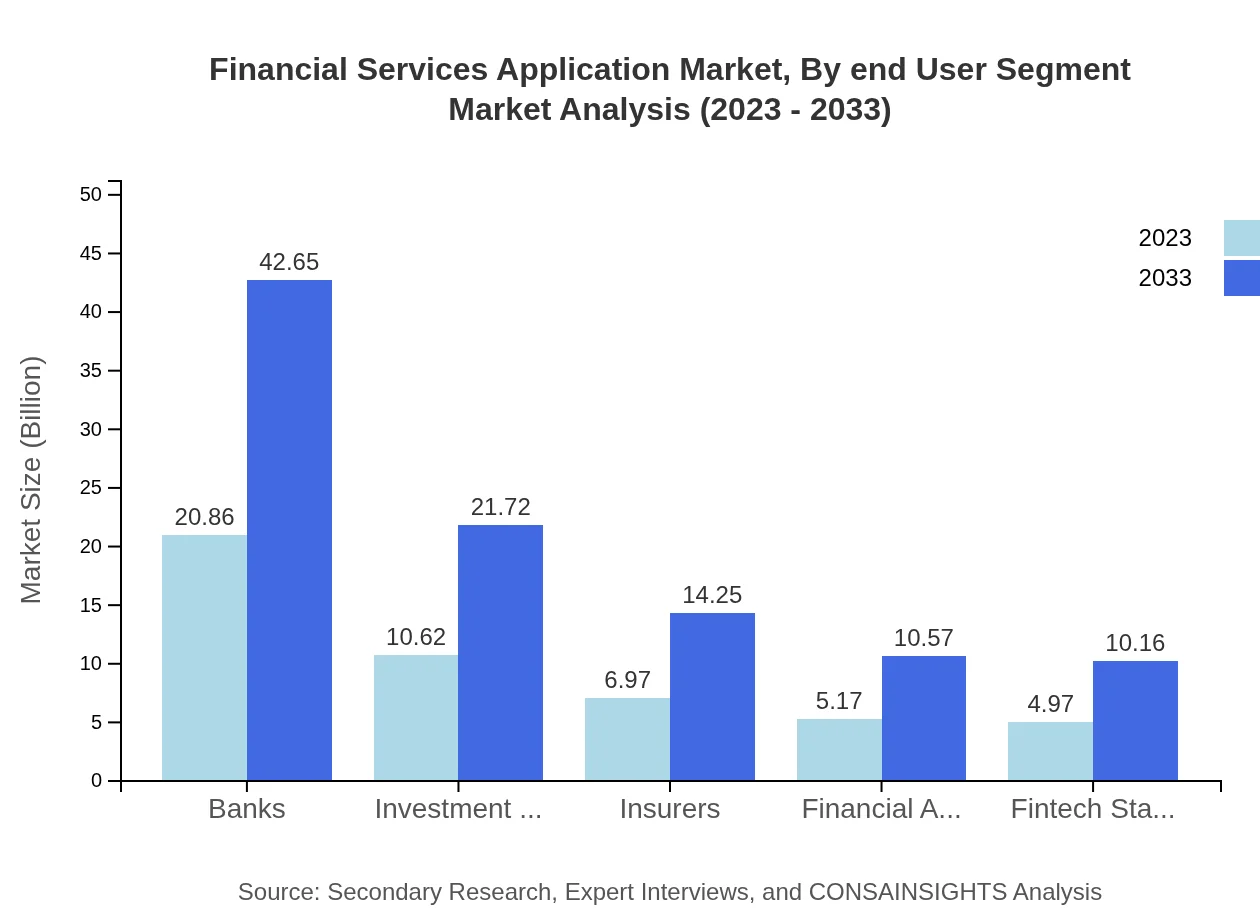

Financial Services Application Market Analysis By End User Segment

End-user segments consist of banks, investment firms, insurers, and financial advisors. Banks are projected to lead this segment, with a market size of $20.86 billion in 2023 and expected growth to $42.65 billion by 2033, highlighting the vital role they play in adopting innovative financial solutions.

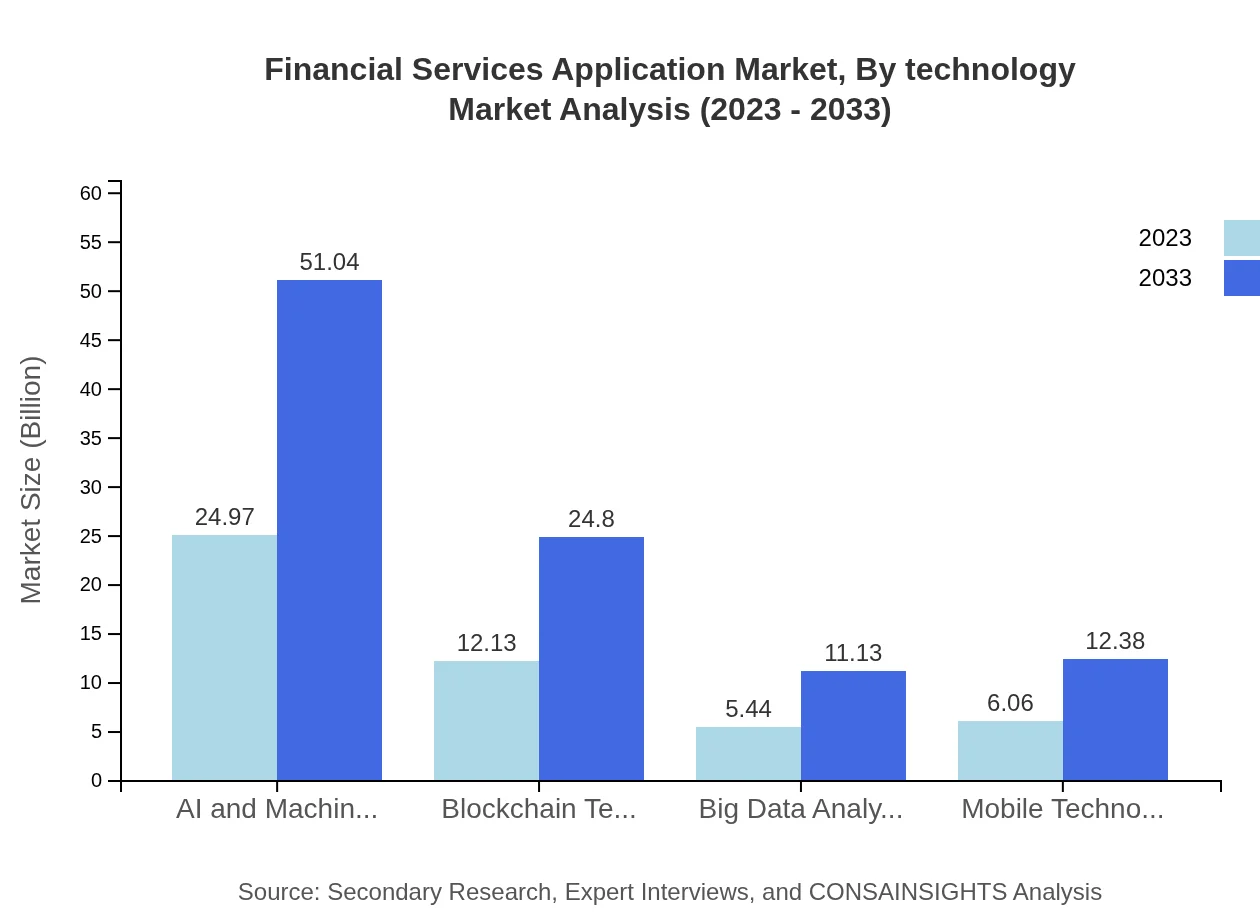

Financial Services Application Market Analysis By Technology

Technological advancements greatly impact the financial services applications market. AI and machine learning are particularly noteworthy, with a projected market size of $24.97 billion in 2023, rising to $51.04 billion by 2033, as institutions leverage analytics for enhanced decision-making and customer personalization.

Financial Services Application Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Financial Services Application Industry

IBM:

IBM provides a variety of financial services applications that incorporate AI and analytics for data-driven decision-making and enhanced customer experiences.Oracle:

Oracle offers cloud-based financial services software that supports banks and investment firms in managing their operations efficiently and securely.Microsoft:

Microsoft is recognized for its comprehensive solutions for financial services, particularly through its Azure cloud platform, which enables robust data management and analytics.SAP:

SAP specializes in enterprise resource planning solutions that assist financial institutions in streamlining processes and achieving regulatory compliance.Salesforce:

Salesforce provides innovative CRM platforms that empower financial service providers to enhance customer engagement and loyalty through personalized services.We're grateful to work with incredible clients.

FAQs

What is the market size of financial Services Application?

The financial services application market is currently valued at approximately $48.6 billion and is projected to grow at a CAGR of 7.2% from 2023 to 2033. This growth reflects the increasing demand for digital transformation across financial sectors.

What are the key market players or companies in this financial Services Application industry?

Key players in the financial services application industry include major banks, fintech startups, and technology companies providing software solutions. Notable companies are Accenture, FIS, Oracle, and SAP, among others, driving innovation and service delivery in this sector.

What are the primary factors driving the growth in the financial services application industry?

Growth in the financial services application industry is primarily driven by advancements in technology, including AI and machine learning, increased demand for mobile applications, and regulatory compliance needs. Additionally, consumer expectations for seamless digital experiences are significantly influencing growth.

Which region is the fastest Growing in the financial services application?

The fastest-growing region in the financial services application market is Europe, which is expected to grow from $16.77 billion in 2023 to $34.27 billion by 2033. North America follows closely with significant advancements in fintech and cloud-based solutions.

Does ConsaInsights provide customized market report data for the financial services application industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the financial services application industry. Clients can request detailed analyses to focus on particular segments or geographic regions for better strategic insights.

What deliverables can I expect from this financial services application market research project?

The deliverables from the financial services application market research project typically include a comprehensive report detailing market size, regional insights, segment analysis, competitive landscape, and forecasts. Infographics and summaries for quick reference may also be provided.

What are the market trends of financial services application?

Key market trends in financial services applications include the rising integration of AI and machine learning, a shift towards cloud-based solutions, and increased investment in cybersecurity measures to protect financial data. Additionally, mobile-first strategies are becoming essential.