Financial Services Security Software Market Report

Published Date: 31 January 2026 | Report Code: financial-services-security-software

Financial Services Security Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Financial Services Security Software market from 2023 to 2033, including insights on market trends, regional performance, segmentation, and forecasted growth.

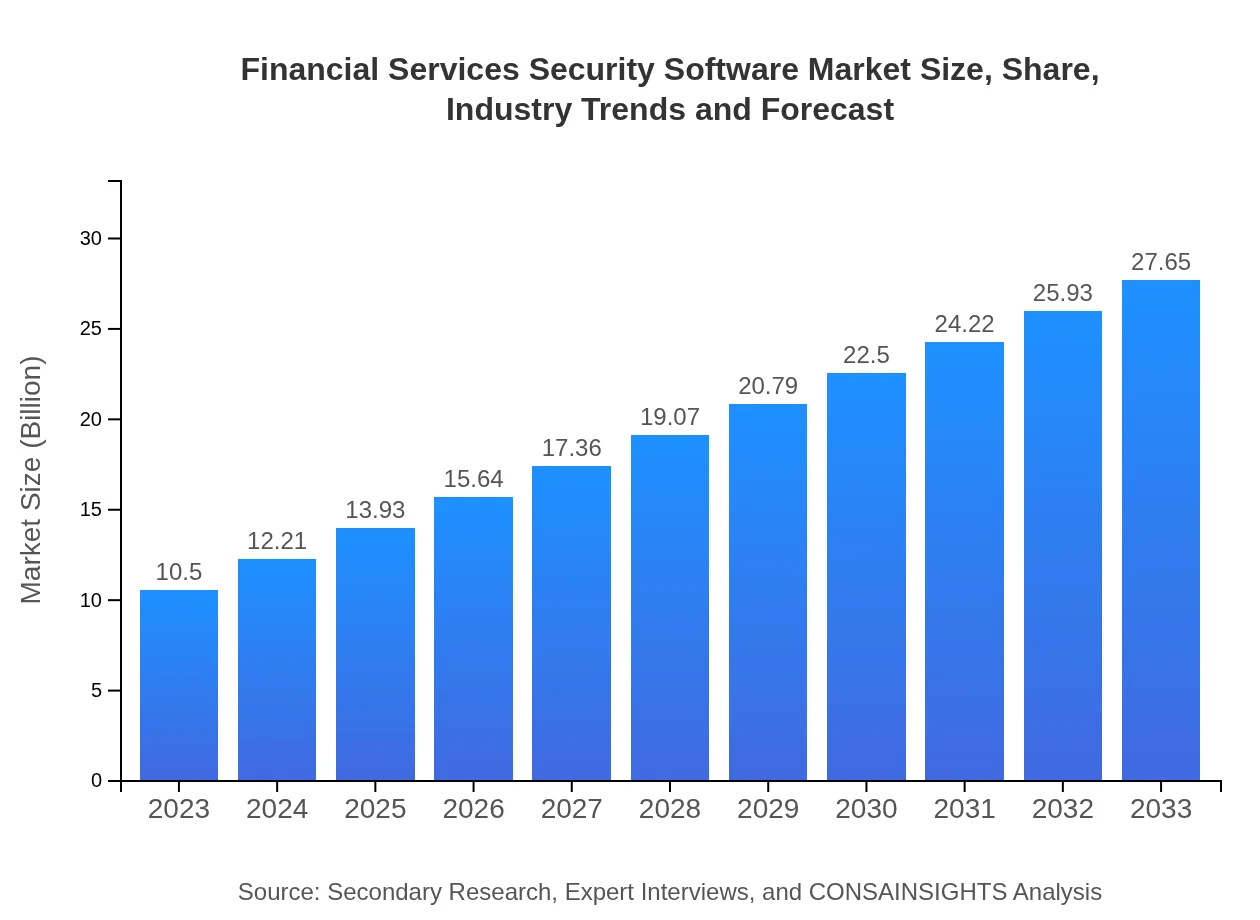

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $27.65 Billion |

| Top Companies | Symantec, McAfee, Palo Alto Networks, IBM Security |

| Last Modified Date | 31 January 2026 |

Financial Services Security Software Market Overview

Customize Financial Services Security Software Market Report market research report

- ✔ Get in-depth analysis of Financial Services Security Software market size, growth, and forecasts.

- ✔ Understand Financial Services Security Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Financial Services Security Software

What is the Market Size & CAGR of Financial Services Security Software market in 2023?

Financial Services Security Software Industry Analysis

Financial Services Security Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Financial Services Security Software Market Analysis Report by Region

Europe Financial Services Security Software Market Report:

Europe's market is projected to grow from $3.46 billion in 2023 to $9.11 billion by 2033. Regulatory pressures concerning data protection and privacy issues, alongside increasing cyber threats, are pushing financial companies in the region to enhance their security measures.Asia Pacific Financial Services Security Software Market Report:

In the Asia Pacific region, the Financial Services Security Software market is expected to grow from $1.92 billion in 2023 to $5.04 billion by 2033. The rapid adoption of digital banking and investment in cybersecurity by financial organizations is driving this growth, supported by government initiatives for IT advancements and regulatory compliance.North America Financial Services Security Software Market Report:

North America stands as the largest market, with a size of $3.83 billion in 2023 expected to reach $10.10 billion by 2033. The presence of major financial institutions and the concentration of tech giants focusing on security innovation play a critical role in this growth.South America Financial Services Security Software Market Report:

The South American market, though smaller, is projected to rise from $0.70 billion in 2023 to $1.84 billion in 2033. Local financial institutions are increasingly focusing on improving security to counteract rising cyber threats, thereby spurring demand for security software.Middle East & Africa Financial Services Security Software Market Report:

The market in the Middle East and Africa is anticipated to grow from $0.59 billion in 2023 to $1.56 billion by 2033. With many countries in the region focusing on technological advancements, there is a significant push for effective cybersecurity solutions in financial services.Tell us your focus area and get a customized research report.

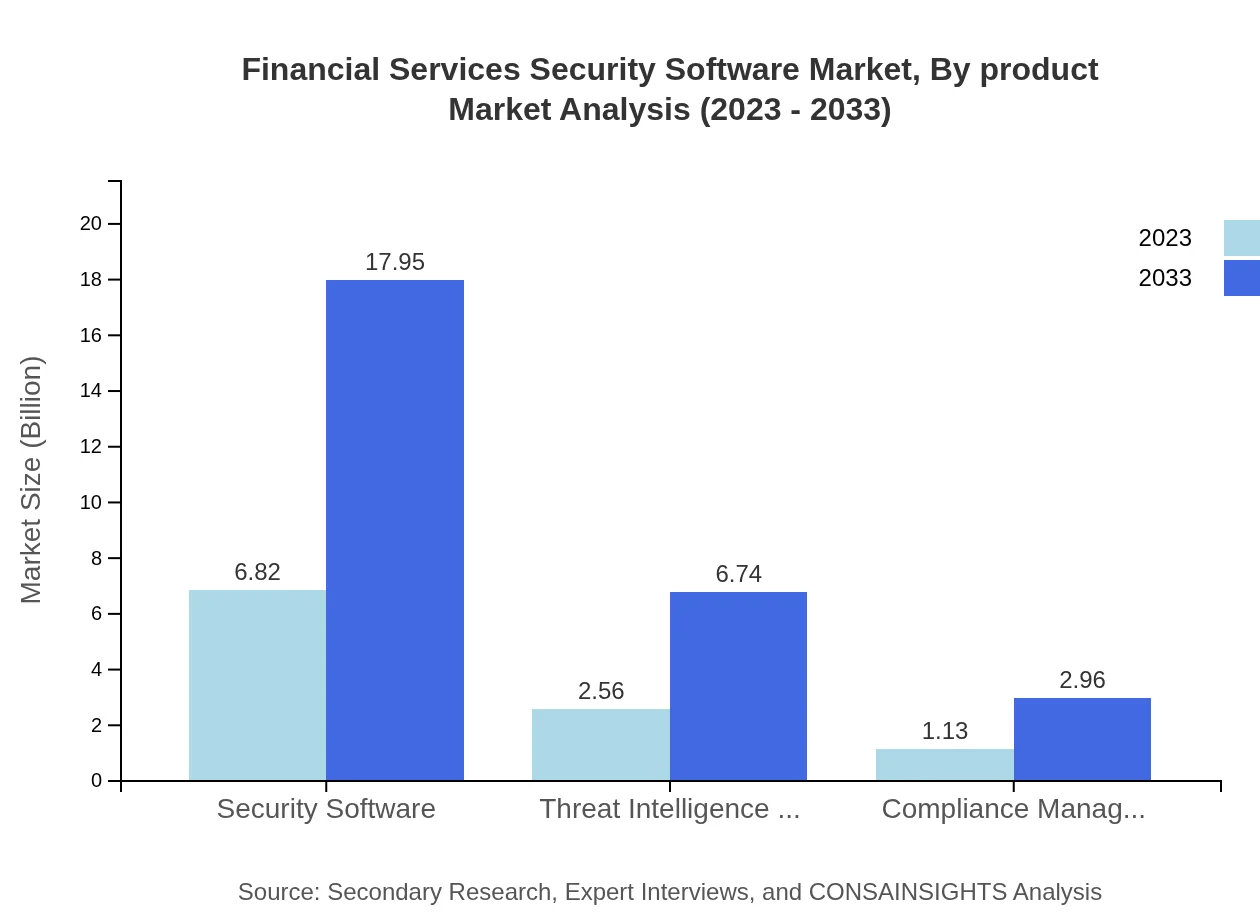

Financial Services Security Software Market Analysis By Product

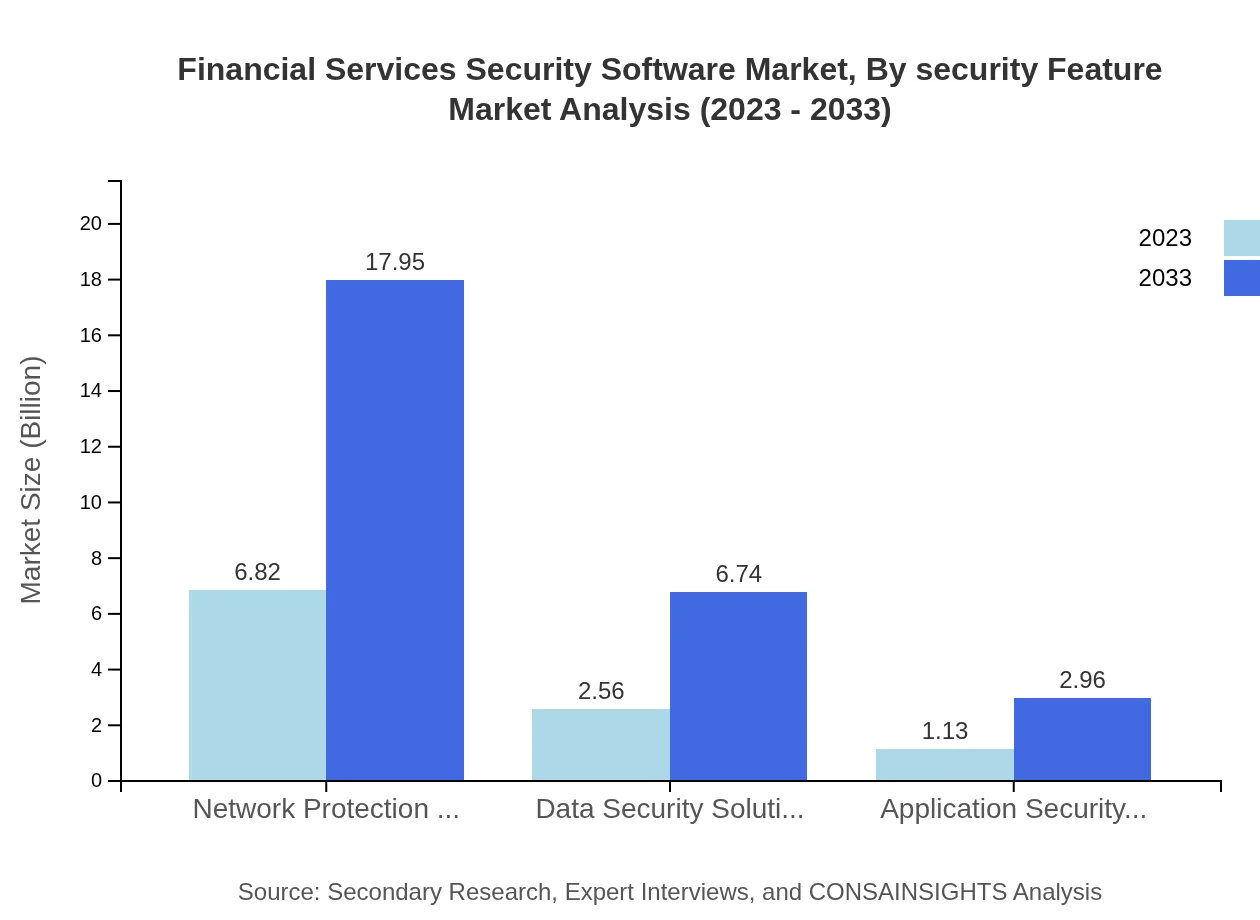

The Financial Services Security Software market is primarily driven by Security Software, which accounts for a significant market size of $6.82 billion in 2023, projected to grow to $17.95 billion by 2033. Threat Intelligence Solutions and Compliance Management Tools also play critical roles, with respective market sizes of $2.56 billion and $1.13 billion in 2023, growing to $6.74 billion and $2.96 billion by 2033.

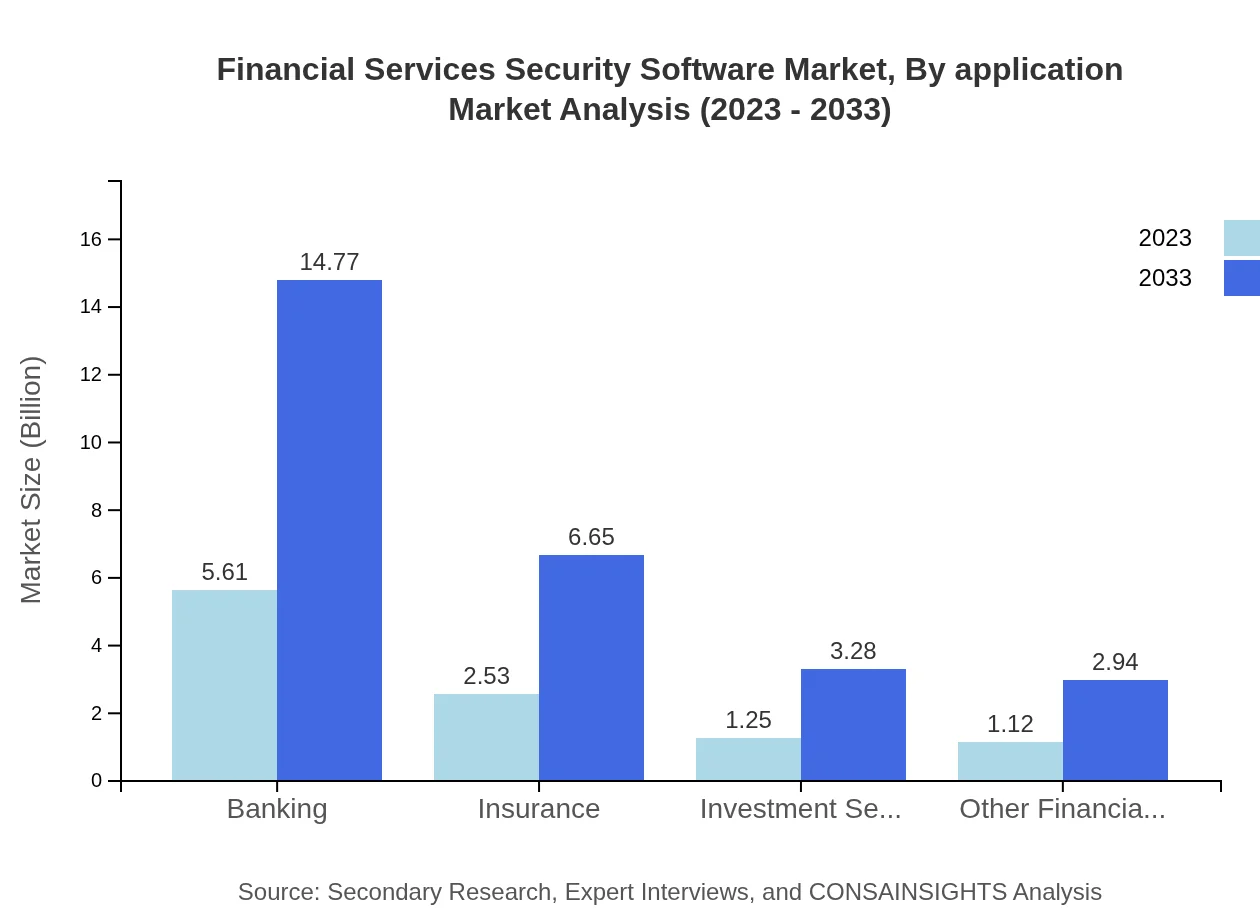

Financial Services Security Software Market Analysis By Application

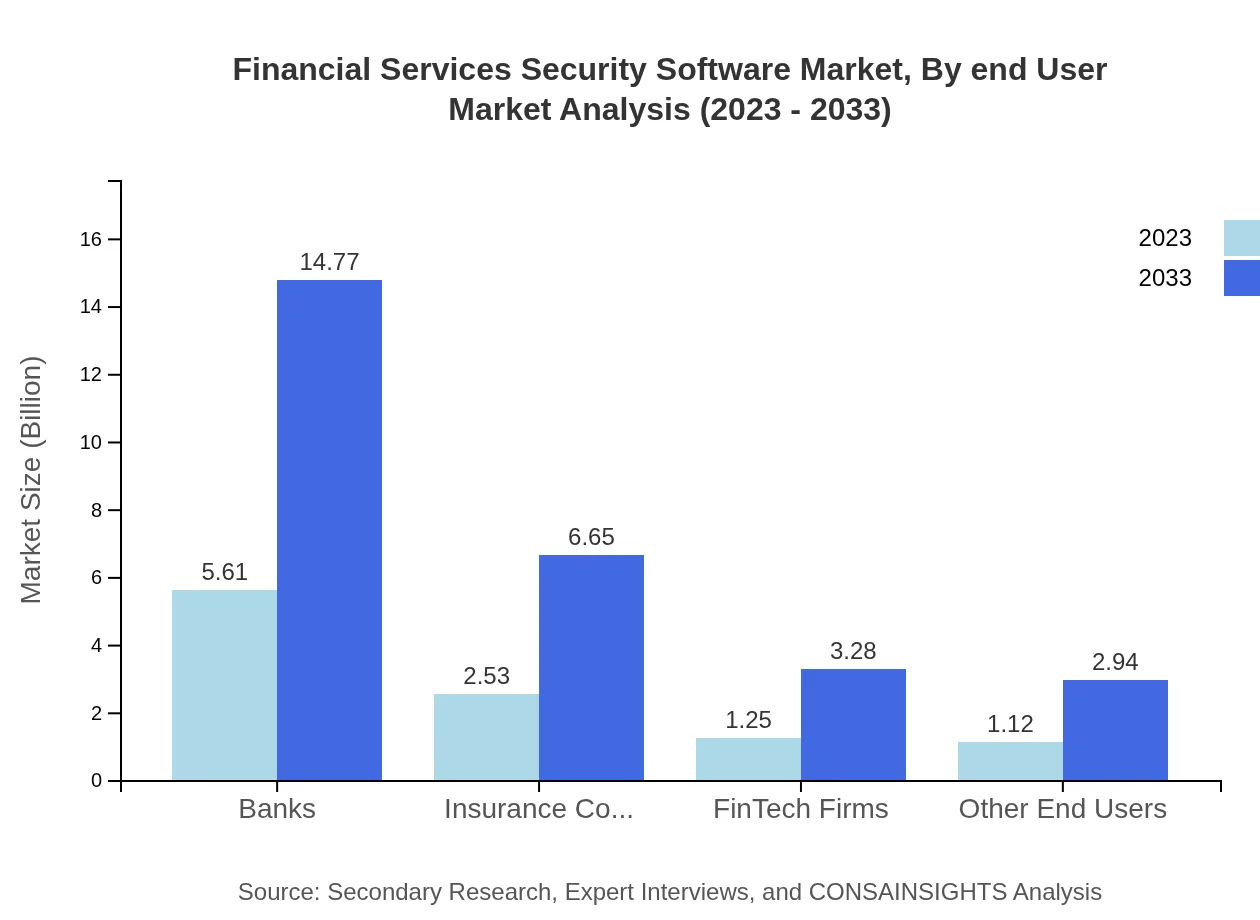

The Banking segment holds a major share of the market at $5.61 billion in 2023, expected to reach $14.77 billion by 2033. Other applications include Insurance, Investment Services, and Other Financial Services, with market sizes of $2.53 billion, $1.25 billion, and $1.12 billion respectively in 2023.

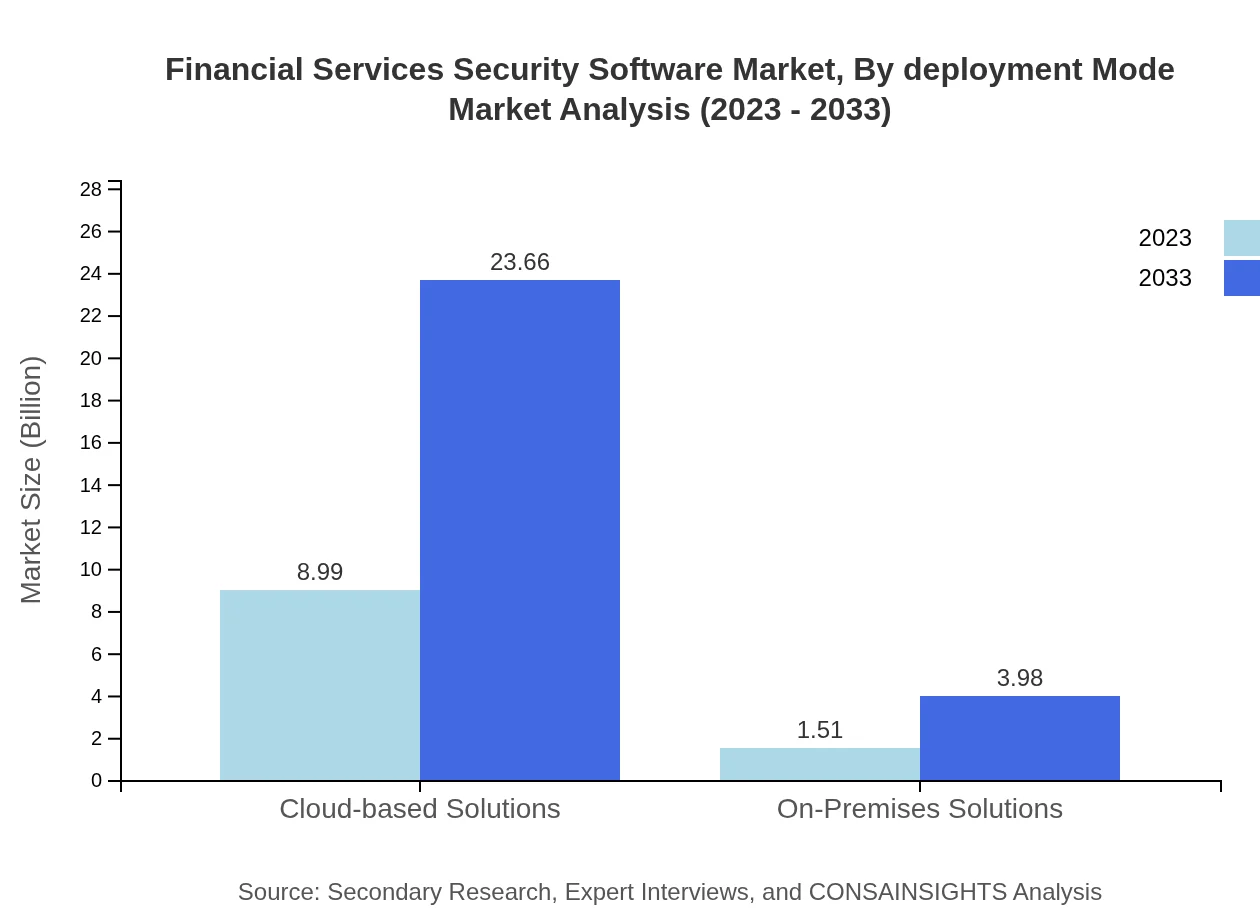

Financial Services Security Software Market Analysis By Deployment Mode

In terms of deployment mode, the Cloud-based Solutions dominate the market significantly with a projected size of $8.99 billion in 2023 and expected to grow to $23.66 billion by 2033. In contrast, On-Premises Solutions have a much smaller footprint at $1.51 billion in 2023 but are anticipated to grow to $3.98 billion over the same period.

Financial Services Security Software Market Analysis By End User

Banks lead the end-user segment, constituting a considerable market size of $5.61 billion in 2023, followed closely by Insurance Companies at $2.53 billion. The growth of FinTech Firms, which are estimated at $1.25 billion in the same year, highlights the increasing diversification in the financial services sector.

Financial Services Security Software Market Analysis By Security Feature

The Network Protection Solutions account for a substantial market share of $6.82 billion in 2023, expected to grow to $17.95 billion by 2033. Data Security Solutions contribute $2.56 billion, while Application Security Solutions reflect a smaller but growing share at $1.13 billion.

Financial Services Security Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Financial Services Security Software Industry

Symantec:

A frontrunner in cybersecurity, Symantec provides advanced threat protection and compliance management tools across various sectors, including financial services.McAfee:

McAfee is renowned for its security solutions designed for financial institutions, focusing on endpoint security and threat intelligence.Palo Alto Networks:

Specializing in advanced firewalls and cloud-based security, Palo Alto Networks leads the way in defending financial organizations from sophisticated cyber threats.IBM Security:

IBM Security offers comprehensive solutions including data security and identity management tailored for the financial services sector.We're grateful to work with incredible clients.

FAQs

What is the market size of Financial Services Security Software?

The Financial Services Security Software market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 9.8% from 2023 to 2033. This marks significant growth potential in this essential sector.

What are the key market players or companies in this Financial Services Security Software industry?

Key players in the Financial Services Security Software industry include major firms such as IBM, McAfee, Symantec, and FireEye, among others. These companies lead the sector by providing cutting-edge security solutions tailored for financial services.

What are the primary factors driving the growth in the Financial Services Security Software industry?

Growth in the Financial Services Security Software industry is driven by increasing cyber threats, regulatory compliance requirements, and the push for digital transformation across financial institutions. Moreover, the rising awareness of data protection is propelling investment in security solutions.

Which region is the fastest Growing in the Financial Services Security Software?

The North America region is forecasted to be the fastest-growing area in the Financial Services Security Software market, expanding from $3.83 billion in 2023 to $10.10 billion by 2033, driven by high investment in cybersecurity solutions.

Does ConsaInsights provide customized market report data for the Financial Services Security Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the Financial Services Security Software industry. This allows stakeholders to obtain insights relevant to their business strategies and objectives.

What deliverables can I expect from this Financial Services Security Software market research project?

Deliverables from the Financial Services Security Software market research project include comprehensive market analysis reports, trend insights, competitive landscape evaluations, and detailed forecasts on market growth segmented by region and product type.

What are the market trends of Financial Services Security Software?

Trends in the Financial Services Security Software market include the shift towards cloud-based solutions, increased implementation of threat intelligence, and the growth of compliance management tools. These trends reflect a heightened focus on security and regulatory adherence among financial organizations.