Freight And Logistics Market Report

Published Date: 02 February 2026 | Report Code: freight-and-logistics

Freight And Logistics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Freight And Logistics market from 2023 to 2033, including insights on market size, industry trends, technological advancements, and a regional breakdown of key market players.

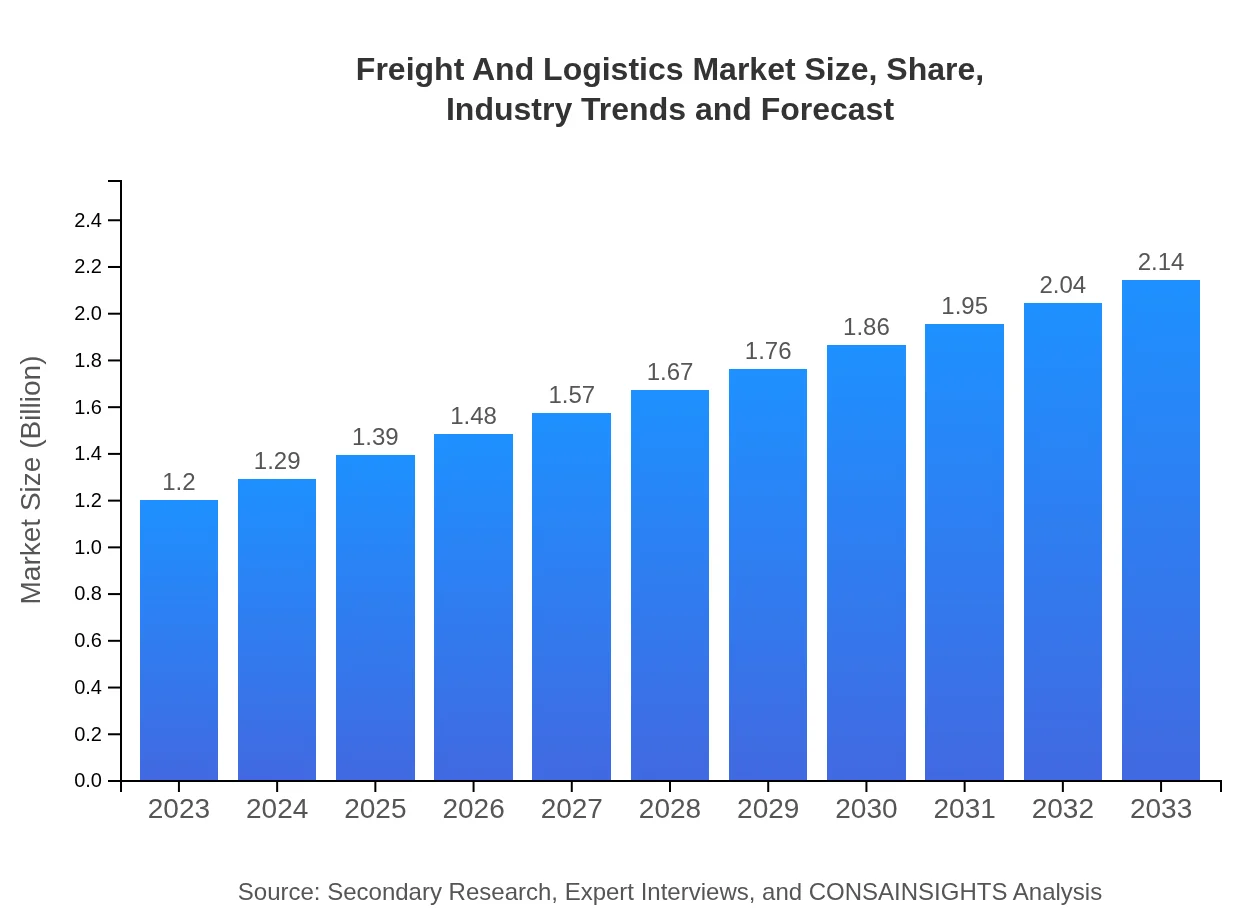

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.14 Trillion |

| Top Companies | DHL Supply Chain, FedEx Corporation, XPO Logistics, Kuehne + Nagel |

| Last Modified Date | 02 February 2026 |

Freight And Logistics Market Overview

Customize Freight And Logistics Market Report market research report

- ✔ Get in-depth analysis of Freight And Logistics market size, growth, and forecasts.

- ✔ Understand Freight And Logistics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Freight And Logistics

What is the Market Size & CAGR of Freight And Logistics market in 2023?

Freight And Logistics Industry Analysis

Freight And Logistics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Freight And Logistics Market Analysis Report by Region

Europe Freight And Logistics Market Report:

In 2023, Europe represented a market size of $0.38 trillion, expected to rise to $0.68 trillion by 2033. The European logistics market is characterized by strong regulatory oversight and a focus on sustainability, with many firms investing in greener logistics solutions.Asia Pacific Freight And Logistics Market Report:

In 2023, the market size in the Asia Pacific region was approximately $0.21 trillion, projected to grow to $0.37 trillion by 2033. The region benefits from robust manufacturing sectors and a rapidly growing e-commerce industry, which is a primary driver of logistics demand. Innovations such as drone deliveries and smart transportation networks are expected to reshape logistics in this region.North America Freight And Logistics Market Report:

North America had a market size of $0.46 trillion in 2023, projected to grow to $0.81 trillion by 2033. The region is a leader in logistics technology and e-commerce fulfillment, with companies increasingly adopting automation and data analytics to enhance supply chain efficiency.South America Freight And Logistics Market Report:

The South American market was valued at $0.02 trillion in 2023 and is expected to reach $0.03 trillion by 2033. Despite facing challenges such as infrastructure deficits, growth is anticipated due to increasing trade ties within the region and improvements in logistics networks.Middle East & Africa Freight And Logistics Market Report:

The Middle East and Africa market was estimated at $0.14 trillion in 2023, expected to expand to $0.24 trillion by 2033. The development of infrastructure and increased oil exports contribute to growth, alongside a rising demand for logistics services in various sectors.Tell us your focus area and get a customized research report.

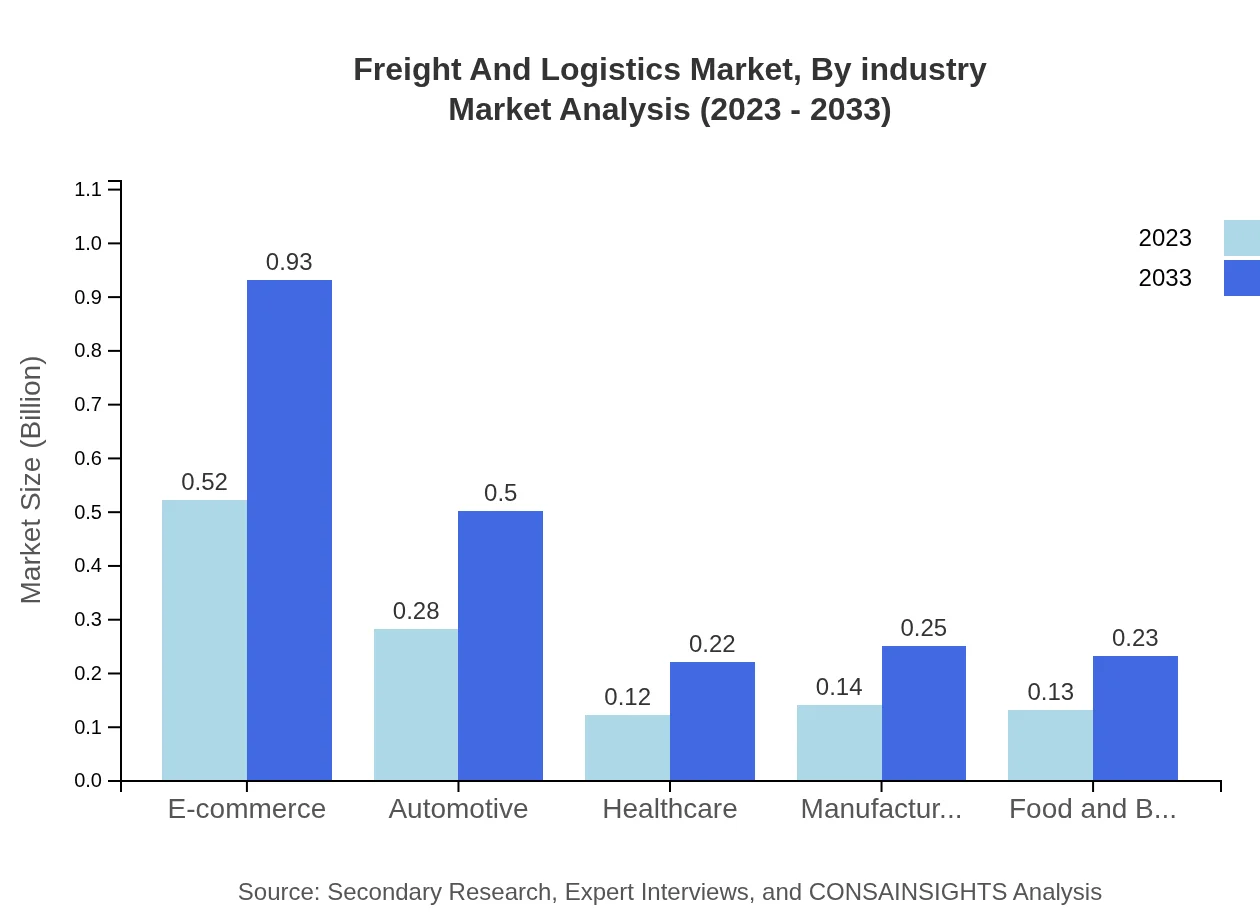

Freight And Logistics Market Analysis By Industry

The e-commerce segment is dominant in 2023 with a market size of $0.52 trillion, projected to expand to $0.93 trillion by 2033, accounting for 43.63% of the market share. The automotive industry follows, with a size of $0.28 trillion in 2023, expected to increase to $0.50 trillion. The healthcare segment is also growing, estimated at $0.12 trillion and projected to reach $0.22 trillion. Manufacturing and food & beverage industries are essential segments as well, with sizes of $0.14 trillion and $0.13 trillion respectively. Telecommunication technologies such as IoT, blockchain, and telematics are also vital contributors to the segment performance.

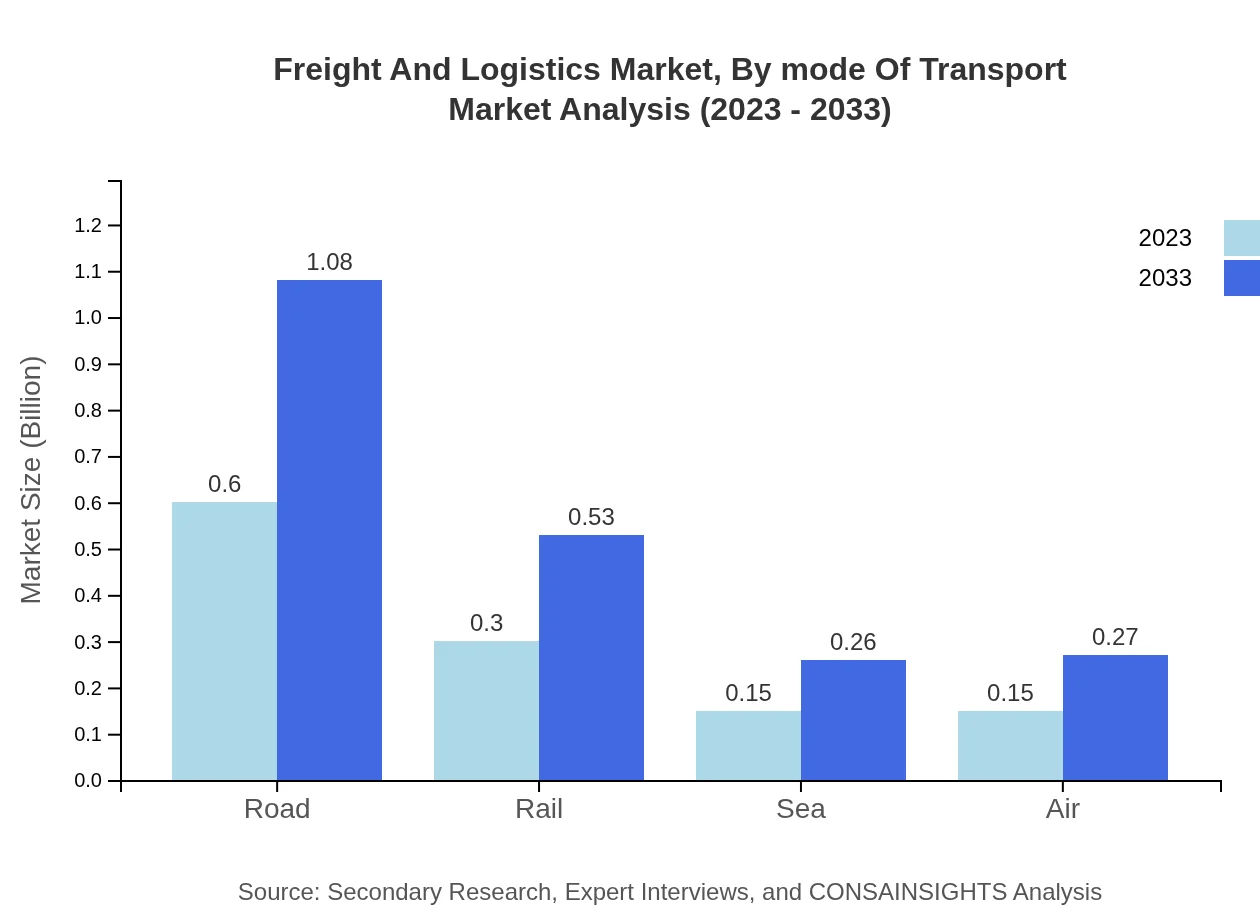

Freight And Logistics Market Analysis By Mode Of Transport

The road transport segment dominates the market with a size of $0.60 trillion in 2023, anticipated to grow to $1.08 trillion by 2033, accounting for 50.36% market share. Rail and sea-based transport segments are projected to increase moderately, driven by improvements in infrastructure. The air transport segment remains crucial for high-value goods, with growth projected to increase from $0.15 trillion in 2023 to $0.27 trillion.

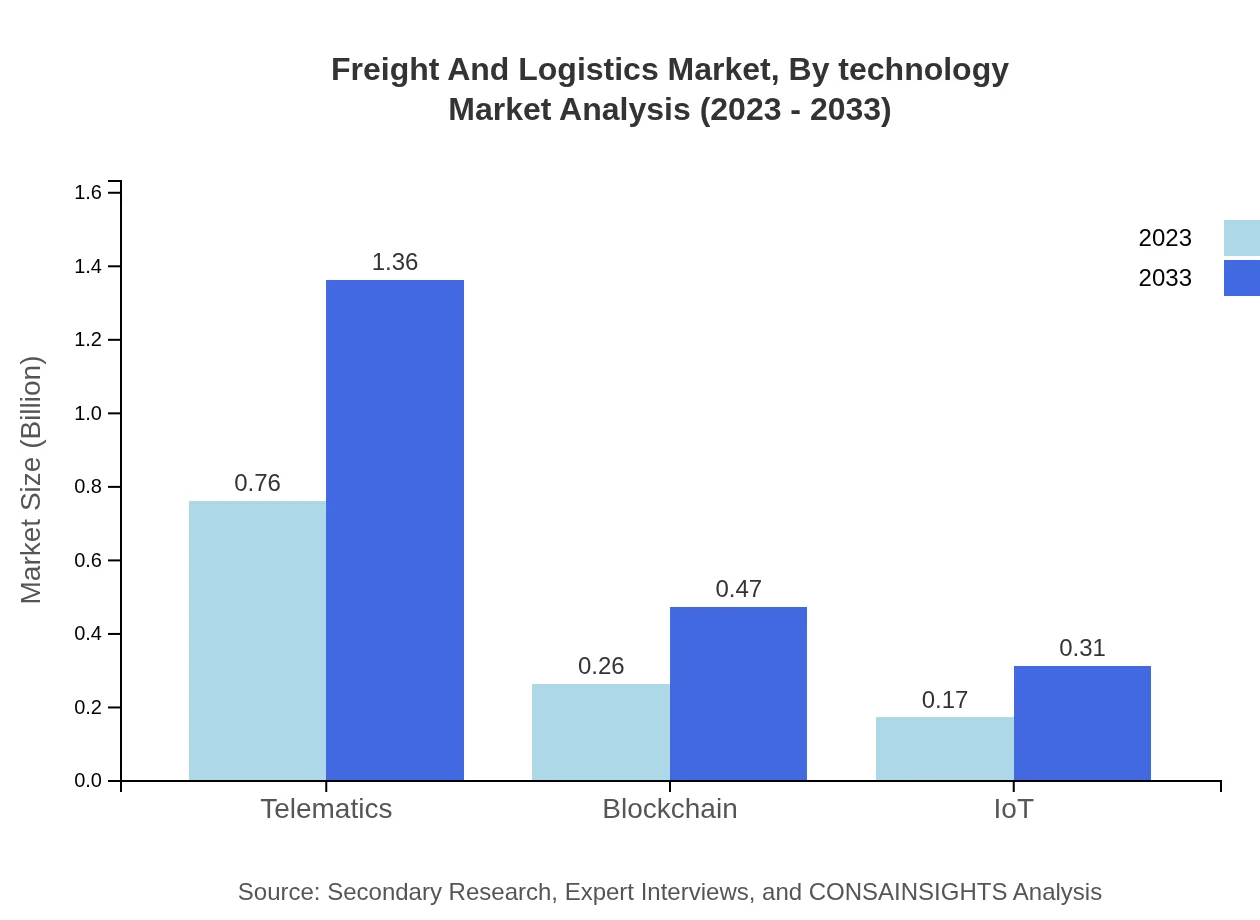

Freight And Logistics Market Analysis By Technology

Technological advancements such as IoT and telematics are at the forefront of growth in the Freight And Logistics sector. In 2023, telematics stood at $0.76 trillion, expected to grow to $1.36 trillion by 2033. Blockchain technology is forecasted to rise from $0.26 trillion in 2023 to $0.47 trillion, revolutionizing transparency in supply chains.

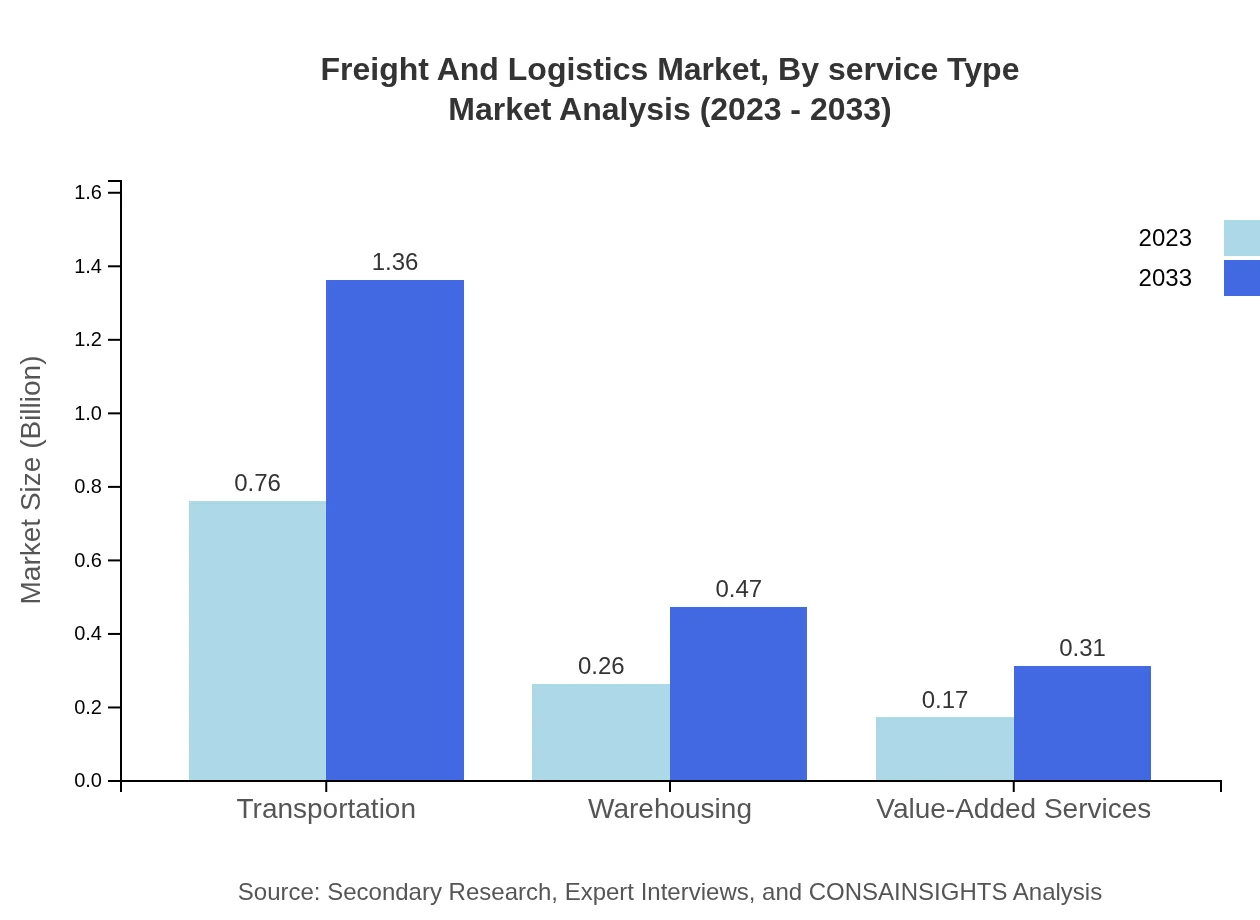

Freight And Logistics Market Analysis By Service Type

Transportation services currently dominate with a market size of $0.76 trillion in 2023, projected to grow to $1.36 trillion by 2033. Warehousing services, valued at $0.26 trillion, are expected to rise similarly as demand for storage solutions increases, alongside value-added services.

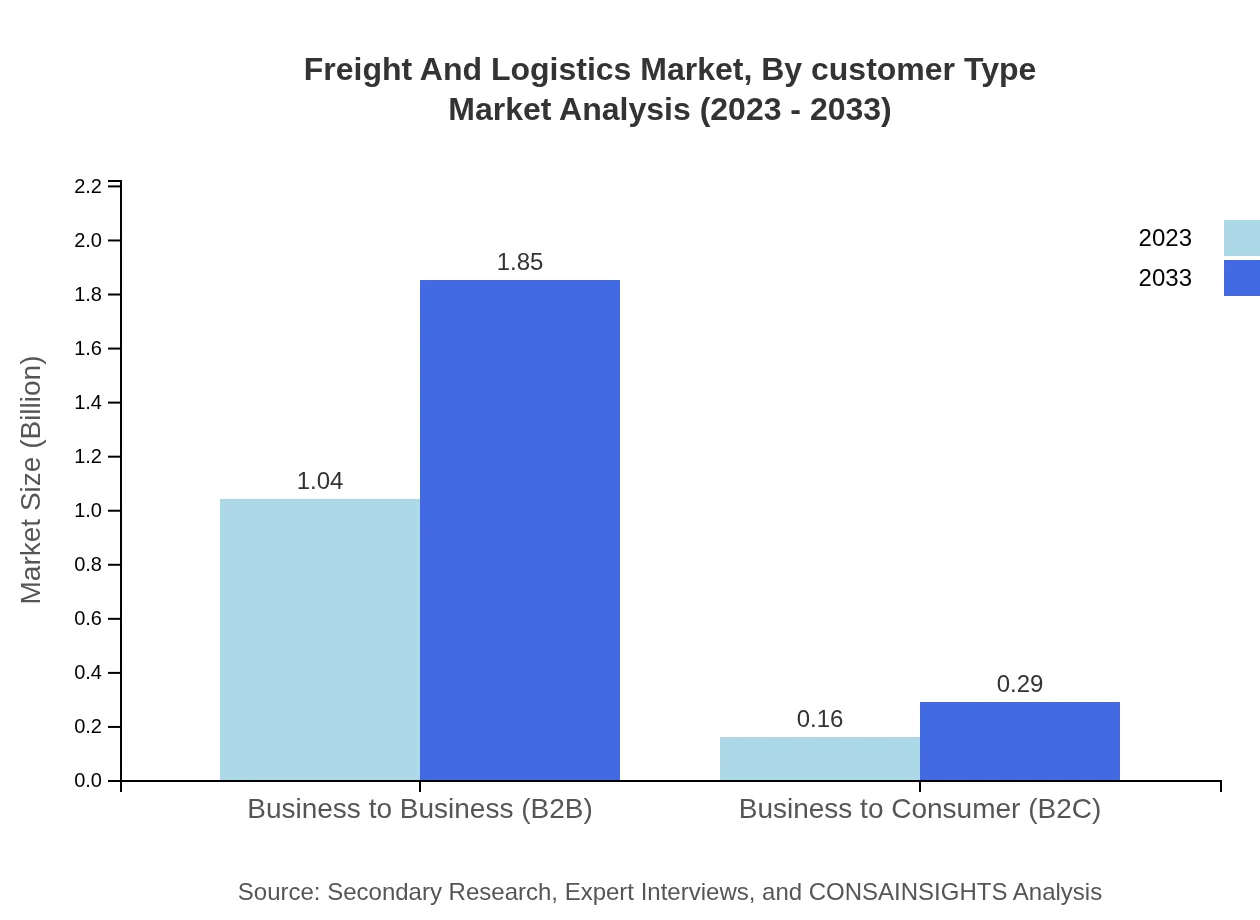

Freight And Logistics Market Analysis By Customer Type

The Business to Business (B2B) segment leads the market, with a size of $1.04 trillion in 2023, projected to grow to $1.85 trillion. In contrast, the Business to Consumer (B2C) segment has a smaller footprint, expected to grow from $0.16 trillion to $0.29 trillion by 2033.

Freight And Logistics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Freight And Logistics Industry

DHL Supply Chain:

DHL Supply Chain is a global leader in contract logistics and is known for its innovative solutions to enhance supply chain efficiency.FedEx Corporation:

FedEx serves a vast network worldwide with robust transportation and logistics services, continually investing in technology and infrastructure.XPO Logistics:

A leading provider of logistics services in the U.S., XPO is distinguished by its advanced tech solutions for freight optimization.Kuehne + Nagel:

Kuehne + Nagel is one of the world's leading logistics service providers offering integrated supply chain solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of freight And Logistics?

The freight and logistics market is valued at approximately $1.2 trillion in 2023, with a projected CAGR of 5.8% through 2033. This significant market size reflects the growing demand for efficient supply chain solutions across various sectors.

What are the key market players or companies in this freight And Logistics industry?

Key players in the freight and logistics industry include companies like DHL, FedEx, UPS, Maersk, and XPO Logistics. These firms are notable for their extensive networks and innovative logistics solutions, contributing significantly to market dynamics.

What are the primary factors driving the growth in the freight and logistics industry?

Drivers of growth in the freight and logistics industry include the rise of e-commerce, increasing globalization, technological advancements (such as IoT and blockchain), and enhanced demand for fast delivery services, which all contribute to market expansion.

Which region is the fastest Growing in the freight And Logistics?

Asia Pacific is the fastest-growing region in the freight and logistics market, projected to grow from $0.21 trillion in 2023 to $0.37 trillion by 2033, indicating robust economic developments and rising trade activities.

Does ConsaInsights provide customized market report data for the freight And Logistics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the freight and logistics industry, enabling businesses to access insights aligned with their strategic goals and market conditions.

What deliverables can I expect from this freight And Logistics market research project?

Deliverables from the freight and logistics market research project include detailed market analysis, regional forecast reports, segment performance insights, and actionable recommendations to guide strategic decision-making.

What are the market trends of freight And Logistics?

Current market trends in freight and logistics include increased adoption of automation and AI technologies, sustainability initiatives, integration of telematics, and a focus on enhancing customer experience through real-time tracking and fast delivery options.