Automotive Chassis Market Report

Published Date: 02 February 2026 | Report Code: automotive-chassis

Automotive Chassis Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the automotive chassis market, covering trends, regional developments, market size, and projections from 2023 to 2033.

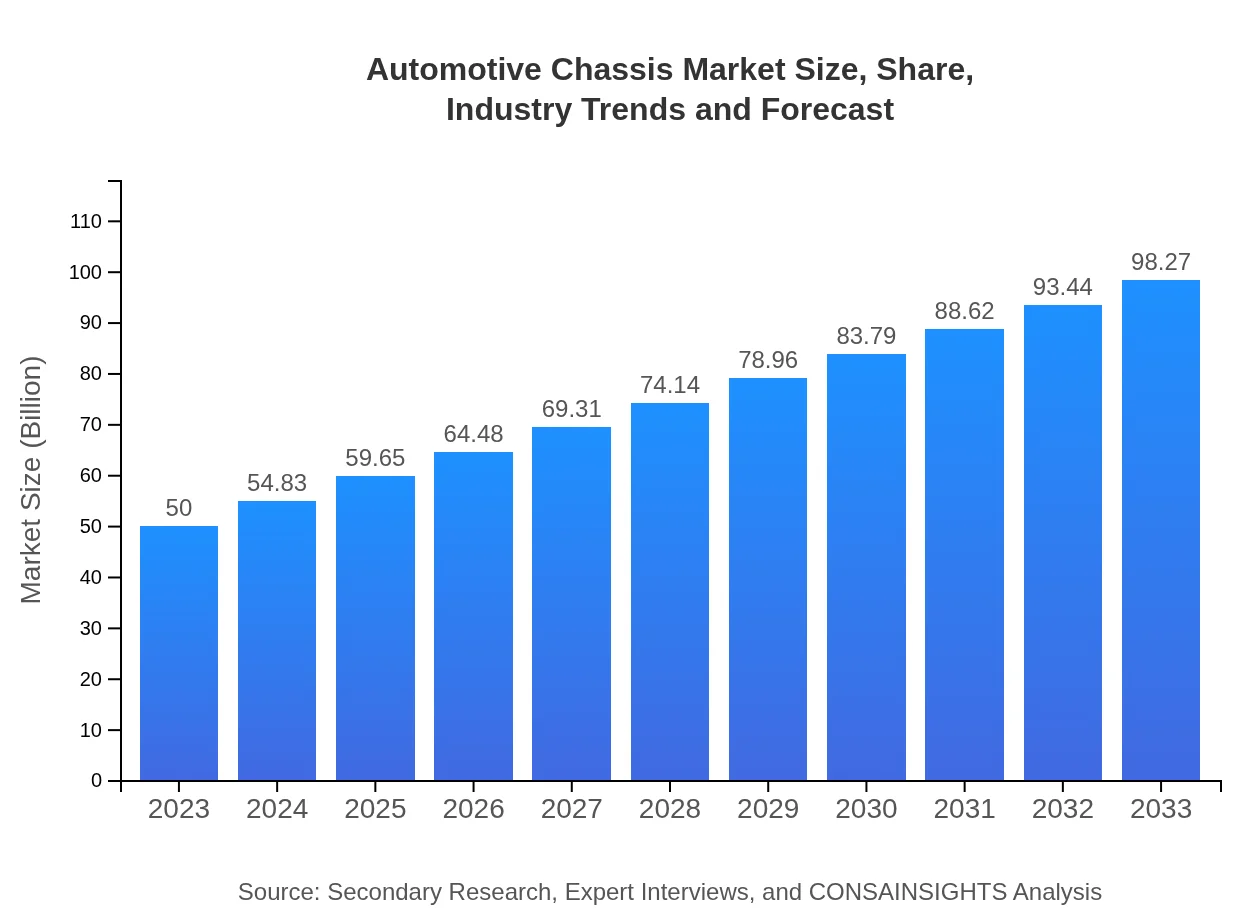

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $98.27 Billion |

| Top Companies | Continental AG, Daimler AG, Hyundai Mobis, Faurecia, Tata Autocomp Systems |

| Last Modified Date | 02 February 2026 |

Automotive Chassis Market Overview

Customize Automotive Chassis Market Report market research report

- ✔ Get in-depth analysis of Automotive Chassis market size, growth, and forecasts.

- ✔ Understand Automotive Chassis's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Chassis

What is the Market Size & CAGR of Automotive Chassis market in 2023?

Automotive Chassis Industry Analysis

Automotive Chassis Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Chassis Market Analysis Report by Region

Europe Automotive Chassis Market Report:

The European automotive chassis market is projected to grow from $13.47 billion in 2023 to $26.47 billion by 2033, driven by leading manufacturers focusing on lightweight chassis solutions and the shift towards electric mobility.Asia Pacific Automotive Chassis Market Report:

The Asia Pacific region, valued at $9.92 billion in 2023, is anticipated to grow to $19.50 billion by 2033. This growth is attributed to the rapid expansion of the automotive industry in countries like China and India, emphasizing electric vehicles and advanced chassis technologies.North America Automotive Chassis Market Report:

North America holds a significant market worth approximately $17.94 billion in 2023, expected to reach $35.26 billion by 2033. The region is characterized by high chassis production standards, supported by technological innovations and stringent safety regulations.South America Automotive Chassis Market Report:

South America’s automotive chassis market is projected to increase from $2.90 billion in 2023 to $5.69 billion by 2033. Brazil leads this growth due to its substantial automotive production and increasing investments in automotive infrastructure.Middle East & Africa Automotive Chassis Market Report:

The Middle East and Africa market is expected to grow from $5.78 billion in 2023 to $11.35 billion by 2033, supported by the increasing vehicular demand and local manufacturing initiatives aimed at improving the region's automotive capabilities.Tell us your focus area and get a customized research report.

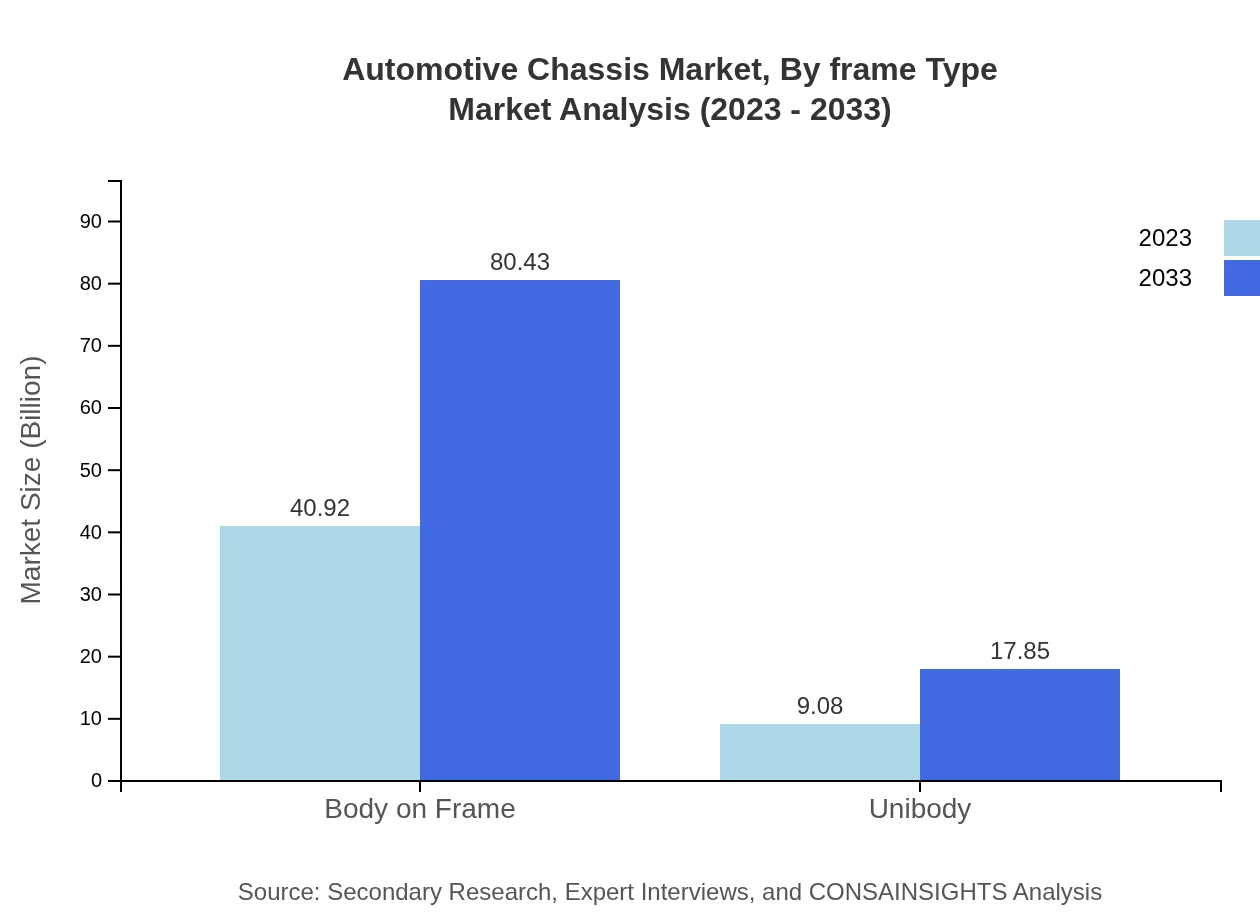

Automotive Chassis Market Analysis By Frame Type

The automotive chassis market segment by frame type includes body-on-frame and unibody constructions. As of 2023, the body-on-frame segment dominates with $40.92 billion, expected to reach $80.43 billion by 2033, holding a significant share of 81.84% of the market. The unibody segment, while smaller, represents a growing area of interest due to advancements in design and materials.

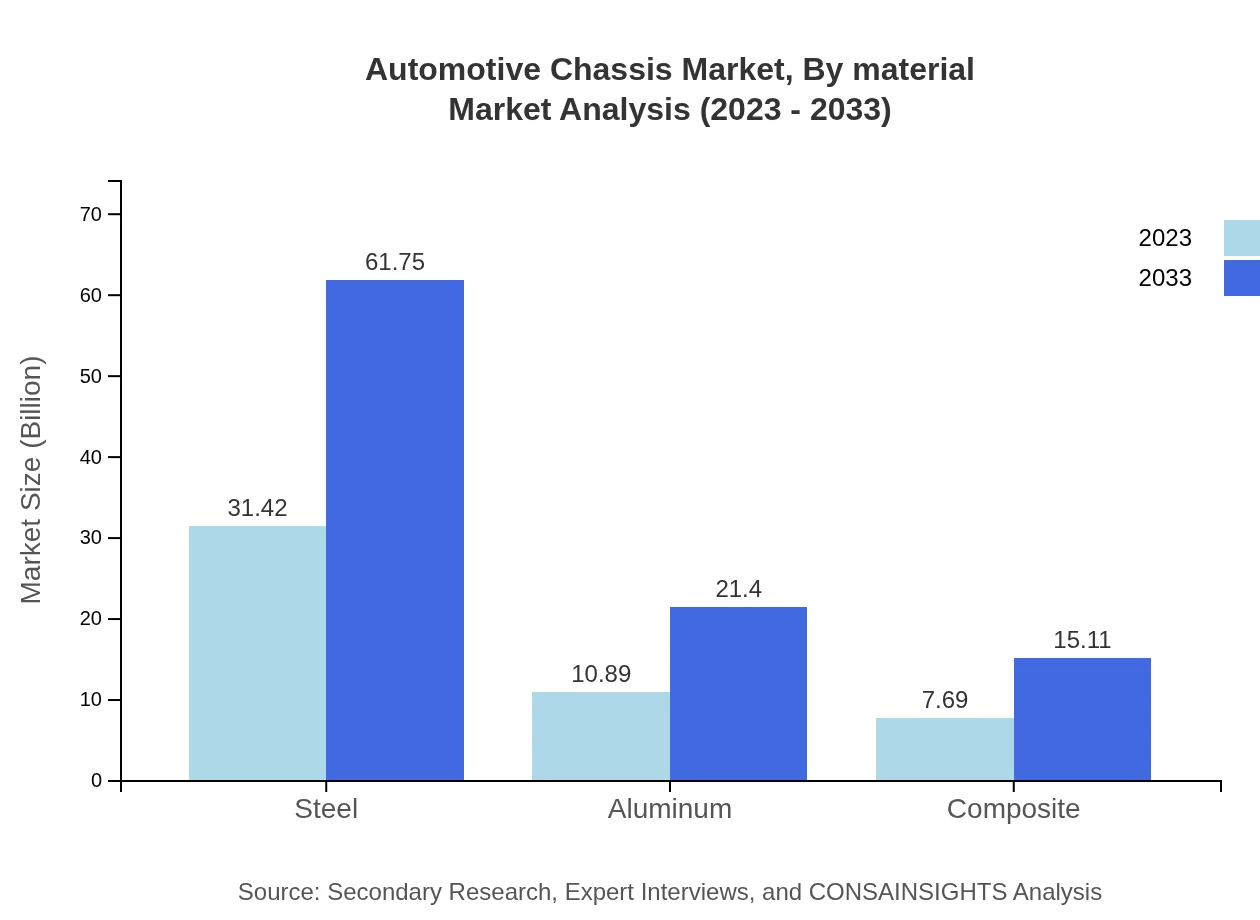

Automotive Chassis Market Analysis By Material

In terms of materials, steel, aluminum, and composites are the forefront materials utilized in automotive chassis manufacturing. Steel leads with a market size of $31.42 billion in 2023 and is projected to reach $61.75 billion by 2033 due to its strength and cost-effectiveness. Aluminum and composites are gaining traction, with estimated market values of $10.89 billion and $7.69 billion in 2023, respectively.

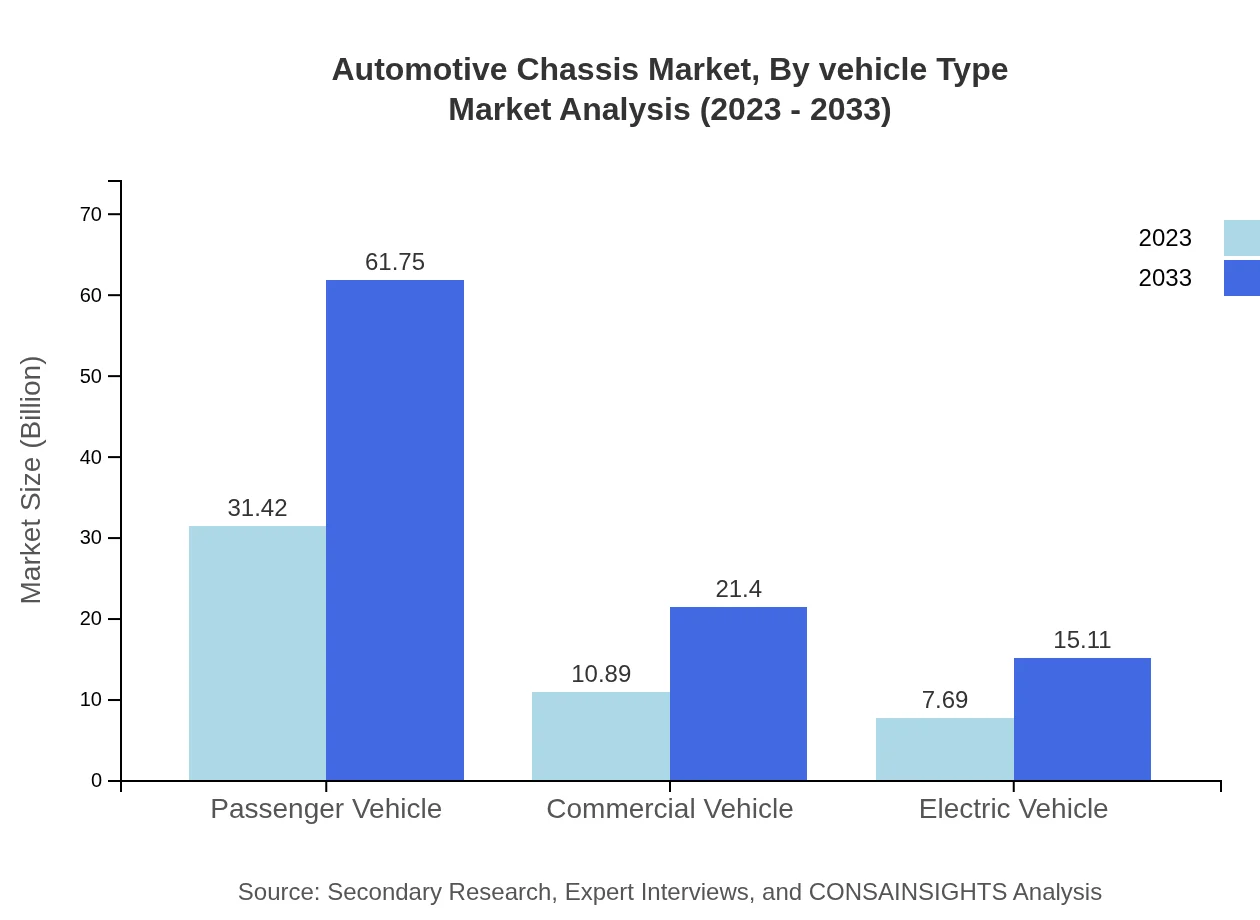

Automotive Chassis Market Analysis By Vehicle Type

The market can also be segmented by vehicle type, prominently featuring passenger vehicles and commercial vehicles. Passenger vehicles account for $31.42 billion of the market in 2023, with projections of $61.75 billion by 2033, making up 62.84% of the segment. The commercial vehicle segment, while smaller at $10.89 billion, is on track for healthy growth.

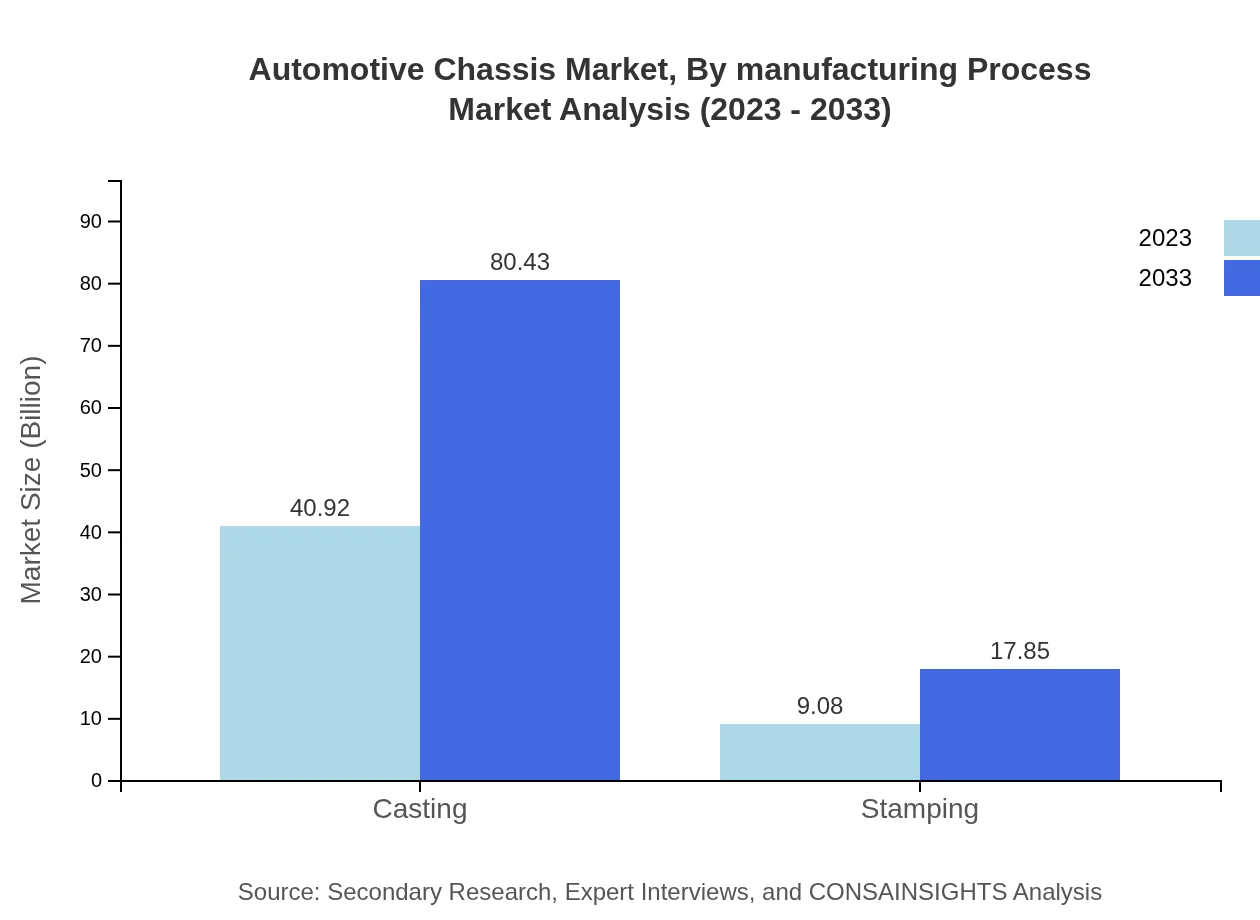

Automotive Chassis Market Analysis By Manufacturing Process

Manufacturing processes like casting and stamping play critical roles in automotive chassis production. The casting process currently dominates this segment with a market size of $40.92 billion expected to grow to $80.43 billion by 2033, accounting for 81.84% of the market. Stamping, while smaller, also shows substantial growth prospects.

Automotive Chassis Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Chassis Industry

Continental AG:

A leading automotive supplier specializing in chassis and braking systems, with innovations focused on safety and performance enhancements.Daimler AG:

A pioneer in vehicle manufacturing with significant contributions to truck and passenger vehicle chassis development.Hyundai Mobis:

One of the largest automotive suppliers global recognized for advancements in chassis technologies including electric vehicle platforms.Faurecia:

An innovative company focusing on reducing vehicle weight while enhancing chassis performance and safety.Tata Autocomp Systems:

An India-based company that provides a variety of chassis solutions, contributing robustly to the Asian automotive market.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Chassis?

The automotive chassis market is projected to reach approximately $50 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from its current levels. This strong growth reflects the increasing demand for advanced vehicle designs and technologies.

What are the key market players or companies in the automotive Chassis industry?

Key players in the automotive chassis market include leading manufacturers like Magna International, Johnson Controls, and Continental AG. These companies are pivotal in driving innovation and competing in various market segments, thereby influencing the market landscape significantly.

What are the primary factors driving the growth in the automotive Chassis industry?

The growth in the automotive chassis market is driven by increasing vehicle production, advancements in chassis design, and a rising demand for electric vehicles. The shift towards lightweight materials for better fuel efficiency also significantly contributes to market expansion.

Which region is the fastest Growing in the automotive Chassis?

The North America region is expected to exhibit the fastest growth in the automotive chassis market, with a market size increasing from $17.94 billion in 2023 to $35.26 billion by 2033, driven by a robust automotive industry and innovation.

Does ConsaInsights provide customized market report data for the automotive Chassis industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the automotive chassis industry, ensuring stakeholders gain deeper insights pertinent to their business strategies and market conditions.

What deliverables can I expect from this automotive Chassis market research project?

From the automotive chassis market research project, you can expect detailed reports including market size analysis, growth forecasts, regional insights, competitive landscape evaluations, and data segmentation for different chassis types and vehicle categories.

What are the market trends of automotive Chassis?

Current market trends in automotive chassis include the adoption of lightweight materials, increased focus on electric vehicle development, and advancements in manufacturing processes such as stamping and casting, all contributing to enhanced vehicle performance and sustainability.