Smart Manufacturing Market Report

Published Date: 22 January 2026 | Report Code: smart-manufacturing

Smart Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Smart Manufacturing market from 2023 to 2033, highlighting insights on market trends, size, segmentation, regional analysis, and key players shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

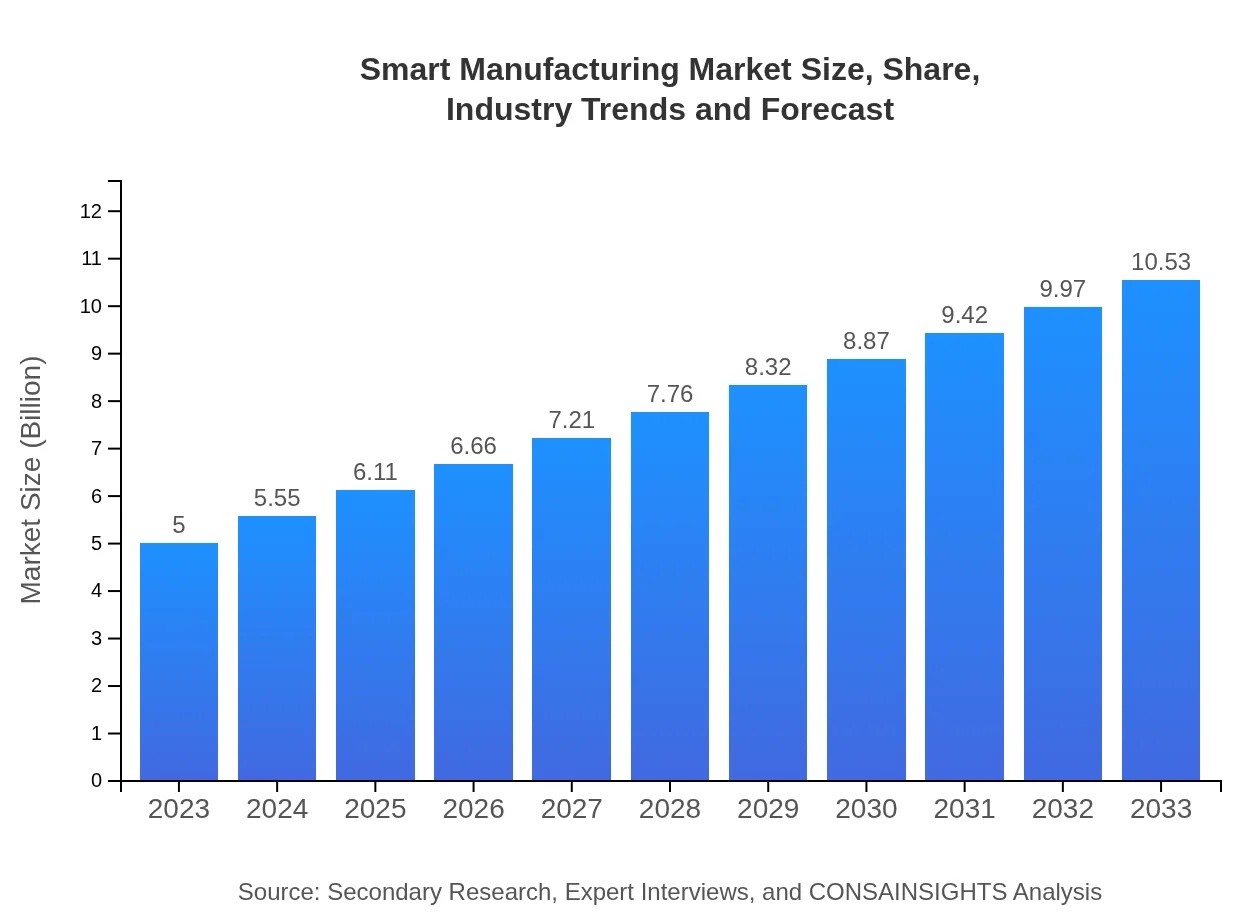

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Siemens AG, General Electric Company, Rockwell Automation, Inc., ABB Ltd., Honeywell International Inc. |

| Last Modified Date | 22 January 2026 |

Smart Manufacturing Market Overview

Customize Smart Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Smart Manufacturing market size, growth, and forecasts.

- ✔ Understand Smart Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Manufacturing

What is the Market Size & CAGR of Smart Manufacturing market in 2023?

Smart Manufacturing Industry Analysis

Smart Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Manufacturing Market Analysis Report by Region

Europe Smart Manufacturing Market Report:

Europe’s Smart Manufacturing market is anticipated to rise from $1.34 billion in 2023 to $2.83 billion by 2033. The region focuses on sustainability, coupled with strong regulatory support for innovative manufacturing practices.Asia Pacific Smart Manufacturing Market Report:

The Asia-Pacific region, valued at $1.08 billion in 2023, is expected to grow to $2.28 billion by 2033. The proliferation of manufacturing hubs and increasing investments in automation technologies underscore this growth, especially in countries like China, Japan, and South Korea.North America Smart Manufacturing Market Report:

North America, valued at $1.71 billion in 2023, is projected to reach $3.61 billion by 2033, primarily driven by heavy investments in technology and increased demand for efficiency and production optimization across industries.South America Smart Manufacturing Market Report:

In South America, the Smart Manufacturing market is projected to increase from $0.17 billion in 2023 to $0.35 billion by 2033. Growth factors include rising government initiatives and a shift towards more automated solutions in manufacturing.Middle East & Africa Smart Manufacturing Market Report:

The market in the Middle East and Africa is valued at $0.69 billion in 2023 and expected to reach $1.46 billion by 2033 due to rapid industrialization and growing adoption of automation technologies.Tell us your focus area and get a customized research report.

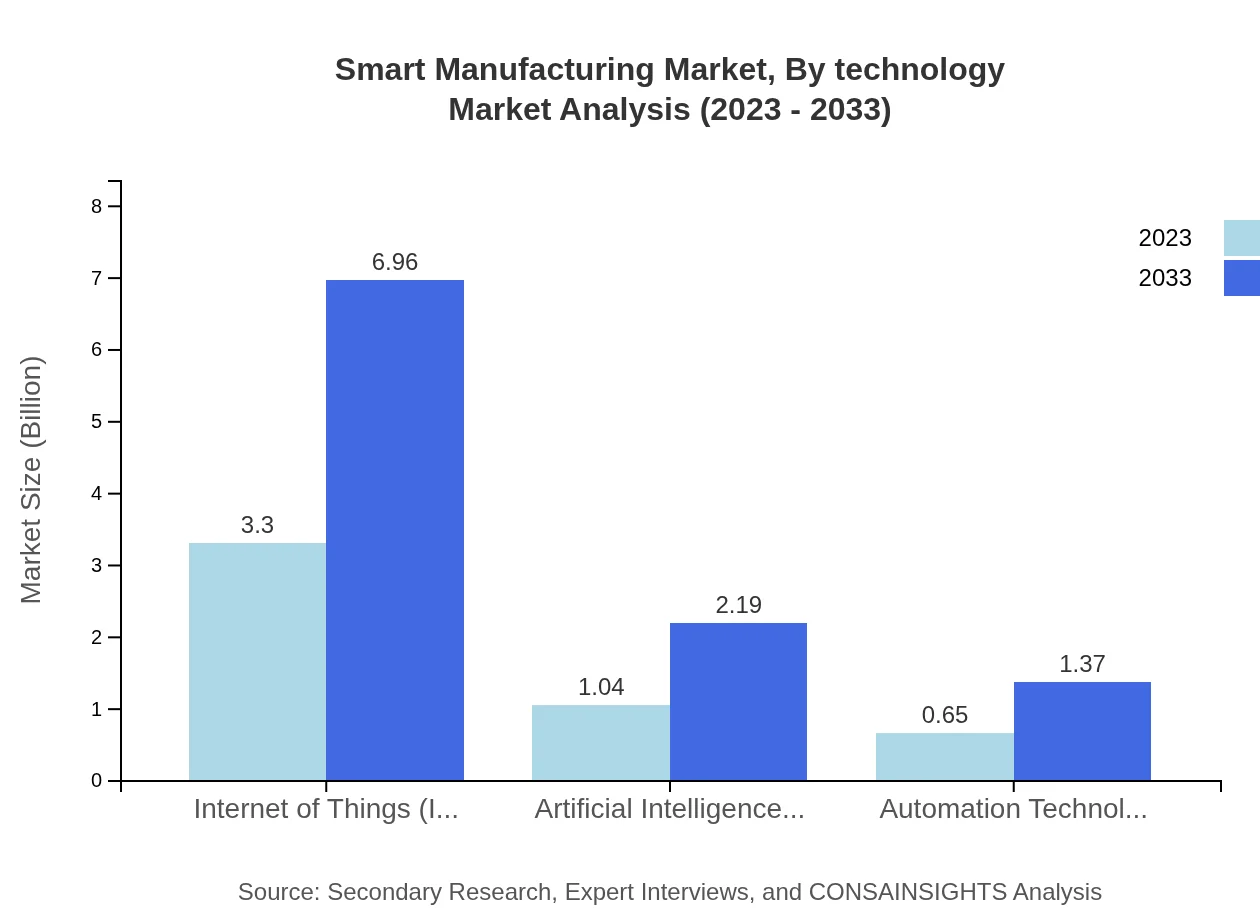

Smart Manufacturing Market Analysis By Technology

The Smart Manufacturing market, by technology, shows significant growth in various areas. The Internet of Things (IoT) segment is leading with a size increasing from $3.30 billion in 2023 to $6.96 billion in 2033, maintaining a share of 66.1%. Meanwhile, Artificial Intelligence and Machine Learning segments are projected to grow from $1.04 billion to $2.19 billion by 2033, making up 20.84% share.

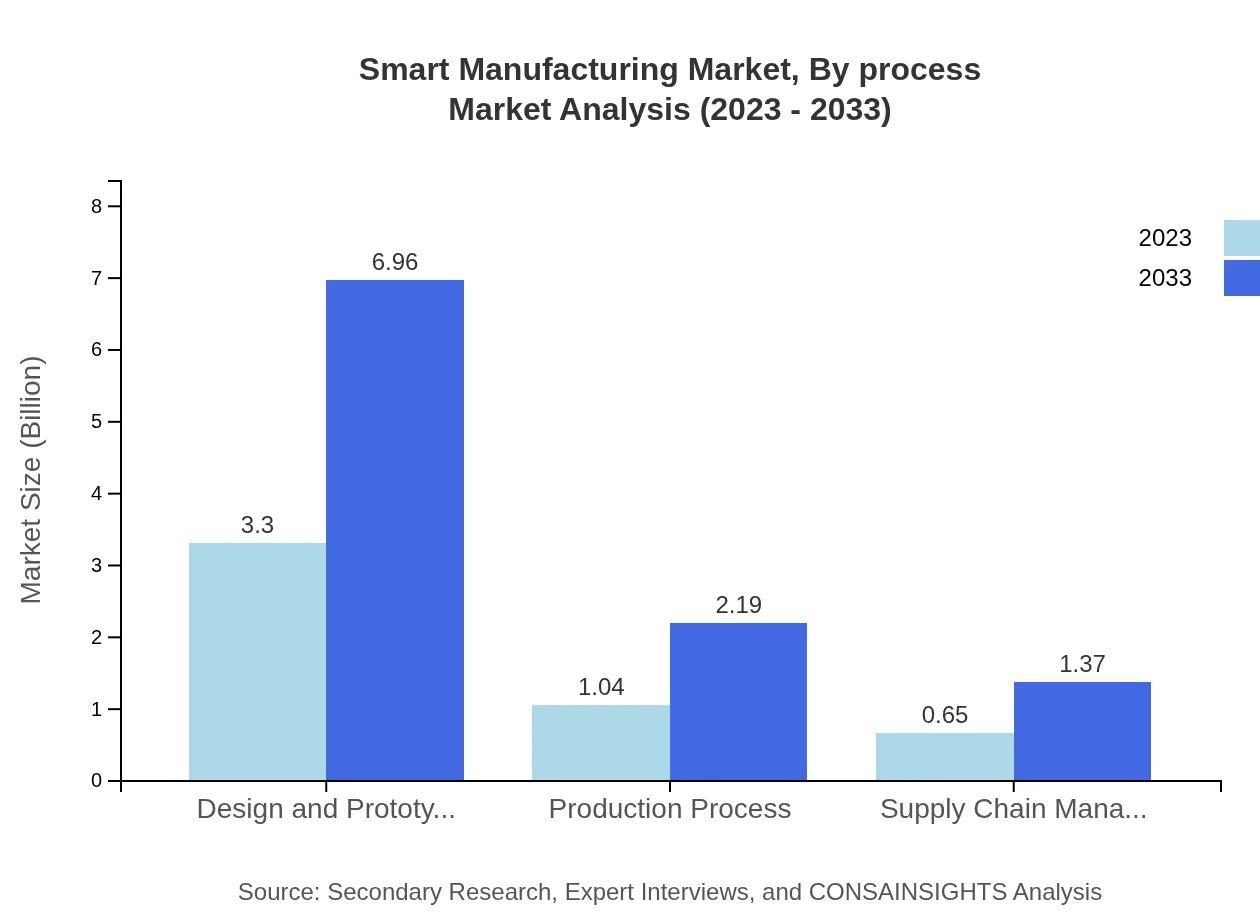

Smart Manufacturing Market Analysis By Process

The process segment, essential for manufacturing efficiency, shows growth with the production process segment increasing from $1.04 billion in 2023 to $2.19 billion by 2033 (20.84% share), while design and prototyping will expand from $3.30 billion to $6.96 billion (66.1% share).

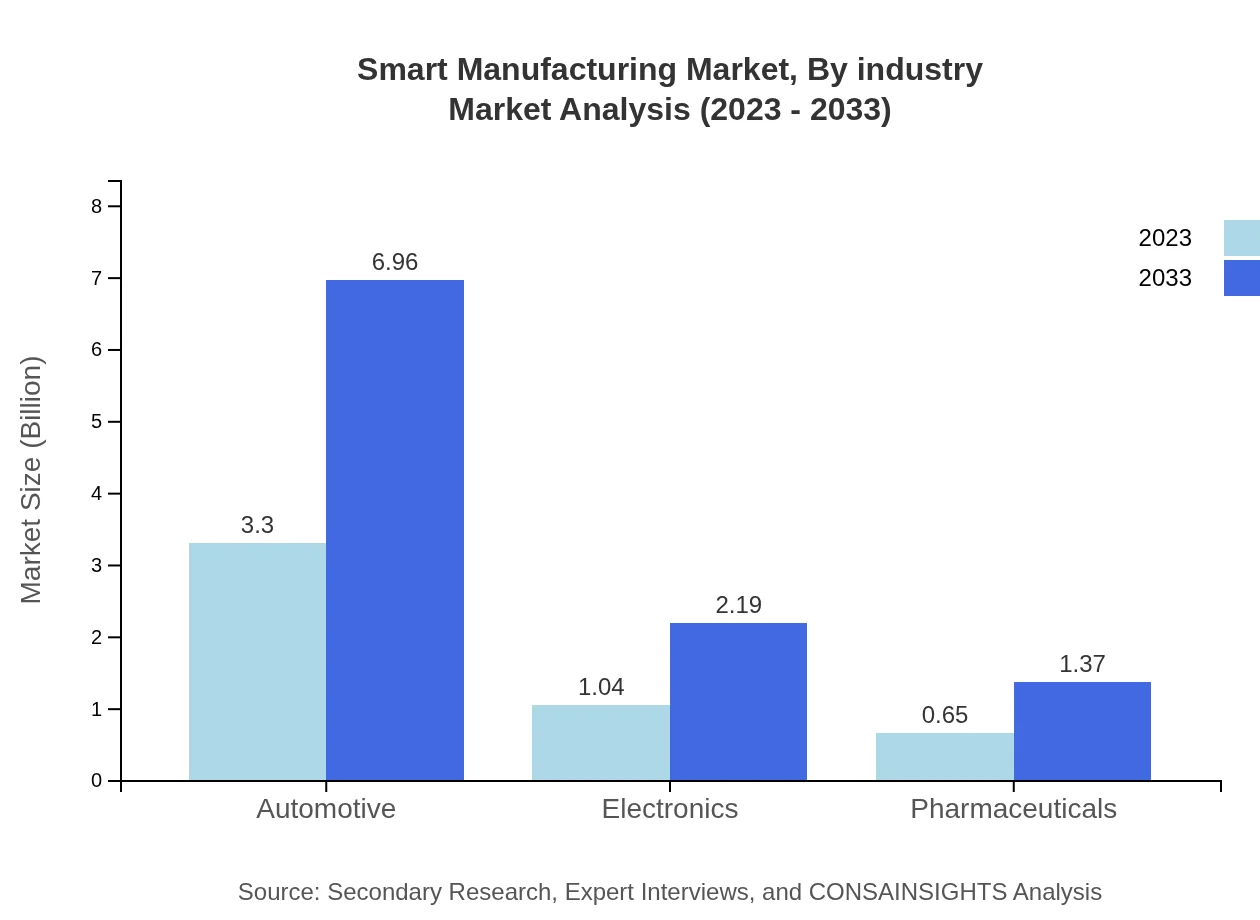

Smart Manufacturing Market Analysis By Industry

In the industry segment, the automotive sector is expected to grow from $3.30 billion in 2023 to $6.96 billion by 2033 (66.1% share). Electronics and pharmaceuticals also demonstrate significant growth potential, showing increases reflective of their dependence on smart technologies.

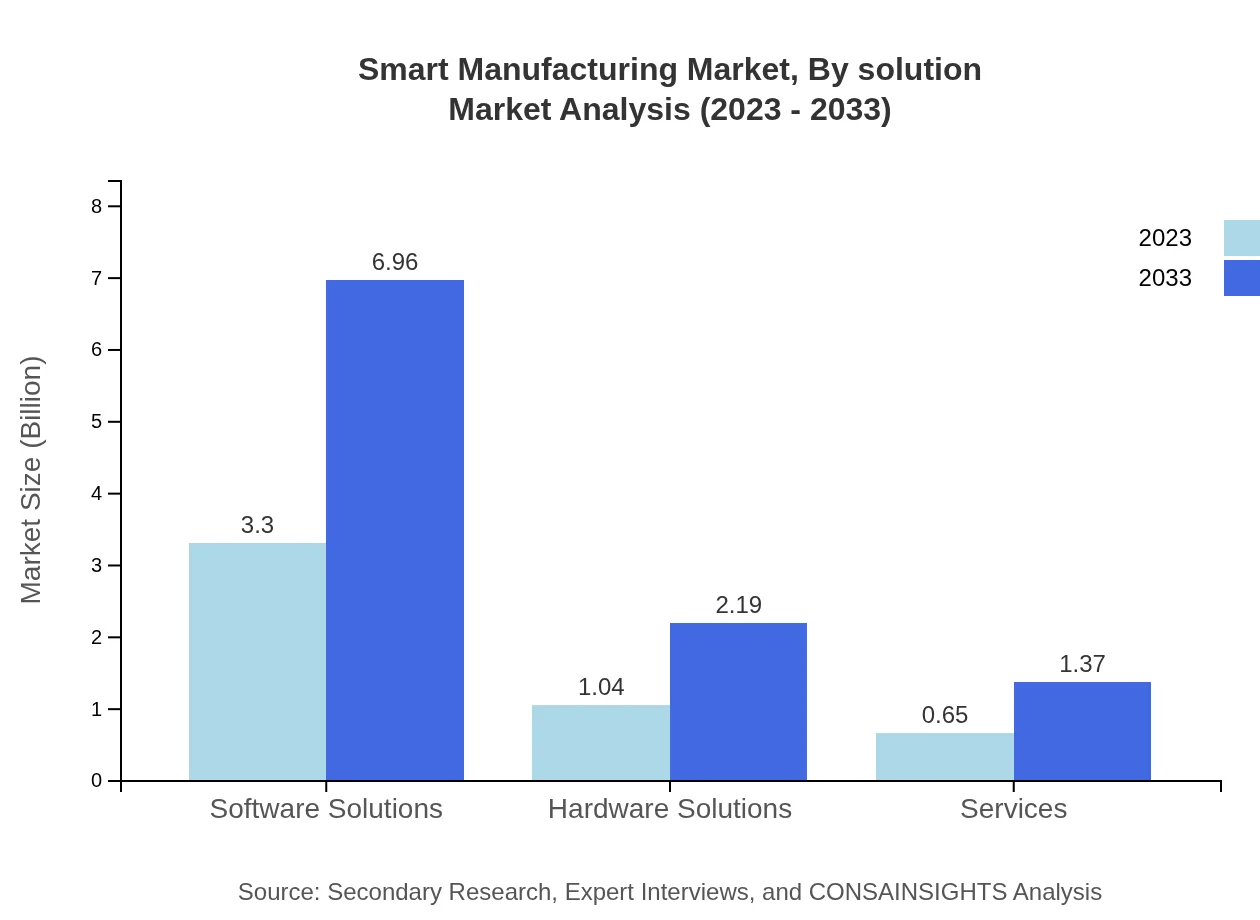

Smart Manufacturing Market Analysis By Solution

The solution segment includes services, expected to double from $0.65 billion in 2023 to $1.37 billion in 2033, indicating the rising need for comprehensive service support in smart manufacturing systems.

Smart Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Manufacturing Industry

Siemens AG:

Siemens AG is a leading player in the smart manufacturing industry, providing comprehensive automation technologies and industrial digitalization solutions.General Electric Company:

General Electric is known for its innovations in industrial IoT and smart manufacturing, focusing on sustainability and efficiency improvements.Rockwell Automation, Inc.:

Rockwell Automation specializes in industrial automation and information, playing a crucial role in advancing smart manufacturing technologies.ABB Ltd.:

ABB is a global leader in power and automation technologies, with a strong presence in the Smart Manufacturing sector, focused on improving productivity and reliability.Honeywell International Inc.:

Honeywell leverages its expertise in software and automation to transform manufacturing processes through smart solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of smart manufacturing?

The smart manufacturing market is projected to grow from approximately $5 billion in 2023, with a robust CAGR of 7.5%, indicating strong growth potential. By 2033, the market is expected to expand significantly, reflecting advancements in technology and manufacturing processes.

What are the key market players or companies in the smart manufacturing industry?

Key players in the smart manufacturing industry include major technology firms and solution providers specializing in automation and IoT integration. Companies leading in innovation and market presence are essential for driving advancements and establishing competitive benchmarks.

What are the primary factors driving the growth in the smart manufacturing industry?

The growth of smart manufacturing is driven by a combination of factors such as increased automation, the adoption of IoT technologies, rising demand for efficiency, improved supply chain management, and the need for real-time data analysis to enhance production capabilities.

Which region is the fastest Growing in the smart manufacturing?

North America is currently the fastest-growing region in the smart manufacturing sector, with market size predictions soaring from $1.71 billion in 2023 to $3.61 billion by 2033, fueled by technological innovation and substantial investments in smart solutions.

Does ConsaInsights provide customized market report data for the smart manufacturing industry?

Yes, ConsaInsights offers customized market report data tailored to the smart manufacturing industry, allowing clients to obtain specific insights and analyses that meet their unique organizational needs and goals for market entry or expansion.

What deliverables can I expect from this smart manufacturing market research project?

Clients can expect comprehensive deliverables such as detailed market analysis reports, trend forecasts, competitive assessments, customer insights, and actionable recommendations tailored to enhance understanding and strategic positioning in the smart manufacturing landscape.

What are the market trends of smart manufacturing?

Current trends in smart manufacturing include a heightened focus on IoT integration, advancements in AI and machine learning applications, increased automation, and a shift towards sustainable practices as industries strive to reduce waste and enhance operational efficiency.