Automotive Software Market Report

Published Date: 02 February 2026 | Report Code: automotive-software

Automotive Software Market Size, Share, Industry Trends and Forecast to 2033

This detailed report offers insights into the automotive software market, covering market size, CAGR, segmentation, industry analysis, regional trends, and forecasts from 2023 to 2033. It provides crucial data for stakeholders aiming to understand market trends and dynamics.

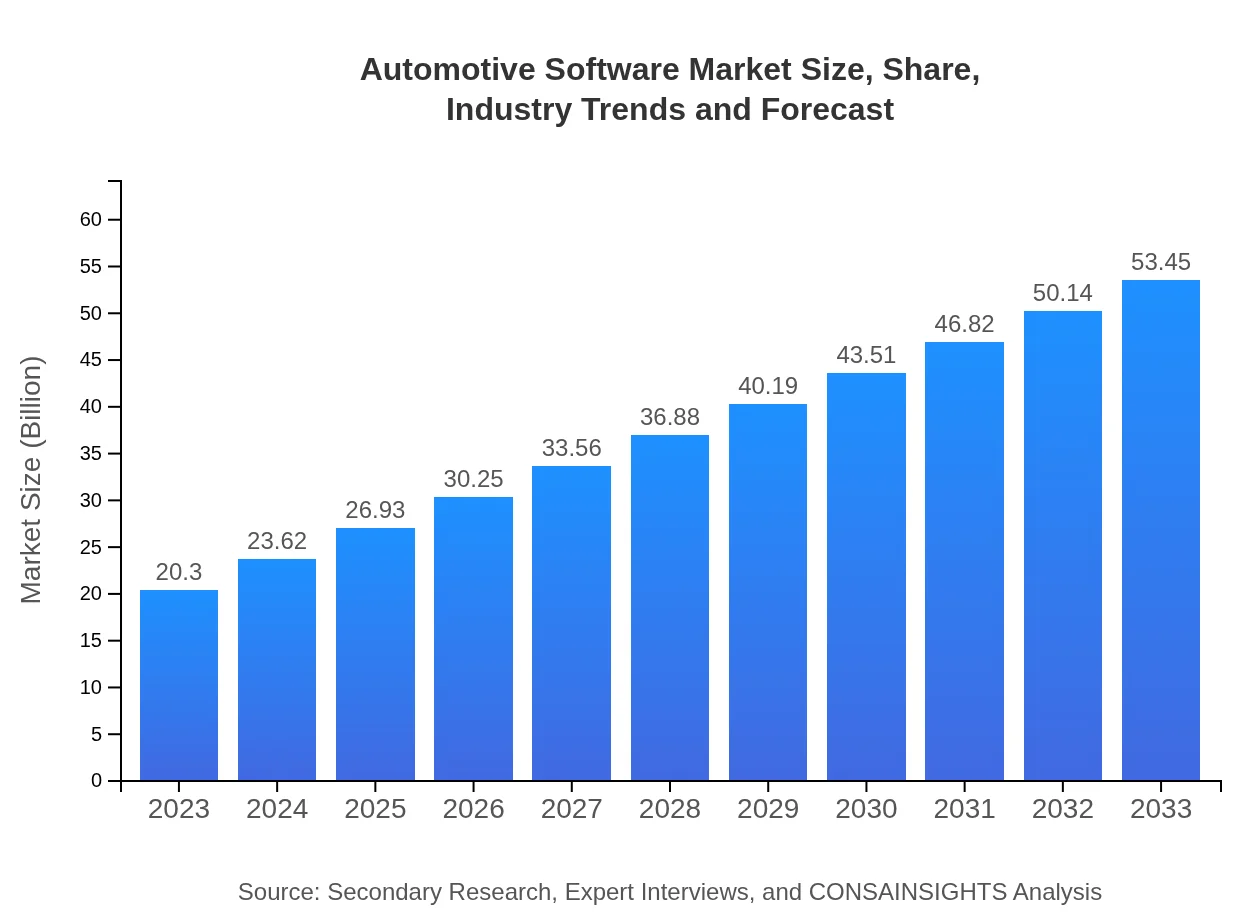

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.30 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $53.45 Billion |

| Top Companies | Wind River, Continental AG, Robert Bosch GmbH, NVIDIA Corporation, Qualcomm Technologies, Inc. |

| Last Modified Date | 02 February 2026 |

Automotive Software Market Overview

Customize Automotive Software Market Report market research report

- ✔ Get in-depth analysis of Automotive Software market size, growth, and forecasts.

- ✔ Understand Automotive Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Software

What is the Market Size & CAGR of Automotive Software market in 2023?

Automotive Software Industry Analysis

Automotive Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Software Market Analysis Report by Region

Europe Automotive Software Market Report:

The European automotive software market is anticipated to expand from $5.38 billion in 2023 to $14.17 billion by 2033. Key drivers include stringent emissions standards, a strong push towards electric mobility, and a growing emphasis on driver safety. Europe is also seeing significant R&D activities targeting advancements in automotive technologies, enhancing the overall software market.Asia Pacific Automotive Software Market Report:

The Asia Pacific region is expected to show substantial growth in the automotive software market, reaching around $11.05 billion by 2033 from $4.20 billion in 2023. Rapid urbanization, increased disposable income, and a growing automotive industry in countries like China and India are major factors driving demand. Furthermore, advancements in electric vehicles and stringent government regulations aimed at enhancing vehicle safety and environmental standards contribute to this growth.North America Automotive Software Market Report:

North America holds a significant share of the automotive software market, with a forecast market size of $17.46 billion by 2033, up from $6.63 billion in 2023. This growth is supported by the presence of major automotive manufacturers, increased adoption of electric and autonomous vehicles, and the ongoing digital transformation within the automotive sector. Innovations in connected vehicle technologies and software development are expected to further fuel the market in this region.South America Automotive Software Market Report:

In South America, the market is projected to grow from $1.77 billion in 2023 to $4.67 billion by 2033. The increase is likely driven by rising vehicle sales and improvements in technological infrastructure. Although the market faces challenges such as economic instability and supply chain issues, increasing investment in smart automotive solutions is expected to positively impact growth.Middle East & Africa Automotive Software Market Report:

The market in the Middle East and Africa is expected to witness growth from $2.32 billion in 2023 to $6.12 billion by 2033. With increasing government support for modern transportation systems and rising demand for high-tech vehicle features, there are numerous opportunities for software applications in this region. However, market growth may be restrained by infrastructural challenges and economic variability.Tell us your focus area and get a customized research report.

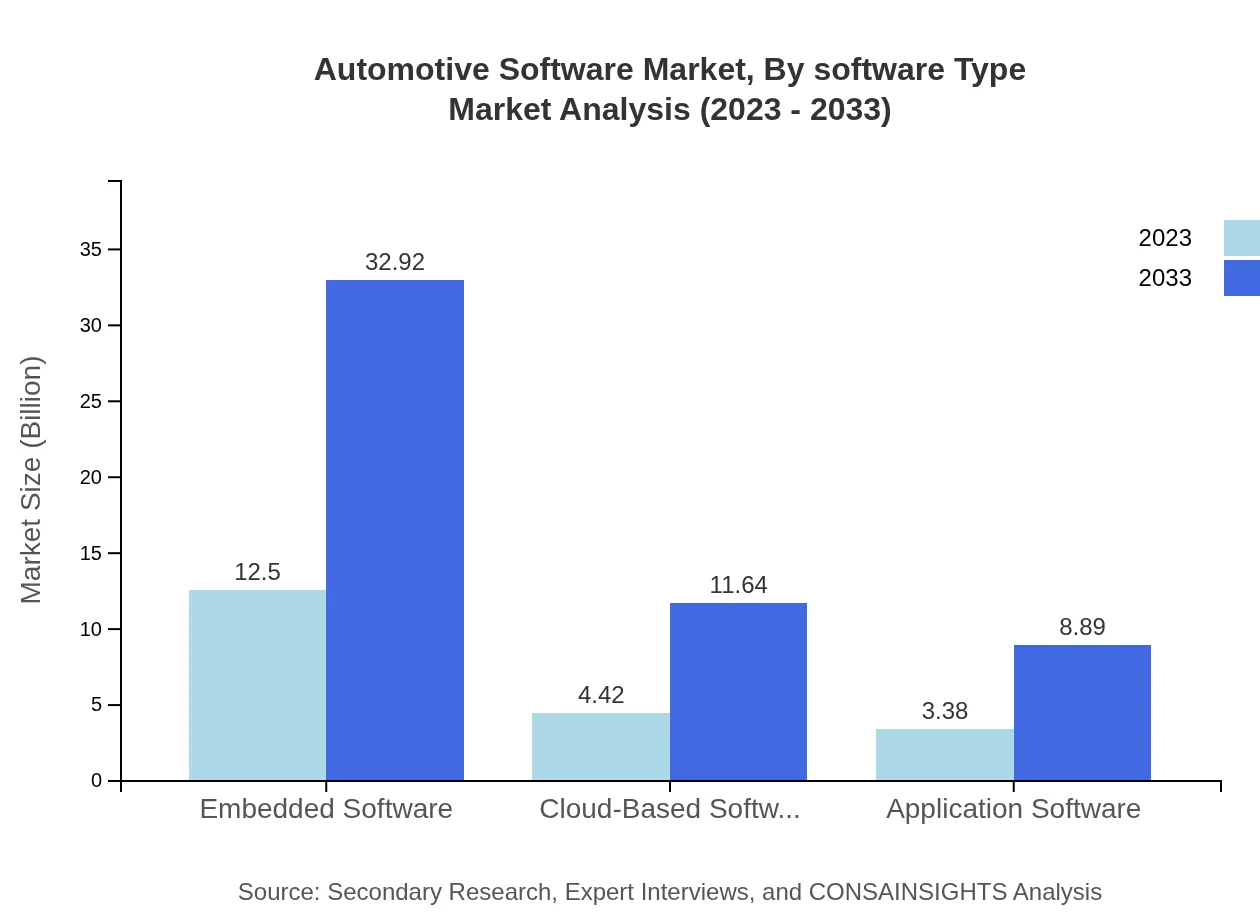

Automotive Software Market Analysis By Software Type

The automotive software market can be categorized into various software types including embedded software, cloud-based software, and application software. As of 2023, embedded software dominates the market with a size of approximately $12.50 billion, accounting for 61.59% of the market share. By 2033, its size is projected to rise to $32.92 billion. Cloud-based solutions, presently valued at $4.42 billion (21.78% market share), are also expected to grow significantly, reaching around $11.64 billion by 2033.

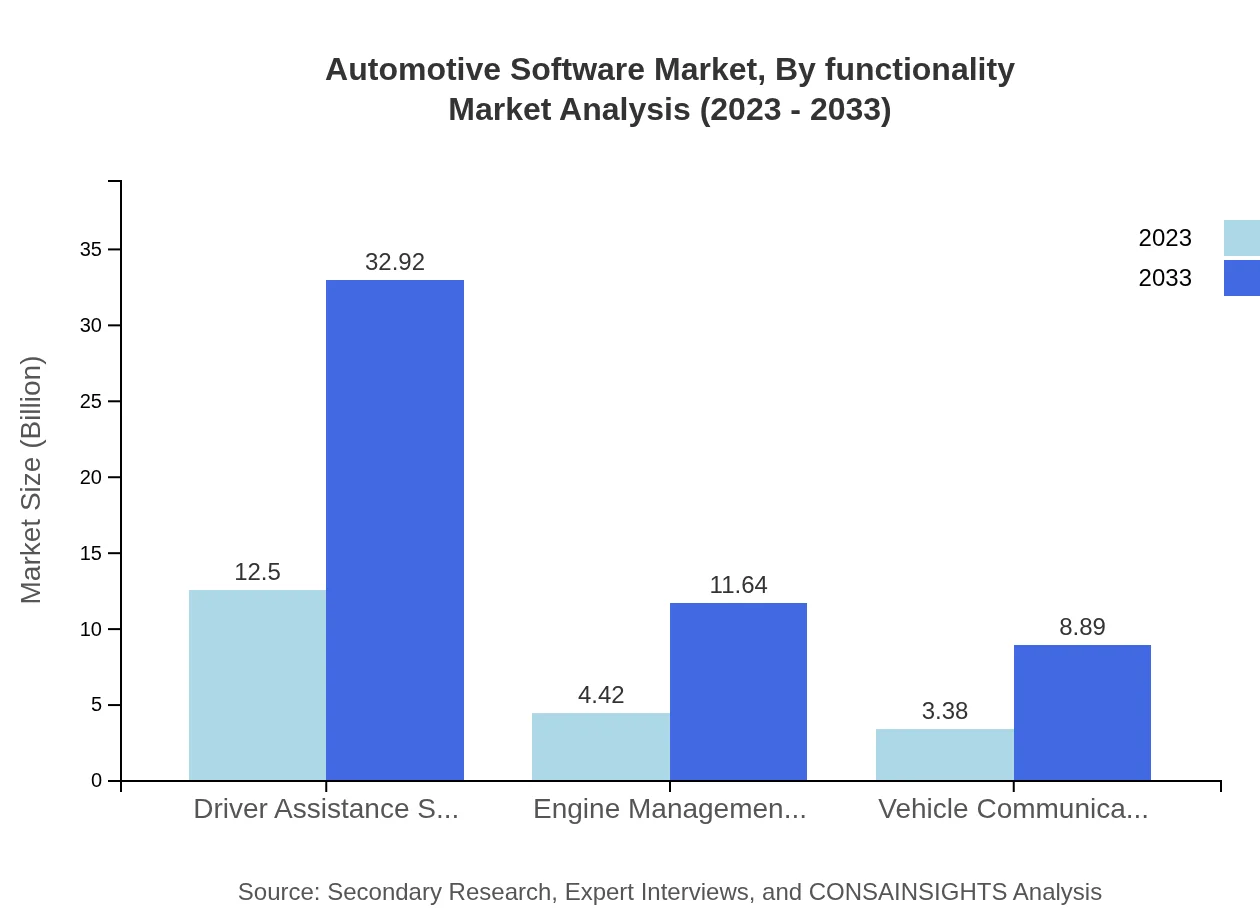

Automotive Software Market Analysis By Functionality

The market can be analyzed based on functionalities such as driver assistance systems, engine management systems, and vehicle communication software. Driver assistance systems currently lead the market with an estimated size of $12.50 billion and a significant share of 61.59%, while by 2033, this segment is expected to grow to $32.92 billion.

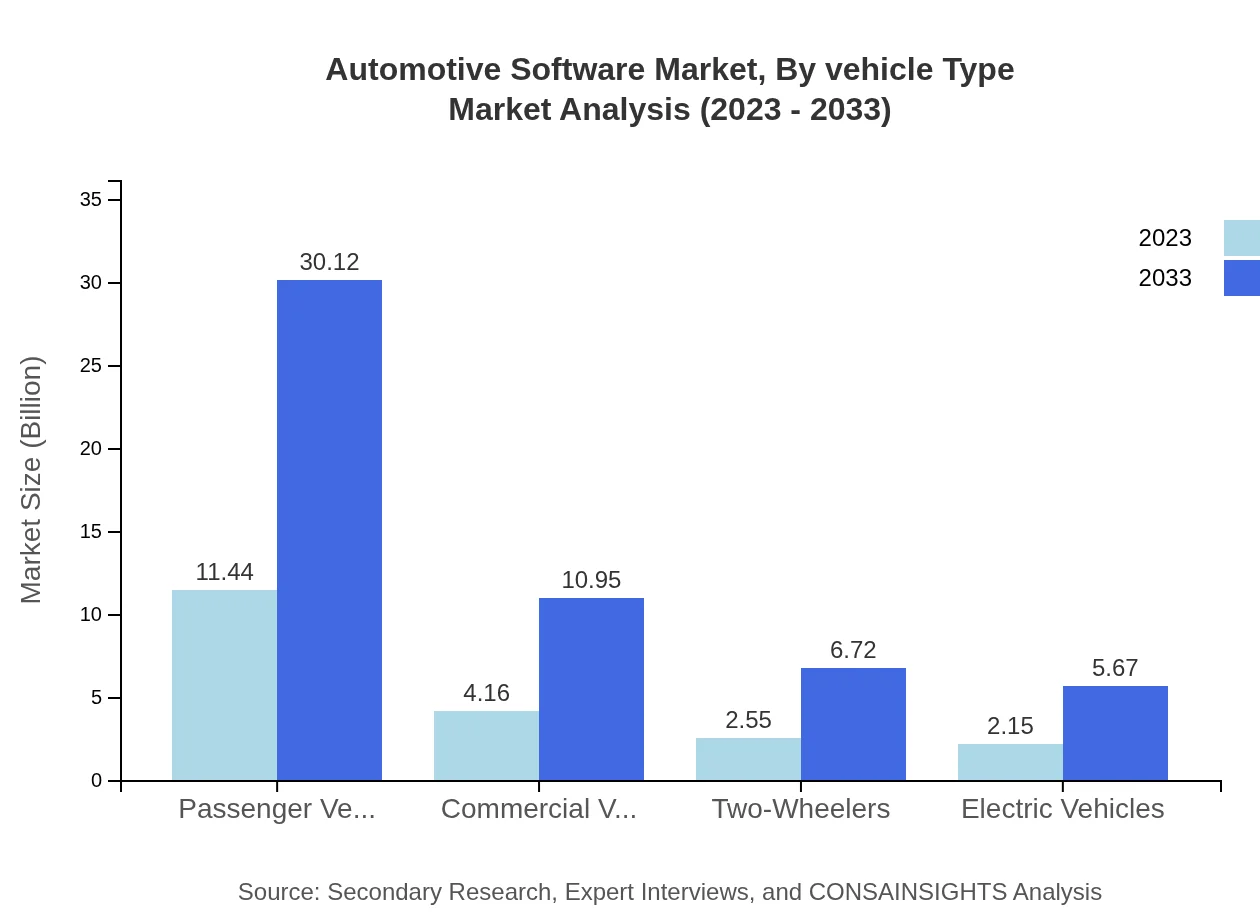

Automotive Software Market Analysis By Vehicle Type

The automotive software market's segmentation by vehicle type reveals a substantial size for passenger vehicles at $11.44 billion (56.35% share) in 2023, with projected growth to $30.12 billion by 2033. Meanwhile, commercial vehicles and electric vehicles represent other crucial segments, with significant growth expected in the coming years.

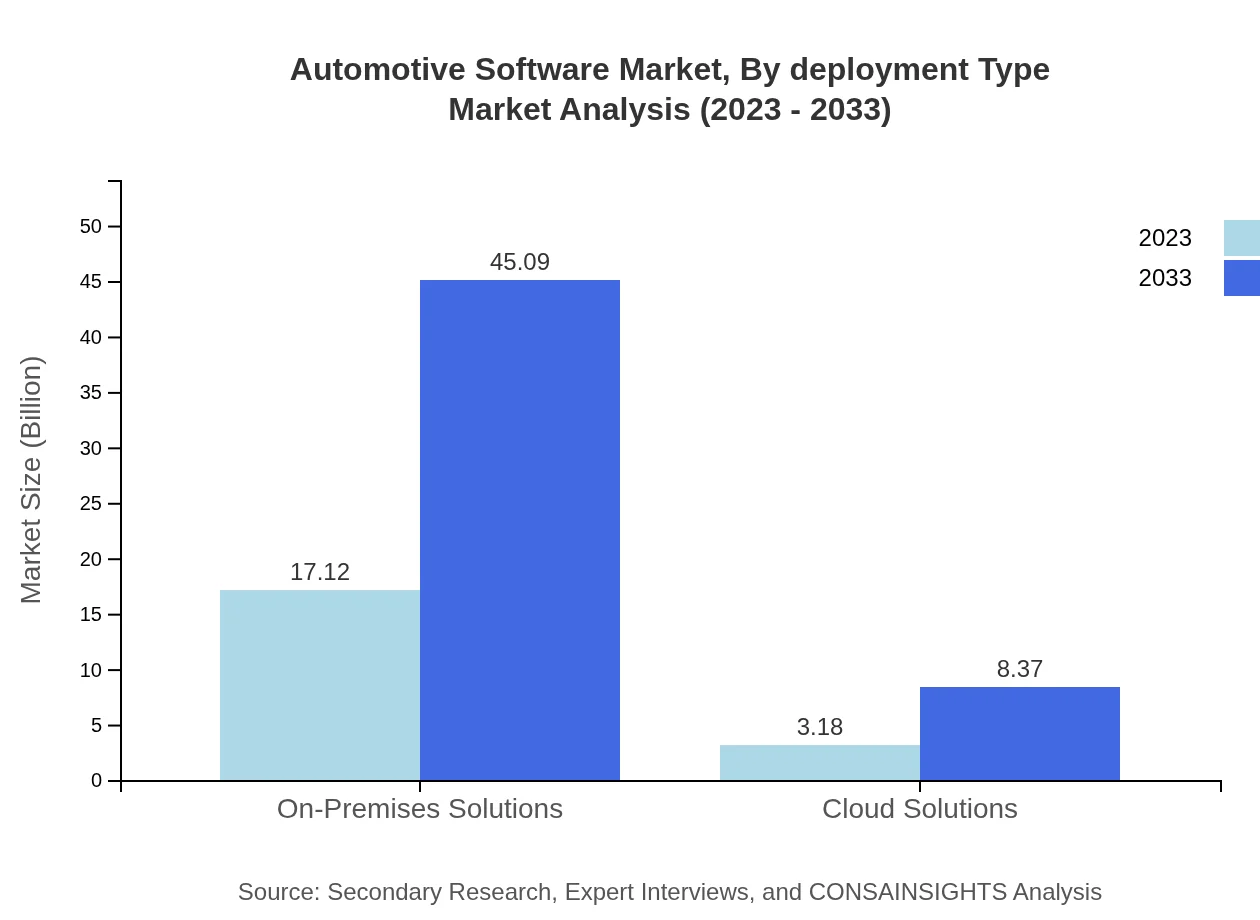

Automotive Software Market Analysis By Deployment Type

Deployment types in the automotive software market include on-premises solutions and cloud solutions. On-premises solutions dominate with about $17.12 billion market size and an 84.35% share in 2023, projected to increase to $45.09 billion by 2033, while the cloud solution segment is anticipated to grow as more companies opt for cloud-based applications.

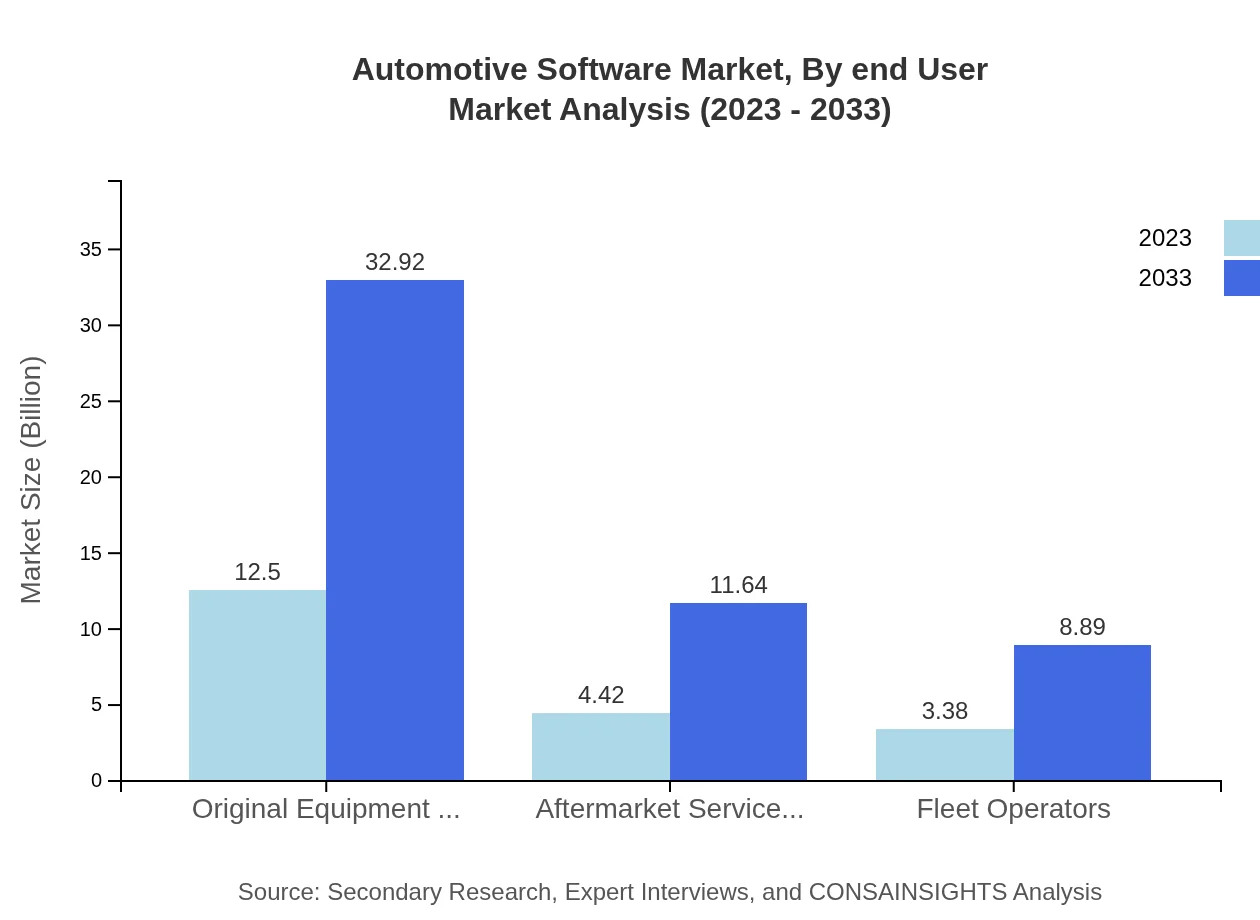

Automotive Software Market Analysis By End User

The end-user segmentation reveals Original Equipment Manufacturers (OEMs) leading with $12.50 billion in market size (61.59% share) in 2023, poised to reach $32.92 billion by 2033. Aftermarket service providers and fleet operators represent additional segments with their own distinct growth potential.

Automotive Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Software Industry

Wind River:

A key player in the automotive industry, Wind River offers solutions for embedded software that enhance vehicle performance, safety, and reliability.Continental AG:

Continental AG focuses on technological innovation in automotive software, producing software solutions essential for vehicle communication, driver assistance, and infotainment.Robert Bosch GmbH:

Robert Bosch GmbH is known for its comprehensive automotive software and IoT solutions that drive efficiency and safety in modern vehicles.NVIDIA Corporation:

NVIDIA specializes in AI and deep learning software that supports autonomous driving, providing high-performance computing for automotive applications.Qualcomm Technologies, Inc.:

Qualcomm delivers advanced automotive software solutions catering to connectivity and infotainment systems, enhancing the in-car experience.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive software?

The automotive software market is valued at $20.3 billion in 2023, with a projected CAGR of 9.8% until 2033, indicating significant growth in this sector across various segments.

What are the key market players or companies in this automotive software industry?

Key players in the automotive software industry include major automotive manufacturers, software developers, and technology firms focusing on smart vehicle solutions and OEM partnerships.

What are the primary factors driving the growth in the automotive software industry?

Factors driving growth include the rise of electric and autonomous vehicles, increased demand for connectivity features, advanced driver-assistance systems (ADAS), and regulatory requirements.

Which region is the fastest Growing in the automotive software?

North America is the fastest-growing region, expanding from $6.63 billion in 2023 to $17.46 billion by 2033, driven by technological innovations and increased adoption of software in vehicles.

Does ConsaInsights provide customized market report data for the automotive software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, including detailed analyses of segments, companies, and regional trends.

What deliverables can I expect from this automotive software market research project?

Deliverables include comprehensive market analysis reports, trend forecasts, competitor benchmarking, segment insights, and actionable strategies tailored to client specifications.

What are the market trends of automotive software?

Emerging trends include increased integration of AI in vehicle systems, growth of on-premises solutions, adoption of cloud technologies, and a rise in vehicle-to-everything (V2X) communication.