Gas Turbines Market Report

Published Date: 22 January 2026 | Report Code: gas-turbines

Gas Turbines Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Gas Turbines market, exploring key trends, technologies, and forecasts for the period from 2023 to 2033. It aims to offer insights into market dynamics, segmentation, regional performances, and growth opportunities.

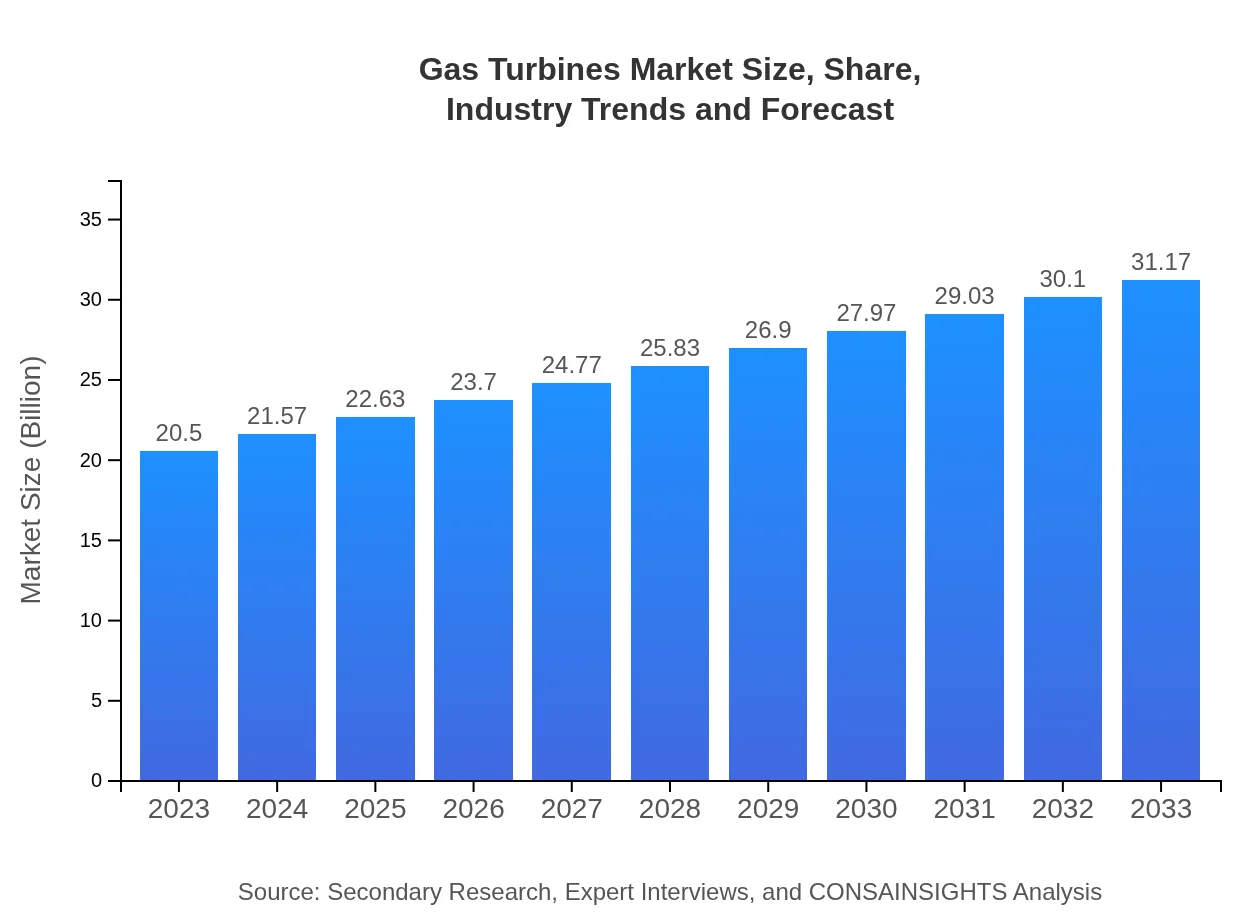

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $31.17 Billion |

| Top Companies | General Electric, Siemens AG, Mitsubishi Power, Ansaldo Energia, NNG |

| Last Modified Date | 22 January 2026 |

Gas Turbines Market Overview

Customize Gas Turbines Market Report market research report

- ✔ Get in-depth analysis of Gas Turbines market size, growth, and forecasts.

- ✔ Understand Gas Turbines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Turbines

What is the Market Size & CAGR of Gas Turbines market in 2023?

Gas Turbines Industry Analysis

Gas Turbines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Turbines Market Analysis Report by Region

Europe Gas Turbines Market Report:

Europe showcases a robust Gas Turbines market, starting at $6.34 billion in 2023 and projected to grow to $9.64 billion by 2033. Stringent emission regulations and a focus on renewable integration further stimulate investments in gas turbine technologies.Asia Pacific Gas Turbines Market Report:

In 2023, the Gas Turbines market in the Asia Pacific is valued at $3.14 billion, with projections to grow to $4.77 billion by 2033. The region is experiencing rapid industrial growth, increasing energy demands, and significant government investments in infrastructure, bolstering gas turbine adoption.North America Gas Turbines Market Report:

North America holds a substantial market share, valued at $7.96 billion in 2023, with forecasts indicating $12.11 billion by 2033. This growth is influenced by the presence of major gas utility companies, technological advancements, and a shift towards natural gas consumption.South America Gas Turbines Market Report:

For South America, the market starts at $2.04 billion in 2023 and is expected to reach $3.11 billion by 2033, as countries seek to improve their energy security and invest in cleaner technologies driven by the need for sustainable solutions.Middle East & Africa Gas Turbines Market Report:

The Middle East and Africa region presents a market value of $1.02 billion in 2023, anticipated to expand to $1.55 billion by 2033, driven by oil and gas exploration activities and a gradual shift towards natural gas for power generation.Tell us your focus area and get a customized research report.

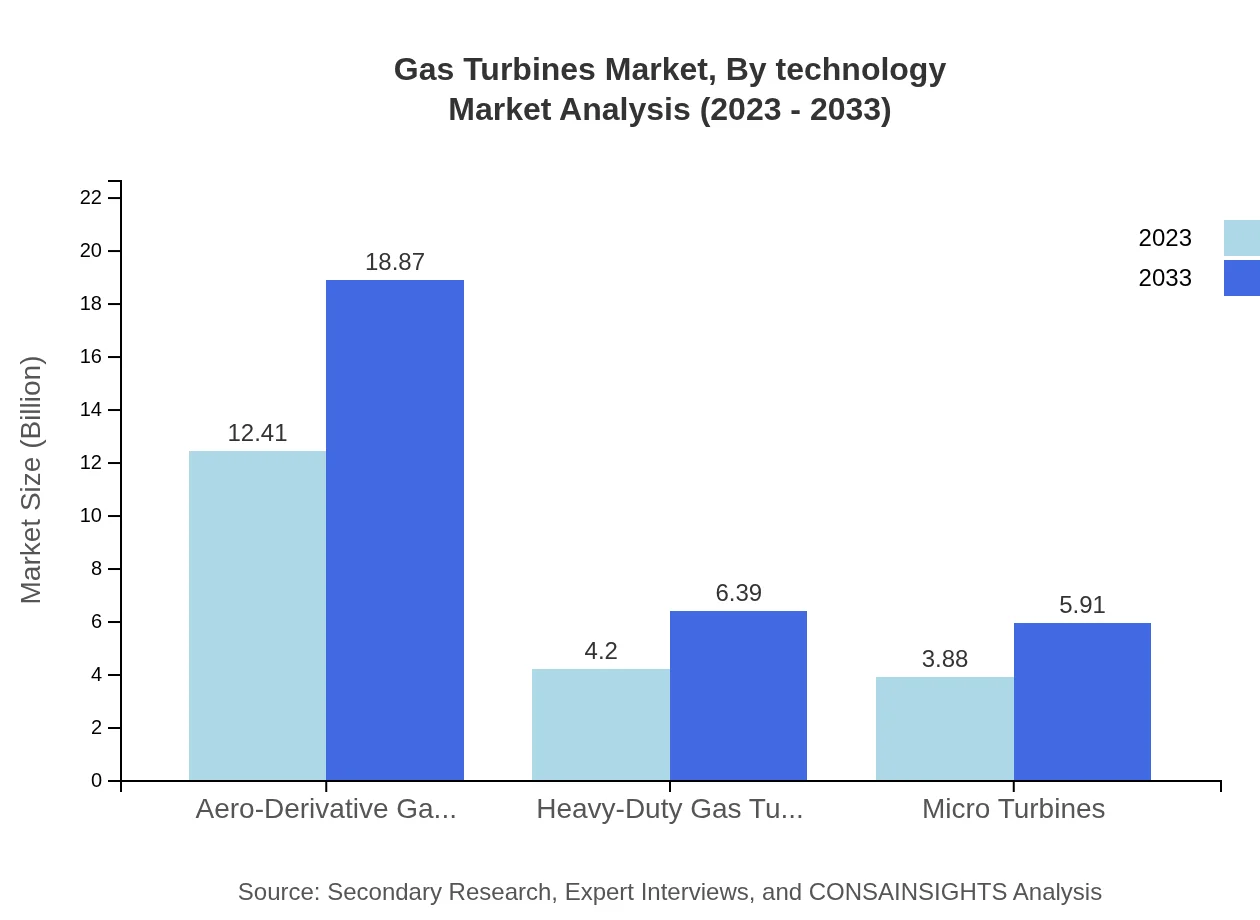

Gas Turbines Market Analysis By Technology

The Gas Turbines Market is witnessing significant activity across various technology segments. Aero-Derivative Gas Turbines currently dominate the market, accounting for approximately $12.41 billion in 2023, expected to grow to $18.87 billion by 2033. Their flexibility and efficiency make them suitable for both power generation and industrial applications. Heavy-Duty Gas Turbines hold a market size of $4.20 billion in 2023, growing to $6.39 billion by 2033, primarily due to their reliability in large-scale power generation. Micro Turbines are emerging as a vital segment, valued at $3.88 billion in 2023, projected to reach $5.91 billion by 2033, fueled by their application in distributed energy systems.

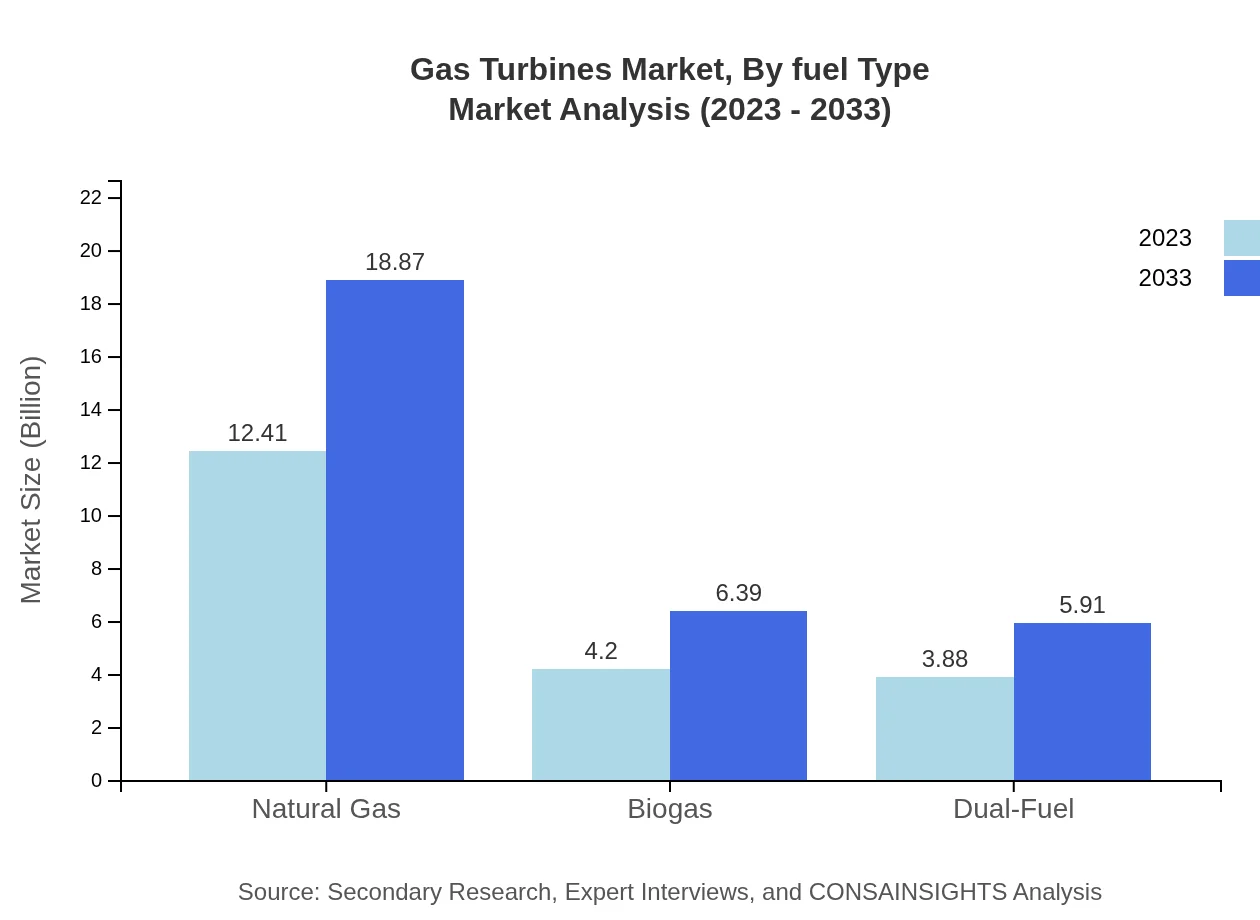

Gas Turbines Market Analysis By Fuel Type

Natural Gas remains the primary fuel source in the Gas Turbines market, anticipated to generate $12.41 billion in 2023 and rise to $18.87 billion by 2033, capturing 60.56% of the market share. Biogas and Dual-Fuel options are also growing, with Biogas leveraging a market value of $4.20 billion in 2023, expected to reach $6.39 billion by 2033. The rising environmental concerns and regulations favor the use of cleaner fuel options, thus widening the scope for biogas solutions.

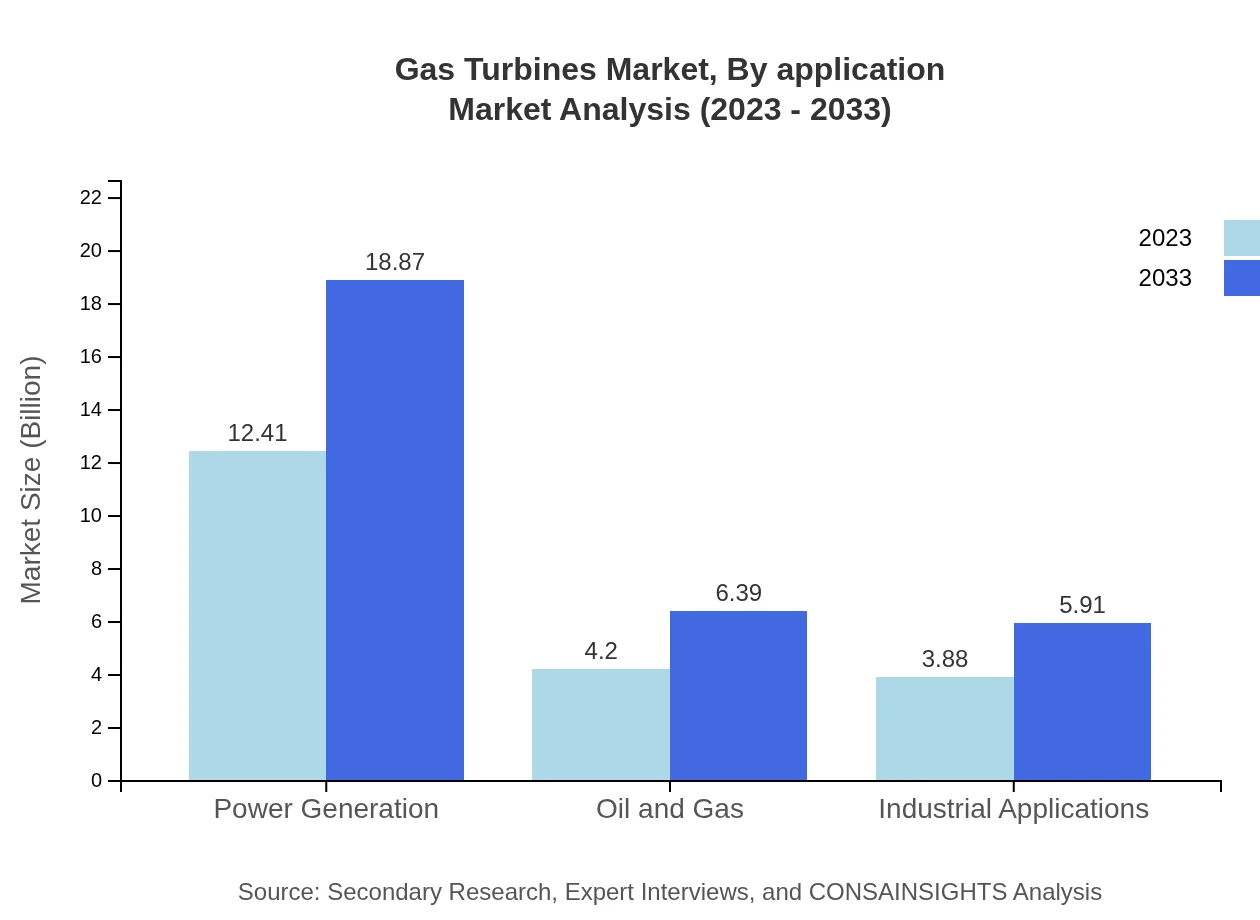

Gas Turbines Market Analysis By Application

The application of Gas Turbines spans several sectors, with Power Generation leading the market, valued at $12.41 billion in 2023 and anticipated to grow to $18.87 billion by 2033. The Oil and Gas sector follows, currently valued at $4.20 billion, projected to increase to $6.39 billion, driven by the essential role of gas turbines in production and processing operations. Emerging applications in Industrial sectors also showcase significant growth potential, reflecting the versatility of gas turbines.

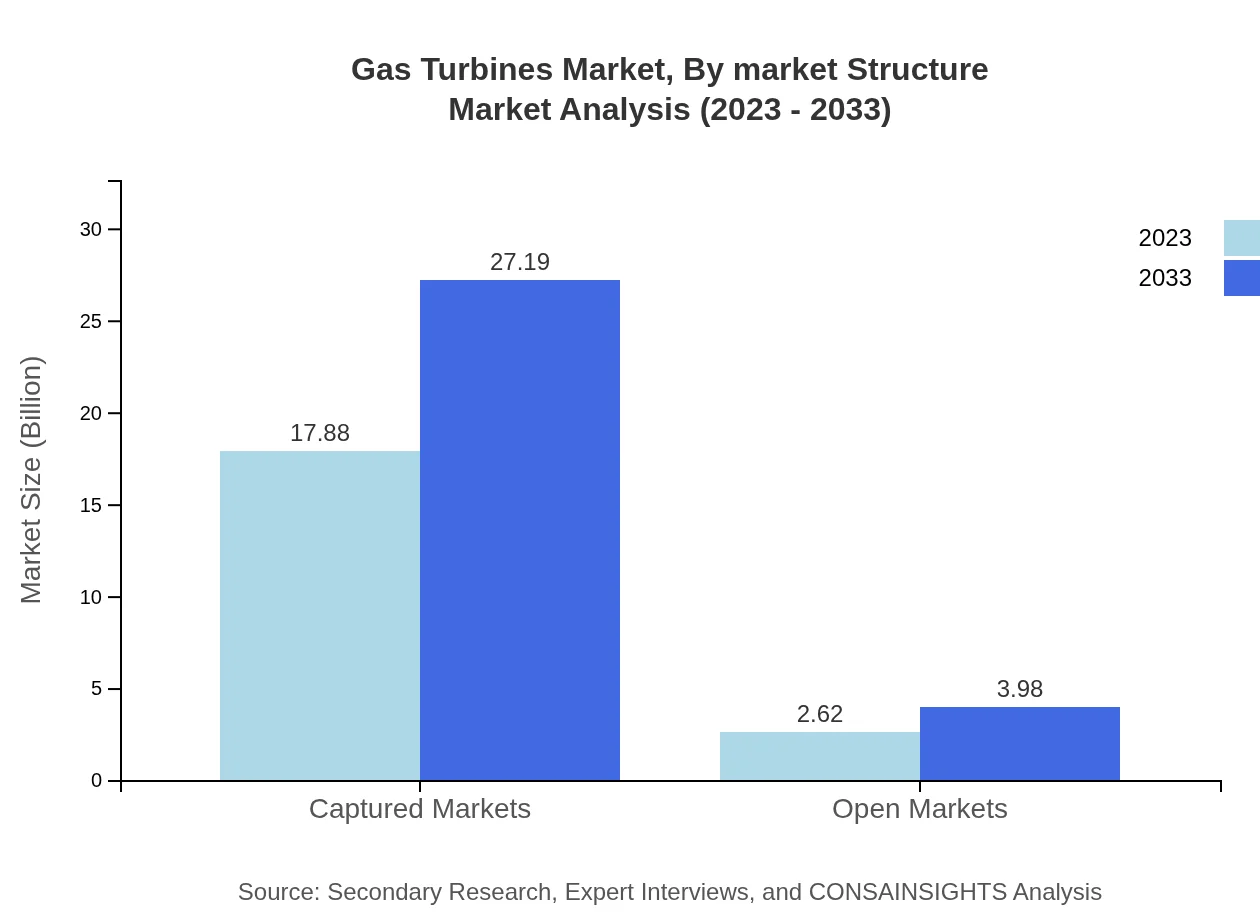

Gas Turbines Market Analysis By Market Structure

The market structure of Gas Turbines can be classified into Captured Markets and Open Markets. Captured Markets dominate with a size of $17.88 billion in 2023, expanding to $27.19 billion by 2033, signifying robust demand from established players and steady revenues. Open Markets present a smaller segment, starting at $2.62 billion and expected to grow to $3.98 billion, showcasing opportunities for new entrants and innovation.

Gas Turbines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Turbines Industry

General Electric:

A leading player in the Gas Turbines market, GE focuses on energy efficiency and cutting-edge technology, offering a wide range of gas turbine solutions for diverse applications.Siemens AG:

Known for its advanced gas turbine technologies, Siemens AG employs innovative methods for energy production, emphasizing environmental sustainability and high reliability.Mitsubishi Power:

Mitsubishi Power is recognized for its significant contributions to gas turbine technology, providing solutions that enhance performance and lower emissions.Ansaldo Energia:

Ansaldo Energia specializes in power generation solutions and contributes to the Gas Turbines market with efficient turbine designs and maintenance services.NNG:

NNG focuses on gas turbines' optimization for offshore and onshore applications; helping industries to facilitate the transition to cleaner power generation.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Turbines?

The global gas turbines market is valued at approximately $20.5 billion in 2023 and is expected to grow at a CAGR of 4.2%, reaching notable growth by 2033.

What are the key market players or companies in this gas Turbines industry?

Key players in the gas turbines market include General Electric, Siemens, Mitsubishi Heavy Industries, and Alstom. These companies are known for their innovative technologies and robust market presence.

What are the primary factors driving the growth in the gas Turbines industry?

Growth is driven by increasing demand for cleaner energy solutions, advancements in technology, and the expansion of power generation capacity due to population growth.

Which region is the fastest Growing in the gas Turbines?

North America is the fastest-growing region in the gas turbines market, projected to expand from $7.96 billion in 2023 to $12.11 billion by 2033, highlighting robust demand for energy solutions.

Does ConsaInsights provide customized market report data for the gas Turbines industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the gas turbines sector, enabling targeted insights and detailed analysis.

What deliverables can I expect from this gas Turbines market research project?

Deliverables include a comprehensive market analysis, segmentation data, regional insights, and competitive landscape assessments tailored to client objectives in the gas turbines industry.

What are the market trends of gas Turbines?

Current trends in the gas turbines market include a shift towards natural gas utilization, increasing adoption of biogas technologies, and greater emphasis on energy efficiency in industrial applications.