Gcc Construction Machinery Market Report

Published Date: 02 February 2026 | Report Code: gcc-construction-machinery

Gcc Construction Machinery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gcc construction machinery market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional dynamics, technology advancements, and key players in the industry.

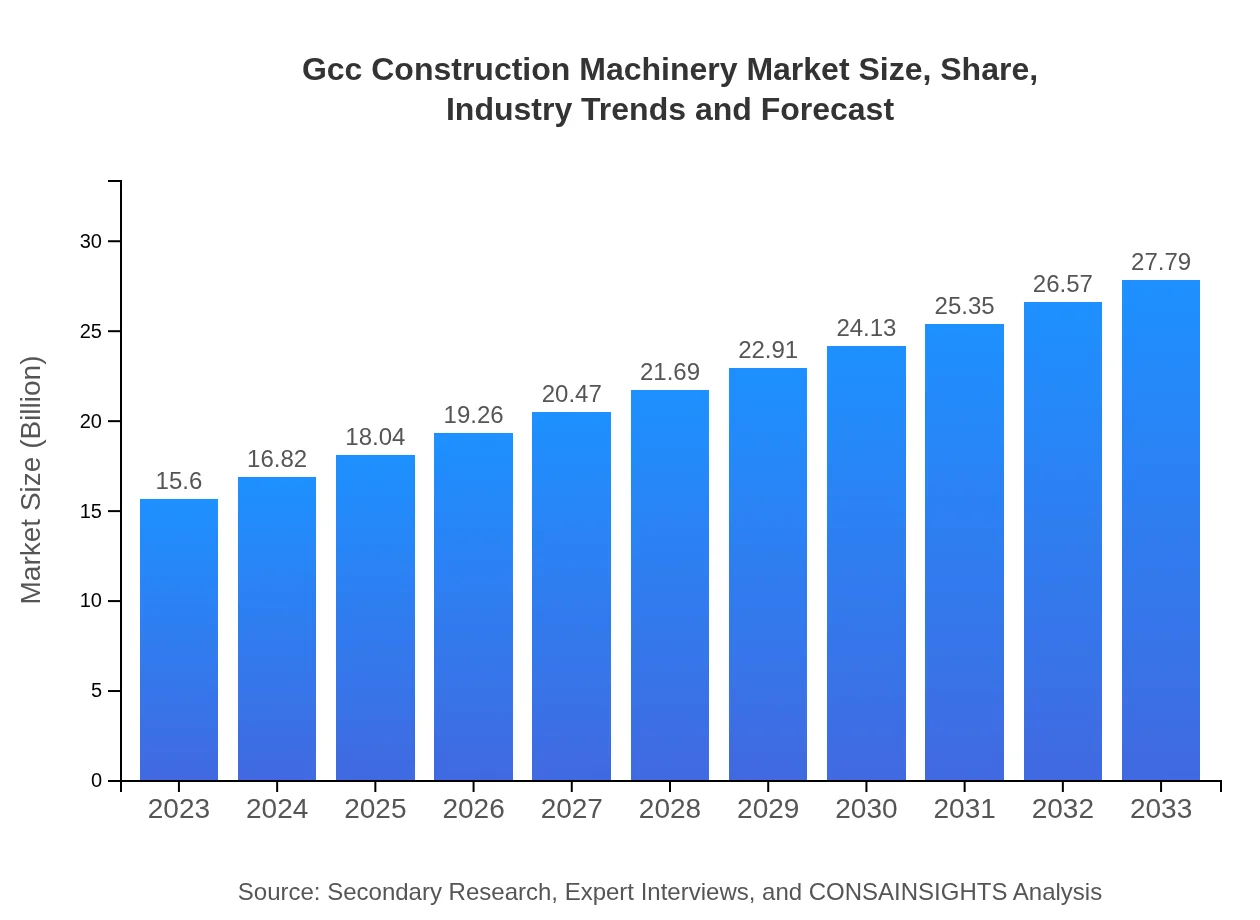

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., JCB |

| Last Modified Date | 02 February 2026 |

Gcc Construction Machinery Market Overview

Customize Gcc Construction Machinery Market Report market research report

- ✔ Get in-depth analysis of Gcc Construction Machinery market size, growth, and forecasts.

- ✔ Understand Gcc Construction Machinery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gcc Construction Machinery

What is the Market Size & CAGR of Gcc Construction Machinery market in 2023?

Gcc Construction Machinery Industry Analysis

Gcc Construction Machinery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gcc Construction Machinery Market Analysis Report by Region

Europe Gcc Construction Machinery Market Report:

In Europe, the Gcc construction machinery market is expected to rise from $5.03 billion in 2023 to $8.95 billion by 2033. The demand for modern, energy-efficient machinery is on the rise, driven by sustainability initiatives and stricter regulations on emissions.Asia Pacific Gcc Construction Machinery Market Report:

In the Asia Pacific region, the Gcc construction machinery market is set to grow from $2.98 billion in 2023 to $5.31 billion by 2033, reflecting a growing focus on infrastructure projects and urbanization in countries like India and China. Technological advancements and increasing adoption of electric machinery are also anticipated to influence market trends.North America Gcc Construction Machinery Market Report:

The North American market will see significant growth from $5.25 billion in 2023 to approximately $9.35 billion by 2033. The region's advanced construction technology utilization and increased investments in public infrastructure are key factors driving this growth.South America Gcc Construction Machinery Market Report:

The South American market is comparatively smaller, with an estimated size of $1.29 billion in 2023, projected to grow to $2.29 billion by 2033. Growth drivers include the emerging construction sector in countries like Brazil and Argentina, focusing on infrastructure development and modernization of existing construction equipment.Middle East & Africa Gcc Construction Machinery Market Report:

With a market size of $1.06 billion in 2023 expected to increase to $1.88 billion by 2033, the Middle East and Africa exhibit strong growth potential, fueled by ongoing urbanization and mega infrastructure projects, particularly in the UAE and Saudi Arabia.Tell us your focus area and get a customized research report.

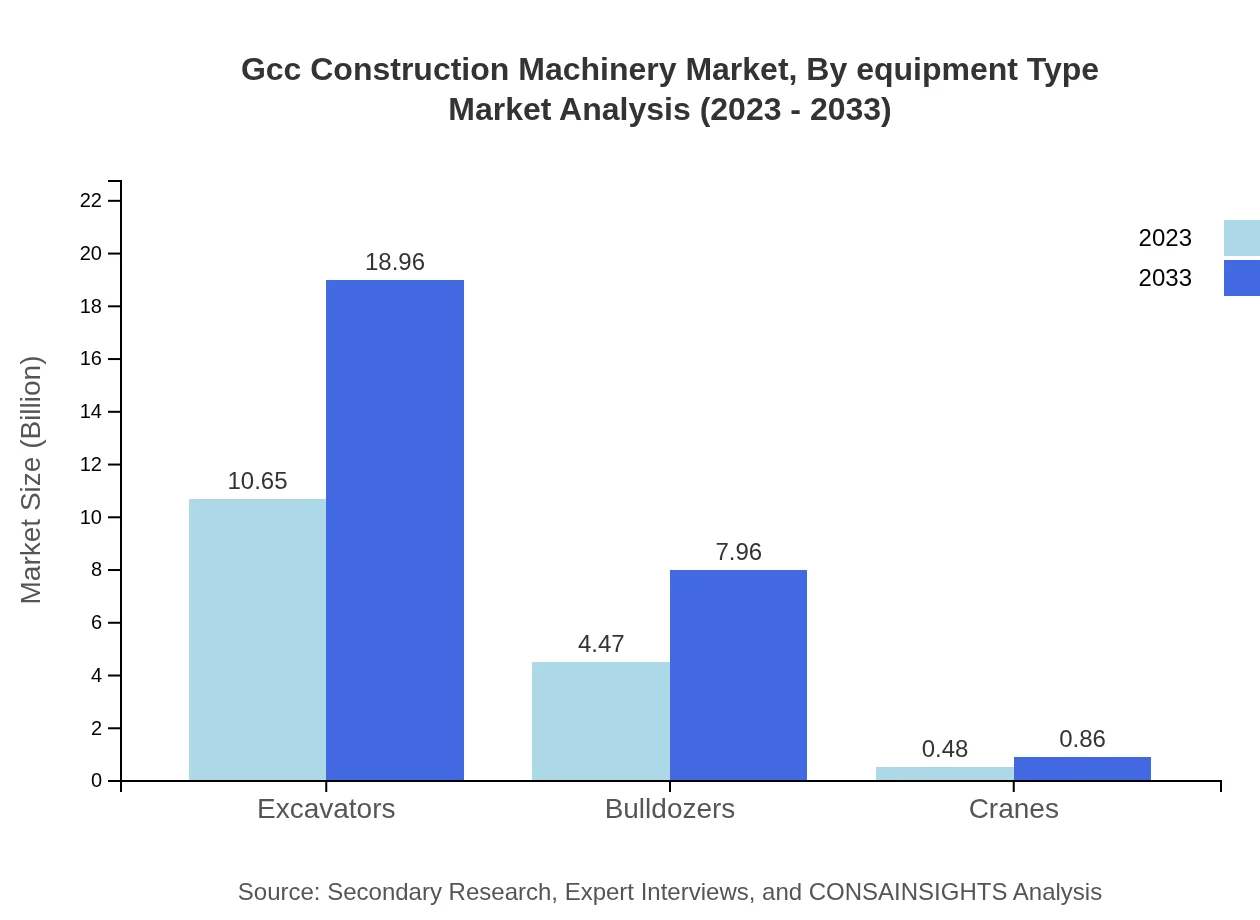

Gcc Construction Machinery Market Analysis By Equipment Type

The equipment type segment dominates the Gcc construction machinery market, with excavators holding a significant share due to their versatility and extensive application across various construction activities. In 2023, the excavator market was valued at $10.65 billion, comprising 68.25% market share. Other essential machinery includes bulldozers and cranes, which together cater to heavy lifting and foundational tasks in construction projects.

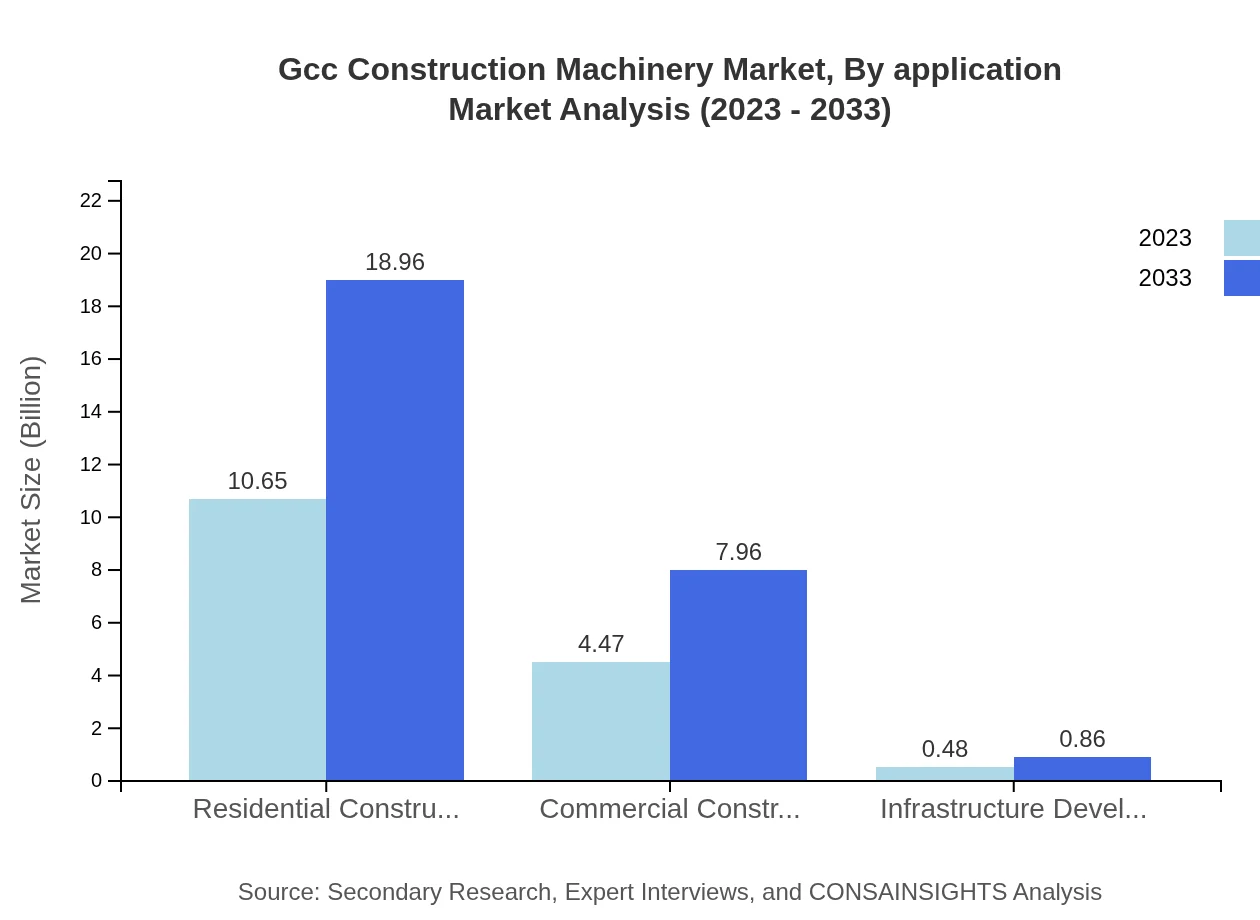

Gcc Construction Machinery Market Analysis By Application

The application segment encompasses residential, commercial, and infrastructure construction, with residential construction leading the market. In 2023, the residential construction segment accounted for approximately 68.25% of the market share. Government projects, focusing on civic infrastructure, are also vital, with a remarkable market presence due to increasing public sector investments.

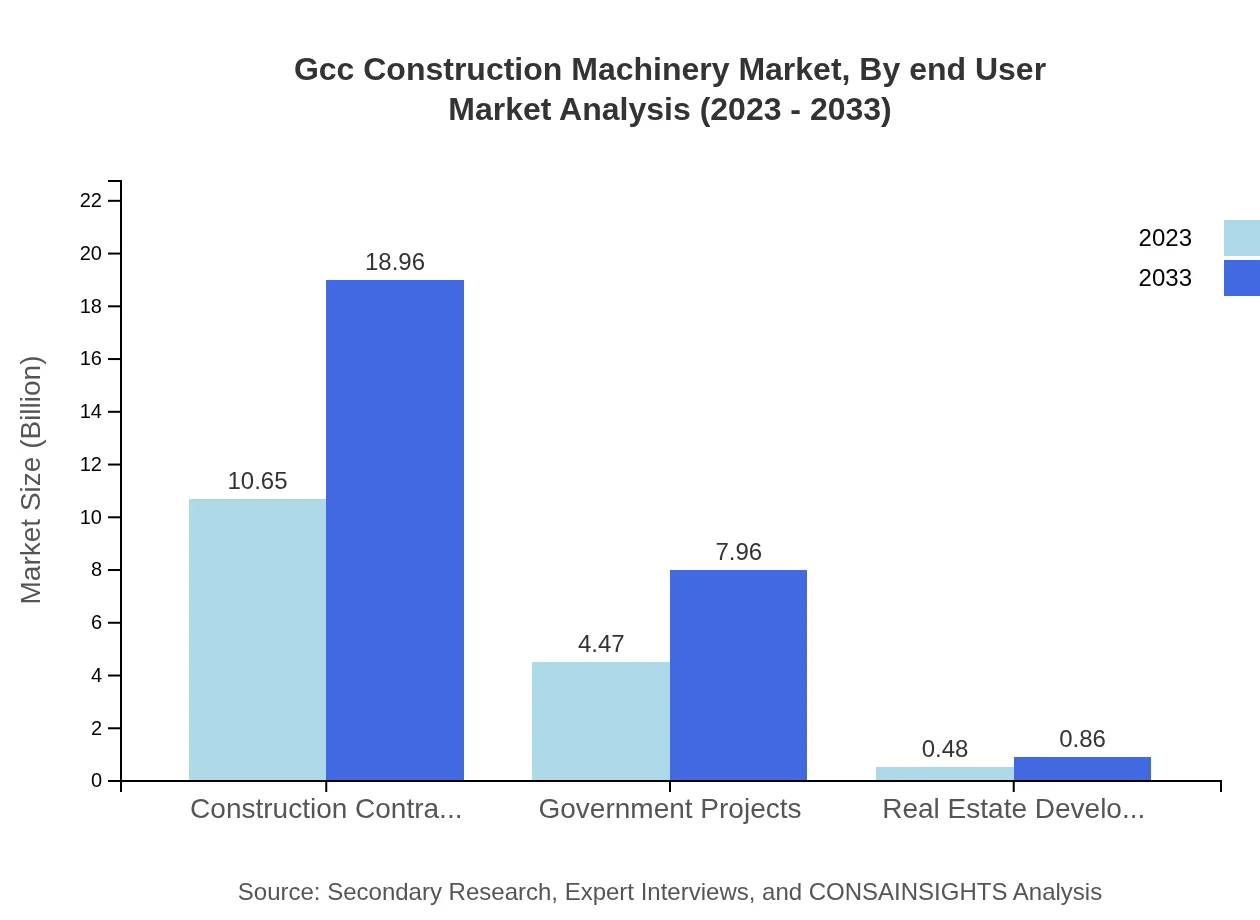

Gcc Construction Machinery Market Analysis By End User

Construction contractors are the primary end-users of Gcc construction machinery, contributing to around 68.25% of the market share as of 2023. Government projects follow, demonstrating their importance in regional infrastructure development. Real estate developers also contribute, though they hold a smaller market share.

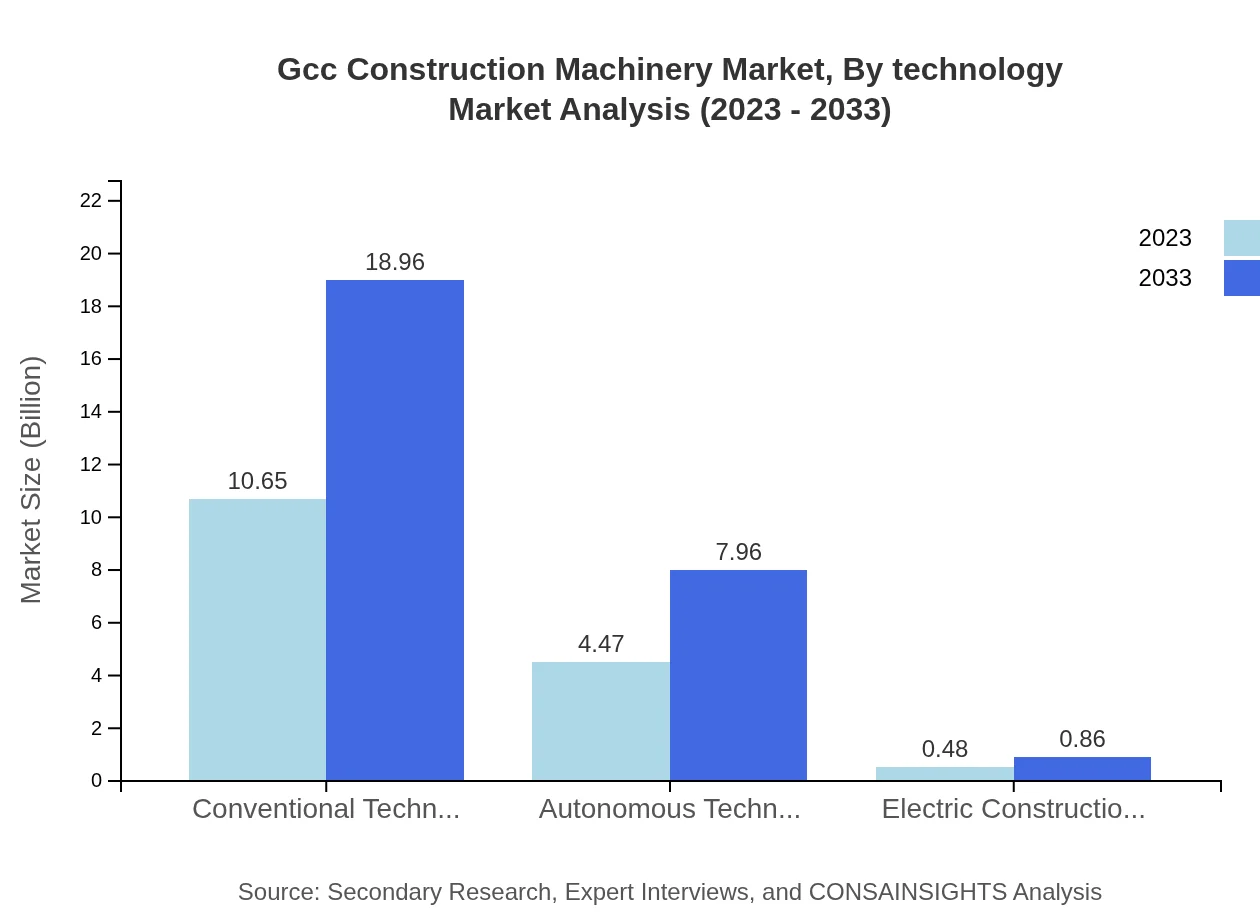

Gcc Construction Machinery Market Analysis By Technology

The technology segment showcases a shift towards electric and autonomous machinery, although conventional technology continues to dominate, contributing about 68.25% of the market by 2023. Autonomous technology is gaining traction due to enhanced productivity and efficiency, while electric machinery is viewed as a sustainable alternative.

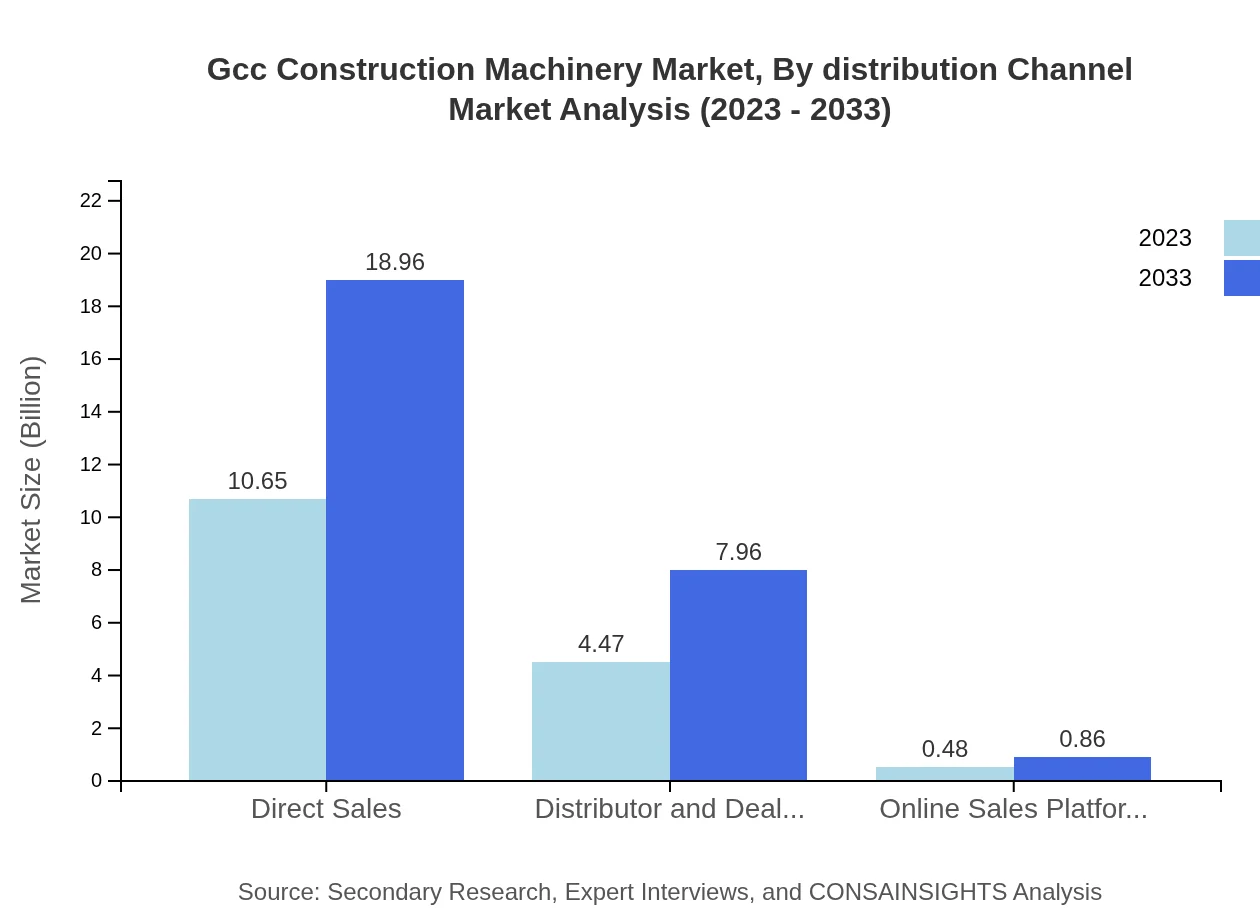

Gcc Construction Machinery Market Analysis By Distribution Channel

The distribution channel is categorically analyzed by direct sales, distributor and dealer networks, and online platforms. Direct sales dominate the channel, with substantial contributions of 68.25% in 2023, while online sales platforms grow steadily as consumer preferences shift towards digital transactions.

Gcc Construction Machinery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gcc Construction Machinery Industry

Caterpillar Inc.:

Caterpillar is a leading provider of construction machinery and equipment. Their commitment to innovation and providing robust machinery solutions has solidified their market position in the GCC.Komatsu Ltd.:

Komatsu is known for its cutting-edge technology and extensive machinery lineup. Their focus on autonomous equipment and sustainable solutions has amplified their presence in the GCC construction machinery market.Volvo Construction Equipment:

Volvo specializes in the design and manufacture of heavy equipment, emphasizing safety and environmental sustainability, catering to various construction needs in the GCC.Hitachi Construction Machinery Co.:

Hitachi delivers a range of construction machinery known for quality and reliability, with a growing market presence in infrastructure projects across the GCC.JCB:

JCB is a renowned manufacturer of construction equipment specializing in excavators and backhoe loaders, with a strong footprint in the GCC region.We're grateful to work with incredible clients.

FAQs

What is the market size of GCC Construction Machinery?

The GCC Construction Machinery market is valued at approximately $15.6 billion in 2023, with a projected CAGR of 5.8% from 2023 to 2033, reflecting strong growth potential in this sector.

What are the key market players or companies in the GCC Construction Machinery industry?

Key players in the GCC Construction Machinery industry include Caterpillar Inc., Komatsu Ltd., Link-Belt Construction Equipment, and Volvo Construction Equipment, among others, all vying for market share in a competitive landscape.

What are the primary factors driving the growth in the GCC Construction Machinery industry?

Factors contributing to growth in the GCC Construction Machinery market include increased infrastructure development, government spending on construction projects, and a surge in private sector investments, which necessitate advanced machinery.

Which region is the fastest Growing in the GCC Construction Machinery market?

The Asia-Pacific region is the fastest-growing in the GCC Construction Machinery market, expected to grow from $2.98 billion in 2023 to $5.31 billion by 2033, driven by urbanization and construction activities.

Does ConsaInsights provide customized market report data for the GCC Construction Machinery industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the GCC Construction Machinery sector, allowing clients to gain insights into niche markets or particular regional trends.

What deliverables can I expect from this GCC Construction Machinery market research project?

Deliverables from the GCC Construction Machinery market research will include comprehensive reports, market analysis, segmented data views, strategic insights, and actionable recommendations tailored to your business needs.

What are the market trends of GCC Construction Machinery?

Current market trends in GCC Construction Machinery include the rise of electric and autonomous machinery, a shift towards sustainability, and increased adoption of advanced technology, which reflects a changing landscape in construction practices.