Glass Ceramics Market Report

Published Date: 02 February 2026 | Report Code: glass-ceramics

Glass Ceramics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Glass Ceramics market from 2023 to 2033, covering market size, growth trends, and key players. Insights include detailed segmentation, regional performances, technological advancements, and future forecasts.

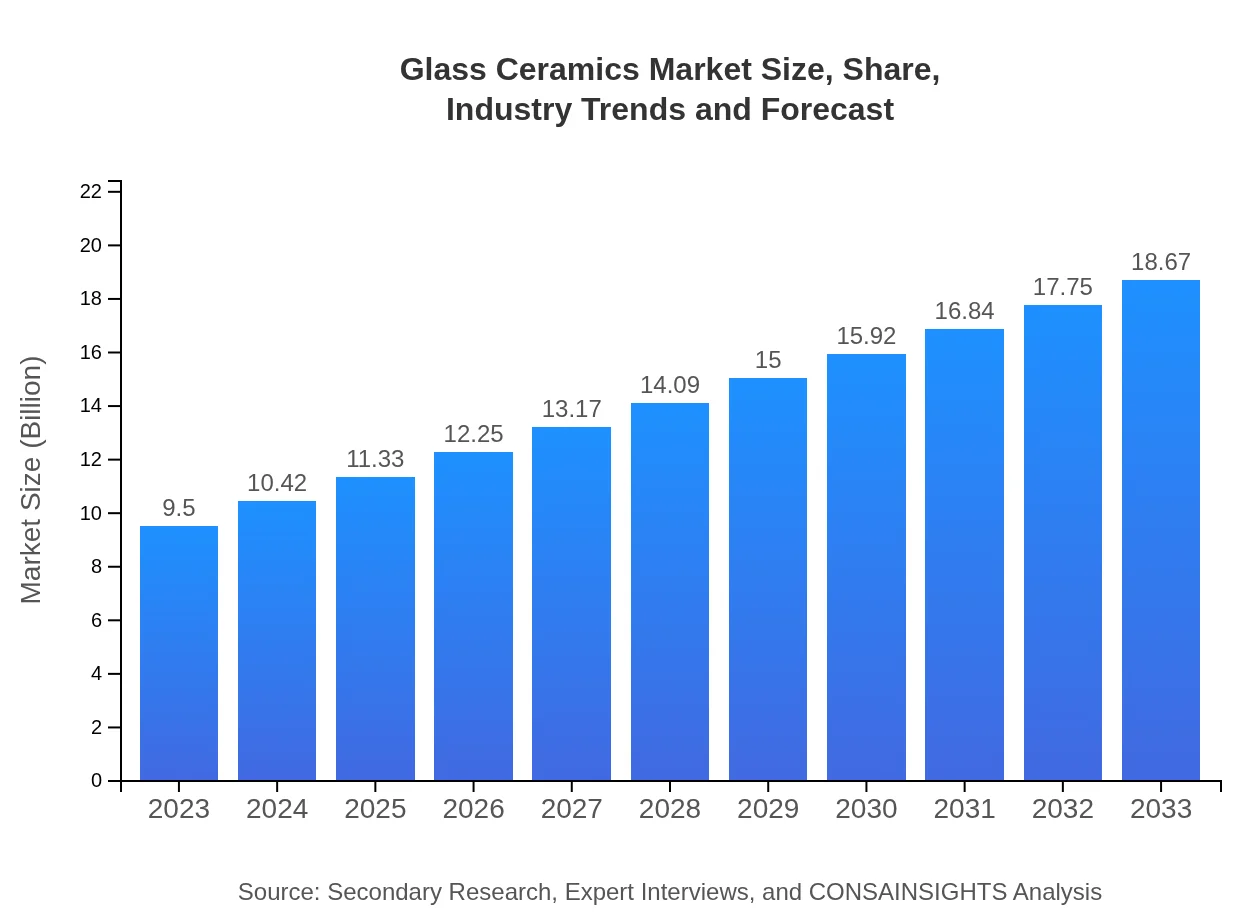

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $18.67 Billion |

| Top Companies | Corning Incorporated, Schott AG, Keralit, Nippon Electric Glass, Ceradyne, Inc. |

| Last Modified Date | 02 February 2026 |

Glass Ceramics Market Overview

Customize Glass Ceramics Market Report market research report

- ✔ Get in-depth analysis of Glass Ceramics market size, growth, and forecasts.

- ✔ Understand Glass Ceramics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Glass Ceramics

What is the Market Size & CAGR of Glass Ceramics market in 2023?

Glass Ceramics Industry Analysis

Glass Ceramics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Glass Ceramics Market Analysis Report by Region

Europe Glass Ceramics Market Report:

The European Glass Ceramics market is anticipated to grow from $2.31 billion in 2023 to $4.53 billion by 2033. Key markets like Germany, France, and the UK showcase robust growth due to technological innovation and a high level of manufacturing capabilities. Increasing focus on sustainable materials fuels demand across various sectors.Asia Pacific Glass Ceramics Market Report:

In the Asia Pacific region, the Glass Ceramics market is projected to grow from $1.88 billion in 2023 to $3.69 billion by 2033. Rapid industrialization, coupled with growing urbanization and increased consumer spending in countries like China and India, drives demand for innovative glass products for applications in construction, electronics, and automotive.North America Glass Ceramics Market Report:

North America is a significant market for Glass Ceramics, forecasted to expand from $3.69 billion in 2023 to $7.25 billion by 2033. The region boasts advanced manufacturing capabilities and a strong emphasis on technology innovation, driving the demand for high-performance glass ceramics in medical applications and consumer products.South America Glass Ceramics Market Report:

The South American market, while smaller, is expected to experience steady growth from $0.81 billion in 2023 to approximately $1.60 billion in 2033. Countries are increasingly adopting glass ceramics in industries such as construction and consumer goods, with rising investment supporting regional development.Middle East & Africa Glass Ceramics Market Report:

In the Middle East and Africa, the market for Glass Ceramics is projected to grow from $0.82 billion in 2023 to $1.60 billion by 2033. Growth in construction and infrastructure development in the region presents ample opportunities, as the industry adapts glass ceramics for a wider range of applications.Tell us your focus area and get a customized research report.

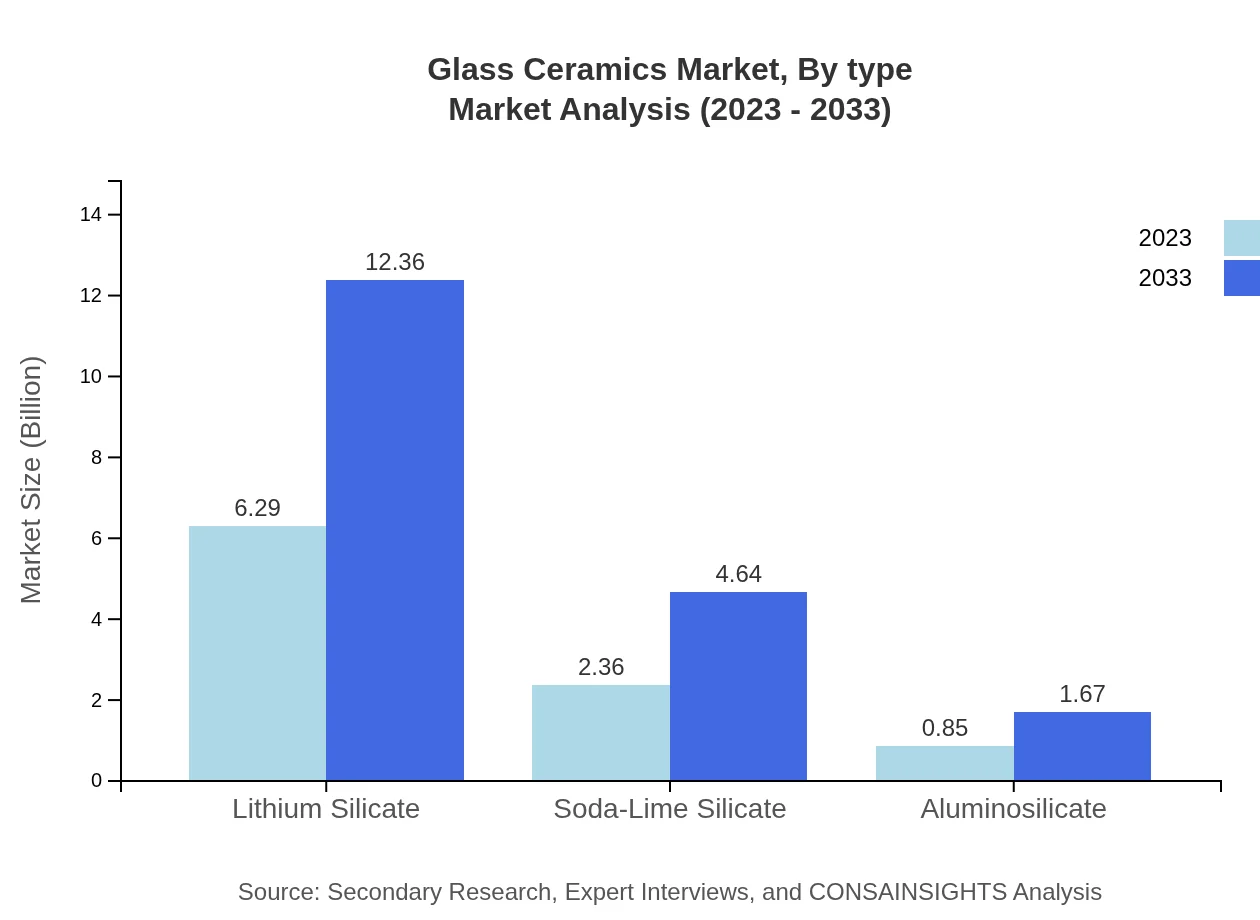

Glass Ceramics Market Analysis By Type

The market is dominated by Lithium Silicate, which is expected to grow from $6.29 billion in 2023 to $12.36 billion by 2033, representing 66.18% market share. Soda-Lime Silicate follows, showing moderate growth from $2.36 billion to $4.64 billion with a share of 24.87%. Aluminosilicate, while smaller at $0.85 billion growing to $1.67 billion, represents niche applications accounting for 8.95% share.

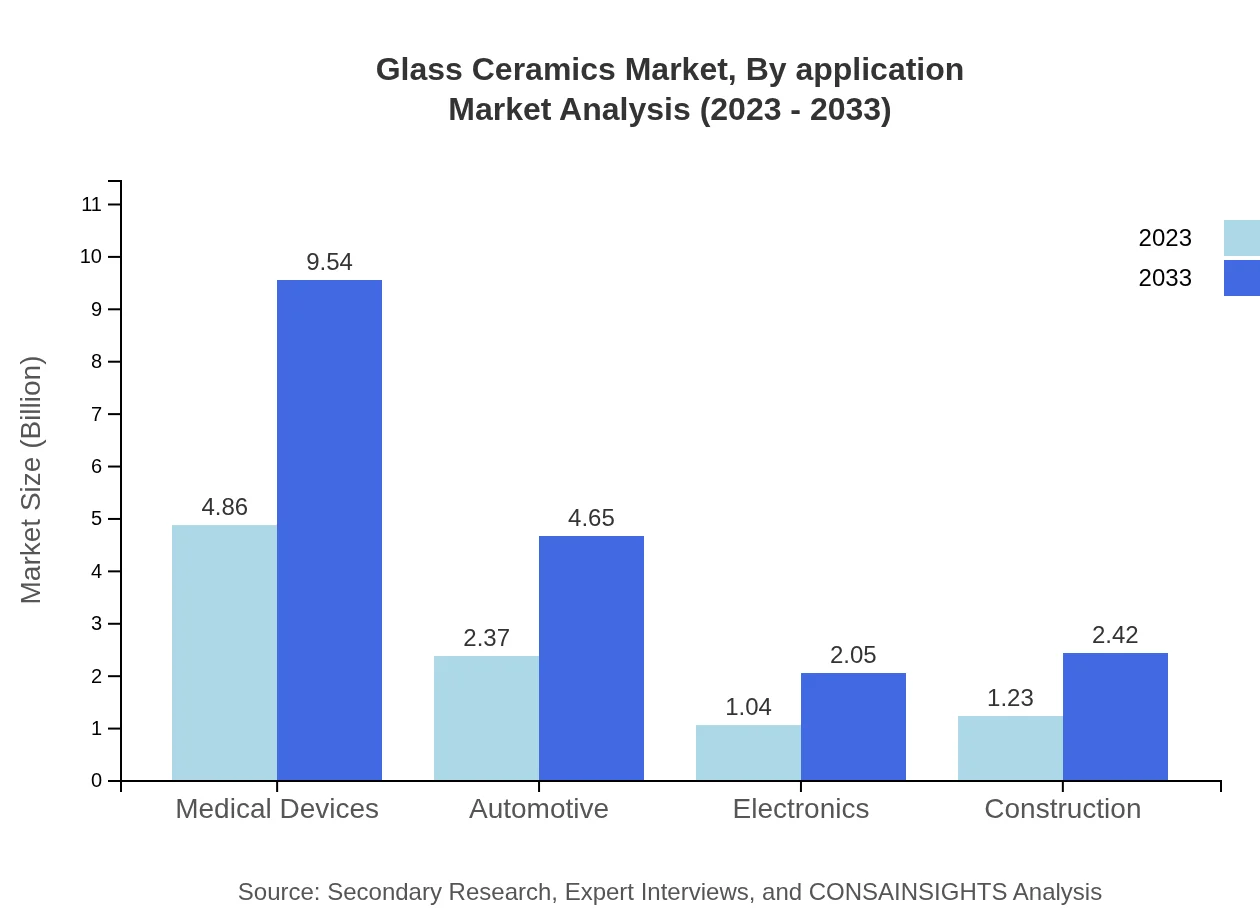

Glass Ceramics Market Analysis By Application

Consumer goods represent a major application sector, with a size estimated at $6.29 billion in 2023, expected to double to $12.36 billion by 2033 (66.18% share). Medical devices are projected to grow from $4.86 billion to $9.54 billion (51.11% share). Other applications include automotive, electronics, and construction, reflecting a diverse portfolio of end users.

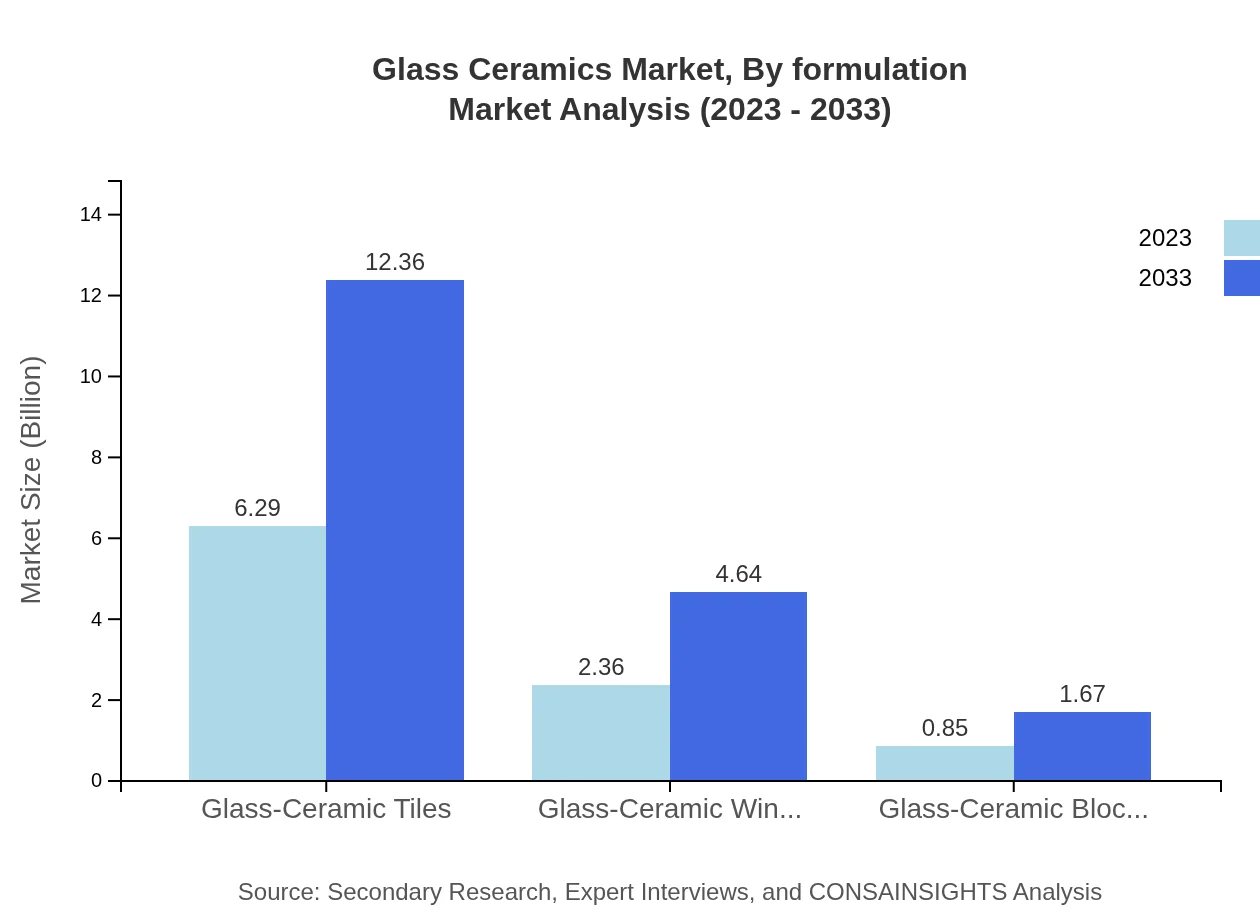

Glass Ceramics Market Analysis By Formulation

In terms of formulation, the Cold Process is the leading method of production, showing a growth from $6.29 billion in 2023 to $12.36 billion by 2033, maintaining a consistent market share of 66.18%. Hot Process and Chemical Vapor Deposition, although smaller, are important for specific applications, catering to niche demands in advanced sectors.

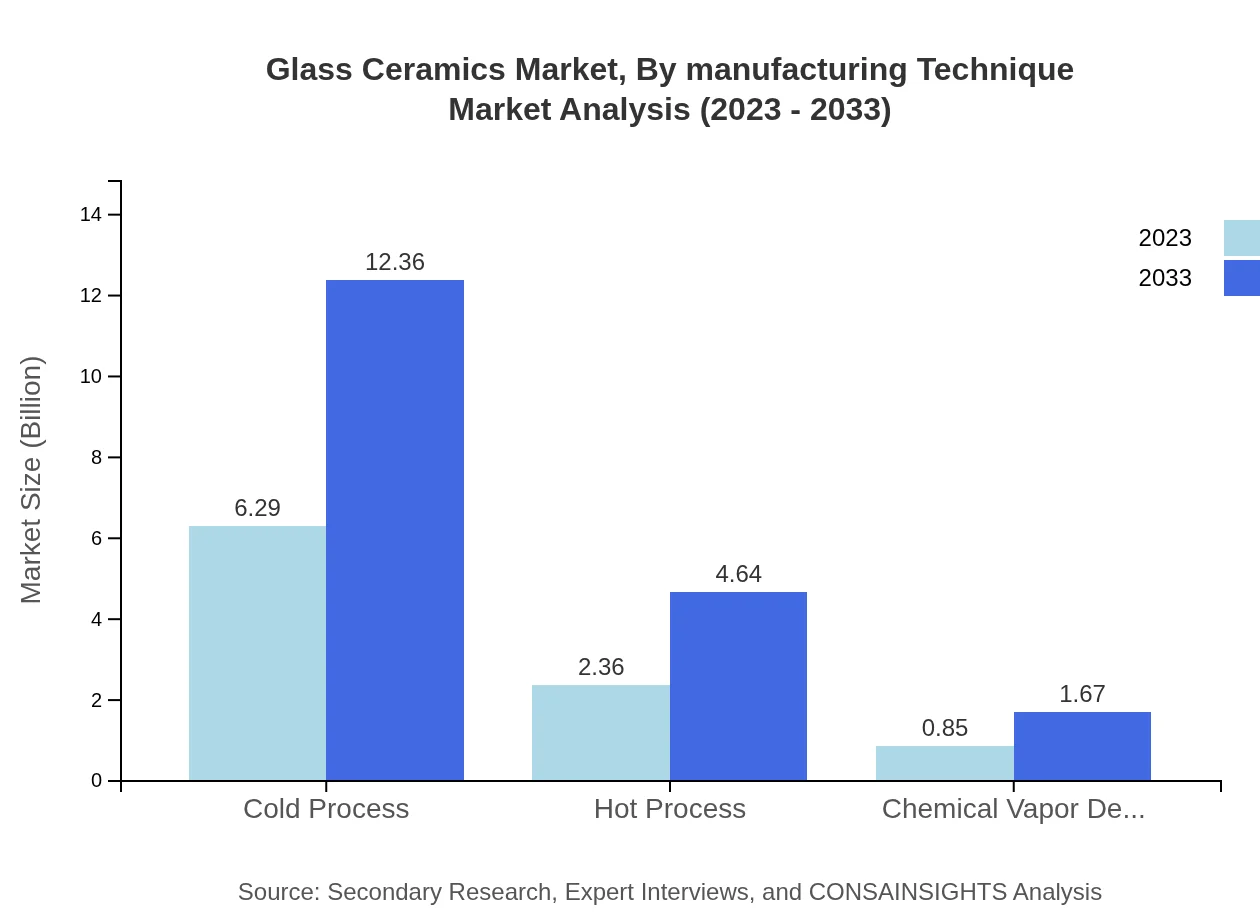

Glass Ceramics Market Analysis By Manufacturing Technique

The manufacturing techniques utilized—including Cold Process, Hot Process, and Chemical Vapor Deposition—play a major role in defining product characteristics. Cold Process involves low-cost and flexible production methods ideal for high-volume applications, while Hot Process is suitable for specialized needs. Product differentiation helps cater to the growing demands for quality in various applications.

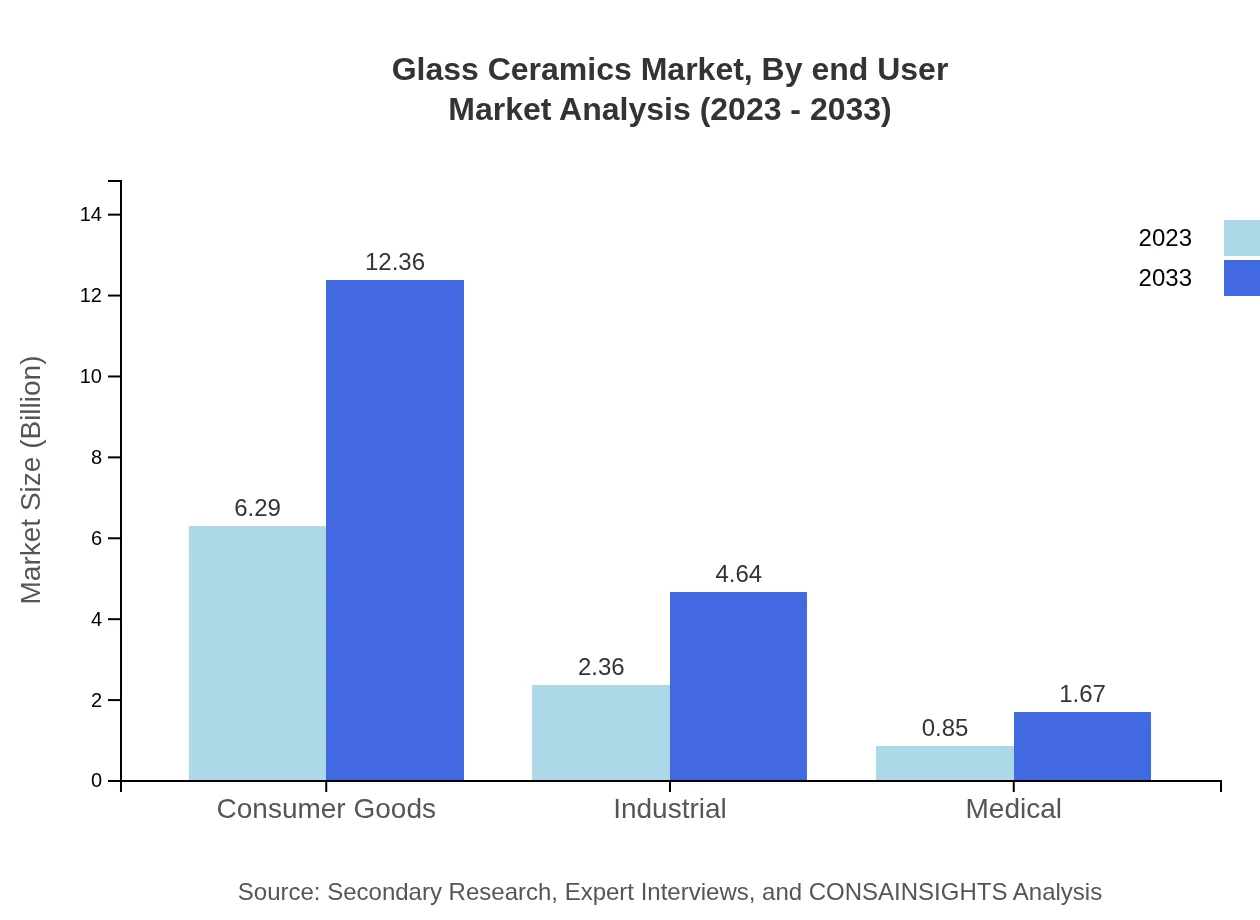

Glass Ceramics Market Analysis By End User

End-user industries such as medical devices, automotive, construction, and electronics adapt glass ceramics for its myriad advantages. The medical device sector leads with significant growth projections, as safety and performance remain paramount. The automotive sector, emphasizing lightweight materials, boosts demand substantially, while construction and electronics continue to provide steady growth opportunities.

Glass Ceramics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Glass Ceramics Industry

Corning Incorporated:

A pioneer in glass technology, Corning is known for its innovations in advanced glass ceramics, particularly for consumer electronics and display technologies.Schott AG:

A global leader in specialty glass and glass-ceramics, Schott provides innovative solutions for diverse applications including medical technology and architecture.Keralit:

Keralit specializes in producing high-performance glass ceramics for cooking surfaces and ranges, emphasizing product durability and thermal resistance.Nippon Electric Glass:

This company focuses on producing a variety of glass products for electronic applications, including high-tech glass-ceramics used in telecommunications.Ceradyne, Inc.:

Known for its high-performance ceramic products, Ceradyne manufactures advanced glass-ceramics for industrial applications and military uses.We're grateful to work with incredible clients.

FAQs

What is the market size of glass Ceramics?

The global glass-ceramics market is projected to reach approximately $9.5 billion by 2033, growing at a CAGR of 6.8%. This growth is fueled by diverse applications in household, industrial, and medical sectors.

What are the key market players or companies in the glass Ceramics industry?

Key players in the glass-ceramics market include Corning Inc., Schott AG, and LSP Technologies. These companies lead the industry with innovations in product development and sustainability, catering to various applications from consumer goods to high-tech industries.

What are the primary factors driving the growth in the glass Ceramics industry?

Growth in the glass-ceramics industry is driven by rising demand in medical devices, expanding construction applications, and innovative product developments. Increasing emphasis on sustainability also bolsters industry advancements, attracting investment in research and development.

Which region is the fastest Growing in the glass Ceramics market?

The Asia-Pacific region is expected to be the fastest-growing region in the glass-ceramics market, with a growth from $1.88 billion in 2023 to $3.69 billion by 2033. This is driven by industrial expansion and increasing consumer demand.

Does ConsaInsights provide customized market report data for the glass Ceramics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the glass-ceramics industry. Clients can request segment-focused analysis or insights based on regional demands to better inform their strategic decisions.

What deliverables can I expect from this glass Ceramics market research project?

From the glass-ceramics market research project, you can expect comprehensive reports covering market trends, competitive landscape analysis, segmented insights, and forecasts, along with strategic recommendations to optimize your market entry or growth.

What are the market trends of glass Ceramics?

Current trends in the glass-ceramics market include increasing adoption in renewable energy solutions and advanced medical technologies. Consumer preferences are also shifting towards aesthetically appealing and functional materials, driving innovation and product diversity.