Ground Control Station Market Report

Published Date: 03 February 2026 | Report Code: ground-control-station

Ground Control Station Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Ground Control Station market from 2023 to 2033, including insights about market size, trends, segmentation by technology and application, and regional performance. The report forecasts growth opportunities and challenges within the industry.

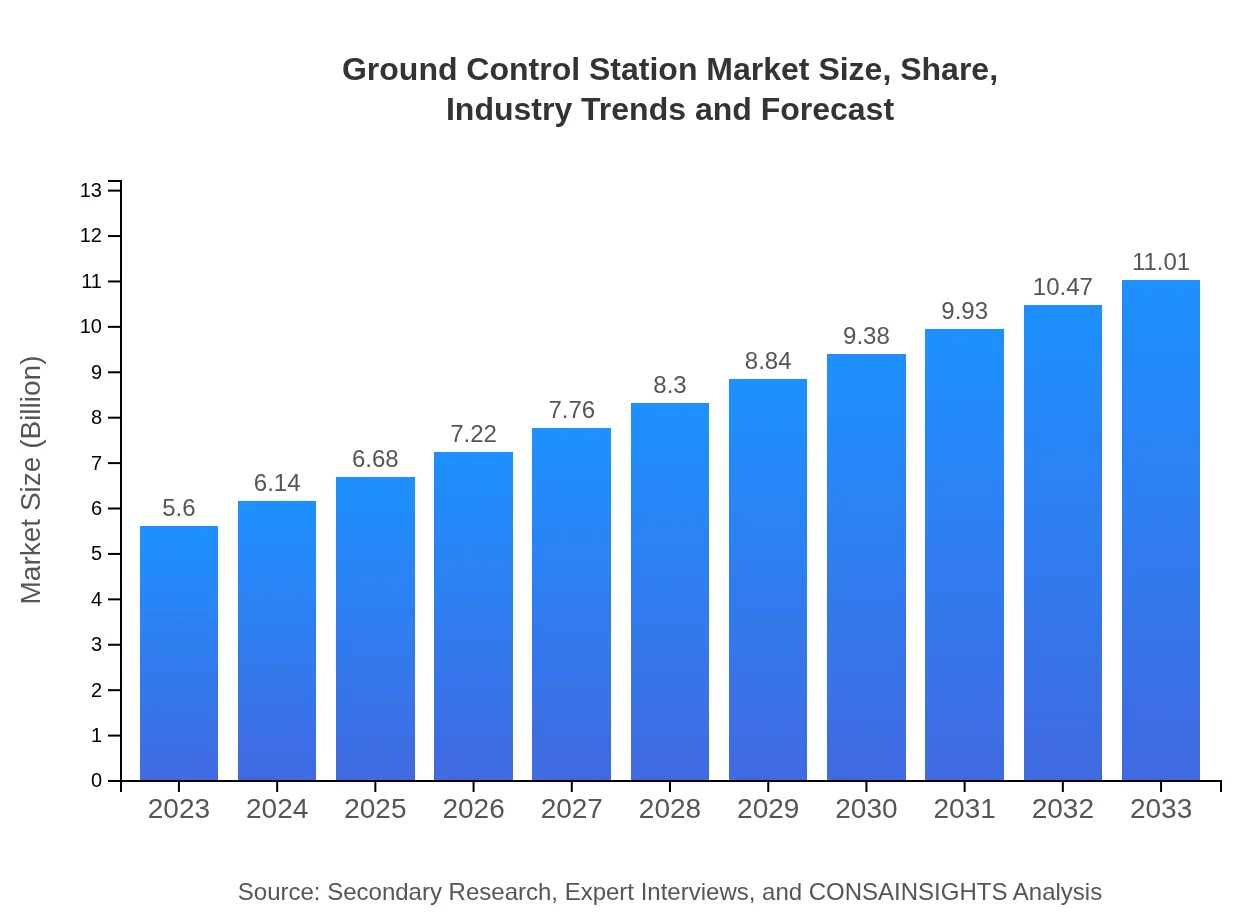

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | General Atomics, Airbus, Northrop Grumman, Lockheed Martin, Boeing |

| Last Modified Date | 03 February 2026 |

Ground Control Station Market Overview

Customize Ground Control Station Market Report market research report

- ✔ Get in-depth analysis of Ground Control Station market size, growth, and forecasts.

- ✔ Understand Ground Control Station's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ground Control Station

What is the Market Size & CAGR of Ground Control Station market in 2023?

Ground Control Station Industry Analysis

Ground Control Station Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ground Control Station Market Analysis Report by Region

Europe Ground Control Station Market Report:

The European market is also growing, projected to move from USD 1.54 billion in 2023 to USD 3.03 billion by 2033. The increase in regulations regarding drone operation and rising investment in defense technology are key factors influencing growth.Asia Pacific Ground Control Station Market Report:

The Asia Pacific region is projected to grow significantly, with the market expected to reach USD 2.26 billion by 2033 from USD 1.15 billion in 2023. This growth is attributed to increasing investments in UAV technology and initiatives by governments to enhance surveillance and security capabilities.North America Ground Control Station Market Report:

North America remains the largest market for Ground Control Stations, anticipated to reach USD 3.99 billion by 2033, up from USD 2.03 billion in 2023. The region's advancements in military technologies and widespread adoption of drones in commercial sectors are pivotal in driving market growth.South America Ground Control Station Market Report:

In South America, the Ground Control Station market is expected to expand from USD 0.31 billion in 2023 to USD 0.60 billion by 2033. Growing agricultural sectors and governmental interest in modernizing surveillance capabilities contribute to this growth.Middle East & Africa Ground Control Station Market Report:

The Middle East and Africa market for Ground Control Stations will increase from USD 0.57 billion in 2023 to USD 1.12 billion by 2033, driven by the demand for enhanced defense systems and the modernization of existing infrastructure.Tell us your focus area and get a customized research report.

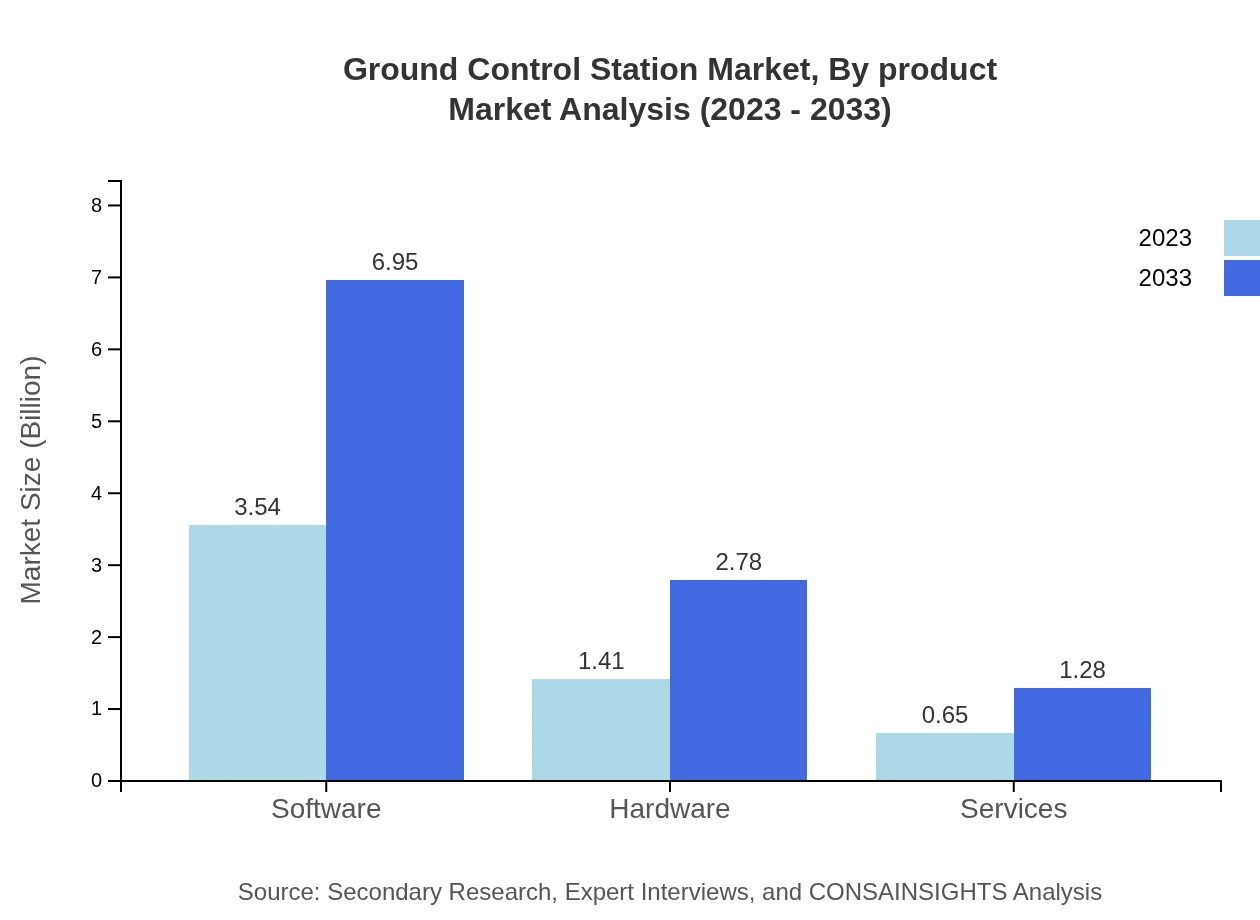

Ground Control Station Market Analysis By Product

The product segmentation shows that software leads the market sales due to the growing need for effective data management. In 2023, the software segment's market size is USD 3.54 billion, expected to nearly double to USD 6.95 billion by 2033. Hardware and services, although trailing, are projected to grow as well, pointing towards a balanced development across segments.

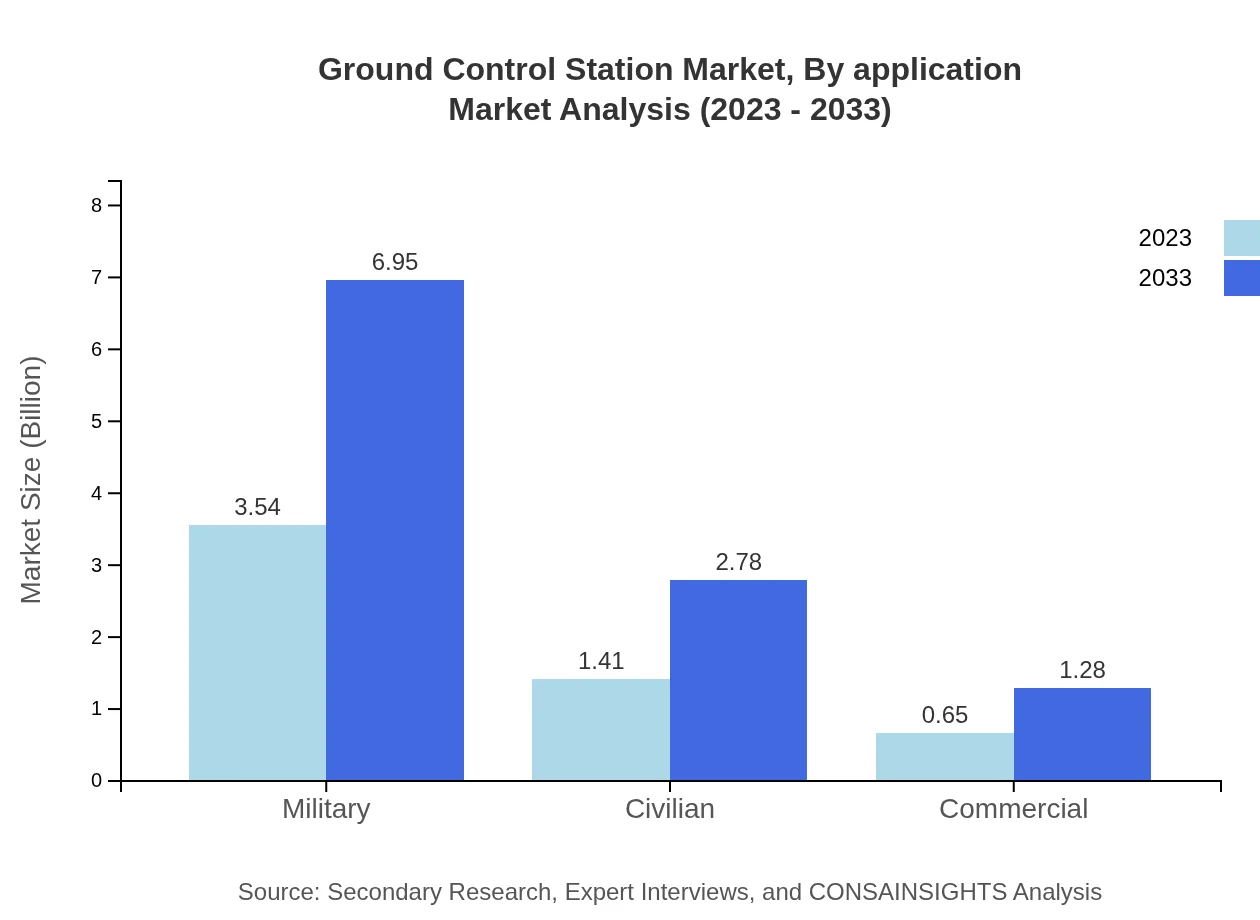

Ground Control Station Market Analysis By Application

The application segmentation breaks down the market into defense, government, and private sector use, emphasizing military applications which account for the largest share of the market, with an expected size of USD 3.54 billion in 2023, growing to USD 6.95 billion by 2033. Civilian applications in agriculture and infrastructure also show substantial growth potential, indicating an expanding dual-use market for ground control stations.

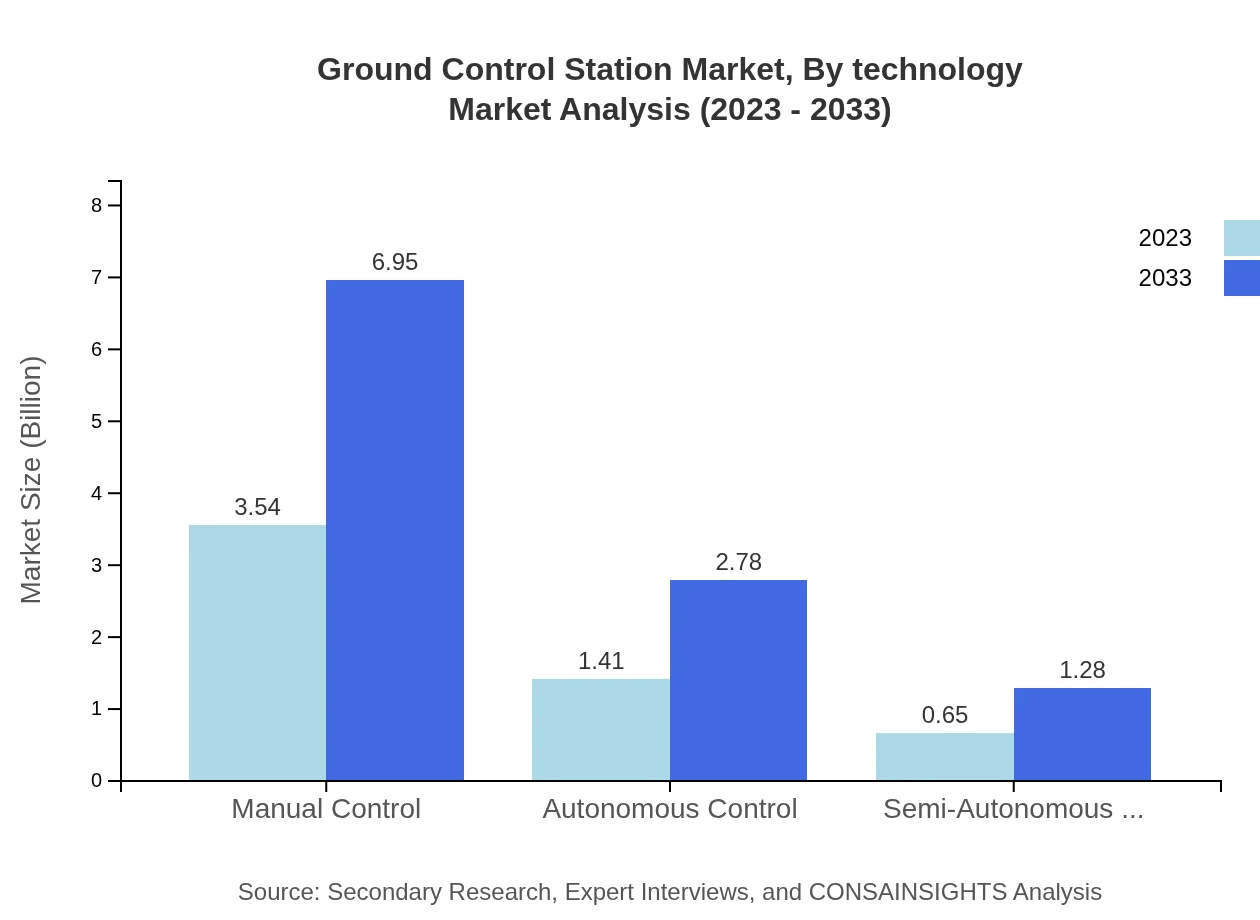

Ground Control Station Market Analysis By Technology

The division of market by technology reveals that manual control remains predominant but faces competition from autonomous and semi-autonomous control systems. The market size for manual control is estimated at USD 3.54 billion in 2023, expanding to USD 6.95 billion by 2033, while autonomous systems are expected to see an increase from USD 1.41 billion to USD 2.78 billion during the same period.

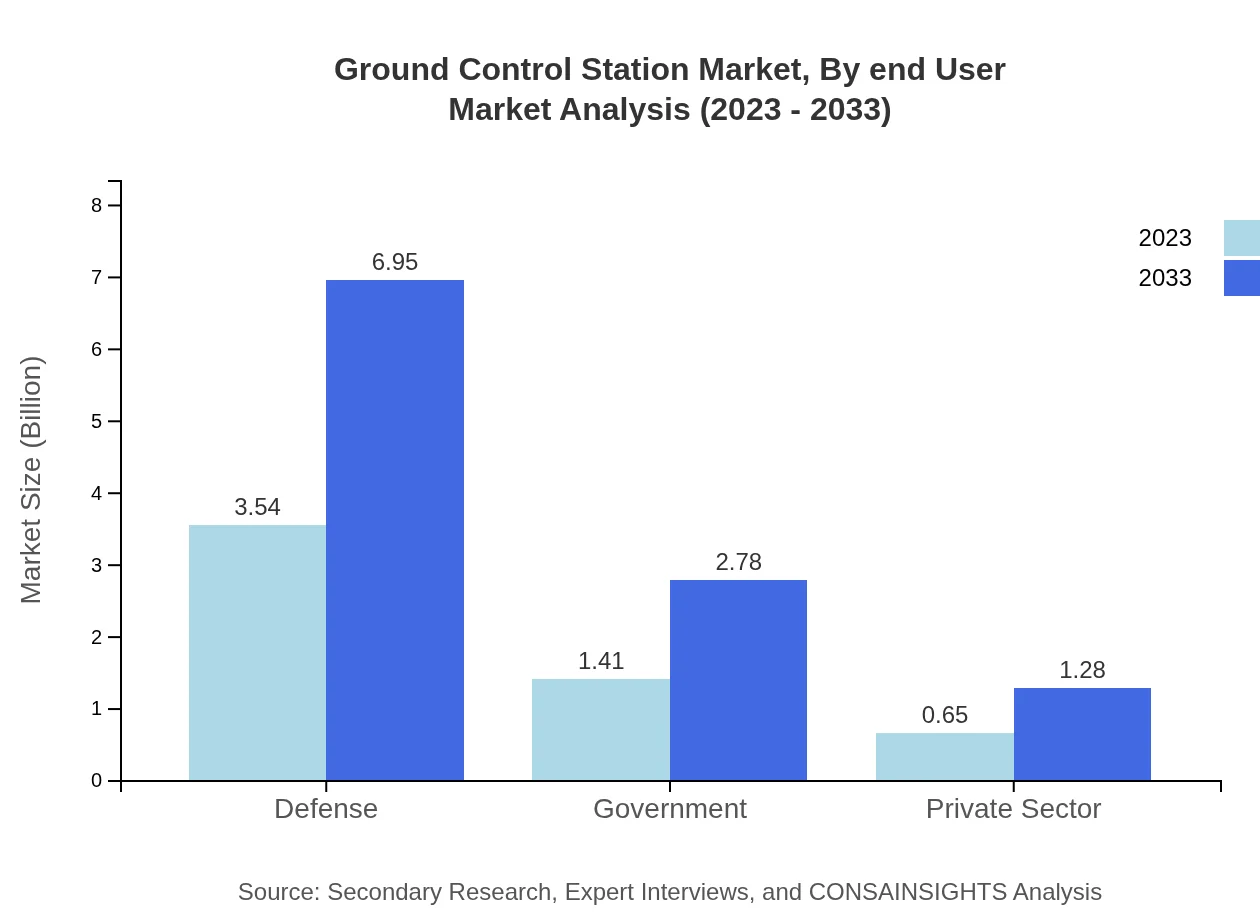

Ground Control Station Market Analysis By End User

By end-user, the military segment shows a strong presence, significantly impacting overall market growth. As military spending on drone technology rises, Ground Control Stations catering to these needs are poised to expand from USD 3.54 billion in 2023 to USD 6.95 billion by 2033, while civilian applications follow with expected growth from USD 1.41 billion to USD 2.78 billion.

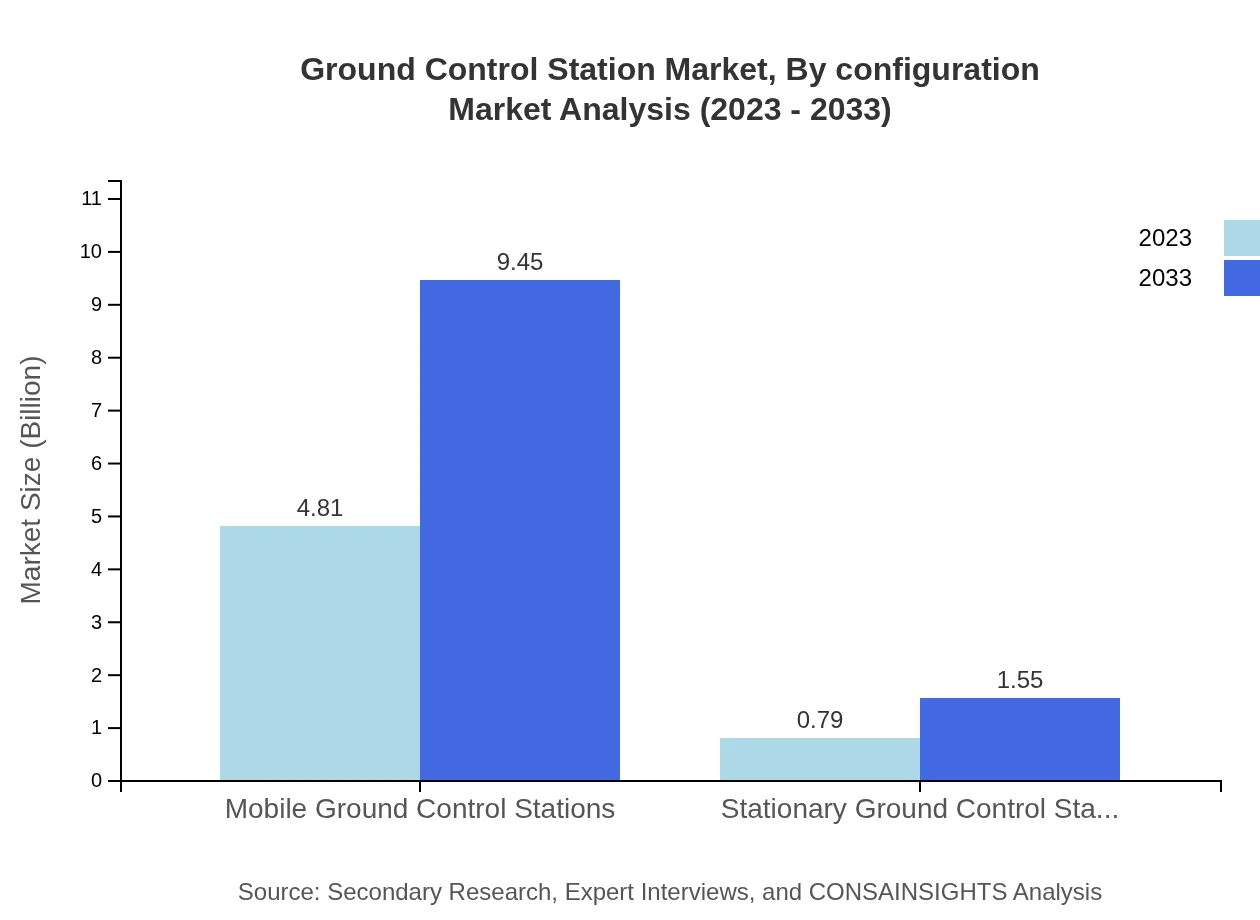

Ground Control Station Market Analysis By Configuration

Configuration analysis highlights mobile ground control stations as the most significant segment in 2023 with a market size of USD 4.81 billion, likely reaching USD 9.45 billion by 2033. Conversely, stationary stations will remain relevant but grow at a slower pace, moving from USD 0.79 billion to USD 1.55 billion.

Ground Control Station Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ground Control Station Industry

General Atomics:

A leading company specializing in developing advanced UAV technologies and Ground Control Stations, contributing significantly to military applications.Airbus:

An aerospace leader actively involved in the GCS sector, providing integrated solutions that enhance drone operational capabilities.Northrop Grumman:

Known for its innovative defense technologies, it plays a crucial role in the GCS space, mainly for military applications.Lockheed Martin:

A prominent defense contractor involved in the development of sophisticated GCS systems for national security operations.Boeing :

Integrates GCS within various UAV platforms, enhancing the operational efficiency of drones in both commercial and military sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of ground Control Station?

The global ground control station market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 6.8%. This growth reflects the increasing demand for advanced control systems across various applications.

What are the key market players or companies in this ground Control Station industry?

Key players in the ground control station market include major defense contractors and technology providers focusing on aerospace and defense solutions. These companies are pivotal in shaping the market dynamics through innovation and strategic partnerships.

What are the primary factors driving the growth in the ground Control Station industry?

The growth in the ground control station industry is primarily driven by technological advancements, rising defense budgets globally, and the increasing demand for unmanned aerial systems. Additionally, the need for enhanced surveillance capabilities plays a crucial role.

Which region is the fastest Growing in the ground Control Station?

Among the various regions, Europe is forecasted to experience substantial growth, with the market expanding from $1.54 billion in 2023 to $3.03 billion by 2033. North America follows closely, expanding from $2.03 billion to $3.99 billion in the same period.

Does ConsaInsights provide customized market report data for the ground Control Station industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the ground control station industry. This includes insights into market trends, competitive analysis, and segment-specific data for informed decision-making.

What deliverables can I expect from this ground Control Station market research project?

Expect comprehensive deliverables from the ground control station market research project, including detailed reports, executive summaries, market forecasts, competitive landscape overviews, and tailored data to help guide strategic business decisions.

What are the market trends of ground Control Station?

Current market trends in the ground control station industry include an increased focus on mobile control systems, advancements in software integration, and the rise of autonomous technologies. This evolution is reshaping operational capabilities and enhancing efficiency.