Hospital Supplies Market Report

Published Date: 31 January 2026 | Report Code: hospital-supplies

Hospital Supplies Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hospital Supplies market, including detailed insights into market size, growth forecasts, technological innovations, and regional analysis for the forecast period 2023 to 2033.

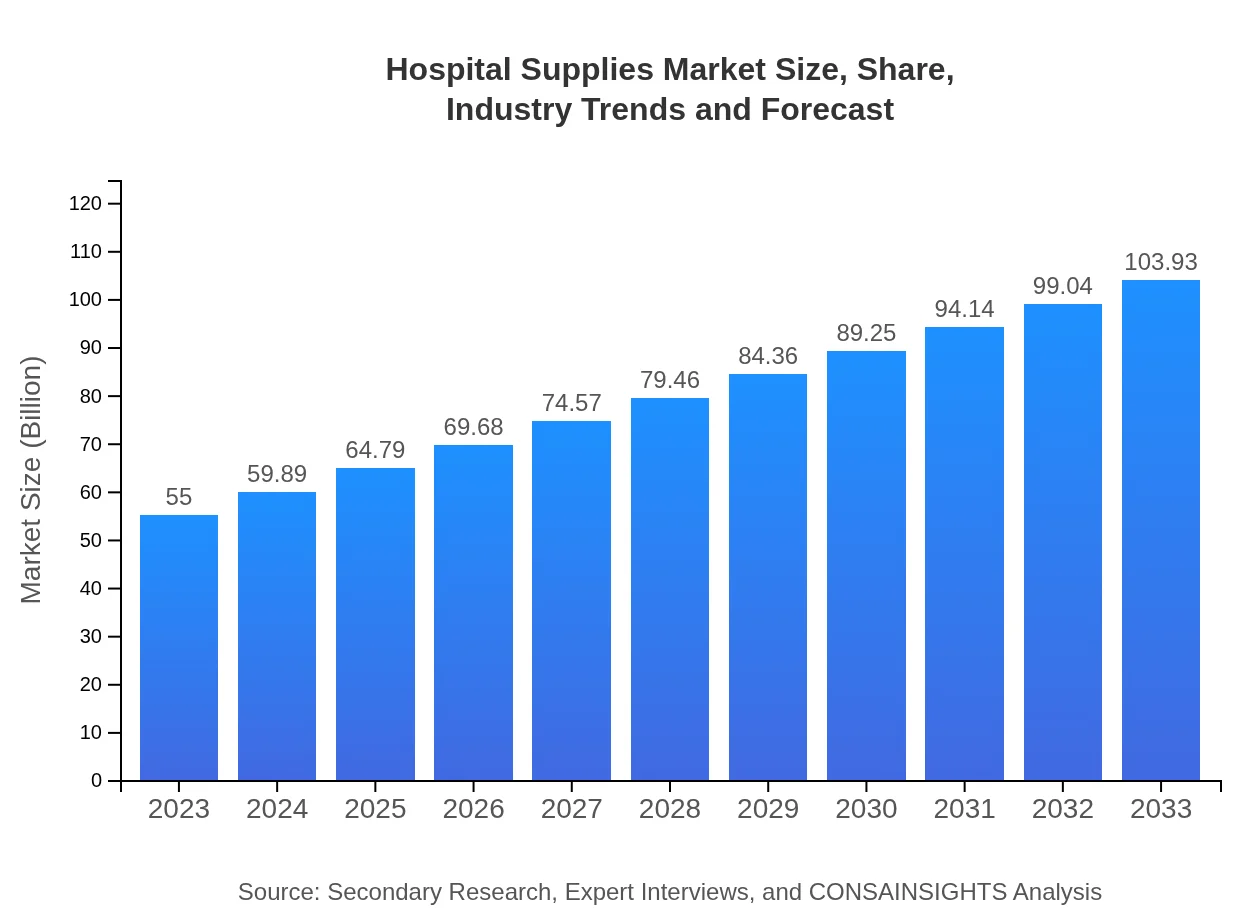

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $55.00 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $103.93 Billion |

| Top Companies | Johnson & Johnson, Medtronic , Baxter International, 3M, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Hospital Supplies Market Overview

Customize Hospital Supplies Market Report market research report

- ✔ Get in-depth analysis of Hospital Supplies market size, growth, and forecasts.

- ✔ Understand Hospital Supplies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hospital Supplies

What is the Market Size & CAGR of Hospital Supplies market in 2023?

Hospital Supplies Industry Analysis

Hospital Supplies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hospital Supplies Market Analysis Report by Region

Europe Hospital Supplies Market Report:

In Europe, the market is anticipated to increase from $14.54 billion in 2023 to $27.48 billion by 2033. Factors such as the aging population and chronic disease prevalence are driving the market forward.Asia Pacific Hospital Supplies Market Report:

In the Asia Pacific region, the Hospital Supplies market is projected to grow significantly, from $10.58 billion in 2023 to $19.99 billion by 2033. This growth can be attributed to improving healthcare infrastructure, rising healthcare expenditures, and increased patient populations.North America Hospital Supplies Market Report:

The North American market is the largest globally, expected to grow from $21.34 billion in 2023 to $40.32 billion by 2033. The region's dominant position is backed by advanced healthcare systems, high per capita income, and significant healthcare spending.South America Hospital Supplies Market Report:

Latin America’s Hospital Supplies market is forecasted to expand from $1.24 billion in 2023 to $2.34 billion in 2033. The growth is expected due to increasing government funding for healthcare and rising awareness regarding healthcare innovations.Middle East & Africa Hospital Supplies Market Report:

The Middle East and Africa's Hospital Supplies market is projected to rise from $7.30 billion in 2023 to $13.80 billion by 2033. Growth is underpinned by improving healthcare facilities and supportive government initiatives.Tell us your focus area and get a customized research report.

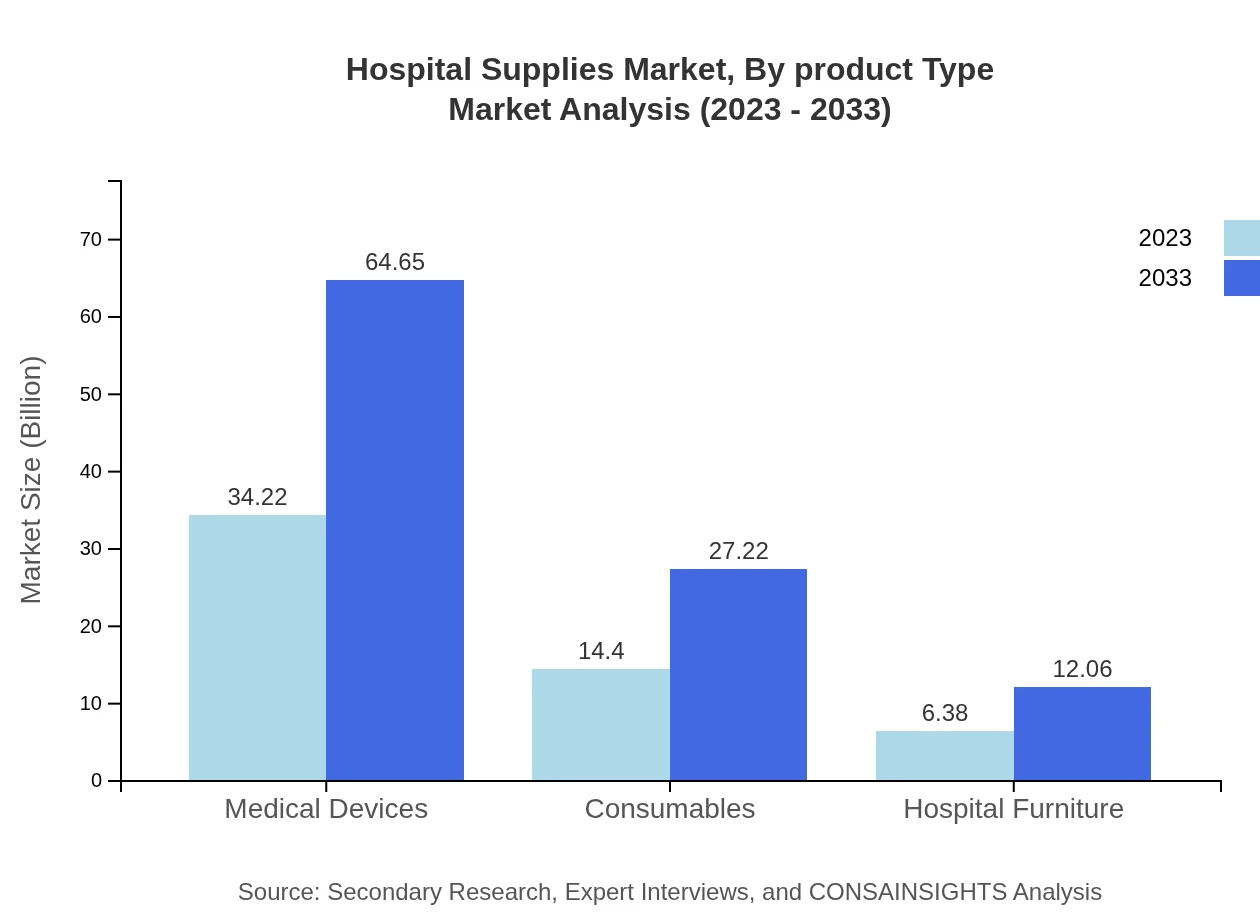

Hospital Supplies Market Analysis By Product Type

The Hospital Supplies market is divided into various product types, primarily including medical devices, consumables, and hospital furniture. Medical devices are expected to lead in terms of size and growth, expected to reach $34.22 billion by 2033. Consumables and hospital furniture, while smaller in market size, are also projected to witness steady growth. For instance, consumables are estimated to expand from $14.40 billion in 2023 to $27.22 billion by 2033.

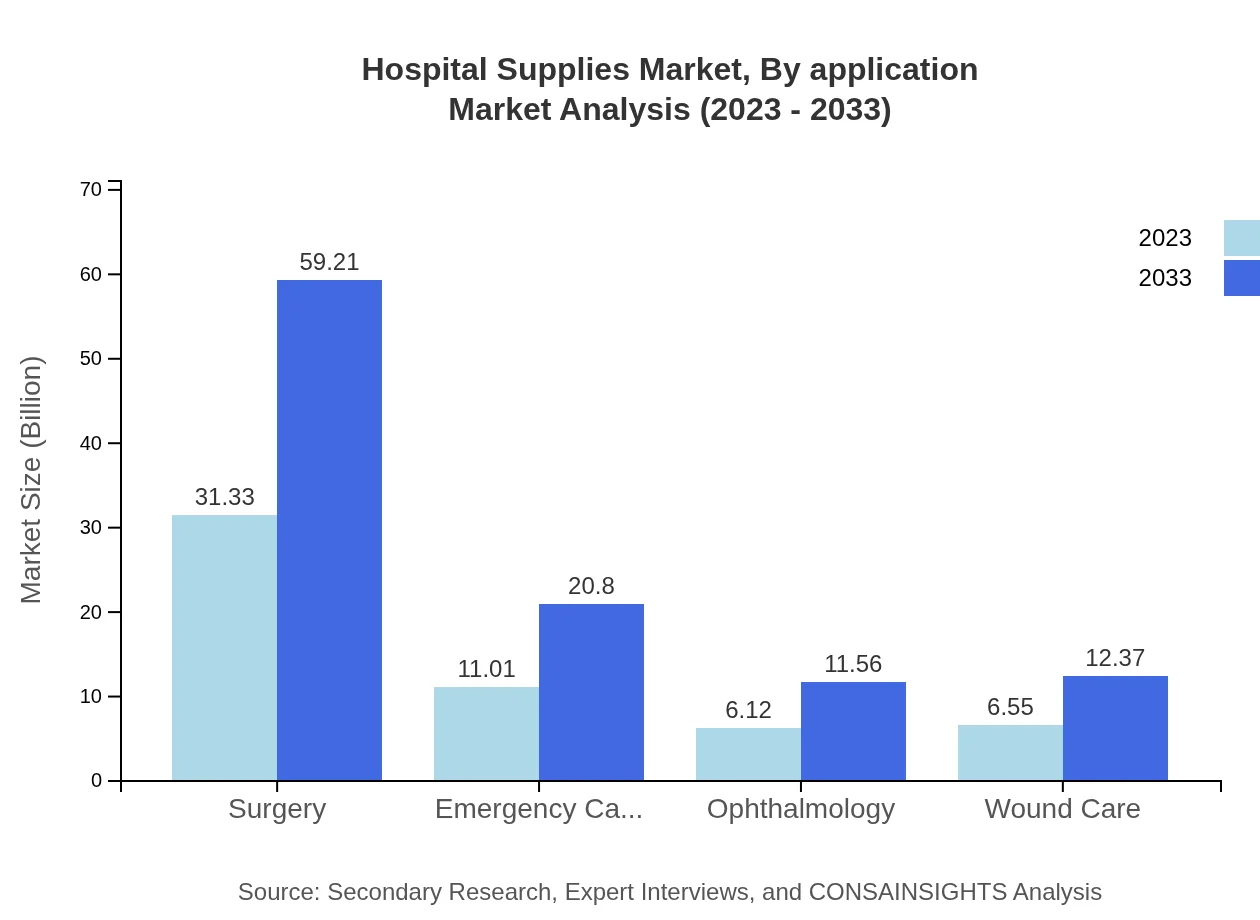

Hospital Supplies Market Analysis By Application

By application, the market is segmented into surgery, emergency care, ophthalmology, and wound care. The surgery segment is critical, projected to grow from $31.33 billion in 2023 to $59.21 billion by 2033, making it a key player in the Hospital Supplies market. Emergency care and wound care supplies are also seeing growth, with applications in various healthcare settings.

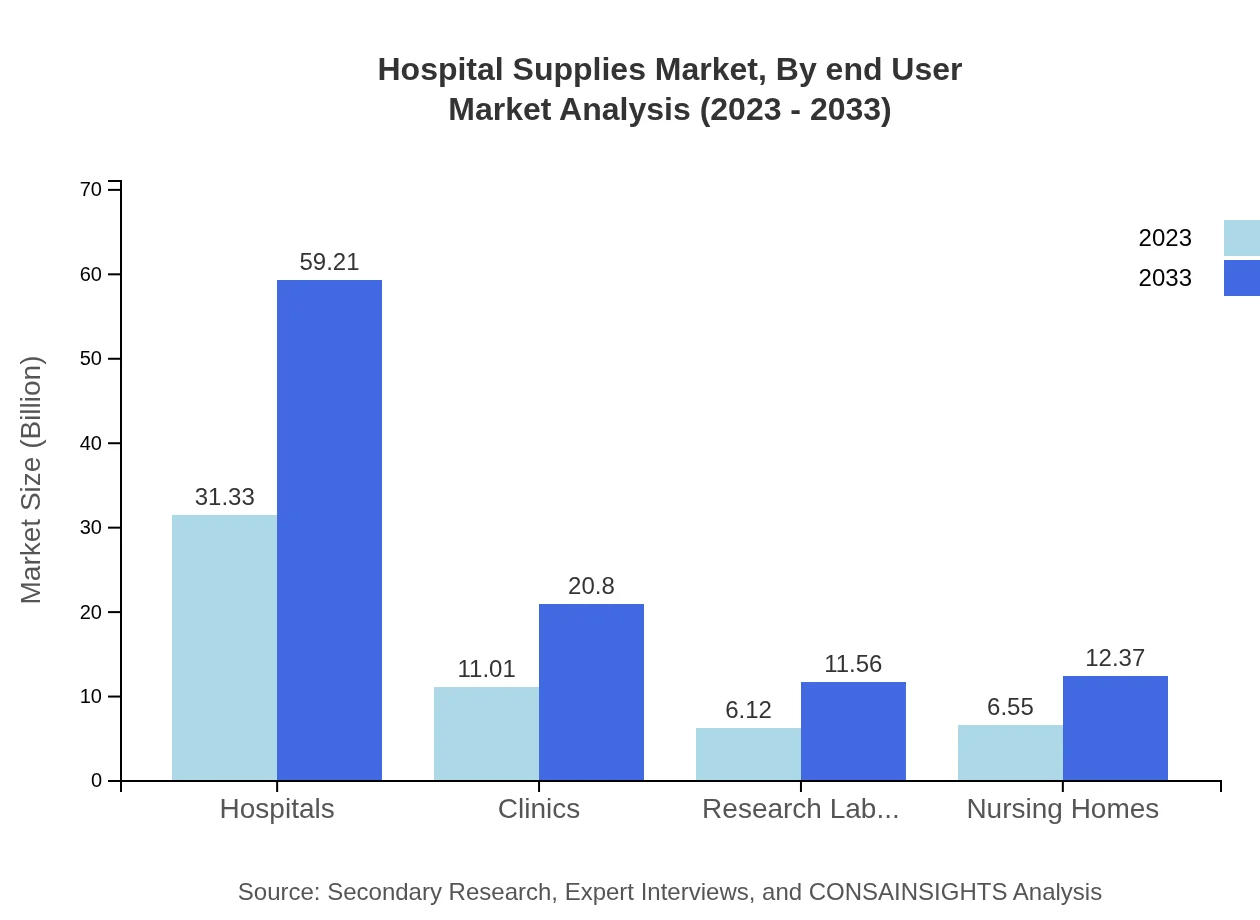

Hospital Supplies Market Analysis By End User

The primary end-users in the Hospital Supplies market include hospitals, clinics, and research laboratories. Hospitals dominate the user base, expected to hold approximately 56.97% of the share in 2023, growing alongside clinic and laboratory segments, which are also gaining market traction.

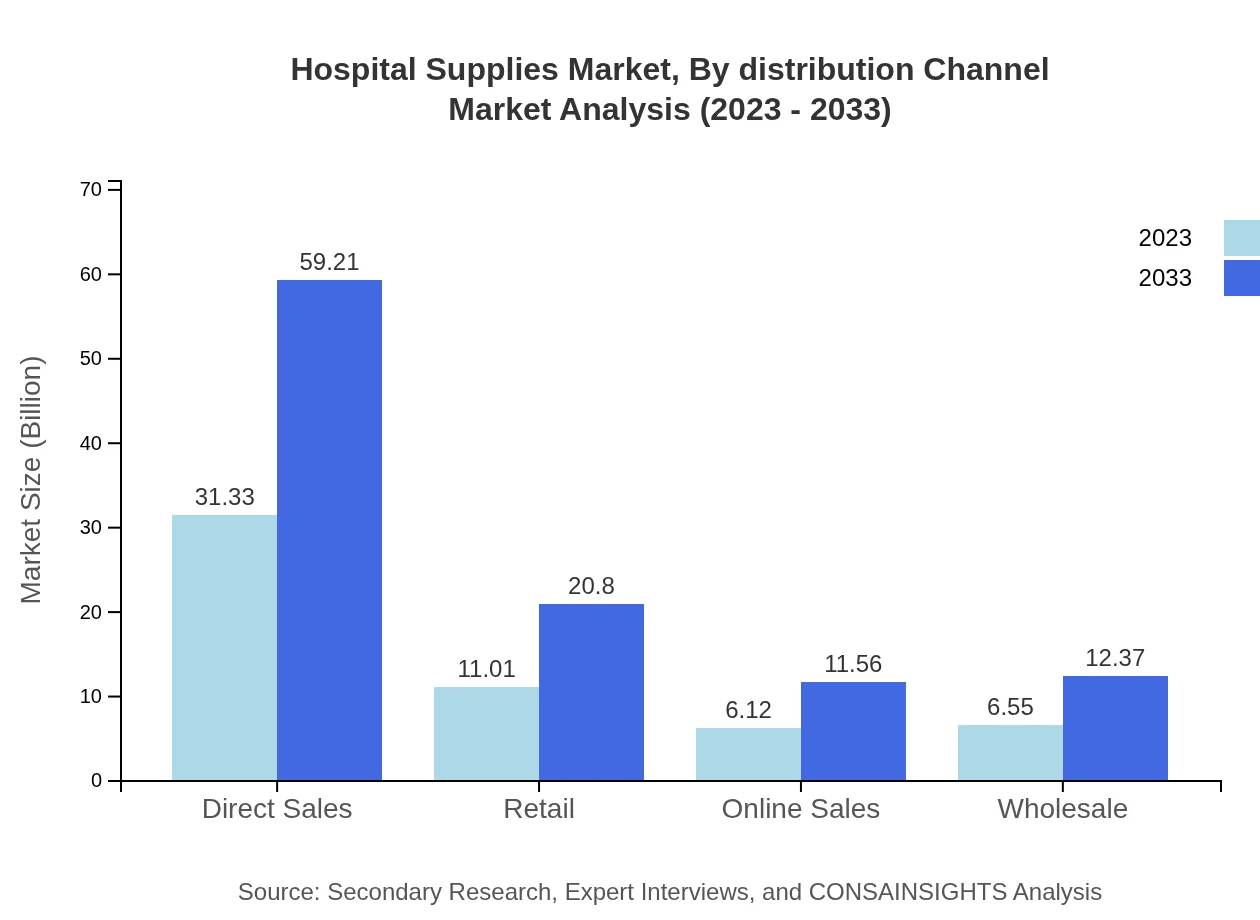

Hospital Supplies Market Analysis By Distribution Channel

Distribution channels for Hospital Supplies include direct sales, retail, online sales, and wholesale. Direct sales are leading in market share, accounting for 56.97% in 2023, with online sales gaining popularity as the demand for convenient purchasing options increases.

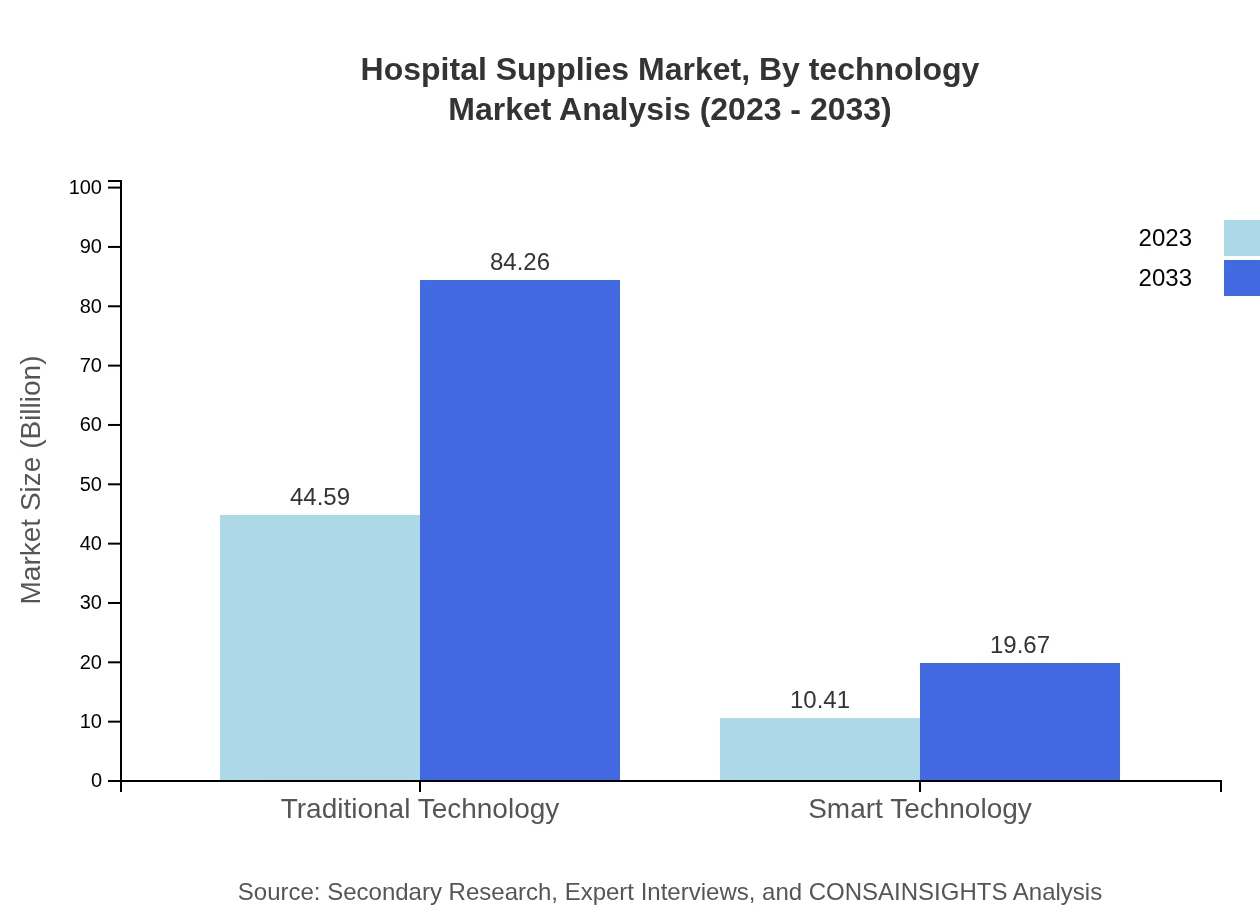

Hospital Supplies Market Analysis By Technology

Technological advancements are pivotal in shaping the Hospital Supplies market. The split between traditional technology and smart technology is evident, with traditional technology holding 81.07% of the market in 2023. However, smart technology is emerging rapidly, anticipating strong growth due to increasing adoption of IoT and digital health technologies.

Hospital Supplies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hospital Supplies Industry

Johnson & Johnson:

A leader in the healthcare industry, offering a broad range of medical devices and supplies that enhance patient care and healthcare outcomes.Medtronic :

Specializes in medical devices and supplies geared towards treating chronic diseases and improving overall healthcare through innovative technology.Baxter International:

A global leader in hospital supplies, focusing on lifesaving products and therapies for chronic and acute health conditions.3M:

Known for its innovative solutions in the medical supplies domain, addressing various hospital supply needs with cutting-edge technology.Siemens Healthineers:

Offers advanced imaging and diagnostic tools, integral to hospital operations and patient care delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of hospital supplies?

The global hospital supplies market is valued at approximately $55 billion in 2023, with a projected CAGR of 6.4% leading to significant growth by 2033.

What are the key market players or companies in this hospital supplies industry?

Key players include major healthcare suppliers like Johnson & Johnson, Medtronic, 3M Company, and Cardinal Health, focusing on innovative hospital supplies and medical devices.

What are the primary factors driving the growth in the hospital supplies industry?

Growth factors include increasing healthcare expenditures, technological advancements in medical supplies, a rising geriatric population, and a growing demand for advanced medical services.

Which region is the fastest Growing in the hospital supplies?

North America is the fastest-growing region in the hospital supplies market, projected to grow from $21.34 billion in 2023 to $40.32 billion by 2033.

Does ConsaInsights provide customized market report data for the hospital supplies industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the hospital supplies industry, ensuring relevant and actionable insights.

What deliverables can I expect from this hospital supplies market research project?

Expect detailed visual data presentations, market size profiles, growth forecasts, competitive analysis, and actionable insights tailored to your business needs.

What are the market trends of hospital supplies?

Current trends include a shift towards smart medical technologies, increased focus on patient safety, a rise in telemedicine, and an emphasis on sustainability in hospital supplies.